|

市場調查報告書

商品編碼

1683433

無源電子元件市場:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Passive Electronic Components - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

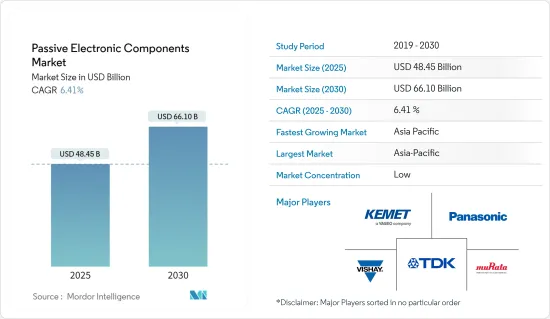

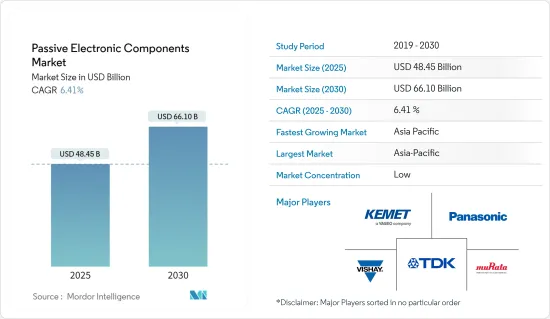

預計 2025 年被動電子元件市場規模為 484.5 億美元,到 2030 年將達到 661 億美元,預測期內(2025-2030 年)的複合年成長率為 6.41%。

被動電子元件是所有電子元件的基礎,以物理設計和電路建模的語言來描述複雜系統的電氣行為。積體電路包含這些元件,而電路基板包含分離式被動元件。電子設備需求的不斷成長預計將推動被動電子元件市場的成長。

關鍵亮點

- 由於產品發布的增加、家用電子電器領域的發展、汽車電子中電感器的使用增加以及智慧電網的採用,電感器的成長目前保持強勁。在全球範圍內,平板電腦、智慧型手機、筆記型電腦、機上盒和掌上遊戲機等家用電子電器的需求不斷成長是推動電感器需求的主要因素。

- 隨著技術的進步,電子設備和裝置變得越來越複雜,這主要是由於消費者對更小或更薄的設備的需求不斷增加。現在,消費者對這些裝置有一定的標準,例如時尚、纖薄的設計以及無邊框螢幕。

- 此外,由於成本低、體積小、重量輕,MEMS 陀螺儀在智慧型手機中取得了巨大的成功。過去幾年中,語音智慧型設備等功能的普及率也不斷提高。預計到 2023年終,Amazon Echo、Google Home 和 Sonos 等智慧型裝置的普及率將大幅提升。年輕一代將這些設備視為執行日常活動的更聰明、更快捷、更輕鬆的方式。

- 過去幾年,穿戴式裝置在醫療保健領域的應用日益受到關注,進而成為影響研究市場的關鍵因素之一。穿戴式連線裝置的主要趨勢包括用於疼痛管理的穿戴式裝置的需求不斷增加,以及在心血管疾病管理中穿戴式裝置的使用不斷增加。

- 鎳對工業國家至關重要,因為它是鋼鐵工業中必不可少的元素。印尼是最大的礦產和鎳出口國,由於對中國的供應受到限制,該國已禁止鎳出口,希望提高鎳價。

- 新冠肺炎疫情對全球產業供應鏈造成嚴重破壞。為了防止病毒傳播,全球許多企業已暫停或縮減營運。疫情影響了被動電子元件市場,導致整個供應鏈的原料和元件生產層面的營運水準下降。這導致各個地區和國家的銷售額下降。

- 疫情過後,家用電子電器產業需求增加預計將推動無源電子元件市場的需求。例如,根據產業機構印度蜂窩和電子協會 (ICEA) 的數據,2022 年 4 月至 2023 年 2 月期間,智慧型手機出口額比前一年加倍,徘徊在 45 億美元左右。此外,由於製造商加大了產量和外部出貨量,印度的行動電話出口(主要受蘋果和三星的推動)在 2023 年前兩個月突破了 20 億美元,自 2022 年 4 月以來的整體出口額超過 90 億美元。

被動電子元件市場趨勢

電感器領域、消費性電子和計算行業預計將佔據主要市場佔有率

- 電感器在電路中扮演調節電壓、濾除雜訊、控制電流等重要角色。由於它們高度依賴直流電,因此廣泛應用於家用電子電器。在各種消費性產品中的開關電源設備中,電感器用作能源儲存元件來產生直流電。家用電子電器領域的擴張和產業投資的增加預計將推動市場需求。

- 電感器在家用電子電器領域最為重要,因為它們有多種用途。它用於電源管理、訊號濾波和電磁干擾抑制。電感器在電視、數位機上盒、智慧型手錶、印表機、音響設備等家用電子電器中發揮重要作用。其主要作用是確保電源穩定、消除雜訊、實現可靠的訊號傳輸。精心挑選和設計電感器可最佳化家用電子電器產品的效能,最終改善整體使用者體驗。將電感器加入這些設備可提高效率、穩定性和可靠性。

- 近年來,許多技術進步導致家用電子電器的使用量激增。各種技術改進的結合正在吸引客戶,從而導致電感器的需求增加。家用電子電器中觸控螢幕和其他先進功能的引入進一步增加了產業對電感器的需求。隨著家用電子電器領域產品的不斷推出,對電感器的需求也增加。

- 智慧型手機已經成為使用電感器不可或缺的部件。高頻電感一般應用在行動電話中,已經成為我們日常生活中不可或缺的元件。內建高頻電感,讓網路瀏覽速度更快、更穩定,讓您隨時隨地了解最新社會動態,提升通話質量,提升整體行動電話用戶體驗。

- 由於智慧型手機技術對消費者需求的依賴性很強,因此其成長速度比其他技術更快。隨著每代行動通訊網路的發展,行動電話中電感的數量都大大增加。隨著智慧型手機的不斷發展和普及,特別是在開發中國家,其擴展管道將進一步擴大。 5G智慧型手機的普及以及5G行動電話製造投資的不斷成長預計將增加對電感器的需求。

- 根據愛立信的最新報告,全球智慧型手機行動網路用戶數量預計將在2022年達到近64億,到2028年將超過77億人。值得注意的是,中國、印度和美國在智慧型手機和行動網路用戶數量方面處於領先地位。儘管預計 2022 年銷量將趨於平穩,但智慧型手機的平均售價正在上漲,預計將在未來幾年推動市場發展。

亞太地區電感器市場預計將顯著成長

- 日本、中國、韓國和台灣等許多國家和地區都擁有大型無源電子巨頭和代工廠。受智慧家用電子電器、創新高階產品和新型智慧型手機的推動,亞太消費電子市場預計將持續成長。因此,受該地區銷售額成長的推動,電感器的需求預計會增加。

- 工業和資訊化部表示,中國在創新和品牌建立方面表現出色,鞏固了其在家用電子電器產品生產和銷售領域的全球領先地位。隨著該地區不斷增加的投資以提高生產能力,消費性電子市場有望實現成長。

- 印度電子與資訊技術部(MeitY)預測,到2026年,該國電子製造業的價值將達到3,000億美元,其中行動電話銷售將引領市場。據 ICEA 稱,2022 年行動電話銷售額預計將達到 400 億美元,預計到 2026 年將成長到 800 億美元。這些政府旨在提高該地區行動電話製造能力的措施預計將帶來對電感器的需求。

- 根據GSMA的報告,印度可望成為亞太地區領先的國家,到2030年智慧型手機連線數將達到13億。該地區擁有成長最快的5G市場,愛立信預測,到2028年,5G將佔印度行動用戶的57%,總合用戶數將達到6.998億。因此,預計市場將受到行動電話需求、網路廣泛普及和創新影像技術的推動。

- 愛立信預測,到2028年終,東南亞和大洋洲的5G用戶數將達到約6.2億,這意味著5G將超越其他技術,成為用戶的壓倒性選擇,滲透率將達到48%。此外,預計到 2022 年該地區的 5G 用戶數將接近 3,000 萬。 5G舉措的不斷增加預計將增加市場機會。

無源電子元件市場概況

無源電子元件市場主要分為台達電子股份有限公司、松下電器產業株式會社、TDK 株式會社、Vishay Intertechnology Inc. 和村田製作所等主要企業。該市場的參與企業正在採用合作和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2023 年 10 月,TDK 公司宣布推出 PLEA85,這是專為電池供電的穿戴式裝置和其他裝置開發的一系列高效能功率電感器,可延長運作時間。新系列採用TDK新開發的低損耗磁性材料和薄膜加工技術,實現了業界最薄的尺寸。

- 2023 年 10 月,Vishay Intertechnology Inc. 推出了一系列採用密封玻璃金屬密封的濕鉭電容器。對於航空電子和航太,STH電解電容器具有 Vishay SuperTan 擴展系列元件的所有優點,同時採用高可靠性設計,提高了軍用 H 級衝擊和振動能力,並將熱衝擊能力提高到 300 次循環。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 產業價值鏈分析

- 新冠肺炎疫情及其他宏觀經濟因素對市場的影響

- 2022 年鈀和釕的需求和供應情況以及 2023 年預測

第5章 市場動態

- 市場促進因素

- 電子產品日益複雜

- 設計越來越趨向小型化

- 市場問題

- 金屬價格上漲影響零件製造成本

第6章 市場細分

- 電容器

- 按類型

- 陶瓷電容器

- 鉭電容器

- 電解電容器

- 紙/塑膠薄膜電容器

- 超級電容

- 按最終用戶產業

- 車

- 工業的

- 航太和國防

- 能源

- 通訊/伺服器/資料存儲

- 消費性電子產品

- 醫療

- 按地區

- 美洲

- 歐洲、中東和非洲

- 亞太地區(日本和韓國除外)

- 日本和韓國

- 按類型

- 電感器

- 按類型

- 力量

- 按頻率

- 按最終用戶產業

- 車

- 航太和國防

- 通訊

- 家用電子電器與電腦

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

- 按類型

- 電阻器

- 按類型

- 表面黏著技術晶片

- 網路

- 繞線

- 薄膜/氧化膜/箔

- 碳

- 按最終用戶產業

- 車

- 航太和國防

- 通訊

- 家用電子電器與電腦

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

- 按類型

第7章 競爭格局

- 公司簡介

- Delta Electronics Inc.

- Panasonic Corporation

- TDK Corporation

- Vishay Intertechnology Inc.

- Murata Manufacturing Co. Ltd

- AVX Corporation(Kyocera Corporation)

- Taiyo Yuden Co. Ltd

- Sagami Elec Co. Ltd

- WIMA GmbH & Co. KG

- Cornell Dubilier Electronics Inc.

- Yageo Corporation

- Lelon Electronics Corp.

- United Chemi-Con(Nippon Chemi-con Corporation)

- Bourns Inc.

- Wurth Elektronik Group

- API Delevan(Fortive Corporation)

- Eaton Corporation

- Coilcraft Inc.

- TT Electronics PLC

- KOA Speer Electronics Inc.

- TE Connectivity Ltd

- Ohmite Manufacturing Company

- Susumu Co. Ltd

- Viking Tech Corporation

- Honeywell International Inc.

第8章 中國廠商名單

第9章投資分析

第 10 章:投資分析市場的未來

The Passive Electronic Components Market size is estimated at USD 48.45 billion in 2025, and is expected to reach USD 66.10 billion by 2030, at a CAGR of 6.41% during the forecast period (2025-2030).

Passive electronic components are the cornerstone of all electronics, in physical design and circuit models' language, representing electrical behavior in complicated systems. Integrated circuits include these components, and circuit boards contain discrete passive components. The increasing demand for electronic devices is anticipated to boost the passive electronic components market's growth.

Key Highlights

- The growth of inductors is presently steady, owing to the increasing number of product launches, the developments in the consumer electronics sector, the rising use of inductors in automotive electronics, and the adoption of smart grids. Globally, the rising demand for consumer electronics, such as tablets, smartphones, laptops, set-top boxes, and portable gaming consoles, is the major factor boosting the need for inductors.

- With the advent of technological advancements, electronics, and electronic devices are getting more complex, primarily due to the increasing consumer demand for small or slim devices. Customers have a specific standard for these devices nowadays, such as a sleek, thin design, with the screen going from edge to edge.

- Moreover, smartphones have witnessed the great success of MEMS gyroscopes owing to their low cost, miniature size, and lightweight nature. Features like voice-enabled smart devices have also been witnessing increased adoption over the past few years. The adoption of smart devices, such as the Amazon Echo, Google Home, and Sonos, was estimated to be aggressive by the end of 2023. The younger generation views these devices as the smarter, faster, and easier way to perform everyday activities.

- The adoption of wearables in the healthcare sector has been gaining traction in recent times, which, in turn, has been one of the significant factors influencing the market studied. The major trends in wearable connected devices include the increasing demand for pain management wearable devices and the increasing use of wearables for cardiovascular disease management.

- As nickel is an essential element for steel industries and, therefore, crucial to industrial countries, in recent times, the price of the element has been most affected by continuing lockdowns in some parts of the world, coupled with supply-side restraints. Indonesia, the largest miner and nickel exporter, banned metal exports in the hopes of a price rise in the wake of limited supplies to China.

- The COVID-19 pandemic led to immense disruptions in supply chains across industries globally. Many businesses globally halted or reduced operations to help combat the spread of the virus. The pandemic impacted the passive electronic components market, leading to decreased operation levels across the supply chain on the raw material and component production levels. This denoted a fall in sales in a range of regions and countries.

- The demand from consumer electronics industries has increased post-pandemic and is anticipated to boost the demand in the passive electronic components market. For instance, according to the industry body India Cellular and Electronics Association (ICEA), smartphone exports in the April 2022-February 2023 years doubled from a year ago when exports hovered around USD 4.5 billion. In addition, India's mobile phone exports crossed USD 2 billion in the first two months of 2023, driven mainly by Apple and Samsung, taking the entire export value to over USD 9 billion since April 2022, as manufacturers stepped up production and external shipments.

Passive Electronic Components Market Trends

The Consumer Electronics and Computing Industry in the Inductors Segment is Expected to Hold a Significant Market Share

- Inductors have a significant function in the regulation of voltage, noise filtration, and current control within electrical circuits. Their usage is widespread in consumer electronics due to their strong reliance on DC power. In switched-mode power devices in various consumer products, inductors serve as energy storage components to generate DC current. The market is anticipated to experience increased demand due to the expanding consumer electronics sector and growing investments in the industry.

- Inductors are of utmost importance in the consumer electronics sector as they serve multiple purposes. They are utilized for power management, signal filtering, and suppressing electromagnetic interference. In consumer electronic devices like televisions, digital set-top boxes, smartwatches, printers, and audio equipment, inductors act as crucial components. Their primary function is to ensure a steady power supply and eliminate noise, thereby ensuring reliable signal transmission. By carefully selecting and designing inductors, the performance of consumer electronics is optimized, ultimately enhancing the overall user experience. The incorporation of inductors in these devices leads to improved efficiency, stability, and reliability.

- Due to numerous technological advancements, there has been a significant surge in the utilization of consumer electronic devices in recent years. The incorporation of various technological enhancements has captivated customers, leading to a higher demand for inductors. The introduction of touch screens and other advanced functionalities in consumer electronics has further fueled the need for inductors within the industry. With the increasing number of product launches in the consumer electronics sector, there is a growing demand for inductors in the industry.

- Smartphones have become integral components for the utilization of inductors. Typically, high-frequency inductors find their application in mobile phones, which have now become indispensable in day-to-day lives. The incorporation of high-frequency inductors enables faster and more stable internet browsing, facilitates staying updated with the latest social events at any time and place, enhances call quality, and elevates the overall mobile phone user experience.

- Smartphone technology is experiencing rapid growth in comparison to other technologies due to its strong reliance on consumer demand. The quantity of inductors in mobile phones experiences a substantial rise with every successive generation of the mobile communication network. As smartphones continue to evolve and their adoption rate expands, particularly in developing nations, additional avenues for expansion arise. The surge in 5G smartphones and the escalating investments in the manufacturing of 5G mobile phones are projected to amplify the need for inductors.

- Ericsson's most recent report disclosed that the global count of smartphone mobile network subscriptions nearly reached 6.4 billion in 2022, and it is projected to surpass 7.7 billion by 2028. It is noteworthy that China, India, and the United States are at the forefront, boasting the highest number of smartphone mobile network subscriptions. Although sales plateaued in 2022, the rising average selling price of smartphones is anticipated to propel the market in the forthcoming years.

Asia-Pacific is Expected to Witness Significant Growth in the Inductors Segment

- The demand for inductors is primarily felt in Asia-Pacific, with many countries, like Japan, China, South Korea, and Taiwan, hosting massive companies and foundries for several major passive electronic powerhouses. The consumer electronics market in Asia-Pacific is expected to witness consistent growth, driven by the popularity of smart appliances, innovative high-end products, and new smartphones. As a result, the demand for inductors is also expected to increase, fueled by the expanding sales in the region.

- China, in particular, has excelled in innovation and brand building, securing its position as the global leader in the production and sales of consumer electronics, as stated by the Ministry of Industry and Information Technology. With increasing investments in the region to enhance production capabilities, the consumer electronics market is poised for growth.

- The Ministry of Electronics and Information Technology (MeitY) in India has forecasted that the electronics manufacturing sector in the country will achieve a worth of USD 300 billion by 2026, with mobile phone sales taking the lead in the market. As per ICEA, mobile phone sales were estimated at USD 40 billion in 2022 and are anticipated to rise to USD 80 billion by 2026. These governmental efforts to enhance the mobile phone production capabilities in the region are expected to consequently generate demand for inductors.

- As per the GSMA report, India is anticipated to emerge as the leading country in Asia-Pacific by 2030, with 1.3 billion smartphone connections. The region boasts some of the most rapidly expanding 5G markets, and by 2028, Ericsson predicts that 5G will constitute 57% of mobile subscriptions in India, totaling 699.8 million subscriptions. Consequently, the market is anticipated to be propelled by the demand for mobile phones, facilitated by extensive internet penetration and innovative imaging technology.

- Ericsson predicts that by the end of 2028, the number of 5G subscriptions in Southeast Asia and Oceania will reach approximately 620 million. This indicates that 5G will surpass other technologies and become the dominant choice for subscribers, with a penetration rate of 48%. Furthermore, it is projected that the region will have nearly 30 million 5G subscriptions by 2022. Such increasing 5G deployment initiatives are expected to enhance the market opportunities.

Passive Electronic Components Market Overview

The passive electronic components market is fragmented with the presence of major players like Delta Electronics Inc., Panasonic Corporation, TDK Corporation, Vishay Intertechnology Inc., and Murata Manufacturing Co. Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In October 2023, TDK Corporation announced the launch of its new PLEA85 series of high-efficiency power inductors developed for battery-powered wearables and other devices, improving operating times. The new series has the lowest profile in the industry, owing to the use of TDK's newly developed low-loss magnetic material and its thin-film processing techniques.

- In October 2023, Vishay Intertechnology Inc. launched a new series of wet tantalum capacitors with hermetic glass-to-metal seals. For avionics and aerospace applications, the STH electrolytic capacitors provide all the advantages of Vishay's SuperTan extended series devices while offering a higher reliability design for improved military H-level shock and vibration capabilities and increased thermal shock up to 300 cycles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 and Other Macroeconomic Factors on the Market

- 4.5 Demand and Supply of Palladium and Ruthenium Till 2022 and Forecast for 2023

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Complexity of Electronics

- 5.1.2 Increasing Miniaturized Design Preferences

- 5.2 Market Challenges

- 5.2.1 Rising Metal Prices Impacting Component Production Costs

6 MARKET SEGMENTATION

- 6.1 Capacitors

- 6.1.1 By Type

- 6.1.1.1 Ceramic Capacitors

- 6.1.1.2 Tantalum Capacitors

- 6.1.1.3 Aluminum Electrolytic Capacitors

- 6.1.1.4 Paper and Plastic Film Capacitors

- 6.1.1.5 Supercapacitors

- 6.1.2 By End-user Industry

- 6.1.2.1 Automotive

- 6.1.2.2 Industrial

- 6.1.2.3 Aerospace and Defense

- 6.1.2.4 Energy

- 6.1.2.5 Communications/Servers/Data Storage

- 6.1.2.6 Consumer Electronics

- 6.1.2.7 Medical

- 6.1.3 By Geography

- 6.1.3.1 Americas

- 6.1.3.2 Europe, Middle East and Africa

- 6.1.3.3 Asia-Pacific (Excl. Japan and Korea)

- 6.1.3.4 Japan and South Korea

- 6.1.1 By Type

- 6.2 Inductors

- 6.2.1 By Type

- 6.2.1.1 Power

- 6.2.1.2 Frequency

- 6.2.2 By End-user Industry

- 6.2.2.1 Automotive

- 6.2.2.2 Aerospace and Defense

- 6.2.2.3 Communications

- 6.2.2.4 Consumer Electronics and Computing

- 6.2.2.5 Other End-user Industries

- 6.2.3 By Geography

- 6.2.3.1 North America

- 6.2.3.2 Europe

- 6.2.3.3 Asia-Pacific

- 6.2.3.4 Rest of the World

- 6.2.1 By Type

- 6.3 Resistors

- 6.3.1 By Type

- 6.3.1.1 Surface-mounted Chips

- 6.3.1.2 Network

- 6.3.1.3 Wirewound

- 6.3.1.4 Film/Oxide/Foil

- 6.3.1.5 Carbon

- 6.3.2 By End-user Industry

- 6.3.2.1 Automotive

- 6.3.2.2 Aerospace and Defense

- 6.3.2.3 Communications

- 6.3.2.4 Consumer Electronics and Computing

- 6.3.2.5 Other End-user Industries

- 6.3.3 By Geography

- 6.3.3.1 North America

- 6.3.3.2 Europe

- 6.3.3.3 Asia-Pacific

- 6.3.3.4 Rest of the World

- 6.3.1 By Type

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Delta Electronics Inc.

- 7.1.2 Panasonic Corporation

- 7.1.3 TDK Corporation

- 7.1.4 Vishay Intertechnology Inc.

- 7.1.5 Murata Manufacturing Co. Ltd

- 7.1.6 AVX Corporation (Kyocera Corporation)

- 7.1.7 Taiyo Yuden Co. Ltd

- 7.1.8 Sagami Elec Co. Ltd

- 7.1.9 WIMA GmbH & Co. KG

- 7.1.10 Cornell Dubilier Electronics Inc.

- 7.1.11 Yageo Corporation

- 7.1.12 Lelon Electronics Corp.

- 7.1.13 United Chemi-Con (Nippon Chemi-con Corporation)

- 7.1.14 Bourns Inc.

- 7.1.15 Wurth Elektronik Group

- 7.1.16 API Delevan (Fortive Corporation)

- 7.1.17 Eaton Corporation

- 7.1.18 Coilcraft Inc.

- 7.1.19 TT Electronics PLC

- 7.1.20 KOA Speer Electronics Inc.

- 7.1.21 TE Connectivity Ltd

- 7.1.22 Ohmite Manufacturing Company

- 7.1.23 Susumu Co. Ltd

- 7.1.24 Viking Tech Corporation

- 7.1.25 Honeywell International Inc.