|

市場調查報告書

商品編碼

1906926

遊戲化:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Gamification - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

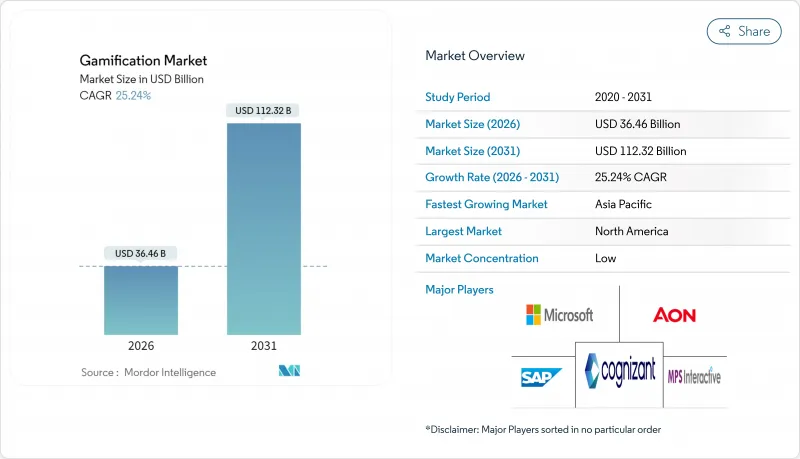

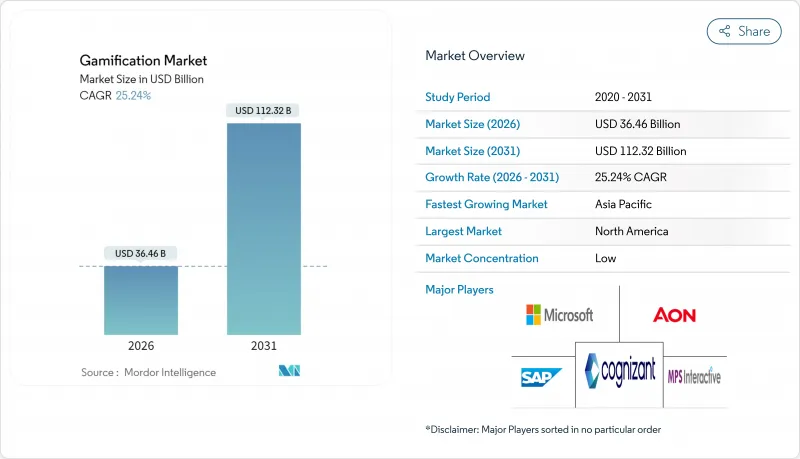

2025 年遊戲化市場價值 291.1 億美元,預計從 2026 年的 364.6 億美元成長到 2031 年的 1123.2 億美元,在預測期(2026-2031 年)內複合年成長率為 25.24%。

基於雲端的部署已佔據大部分支出,並透過為分散式團隊提供即時分析,為當前的業務擴張提供了強力的支援。雖然大型企業仍然佔據大部分收入,但隨著低程式碼平台實施成本的下降,中小企業 (SME) 的成長速度正在加快。零售業的忠誠度計畫是最大的應用領域,而員工計劃,尤其是微學習計劃,則獲得了最快的普及。從區域來看,北美保持主導地位,但亞太地區以行動優先的商業文化正將重心轉移到新興數位經濟體。競爭依然激烈,成熟的軟體供應商和專業的Start-Ups在爭奪受監管行業中尚未開發的市場機會。

全球遊戲化市場趨勢與洞察

雲端優先的數位化工作場所採用率激增

企業加速雲端遷移需要能夠原生支援混合團隊協作的互動工具。 Microsoft Power Apps 將遊戲機制直接嵌入工作流程,將採用時間從數月縮短至數週。雲端託管平台預計將以 27.58% 的複合年成長率成長,因為它們能夠統一資料流並向任何裝置提供即時排行榜。將遊戲化與現有雲端基礎設施整合的組織報告稱,在遠端辦公環境中,生產力提升高達 90%。訂閱授權的成本優勢進一步加速了雲端原生應用程式的普及。隨著 IT 部門精簡本地資產,雲端原生供應商獲得了結構性優勢,這一趨勢在預測期內不太可能逆轉。

低程式碼遊戲化平台的興起

拖放式開發使互動體驗的設計更加大眾化。 SAP Build 讓非專業開發者無需編寫程式碼即可將挑戰、徽章和獎勵嵌入核心業務流程,與客製化計劃相比,開發成本降低了 70%。這種更高的可近性將目標市場擴展到了缺乏技術資源的中小型企業。平台供應商報告稱,專門用於銷售競賽和新用戶入職任務的模板數量激增,這表明這些模板在商業領域日益普及。低程式碼技術堆疊還可以縮短價值驗證週期,這對中小企業來說是一個重要的採購障礙,因為它們可以直接連接到 SaaS 生態系統。客製化開發的結構性下降與中小企業領域 28.67% 的複合年成長率相符。

設計不良的項目會產生負投資報酬率。

粗放式的推廣和敷衍了事的認證會疏遠員工並浪費預算。 Versus Systems 的採用率從 2023 年的 16 家驟降至 5 家。此案例研究凸顯了人們對膚淺推廣的抵觸情緒,而這種推廣不足導致用戶興趣無法持續。如今,企業在核准新計畫之前,需要以業務成果指標(例如收入成長和錯誤率降低)為基礎。這種嚴格的審查延長了銷售週期,並迫使供應商提供更多諮詢支援。早期採用者的錯誤會讓後進企業心存疑慮,進而限制短期支出。忽視教學設計和行為科學的供應商將面臨聲譽風險,這種風險可能會波及整個遊戲化市場。

細分市場分析

預計到2025年,雲端解決方案將佔遊戲化市場收入的67.62%,並將在2031年之前以26.91%的複合年成長率進一步擴大其市場佔有率。即時遙測、無縫更新和彈性儲存是雲端解決方案備受青睞的原因,而成熟的安全認證甚至正在影響一些較保守的行業。雖然在資料主權至關重要的領域,本地部署方案仍然非常重要,但IT預算的縮減和網路保險費用的增加正使託管服務在成本效益方面更具優勢。

透過持續交付管道實現的快速迭代周期,使雲端供應商能夠微調交付演算法並進行 A/B 測試,而無需客戶端打補丁。當高階分析即時提案個人化挑戰時,企業報告生產力提高了 37%。混合部署是一種過渡方案,允許敏感資料保留在本地,而交互邏輯則駐留在雲端。在預測期內,遷移到公共雲端基礎設施有望實現整合模式的標準化,降低整體擁有成本並整合供應商資源。

大型企業將佔2025年收入的57.02%,反映出它們雄厚的預算和複雜的整合需求。同時,中小企業是遊戲化市場成長最快的細分市場,年複合成長率高達27.65%。免費增值模式、範本庫和收費付費架構降低了中小企業的進入門檻。

中小企業通常會部署這些工具來解決特定問題,例如激勵銷售團隊或培訓季節性員工,並可在幾週內展現投資報酬率。新加坡等市場的政府數位化津貼透過補貼訂閱費用進一步推動了這些工具的普及。隨著雲端平台以大眾市場價格提供企業級身分管理功能,功能差距正在縮小。因此,中階市場負責人越來越需要符合 SOC 2 標準和單一登入功能,迫使供應商在保持價格彈性的同時加快安全藍圖的開發。

區域分析

北美地區將占到2025年總收入的38.74%,這得益於SaaS的早期普及和完善的供應商生態系統。隨著企業優先考慮與人力資源資訊系統(HRIS)和客戶關係管理(CRM)套件的整合,快速的功能推出正在推動市場佔有率的成長。聯邦政府無障礙訴訟的風險促使平台投資於符合WCAG標準的設計,從而提高了所有供應商的品質標準。

亞太地區以28.6%的複合年成長率領先,這主要得益於行動優先的工作模式和政府主導的數位技能培訓計畫。新加坡在公共服務領域所推行的遊戲化措施已取得顯著成效,並鼓勵私部門效法。泰國正在嘗試利用遊戲化獎勵來推廣其央行數位貨幣(CBDC),這表明泰國在政策層面給予了支持。企業正受益於提供針對低延遲5G網路最佳化的輕量級應用程式,加速了印度和印尼等人口稠密市場的普及。

儘管歐洲的隱私法規十分嚴格,但市場需求依然穩定。 GDPR 的強制要求正在推動差分隱私分析領域的創新,以實現薪資資料的匿名化。擁有內部法律團隊的供應商在為受 MiFID-II 約束的金融機構客製化同意流程方面具有優勢。雖然南美和中東及非洲地區的市場規模相對落後,但智慧型手機普及率的不斷提高使雲端託管的行動原生解決方案成為首選。在這些新興地區,語言和文化在地化仍然是影響轉換率的關鍵因素。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 市場促進因素

- 雲端優先的數位化工作場所採用率激增

- 低程式碼遊戲化平台的興起

- 零售業日益激烈的忠誠度之爭以及積分徽章系統的引入

- 針對第一線員工的智慧型手機微學習培訓

- 保護隱私的互動分析

- 中央銀行的遊戲化央行數位貨幣試點項目

- 市場限制

- 設計不良的項目會帶來負投資收益。

- 平台間的資料所有權糾紛

- 特定產業合規性中的反賭博條款(HIPAA、MiFID-II)

- 因遊戲機制不包容而引發的無障礙訴訟

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業生態系分析

- 主要用例和案例研究

- 宏觀經濟趨勢評估

- 投資分析

第5章 市場規模與成長預測

- 透過部署

- 本地部署

- 雲

- 按組織規模

- 主要企業

- 中小企業

- 按行業

- 零售

- BFSI

- 政府

- 衛生保健

- 教育與研究

- 資訊科技和電信

- 其他

- 透過使用

- 行銷與銷售

- 人員和培訓

- 產品開發與創新

- 客戶支援與客戶經驗

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 荷蘭

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 新加坡

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Microsoft Corporation

- SAP SE

- Cognizant Technology Solutions Corp.

- Axonify Inc.

- Aon plc(incl. Aon Assessment)

- Bunchball Inc.

- Salesforce Inc.(incl. Trailhead)

- Cisco Systems Inc.

- LevelEleven LLC

- Badgeville Inc.

- Genesys Cloud Services Inc.

- Callidus Software Inc.(SAP Litmos)

- Ambition Solutions Inc.

- MPS Interactive Systems Ltd.

- IACTIONABLE Inc.

- G-Cube Solutions

- Gamifier Inc.

- BI Worldwide

- Kahoot!ASA

- Classcraft Studios Inc.

第7章 市場機會與未來展望

The gamification market was valued at USD 29.11 billion in 2025 and estimated to grow from USD 36.46 billion in 2026 to reach USD 112.32 billion by 2031, at a CAGR of 25.24% during the forecast period (2026-2031).

Cloud-based deployments already capture the majority of spend and, by delivering real-time analytics across distributed teams, underpin much of the current expansion. Large enterprises still account for the bulk of revenue, yet small and medium enterprises (SMEs) are scaling faster as low-code platforms lower adoption costs. Retail loyalty schemes remain the single-largest application, but employee-centric programs-particularly micro-learning initiatives-are recording the strongest uptake. Regionally, North America holds the lead, although Asia-Pacific's mobile-first business culture is shifting the center of gravity toward emerging digital economies. Competitive intensity stays high because established software vendors and specialist start-ups target the same white-space opportunities in regulated verticals.

Global Gamification Market Trends and Insights

Surge in Cloud-First Digital-Workplace Roll-Outs

Enterprises accelerating cloud migration need engagement tools that function natively across hybrid teams. Microsoft Power Apps embeds game mechanics directly into workflows, cutting rollout times from months to weeks . Cloud-hosted platforms generate the 27.58% CAGR forecast because they consolidate data streams and push real-time leaderboards to any device. Organizations integrating gamification with existing cloud infrastructure report up to 90% productivity improvement in remote work settings. The cost advantages of subscription licensing further accelerate adoption. As IT departments rationalize on-premise assets, cloud-native vendors gain a structural advantage that is unlikely to reverse over the outlook period.

Proliferation of Low-Code Gamification Platforms

Drag-and-drop development is democratizing the design of engagement experiences. SAP Build allows citizen developers to insert challenges, badges, and rewards into core business processes without writing code, trimming development spend by 70% against bespoke projects. The accessibility expands the total addressable base beyond large enterprises to SMEs that lacked technical resources. Platform vendors report a surge in templates focused on sales contests and onboarding missions, indicating mainstream business adoption. Because low-code stacks connect directly to SaaS ecosystems, they also shorten proof-of-value cycles, a key procurement hurdle for smaller firms. The structural decline in custom development aligns with the segment's 28.67% SME CAGR.

Poorly-Designed Programs Deliver Negative ROI

Superficial point-and-badge deployments risk disengagement and budget waste. Versus Systems' client roster fell from 16 to 5 in 2023 after lackluster implementations failed to sustain user interest, exemplifying backlash against gimmicky rollouts. Enterprises now demand business-outcome metrics, such as sales lift or error-rate reduction, before green-lighting new projects. This scrutiny lengthens sales cycles and forces vendors to provide stronger consultative support. Implementation missteps in early-adopter sectors also create caution among laggards, dampening near-term spend. Vendors that neglect instructional design and behavioral science risk reputational damage that can reverberate across the wider gamification market.

Other drivers and restraints analyzed in the detailed report include:

- Retail Loyalty Wars Escalating Points and Badges Adoption

- Smartphone-Centric Micro-Learning for Frontline Workforces

- Antigaming Clauses in Sector-Specific Compliance (HIPAA, MiFID-II)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud solutions accounted for 67.62% of 2025 revenue, and their share of the gamification market size is projected to climb further, given a 26.91% CAGR to 2031. Real-time telemetry, seamless updates, and elastic storage underpin the preference, while maturing security certifications sway even conservative sectors. On-premise packages remain relevant where data sovereignty is paramount, yet shrinking IT budgets and rising cyber-insurance premiums tilt cost-benefit equations toward managed hosting.

Rapid iteration cycles, achieved through continuous delivery pipelines, let cloud vendors fine-tune achievement algorithms and A/B-test narratives without client-side patches. Enterprises report 37% productivity gains when advanced analytics recommend personalized challenges in real time. Hybrid rollouts serve as a transitional choice, allowing sensitive data to stay on site while engagement logic resides in the cloud. Over the forecast, migration to public-cloud stacks is expected to standardize integration patterns, reducing total cost of ownership and consolidating vendor footprints.

Large enterprises contributed 57.02% to 2025 revenue, reflecting deep budgets and complex integration needs. In contrast, SMEs represent the fastest-growing slice of the gamification market, expanding at 27.65% CAGR. Freemium pricing, template libraries, and pay-as-you-grow architectures lower entry barriers for smaller firms.

SMEs typically target narrow pain points-motivating a sales pod or onboarding seasonal staff-allowing them to demonstrate ROI within weeks. Government digitalization grants in markets such as Singapore further stimulate uptake by offsetting subscription fees. Feature parity is narrowing because cloud platforms offer enterprise-grade identity management at mass-market price tiers. As a result, mid-market buyers increasingly insist on SOC 2 compliance and single-sign-on, forcing vendors to harden security roadmaps while keeping price elasticity.

Gamification Market Report is Segmented by Deployment (On-Premise, and Cloud), Organization Size (Small and Medium Enterprises, and Large Enterprises), Industry Vertical (Retail, BFSI, Government, Healthcare, and More), Application (Marketing and Sales, HR and Training, Product Development and Innovation, Customer Support and Experience, and Others), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38.74% of 2025 revenue, benefitting from early SaaS adoption and a deep vendor ecosystem. Corporations prioritize integrations with HRIS and CRM suites, leading to rapid feature rollouts that drive wallet share. Federal accessibility litigation risk motivates platforms to invest in WCAG-compliant design, raising quality thresholds for all suppliers.

Asia-Pacific records the highest regional CAGR at 28.6%, powered by mobile-first working patterns and government-sponsored digital-skills programs. Singapore's public-service gamification initiatives validate efficacy and encourage private-sector replication. Thailand's digital-wallet scheme experiments with gamified Central Bank Digital Currency incentives, signaling policy-level endorsement. Companies capitalize by shipping lightweight applications optimized for low-latency 5G networks, accelerating uptake in populous markets such as India and Indonesia.

Europe shows steady demand despite stringent privacy rules. GDPR obligations spur innovation in differential-privacy analytics that anonymize reward data. Vendors with in-house legal teams gain an edge when customizing consent flows for financial institutions subject to MiFID-II. South America and the Middle East and Africa trail in absolute dollars but benefit from growing smartphone penetration, making cloud-hosted, mobile-native solutions the default choice. Localization-both linguistic and cultural-remains a decisive factor in conversion rates across these emerging territories.

- Microsoft Corporation

- SAP SE

- Cognizant Technology Solutions Corp.

- Axonify Inc.

- Aon plc (incl. Aon Assessment)

- Bunchball Inc.

- Salesforce Inc. (incl. Trailhead)

- Cisco Systems Inc.

- LevelEleven LLC

- Badgeville Inc.

- Genesys Cloud Services Inc.

- Callidus Software Inc. (SAP Litmos)

- Ambition Solutions Inc.

- MPS Interactive Systems Ltd.

- IACTIONABLE Inc.

- G-Cube Solutions

- Gamifier Inc.

- BI Worldwide

- Kahoot! ASA

- Classcraft Studios Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in cloud-first digital-workplace roll-outs

- 4.2.2 Proliferation of low-code gamification platforms

- 4.2.3 Retail loyalty wars escalating points and badges adoption

- 4.2.4 Smartphone-centric micro-learning for frontline workforces

- 4.2.5 Privacy-preserving engagement analytics

- 4.2.6 Gamified CBDC pilots by central banks

- 4.3 Market Restraints

- 4.3.1 Poorly-designed programs deliver negative ROI

- 4.3.2 Inter-platform data-ownership disputes

- 4.3.3 Antigaming clauses in sector-specific compliance (HIPAA, MiFID-II)

- 4.3.4 Accessibility lawsuits on non-inclusive game mechanics

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Ecosystem Analysis

- 4.9 Key Use Cases and Case Studies

- 4.10 Assessment of Macroeconomic Trends

- 4.11 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-Premise

- 5.1.2 Cloud

- 5.2 By Organization Size

- 5.2.1 Large Enterprises

- 5.2.2 Small and Medium Enterprises (SMEs)

- 5.3 By Industry Vertical

- 5.3.1 Retail

- 5.3.2 BFSI

- 5.3.3 Government

- 5.3.4 Healthcare

- 5.3.5 Education and Research

- 5.3.6 IT and Telecom

- 5.3.7 Others

- 5.4 By Application

- 5.4.1 Marketing and Sales

- 5.4.2 HR and Training

- 5.4.3 Product Development and Innovation

- 5.4.4 Customer Support and Experience

- 5.4.5 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Netherlands

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Singapore

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Microsoft Corporation

- 6.4.2 SAP SE

- 6.4.3 Cognizant Technology Solutions Corp.

- 6.4.4 Axonify Inc.

- 6.4.5 Aon plc (incl. Aon Assessment)

- 6.4.6 Bunchball Inc.

- 6.4.7 Salesforce Inc. (incl. Trailhead)

- 6.4.8 Cisco Systems Inc.

- 6.4.9 LevelEleven LLC

- 6.4.10 Badgeville Inc.

- 6.4.11 Genesys Cloud Services Inc.

- 6.4.12 Callidus Software Inc. (SAP Litmos)

- 6.4.13 Ambition Solutions Inc.

- 6.4.14 MPS Interactive Systems Ltd.

- 6.4.15 IACTIONABLE Inc.

- 6.4.16 G-Cube Solutions

- 6.4.17 Gamifier Inc.

- 6.4.18 BI Worldwide

- 6.4.19 Kahoot! ASA

- 6.4.20 Classcraft Studios Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment