|

市場調查報告書

商品編碼

1906284

歐洲航太與國防領域被動電子元件:市場佔有率分析、產業趨勢、統計數據和成長預測(2026-2031 年)Europe Passive Electronic Components In Aerospace And Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

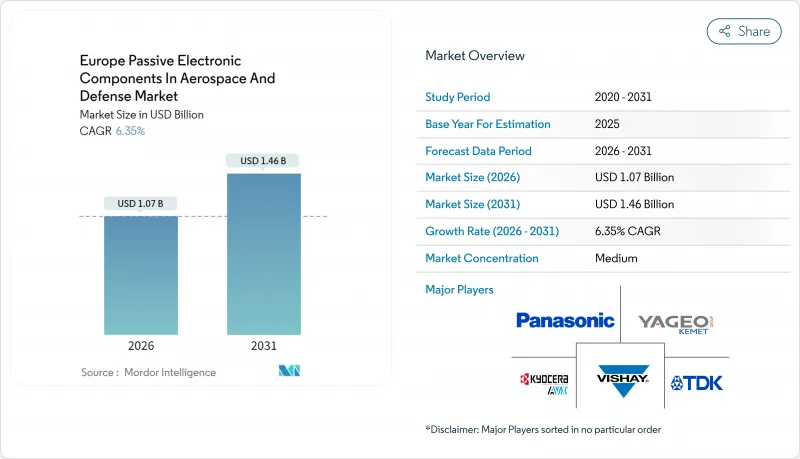

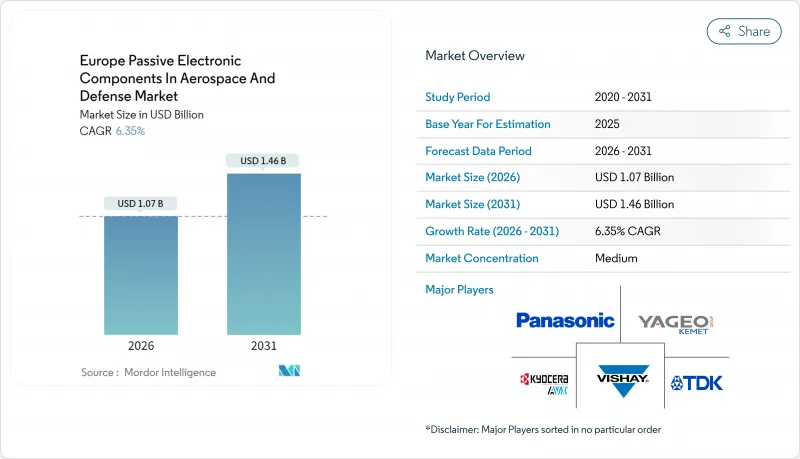

2025年歐洲航太和國防被動電子元件市場價值為10.1億美元,預計2031年將達到14.6億美元,高於2026年的10.7億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 6.35%。

國防現代化計畫的推進、小型衛星星系的擴張以及向電動飛機(MEA)架構的轉變,正在推動對堅固耐用、高可靠性被動元件的需求。供應方面的動力也源自於歐盟委員會的「重整歐洲」(ReArm Europe)舉措,該計畫調動高達8,000億歐元用於加強國防能力。這為符合歐盟嚴格在地採購要求的元件供應商帶來了更廣闊的機會。在平台層面,商用固定翼飛機仍佔大部分支出,但隨著歐洲各國政府和私人業者擴大用於觀測、通訊和軍事監視的軌道資產,衛星和太空船的採購量成長速度目前最快。同時,政策主導的在地化、氮化鎵(GaN)功率元件的探索以及反無人機需求正在重塑競爭格局,迫使供應商加強其區域製造地並加速材料創新。

歐洲航太與國防被動電子元件市場趨勢與洞察

歐洲國防電子現代化計畫激增

2024年創紀錄的3,260億歐元國防預算加速了尖端航空電子設備、雷達和電子戰系統的累計,這些系統廣泛使用高密度電容器、電感器和濾波器。新武器支出從2021年的590億歐元飆升至2024年的1020億歐元,為戰術無線電、主動相控陣雷達和數位飛行電腦提供了更多高品質的被動元件。歐洲防務基金2025年產業計畫(10.65億歐元)為聯合感測器和電子戰研發撥出大量津貼,使歐洲供應商在早期設計機會中領先。同時,一項到2030年將50%的國防採購預算分配給歐盟供應商的政策要求,獎勵主要企業深化與本地被動元件專家的合作,從而鞏固歐洲航太和國防被動電子元件市場的結構性成長路徑。

由於小型衛星和發射服務的擴張,需求迅速成長

歐洲對微型和衛星星系的重視,使得每次發射所需的抗輻射加固被動元件數量加倍。歐洲太空總署(ESA)已為「新雅典娜」計畫累計850萬歐元,並為2024年潛在的M7任務撥款130萬歐元,凸顯了科學和安全有效載荷穩定供應的重要性。元件製造商正積極響應,推出小型化和密封設計,例如Exxelia公司專為低地球軌道(LEO)衛星星座設計的專有MML薄膜電容器。兼具民用和國防成像功能的兩用衛星進一步擴大了市場,隨著各國政府和私營運營商尋求更具韌性的空間基礎設施,歐洲航太和國防被動電子元件市場的持續成長也因此得以實現。

鉭和鐵氧體供應的地緣政治波動

鉭礦通常產自政治不穩定的地區,而鐵氧體原料則嚴重依賴中國的加工能力。出口限制引發的緊張局勢加劇,導致現貨價格上漲和交貨前置作業時間延長。歐洲企業被迫將資金轉移到安全庫存或尋求替代化學品,這給歐洲航太和國防市場被動電子元件的利潤率帶來了壓力。歐盟的《關鍵材料法案》旨在2030年實現10%的國內開採和40%的國內加工,但供應不穩定在短期內仍將阻礙這一目標的實現。

細分市場分析

到2025年,電容器將佔據歐洲航太和國防被動電子元件市場47.15%的主導佔有率,市場規模將達到4.8億美元。陶瓷多層陶瓷電容器(MLCC)在飛行控制系統、雷達和飛彈探求者中發揮電源完整性和去耦功能。儘管價格波動,但其體積效率和抗輻射性能使其市場地位穩固。同時,在中東和非洲(MEA)地區,電感器預計將以7.05%的複合年成長率快速成長,這主要得益於子系統中高密度功率轉換器和電磁干擾(EMI)濾波器的廣泛應用。薄膜和模壓功率電感器擴大應用於氮化鎵(GaN)基轉換器中,而環形扼流圈則用於保護航空電子訊號線免受干擾。

整合式被動元件 (IPD) 透過將電阻元件和電容元件共置於氧化鋁基板上,模糊了不同類別之間的界限,從而實現了更小的尺寸和更高的可靠性。用於主動相控陣雷達 (AESA) 的新興射頻濾波器組件將共振器和電容器整合在單晶片模組中,並加快了認證流程。電阻器、變壓器和射頻濾波器仍然扮演著重要的角色,尤其是在電子戰吊艙中,精確的電阻至關重要。各類別元件的整體動態變化印證了歐洲航太和國防市場被動電子元件的穩定多元化發展路徑,從而支撐了其廣泛的應用。

到2025年,陶瓷技術將佔據歐洲航太和國防被動電子元件市場53.10%的佔有率,這主要得益於其廣泛的應用,包括多層陶瓷電容器(MLCC)、共振器和基板。先進的鈦酸鋇配方技術可在軍用溫度範圍內提供穩定的介電常數,而高溫共燒陶瓷則為嵌入式被動元件提供了支撐。鉭預計將以6.56%的複合年成長率(CAGR)實現最快成長,這主要歸功於其卓越的體積電容,尤其是在衛星和飛彈的負載點轉換器中,體積效率和突波抗擾度比其較高的成本更為重要。

電解電容器仍然是飛機雷達處理器中高容量儲能的關鍵元件,但其在125°C以上溫度下的壽命縮短限制了其在引擎室的應用。採用PPS和PTFE薄膜的薄膜電容器則用於定向能研究和航太推進系統中的脈衝功率線圈。鐵氧體材料是電子戰接收器中環形電感器和寬頻變壓器的基礎,但供應風險迫使供應商對錳鋅合金替代品進行認證。因此,材料的多樣性有助於抵禦地緣政治波動的影響,並維持歐洲航太和國防被動電子元件市場的成長動能。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐洲國防電子現代化計畫激增

- 英國、法國和德國對小型衛星和發射服務的需求激增。

- 分子電飛機(MEA)架構牽引高溫被動元件

- 歐盟支持的氮化鎵功率元件研發:促進先進被動元件的整合

- 有利於區域被動元件供應商的抵銷和在地採購要求

- 烏克蘭衝突後迅速採取反無人機措施和部署精確導引武器

- 市場限制

- 鉭和鐵氧體供應的地緣政治波動

- 符合 REACH 標準的無鉛重新設計所帶來的成本負擔

- 由於歐盟內部陶瓷電容器製造能力不足,導致前置作業時間延長。

- 透過整合SiP解決方案,減少了離散被動元件的數量。

- 產業生態系分析

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 激烈的競爭

- 歐洲國家國防費用分析

第5章 市場規模與成長預測

- 按類型

- 電容器

- 電阻器

- 電感器

- 變壓器

- 高頻/微波濾波器

- 其他(壓敏電阻、熱敏電阻器、電晶體)

- 材料

- 陶瓷製品

- 鉭

- 電解電容器

- 電影

- 鐵氧體

- 碳成分和厚膜

- 按平台

- 民用固定翼飛機

- 軍用固定翼飛機

- 旋翼機

- 無人駕駛飛行器(UAV)

- 飛彈和精確導引武器

- 太空船和衛星

- 最終用戶

- OEM生產線

- 維護、修理和大修 (MRO)

- 按國家/地區

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 北歐國家(瑞典、芬蘭、挪威、丹麥)

- 其他歐洲國家(波蘭、荷蘭、比利時等)

第6章 競爭情勢

- 市場集中度

- 策略措施(合作、併購、資本投資)

- 市佔率分析

- 公司簡介

- KEMET(Yageo)

- Panasonic Corp.

- TDK Corp.

- Vishay Intertechnology Inc.

- AVX(Kyocera)

- Taiyo Yuden Co., Ltd.

- WIMA GmbH and Co. KG

- Cornell Dubilier Electronics Inc.

- API Delevan(Regal Rexnord)

- Bourns Inc.

- TE Connectivity plc

- Eaton plc

- TT Electronics plc

- Ohmite Manufacturing Co.

- Honeywell International Inc.

- Murata Manufacturing Co. Ltd.

- Exxelia Group

- Knowles Precision Devices

- Wurth Elektronik

- Smiths Interconnect

- NIC Components Corp.

- AVX Czech Republic sro

第7章 市場機會與未來展望

The Europe passive electronic components in aerospace and defense market was valued at USD 1.01 billion in 2025 and estimated to grow from USD 1.07 billion in 2026 to reach USD 1.46 billion by 2031, at a CAGR of 6.35% during the forecast period (2026-2031).

Rising defense modernization programmes, expanding small-satellite constellations, and the transition toward More-Electric-Aircraft architectures are intensifying demand for rugged, high-reliability passive parts. Supply-side momentum also stems from the European Commission's ReArm Europe initiative, which will mobilize up to EUR 800 billion for defense capability enhancement, opening wider opportunities for component suppliers that can meet stringent EU localization rules. At platform level, commercial fixed-wing aircraft still dominate spend, yet satellites and spacecraft now post the fastest unit growth as European governments and private operators scale orbital assets for observation, connectivity, and military surveillance. Meanwhile, policy-driven localization, GaN power research, and anti-drone requirements are reshaping the competitive playbook, compelling vendors to deepen regional manufacturing footprints and accelerate material innovation.

Europe Passive Electronic Components In Aerospace And Defense Market Trends and Insights

Surge in European defense-electronics modernization programmes

Record defense allocations of EUR 326 billion in 2024 accelerated procurement of cutting-edge avionics, radars, and EW suites that consume dense arrays of capacitors, inductors, and filters. New armaments spending jumped from EUR 59 billion in 2021 to EUR 102 billion in 2024, channeling larger volumes of qualified passives into tactical radios, active-electronically-scanned-array radars, and digital flight computers. The European Defence Fund's EUR 1.065 billion 2025 Work Programme earmarks sizable grants for collaborative sensor and EW R&D, giving European vendors a head-start on early design-in opportunities. In parallel, a policy mandate that 50% of defense procurement budgets flow to EU suppliers by 2030 incentivizes primes to deepen ties with regional passive specialists, reinforcing the Europe passive electronic components in aerospace and defense market's structural growth path.

Demand spike from small-sat and launch-service build-up

Europe's pivot toward constellations of micro and nano-satellites multiplies the number of radiation-tolerant passives required per launch. The European Space Agency set aside EUR 8.5 million for NewAthena and EUR 1.3 million for M7 mission candidates in 2024, underscoring a steady pipeline of science and security payloads. Component makers are responding with miniaturized, hermetic designs such as Exxelia's Trademarked MML film capacitors tailored to LEO constellations. Dual-use satellites that combine civil and defense imagery further expand total available market, positioning the Europe passive electronic components in aerospace and defense market for sustained upside as both governments and commercial operators pursue resilient space infrastructures.

Geopolitical volatility of tantalum and ferrite supply

Tantalum ore often originates from politically unstable regions, while ferrite raw materials depend heavily on Chinese processing capacity. Heightened tension around export controls raises spot prices and lengthens lead times. European firms must divert capital toward safety stock and explore alternate chemistries, squeezing margins within the Europe passive electronic components in aerospace and defense market. The EU's Critical Raw Materials Act aims to localize 10% of extraction and 40% of processing by 2030, yet interim volatility remains a drag on growth.

Other drivers and restraints analyzed in the detailed report include:

- More-Electric-Aircraft architectures driving high-temp passives

- EU-backed GaN power R&D catalysing advanced passives integration

- Cost burden of REACH-compliant lead-free redesigns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Europe passive electronic components in aerospace and defense market size for capacitors reached USD 0.48 billion in 2025, translating to a dominant 47.15% share. Ceramic MLCCs underpin power-integrity and decoupling functions across flight controls, radar, and missile seekers. Their volumetric efficiency and radiation tolerance keep them entrenched despite price swings. Inductors, however, are scaling faster at a 7.05% CAGR as high-density power converters and EMI filters proliferate in MEA subsystems. Thin-film and molded power inductors gain traction inside GaN-based converters, while toroidal chokes secure avionics signal lines against interference.

Integrated Passive Devices (IPDs) are blurring categorical lines by co-locating resistive and capacitive elements onto alumina substrates, shrinking size and boosting reliability. Emerging RF filter assemblies for AESA radar merge resonators and capacitors within monolithic modules to expedite qualification. Resistors, transformers, and RF filters sustain niche but critical roles, particularly in electronic warfare pods where precision impedance matching is essential. The aggregate dynamism across categories confirms a steady diversification path underpinning the broader Europe passive electronic components in aerospace and defense market.

Ceramic technology captured 53.10% of the Europe passive electronic components in aerospace and defense market share in 2025 thanks to its wide utility across MLCCs, resonators, and substrates. Advanced barium-titanate formulations deliver stable dielectric constants across military-temperature ranges, while high-temperature cofired ceramics support embedded passives. Tantalum's superior volumetric capacitance positions it for fastest growth at 6.56% CAGR, particularly within point-of-load converters on satellites and missiles where volumetric efficiency and surge reliability outweigh cost premiums.

Aluminum electrolytics remain indispensable for bulk energy storage inside airborne radar processors, though life-time derating above 125 °C limits their use in engine bays. Film capacitors leveraging PPS and PTFE films cater to pulse-power coils in directed-energy research and space propulsion. Ferrite materials underpin toroidal inductors and broadband transformers in EW receivers, yet supply risk forces vendors to qualify manganese-zinc substitutes. Consequently, material diversity acts as a hedge against geopolitical volatility, sustaining momentum for the Europe passive electronic components in aerospace and defense market.

The Europe Passive Electronic Components in Aerospace and Defense Market Report is Segmented by Type (Capacitors, Resistors, Inductors, and More), Material (Ceramic, Tantalum, Aluminum Electrolytic, Film, Ferrite, and More), Platform (Commercial Fixed-Wing Aircraft, Military Fixed-Wing Aircraft, Rotorcraft and More), End-User (OEM Production Lines, and MRO), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- KEMET (Yageo)

- Panasonic Corp.

- TDK Corp.

- Vishay Intertechnology Inc.

- AVX (Kyocera)

- Taiyo Yuden Co., Ltd.

- WIMA GmbH and Co. KG

- Cornell Dubilier Electronics Inc.

- API Delevan (Regal Rexnord)

- Bourns Inc.

- TE Connectivity plc

- Eaton plc

- TT Electronics plc

- Ohmite Manufacturing Co.

- Honeywell International Inc.

- Murata Manufacturing Co. Ltd.

- Exxelia Group

- Knowles Precision Devices

- Wurth Elektronik

- Smiths Interconnect

- NIC Components Corp.

- AVX Czech Republic s.r.o.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in European defense-electronics modernization programmes

- 4.2.2 Demand spike from small-sat and launch-service build-up in United Kingdom, France and Germany

- 4.2.3 More-Electric-Aircraft (MEA) architectures driving high-temp passives

- 4.2.4 EU-backed GaN power R&D catalysing advanced passives integration

- 4.2.5 Offset and localisation mandates favouring regional passive suppliers

- 4.2.6 Rapid anti-drone and precision-munition deployment post-Ukraine conflict

- 4.3 Market Restraints

- 4.3.1 Geopolitical volatility of tantalum and ferrite supply

- 4.3.2 Cost burden of REACH-compliant lead-free redesigns

- 4.3.3 Limited EU ceramic-capacitor fab capacity lengthening lead-times

- 4.3.4 Integration of SiP solutions reducing discrete passive counts

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

- 4.7 Defense Spending Analysis - European Countries

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Capacitors

- 5.1.2 Resistors

- 5.1.3 Inductors

- 5.1.4 Transformers

- 5.1.5 RF and Microwave Filters

- 5.1.6 Others (Varistors, Thermistors, Quartz)

- 5.2 By Material

- 5.2.1 Ceramic

- 5.2.2 Tantalum

- 5.2.3 Aluminum Electrolytic

- 5.2.4 Film

- 5.2.5 Ferrite

- 5.2.6 Carbon Composition and Thick Film

- 5.3 By Platform

- 5.3.1 Commercial Fixed-Wing Aircraft

- 5.3.2 Military Fixed-Wing Aircraft

- 5.3.3 Rotorcraft

- 5.3.4 Unmanned Aerial Vehicles (UAVs)

- 5.3.5 Missiles and Precision Munitions

- 5.3.6 Spacecraft and Satellites

- 5.4 By End-User

- 5.4.1 OEM Production Lines

- 5.4.2 Maintenance, Repair and Overhaul (MRO)

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 France

- 5.5.3 United Kingdom

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Nordics (Sweden, Finland, Norway, Denmark)

- 5.5.7 Rest of Europe (Poland, Netherlands, Belgium and Others)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (Partnerships, M&A, CapEx)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 KEMET (Yageo)

- 6.4.2 Panasonic Corp.

- 6.4.3 TDK Corp.

- 6.4.4 Vishay Intertechnology Inc.

- 6.4.5 AVX (Kyocera)

- 6.4.6 Taiyo Yuden Co., Ltd.

- 6.4.7 WIMA GmbH and Co. KG

- 6.4.8 Cornell Dubilier Electronics Inc.

- 6.4.9 API Delevan (Regal Rexnord)

- 6.4.10 Bourns Inc.

- 6.4.11 TE Connectivity plc

- 6.4.12 Eaton plc

- 6.4.13 TT Electronics plc

- 6.4.14 Ohmite Manufacturing Co.

- 6.4.15 Honeywell International Inc.

- 6.4.16 Murata Manufacturing Co. Ltd.

- 6.4.17 Exxelia Group

- 6.4.18 Knowles Precision Devices

- 6.4.19 Wurth Elektronik

- 6.4.20 Smiths Interconnect

- 6.4.21 NIC Components Corp.

- 6.4.22 AVX Czech Republic s.r.o.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment