|

市場調查報告書

商品編碼

1906915

再生包裝解決方案:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031 年)Recycled Materials Packaging Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

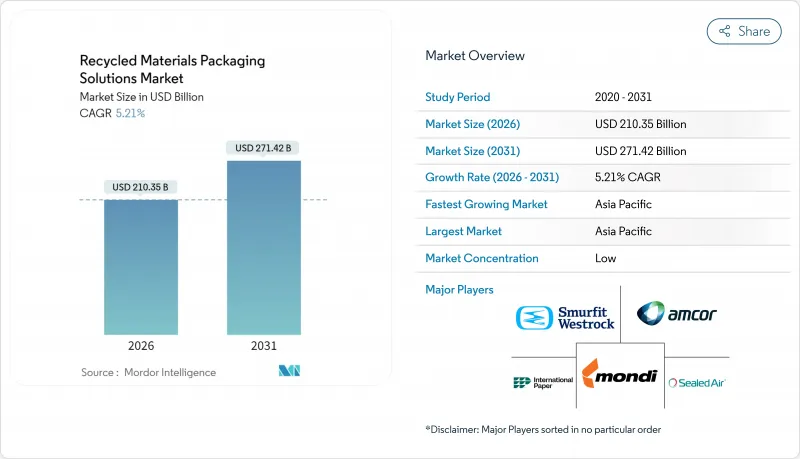

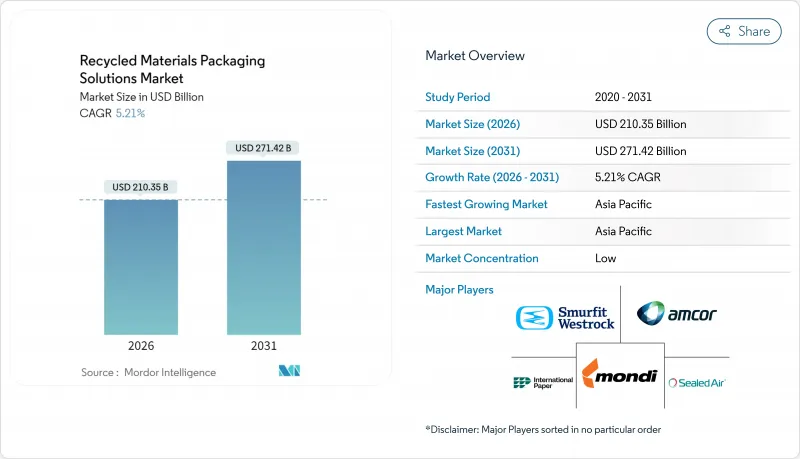

預計到 2026 年,再生材料包裝解決方案市場規模將達到 2,103.5 億美元,從 2025 年的 1999.3 億美元成長到 2031 年的 2714.2 億美元,2026 年至 2031 年的年複合成長率(CAGR)為 5.21%。

不斷擴大的生產者延伸責任制 (EPR) 要求、品牌所有者對再生材料含量的目標以及對人工智慧 (AI) 分揀技術的投資,正在推動再生包裝解決方案市場的持續成長。亞太地區憑藉著不斷完善的法規和大規模的基礎設施計劃,已獲得先發優勢;而北美和歐洲則透過化學回收和垂直整合的原料採購來提升產能。消費者願意為低碳包裝支付溢價,這支撐著市場發展,並縮小了再生材料與原生材料之間的成本差距。同時,諸如基於解決方案的回收和單一材料軟包裝袋等供應側創新,正在縮小再生材料解決方案與現有原生材料解決方案之間的性能差距。

全球再生包裝解決方案市場趨勢與洞察

擴大生產者延伸責任制(EPR)體系

生產者責任延伸制度(EPR)將廢棄物處理成本從市政當局轉移到生產商,使使用再生材料在經濟上更具吸引力。越南2024年的法規要求硬質寶特瓶含有22%的再生材料和40%的材料回收率,鼓勵了設備的快速升級。韓國正在將寶特瓶再生塑膠的含量從3%提高到10%,目標是到2030年達到30%。泰國的「無標定PET」舉措正在減少污染,並探索對再生樹脂的稅額扣抵抵免。歐盟的《包裝和包裝廢棄物條例》規定,到2030年,食品包裝中必須含有30%的再生PET。印度現在允許在食品包裝中使用某些再生塑膠,並要求可追溯性標籤標註。

品牌擁有者2025年再生材料含量目標

全球品牌正在自願超越監管要求:雅詩蘭黛的目標是到 2030 年使用至少 25% 的再生塑膠 (PCR),並將原生塑膠的使用量減半;瑪氏公司已將其主要糖果甜點罐更換為 100% 再生樹脂,每年減少 1300 噸原生塑膠的使用;億滋國際將使用 80% 可識別的可識別塑膠包裝 33 可識別的國際化;億條吉百利分享裝巧克力;吉百利澳洲公司已為其牛奶巧克力棒採購了 1000 噸化學回收聚丙烯。

優質再生原料供應不穩定

再生PET和高密度聚苯乙烯的價格波動很大,為加工商的預算帶來了挑戰。飲料品牌最近發現,食品級再生PET(rPET)的交貨週期長達六到八週,而原生塑膠替代品只需三週即可到貨。由於受到污染,15%到25%的回收塑膠未能通過食品級檢測,導致一些品牌無法達到其再生塑膠含量承諾。這種價格波動對於阻隔材料而言特別顯著,因為這類材料需要特殊等級的再生PET。

細分市場分析

截至2025年,紙張將佔再生包裝解決方案市場44.25%的佔有率,這反映出北美地區纖維回收系統的成熟以及紙板回收率超過90%。預計到2031年,塑膠將以6.03%的複合年成長率成長,這主要得益於化學回收提高了食品級塑膠的品質以及新應用領域的開發。玻璃在高階飲料和化妝品領域的需求仍然旺盛,這些領域的品牌價值強調豐富的觸感。金屬具有無限的可再生,吸引了閉合迴路買家,並在氣霧劑、飲料和化妝品包裝領域鞏固了其地位,儘管目前市場佔有率不大。

儘管在全球電子商務的推動下,紙張市場持續穩定成長,但塑膠市場也蘊藏著巨大的未來成長潛力。超過80億美元的投資正在加速化學回收利用,以填補食品級再生PET(rPET)的短缺。例如,伊士曼公司的Gemini Compact等產品,利用分子回收樹脂,推動了塑膠在化妝品領域的應用。因此,預計再生包裝解決方案市場將逐漸實現紙本和塑膠解決方案之間的材料組合整合。

到2025年,食品應用將佔總需求的36.20%,但監管安全標準限制了其成長。印度最近批准在食品包裝中使用某些可回收塑膠,並要求嚴格的可追溯性,這在一定程度上緩解了障礙。百事可樂等飲料品牌已推出由50%再生聚丙烯製成的零食包裝,顯示在性能可接受的領域,再生塑膠的應用正在增加。

由於消費者越來越重視低碳產品,家居及個人護理用品市場預計將以6.58%的複合年成長率成長。波爾公司對Meadow的投資以及推出的可完全回收的鋁製肥皂和洗髮精包裝盒表明,各大品牌已準備好快速更換包裝材料。隨著回收網路的日趨成熟,電子商務和工業包裝等二次產業也開始更多地採用消費後回收材料,從而擴大了再生包裝解決方案的市場。

區域分析

預計到2025年,亞太地區將佔全球再生包裝解決方案市場規模的45.80%,複合年成長率達7.55%。越南的生產者責任延伸制度(EPR)目標、韓國的再生材料含量標準以及泰國的稅收優惠等監管政策的明朗化,正在促進投資流入。東南亞國協的基礎設施資金籌措正在消除回收瓶頸,並彌合長期以來阻礙供應安全的歷史遺留問題。

在北美,自2017年以來宣布的80億美元回收擴建計畫將每年新增約900萬噸廢棄物能力。奧勒岡州和科羅拉多的「生產者延伸責任制」(EPR)將於2025年7月生效,該制度將明確生產者收費標準,並鼓勵產品設計以方便回收。企業採購承諾帶來的穩定回收需求支撐了強勁的投資前景。歐洲保持其監管領域的主導地位。到2030年,PET食品包裝中再生材料含量必須達到30%的強制性要求以及「可回收設計」(Design for Recycle)標準將促進創新。諸如4evergreen和FINAT等合作平台正在分別制定紙張和標籤襯紙回收的技術指南。南美洲以及中東和非洲的溫和成長反映了再生包裝解決方案市場的逐步擴張,這得益於津貼計畫的擴展和已建立的EPR框架。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 擴大強制性生產者延伸責任制(EPR)體系

- 品牌擁有者2025年再生材料目標

- 先進的分選技術:減少污染物

- 消費者偏好低碳包裝

- 企業淨零排放目標加速PCR採購

- 化學品回收產能的投資激增

- 市場限制

- 優質再生原料供應波動

- 來自替代紡織包裝材料的競爭性需求

- 由於原生樹脂價格下跌,經濟狀況惡化

- 新興市場缺乏回收基礎設施

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素如何影響市場

第5章 市場規模與成長預測

- 依材料類型

- 塑膠

- 紙

- 玻璃

- 金屬

- 按最終用戶行業分類

- 食物

- 飲料

- 居家及個人護理

- 衛生保健

- 其他終端用戶產業

- 按包裝類型

- 硬包裝

- 軟包裝

- 按來源分類的回收材料

- 消費後回收材料(PCR)

- 工業後回收材料(PIR)

- 海洋廢棄物和回收廢棄物

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amcor plc

- Kruger Inc.

- Smurfit WestRock plc

- Packaging Corporation of America

- Tetra Laval International SA

- International Paper Company

- Mondi plc

- Verallia SA

- Sealed Air Corporation

- Ardagh Group

- Plastipak Holdings, Inc.

- Billerud AB

- Stora Enso Oyj

- UPM-Kymmene Corporation

- Huhtamaki Oyj

- Graphic Packaging Holding Company

- Veolia Environnement SA

- Eco-Products, Inc.

- Loop Industries, Inc.

- Sonoco Products Company

第7章 市場機會與未來展望

The recycled materials packaging solutions market size in 2026 is estimated at USD 210.35 billion, growing from 2025 value of USD 199.93 billion with 2031 projections showing USD 271.42 billion, growing at 5.21% CAGR over 2026-2031.

Rising Extended Producer Responsibility mandates, brand-owner recycled-content targets, and investments in artificial-intelligence sortation are collectively positioning the recycled materials packaging solutions market for sustained growth. Asia-Pacific secures early-mover advantages through evolving regulations and large-scale infrastructure projects, while North America and Europe build capacity through chemical recycling and vertically integrated feedstock procurement. Demand is reinforced by consumers willing to pay premiums for low-carbon packaging, which smooths cost differentials between recycled and virgin materials. At the same time, supply-side innovations such as dissolution-based recycling and mono-material flexible pouches are narrowing performance gaps against incumbent virgin solutions.

Global Recycled Materials Packaging Solutions Market Trends and Insights

Extended Producer Responsibility (EPR) Mandates Expansion

EPR statutes shift end-of-life costs from municipalities to producers, making recycled content economically attractive. Vietnam's 2024 rules require 22% recycling for rigid PET and 40% material recovery rates, sparking rapid equipment upgrades. South Korea is boosting the required recycled plastic in PET bottles from 3% to 10% and targets 30% by 2030. Thailand's label-free PET initiative trims contamination and considers tax credits for recycled resin. The EU Packaging and Packaging Waste Regulation mandates 30% recycled PET in food packaging by 2030. India now allows specified recycled plastics in food packaging, requiring traceability labelling.

Brand-Owner 2025 Recycled-Content Targets

Global brands are voluntarily outpacing regulation. Estee Lauder seeks at least 25% PCR and to halve virgin plastic by 2030. Mars moved key confectionery jars to 100% recycled resin, cutting 1,300 tonnes of virgin plastic each year. Mondelez will package 300 million Cadbury sharing bars in 80% attributable recycled plastic. Cadbury Australia sourced 1,000 tonnes of chemically recycled polypropylene for Dairy Milk bars.

Volatile Supply of High-Quality Recycled Feedstock

Pricing for recycled PET and high-density polyethylene swings widely, imposing budgeting challenges for converters. Beverage brands recently queued 6-8 weeks for food-grade rPET while virgin alternatives were available in 3 weeks. Contamination means 15-25% of collected plastics fail food-grade tests, forcing some brands to under-fulfill recycled-content pledges. The volatility is most acute for barrier materials that demand specialty grades.

Other drivers and restraints analyzed in the detailed report include:

- Advanced Sortation Technologies: Reducing Contamination

- Consumer Preference for Low-Carbon Packaging

- Competing Demand from Fiber-Based Substitute Packaging

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, paper commanded 44.25% of the recycled materials packaging solutions market share, reflecting mature fiber collection systems and corrugated recovery rates above 90% in North America. Plastic is projected to post a 6.03% CAGR through 2031 as chemical recycling improves food-grade quality and unlocks new applications. Glass continues serving premium beverage and cosmetic niches where brand equity values tactile heft. Metal offers infinite recyclability that attracts closed-loop purchasers, buttressing its role in aerosol, beverage, and cosmetics packaging even when volumes remain modest.

Paper maintains steady growth due to global e-commerce, but plastics claim future upside. Investment topping USD 8 billion accelerates chemical recycling to offset the shortfall in food-grade rPET. Examples such as Eastman's Gemini compact underscore plastics' progress into cosmetics using molecularly recycled resins. Consequently, the recycled materials packaging solutions market expects a gradual convergence in the material mix between paper and plastic solutions.

Food applications generated 36.20% of 2025 demand, but regulatory safety thresholds constrain growth. India's new allowance of specific recycled plastics in food packaging under strict traceability slightly relaxes barriers. Beverage brands such as PepsiCo demonstrate 50% recycled polypropylene snack packs, hinting at broader adoption where performance permits.

Home and personal care is set to rise at a 6.58% CAGR, as consumers accept premiums for low-carbon formats. Ball Corporation financed Meadow to launch fully recyclable aluminum cartridges for soaps and shampoos, showing brand readiness to switch materials swiftly. Secondary industries such as e-commerce and industrial packaging also incorporate more PCR as collection networks mature, broadening the recycled materials packaging solutions market.

The Recycled Materials Packaging Solutions Market Report is Segmented by Material Type (Plastic, Paper, Glass, and Metal), End-User Industry (Food, Beverage, Home and Personal Care, Healthcare, and More), Packaging Type (Rigid Packaging, and Flexible Packaging), Source of Recycled Material (Post-Consumer Recyclate, Post-Industrial Recyclate, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 45.80% of the recycled materials packaging solutions market size in 2025 and will grow at a 7.55% CAGR. Regulatory clarity, such as Vietnam's EPR targets, South Korea's recycled-content thresholds, and Thailand's tax incentives, is reinforcing investment flows. Infrastructure financing across ASEAN nations addresses collection bottlenecks, closing gaps that historically impeded supply consistency.

North America benefits from USD 8 billion in announced recycling expansions since 2017, adding capacity to process almost 9 million tonnes of waste annually. Extended Producer Responsibility laws in Oregon and Colorado that take effect in July 2025 clarify producer fees and spur redesign toward recyclability. Corporate procurement commitments secure offtake, supporting a stable investment outlook. Europe sustains regulatory leadership. Mandatory 30% recycled PET for food packaging by 2030 and design-for-recycling criteria foster innovation pipelines. Collaborative platforms such as 4evergreen and FINAT develop technical guidance for paper and label liner recycling, respectively. Moderate growth in South America and the Middle East & Africa reflects emerging grant funding and nascent EPR frameworks that gradually enlarge the recycled materials packaging solutions market.

- Amcor plc

- Kruger Inc.

- Smurfit WestRock plc

- Packaging Corporation of America

- Tetra Laval International S.A.

- International Paper Company

- Mondi plc

- Verallia SA

- Sealed Air Corporation

- Ardagh Group

- Plastipak Holdings, Inc.

- Billerud AB

- Stora Enso Oyj

- UPM-Kymmene Corporation

- Huhtamaki Oyj

- Graphic Packaging Holding Company

- Veolia Environnement S.A.

- Eco-Products, Inc.

- Loop Industries, Inc.

- Sonoco Products Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Extended Producer Responsibility (EPR) Mandates Expansion

- 4.2.2 Brand-Owner 2025 Recycled-Content Targets

- 4.2.3 Advanced Sortation Technologies: Reducing Contamination

- 4.2.4 Consumer Preference for Low-Carbon Packaging

- 4.2.5 Corporate Net-Zero Commitments Accelerating PCR Procurement

- 4.2.6 Surging Investment in Chemical Recycling Capacity

- 4.3 Market Restraints

- 4.3.1 Volatile Supply of High-Quality Recycled Feedstock

- 4.3.2 Competing Demand from Fiber-Based Substitute Packaging

- 4.3.3 Unfavorable Economics when Virgin Resin Prices Decline

- 4.3.4 Recycling Infrastructure Gaps in Emerging Markets

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.2 Paper

- 5.1.3 Glass

- 5.1.4 Metal

- 5.2 By End-User Industry

- 5.2.1 Food

- 5.2.2 Beverage

- 5.2.3 Home and Personal Care

- 5.2.4 Healthcare

- 5.2.5 Other End-user Industries

- 5.3 By Packaging Type

- 5.3.1 Rigid Packaging

- 5.3.2 Flexible Packaging

- 5.4 By Source of Recycled Material

- 5.4.1 Post-consumer Recyclate (PCR)

- 5.4.2 Post-industrial Recyclate (PIR)

- 5.4.3 Ocean-bound and Recovered Waste

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN Countries

- 5.5.4.6 Australia and New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Kruger Inc.

- 6.4.3 Smurfit WestRock plc

- 6.4.4 Packaging Corporation of America

- 6.4.5 Tetra Laval International S.A.

- 6.4.6 International Paper Company

- 6.4.7 Mondi plc

- 6.4.8 Verallia SA

- 6.4.9 Sealed Air Corporation

- 6.4.10 Ardagh Group

- 6.4.11 Plastipak Holdings, Inc.

- 6.4.12 Billerud AB

- 6.4.13 Stora Enso Oyj

- 6.4.14 UPM-Kymmene Corporation

- 6.4.15 Huhtamaki Oyj

- 6.4.16 Graphic Packaging Holding Company

- 6.4.17 Veolia Environnement S.A.

- 6.4.18 Eco-Products, Inc.

- 6.4.19 Loop Industries, Inc.

- 6.4.20 Sonoco Products Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment