|

市場調查報告書

商品編碼

1906865

混合雲端:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Hybrid Cloud - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

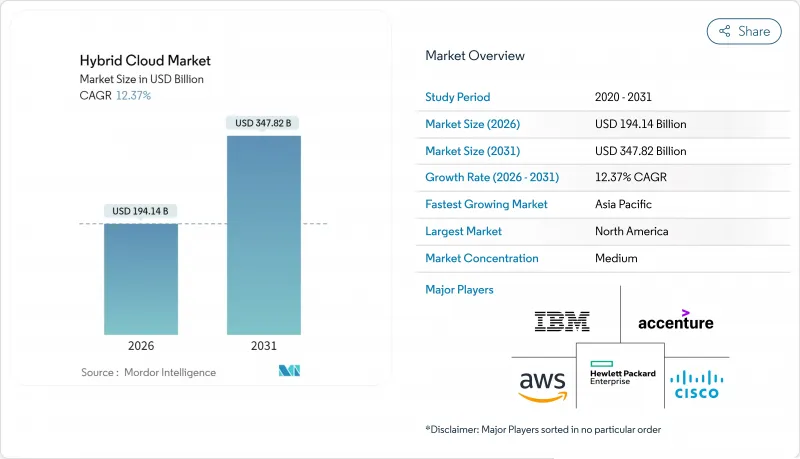

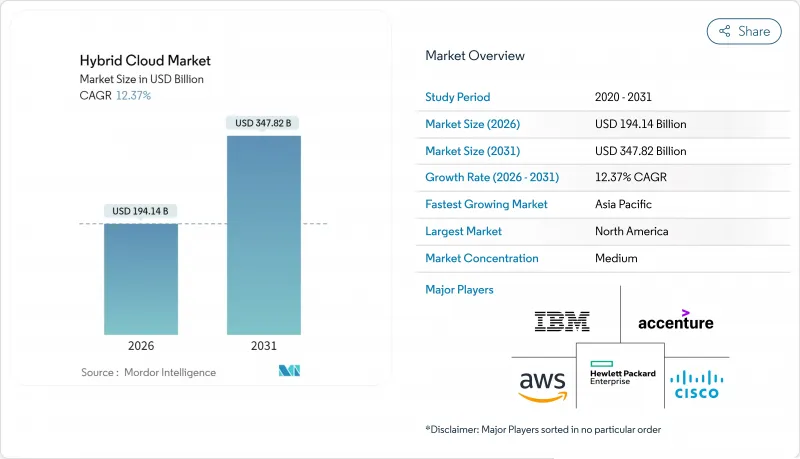

預計到 2025 年,混合雲端市場規模將達到 1,727.7 億美元,到 2026 年將達到 1,941.4 億美元,到 2031 年將達到 3,478.2 億美元,預測期(2026-2031 年)的複合年成長率為 12.37%。

企業正朝著分散式架構轉型,力求在維運控制和雲端原生速度之間取得平衡,尤其是在生成式人工智慧工作負載需要邊緣運算資源和集中式運算資源之間更緊密協調的情況下。更嚴格的主權監管、日益成長的多重雲端趨勢以及日益成熟的容器編排管理框架,都在推動對混合部署模式的需求。邊緣運算投資能夠降低人工智慧推理延遲,同時保留本地數據以滿足合規性要求。大型資料中心營運商正在將基礎設施計劃與企業脫碳目標結合,並將永續性納入採購標準。超大規模資料中心業者和專業邊緣運算供應商的策略性收購,正在加劇混合雲端市場的競爭差異化。

全球混合雲端市場趨勢與洞察

大型企業多重雲端採用率激增

混合環境如今已成為精心建構的多重雲端策略的基礎,87% 的企業都在多個雲端服務供應商之間運行工作負載。平台團隊正在標準化工具,以減少重複支出並提高管治的一致性。從設計之初就建立財務營運實踐,正在減少混合雲端市場的浪費。供應商也積極回應,提供統一的計費儀表板,將使用情況與成本中心關聯起來。隨著多重雲端成熟度的提高,工作負載的無縫遷移已成為混合雲端市場的關鍵採購標準。

資料主權架構的需求日益成長

嚴格的隱私法規正在重塑工作負載部署決策。尤其在歐洲,84% 的組織正在使用主權雲端解決方案,或計劃在未來 12 個月內部署此類解決方案。澳洲和亞洲部分地區也採用了類似的法規,迫使服務提供者推出區域特定的控制平面。專門的主權解決方案承諾提供資料居住、金鑰管理和本地運營商支援。超大規模雲端服務超大規模資料中心業者目前正在為歐盟整合機密運算和專用支援模式,以維持其在混合雲端市場的佔有率。日益複雜的合規性要求推動了對架構設計的需求,這種設計既能將高度監管的工作負載保留在特定司法管轄區內,又能利用全球規模來處理監管較少的工作負載。

遷移複雜性與遺留系統整合成本

現代化計劃常常會暴露出未記錄的依賴關係,導致工期和預算大幅超支。大型銀行在為混合環境重構核心支付系統時,都遭遇了嚴重的超支。如今,73% 的公司選擇重構而非直接遷移,以延長工期為代價,換取了更高的系統彈性。持續整合管道和 API 閘道在一定程度上緩解了瓶頸問題,但技術債仍然是混合雲端市場短期內的一大阻力。

細分市場分析

預計到 2031 年,業務收益將以 14.68% 的複合年成長率成長,而解決方案在 2025 年將保持 64.80% 的混合雲端市場佔有率。這一高成長率主要得益於企業對多重雲端編配、主權映射和 AI 技術棧對齊方面的專家指導的需求。 Rackspace 和 AWS 已推出“快速遷移方案”,將工具和專業服務結合,以縮短遷移時間。

託管式財務運維 (FinOps)、容器安全和平台運維的需求不斷成長,迫使服務提供者擴展其服務範圍。 Nutanix 推出了一款融合軟體和諮詢服務的企業級人工智慧平台,旨在填補技能短缺的空白。這些趨勢表明,隨著企業將複雜維運外包,服務領域將在混合雲端市場中佔據更大的佔有率。

預計從2026年到2031年,IaaS將以13.62%的複合年成長率成長。同時,由於企業套件的普及,SaaS將維持54.10%的市場佔有率。生成式人工智慧訓練需要配備豐富GPU的叢集,客戶通常會在IaaS平台上建立這些集群以進行自訂調優。 Oracle已擴展其分散式雲端產品組合,提供可在惡劣環境下部署運算資源的粗紗邊緣設備,凸顯了IaaS的多功能性。

平台即服務 (PaaS) 是一座策略橋樑,它提供抽象層,同時允許自訂運行時。 Snowflake 已將其平台與 Azure OpenAI 服務整合,以簡化分析開發人員的模型使用。隨著人工智慧和開發工作流程的融合,這三種模式將在混合雲端市場中繼續互通。

混合雲端市場按組件(解決方案、服務)、服務模式(IaaS、PaaS、SaaS)、組織規模(大型企業、中小企業)、最終用戶行業(政府及公共部門、醫療保健及生命科學、銀行、金融服務和保險等)以及地區進行細分。市場預測以美元(USD)計價。

區域分析

北美地區預計到 2025 年將佔據 25.30% 的市場佔有率,這得益於其密集的超大規模超大規模資料中心業者網路,簡化了多重雲端部署。 TP ICAP 計劃在 2026 年將其 80% 的系統遷移到 AWS,同時建立一個人工智慧實驗室,用於資本市場創新。聯邦隱私法規仍然可控,使企業能夠自由最佳化混合雲端市場的工作負載部署。

亞太地區到2031年將以12.89%的複合年成長率領跑,主要受產能擴張和數位服務需求成長的推動。微軟已承諾在日本投資29億美元建造新的人工智慧和雲端運算園區,以滿足日益成長的推理處理需求。隨著國內成長放緩,中國服務供應商正積極拓展海外市場。目前,亞太地區資料中心已投入運作中12,206兆瓦,在建容量達14,338兆瓦,這將為混合雲端市場的未來成長提供有力支撐。

歐洲正穩步推進,84% 的企業正在實施或計劃建立主權雲端框架。微軟已部署了多層主權解決方案,涵蓋邏輯隔離、本地金鑰管理和歐盟本地支援團隊。俄羅斯和沙烏地阿拉伯嚴格的資料在地化法律增加了複雜性,但也為本地專家創造了機會。在中東和非洲 (MEA) 以及南美等新興市場,隨著海底電纜線路和可再生能源計劃的發展降低了准入門檻,投資正在加速成長,從而推動了混合雲端市場的發展。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 大型企業多重雲端採用率激增

- 資料主權架構的需求日益成長

- 加速生成式人工智慧工作負載需要雲端到邊緣的接近性。

- 邊緣原生容器編排管理框架正在日趨成熟

- 企業對成本最佳化和財務營運能力的興趣日益濃厚

- 綠色資料中心指令推動混合環境回歸

- 市場限制

- 遷移複雜性與遺留系統整合成本

- 雲端原生安全和財務維運技能短缺

- 隱藏的資料傳輸費用限制了工作負載的可攜性。

- 地緣政治資料本地化法規使架構碎片化

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 對影響市場的宏觀經濟因素進行評估

第5章 市場規模與成長預測

- 按組件

- 解決方案

- 服務

- 按服務模式

- 基礎設施即服務 (IaaS)

- 平台即服務 (PaaS)

- 軟體即服務 (SaaS)

- 按組織規模

- 主要企業

- 中小企業

- 按最終用戶行業分類

- 政府和公共部門

- 醫療保健和生命科學

- 銀行、金融服務和保險(BFSI)

- 零售與電子商務

- 資訊通訊技術和電訊

- 製造業

- 媒體與娛樂

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amazon Web Services Inc.

- Microsoft Corporation

- Google LLC

- IBM Corporation

- Cisco Systems Inc.

- Hewlett Packard Enterprise Company

- VMware Inc.

- Oracle Corporation

- Alibaba Cloud

- Dell Technologies Inc.

- Rackspace Technology Inc.

- Accenture PLC

- Equinix Inc.

- Fujitsu Ltd.

- NTT Communications Corporation

- DXC Technology Company

- Lumen Technologies Inc.

- Panzura Inc.

- Flexera Software LLC

- Intel Corporation

- Nutanix Inc.

- Red Hat(IBM)

- NetApp Inc.

- Citrix Systems(Cloud Software Group)

第7章 市場機會與未來展望

The hybrid cloud market was valued at USD 172.77 billion in 2025 and estimated to grow from USD 194.14 billion in 2026 to reach USD 347.82 billion by 2031, at a CAGR of 12.37% during the forecast period (2026-2031).

Enterprises are steering toward distributed architectures that balance operational control with cloud-native speed, especially as generative-AI workloads require tight linkage between edge and centralized compute resources. Growing sovereignty rules, multicloud preferences, and maturing container orchestration frameworks spur demand for hybrid deployment models. Edge computing investments shorten latency for AI inference while retaining on-premises data for compliance. Large data-center operators are aligning infrastructure projects with corporate decarbonization targets, adding sustainability as a procurement criterion. Strategic acquisitions by hyperscalers and specialized edge providers intensify competitive differentiation across the hybrid cloud market.

Global Hybrid Cloud Market Trends and Insights

Surge in Multicloud Adoption Among Large Enterprises

Hybrid environments now underpin deliberate multicloud strategies, with 87% of enterprises operating workloads across more than one provider.Platform teams standardize tooling to curb redundant spend and improve governance consistency. Financial-operations practices are embedded at design stages to cut waste in the hybrid cloud market. Vendors respond by offering unified billing dashboards that map usage to cost centers. As multicloud maturity rises, seamless workload portability becomes a core purchase criterion for the hybrid cloud market.

Rising Demand for Data-Sovereign Architectures

Strict privacy regimes reshuffle workload placement decisions, particularly in Europe where 84% of organizations either use or plan sovereign cloud solutions within 12 months.Australia and parts of Asia adopt similar rules, pressing providers to launch region-specific control planes. Specialized sovereign offerings promise residency, key management, and local operator staffing. Hyperscalers now integrate confidential computing and dedicated EU support models to retain share in the hybrid cloud market. Compliance complexity therefore fuels demand for architecture designs that keep sensitive data in jurisdiction while leveraging global scale for less regulated workloads.

Migration Complexity and Legacy Integration Costs

Modernization projects often reveal undocumented dependencies that inflate timelines and budgets. Large banks report significant overruns when refactoring core payment systems for hybrid environments. Seventy-three percent of enterprises now refactor rather than lift-and-shift, extending schedules yet delivering better resilience. Continuous integration pipelines and API gateways partly mitigate the hurdle, but technical debt remains a near-term drag on the hybrid cloud market.

Other drivers and restraints analyzed in the detailed report include:

- GenAI Workload Acceleration Needs Cloud-Edge Proximity

- Green Datacenter Mandates Push Hybrid Repatriation

- Skills Shortage in Cloud-Native Security and FinOps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services revenue is forecast to rise at 14.68% CAGR through 2031, even though solutions retained 64.80% hybrid cloud market share in 2025. The higher growth stems from enterprises requesting expert guidance for multicloud orchestration, sovereignty mapping, and AI stack tuning. Rackspace and AWS launched Rapid Migration Offer programs that bundle tooling with professional services to shorten cut-over durations.

Demand for managed FinOps, container security, and platform operations pushes providers to expand service lines. Nutanix introduced an Enterprise AI platform that blends software with consulting to offset skills shortages. These trends suggest the services segment will account for a larger slice of hybrid cloud market size as organizations outsource complexity.

IaaS is projected to grow at 13.62% CAGR during 2026-2031, while SaaS keeps 54.10% share thanks to entrenched enterprise suites. Generative-AI training needs GPU-rich clusters that customers often build on IaaS for custom tuning. Oracle extended its distributed cloud line with Roving Edge devices that place compute in austere locations, underscoring the versatility of IaaS.

Platform-as-a-Service occupies a strategic bridge, offering abstraction yet permitting custom runtimes. Snowflake linked its platform with Azure OpenAI Service to simplify model usage for analytics developers. The convergence of AI and development workflows will keep all three models interlinked within the hybrid cloud market.

Hybrid Cloud Market is Segmented by Component (Solutions, Services), Service Model (IaaS, Paas, Saas), Organization Size (Large Enterprises, Smes), End-User Industry (Government and Public Sector, Healthcare and Life Sciences, BFSI, and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 25.30% revenue share in 2025 and benefits from dense hyperscaler footprints that simplify multicloud adoption. TP ICAP plans to shift 80% of systems to AWS by 2026 while creating AI labs for capital-markets innovation. Federal privacy rules remain manageable, allowing firms to optimize workload placement freely across the hybrid cloud market.

Asia-Pacific exhibits the steepest 12.89% CAGR through 2031, driven by capacity additions and rising digital-service demand. Microsoft pledged USD 2.9 billion for new AI and cloud zones in Japan to address growing inference requirements. China's providers pursue overseas expansion as domestic growth moderates. Regional data-center capacity now totals 12,206 MW in operation with 14,338 MW under build, underpinning future hybrid cloud market growth.

Europe advances at a steady clip as 84% of firms either deploy or plan sovereign cloud framework adoption. Microsoft rolled out a layered sovereignty solution spanning logical isolation, local key control, and EU-native support teams. Stricter data-localization laws in Russia and Saudi Arabia add complexity but also create opportunities for regional specialists. Emerging markets across MEA and South America accelerate investment as submarine cable routes and renewable energy projects reduce barriers, expanding the hybrid cloud market.

- Amazon Web Services Inc.

- Microsoft Corporation

- Google LLC

- IBM Corporation

- Cisco Systems Inc.

- Hewlett Packard Enterprise Company

- VMware Inc.

- Oracle Corporation

- Alibaba Cloud

- Dell Technologies Inc.

- Rackspace Technology Inc.

- Accenture PLC

- Equinix Inc.

- Fujitsu Ltd.

- NTT Communications Corporation

- DXC Technology Company

- Lumen Technologies Inc.

- Panzura Inc.

- Flexera Software LLC

- Intel Corporation

- Nutanix Inc.

- Red Hat (IBM)

- NetApp Inc.

- Citrix Systems (Cloud Software Group)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in multicloud adoption among large enterprises

- 4.2.2 Rising demand for data-sovereign architectures

- 4.2.3 GenAI workload acceleration needs cloud-edge proximity

- 4.2.4 Edge-native container orchestration frameworks mature

- 4.2.5 Rising enterprise focus on cost optimization and FinOps capabilities

- 4.2.6 Green datacenter mandates push hybrid repatriation

- 4.3 Market Restraints

- 4.3.1 Migration complexity and legacy integration costs

- 4.3.2 Skills shortage in cloud-native security and FinOps

- 4.3.3 Hidden egress-fee economics limit workload portability

- 4.3.4 Geo-political data localization rules fragment architectures

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Service Model

- 5.2.1 Infrastructure as a Service (IaaS)

- 5.2.2 Platform as a Service (PaaS)

- 5.2.3 Software as a Service (SaaS)

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By End-user Industry

- 5.4.1 Government and Public Sector

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Banking, Financial Services and Insurance (BFSI)

- 5.4.4 Retail and E-Commerce

- 5.4.5 Information and Communication Technology and Telecom

- 5.4.6 Manufacturing

- 5.4.7 Media and Entertainment

- 5.4.8 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon Web Services Inc.

- 6.4.2 Microsoft Corporation

- 6.4.3 Google LLC

- 6.4.4 IBM Corporation

- 6.4.5 Cisco Systems Inc.

- 6.4.6 Hewlett Packard Enterprise Company

- 6.4.7 VMware Inc.

- 6.4.8 Oracle Corporation

- 6.4.9 Alibaba Cloud

- 6.4.10 Dell Technologies Inc.

- 6.4.11 Rackspace Technology Inc.

- 6.4.12 Accenture PLC

- 6.4.13 Equinix Inc.

- 6.4.14 Fujitsu Ltd.

- 6.4.15 NTT Communications Corporation

- 6.4.16 DXC Technology Company

- 6.4.17 Lumen Technologies Inc.

- 6.4.18 Panzura Inc.

- 6.4.19 Flexera Software LLC

- 6.4.20 Intel Corporation

- 6.4.21 Nutanix Inc.

- 6.4.22 Red Hat (IBM)

- 6.4.23 NetApp Inc.

- 6.4.24 Citrix Systems (Cloud Software Group)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment