|

市場調查報告書

商品編碼

1906883

北美汽車市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)North America Automotive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

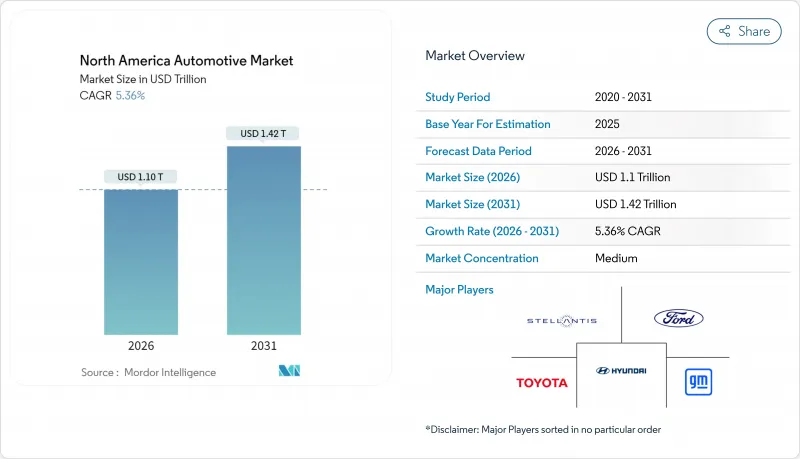

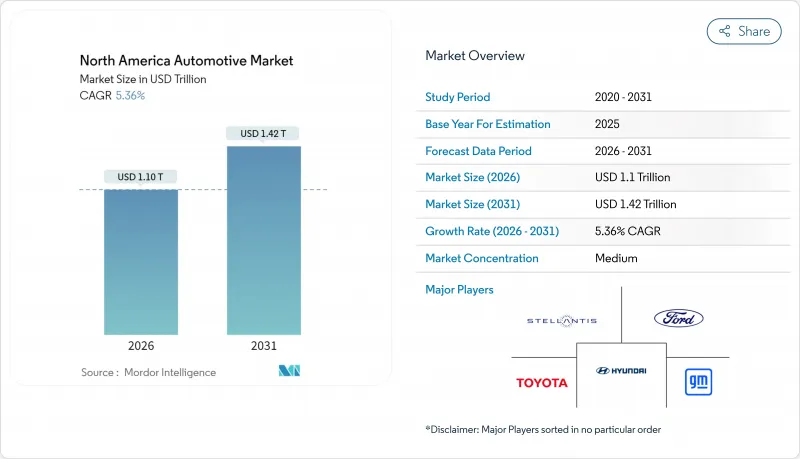

2025年北美汽車市場價值1.04兆美元,預計到2031年將達到1.4222兆美元,高於2026年的1.0957兆美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 5.36%。

聯邦和州政府強力的零排放車輛法規,以及通膨控制法案下的財政激勵措施,都為預期的擴張提供了支撐。汽車製造商正以前所未有的速度推進電池和整車生產的本地化,力求在輕型卡車和SUV銷售帶來的短期盈利與長期電氣化計劃之間取得平衡。隨著車隊營運商優先考慮降低總擁有成本,商用車電氣化進程正在加速,而直銷模式也給現有經銷商網路帶來了壓力。關稅政策收緊和關鍵礦產供應瓶頸仍是近期面臨的不利因素。

北美汽車市場趨勢與洞察

聯邦和州零排放車輛(ZEV)法規

加州的「先進清潔汽車II」法規要求到2026年零排放汽車的銷售比例達到35%,到2035年達到100%。包括華盛頓特區在內的11個州也採用了類似的時間表。加拿大的聯邦零排放汽車法規也設定了2035年的最終目標,並制定了2026年達到20%、2030年達到60%的階段性目標。美國環保署(EPA)提案的法規要求到2030年中型和重型卡車的零排放汽車銷售比例達到30%,到2040年達到100%。該法規採用信用銀行體系,允許領先採用者透過合規獲利,而落後者則面臨更嚴厲的處罰。因此,這個法規結構鼓勵了積極的電氣化投資,並加速了北美汽車市場的供應商整合。

區域電池“自動陣列”

到2023年底,北美電池供應鏈的累積投資將超過2,500億美元,電池工廠與最終組裝廠的平均距離為284英里(約457公里)。電池製造約佔投資的一半,上游礦物加工和下游電動車組裝則佔剩餘部分。加拿大已躍居鋰離子電池供應鏈排名榜首,主要得益於本田投資150億加元的綜合性工廠,該工廠計劃於2028年運作。同時,墨西哥的類似計劃,例如BMW投資8億美元的聖路易斯波托西擴建計劃,在確保成本競爭力的同時,也符合《美國墨加協定》(USMCA)的貿易合格。區域叢集有助於降低北美汽車市場的物流成本和關稅風險。

車輛價格負擔加重

創紀錄的交易價格已將平均月供推至歷史新高,迫使許多普通購車者放棄購車計畫。不斷上漲的獎勵擠壓了利潤空間,但並未恢復購車的可負擔性。自2023年起,租賃成本的飆升促使消費者擴大考慮二手車。電池式電動車(BEV)車型受此衝擊最大,其高昂的前期成本對許多家庭而言超過了終身節省的費用。儘管預期利率下降將起到一定的緩解作用,但消費者對價格的高度敏感預計將在短期內限制北美汽車市場的銷售成長。

細分市場分析

儘管中型和重型商用車的絕對銷量仍然較小,但預計到2031年,其複合年成長率將達到8.22%,遠超乘用車在北美汽車市場的主導地位。從監管角度來看,加州的「先進清潔卡車」法規和美國環保署(EPA)的提案旨在2040年實現100%的卡車零排放銷售。車隊買家由於能夠集中管理充電和可預測的運作週期,因此渴望擁抱電氣化。

到2025年,乘用車仍將佔汽車總收入的68.63%,但面臨價格承受能力和監管成本不斷上漲的壓力。工廠產能改造以適應多種動力傳動系統,使製造商能夠調整產量以滿足不斷變化的市場需求。到2035年,零排放卡車的總擁有成本將與乘用車持平,這將推動對商用車領域的進一步投資,並鞏固北美汽車市場這一細分領域的結構性成長。

到 2025 年,內燃機動力傳動系統將佔市場佔有率的 82.11%,但電池電動車 (BEV) 的市場佔有率將以 9.58% 的複合年成長率成長,這主要得益於高達 7,500 美元的清潔車輛稅額扣抵。混合模式將作為過渡技術,福特報告稱,2024 年混合動力汽車的銷量將實現兩位數成長。

插電式混合動力汽車為長途駕駛者提供續航里程保障,同時也有助於實現部分電氣化目標。由於氫基礎設施不足,燃料電池汽車仍是一個有限的小眾市場。動力系統多元化使汽車製造商能夠降低資本配置風險,同時擴展電池和軟體平台,而這些平台對於不斷發展的北美汽車市場規模至關重要。

北美汽車市場報告按車輛類型(乘用車、輕型商用車等)、動力類型(內燃機等)、銷售管道(OEM 直銷商等)、自動化程度(0-1 級、2 級、3 級、4-5 級)和國家/地區(美國、加拿大、北美其他地區)進行細分。市場預測以價值(美元)和銷售(輛)為單位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 聯邦和州政府的零排放車輛(ZEV)強制規定

- 汽車貸款利率下降和被壓抑的需求

- NEVI資助的電動車充電基礎設施擴建

- 輕型卡車和SUV組合的變化將提高利潤率。

- 電池「汽車產業群聚」的區域化

- 軟體定義汽車的收入模式

- 市場限制

- 汽車價格購買能力收緊

- 半導體和電池用礦物供應受限

- 美墨加協定審查下的關稅邊緣政策

- 尖峰時段「充電排隊」問題令人擔憂

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 中型和大型商用車輛

- 摩托車

- 依推進類型

- 內燃機(ICE)

- 混合動力電動車(HEV)

- 插電式混合動力汽車(PHEV)

- 電池電動車(BEV)

- 燃料電池電動車(FCEV)

- 天然氣汽車(NGV)

- 按銷售管道

- OEM授權經銷商銷售

- D2C(線上)

- 車隊和租賃銷售

- 按自動化級別

- 0-1級(基礎/無ADAS)

- 二級(部分自動化)

- 3級(有條件自動駕駛)

- 4-5級(高度/完全自動駕駛)

- 按國家/地區

- 美國

- 加拿大

- 北美其他地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- General Motors Company

- Toyota Motor Corporation

- Ford Motor Company

- Stellantis NV

- Hyundai Motor Company

- Honda Motor Co., Ltd.

- Nissan Motor Co., Ltd.

- BMW AG

- Tesla, Inc.

- Volkswagen AG

- Mercedes-Benz Group AG

- Kia Corporation

- Subaru Corporation

- Mazda Motor Corporation

- Rivian Automotive, Inc.

- Lucid Group, Inc.

- BYD Company Ltd.

- Volvo Car Corporation

- Mitsubishi Motors Corporation

- Daimler Truck Holding AG

- PACCAR Inc.

- Navistar International Corp.

- Harley-Davidson, Inc.

- Yamaha Motor Co., Ltd.

第7章 市場機會與未來展望

The North America automotive market was valued at USD 1040 billion in 2025 and estimated to grow from USD 1095.7 billion in 2026 to reach USD 1422.2 billion by 2031, at a CAGR of 5.36% during the forecast period (2026-2031).

Robust federal and provincial zero-emission vehicle mandates and fiscal incentives in the Inflation Reduction Act underpin the projected expansion. Automakers are localizing battery and vehicle production at unprecedented speed, balancing short-term profitability from light-truck and SUV sales with long-term electrification commitments. Commercial vehicle electrification is accelerating as fleet operators prioritize total cost-of-ownership gains, while direct-to-consumer sales models pressure entrenched dealer networks. Intensifying tariff policies and critical-mineral bottlenecks remain near-term headwinds.

North America Automotive Market Trends and Insights

Federal and State ZEV Mandates

California's Advanced Clean Cars II regulation requires 35% zero-emission sales by 2026 and 100% by 2035; eleven additional states and Washington, D.C. have adopted identical timelines. Canada's federal ZEV rule mirrors the 2035 deadline with interim 20% and 60% milestones for 2026 and 2030, respectively. Proposed U.S. EPA limits push 30% zero-emission medium- and heavy-truck sales by 2030, rising to 100% by 2040. Credit banking lets early movers monetize compliance, whereas laggards face increasing penalties. The mandate architecture, therefore, rewards proactive electrification investments and accelerates supplier realignment across North America automotive market participants.

Battery "Auto-Alley" Localization

Cumulative North American battery supply-chain commitments topped USD 250 billion by end-2023, with cell plants positioned a median 284 miles from final assembly sites. Cell fabrication absorbs roughly half of the outlays, with upstream mineral processing and downstream EV assembly splitting the remainder. Canada rose first in the lithium-ion supply-chain ranking, buoyed by Honda's CAD 15 billion integrated complex slated for 2028. Parallel Mexican projects, such as BMW's USD 800 million San Luis Potosi expansion, secure cost-competitive capacity while preserving USMCA trade eligibility. Localized clusters mitigate logistics expense and tariff risk across the North America automotive market.

Vehicle Affordability Squeeze

Record transaction prices have pushed average monthly payments to historic highs, sidelining a swath of mainstream buyers. Rising incentives strain margins yet fail to restore affordability. Leasing costs have climbed sharply since 2023, nudging consumers toward used-vehicle substitutes. The pinch is most acute for battery-electric models whose upfront premiums outweigh lifetime savings for many households. Although falling interest-rate expectations offer relief, price sensitivity will cap near-term volume upside in the North America automotive market.

Other drivers and restraints analyzed in the detailed report include:

- NEVI-Funded EV-Charging Build-Out

- Software-Defined-Vehicle Revenue Model

- Peak-Hour "Charging-Queue" Anxiety

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Medium-and heavy-commercial vehicles, though smaller in absolute volume, expand at 8.22% CAGR through 2031, materially outpacing passenger cars' dominion in the North American automotive market. A regulatory push-California's Advanced Clean Trucks rule and U.S. EPA proposals-targets 100% zero-emission truck sales by 2040. Fleet buyers embrace electrification, where charging can be centralized and duty cycles predictable.

Passenger cars still anchor 68.63% 2025 revenue but contend with affordability pressures and rising compliance outlays. Plant retooling for multi-powertrain flexibility enables manufacturers to modulate output amid shifting demand. Total cost-of-ownership parity for zero-emission trucks by 2035 will further tilt investment toward commercial applications, reinforcing structural growth in this segment of the North America automotive market.

Internal-combustion powertrains command an 82.11% share in 2025; however, battery-electric vehicles will capture incremental gains at 9.58% CAGR, supported by up to USD 7,500 clean-vehicle tax credits. Hybrid models act as a bridge technology, with Ford reporting double-digit hybrid sales gains in 2024.

Plug-in hybrids provide range assurance for long-distance drivers while meeting partial electrification quotas. Fuel-cell offerings remain niche, limited by hydrogen infrastructure gaps. Propulsion diversification allows OEMs to de-risk capital allocation while scaling batteries and software platforms central to the evolving North America automotive market size.

The North America Automotive Market Report is Segmented by Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Propulsion Type (ICE, and More), Sales Channel (OEM-Franchised Dealer, and More), Level of Automation (Level 0-1, Level 2, Level 3, and Level 4-5), and Country (United States, Canada, Rest of North America). The Market Forecasts are Provided in Terms of Value (USD) and Volume in Units.

List of Companies Covered in this Report:

- General Motors Company

- Toyota Motor Corporation

- Ford Motor Company

- Stellantis N.V.

- Hyundai Motor Company

- Honda Motor Co., Ltd.

- Nissan Motor Co., Ltd.

- BMW AG

- Tesla, Inc.

- Volkswagen AG

- Mercedes-Benz Group AG

- Kia Corporation

- Subaru Corporation

- Mazda Motor Corporation

- Rivian Automotive, Inc.

- Lucid Group, Inc.

- BYD Company Ltd.

- Volvo Car Corporation

- Mitsubishi Motors Corporation

- Daimler Truck Holding AG

- PACCAR Inc.

- Navistar International Corp.

- Harley-Davidson, Inc.

- Yamaha Motor Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Federal and State ZEV Mandates

- 4.2.2 Falling Auto-Loan Rates and Pent-Up Demand

- 4.2.3 NEVI-Funded EV-Charging Build-Out

- 4.2.4 Light-Truck/SUV Mix Shift Lifts Margins.

- 4.2.5 Battery "Auto-Alley" Localization

- 4.2.6 Software-Defined-Vehicle Revenue Model

- 4.3 Market Restraints

- 4.3.1 Vehicle Affordability Squeeze

- 4.3.2 Chip and Battery-Grade Mineral Bottlenecks

- 4.3.3 Tariff Brinkmanship Under USMCA Review

- 4.3.4 Peak-Hour "Charging-Queue" Anxiety

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Light Commercial Vehicles

- 5.1.3 Medium & Heavy Commercial Vehicles

- 5.1.4 Two-Wheelers

- 5.2 By Propulsion Type

- 5.2.1 Internal Combustion Engine (ICE)

- 5.2.2 Hybrid Electric Vehicles (HEV)

- 5.2.3 Plug-in Hybrid Vehicles (PHEV)

- 5.2.4 Battery Electric Vehicles (BEV)

- 5.2.5 Fuel-Cell Electric Vehicles (FCEV)

- 5.2.6 Natural-Gas Vehicles (NGV)

- 5.3 By Sales Channel

- 5.3.1 OEM-Franchised Dealer Sales

- 5.3.2 Direct-to-Consumer (Online)

- 5.3.3 Fleet and Rental Sales

- 5.4 By Level of Automation (Value)

- 5.4.1 Level 0 - 1 (Basic / No ADAS)

- 5.4.2 Level 2 (Partial Automation)

- 5.4.3 Level 3 (Conditional Automation)

- 5.4.4 Level 4 - 5 (High / Full Automation)

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Rest of North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 General Motors Company

- 6.4.2 Toyota Motor Corporation

- 6.4.3 Ford Motor Company

- 6.4.4 Stellantis N.V.

- 6.4.5 Hyundai Motor Company

- 6.4.6 Honda Motor Co., Ltd.

- 6.4.7 Nissan Motor Co., Ltd.

- 6.4.8 BMW AG

- 6.4.9 Tesla, Inc.

- 6.4.10 Volkswagen AG

- 6.4.11 Mercedes-Benz Group AG

- 6.4.12 Kia Corporation

- 6.4.13 Subaru Corporation

- 6.4.14 Mazda Motor Corporation

- 6.4.15 Rivian Automotive, Inc.

- 6.4.16 Lucid Group, Inc.

- 6.4.17 BYD Company Ltd.

- 6.4.18 Volvo Car Corporation

- 6.4.19 Mitsubishi Motors Corporation

- 6.4.20 Daimler Truck Holding AG

- 6.4.21 PACCAR Inc.

- 6.4.22 Navistar International Corp.

- 6.4.23 Harley-Davidson, Inc.

- 6.4.24 Yamaha Motor Co., Ltd.