|

市場調查報告書

商品編碼

1906980

歐洲自動導引車(AGV)市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Europe Automated Guided Vehicle (AGV) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

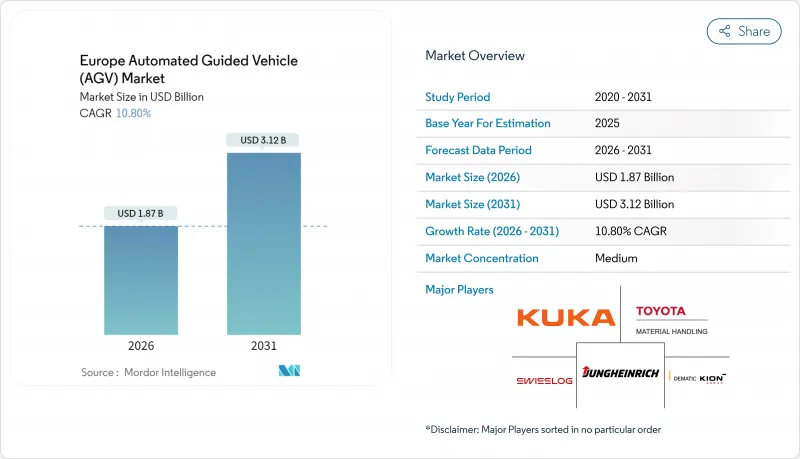

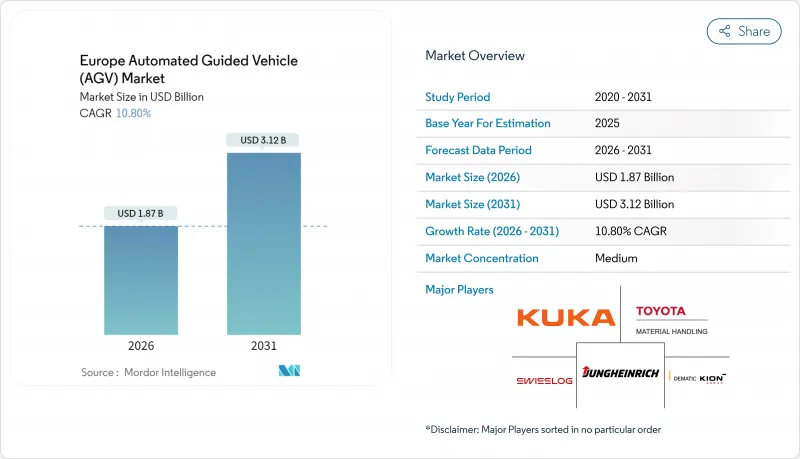

歐洲自動導引車 (AGV) 市場預計到 2026 年將達到 18.7 億美元,高於 2025 年的 16.9 億美元,預計到 2031 年將達到 31.2 億美元,2026 年至 2031 年的年複合成長率(CAGR)為 10.8%。

汽車產業的彈性製造舉措、大規模港口自動化專案以及電子商務的持續擴張是推動成長的關鍵因素,而電子商務的擴張需要高吞吐量的物流。鋰離子驅動系統、5G賦能的車隊協調以及基於人工智慧的交通管理平台正在融合,以提高整體設施生產力,同時滿足歐盟的脫碳目標。德國在自動化領域的領先地位、荷蘭的港口計劃以及英國應對嚴重勞動力短缺的舉措,都是推動技術應用的重要因素,而射頻頻譜碎片化和高昂的整合成本仍然是限制技術普及率的因素。

歐洲自動導引車(AGV)市場趨勢與洞察

歐洲都市區履約中心數量快速成長

都市區履約中心的快速成長正在重新定義AGV的設計重點,使其更加面積,並實現全天候運作。 REWE集團位於馬德堡、耗資2.5億歐元的物流中心實現了50%的內部物流自動化,每天處理28.6萬個包裹,充分展現了以AGV為中心的佈局所帶來的規模經濟效益。專業零售商也紛紛效仿,例如Dr. Max在義大利新建的倉庫就利用行動機器人來支援線上銷售額55%的成長。隨著物流地產空置率趨於穩定,零售商們正在積極洽談,以獲得具備自動化功能的倉儲空間,從而支持AGV快速充電基礎設施的建設。

德國汽車工廠的軟性生產線符合工業4.0標準

德國汽車製造商正逐步拋棄固定式輸送機,轉而採用配備AGV車隊的矩陣式生產模式。在梅賽德斯-賓士的素車製造流程中,約100輛庫卡AGV能夠即時自主地調整零件流轉。在BMW工廠,人工智慧集群控制軟體能夠根據車型組合的變化自動調整運輸路線,實現零停機。像杜爾的EcoProFleet這樣的專用於噴漆車間的AGV,將這一理念延伸至塗裝線,使多種車型能夠共用資源運作。

中小企業初始系統整合和定製成本較高

許多中小企業僅兩台自動導引車 (AGV) 的整合報價就高達 49,000 歐元以上,這限制了其市場滲透率。雖然最佳化後的佈局可以將投資回收期縮短至八個月以內,但由於缺乏內部專業知識和對補貼計劃了解有限,採用率仍然參差不齊。經合組織的一項調查顯示,72% 的歐洲中小企業了解數位化帶來的好處,但由於技能和資金方面的差距,只有 18% 的企業正在積極採用先進的自動化技術。

細分市場分析

截至2025年,自動堆高機在歐洲AGV市佔率中佔比37.60%,這主要得益於其與現有托盤工作流程的兼容性以及成熟的安全認證。牽引車和拖車是大型製造園區的主力設備,而組裝平台則履約汽車產業的準時生產。受電子商務物流需求的推動,單元貨載具預計到2031年將以12.6%的複合年成長率成長,從而進一步擴大其在歐洲AGV市場規模中的佔比。

技術進步正在模糊傳統的產品類別界線。凱傲的KAnIS計劃展示了一款支援5G連接的室外堆高機,它能夠與室內車隊協同工作,將自動化延伸至場地區域。豐田與吉迪恩的合作則將堆高機的傳統技術與人工智慧驅動的自主移動機器人(AMR)結合,標誌著這家供應商正在轉型為一個高度適應性強、用途廣泛的平台。

由於雷射導引在結構化路徑中展現出卓越的精度,預計到2025年,其市場佔有率將達到41.40%。視覺引導車輛將以13.9%的複合年成長率成長,利用SLAM和感測器融合技術自主繪製複雜環境地圖,並減少基礎設施維修。磁力路徑和引導路徑將繼續應用於低溫運輸隧道等關鍵路徑追蹤場景。弗勞恩霍夫IPA研究所的自由導航研究表明,混合視覺-雷射方法無需固定反射器即可保持毫米級精度。 Inoc Robotics公司正利用LiDAR和運動追蹤器融合技術,將此模型擴展到崎嶇的戶外環境。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐洲都市區履約中心數量快速成長

- 德國汽車工廠的軟性生產線符合工業4.0標準

- 西歐物流人事費用上升和人口短缺

- 歐盟綠色交易為低排放量物流設備提供獎勵措施

- 鹿特丹和安特衛普的港口自動化計劃推動了船舶自動導引車(AGV)的普及應用。

- 歐盟「地平線」計畫資助下一代群眾外包導航演算法

- 市場限制

- 中小企業系統整合和客製化的初始成本較高

- 歐洲射頻頻譜碎片化導致高密度倉庫網路延遲。

- CE標誌和ISO 3691-4安全認證的前置作業時間較長

- 熟練的AGV系統整合商數量有限

- 價值/供應鏈分析

- 監理與技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

第5章 市場規模與成長預測

- 按車輛類型

- 自動堆高機

- 牽引車輛/曳引機/拖船

- 單元貨載機

- 組裝車輛

- 特殊應用/客製化規格

- 透過導航技術

- 雷射導

- 磁感應法/感應法

- 視覺引導

- 自然地形辨識/SLAM

- 依電池類型

- 鉛酸電池

- 鋰離子

- 鎳氫電池

- 超級電容/快速充電

- 按操作模式

- 手動操作

- 混合/雙模式

- 完全自主

- 透過使用

- 運輸/配送

- 儲存和檢索

- 組裝/套件組裝

- 包裝和托盤堆垛

- 按最終用戶行業分類

- 車

- 食品/飲料

- 零售與電子商務

- 電學

- 一般製造業

- 製藥

- 航太/國防

- 按國家/地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Swisslog Holding AG

- KUKA AG

- Jungheinrich AG

- Toyota Material Handling Europe AB

- Dematic(KION Group)

- SSI Schaefer AG

- Murata Machinery Ltd

- ABB Ltd

- Seegrid Corporation

- AGILOX Services GmbH

- Balyo SA

- Elettric 80 SpA

- Linde Material Handling GmbH

- STILL GmbH

- Mobile Industrial Robots(MiR)

- Fives Intralogistics SAS

- Euroimpianti SpA

- Oceaneering International(AGV Systems)

- Transbotics Corporation

- Amerden Inc.

第7章 市場機會與未來展望

European AGV market size in 2026 is estimated at USD 1.87 billion, growing from 2025 value of USD 1.69 billion with 2031 projections showing USD 3.12 billion, growing at 10.8% CAGR over 2026-2031.

Growth is driven by flexible manufacturing initiatives in the automotive sector, large-scale port automation programs, and sustained e-commerce expansion that demands high-throughput intralogistics. Lithium-ion powertrains, 5G-enabled fleet orchestration, and AI-based traffic management platforms are converging to raise overall equipment productivity while meeting EU decarbonization targets. Germany's automation leadership, the Netherlands' port projects, and the United Kingdom's response to acute labor shortages serve as powerful adoption catalysts, whereas fragmented RF spectrum and high integration costs still moderate deployment velocity.

Europe Automated Guided Vehicle (AGV) Market Trends and Insights

E-commerce fulfilment centres' surge across urban Europe

Rapid growth in urban fulfilment hubs is resetting AGV design priorities toward compact footprints and 24/7 availability. REWE Group's EUR 250 million logistics hub in Magdeburg automates 50% of intralogistics and handles 286,000 packages per day, proving the scale advantages of AGV-centric layouts. Specialty retailers follow suit; Dr. Max's new Italian warehouse uses mobile robots to sustain 55% online-sales growth. Combined with stabilizing logistics-real-estate vacancies, retailers now negotiate for automation-ready space that supports rapid AGV charging infrastructure.

Industry 4.0-enabled flexible manufacturing lines in German automotive plants

German automakers are dismantling rigid conveyor lines in favor of matrix production orchestrated by AGV fleets. Mercedes-Benz's body-in-white operations run nearly 100 KUKA vehicles that autonomously synchronize component flows in real time. BMW's factory implementations rely on AI fleet control software to adapt transport routes to model-mix changes without downtime. Purpose-built paint-shop AGVs such as Durr's EcoProFleet expand the concept to finishing lines, allowing multiple vehicle types to run on shared resources.

High up-front system integration & customisation costs for SMEs

Many SMEs confront integration quotations exceeding EUR 49,000 for a modest two-AGV installation, stalling broader market penetration. Although payback can arrive within eight months in optimized layouts, limited in-house expertise and low awareness of subsidy programs leave uptake uneven. OECD surveys show 72% of European SMEs understand digital benefits, yet only 18% actively deploy advanced automation due to skills and funding gaps.

Other drivers and restraints analyzed in the detailed report include:

- Labour-cost inflation & demographic shortages in Western Europe's logistics workforce

- EU Green Deal incentives for low-emission intralogistics equipment

- Fragmented European RF spectrum causing network latency in dense warehouses

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automated forklifts captured 37.60% of the European AGV market share in 2025, underpinned by drop-in compatibility with existing pallet workflows and mature safety certifications. Tow tractors and tug vehicles remain staples in large manufacturing campuses, whereas assembly line platforms support just-in-time automotive sequencing. Unit-load carriers, propelled by e-commerce fulfilment needs, are forecast to grow at a 12.6% CAGR, increasing their contribution to the European AGV market size through 2031.

Technical evolution blurs legacy categories: KION's KAnIS project demonstrates 5G-linked outdoor forklifts that coordinate with indoor fleets, extending automated coverage to yard areas. Toyota's alliance with Gideon blends forklift heritage with AI-driven AMRs, revealing how suppliers reposition toward adaptable multi-purpose platforms.

Laser guidance commanded 41.40% share in 2025 thanks to proven precision in structured aisles. Vision-guided vehicles, growing at 13.9% CAGR, leverage SLAM and sensor fusion to self-map unpredictable environments, reducing infrastructure retrofits. Magnetic and inductive paths persist in critical path-following use cases such as cold-chain tunnels. Free-navigation research at Fraunhofer IPA shows how hybrid vision-laser stacks eliminate fixed reflectors while preserving millimetric accuracy. Innok Robotics extends this model outdoors with LiDAR plus motion-tracker fusion for rough terrain.

The European AGV Market Report is Segmented by Vehicle Type (Automated Forklift, Unit-Load Carrier, and More), Navigation Technology (Laser Guided, Magnetic/Inductive Guided, and More), Battery Type (Lead-Acid, Lithium-Ion, Nickel-Metal Hydride, and More), Mode of Operation (Manual Override, Hybrid/Dual-Mode, and More), Application, End-User Industry, and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Swisslog Holding AG

- KUKA AG

- Jungheinrich AG

- Toyota Material Handling Europe AB

- Dematic (KION Group)

- SSI Schaefer AG

- Murata Machinery Ltd

- ABB Ltd

- Seegrid Corporation

- AGILOX Services GmbH

- Balyo SA

- Elettric 80 SpA

- Linde Material Handling GmbH

- STILL GmbH

- Mobile Industrial Robots (MiR)

- Fives Intralogistics SAS

- Euroimpianti SpA

- Oceaneering International (AGV Systems)

- Transbotics Corporation

- Amerden Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce Fulfilment Centres Surge Across Urban Europe

- 4.2.2 Industry 4.0 Enabled Flexible Manufacturing Lines in German Automotive Plants

- 4.2.3 Labour-Cost Inflation and Demographic Shortages in Western Europes Logistics Workforce

- 4.2.4 EU Green Deal Incentives for Low-Emission Intralogistics Equipment

- 4.2.5 Port Automation Projects in Rotterdam and Antwerp Boosting Maritime AGV Adoption

- 4.2.6 Horizon Europe Funding for Next-Gen Swarm Navigation Algorithms

- 4.3 Market Restraints

- 4.3.1 High Up-front System Integration and Customisation Costs for SMEs

- 4.3.2 Fragmented European RF Spectrum Causing Network Latency in Dense Warehouses

- 4.3.3 Lengthy CE-Mark and ISO 3691-4 Safety Certification Lead-Times

- 4.3.4 Limited Availability of Skilled AGV Systems Integrators

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Industry Value-Chain Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Vehicle Type

- 5.1.1 Automated Forklift

- 5.1.2 Tow / Tractor / Tug

- 5.1.3 Unit-Load Carrier

- 5.1.4 Assembly Line Vehicle

- 5.1.5 Special-Purpose / Custom

- 5.2 By Navigation Technology

- 5.2.1 Laser Guided

- 5.2.2 Magnetic / Inductive Guided

- 5.2.3 Vision Guided

- 5.2.4 Natural Feature / SLAM

- 5.3 By Battery Type

- 5.3.1 Lead-acid

- 5.3.2 Lithium-ion

- 5.3.3 Nickel-Metal Hydride

- 5.3.4 Super-capacitor / Fast-Charge

- 5.4 By Mode of Operation

- 5.4.1 Manual Override

- 5.4.2 Hybrid / Dual-Mode

- 5.4.3 Fully Autonomous

- 5.5 By Application

- 5.5.1 Transportation and Distribution

- 5.5.2 Storage and Retrieval

- 5.5.3 Assembly and Kitting

- 5.5.4 Packaging and Palletising

- 5.6 By End-User Industry

- 5.6.1 Automotive

- 5.6.2 Food and Beverage

- 5.6.3 Retail and E-commerce

- 5.6.4 Electronics and Electrical

- 5.6.5 General Manufacturing

- 5.6.6 Pharmaceuticals

- 5.6.7 Aerospace and Defence

- 5.7 By Country

- 5.7.1 Germany

- 5.7.2 United Kingdom

- 5.7.3 France

- 5.7.4 Italy

- 5.7.5 Spain

- 5.7.6 Netherlands

- 5.7.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Swisslog Holding AG

- 6.4.2 KUKA AG

- 6.4.3 Jungheinrich AG

- 6.4.4 Toyota Material Handling Europe AB

- 6.4.5 Dematic (KION Group)

- 6.4.6 SSI Schaefer AG

- 6.4.7 Murata Machinery Ltd

- 6.4.8 ABB Ltd

- 6.4.9 Seegrid Corporation

- 6.4.10 AGILOX Services GmbH

- 6.4.11 Balyo SA

- 6.4.12 Elettric 80 SpA

- 6.4.13 Linde Material Handling GmbH

- 6.4.14 STILL GmbH

- 6.4.15 Mobile Industrial Robots (MiR)

- 6.4.16 Fives Intralogistics SAS

- 6.4.17 Euroimpianti SpA

- 6.4.18 Oceaneering International (AGV Systems)

- 6.4.19 Transbotics Corporation

- 6.4.20 Amerden Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment