|

市場調查報告書

商品編碼

1906929

歐洲數位電子看板市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Europe Digital Signage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

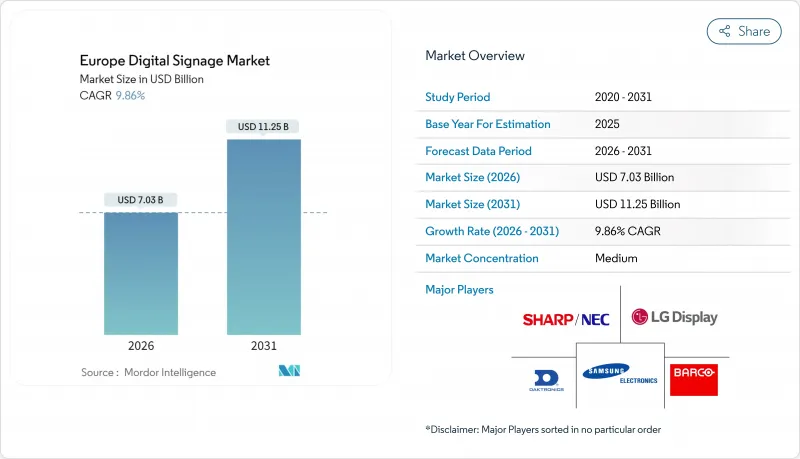

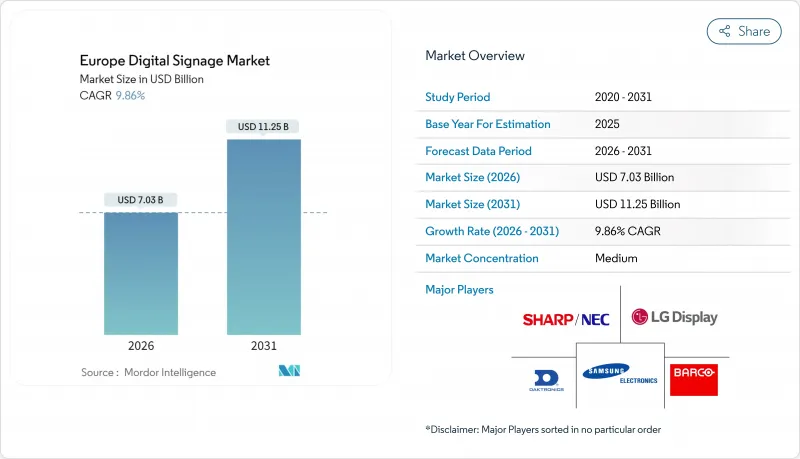

預計到 2026 年,歐洲數位電子看板市場規模將達到 70.3 億美元,從 2025 年的 64 億美元成長到 2031 年的 112.5 億美元,2026 年至 2031 年的複合年成長率為 9.86%。

零售商將電視牆升級至 4K 和 8K 解析度、交通部門將乘客資訊系統數位化以及程式化數位戶外廣告 (DOOH) 平台普及的小型品牌自動化購買,共同推動了成長。歐洲數位電子看板市場受益於歐盟生態設計法規,該法規旨在減少一次性印刷媒體的使用,並鼓勵使用節能顯示器。硬體供應商正積極響應,推出低功耗微型 LED 和覆晶顯示螢幕,軟體供應商則將人工智慧融入其中,以實現近乎即時的內容個性化。同時,STRATACACHE、ZetaDisplay 和 Vertiseit 等公司的合併正在重組供應鏈結構,並創建覆蓋整個歐洲大陸的服務網路,從而能夠支援複雜的跨國部署。

歐洲數位電子看板市場趨勢與洞察

數位戶外廣告支出穩定成長

隨著廣告主將預算從靜態海報轉向能夠根據天氣和人群移動等條件觸發因素做出響應的數據驅動型螢幕,程式化戶外數位廣告 (DOOH) 的佔有率正在迅速成長。 Clear Channel累計,到 2024 年,北歐地區的營收將達到 6.62 億美元,其中一半已經來自數位面板。此外,與循環廣告銷售相比,程序化交易的 CPM 溢價已達到 30% 至 300%。北歐國家是該領先指標,因為其智慧型手機的高普及率和開放的數據政策促進了即時競價。不斷成長的媒體收入正在為更多螢幕的部署資金籌措,從而加強了支撐歐洲數位電子看板市場的反饋循環。

承包解決方案的演變

企業越來越傾向於選擇整合顯示器、媒體播放機、內容管理、分析和本地服務的單一供應商合約。三星的VXT雲端內容管理系統(CMS)託管於法蘭克福,並通過了GDPR合規認證,這是一個降低複雜性並確保資料主權的整合解決方案的提案。 LG與BrightSign的合作將系統晶片媒體播放機直接嵌入專業面板,無需笨重的外部硬體。承包模式縮短了引進週期,對於正在從紙質時刻表過渡到動態顯示器的機場和鐵路營運商而言,這是一個決定性因素。整合商和終端客戶之間的風險共擔也降低了全生命週期成本,從而鼓勵中型企業進入歐洲數位電子看板產業。

客戶隱私問題

GDPR 對臉部辨識、人口統計分析和影像分析施加了嚴格的同意規則,迫使企業即時匿名化資料或完全避免資料收集。零售商若部署攝影機進行受眾測量,則必須張貼醒目的通知並提供退出機制,這增加了其資本和法律成本。儘管人工智慧驅動的定向技術已被證明能夠有效提升用戶參與度,但這些強制規定正在減緩其普及速度,並限制歐洲數位電子看板市場近期的商機。

細分市場分析

到2025年,硬體將佔據歐洲數位電子看板市場65.78%的佔有率,凸顯了螢幕基礎設施的資本密集特性。 LCD和LED面板主導訂單,例如伊麗莎白線等交通計劃就採用了55英寸、700尼特亮度的面板,用於多語言乘客提示。 OLED顯示器在高階精品店中越來越受歡迎,其深邃的黑色和寬廣的可視角度使其較高的價格物有所值。同時,MicroLED已從原型階段進入小批量生產階段,預示著它未來將取代拼接式LED。媒體播放機正朝著基於ARM架構、無風扇設計的方向發展,能夠全天候運作,這進一步鞏固了硬體作為歐洲數位電子看板市場基礎的地位。

隨著廣告商轉向程式化競標和人工智慧驅動的創新最佳化,預計到2031年,軟體產業將以10.88%的複合年成長率成長。開放API實現了自助服務終端、行動應用程式和網路商店之間的跨平台整合,從而打造全通路體驗。正如Navori Labs的收購案例所示,針對內容管理系統(CMS)供應商的投資表明,經常性授權收入超過了一次性硬體利潤。服務提供從設計、安裝到營運管理的完整解決方案,既能幫助供應商抵禦硬體價格下跌的風險,也能滿足企業對承包工程的需求。

在身臨其境型故事敘述和動態定價的驅動下,到2025年,零售業將佔據歐洲數位電子看板市場35.62%的佔有率。服飾連鎖店正在利用店內LED顯示器上的3D產品渲染圖,以強化社群媒體趨勢並提升即時。雜貨店則採用與會員資料庫連結的電子貨架標籤,以提供個人化優惠。這些創新使實體店在電商時代保持競爭力,而歐洲數位電子看板市場仍是全通路策略的核心支柱。

到2031年,交通運輸計劃將成為成長最快的領域,複合年成長率將達到10.95%。例如,法蘭克福機場正在出發大廳安裝多功能顯示螢幕,用於交替顯示航班資訊和與乘客人口統計相關的程式化廣告。鐵路營運商正在月台上安裝耐環境的2.5毫米像素LED燈帶,以提供即時服務資訊。這些投資正在透過廣告空間促進收入來源多元化,也印證了歐洲數位電子看板市場對基礎設施所有者的巨大吸引力。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 數位戶外廣告支出穩定成長

- 承包解決方案的演變

- 零售業對4K/8K電視牆的需求

- 透過POS系統整合實現動態定價

- 根據歐盟生態設計法規進行印刷品更換

- 小型企業的程式化數位戶外廣告接入

- 市場限制

- 客戶隱私問題

- 大型網路中的高額資本支出(CAPEX)和營運費用(OPEX)

- CMS相容性片段化

- 半導體供應波動

- 產業供應鏈分析

- 監管環境

- 宏觀經濟因素的影響

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 硬體

- LCD/LED顯示器

- OLED顯示器

- 媒體播放機

- 投影機/螢幕

- 其他硬體

- 軟體

- 服務

- 硬體

- 按最終用戶行業分類

- 零售

- 運輸

- 飯店業

- 對於企業

- 教育

- 政府機構

- 其他終端用戶產業

- 透過分銷管道

- 直接的

- 系統整合商

- 透過使用

- 室內數位電子看板

- 戶外數位電子看板

- 互動式數位電子看板

- 電視牆

- 數位海報/資訊亭

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Samsung Electronics Co. Ltd(Display Solutions)

- LG Display Co. Ltd

- Sharp NEC Display Solutions Ltd

- Barco NV

- Daktronics Inc.

- Leyard Europe Srl

- Innolux Corp.

- Sony Group Corp.

- Planar Systems Inc.

- BrightSign LLC

- Stratacache Inc.(Scala)

- ZetaDisplay AB

- Broadsign International LLC

- Mvix(USA)Inc.

- Unilumin Group Co. Ltd

- Absen Optoelectronic Co. Ltd

- AOPEN Inc.

- 22Miles Inc.

- Navori Labs SA

- FocusNeo AB

第7章 市場機會與未來展望

Europe digital signage market size in 2026 is estimated at USD 7.03 billion, growing from 2025 value of USD 6.4 billion with 2031 projections showing USD 11.25 billion, growing at 9.86% CAGR over 2026-2031.

Growth accelerates as retailers upgrade video walls to 4K and 8K resolution, transportation authorities digitize passenger information systems, and programmatic digital-out-of-home (DOOH) platforms democratize automated buying for small and mid-sized brands. The Europe digital signage market benefits from EU eco-design rules that discourage single-use print media and incentivize energy-efficient displays. Hardware vendors respond with lower-power microLED and flip-chip displays, while software providers embed AI to personalize content in near real time. At the same time, mergers involving STRATACACHE, ZetaDisplay, Vertiseit, and others are reshaping supply dynamics and creating continental service networks able to support complex, multi-country deployments.

Europe Digital Signage Market Trends and Insights

Steady increase in DOOH ad spend

Programmatic DOOH is gaining share rapidly as advertisers migrate budgets from static posters to data-driven screens that support conditional triggers such as weather or audience movement. Clear Channel generated USD 662 million across Northern Europe in 2024, half of which already came from digital panels, while CPM premiums on programmatic transactions reached 30%-300% over loop-based sales. The Nordic cluster acts as a bellwether because its high smartphone penetration and open data policies foster real-time bidding environments. Higher media yields finance additional screen rollouts, reinforcing a feedback loop that underpins the Europe digital signage market.

Evolution of turnkey solutions

Enterprises increasingly favor single-vendor contracts that bundle displays, media players, content management, analytics, and on-site services. Samsung's VXT cloud CMS, hosted in Frankfurt and certified for GDPR compliance, illustrates how vendors position integrated offers that reduce complexity and ensure data sovereignty. LG's collaboration with BrightSign packages system-on-chip media players directly inside professional panels, eliminating bulky external hardware. Turnkey models shorten deployment cycles, a decisive factor for airports and rail operators migrating from paper timetables to dynamic displays. They also lower lifetime costs by sharing risk between integrators and end clients, encouraging mid-sized enterprises to join the Europe digital signage industry.

Concerns over customer privacy

GDPR imposes strict consent rules on facial recognition, demographic analytics, and video analytics, forcing operators to anonymize data immediately or avoid collection altogether. Retailers that deploy cameras for audience metrics must install visible notices and offer opt-out mechanisms, adding capital and legal costs. These obligations slow the rollout of AI-driven targeting despite proven engagement benefits, dampening near-term revenue opportunities for the Europe digital signage market.

Other drivers and restraints analyzed in the detailed report include:

- Retail demand for 4K / 8K video walls

- Dynamic pricing via POS integration

- High CAPEX and OPEX of large networks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware accounted for 65.78% of Europe digital signage market share in 2025, underscoring the capital intensity of screen infrastructure. LCD and LED panels dominate orders, with transportation projects such as the Elizabeth line adopting 55-inch, 700-nit boards for multi-lingual passenger alerts. OLED displays gain favor in premium boutiques where deep blacks and wide angles justify higher pricing, while microLED moves from prototype to limited production and signals future displacement of tiled LED. Media players transition to ARM-based, fanless designs that withstand 24/7 cycles, further reinforcing hardware as the bedrock of the Europe digital signage market.

Software is poised for an 10.88% CAGR through 2031 as advertisers pivot to programmatic bidding and AI-driven creative optimization. Open APIs enable cross-platform orchestration of kiosks, mobile apps, and web storefronts, creating omnichannel journeys. Investment vehicles targeting CMS suppliers, as seen in the Navori Labs sale, reveal confidence that recurring license income will outpace one-off hardware margins. Services round out solutions through design, installation, and managed operations, offering vendors a hedge against hardware price compression while meeting enterprise demand for turnkey contracts.

Retail commanded 35.62% of Europe digital signage market in 2025, driven by immersive storytelling and dynamic price labeling. Apparel chains use 3D product renders on in-store LED portals to amplify social media trends and drive immediacy. Grocery stores adopt electronic shelf labels that synchronize with loyalty databases to push individualized offers. These innovations keep physical outlets relevant in an e-commerce era and sustain the Europe digital signage market as a core pillar of omnichannel strategies.

Transportation projects are expanding at an 10.95% CAGR, making them the fastest-growing vertical through 2031. Airports like Frankfurt retrofit departure halls with dual-purpose displays that alternate between flight data and programmatic ads linked to passenger demographic data. Rail operators deploy ruggedized 2.5-millimeter-pixel LED ribbons along platforms for real-time service alerts. Such investments diversify revenue streams via advertising concessions, reinforcing the Europe digital signage market's appeal to infrastructure owners.

The Europe Digital Signage Market Report is Segmented by Type (Hardware, Software, and Services), End-User Vertical (Retail, Transportation, Hospitality, Corporate, and More), Distribution Channel (Direct and System Integrators), and Application (Indoor Digital Signage, Outdoor Digital Signage, Interactive Digital Signage, Video Walls, and Digital Posters/Kiosks). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Samsung Electronics Co. Ltd (Display Solutions)

- LG Display Co. Ltd

- Sharp NEC Display Solutions Ltd

- Barco NV

- Daktronics Inc.

- Leyard Europe Srl

- Innolux Corp.

- Sony Group Corp.

- Planar Systems Inc.

- BrightSign LLC

- Stratacache Inc. (Scala)

- ZetaDisplay AB

- Broadsign International LLC

- Mvix (USA) Inc.

- Unilumin Group Co. Ltd

- Absen Optoelectronic Co. Ltd

- AOPEN Inc.

- 22Miles Inc.

- Navori Labs SA

- FocusNeo AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Steady increase in DOOH ad spend

- 4.2.2 Evolution of turnkey solutions

- 4.2.3 Retail demand for 4K/8K video walls

- 4.2.4 Dynamic pricing via POS integration

- 4.2.5 EU eco-design rules replacing print media

- 4.2.6 Programmatic DOOH access for SMBs

- 4.3 Market Restraints

- 4.3.1 Concerns over customer privacy

- 4.3.2 High CAPEX and OPEX of large networks

- 4.3.3 CMS compatibility fragmentation

- 4.3.4 Semiconductor supply volatility

- 4.4 Industry Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Impact of Macroeconomic Factors

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Hardware

- 5.1.1.1 LCD / LED Displays

- 5.1.1.2 OLED Displays

- 5.1.1.3 Media Players

- 5.1.1.4 Projectors / Screens

- 5.1.1.5 Other Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.1.1 Hardware

- 5.2 By End-User Vertical

- 5.2.1 Retail

- 5.2.2 Transportation

- 5.2.3 Hospitality

- 5.2.4 Corporate

- 5.2.5 Education

- 5.2.6 Government

- 5.2.7 Other End-User Verticals

- 5.3 By Distribution Channel

- 5.3.1 Direct

- 5.3.2 System Integrators

- 5.4 By Application

- 5.4.1 Indoor Digital Signage

- 5.4.2 Outdoor Digital Signage

- 5.4.3 Interactive Digital Signage

- 5.4.4 Video Walls

- 5.4.5 Digital Posters / Kiosks

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Samsung Electronics Co. Ltd (Display Solutions)

- 6.4.2 LG Display Co. Ltd

- 6.4.3 Sharp NEC Display Solutions Ltd

- 6.4.4 Barco NV

- 6.4.5 Daktronics Inc.

- 6.4.6 Leyard Europe Srl

- 6.4.7 Innolux Corp.

- 6.4.8 Sony Group Corp.

- 6.4.9 Planar Systems Inc.

- 6.4.10 BrightSign LLC

- 6.4.11 Stratacache Inc. (Scala)

- 6.4.12 ZetaDisplay AB

- 6.4.13 Broadsign International LLC

- 6.4.14 Mvix (USA) Inc.

- 6.4.15 Unilumin Group Co. Ltd

- 6.4.16 Absen Optoelectronic Co. Ltd

- 6.4.17 AOPEN Inc.

- 6.4.18 22Miles Inc.

- 6.4.19 Navori Labs SA

- 6.4.20 FocusNeo AB

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment