|

市場調查報告書

商品編碼

1906893

印尼油氣:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Indonesia Oil And Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

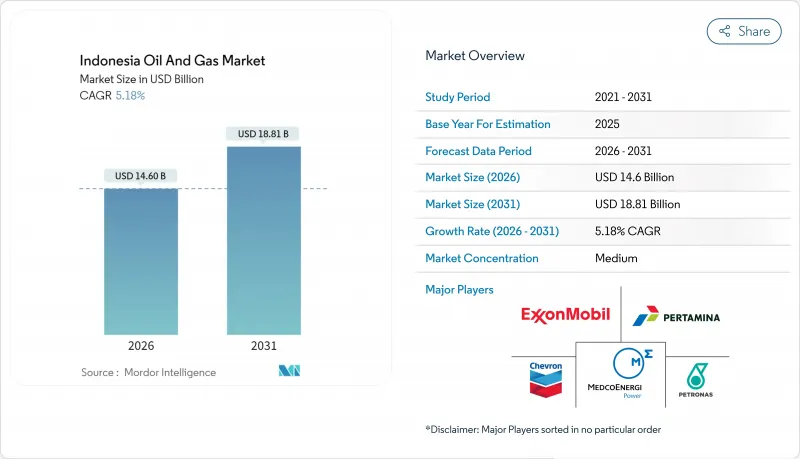

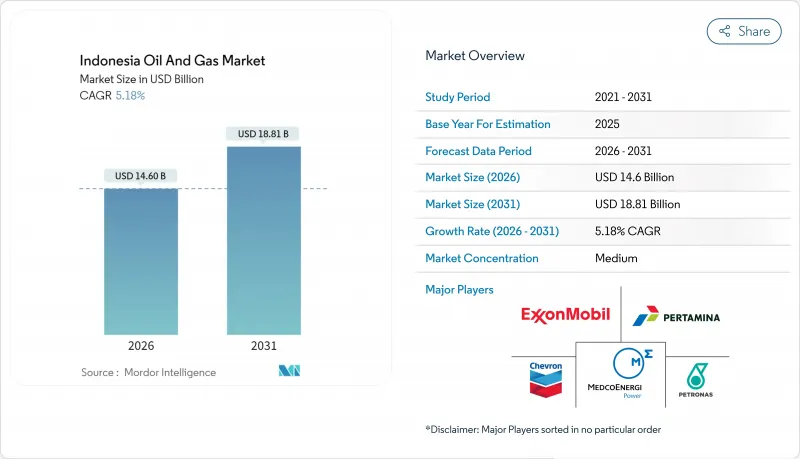

預計印尼石油和天然氣市場規模將從 2025 年的 138.8 億美元成長到 2026 年的 146 億美元,到 2031 年將達到 188.1 億美元,2026 年至 2031 年的複合年成長率為 5.18%。

這一成長軌跡標誌著印尼油氣市場正從成熟的陸上油田向不斷擴張的海上開發、碳捕獲技術的整合以及數位轉型轉型。不斷成長的國內需求、有利的產量分成合約條款以及新的深水油田發現正推動資本流入探勘,而維護和維修老舊基礎設施的業務收益也持續成長。印尼國家石油公司(Pertamina)佔據了國內60%的產量佔有率,其市場競爭日益激烈;國際石油公司利用先進的採油技術重返印尼市場;以及對碳捕獲、利用與封存(CCUS)中心的投資不斷增加,旨在延長浮式生產儲油卸油設備並減少全生命週期排放。在納土納海、阿巴迪-馬塞拉和馬哈坎Delta的海上油田,浮式生產儲卸油船(FPSO)和海底管線回接技術顯著縮短了首次產氣時間,並重新定義了計劃的經濟效益。同時,小規模天然氣(LNG)解決方案正助力市場向離島和礦區拓展。

印尼油氣市場趨勢與洞察

中產階級的壯大帶動了強勁的國內需求。

印尼不斷壯大的中產階級正在推動汽油、柴油和石化產品消費量的成長。預計到2030年,原油日需求量將達到180萬桶,高於2025年的約160萬桶。爪哇島的都市化超過60%,儘管採取了提高能源效率的措施,但交通運輸燃料的使用量仍不斷增加。個人收入的成長也帶動了對塑膠和包裝材料需求的成長。預計到2030年,天然氣日需求量將達到120億立方英尺,這主要得益於聯合循環發電廠的普及,這些電廠可以彌補可再生能源的波動性,並滿足工業鍋爐的需求。透過燃料補貼改革節省下來的資金可以重新用於公路、港口和公共交通計劃,從而進一步刺激能源需求,並增強對國內油氣資源的長期需求。

政府的目標是到2030年實現原油日產量100萬桶,天然氣日產量120億立方英尺。

鑑於SKK Migas公司成品油進口已達60%,該公司已設定原油日產量目標為100萬桶(bbl/d),天然氣日產量目標為120億立方英尺(Bcf/d),以降低進口依賴度。其優先事項包括加速核准127個區塊、為增產技術提供財政激勵,以及建立數位化油田監測系統以提高低產儲存的產量。阿巴迪液化天然氣計劃和唐古擴建計畫等計劃有助於提升天然氣供給能力,而米納斯和杜里地區的水力壓裂和強化化學採油(EOR)作業則減緩了基礎油氣資源的損耗。監管措施包括採用總分生產分成合約(PSC),該合約簡化了審核,並確保早期現金流,從而吸引了雪佛龍、哈伯能源和Medco等公司進駐邊遠地區。

可再生能源的擴張和電動車的普及

印尼的目標是到2025年達到23%的可再生能源佔比,到2060年達到淨零排放。這項雄心勃勃的計畫正推動資本從石化燃料計劃轉向太陽能、風能和地熱發電(目前在建裝置容量總合10吉瓦)。為電動車組裝廠提供的稅收優惠政策正吸引全球汽車製造商落腳西爪哇,這與印尼到2030年實現200萬輛電池式電動車上路的目標相符。雖然天然氣目前仍能彌補間歇性用電的不足,但隨著收費公路沿線充電網路的日益密集,長期汽油需求正在下降。然而,基礎設施的匱乏和對價格的高度敏感性限制了短期內的替代,印尼的油氣市場仍然是交通運輸和工業領域的核心力量。

細分市場分析

預計到2025年,印尼油氣市場的上游部分規模將達到100.1億美元(佔總營收的72.10%),到2031年將以5.55%的複合年成長率成長。主要資本投資包括BP投資70億美元的唐福UCC計劃和Inpex投資200億美元的阿巴迪LNG計劃,顯示各公司對長期天然氣計劃充滿信心。隨著盆地的成熟,生產分成合約的改革、數位地下成像技術的應用以及儲存機器人技術的應用正在提高現有油井的採收率,並增強上游現金流。

產量分成合約(PSC)提高了透明度和成本確定性,使得雪佛龍得以重返拉帕克油田,哈伯能源得以在圖納油田開展蘊藏量補充宣傳活動。印尼國家石油公司(Pertamina)和FPT軟體公司共同實施的數位化資產健康系統將計畫外停機時間減少了15%,展現了人工智慧整合帶來的營運優勢。中游擴建計畫(一條連接中蘇拉威西和爪哇的新管道)保障了運輸經濟效益;下游方面,圖班煉油廠的石化一體化計畫正在將高黏度原油轉化為高利潤烯烴。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 不斷壯大的中產階級帶來的強勁國內需求

- 政府爭取2030年原油日產量提高100萬桶,天然氣日產量提高120億立方英尺。

- 向東北亞出口液化天然氣套利

- 產品分成合約總分配製度的激勵措施吸引了國際石油公司的興趣。

- 碳捕獲中心改善成熟油田的經濟效益

- 人工智慧驅動的數位化油田可降低鑽井成本

- 市場限制

- 可再生能源的擴張和電動車的普及

- 老舊盆地產量下降

- 土地權利以及與原住民社區的衝突

- 環境、社會及公司治理(ESG)相關資金籌措的限制

- 供應鏈分析

- 監管環境

- 技術展望

- 原油產量和消費量預測

- 天然氣生產與消費預測

- 已安裝管道容量分析

- 非傳統資源資本支出展望(緻密油、油砂、深水)

- LNG接收站產能預測

- 波特五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- PESTEL 分析

第5章 市場規模與成長預測

- 按行業

- 上游部門

- 中游產業

- 下游產業

- 按位置

- 陸上

- 離岸

- 透過服務

- 建造

- 維護和檢修

- 退休

第6章 競爭情勢

- 市場集中度

- 策略趨勢(併購、聯盟、購電協議)

- 市場佔有率分析(主要企業的市場排名和佔有率)

- 公司簡介

- Pertamina

- Chevron

- ExxonMobil

- Shell

- BP

- Petronas

- ConocoPhillips

- Medco Energi

- Eni

- TotalEnergies

- Repsol

- Sinopec

- PGN

- Chandra Asri

- Inpex

- Mubadala Energy

- Harbour Energy

- Conrad Asia Energy

- PT Connusa Energindo

- CNOOC

第7章 市場機會與未來展望

The Indonesia Oil And Gas market is expected to grow from USD 13.88 billion in 2025 to USD 14.6 billion in 2026 and is forecast to reach USD 18.81 billion by 2031 at 5.18% CAGR over 2026-2031.

This trajectory highlights how the Indonesian oil and gas market is shifting from long-mature onshore basins toward offshore growth, carbon capture integration, and digital transformation. Rising domestic demand, favorable production-sharing terms, and deep-water discoveries are widening capital flows into exploration while sustaining service revenues from maintenance and turnaround activities that keep aging infrastructure online. Competitive intensity is shaped by Pertamina's 60% share of national output, the return of international oil companies that leverage advanced recovery techniques, and escalating investment in CCUS hubs, which extend field life and lower lifecycle emissions. Offshore fields in the Natuna Sea, Abadi Masela, and Mahakam Delta are redefining project economics, with FPSOs and subsea tiebacks significantly shortening the time to first gas. Meanwhile, small-scale LNG solutions are broadening the market reach to remote islands and mining enclaves.

Indonesia Oil And Gas Market Trends and Insights

Robust Domestic Demand from Rising Middle Class

Indonesia's growing middle class is driving up gasoline, diesel, and petrochemical consumption, with daily crude demand projected to reach 1.8 million barrels by 2030, up from roughly 1.6 million barrels in 2025. Java's urbanization rate above 60% intensifies transport fuel use, despite efficiency drives, while rising personal incomes underpin higher demand for plastics and packaging. Natural gas demand is expected to reach 12 Bcf/d by 2030, as combined-cycle power plants supplement renewable energy intermittency and meet the needs of industrial boilers. Fuel-subsidy reforms redirect savings into roads, ports, and mass transit projects, which further spur energy needs, reinforcing the long-term pull for domestic hydrocarbons.

Government Push for 1 Million bbl/d Crude and 12 Bcf/d Gas by 2030

SKK Migas targets 1 million barrels per day (bbl/d) of oil and 12 billion cubic feet per day (Bcf/d) of gas to curb import dependence, which already covers 60% of refined-product demand. Priority accelerators include 127 blocks slated for fast-track approval, fiscal sweeteners for enhanced recovery, and digital field surveillance that lifts output from marginal reservoirs. Projects such as Abadi LNG and the Tangguh expansion underpin gas deliverability, whereas steamflood and chemical EOR initiatives at Minas and Duri slow base decline. The regulatory path features gross-split PSCs that streamline audits and guarantee earlier cash flow, attracting Chevron, Harbour Energy, and Medco into frontier acreage.

Renewable-Energy Build-Out and EV Adoption

Indonesia aims for 23% renewable energy penetration by 2025 and net-zero emissions by 2060, ambitions that redirect capital from fossil fuel projects into solar, wind, and geothermal units totaling 10 GW under construction. Fiscal incentives for EV assembly plants draw global OEMs to West Java, in line with a national goal of 2 million battery electric vehicles on the roads by 2030. While gas still balances intermittency, long-run gasoline demand faces attrition as charging networks densify across toll-road corridors. Yet infrastructure gaps and price sensitivity moderate short-term displacement, allowing the Indonesian oil and gas market to retain core transport and industrial segments.

Other drivers and restraints analyzed in the detailed report include:

- LNG Export Arbitrage to North-East Asia

- PSC Gross-Split Incentives Attracting IOCs

- Declining Output from Ageing Basins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Indonesia's oil and gas market size for the upstream segment was USD 10.01 billion in 2025, accounting for 72.10% of the overall revenue and projected to grow at a 5.55% CAGR through 2031. Major capital commitments include BP's USD 7 billion Tangguh UCC and Inpex's USD 20 billion Abadi LNG project, signaling durable corporate confidence in long-cycle gas projects. Production-sharing reforms, digital subsurface imaging, and reservoir robotics enhance recovery rates from legacy wells, reinforcing upstream cash flow even as basins mature.

Gross-split PSCs heighten transparency, with cost certainty spurring Chevron's return to the Rapak Block and Harbour Energy's infill campaign at Tuna. Digital asset integrity systems deployed by Pertamina and FPT Software reduced unplanned shutdowns by 15%, demonstrating the operational advantage that AI integration provides. Midstream expansions-new pipelines linking Central Sulawesi to Java-protect evacuation economics, while downstream petrochemical integration at Tuban refinery monetizes heavier crudes into high-margin olefins.

The Indonesia Oil and Gas Market Report is Segmented by Sector (Upstream, Midstream, and Downstream), Location (Onshore and Offshore), and Service (Construction, Maintenance and Turn-Around, and Decommissioning). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Pertamina

- Chevron

- ExxonMobil

- Shell

- BP

- Petronas

- ConocoPhillips

- Medco Energi

- Eni

- TotalEnergies

- Repsol

- Sinopec

- PGN

- Chandra Asri

- Inpex

- Mubadala Energy

- Harbour Energy

- Conrad Asia Energy

- PT Connusa Energindo

- CNOOC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Robust domestic demand from rising middle class

- 4.2.2 Government push for 1 mb/d crude & 12 Bcf/d gas by 2030

- 4.2.3 LNG export arbitrage to North-East Asia

- 4.2.4 PSC gross-split incentives attracting IOCs

- 4.2.5 Carbon-capture hubs boosting mature-field economics

- 4.2.6 AI-enabled digital oilfields cutting lifting cost

- 4.3 Market Restraints

- 4.3.1 Renewable-energy build-out & EV adoption

- 4.3.2 Declining output from ageing basins

- 4.3.3 Land-right & indigenous community disputes

- 4.3.4 ESG-linked financing constraints

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Crude-Oil Production & Consumption Outlook

- 4.8 Natural-Gas Production & Consumption Outlook

- 4.9 Installed Pipeline Capacity Analysis

- 4.10 Unconventional Resources CAPEX Outlook (tight oil, oil sands, deep-water)

- 4.11 LNG Terminal Capacity Outlook

- 4.12 Porter's Five Forces

- 4.12.1 Threat of New Entrants

- 4.12.2 Bargaining Power of Suppliers

- 4.12.3 Bargaining Power of Buyers

- 4.12.4 Threat of Substitutes

- 4.12.5 Competitive Rivalry

- 4.13 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Sector

- 5.1.1 Upstream

- 5.1.2 Midstream

- 5.1.3 Downstream

- 5.2 By Location

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 By Service

- 5.3.1 Construction

- 5.3.2 Maintenance and Turn-around

- 5.3.3 Decommissioning

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Pertamina

- 6.4.2 Chevron

- 6.4.3 ExxonMobil

- 6.4.4 Shell

- 6.4.5 BP

- 6.4.6 Petronas

- 6.4.7 ConocoPhillips

- 6.4.8 Medco Energi

- 6.4.9 Eni

- 6.4.10 TotalEnergies

- 6.4.11 Repsol

- 6.4.12 Sinopec

- 6.4.13 PGN

- 6.4.14 Chandra Asri

- 6.4.15 Inpex

- 6.4.16 Mubadala Energy

- 6.4.17 Harbour Energy

- 6.4.18 Conrad Asia Energy

- 6.4.19 PT Connusa Energindo

- 6.4.20 CNOOC

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment