|

市場調查報告書

商品編碼

1906966

燃油添加劑:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Fuel Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

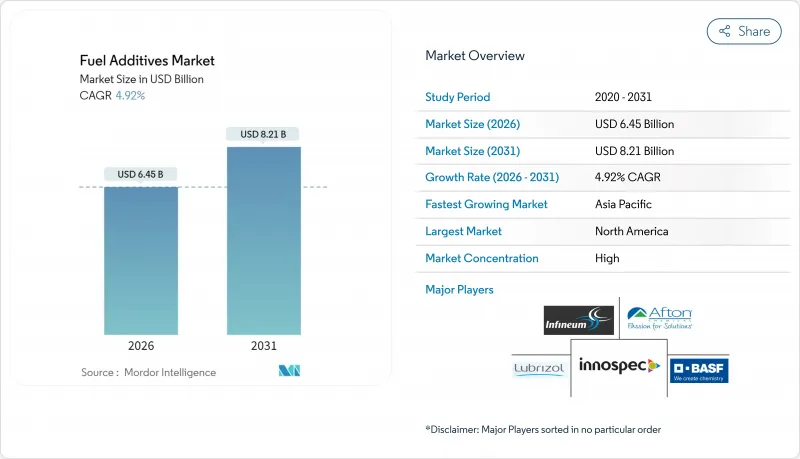

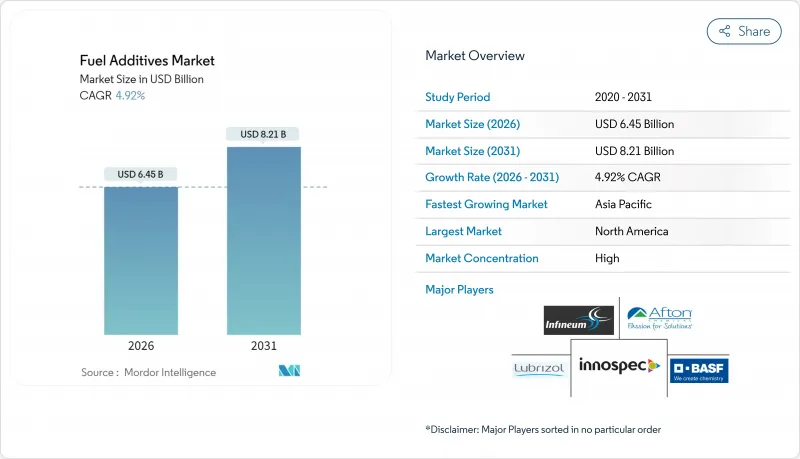

預計燃油添加劑市場將從 2025 年的 61.5 億美元成長到 2026 年的 64.5 億美元,到 2031 年將達到 82.1 億美元,2026 年至 2031 年的複合年成長率為 4.92%。

全球排放法規日益嚴格,刺激了對燃油添加劑的需求,而電池式電動車的普及預計將導致燃油消費量的長期下降。噴射機燃料的持續需求,以及新興國家超低硫柴油(ULSD)的引入,支撐了燃油添加劑市場的上升趨勢。航空業的復甦、生質柴油強制摻混比例的提高以及重質和低品質原油煉製技術的進步,都在推動產品不斷創新。隨著供應商轉向多功能、生質燃料相容型產品,並整合原料採購以應對成本壓力,市場競爭日益激烈。

全球燃油添加劑市場趨勢與洞察

嚴格執行環境法規

隨著全球監管日益嚴格,燃料生產商面臨更複雜的合規要求,添加劑的消費格局正在重塑。美國可再生燃料標準 (RFS) 強制規定了乙醇和生質柴油混合燃料的添加劑要求,而歐盟的歐7排放氣體標準則要求更高的清潔性能,以在更長的換油週期內保持後處理效率。儘管加州計劃在2035年逐步淘汰內燃機,但其「先進清潔汽車II (ACCII)」框架仍在推動對優質汽油添加劑的短期需求,以控制排放和粒狀物排放。國際海事組織 (IMO) 2020 年的硫排放法規也對陸基柴油燃料市場產生了影響,進一步擴大了多功能添加劑包的潛在市場。諸如 ISO 8217 和 ASTM D975 等正式的測試通訊協定促使業務流向擁有認證測試實驗室的供應商,從而提高了新進入者的進入門檻。

原油品質劣化加劇了沉澱物問題。

重質原油(污染性較強)在煉油廠原料混合物中的佔比越來越大,增加了儲存和燃燒循環過程中沉積物形成的風險。頁岩氣衍生的石蠟基原油會促進蠟沉積,而加拿大油砂原料則會在長途運輸過程中加劇腐蝕和氧化壓力。這些趨勢推動了對沉積物抑制劑、抗氧化劑和防腐蝕添加劑的需求,這些添加劑能夠在嚴苛的熱負荷和化學負荷下保持燃料的完整性。在中東,尋求銷售柔軟性的重質原料處理煉油廠也面臨類似的挑戰。隨著煉油廠尋求從低品質原料中獲取經濟價值,集清潔、金屬惰性和穩定功能於一體的添加劑組合正日益受到歡迎。

電動車的激增

電動出行正在重塑能源格局。到2024年,中國的電動車滲透率將超過45%,國際能源總署(IEA)預測,到2030年,電動車將佔全球輕型車銷量的60%。隨著汽油和柴油消費量達到峰值,道路運輸添加劑的需求正面臨結構性阻力。重型車輛的電氣化將加劇這種影響,尤其對柴油添加劑供應商而言。然而,航空、船舶和非道路領域仍保持韌性,供應商正將研發和資金集中投入這些高價值領域,同時也在探索氨和氫載體等替代燃料的添加劑。

細分市場分析

到2025年,積碳控制添加劑將佔據燃油添加劑市場28.78%的佔有率,鞏固其作為現代燃油品管系統基石的地位。它們能夠確保進氣閥和噴油器清潔,滿足美國環保署第三階段排放標準(EPA Tier 3)和歐洲標準EN 228汽油標準的要求,從而保護燃燒效率和排氣系統耐久性。缸內噴油引擎的日益普及也推動了這個細分市場的發展,因為這類引擎更容易產生氣門積碳。同樣重要的是,高壓柴油噴射系統也需要清潔劑來防止噴嘴結焦。

預計到2031年,低溫流動改良劑將成為所有產品類別中成長最快的,複合年成長率將達到5.43%,這主要得益於生物柴油摻混比例的擴大以及加拿大、北歐和中國東北地區對冬季運作日益成長的需求。隨著這些法規的不斷完善,流動點降低劑技術正受到越來越多的關注,以解決生質柴油的濁點和流點過高的問題。隨著商用車輛向更高效的引擎轉型,對十六烷改良劑的需求也在不斷成長,這些引擎需要可靠的冷啟動性能和更短的點火延遲。多功能組合藥物因其能夠降低煉油廠和下游燃料經銷商添加劑配比的複雜性而日益普及,使他們能夠將性能目標整合到單一產品單元(SKU)中。

燃油添加劑、腐蝕抑制劑、低溫流動十六烷改良劑、防腐蝕添加劑及其他產品類型)、應用領域(柴油、汽油、噴射機燃料及其他應用領域)和地區(亞太地區、北美地區、歐洲地區、南美地區以及中東和非洲地區)進行細分。市場預測以以金額為準和銷售兩種形式呈現。

區域分析

截至2025年,北美佔據了燃油添加劑市場35.55%的佔有率。長期有效的美國環保署(EPA)法規和成熟的煉油廠支撐了穩定的需求,而加拿大嚴酷的冬季氣候則推動了對低溫流動改進劑的需求。在「頂級汽油」(TOP TIER)零售計畫的推動下,汽油清潔劑的需求仍然強勁,該計畫要求更高的沉積物控制水平以保持引擎清潔。

預計亞太地區將成為成長最快的地區,到2031年複合年成長率將達到5.48%。隨著煉油廠升級其加氫脫硫裝置,中國國六和印度國六標準的實施正在加速對潤滑性添加劑和十六烷改良劑的需求。快速的都市化正在擴大商用車輛保有量,搭乘用電動車(EV)的日益普及也增加了柴油添加劑的消費量。東南亞國家超低硫柴油(ULSD)和E10汽油的日益普及,也催生了對多種產品的需求,包括生物柴油穩定劑、抗氧化劑和潤滑性促進劑。

在歐洲,隨著積極的脫碳目標推動產品結構向生質燃料相容型添加劑轉變,絕對成長將保持溫和但穩健。歐盟航空和海運硫排放法規將創造對利潤豐厚的特殊添加劑的需求,從而抵消道路燃料需求的下降。在中東和非洲,沙烏地阿拉伯和奈及利亞煉油廠的擴建將擴大該地區的成品燃料供應,並增加符合出口標準的添加劑的進口。在巴西乙醇計畫的推動下,南美洲對高混合汽油等級的抗氧化劑和腐蝕抑制劑的需求將繼續保持強勁。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 嚴格執行環境法規

- 原油品質劣化會導致沉澱物問題加劇。

- 新興經濟體嚴格的超低硫柴油(ULSD)標準

- 全球航空運輸量和噴射機燃料需求不斷成長

- 生質燃料相容添加劑化學品(E10-E85)

- 市場限制

- 電池式電動車越來越受歡迎

- 多功能添加劑包的高昂研發成本

- 禁止使用含金屬添加劑(例如,限制使用蒙脫石)

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模及成長預測(以金額為準/數量)

- 依產品類型

- 泥沙控制

- 十六烷改良劑

- 潤滑添加劑

- 抗氧化劑

- 防腐蝕

- 低溫流動改善劑

- 抗爆劑

- 其他產品類型

- 透過使用

- 柴油引擎

- 汽油

- 噴射機燃料

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- AFTON CHEMICAL

- Baker Hughes Company

- BASF

- Cargill Incorporated

- Chevron Corporation

- Clariant

- Dorf Ketal Chemicals

- Evonik Industries AG

- Exxon Mobil Corporation

- Infineum International Limited

- Innospec

- Lanxess

- The Lubrizol Corporation

- TotalEnergies

第7章 市場機會與未來展望

The Fuel Additives market is expected to grow from USD 6.15 billion in 2025 to USD 6.45 billion in 2026 and is forecast to reach USD 8.21 billion by 2031 at 4.92% CAGR over 2026-2031.

The outlook balances tightening global emission rules that stimulate additive demand against the long-run decline in fuel consumption tied to battery-electric vehicle adoption. Sustained jet-fuel needs, coupled with emerging-economy rollouts of ultra-low sulfur diesel (ULSD), keep the fuel additives market on an upward trajectory. Aviation recovery, expanding biodiesel mandates, and the refinement of heavy, lower-quality crudes collectively underpin steady product innovation. Competitive intensity has risen as suppliers pivot to multifunctional, biofuel-ready packages while securing raw-material integration to offset cost pressures.

Global Fuel Additives Market Trends and Insights

Enactment of Stringent Environmental Regulations

Global regulatory tightening is reshaping additive consumption as fuel producers align with more complex compliance layers. The U.S. Renewable Fuel Standard embeds additive requirements for ethanol and biodiesel blending, while Euro 7 emission rules in the European Union call for higher detergency to preserve after-treatment efficiency across longer drain intervals. California's Advanced Clean Cars II framework, despite its 2035 internal-combustion phase-out target, lifts near-term demand for premium gasoline additives that curb evaporative and particulate emissions. Maritime sulfur caps under IMO 2020 have spilled into land-based diesel pools, further widening the addressable market for multifunctional packages. Formal test protocols such as ISO 8217 and ASTM D975 channel business toward suppliers that operate accredited laboratories, tightening the qualification bar for new entrants.

Degrading Crude-Oil Quality Raising Deposit Issues

Heavier, higher-contaminant opportunity crudes now fill a larger slice of refinery slates, escalating deposit formation risks throughout storage and combustion cycles. Shale-derived paraffinic crudes elevate wax precipitation, while Canadian oil-sands feedstocks heighten corrosion and oxidation stress during long-haul transport. These dynamics bolster demand for deposit control, antioxidant, and anticorrosion additives that maintain fuel integrity under harsher thermal and chemical loads. In the Middle East, refineries running heavier feed face similar issues as they chase merchandising flexibility. As refiners squeeze economics from lower-grade inputs, additive packages that combine detergency, metal-deactivating, and stabilization functions gain favor.

Surging Adoption of Battery-Electric Vehicles

Electric mobility is redrawing the energy map. China surpassed 45% EV penetration in 2024, and the International Energy Agency sees EVs reaching 60% of global light-duty sales by 2030. As gasoline and diesel consumption peaks, additive volumes linked to road transport face a structural headwind. Heavy-duty fleet electrification compounds the effect, especially for diesel additive vendors. Nevertheless, aviation, marine, and off-road segments remain insulated, prompting suppliers to concentrate research and development and capital around these higher-value niches while exploring additives for alternative fuels such as ammonia and hydrogen carriers.

Other drivers and restraints analyzed in the detailed report include:

- Tight ULSD Specifications in Emerging Economies

- Rising Global Aviation Traffic and Jet-Fuel Demand

- High Research and Development Cost for Multi-Functional Additive Packages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Deposit control additives commanded 28.78% of the fuel additives market share in 2025, cementing their role as the cornerstone of modern fuel quality regimes. They ensure intake-valve and injector cleanliness demanded by EPA Tier 3 and EN 228 gasoline standards, safeguarding combustion efficiency and emission-system longevity. The segment benefits from the proliferation of gasoline direct-injection engines, which are more prone to valve deposits. Equally important, high-pressure diesel injection systems demand detergents to prevent nozzle coking.

Cold flow improvers register a 5.43% CAGR to 2031, the fastest within the product spectrum, as biodiesel blending widens and winter operability becomes mission-critical in Canada, Northern Europe, and Northeast China. As these mandates scale, pour-point depressant technologies that manage biodiesel's higher cloud and pour points gain traction. Cetane improvers follow as commercial fleets upgrade to higher-efficiency engines requiring reliable cold starts and reduced ignition delay. Multifunctional formulations are gaining favor because they reduce treat-rate complexity for refiners and downstream fuel marketers, consolidating performance goals into one SKU.

The Fuel Additives Report is Segmented by Product Type (Deposit Control, Cetane Improvers, Lubricity Additives, Antioxidants, Anticorrosion, Cold Flow Improvers, Antiknock Agents, and Other Product Types), Application (Diesel, Gasoline, Jet Fuel, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value and Volume.

Geography Analysis

North America accounted for 35.55% of the fuel additives market share in 2025. Long-standing EPA rules and mature refining assets foster dependable volume, while extreme winter conditions in Canada stimulate cold flow improver uptake. Gasoline detergent demand remains buoyant under the TOP TIER retail program, which mandates higher deposit-control levels to maintain engine cleanliness.

Asia-Pacific is the fastest-growing region, charting a 5.48% CAGR to 2031. China's enforcement of National VI and India's BS-VI standards accelerates lubricity and cetane additive demand as refineries update hydrodesulfurization units. Rapid urbanization expands commercial vehicle fleets, boosting diesel additive consumption even as passenger EV adoption rises. Southeast Asian economies pursue ULSD and E10 gasoline rollouts, creating multi-product pull across biodiesel stabilizers, antioxidants, and lubricity improvers.

Europe shows steady but lower absolute growth, underpinned by aggressive decarbonization goals that shift the product mix toward biofuel-compatible additives. ReFuelEU Aviation and maritime sulfur caps generate high-margin specialty demand, offsetting declining road-fuel volumes. In the Middle East and Africa, expanding refinery complexes in Saudi Arabia and Nigeria widen regional availability of finished fuels, drawing additive imports to hit export-grade specifications. South America, led by Brazil's ethanol program, sustains robust antioxidant and corrosion-inhibitor demand for high-blend gasoline grades.

- AFTON CHEMICAL

- Baker Hughes Company

- BASF

- Cargill Incorporated

- Chevron Corporation

- Clariant

- Dorf Ketal Chemicals

- Evonik Industries AG

- Exxon Mobil Corporation

- Infineum International Limited

- Innospec

- Lanxess

- The Lubrizol Corporation

- TotalEnergies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Enactment of stringent environmental regulations

- 4.2.2 Degrading crude-oil quality raising deposit issues

- 4.2.3 Tight ULSD specifications in emerging economies

- 4.2.4 Rising global aviation traffic and jet-fuel demand

- 4.2.5 Biofuel-compatible additive chemistries (E10-E85)

- 4.3 Market Restraints

- 4.3.1 Surging adoption of battery-electric vehicles

- 4.3.2 High research and development cost for multi-functional additive packages

- 4.3.3 Metal-containing additive bans (e.g., MMT limits)

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Product Type

- 5.1.1 Deposit Control

- 5.1.2 Cetane Improvers

- 5.1.3 Lubricity Additives

- 5.1.4 Antioxidants

- 5.1.5 Anticorrosion

- 5.1.6 Cold Flow Improvers

- 5.1.7 Antiknock Agents

- 5.1.8 Other Product Types

- 5.2 By Application

- 5.2.1 Diesel

- 5.2.2 Gasoline

- 5.2.3 Jet Fuel

- 5.2.4 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 AFTON CHEMICAL

- 6.4.2 Baker Hughes Company

- 6.4.3 BASF

- 6.4.4 Cargill Incorporated

- 6.4.5 Chevron Corporation

- 6.4.6 Clariant

- 6.4.7 Dorf Ketal Chemicals

- 6.4.8 Evonik Industries AG

- 6.4.9 Exxon Mobil Corporation

- 6.4.10 Infineum International Limited

- 6.4.11 Innospec

- 6.4.12 Lanxess

- 6.4.13 The Lubrizol Corporation

- 6.4.14 TotalEnergies

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment