|

市場調查報告書

商品編碼

1905983

北美燃油添加劑:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031 年)North America Fuel Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

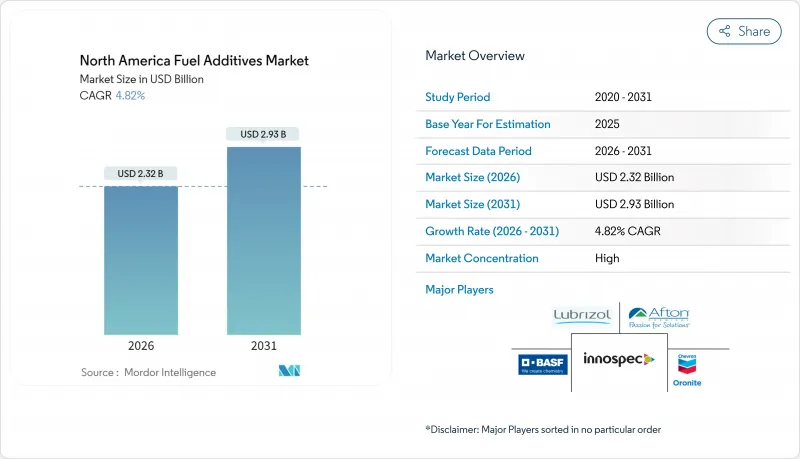

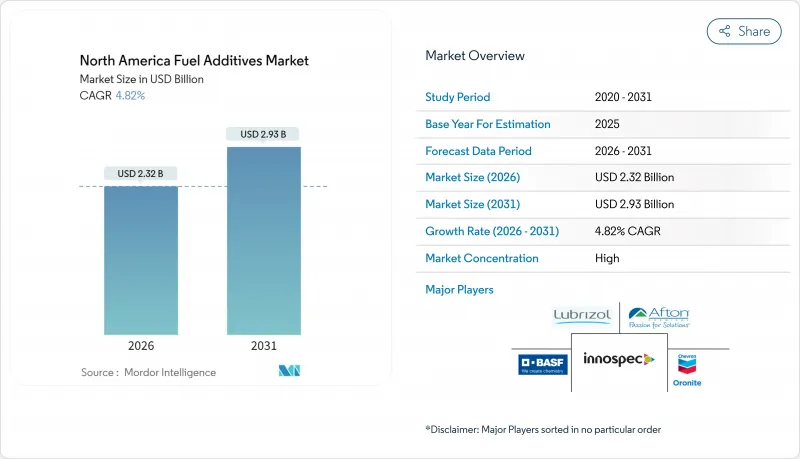

預計北美燃料添加劑市場將從 2025 年的 22.1 億美元成長到 2026 年的 23.2 億美元,到 2031 年將達到 29.3 億美元,2026 年至 2031 年的複合年成長率為 4.82%。

目前市場成長的促進因素包括:更嚴格的減硫法規、老舊內燃機車輛對耐久性的需求,以及隨著可再生燃料的普及,維持汽油和柴油引擎效率的必要性。缸內噴油(GDI)引擎比傳統的歧管噴射平台更容易積碳,因此積碳控制化學品的使用日益普遍。同時,隨著煉油商尋求在不增加芳烴含量的情況下提高引擎壓縮比,辛烷值提升型抗爆添加劑正成為成長最快的市場。商用柴油用戶推動了對潤滑性促進劑和十六烷改良劑的需求,以彌補超低硫柴油(ULSD)的不足。供應商也受惠於利潤率高於煉油廠出口的售後市場管道。隨著液體燃料市場繼續為傳統乘用車、重型商用車、船用燃料和永續航空燃料應用提供燃料,即使電池式電動車(BEV)日益普及,北美燃料添加劑市場仍在持續擴張。

北美燃油添加劑市場趨勢與洞察

嚴格的第三階段排放標準和排放控制區硫含量限制

Tier-3汽油10ppm的含硫量上限以及排放控制區(ECA)0.1%的船用燃料含硫量要求,永久改變了添加劑的需求格局。煉油廠依賴多功能添加劑來彌補潤滑性能的損失、維持辛烷值、分散沉積物並防止腐蝕。在加州,先進清潔汽車II框架將低硫法規的有效期延長至2035年,進一步增加了合規成本。同時,碼頭業者正在採用殺菌劑來防止低硫燃料儲存過程中的微生物污染。這些累積效應導致北美燃料添加劑市場加工量出現結構性成長,即使汽油和柴油的基準加工量保持穩定,也支撐了強勁的添加劑需求。

加快超低硫柴油和氣體直接排放柴油清潔度標準

超低硫柴油(ULSD)本身潤滑性較差,而缸內直噴(GDI)引擎的進氣門積碳速度是端口式引擎的10倍。這種協同效應正推動清潔劑化學技術的快速創新,例如耐高溫卡死的聚異丁胺和聚醚胺混合物。美國環保署(EPA)第三階段排放法規要求汽車製造商維持觸媒效率,而積碳的增加會降低觸媒效率。同時,氫化可再生柴油的日益普及造成了傳統石油基餾分油所不具備的潤滑性差距。這些因素共同擴大了北美燃油添加劑市場中清潔劑、潤滑性促進劑和十六烷改良劑的應用範圍和商機。

由於電動車的普及,液態燃料市場正在萎縮。

預測顯示,到2030年,人口稠密地區新車銷售的一半將是電動車。每輛電動車都會永久取代部分汽油需求,逐步縮小北美燃油添加劑市場的潛在規模。隨著宅配和城市公車試點使用電池動力平台,柴油車的防禦優勢正在削弱,面向高運轉率商業客戶的傳統添加劑銷售量也在下降。供應商正透過轉向航空、海運和工業領域來應對這項挑戰,因為這些領域在電氣化方面仍然面臨著巨大的障礙。

細分市場分析

北美燃油添加劑市場中,積碳控制產品佔33.02%。基於聚醚胺和聚異丁烯琥珀醯亞胺的多功能清潔劑能夠清除現代汽缸內直噴(GDI)引擎上積聚的氣門、噴油器和燃燒室積碳。高壓縮比引擎推動了辛烷值需求,進而帶動抗爆添加劑銷量在2031年前以5.28%的複合年成長率成長。

低溫流動改良劑能確保柴油在加拿大和美國北部各州低至-10°F(約-23°C)的溫度下仍能保持良好的運作性能。同時,十六烷改良劑、潤滑性促進劑和腐蝕抑制劑在低芳烴和低硫含量的可再生柴油混合燃料中日益重要。供應商正擴大將這些化學品整合到一個包裝中,使煉油廠能夠在滿足ASTM、EPA和加拿大運輸部規範的同時降低加工成本。日益嚴格的檢驗要求使得少數技術實力雄厚的公司擁有了更強的議價能力,同時,生物柴油穩定劑和高閃點船用添加劑等細分領域也湧現出了許多專業公司,進一步加劇了北美燃料添加劑市場的競爭。

北美燃油添加劑、腐蝕抑制劑、低溫流動十六烷改良劑、防腐蝕劑及其他產品類型)、應用領域(柴油、汽油、噴射機燃料及其他應用領域)和地區(美國、加拿大和墨西哥)進行細分。市場預測以美元以金額為準。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 嚴格的Tier-3和ECA硫排放法規

- 加快超低硫柴油和氣體直接排放柴油清潔度標準的製定

- 車輛老化導致售後市場需求不斷成長

- 可直接替代的可再生柴油和SAF相容性需求

- 配備SCR/DEF系統的非公路用車輛改裝熱潮

- 市場限制

- 由於電動車的普及,液體燃料需求下降

- 處理速率的檢驗成本和研發成本很高

- 特種化學品供應鏈中斷

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 存款控制

- 十六烷改良劑

- 潤滑添加劑

- 抗氧化劑

- 防腐蝕抑制劑

- 低溫流動改善劑

- 抗爆劑

- 其他產品類型

- 透過使用

- 柴油引擎

- 汽油

- 噴射機燃料

- 其他用途

- 按地區

- 美國

- 加拿大

- 墨西哥

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- AFTON CHEMICAL

- Baker Hughes Company

- BASF

- Chevron Oronite Company LLC

- Clariant AG

- Croda International Plc

- Dorf Ketal Chemicals

- Evonik Industries AG

- Exxon Mobil Corporation

- Infineum International Limited

- Innospec

- LANXESS AG

- Shell plc

- The Lubrizol Corporation

- TotalEnergies

第7章 市場機會與未來展望

The North America Fuel Additives Market is expected to grow from USD 2.21 billion in 2025 to USD 2.32 billion in 2026 and is forecast to reach USD 2.93 billion by 2031 at 4.82% CAGR over 2026-2031.

Current growth rests on aggressive sulfur-reduction rules, the durability needs of an aging internal-combustion fleet, and the need to keep both gasoline and diesel engines efficient as renewable drop-ins enter mainstream supply. Deposit control chemistries dominate because gasoline direct-injection (GDI) engines foul more readily than legacy port-injection platforms, while octane-boosting antiknock agents record the quickest uptake as refiners strive for higher engine compression ratios without aromatics spikes. Commercial diesel users push demand for lubricity and cetane improvers that offset ultra-low-sulfur diesel (ULSD) shortcomings. Suppliers further benefit from aftermarket channels where margin opportunities remain stronger than at the refinery gate. Even with battery-electric vehicle (BEV) penetration climbing, the North America fuel additives market continues to expand because the liquid-fuel pool still serves legacy passenger vehicles, heavy-duty fleets, marine bunkers, and sustainable aviation fuel applications.

North America Fuel Additives Market Trends and Insights

Stringent Tier-3 and ECA Sulfur Limits

Tier-3 gasoline caps at 10 ppm sulfur and Emission Control Area marine requirements of 0.1% sulfur have permanently reset additive demand. Refiners rely on multifunctional packages that replace lost lubricity, maintain octane, disperse deposits, and guard against corrosion. Compliance costs rise further in California, where the Advanced Clean Cars II framework extends low-sulfur mandates through 2035. Terminal operators simultaneously adopt biocides that prevent microbial contamination during low-sulfur storage seasons. The cumulative effect drives a structural uptick in treat rates across the North America fuel additives market, keeping volumes resilient even when baseline gasoline and diesel throughput plateaus.

Accelerating ULSD and GDI Cleanliness Standards

ULSD carries lower natural lubricity, while GDI engines generate intake-valve deposits at 10X the rate of port systems. This intersection fuels rapid innovation in detergency chemistries such as polyisobutylamine and polyetheramine blends that resist high-temperature bake-on. EPA Tier 3 emission limits obligate automakers to maintain catalyst efficiency, which is compromised when coking rises. Concurrent growth in hydrogenated renewable diesel raises lubricity gaps that traditional petroleum fractions never posed. Together, these vectors expand the functional scope-and revenue opportunity-of detergent, lubricity, and cetane improvers across the North America fuel additives market.

BEV Penetration Reducing Liquid-Fuel Pool

Forecasts point to half of new-light-duty sales being electric by 2030 in densely populated corridors. Each incremental EV permanently displaces gasoline demand and gradually trims the North America fuel additives market addressable volume. Diesel's defensive moat erodes as parcel-delivery and municipal bus fleets test battery platforms, curtailing traditional additive sales to high-throughput commercial accounts. Suppliers respond by pivoting toward aviation, marine, and industrial channels where electrification hurdles remain significant.

Other drivers and restraints analyzed in the detailed report include:

- Rising Aftermarket Demand from Aging Fleet

- Drop-In Renewable Diesel and SAF Compatibility Needs

- High Validation and Treat-Rate Research and Development Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Deposit control packages held 33.02% of the North America fuel additives market share. Multifunctional detergents based on polyetheramines and polyisobutylene succinimides strip valve, injector, and combustion-chamber deposits that proliferate in modern GDI platforms. Higher compression engines spur octane demand, lifting antiknock agent sales at a projected 5.28% CAGR through 2031.

Cold-flow improvers preserve diesel operability below -10 °F in Canadian and Northern U.S. states, while cetane, lubricity, and corrosion inhibitors find fresh relevance in renewable diesel blends that arrive with low aromatics and sulfur. Suppliers increasingly bundle these chemistries into single packages, allowing refiners to reduce treat cost while meeting ASTM, EPA, and Transport Canada specifications. Escalating validation hurdles consolidate bargaining power within a handful of technology owners, yet specialty players still carve out sub-segments such as biodiesel stabilizers and high-flash-point marine additives, ensuring competitive churn inside the North America fuel additives market.

The North America Fuel Additives Report is Segmented by Product Type (Deposit Control, Cetane Improvers, Lubricity Additives, Antioxidants, Anticorrosion, Cold Flow Improvers, Antiknock Agents, and Other Product Types), Application (Diesel, Gasoline, Jet Fuel, and Other Applications), and Geography (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AFTON CHEMICAL

- Baker Hughes Company

- BASF

- Chevron Oronite Company LLC

- Clariant AG

- Croda International Plc

- Dorf Ketal Chemicals

- Evonik Industries AG

- Exxon Mobil Corporation

- Infineum International Limited

- Innospec

- LANXESS AG

- Shell plc

- The Lubrizol Corporation

- TotalEnergies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Tier-3 and ECA sulfur limits

- 4.2.2 Accelerating ULSD and GDI cleanliness standards

- 4.2.3 Rising aftermarket demand from ageing fleet

- 4.2.4 Drop-in renewable diesel and SAF compatibility needs

- 4.2.5 Off-highway retrofit boom for SCR/DEF

- 4.3 Market Restraints

- 4.3.1 BEV penetration reducing liquid-fuel pool

- 4.3.2 High validation and treat-rate RandD costs

- 4.3.3 Specialty-chemical supply-chain shocks

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Deposit Control

- 5.1.2 Cetane Improvers

- 5.1.3 Lubricity Additives

- 5.1.4 Antioxidants

- 5.1.5 Anticorrosion

- 5.1.6 Cold Flow Improvers

- 5.1.7 Antiknock Agents

- 5.1.8 Other Product Types

- 5.2 By Application

- 5.2.1 Diesel

- 5.2.2 Gasoline

- 5.2.3 Jet Fuel

- 5.2.4 Other Applications

- 5.3 By Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AFTON CHEMICAL

- 6.4.2 Baker Hughes Company

- 6.4.3 BASF

- 6.4.4 Chevron Oronite Company LLC

- 6.4.5 Clariant AG

- 6.4.6 Croda International Plc

- 6.4.7 Dorf Ketal Chemicals

- 6.4.8 Evonik Industries AG

- 6.4.9 Exxon Mobil Corporation

- 6.4.10 Infineum International Limited

- 6.4.11 Innospec

- 6.4.12 LANXESS AG

- 6.4.13 Shell plc

- 6.4.14 The Lubrizol Corporation

- 6.4.15 TotalEnergies

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment