|

市場調查報告書

商品編碼

1689905

纖維增強聚合物 (FRP) 複合材料:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Fiber-Reinforced Polymer (FRP) Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

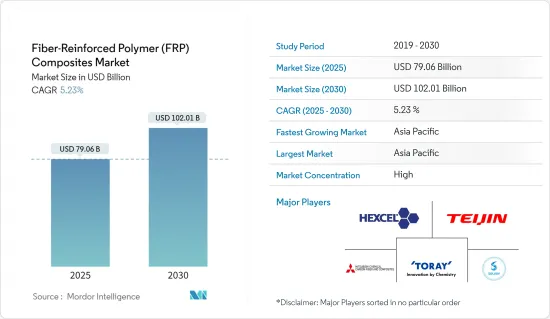

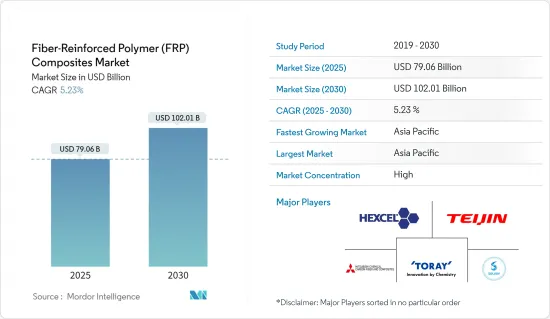

纖維增強聚合物 (FRP) 複合材料的市場規模預計在 2025 年為 790.6 億美元,預計到 2030 年將達到 1020.1 億美元,預測期內(2025-2030 年)的複合年成長率為 5.23%。

新冠疫情對整個 2020 年以及 2021 年中期的市場產生了負面影響。由於疫情,建築和製造活動暫時停止,阻礙了材料市場的發展,包括這些行業使用的纖維增強聚合物(FRP)複合材料。不過,預計疫情過後產業將會復甦,市場可望維持成長軌跡。

主要亮點

- 短期內,建築業的需求不斷成長以及航太和汽車行業對能源效率的需求不斷上升預計將推動市場成長。

- 另一方面,替代品的可用性預計會阻礙市場的成長。

- 然而,在預測期內,新型和先進形式的 FRP 材料的開發以及運輸業使用的複合材料的開發可能會為市場帶來機會。

- 由於中國、印度和日本等國家的消費量不斷增加,預計亞太地區將在預測期內佔據最大的市場。

纖維增強聚合物 (FRP) 複合材料的市場趨勢

運輸業佔市場主導地位

- 纖維增強聚合物 (FRP) 複合材料是汽車和運輸行業廣泛接受的材料,因為它們被用作汽車輕量化的替代材料。

- 與其他傳統汽車零件相比,這些材料具有更優異的性能,例如更易於成型、更美觀、重量更輕、衝擊強度更高。

- 纖維增強聚合物(FRP)複合材料的主要優點是可以最大限度地減輕車輛質量,並透過減輕車輛整體重量來減少二氧化碳排放。

- 根據國際汽車工業組織(OICA)的數據,2022年全球汽車產量將達到約8,501萬輛,而2021年為8,020萬輛,成長率為5.99%。

- 電動車需求的不斷成長也推動了該行業的成長。根據世界經濟論壇 (WEF) 的數據,2022 年上半年全球售出了近 430 萬輛新型純電動車 (BEV) 和插電式混合動力車 (PHEV)。這推動了對纖維增強聚合物 (FRP) 複合材料等材料的需求。

- 根據歐洲汽車工業協會預測,2022年北美汽車產量將成長10.3%,達到1,040萬輛,主要受美國強勁需求的推動。 2022年全球新車註冊量將達6,620萬輛。

- 德國是領先的汽車製造商之一。德國汽車製造業是歐洲地區整體汽車產量的主要股東。該國是主要汽車製造品牌的所在地,例如大眾、梅賽德斯-奔馳、奧迪、寶馬和保時捷。

- 預計所有這些因素都將在預測期內影響運輸業對纖維增強聚合物 (FRP) 複合材料的需求。

亞太地區佔市場主導地位

- 預計預測期內亞太地區將主導纖維增強聚合物 (FRP) 複合材料市場。中國、印度和日本等國家對應用的高需求正在推動該地區對 FRP 複合材料的需求。

- 亞太地區建築業是世界上最大的建築業。由於人口成長、中產階級的壯大和都市化,中國經濟正在健康成長。在亞太地區,受中國和印度住宅建築市場擴張的推動,住宅預計將實現最高成長。

- 由於家庭收入水準不斷提高和農村人口向都市區的遷移,中國住宅建築業的需求預計將繼續擴大。

- 此外,中國擁有全球最大的建築市場,佔全球整體建築投資的20%。預計到2030年,中國將在建築領域投資近13兆美元,為纖維增強聚合物(FRP)複合材料市場創造了光明的市場前景。

- 此外,建築業是印度經濟成長的重要支柱。印度政府正在積極推動住宅建設,目標是為約13億人提供住宅。

- 例如,瑪魯蒂鈴木印度公司於 2022 年 11 月宣布將在各種計劃上投資 8.6512 億美元,包括建立新設施和推出新車型。

- 2022年1月,本田的中國合資企業東風汽車公司宣佈在武漢建立電動車製造廠。東風本田汽車新廠計畫於2024年投產,年產能12萬輛。

- 根據東南亞國家聯盟汽車聯合會統計,2022年亞太地區汽車產量為4833744輛,其中摩托車和Scooter產量為3636453輛。同年,汽車銷量超過3,424,935輛,摩托車銷量超過4,049,598輛。

- 亞太地區電子產品的需求主要來自中國、印度和日本。由於人事費用低廉且政策靈活,中國對電子製造商來說是一個強大且利潤豐厚的市場。

- 中國市場是世界上最大的市場,比工業國家市場的總合還要大。 2022年中國電子產業預計成長14%,2023年成長8%。

- 印度電子產業蓬勃發展,得益於印度製造、國家電子政策、電子產品淨零進口和零缺陷零效應等政府計劃,這些計劃有利於促進國內製造業的成長,減少進口依賴,促進出口和對製造業的投入。

- 因此,預計所有這些因素將在預測期內推動纖維增強聚合物 (FRP) 複合材料市場的成長。

纖維增強聚合物 (FRP) 複合材料產業概況

全球纖維增強聚合物 (FRP) 複合材料市場本質上是部分整合的,主要企業佔據所研究市場的大部分佔有率。主要企業包括(不分先後順序):赫氏株式會社、帝人株式會社、東麗工業公司、索爾維、三菱化學碳纖維及複合材料公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 建築業需求增加

- 航太和汽車產業對能源效率的需求日益增加

- 限制因素

- 纖維增強聚合物 (FRP) 材料的缺點

- 替代產品的可用性

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 光纖類型

- 玻璃纖維增強聚合物

- 碳纖維增強聚合物

- 醯胺纖維增強聚合物

- 玄武岩纖維增強聚合物

- 其他纖維類型

- 最終用戶產業

- 建築和施工

- 運輸

- 電氣和電子

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Aegion Corporation

- AGC Chemicals Americas

- Gurit

- GSC

- Hexcel Corporation

- Kordsa Teknik Tekstil AS

- Mitsubishi Chemical Carbon Fiber and Composites Inc.

- Nippon Electric Glass Co. Ltd.

- Owens Corning

- Park Aerospace Corp.

- SGL carbon

- Solvay

- TEIJIN LIMITED

- TORAY INDUSTRIES INC.

第7章 市場機會與未來趨勢

- 新型玻璃鋼材質的開發

- 交通運輸業複合材料領域的開發與合作

The Fiber-Reinforced Polymer Composites Market size is estimated at USD 79.06 billion in 2025, and is expected to reach USD 102.01 billion by 2030, at a CAGR of 5.23% during the forecast period (2025-2030).

COVID-19 negatively impacted the market from 2020 to mid-2021. Due to the pandemic, construction and manufacturing activities were temporarily stopped, which hampered the market for materials, including fiber reinforced polymer composites to be used in these industries. However, post-pandemic, the industries recovered, and the market is expected to retain its growth trajectory in the coming years.

Key Highlights

- Over the short term, the increasing demand from the construction sector and the growing demand for energy efficiency in the aerospace and automotive industries are expected to drive the market's growth.

- On the flip side, the availability of substitutes is expected to hinder the market's growth.

- Nevertheless, the development of new advanced forms of FRP materials and the development of composite materials to be used in the transportation industry are likely to act as opportunities for the market over the forecast period.

- The Asia-Pacific is expected to represent the largest market over the forecast period, owing to the increasing consumption from countries such as China, India, and Japan.

Fiber Reinforced Polymer (FRP) Composites Market Trends

Transportation Industry to Dominate the Market

- Fiber-reinforced polymer composites are widely accepted materials in the automotive and transportation industry as these materials are used as alternatives for lightweight of automobiles.

- These materials offer enhanced properties, such as easy moldability, improved aesthetics, reduced weight, and impact strength, as compared to other conventional automotive components.

- The main advantage of fiber-reinforced polymer composites is their ability to exhibit maximum mass reduction of automobile and carbon emission reduction potential by reducing the overall weight of the vehicle.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022, around 85.01 million vehicles were produced across the globe, witnessing a growth rate of 5.99% compared to 80.20 million vehicles in 2021, thereby indicating an increased demand for fiber reinforced polymer composites from the automotive and transportation industry.

- The growth in the industry can also be seen due to the rising demand for electric vehicles. As per the World Economic Forum (WEF), nearly 4.3 million new battery-powered EVs (BEVs) and plug-in hybrid electric vehicles (PHEVs) were sold globally in the first half of 2022. Therefore, enhancing the demand for materials such as fiber reinforced polymer composites, and others.

- According to the European Automobile Manufacturers Association, the car production rate in the North America region rose by 10.3% in 2022 to 10.4 million units, primarily driven by strong demand in the United States. In 2022, global new car registrations reached 66.2 million units.

- Germany is among the key manufacturer of vehicles. The automobile manufacturing industry in Germany is a prominent shareholder of the overall automotive production in the European region. The country hosts major car-making brands, including Volkswagen, Mercedes-Benz, Audi, BMW, Porsche, among others.

- All these factors are expected to impact the demand for the fiber reinforced polymer composites from the transportation industry, during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the fiber-reinforced polymer (FRP) composites market during the forecast period. Due to the high demand for applications from countries like China, India, and Japan, the demand for FRP composites is increasing in the region.

- The construction sector in the Asia-Pacific region is the largest in the world. It is increasing at a healthy rate, owing to the rising population, increase in middle-class income, and urbanization. The highest growth for housing is expected to be registered in the Asia-Pacific region, owing to the expanding housing construction markets in China and India.

- The rising household income levels, combined with the population migrating from rural to urban areas, are expected to continue to drive the demand for the residential construction sector in China.

- In addition, the country has the largest construction market in the world, encompassing 20% of all construction investments globally. China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive market outlook for the fiber-reinforced polymer composites market.

- Furthermore, the construction sector is an important pillar for the growth of the Indian economy. The Indian government has been actively boosting housing construction, aiming to provide houses to about 1.3 billion people.

- Many Automakers are investing heavily in various segments of the industry; for instance, in November 2022, Maruti Suzuki India announced an investment of USD 865.12 million on various projects, including new facilities set-up and introduction of new models.

- In January 2022, Honda's Chinese joint venture with Dongfeng Motor Corporation Ltd. announced the development of an electric vehicle manufacturing factory in Wuhan. The new Dongfeng-Honda Automobile facility will be opened in 2024 with a production capacity of 120,000 units per year.

- According to the Association of Southeast Asian Nations Automotive Federation, Asia Pacific produced 4,383,744 units of motor vehicles and 3,636,453 units of motorcycles and scooters in 2022. It sold over 3,424,935 and 4,049,598 units of motor vehicles and two-wheelers, respectively, in the same year.

- The demand for electronics products in the Asia-Pacific region majorly comes from China, India, and Japan. China is a strong, favorable market for electronics producers, owing to the country's low labor cost and flexible policies.

- China's market is the largest in the world, even larger than the combined markets of all industrialized countries. In the year 2022, the Chinese electronic industry expanded by 14% and is expected to grow by 8% in 2023.

- In India, the electronics sector is seeing rapid growth owing to government schemes such as Make in India, National Policy of Electronics, Net Zero Imports in Electronics, and Zero Defect Zero Effect, which offer a commitment to growth in domestic manufacturing, lowering import dependence, energizing exports, and manufacturing.

- Thus, all such factors are likely to drive the growth of the fiber-reinforced polymer composites market during the forecast period.

Fiber Reinforced Polymer (FRP) Composites Industry Overview

The global fiber-reinforced polymer (FRP) composites market is partially consolidated in nature, with the top five players accounting for a major share of the market studied. Some of the key players include (not in any particular order) Hexcel Corporation, Teijin Limited, Toray Industries Inc., Solvay, and Mitsubishi Chemical Carbon Fiber and Composites Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Construction Sector

- 4.1.2 Growing Demand for Energy Efficiency in the Aerospace and Automotive Industries

- 4.2 Restraints

- 4.2.1 Fiber-reinforced Polymer (FRP) Material Shortcomings

- 4.2.2 Availability of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Fiber Type

- 5.1.1 Glass Fiber-reinforced Polymer

- 5.1.2 Carbon Fiber-reinforced Polymer

- 5.1.3 Aramid Fiber-reinforced Polymer

- 5.1.4 Basalt Fiber-reinforced Polymer

- 5.1.5 Other Fiber Types

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Transportation

- 5.2.3 Electrical and Electronics

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aegion Corporation

- 6.4.2 AGC Chemicals Americas

- 6.4.3 Gurit

- 6.4.4 GSC

- 6.4.5 Hexcel Corporation

- 6.4.6 Kordsa Teknik Tekstil A.S.

- 6.4.7 Mitsubishi Chemical Carbon Fiber and Composites Inc.

- 6.4.8 Nippon Electric Glass Co. Ltd.

- 6.4.9 Owens Corning

- 6.4.10 Park Aerospace Corp.

- 6.4.11 SGL carbon

- 6.4.12 Solvay

- 6.4.13 TEIJIN LIMITED

- 6.4.14 TORAY INDUSTRIES INC.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of New Advanced Forms of FRP Materials

- 7.2 Developments and Partnerships In the Field of Composite Material From the Transportation Industry