|

市場調查報告書

商品編碼

1906878

聚甲醛(POM):市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Polyoxymethylene (POM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

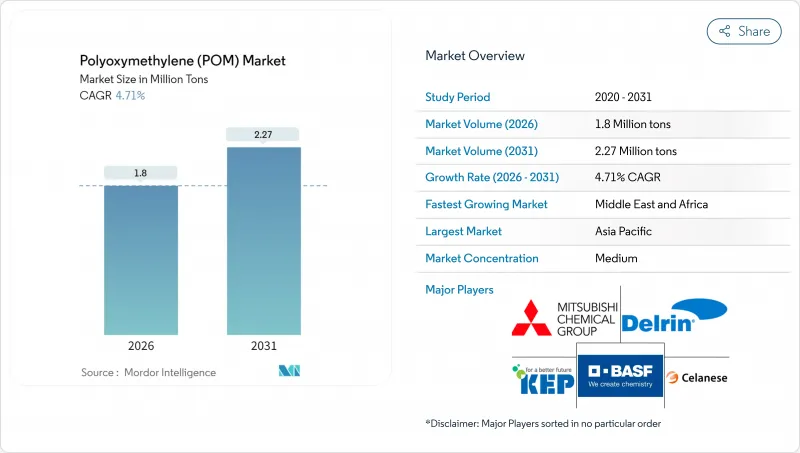

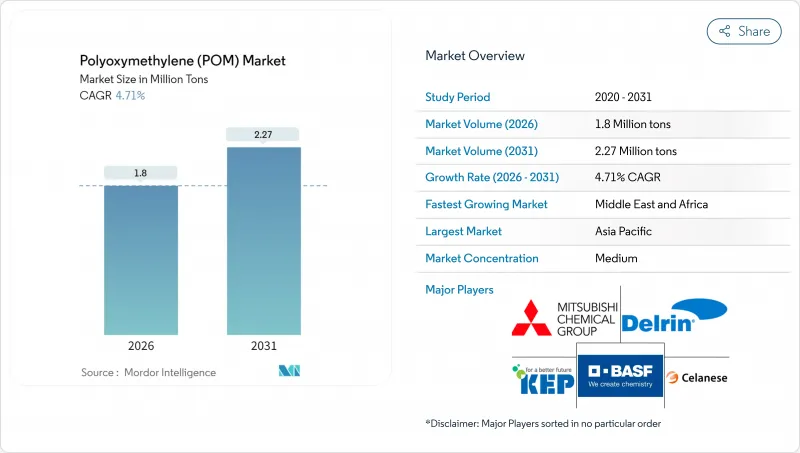

預計到 2026 年,聚甲醛 (POM) 市場規模將達到 180 萬噸。

這比 2025 年的 172 萬噸有所增加,預計到 2031 年將達到 227 萬噸,2026 年至 2031 年的年複合成長率(CAGR)為 4.71%。

需求成長主要受車輛輕量化、電子產品小型化以及精密機械領域從金屬轉變為塑膠的轉變所驅動。歐盟、中國和美國日益嚴格的汽車排放氣體法規推動了尺寸穩定性工程樹脂的應用。原始設備製造商 (OEM) 正在設計單一材料模組,以減少零件數量並簡化回收流程,這種做法促使人們選擇縮醛縮醛。同時,永續性計劃正推動製造商開發低甲醛和再生材料含量的產品,這些產品既符合監管標準,又不犧牲機械性能。在競爭方面,亞洲一體化製造商正利用其內部甲烷供應和與下游加工商的接近性來增強成本優勢,而歐美供應商則透過為電動車 (EV) 內飾和半導體製造設備開發專用配方來脫穎而出。

全球聚甲醛(POM)市場趨勢與洞察

汽車輕量化快速發展

汽車製造商正在指定使用聚甲醛縮醛來減輕車輛重量,同時保持結構剛性,尤其是在燃油模組、車門鎖扣和變速箱零件中。到2024年,平均每輛汽車將包含8到10磅的聚甲醛(POM),而且隨著每款新型純電動車的推出,這一數字還在增加。電動車的溫度控管系統正在增強這種樹脂的抗蠕變性和化學惰性,從而能夠製造出可以承受引擎室內熱循環的薄壁部件。諸如車窗穩壓器之類的滑動機構採用聚甲醛齒輪,以實現終身噪音、振動和不平順性(NVH)目標。汽車製造商還將導軌、密封件和鉸鏈銷等多個子功能整合到單一射出成型模組中,以最大限度地減輕重量,同時簡化報廢時的拆卸。 2024年,汽車產業的需求將佔聚甲醛總需求的31.05%,證實了這種聚合物在下一代出行解決方案中的重要角色。

電氣和電子設備的微型化

智慧型手機、穿戴式裝置和5G基礎設施中組件的微型化推動了對尺寸穩定性塑膠的需求,這些塑膠需保持微米等級的公差。聚甲醛(POM)的低吸濕性可防止其在潮濕環境中膨脹,從而保護細間距連接器和微型齒輪的精確度。防靜電等級的POM可降低晶片處理夾具中靜電放電的風險,而高流動性等級的POM則可實現厚度低至0.25毫米的薄壁成型,適用於相機模組。消費性電子設備製造商正在利用POM樹脂易於加工的特性,快速製作新型致動器設計的原型,從而縮短產品上市時間。物聯網節點的快速成長需要數十個微型運動部件,這進一步擴大了縮醛共聚物在亞太地區契約製造企業的應用範圍。

來自生物基塑膠和高性能塑膠的競爭

在永續性目標的驅動下,原始設備製造商 (OEM) 正在試驗纖維素增強的縮醛和全生物基聚醯胺,這些材料可使生命週期排放降低兩位數百分比。儘管成本增加,航太供應商仍在考慮以聚醚醚酮 (PEEK) 取代聚甲醛 (POM) 用於超過其 100°C排放極限的高溫零件。在歐洲消費品市場,監管機構為碳負排放配方提供優惠的生態稅政策,進而影響採購決策。一些醫療設備製造商正在轉向可承受反覆蒸氣滅菌循環的耐滅菌化學物質,這正在侵蝕 POM 在精密幫浦零件領域的市場佔有率。雖然現有聚合物仍保持著成本績效優勢,但日益嚴格的環境資訊揭露要求正在威脅那些存在環保替代品的應用領域的需求。

細分市場分析

到2025年,片材將佔全球消費量的64.78%,反映出其在汽車門模組、電子設備機殼、工業蓋板等領域的廣泛應用。預計到2031年,該細分市場將維持5.05%的複合年成長率。擠出技術的進步使得片材厚度公差可達到±3%,因此無需二次刨削工序即可直接加工成複雜的3D零件。加工商重視片材均勻的晶體形貌,這有助於減少大尺寸面板熱成型過程中的翹曲。

棒材和管材主要服務於精密零件的細分市場,例如齒輪、止推墊圈和流體處理歧管,這些零件在工作溫度範圍內尺寸偏差不得超過 0.05 毫米。混合動力傳動系統組裝和工廠自動化設備正在推動該市場緩慢但穩定成長。 「其他」類別(主要指射出成型)正吸引設計工程師的關注,他們希望以三分之一的成本獲得類似鋁材的重量。 ASTM D6100 標準統一了所有形狀的公差標準,使全球原始設備製造商 (OEM) 對跨區域採購充滿信心。雖然板材仍佔據主導地位,但從 2027 年起,採用顆粒狀原料進行積層製造可能會推動「其他」子細分市場逐步擴張。

聚甲醛(POM)市場報告按形態(板材、棒材和管材等)、終端用戶行業(航太、汽車、電氣電子、工業機械等)和地區(亞太、北美、歐洲、南美、中東和非洲)進行細分。市場預測以數量(噸)和價值(美元)為單位。

區域分析

到2025年,亞太地區將佔全球出貨量的66.70%,這主要得益於垂直整合的供應鏈以及中國、印度和東南亞原始設備製造商(OEM)的強勁需求。日本製造商持續供應精密齒輪的高結晶質共聚物,而韓國供應商則大力推廣用於半導體製造設備的導電級產品。胡志明市和浦那周邊的產業群聚正在加速從商用板材轉型為汽車零件轉型,從而增強區域自給自足能力。

中東和非洲地區將呈現最快的成長軌跡,到2031年複合年成長率將達到5.90%。像沙烏地基礎工業公司(SABIC)旗下的Petrochemiya這樣的巨型工廠正在整合甲醇、甲醛和下游聚合物生產設施,以確保原料供應穩定和能源效率。阿拉伯聯合大公國的航太零件製造商正在逐步淘汰鋁材,轉而從在地採購),以支持海灣航空公司的機隊擴張計劃。該地區位於亞洲和歐洲消費中心之間,地理位置優越,有助於降低出口商的運輸成本,而紅海航線的瓶頸進一步放大了這一優勢。

北美和歐洲保持著技術優勢,並積極研發低甲醛和再生材料含量的開發平臺。密西根州和巴伐利亞州的一級汽車供應商正與樹脂製造商合作,透過生產流程進行生命週期評估,並縮小規格範圍,以確保與循環經濟的兼容性。儘管南美市場尚未成熟,但受益於巴西汽車產業走廊的製造業投資,其對縮醛的需求與當地燃料系統生產密切相關。總體而言,亞太地區憑藉其高度集中的甲醇原料和成品組裝,可望繼續保持其優勢。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 汽車輕量化的蓬勃發展

- 電氣和電子設備領域的微型化

- 工業機械從金屬到塑膠的轉變

- 擴大亞太地區的製造業

- 用於電動車內裝的低VOC POM等級

- 市場限制

- 來自生物基塑膠和高性能塑膠的競爭

- 原料價格波動和貿易壁壘

- 甲醇制永續航空燃料(SAF)價值鏈

- 價值鏈分析

- 監管環境

- 進出口分析

- 價格趨勢

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 新進入者的威脅

- 終端用戶產業趨勢

- 航太(航太零件生產收入)

- 汽車(汽車產量)

- 建築與施工(新建建築占地面積)

- 電氣電子設備(電氣電子設備生產收入)

- 包裝(塑膠包裝量)

第5章 市場規模及成長預測(價值及數量)

- 按形式

- 床單

- 桿和管

- 其他

- 按最終用戶行業分類

- 航太工業

- 車

- 電氣和電子設備

- 工業和機械

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 馬來西亞

- 亞太其他地區

- 北美洲

- 加拿大

- 墨西哥

- 美國

- 歐洲

- 德國

- 法國

- 義大利

- 英國

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 奈及利亞

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Celanese Corporation

- China BlueChemical Ltd.

- Delrin USA, LLC

- Henan Energy and Chemical Group Co., Ltd.

- Kolon BASF innoPOM, Inc.

- Korea Engineering Plastics Co., Ltd.

- LG Chem

- Mitsubishi Chemical Group Corporation

- Polyplastics Co., Ltd.(Daicel Group)

- SABIC

- Yuntianhua Group Co., Ltd.

第7章 市場機會與未來展望

第8章:執行長面臨的關鍵策略挑戰

Polyoxymethylene market size in 2026 is estimated at 1.80 million tons, growing from 2025 value of 1.72 million tons with 2031 projections showing 2.27 million tons, growing at 4.71% CAGR over 2026-2031.

Elevated demand stems from automotive lightweighting programs, electronics miniaturization, and the shift from metal to plastic in precision machinery. The implementation of tighter vehicle emission rules in the European Union, China, and the United States favors the broader adoption of dimensionally stable engineering resins. Original equipment manufacturers (OEMs) are designing single-material modules to reduce part counts and simplify recycling, an approach that reinforces the selection of acetal copolymers. Meanwhile, sustainability initiatives encourage producers to launch low-formaldehyde and recycled-content grades that meet regulatory thresholds without sacrificing mechanical integrity. On the competitive front, integrated Asian producers leverage captive methanol supply and proximity to downstream converters to reinforce cost advantages, while Western suppliers differentiate through specialty formulations aimed at electric vehicle (EV) interiors and semiconductor tooling.

Global Polyoxymethylene (POM) Market Trends and Insights

Automotive Lightweighting Boom

Carmakers specify acetal copolymers to reduce vehicle mass while retaining structural stiffness, particularly in fuel modules, door latches, and transmission components. The average automobile incorporated 8-10 lb of POM in 2024, a figure that increases with every new battery-electric model. EV thermal-management systems enhance the resin's creep resistance and chemical inertness, allowing for thinner-walled parts that withstand under-hood heat cycling. Sliding assemblies, such as window regulators, adopt POM gears to meet lifetime noise, vibration, and harshness (NVH) targets. Automakers also bundle several sub-functions-such as guide rails, seals, and hinge pins-into single, injection-molded modules, maximizing weight savings while simplifying end-of-life disassembly. The 31.05% slice of 2024 demand tied to automotive underlines the polymer's entrenched role in next-generation mobility solutions.

Miniaturization in Electrical and Electronics

Component scaling in smartphones, wearables, and 5G infrastructure intensifies demand for dimensionally stable plastics that hold micron-level tolerances. POM's low moisture uptake prevents swelling in humid environments, safeguarding precision in fine-pitch connectors and micro-gears. Static-dissipative grades mitigate electrostatic discharge risks in chip-handling fixtures, while high-flow variants enable thin-wall molding down to 0.25 mm for camera modules. Consumer device makers capitalize on the resin's easy machinability to rapidly prototype new actuator designs, thereby shortening the time-to-market. The surge of IoT nodes-each requiring dozens of miniature moving parts-further broadens the addressable base for acetal copolymers across Asia-Pacific contract manufacturing hubs.

Competition from Bio-based and High-Performance Plastics

Sustainability goals prompt OEMs to experiment with cellulose-reinforced acetal and fully bio-derived polyamides, which reduce life-cycle emissions by double-digit percentages. Aerospace suppliers are weighing the substitution of polyetheretherketone (PEEK) for hot-section parts operating above POM's 100 °C ceiling, despite the associated cost premium. In European consumer goods markets, regulators reward carbon-negative formulations through lower eco-taxes, thereby tilting sourcing decisions. Some medical-device firms are pivoting to sterilization-stable chemistries to withstand repeated steam cycles, thereby eroding the share of POM in precision pump components. Although the incumbent polymer retains a cost-performance sweet spot, rising environmental disclosure obligations threaten demand in applications where drop-in greener alternatives exist.

Other drivers and restraints analyzed in the detailed report include:

- Metal-to-Plastic Shift in Industrial Machinery

- Manufacturing Expansion in Asia-Pacific

- Raw-Material Price Volatility and Trade Barriers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The sheet category accounted for 64.78% of global consumption in 2025, reflecting its widespread use in automotive door modules, electronics housings, and industrial covers. The segment is also projected to pace a 5.05% CAGR through 2031. Extrusion advances now yield sheet thickness tolerances of +-3%, allowing for direct machining into complex three-dimensional parts without the need for secondary planing. Converters appreciate the material's uniform crystalline morphology, which resists warp during thermoforming of large panels.

Rod and tube forms serve high-precision niches, such as gears, thrust washers, and fluid-handling manifolds, where dimensional drift cannot exceed 0.05 mm over the service temperature range. Hybrid powertrain assemblies and factory automation equipment drive modest but steady growth. The "others" bucket-principally injection-molded near-net-shapes-attracts design engineers seeking weight parity with aluminum at one-third the cost. The ASTM D6100 specification unifies tolerance benchmarks across all form factors, providing global OEMs with confidence in multi-regional sourcing. Although sheet will remain dominant, the proliferation of additive-manufacturing feedstock pellets could gradually elevate the "others" sub-segment after 2027.

The Polyoxymethylene (POM) Market Report is Segmented by Form Type (Sheet, Rod and Tube, and Others), End-User Industry (Aerospace, Automotive, Electrical and Electronics, Industrial and Machinery, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons) and Value (USD).

Geography Analysis

Asia-Pacific contributed 66.70% of 2025 shipments, buoyed by vertically integrated supply chains and surging demand from Chinese, Indian, and Southeast Asian OEMs. Japanese producers continue supplying high-crystallinity copolymers favored in precision gears, while Korean suppliers push electro-conductive grades for semiconductor tooling. Clusters around Ho Chi Minh City and Pune accelerate the conversion of off-the-shelf sheet into automotive assemblies, reinforcing regional self-sufficiency.

The Middle-East and Africa exhibit the fastest trajectory at 5.90% CAGR through 2031. Mega-sites like SABIC's Petrokemya integrate methanol, formaldehyde, and downstream polymer units, conferring feedstock stability and energy efficiency. Aerospace parts makers in the United Arab Emirates diversify away from aluminum, sourcing POM locally to support Gulf carrier fleet expansion plans. The region's location between Asian and European consumer bases helps exporters minimize freight costs, a factor amplified by Red Sea shipping bottlenecks.

North America and Europe maintain technology leadership, nurturing research and development pipelines for low-formaldehyde and recycled-content variants. Automotive Tier-1 suppliers in Michigan and Bavaria collaborate with resin producers on cradle-to-gate life-cycle assessments, advocating for narrower specification windows that ensure compatibility with the circular economy. South American markets remain nascent but benefit from manufacturing investments in Brazil's automotive corridor, where acetal demand aligns with localized fuel system production. Overall, the Asia-Pacific region appears poised to maintain its dominance, given its concentration of both methanol feedstock and finished goods assembly lines.

- Celanese Corporation

- China BlueChemical Ltd.

- Delrin USA, LLC

- Henan Energy and Chemical Group Co., Ltd.

- Kolon BASF innoPOM, Inc.

- Korea Engineering Plastics Co., Ltd.

- LG Chem

- Mitsubishi Chemical Group Corporation

- Polyplastics Co., Ltd. (Daicel Group)

- SABIC

- Yuntianhua Group Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Automotive Lightweighting Boom

- 4.2.2 Miniaturisation in Electrical and Electronics

- 4.2.3 Metal-to-plastic Shift in Industrial Machinery

- 4.2.4 Manufacturing Expansion in Asia-Pacific

- 4.2.5 Low-VOC POM Grades for EV Interiors

- 4.3 Market Restraints

- 4.3.1 Competition from Bio-based and High-performance Plastics

- 4.3.2 Raw-material Price Volatility and Trade Barriers

- 4.3.3 Methanol Diversion to SAF Value-chain

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Import and Export Analysis

- 4.7 Price Trends

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of Substitutes

- 4.8.4 Competitive Rivalry

- 4.8.5 Threat of New Entrants

- 4.9 End-use Sector Trends

- 4.9.1 Aerospace (Aerospace Component Production Revenue)

- 4.9.2 Automotive (Automobile Production)

- 4.9.3 Building and Construction (New Construction Floor Area)

- 4.9.4 Electrical and Electronics (Electrical and Electronics Production Revenue)

- 4.9.5 Packaging (Plastic Packaging Volume)

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Form Type

- 5.1.1 Sheet

- 5.1.2 Rod and Tube

- 5.1.3 Others

- 5.2 By End-user Industry

- 5.2.1 Aerospace

- 5.2.2 Automotive

- 5.2.3 Electrical and Electronics

- 5.2.4 Industrial and Machinery

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 Australia

- 5.3.1.6 Malaysia

- 5.3.1.7 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 Canada

- 5.3.2.2 Mexico

- 5.3.2.3 United States

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 Italy

- 5.3.3.4 United Kingdom

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Nigeria

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Celanese Corporation

- 6.4.2 China BlueChemical Ltd.

- 6.4.3 Delrin USA, LLC

- 6.4.4 Henan Energy and Chemical Group Co., Ltd.

- 6.4.5 Kolon BASF innoPOM, Inc.

- 6.4.6 Korea Engineering Plastics Co., Ltd.

- 6.4.7 LG Chem

- 6.4.8 Mitsubishi Chemical Group Corporation

- 6.4.9 Polyplastics Co., Ltd. (Daicel Group)

- 6.4.10 SABIC

- 6.4.11 Yuntianhua Group Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment