|

市場調查報告書

商品編碼

1906263

馬來西亞資料中心冷卻:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Malaysia Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

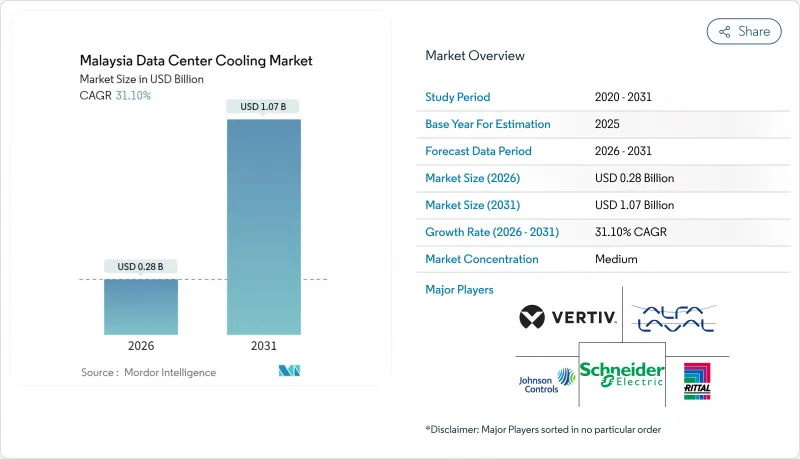

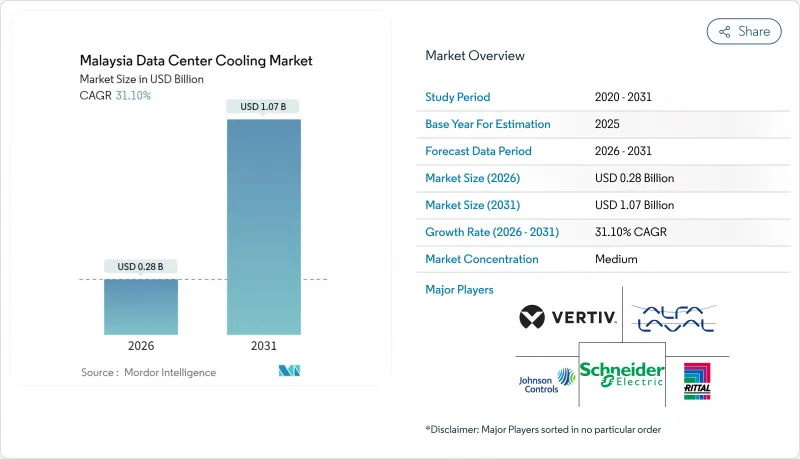

預計到 2026 年,馬來西亞資料中心冷卻市場價值將達到 2.8 億美元。

這代表著從 2025 年的 2.1 億美元成長到 2031 年的 10.7 億美元,2026 年至 2031 年的複合年成長率為 31.10%。

馬來西亞作為東南亞領先的資料中心位置,其發展勢頭強勁,這得益於政府降低營運成本的激勵措施,以及人工智慧(AI)工作負載對先進溫度控管的需求。柔佛州、賽城和吉隆坡大都會大都會圈持續吸引外商直接投資,可再生能源採購計畫也鼓勵營運商升級冷卻基礎設施,以提高能源效率。隨著機架功率密度超過40kW,液冷解決方案正日益普及,但就裝置容量而言,風冷系統仍佔主導地位。供應鏈本地化和組件整合,以及不斷壯大的國內工程師隊伍,使供應商能夠滿足日益成長的需求,即便資源限制給設計選擇帶來了壓力。

馬來西亞資料中心冷卻市場趨勢與洞察

馬來西亞作為亞太地區樞紐的戰略地位

馬來西亞位於新加坡和其他東協市場之間,為超過6.5億用戶提供低於20毫秒的低延遲服務。這促使營運商擴大將計算叢集和相應的冷卻設施部署在本地。高達15條海底光纜的密集部署,使得依賴冗餘冷水循環和獨立機房的高可用性架構成為可能。與新加坡相比,馬來西亞的土地成本低30-40%,這使得專用園區能夠配備冷水-液體轉換室和專用蓄熱倉儲設施,從而降低整體擁有成本。微軟馬來西亞西部雲端區域每個機房採用三條獨立的冷卻管線,以確保高人工智慧密集區域的運作。預計到2030年,該地區的數位經濟收入將成長兩倍,達到1兆美元,因此,新建園區將繼續投資高效能冷卻器和熱通道封閉技術,以確保即使在熱帶環境下也能保持高性能。

超大規模和託管資料中心投資激增,推動降溫需求

柔佛州到2024年IT裝置容量將達到1.6GW,已簽約專案可望推動區域需求到2035年超過5GW。機架密度超過40kW時,需採用接近溫度低於2°C的液冷迴路,以確保晶片可靠性。普林斯頓數位集團(Princeton Digital Group)150MW的園區將已建成面積的35%用於冷卻設備和公用設施走廊,這反映了散熱設備所需面積的不斷成長。超大規模採購正在推動泵浦和熱交換器的在地化生產,馬來西亞國家能源公司(Tenaga Nasional)報告稱,該領域的電力需求實現了兩位數的成長,這為創新型散熱平台的長期發展前景提供了支撐。

資料中心冷卻所需的能源消費量和水資源需求不斷增加

冷卻約佔設施總消費量的40%。到2026年,馬來西亞的電力需求可能成長130%,這將考驗發電儲備。水壓問題更為迫切:柔佛州監管機構預測,資料中心日用水量將達到6.73億公升,但現有供水網路日供水量僅1.42億公升。一項為期三年的飲用水淘汰計畫迫使企業安裝空冷式和再生水冷卻系統,將使資本支出增加高達35%。能夠部署閉式液冷系統的業者可以實現80%至90%的節能,但在快速成長的資本支出週期中,初始成本仍是一大障礙。

細分市場分析

截至2025年,受現有部署和營運商熟悉度的推動,風冷架構在馬來西亞資料中心冷卻市場仍佔71.20%的佔有率。然而,液冷平台繼續以25.85%的複合年成長率成長,預計到2031年將成為馬來西亞資料中心冷卻市場規模成長的最大部分。雖然對於20kW以下的機架,冷卻器機組加CRAH(機房空調機組)設計仍然是首選,但在中等密度機房中,風冷解決方案仍然佔據主導地位,因為間接蒸發冷卻和節熱器盤管可以提高PUE(電源使用效率)。液浸式冷卻槽可將風扇能耗降低到接近零,從而在電費上漲的壓力下降低營運成本。混合式後門熱交換器作為一種過渡技術,無需進行重大設備升級即可實現工作負載遷移。供應商正在推動熱交換器撬裝設備的在地化生產,以縮短前置作業時間並抓住人工智慧應用帶來的機會。

能源和永續性目標也推動了對液冷技術的投資。浸沒式冷卻和晶片級直冷迴路即使在 500kW 的機架負載下也能穩定組件的出口溫度,從而提高單位面積的運算密度,並降低土地資源緊張地區的土地成本。普林斯頓數位集團 (Princeton Digital Group) 位於柔佛州的園區在將其 GPU叢集切換為兩相浸沒式冷卻後,面積減少了 20%,從而實現了長期的成本優勢。隨著人工智慧雲端的擴展,液冷系統很可能在新超大規模資料中心取代風冷系統,但對大規模維修的需求仍將持續存在,風冷系統在二級資料中心和企業級資料中心仍然至關重要。

機房空調(CRAH)和機房冷凍空調(CRAC)機組在馬來西亞資料中心冷卻市場中佔據最大的收入佔有率,達到32.40%,這主要得益於它們在新建和現有設施中的廣泛應用。間接冷卻式冷卻器與板式熱交換器結合,可延長水側節能運轉運作,並將年度電力消耗量降低兩位數。配備智慧風機驅動裝置的冷卻塔可根據濕球溫度的波動調節氣流,從而延長壓縮機壽命並降低尖峰負荷費用。水泵、閥門和變頻驅動裝置可實現精確的流量控制,延長維護週期。控制和監控平台正成為成長重點,它們利用預測分析來預防組件故障並調整閥門位置以實現最佳熱效率。

隨著營運商尋求透過降低PUE值來抵消不斷上漲的電費,軟體的重要性日益凸顯。馬裡蘭大學對控制系統維修,在實施人工智慧驅動的流量分析後,容量提升了100%,PUE值降低了5.5%。馬來西亞賽城的一個類似計畫則利用嵌入冷通道地磚的光纖感測器來調節風扇轉速,實現了每年8%的節能效果。能夠整合硬體、軟體和現場服務的供應商在競標中越來越受到青睞,這標誌著市場正在從零散的設備採購轉向整合式全生命週期解決方案。

馬來西亞資料中心冷卻市場按冷卻技術(氣冷、液冷)、冷卻組件(機房空調機組 (CRAH/CRAC)、冷卻器和熱交換器等)、資料中心類型(超大規模(自有和租賃)、其他)以及最終用戶行業(IT 和電信、零售和消費品等)進行細分。市場預測以美元以金額為準(USD) 為以金額為準。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 冷氣成本的關鍵考慮因素

- 資料中心營運主要成本開銷分析(重點關注冷卻)

- 冷凍技術比較研究(設計複雜性、PUE、優缺點、氣候條件利用率)

- 資料中心冷卻的關鍵創新和發展趨勢

- 資料中心採取的主要節能措施

第5章 市場動態

- 市場促進因素

- 馬來西亞作為亞太地區區域樞紐的戰略定位

- 超大規模和託管資料中心投資激增,推動降溫需求

- 政府稅收優惠和「我的數位藍圖」計畫旨在支持資料中心建設。

- 新加坡資料中心容量的提升推動了柔佛州資料中心的擴張

- AI/GPU工作負載密度不斷增加,推動了先進液冷技術的應用

- 國家電網現代化(CRESS,可再生能源購電)協助高功率資料中心

- 市場限制

- 資料中心冷卻所需的能源消費量和水資源需求不斷增加

- 不斷上漲的電費和新的碳定價機制的不確定性

- 缺乏用於永續冷卻的再生水基礎設施

- 液冷系統設計與維修人員技能缺口

- 市場機遇

- 推動永續性和綠色/可再生能源資料中心的興起

- 價值/供應鏈分析

- 監管環境

- 技術展望

第6章:馬來西亞現有資料中心建設狀況分析

- 資料中心 IT 負載容量(兆瓦)和面積(平方英尺)分析(2019-2031 年)

- 馬來西亞主要資料中心集群分析

- 馬來西亞即將建成的主要超大規模資料中心分析

第7章 市場規模與成長預測

- 透過冷卻技術

- 空氣冷卻法

- 冷卻器和節熱器

- 電腦房空調機組 (CRAH)

- 冷卻塔(直接冷卻式、間接冷卻式、兩級冷卻式)

- 其他空氣冷卻技術

- 液冷法

- 浸沒式冷卻

- 晶片直接冷卻

- 後門式熱交換器

- 空氣冷卻法

- 透過冷卻組件

- 電腦房空調機組(CRAH/CRAC)

- 冷卻器和熱交換裝置

- 冷卻塔和乾式冷卻器

- 泵浦和閥門

- 控制和監控軟體

- 依資料中心類型

- 超大規模(自有和租賃)

- 企業版(本地部署)

- 搭配

- 按最終用戶行業分類

- 資訊科技和電信

- 零售和消費品

- 衛生保健

- 媒體與娛樂

- BFSI

- 其他最終用戶

第8章 競爭情勢

- 市佔率分析

- 公司簡介

- Schneider Electric SE

- Rittal GmbH & Co. KG

- Vertiv Group Corp.

- Johnson Controls Inc.

- Geoclima Srl

- Carrier Global Corporation

- GIGA-BYTE Technology Co. Ltd

- Eaton Corporation PLC

- Right Power Technology Sdn Bhd

- Huawei Digital Power Technologies Co. Ltd

- Alfa Laval AB

- Iceotope Technologies Limited

- Daikin Industries Ltd.

- Stulz GmbH

- Munters Group AB

- Delta Electronics Inc.

- Fujitsu Ltd.

- Nortek Data Center Cooling

- NTT Facilities Inc.

- Trane Technologies plc

- Green Revolution Cooling(GRC)

- CoolIT Systems Inc.

- Asperitas BV

第9章 投資分析

第10章 市場機會與未來趨勢

第11章 關於我們

Malaysia data center cooling market size in 2026 is estimated at USD 0.28 billion, growing from 2025 value of USD 0.21 billion with 2031 projections showing USD 1.07 billion, growing at 31.10% CAGR over 2026-2031.

Momentum is anchored in the nation's emergence as Southeast Asia's preferred data center location, government incentives that reduce operating costs, and artificial-intelligence (AI) workloads that demand advanced thermal management. Foreign direct investment continues to pour into Johor, Cyberjaya and Greater Kuala Lumpur, while renewable-energy procurement schemes encourage operators to upgrade cooling infrastructure for energy efficiency. Liquid-based solutions are gaining attention as rack power densities move past 40 kW, yet air-based systems still dominate installed capacity. Supply-chain localization and component integration, coupled with a growing domestic skills base, position vendors to capture expanding demand even as resource constraints pressure design choices.

Malaysia Data Center Cooling Market Trends and Insights

Strategic Location of Malaysia as Regional Hub in Asia-Pacific

Malaysia's position between Singapore and other ASEAN markets delivers sub-20 ms latency to more than 650 million users, prompting operators to locate compute clusters and corresponding cooling assets locally Submarine-cable density has reached 15 routes, enabling high-availability architectures that rely on redundant chilled-water loops and independent plant rooms. Land costs 30-40% below Singapore allow purpose-built campuses to incorporate chilled-to-liquid conversion rooms and dedicated thermal reservoirs that lower total cost of ownership. Microsoft's Malaysia West cloud region deploys three discrete cooling lines per hall to preserve uptime in AI-heavy zones. As regional digital-economy revenue is forecast to triple to USD 1 trillion by 2030, new campuses continue to allocate capital toward high-efficiency chillers and hot-aisle containment that safeguard performance under tropical conditions.

Surge in Hyperscale and Colocation Investments Accelerating Cooling Demand

Johor recorded 1.6 GW of installed IT load in 2024, and signed commitments could push regional demand beyond 5 GW by 2035. Rack densities above 40 kW necessitate liquid-cooling loops with approach temperatures below 2 °C to maintain chip reliability. Princeton Digital Group's 150 MW campus allocates 35% of built-out space to cooling plant and utility corridors, reflecting the growing footprint required for thermal assets. Hyperscale procurements spur local manufacturing of pumps and heat exchangers, and Tenaga Nasional Berhad reports double-digit power demand growth from the segment, reinforcing the long-term outlook for innovative thermal platforms.

Higher Energy Consumption and Water Needs for DC Cooling

Cooling consumes roughly 40% of total facility energy. Malaysia's grid demand could rise 130% by 2026, testing generation reserves Water pressure is more immediate: Johor regulators expect data center demand to hit 673 million L/day while the network can supply only 142 million L/day. A mandate for zero potable-water use within three years forces adoption of air-cooling and recycled-water plants, lifting capital outlays by as much as 35%. Operators able to deploy sealed-loop liquid systems achieve 80-90% electrical savings, but up-front costs remain a hurdle amid intense capex cycles.

Other drivers and restraints analyzed in the detailed report include:

- Government Tax Incentives and MyDIGITAL Blueprint Supporting DC Build-out

- AI / GPU Workload Density Triggering Shift to Advanced Liquid Cooling

- Rising Electricity Tariffs and Emerging Carbon-Pricing Uncertainty

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Air-based architectures maintained 71.20% Malaysia data center cooling market share in 2025 owing to established deployments and operator familiarity. Yet liquid platforms are advancing at 25.85% CAGR, contributing the largest incremental slice of Malaysia data center cooling market size through 2031. Chiller-plus-CRAH designs remain preferred for sub-20 kW racks, but indirect evaporative-assist and economizer coils enable PUE gains that defend air solutions in moderate-density halls. Liquid immersion tanks cut fan energy to near zero, reducing operating overhead amid rising tariff pressure. Hybrid rear-door heat exchangers provide bridge technology, letting operators migrate workloads without wholesale plant upgrades. Component vendors are localizing heat-exchanger skid production to shorten lead times and capture opportunities tied to AI deployments.

Energy and sustainability goals also catalyze liquid investment. Immersion and direct-to-chip loops keep component exit temperatures stable despite 500 kW rack loads, permitting higher compute density per square foot and lowering land expenditure in land-constrained corridors. Princeton Digital Group's Johor campus reported 20% footprint reduction after switching its GPU clusters to two-phase immersion, underlining the long-run cost advantages. As AI clouds scale, liquid systems are likely to displace air in new hyperscale blocks, yet a sizable retrofit business will persist, keeping air players relevant across secondary and enterprise sites.

CRAH and CRAC units account for the largest revenue share of 32.40% of Malaysia data center cooling market size thanks to their ubiquity in both greenfield and brownfield halls. Indirect-liquid chillers pair with plate heat exchangers to boost water-side economization hours, cutting annual electricity by double digits. Cooling towers with intelligent fan drives modulate airflow to track wet-bulb fluctuation, preserving compressor life and shaving peak demand charges. Pumps, valves and variable-frequency drives deliver fine-grained flow control, extending maintenance intervals. Control-and-monitoring platforms emerge as a growth hotspot, offering predictive analytics that prevent component failure and tune valve positions for optimum thermal efficiency.

Software gains prominence as operators chase marginal PUE reductions to offset tariff hikes. University of Maryland's control retrofit raised capacity by 100% and cut PUE 5.5% after installing AI-driven flow analytics. Comparable deployments in Malaysia's Cyberjaya corridor use fiber sensors embedded in cold-aisle tiles to orchestrate fan-speed modulation, resulting in 8% annual energy savings. Vendors able to bundle hardware, software and field services win preference during tender rounds, illustrating market movement toward integrated life-cycle solutions rather than discrete equipment buys.

Malaysia Data Center Cooling Market is Segmented by Cooling Technology (Air-Based Cooling, Liquid-Based Cooling), Cooling Component (Computer-Room Air Handlers (CRAH/CRAC), Chillers and Heat-Exchanger Units, and More), Data Center Type (Hyperscale (Owned and Leased), and More), End-User Industry (IT and Telecom, Retail and Consumer Goods, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Schneider Electric SE

- Rittal GmbH & Co. KG

- Vertiv Group Corp.

- Johnson Controls Inc.

- Geoclima S.r.l.

- Carrier Global Corporation

- GIGA-BYTE Technology Co. Ltd

- Eaton Corporation PLC

- Right Power Technology Sdn Bhd

- Huawei Digital Power Technologies Co. Ltd

- Alfa Laval AB

- Iceotope Technologies Limited

- Daikin Industries Ltd.

- Stulz GmbH

- Munters Group AB

- Delta Electronics Inc.

- Fujitsu Ltd.

- Nortek Data Center Cooling

- NTT Facilities Inc.

- Trane Technologies plc

- Green Revolution Cooling (GRC)

- CoolIT Systems Inc.

- Asperitas BV

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Key Cost Considerations for Cooling

- 4.2.1 Analysis of Key Cost Overheads Related to DC Operations (Cooling Focus)

- 4.2.2 Comparative Study of Cooling Technologies (Design Complexity, PUE, Pros/Cons, Weather Utilization)

- 4.2.3 Key Innovations and Developments in Data Center Cooling

- 4.2.4 Key Energy-Efficiency Practices Adopted in Data Centers

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strategic Location of Malaysia as Regional Hub in Asia-Pacific

- 5.1.2 Surge in Hyperscale and Colocation Investments Accelerating Cooling Demand

- 5.1.3 Government Tax Incentives and MyDIGITAL Blueprint Supporting DC Build-out

- 5.1.4 Singapore Data Center Cap Driving Spill-over Build-outs in Johor

- 5.1.5 AI / GPU Workload Density Triggering Shift to Advanced Liquid Cooling

- 5.1.6 National Grid-Modernization (CRESS, RE Power Purchase) Enabling High-Power DCs

- 5.2 Market Restraints

- 5.2.1 Higher Energy Consumption and Water Needs for DC Cooling

- 5.2.2 Rising Electricity Tariffs and Emerging Carbon-Pricing Uncertainty

- 5.2.3 Limited Recycled-Water Infrastructure for Sustainable Cooling

- 5.2.4 Skills Gap in Liquid-Cooling Design and Maintenance Workforce

- 5.3 Market Opportunities

- 5.3.1 Sustainability Push and Emergence of Green / Renewable Data Centers

- 5.4 Value / Supply-Chain Analysis

- 5.5 Regulatory Landscape

- 5.6 Technological Outlook

6 ANALYSIS OF THE CURRENT DATA CENTER FOOTPRINT IN MALAYSIA

- 6.1 Analysis of IT Load Capacity (MW) and Area footprint (Sq. Ft.) of Data Centers (for the period of 2019-2031)

- 6.2 Analysis of the major Data Center Hotspots in Malaysia

- 6.3 Analysis of Major Upcoming Hyperscale Facilities in Malaysia

7 MARKET SIZE AND GROWTH FORECAST (VALUE)

- 7.1 By Cooling Technology

- 7.1.1 Air-based Cooling

- 7.1.1.1 Chiller and Economizer

- 7.1.1.2 CRAH (Computer-Room Air Handler)

- 7.1.1.3 Cooling Tower (Direct, Indirect, Two-Stage)

- 7.1.1.4 Other Air-based Cooling Technologies

- 7.1.2 Liquid-based Cooling

- 7.1.2.1 Immersion Cooling

- 7.1.2.2 Direct-to-Chip Cooling

- 7.1.2.3 Rear-Door Heat Exchanger

- 7.1.1 Air-based Cooling

- 7.2 By Cooling Component

- 7.2.1 Computer-Room Air Handlers (CRAH/CRAC)

- 7.2.2 Chillers and Heat-Exchanger Units

- 7.2.3 Cooling Towers and Dry Coolers

- 7.2.4 Pumps and Valves

- 7.2.5 Control and Monitoring Software

- 7.3 By Data Center Type

- 7.3.1 Hyperscale (Owned and Leased)

- 7.3.2 Enterprise (On-Premise)

- 7.3.3 Colocation

- 7.4 By End-user Industry

- 7.4.1 IT and Telecom

- 7.4.2 Retail and Consumer Goods

- 7.4.3 Healthcare

- 7.4.4 Media and Entertainment

- 7.4.5 BFSI

- 7.4.6 Other End users

8 COMPETITIVE LANDSCAPE

- 8.1 Market Share Analysis

- 8.2 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 8.2.1 Schneider Electric SE

- 8.2.2 Rittal GmbH & Co. KG

- 8.2.3 Vertiv Group Corp.

- 8.2.4 Johnson Controls Inc.

- 8.2.5 Geoclima S.r.l.

- 8.2.6 Carrier Global Corporation

- 8.2.7 GIGA-BYTE Technology Co. Ltd

- 8.2.8 Eaton Corporation PLC

- 8.2.9 Right Power Technology Sdn Bhd

- 8.2.10 Huawei Digital Power Technologies Co. Ltd

- 8.2.11 Alfa Laval AB

- 8.2.12 Iceotope Technologies Limited

- 8.2.13 Daikin Industries Ltd.

- 8.2.14 Stulz GmbH

- 8.2.15 Munters Group AB

- 8.2.16 Delta Electronics Inc.

- 8.2.17 Fujitsu Ltd.

- 8.2.18 Nortek Data Center Cooling

- 8.2.19 NTT Facilities Inc.

- 8.2.20 Trane Technologies plc

- 8.2.21 Green Revolution Cooling (GRC)

- 8.2.22 CoolIT Systems Inc.

- 8.2.23 Asperitas BV