|

市場調查報告書

商品編碼

1876801

資料中心冷卻市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Data Center Cooling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

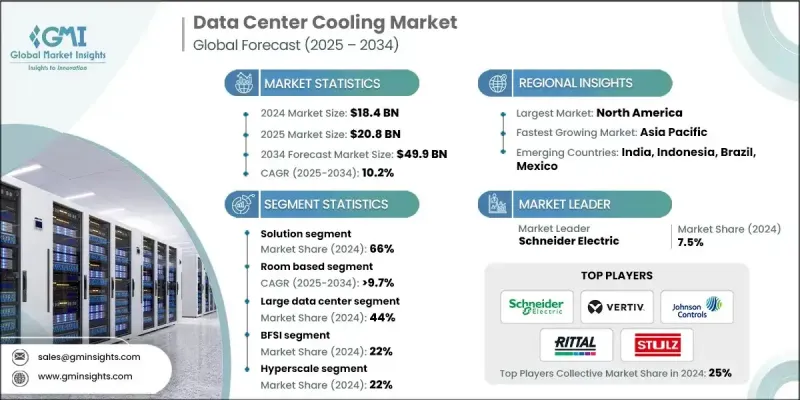

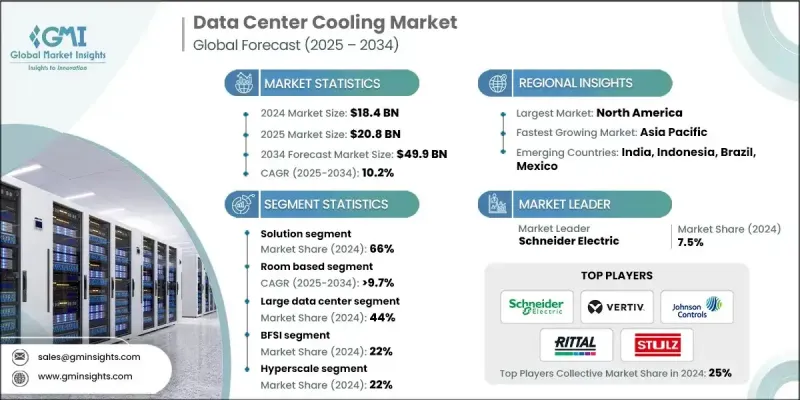

2024 年全球資料中心冷卻市場價值為 184 億美元,預計到 2034 年將以 10.2% 的複合年成長率成長至 499 億美元。

人工智慧和高效能運算 (HPC) 工作負載的不斷成長,正推動著散熱方式從傳統的風冷轉變為先進的液冷解決方案。晶片級直接冷卻和浸沒式冷卻技術正日益應用於 50 至 120 kW 的機架功率密度,使現代資料中心能夠應對最新的運算基礎設施。邊緣資料中心運作於各種不同的環境中,需要靈活的散熱管理來確保在緊湊和偏遠空間中的可靠性。隨著機架功率密度幾乎翻倍,從 5 kW 成長到 8-10 kW,傳統的風冷系統無法滿足需求,促使超大規模資料中心和企業級設施採用液冷解決方案。晶片級直接液冷正成為一種首選方法,它能夠確保高功率 CPU 和 GPU 的溫度穩定,同時降低能耗並提高系統可靠性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 184億美元 |

| 預測值 | 499億美元 |

| 複合年成長率 | 10.2% |

解決方案領域在 2024 年佔據了 66% 的市場佔有率,預計到 2034 年將以 10.4% 的複合年成長率成長。這一成長得益於對能夠支援高密度 AI 和 HPC 工作負載的下一代液冷系統的投資,從而推動了基礎設施支出和先進散熱管理技術的採用。

2024年,房間冷凍市場佔據76.4%的市場佔有率,預計到2034年將以9.7%的複合年成長率成長。現代房間冷卻系統整合了人工智慧輔助最佳化、變速風扇和密閉解決方案,可實現即時氣流調節並提高能源效率。這些創新延長了系統使用壽命,並提高了整體永續性和可靠性。

2024 年,美國資料中心冷卻市場佔 89% 的佔有率,創造了 63 億美元的收入。人工智慧工作負載帶來的不斷上升的熱密度加速了液冷和浸沒式冷卻的普及,營運商正在升級設施以應對超過 80 kW 的機架密度,尤其是在大型園區環境中。

資料中心冷卻市場的主要參與者包括艾默生網路能源、江森自控、Vertiv、施耐德電氣、Motivair、Stulz、Degree Controls、Rittal、Airedale International 和 Coolcentric。這些公司正採取多種策略來鞏固其市場地位。他們加大研發投入,開發能夠應對極端熱密度的高效能液體冷卻和浸沒式冷卻技術。與超大規模和企業級資料中心營運商建立合作關係,有助於推廣先進冷卻解決方案的應用。此外,各公司也持續改進以人工智慧為基礎的即時能源管理最佳化工具。策略性併購則有助於企業拓展技術組合和地理覆蓋範圍。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預測模型

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 日益成長的高密度人工智慧和高效能運算工作負載部署

- 人們越來越關注永續性和能源效率

- 新興地區資料中心容量擴張不斷成長

- DCIM與基於AI的冷卻最佳化整合

- 產業陷阱與挑戰

- 前期成本高和改造挑戰

- 液冷基礎設施管理的複雜性

- 日益嚴格的冷媒環境法規

- 市場機遇

- 亞太和中東非地區超大規模和託管設施的成長

- 整合人工智慧驅動的熱管理

- 轉向模組化、預製資料中心

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 市場成熟度與採納度分析

- 未來趨勢與市場動盪

- 人工智慧在冷卻系統的應用

- 量子計算冷卻需求

- 永續和綠色冷凍技術

- 模組化和預製冷卻解決方案

- 廢熱回收再利用系統

- 先進材料與奈米技術

- 自主冷卻系統管理

- 區塊鏈和分散式計算的影響

- 6G基礎設施冷卻需求

- 資料中心冷卻市場動態及差距分析

- 功率密度趨勢和冷卻需求

- 冷卻技術遷移模式

- 市場差距分析

- 能源效率和永續性勢在必行

- 資料中心機械系統演化

- 策略研發與市場契合框架

- 暖通空調公司的研發投資重點

- 市場協調策略和框架

- 進階解決方案開發路徑

- 夥伴關係和生態系統發展

- 實施路線圖

- 投資分析與市場機遇

- 投資環境概覽

- 創投與私募股權活動

- 策略投資機會

- 市場進入策略

- 技術授權機會

- 地理擴張策略

- 投資報酬分析

- 未來投資趨勢

- 電源使用效率 (PUE) 趨勢與分析

- PUE簡介及其重要性

- 按資料中心類型分類的平均 PUE 基準測試

- 冷卻技術對PUE的影響

- PUE最佳化策略與人工智慧驅動的控制

- PUE 標準的區域和監管影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 解決方案

- 空調

- 空氣處理機組

- 分離式空調系統

- 一體式空調機組(PAC)

- 其他

- 冷卻單元

- 空冷式冷水機

- 水冷式冷水機

- 乙二醇冷卻式冰水機

- 冷卻水塔

- 蒸發冷卻

- 乾燥

- 其他

- 控制系統

- 經濟器系統

- 冷凝

- 非冷凝式

- 液冷系統

- 直接連接到晶片

- 沉浸式

- 單相

- 兩相

- 其他

- 空調

- 服務

- 諮詢

- 維護和支援

- 安裝和部署

第6章:市場估算與預測:依冷凍技術分類,2021-2034年

- 主要趨勢

- 基於貨架/行

- 房間

第7章:市場估算與預測:依資料中心規模分類,2021-2034年

- 主要趨勢

- 小型資料中心

- 中型資料中心

- 大型資料中心

第8章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 金融服務業

- 託管

- 能源

- 政府

- 衛生保健

- 製造業

- 資訊科技與電信

- 其他

第9章:市場估算與預測:依資料中心分類,2021-2034年

- 主要趨勢

- 超大規模

- 託管

- 企業

- 邊緣

- 雲

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 波蘭

- 比荷盧經濟聯盟

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 汶萊

- 柬埔寨

- 印尼

- 寮國

- 馬來西亞

- 緬甸

- 菲律賓

- 新加坡

- 泰國

- 東帝汶

- 越南

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 智利

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- 全球參與者

- Carrier Global

- Daikin Industries

- Emerson Electric

- Honeywell International

- Johnson Controls

- Mitsubishi

- Schneider Electric

- Siemens

- Trane Technologies

- Vertiv

- 區域玩家

- Airedale International

- Asetek

- Coolcentric

- CoolIT Systems

- Green Revolution Cooling (GRC)

- LiquidStack

- Motivair

- Rittal

- STULZ

- Submer Technologies

- 新興參與者

- Boyd

- Chilldyne

- ExaScaler

- Hardcore Computer

- Iceotope Technologies

- Kaltra

- Midas Green Technologies

- Phononic

- TMGcore

- ZutaCore

The Global Data Center Cooling Market was valued at USD 18.4 billion in 2024 and is estimated to grow at a CAGR of 10.2% to reach USD 49.9 billion by 2034.

Rising AI and high-performance computing (HPC) workloads are driving a transition from traditional air-based cooling to advanced liquid cooling solutions. Direct-to-chip and immersion cooling technologies are increasingly managing rack densities of 50 to 120 kW, allowing modern data centers to handle the latest compute infrastructure. Edge data centers, operating in varied environments, require flexible thermal management to maintain reliability in compact and remote spaces. With rack power densities nearly doubling from 5 kW to 8-10 kW, conventional air-based systems can no longer meet demand, prompting hyperscale and enterprise facilities to adopt liquid-based solutions. Direct-to-chip liquid cooling is emerging as a preferred method, ensuring stable temperatures for high-wattage CPUs and GPUs while reducing energy consumption and enhancing system reliability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.4 Billion |

| Forecast Value | $49.9 Billion |

| CAGR | 10.2% |

The solutions segment held a 66% share in 2024 and is expected to grow at a CAGR of 10.4% through 2034. This growth is fueled by investments in next-generation liquid cooling systems capable of supporting high-density AI and HPC workloads, driving infrastructure expenditure and advanced heat management adoption.

The room-based cooling segment held a 76.4% share in 2024 and is projected to grow at a CAGR of 9.7% through 2034. Modern room-based systems now integrate AI-assisted optimization, variable-speed fans, and containment solutions, enabling real-time airflow adjustments and energy efficiency improvements. These innovations extend system lifespan and improve overall sustainability and reliability.

U.S. Data Center Cooling Market held a 89% share and generated USD 6.3 billion in 2024. Rising heat densities from AI workloads have accelerated the adoption of liquid and immersion cooling, as operators upgrade facilities to manage rack densities above 80 kW, particularly in large-scale campus environments.

Key players in the Data Center Cooling Market include Emerson Network Power, Johnson Controls, Vertiv, Schneider Electric, Motivair, Stulz, Degree Controls, Rittal, Airedale International, and Coolcentric. Companies in the Data Center Cooling Market are employing multiple strategies to strengthen their market presence. They are investing in R&D to develop high-efficiency liquid and immersion cooling technologies capable of handling extreme heat densities. Partnerships with hyperscale and enterprise data center operators help expand the adoption of advanced cooling solutions. Firms are also enhancing AI-based optimization tools for real-time energy management. Strategic mergers and acquisitions allow players to broaden their technology portfolios and geographic footprint.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Cooling technique

- 2.2.4 Data center size

- 2.2.5 Application

- 2.2.6 Data center

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing deployment of high-density AI and HPC workloads

- 3.2.1.2 Growing focus on sustainability and energy efficiency

- 3.2.1.3 Rising data center capacity expansions in emerging regions

- 3.2.1.4 Integration of DCIM and AI-based cooling optimization

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High upfront cost and retrofit challenges

- 3.2.2.2 Complexity in managing liquid cooling infrastructure

- 3.2.2.3 Rising environmental regulations on refrigerants

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of hyperscale and colocation facilities in APAC and MEA

- 3.2.3.2 Integration of AI-driven thermal management

- 3.2.3.3 Shift toward modular, prefabricated data centers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 South America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By Products

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.11.6 Market Maturity & Adoption Analysis

- 3.12 Future trends & market disruptions

- 3.12.1 Artificial intelligence integration in cooling

- 3.12.2 Quantum computing cooling requirements

- 3.12.3 Sustainable & green cooling technologies

- 3.12.4 Modular & prefabricated cooling solutions

- 3.12.5 Waste heat recovery & reuse systems

- 3.12.6 Advanced materials & nanotechnology

- 3.12.7 Autonomous cooling system management

- 3.12.8 Blockchain & distributed computing impact

- 3.12.9. 6 G infrastructure cooling requirements

- 3.13 Data center cooling market dynamics & gap analysis

- 3.13.1 Power density trends and cooling requirements

- 3.13.2 Cooling technology migration patterns

- 3.13.3 Market gap analysis

- 3.13.4 Energy efficiency and sustainability imperatives

- 3.13.5 Mechanical systems evolution in data centers

- 3.14 Strategic R&D & market alignment framework

- 3.14.1 R&D investment priorities for HVAC companies

- 3.14.2 Market alignment strategies and frameworks

- 3.14.3 Advanced solutions development pathway

- 3.14.4 Partnership and ecosystem development

- 3.14.5 Implementation roadmap

- 3.15 Investment analysis & market opportunities

- 3.15.1 Investment landscape overview

- 3.15.2 Venture capital & private equity activity

- 3.15.3 Strategic investment opportunities

- 3.15.4 Market entry strategies

- 3.15.5 Technology licensing opportunities

- 3.15.6 Geographic expansion strategies

- 3.15.7 Investment return analysis

- 3.15.8 Future investment trends

- 3.16 Power Usage Effectiveness (PUE) trends and analysis

- 3.16.1 Introduction to PUE and its importance

- 3.16.2 Average PUE benchmarks by data center type

- 3.16.3 Impact of cooling technologies on PUE

- 3.16.4 PUE optimization strategies and ai-driven controls

- 3.16.5 Regional and regulatory implications for PUE standards

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 South America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Air conditioner

- 5.2.1.1 Air handling units

- 5.2.1.2 Split air conditioning systems

- 5.2.1.3 Packaged air conditioning units (PAC)

- 5.2.1.4 Others

- 5.2.2 Chilling unit

- 5.2.2.1 Air-cooled chillers

- 5.2.2.2 Water-cooled chillers

- 5.2.2.3 Glycol-cooled chillers

- 5.2.3 Cooling tower

- 5.2.3.1 Evaporative cooling

- 5.2.3.2 Dry

- 5.2.3.3 Others

- 5.2.4 Control system

- 5.2.4.1 Economizer system

- 5.2.4.2 Condensing

- 5.2.4.3 Non-condensing

- 5.2.5 Liquid cooling system

- 5.2.5.1 Direct to chip

- 5.2.5.2 Immersive

- 5.2.5.2.1 Single phase

- 5.2.5.2.2 Two phase

- 5.2.5.3 Others

- 5.2.1 Air conditioner

- 5.3 Service

- 5.3.1 Consulting

- 5.3.2 Maintenance and support

- 5.3.3 Installation and deployment

Chapter 6 Market Estimates & Forecast, By Cooling Technique, 2021-2034 ($Bn)

- 6.1 Key trends

- 6.2 Rack/row based

- 6.3 Room based

Chapter 7 Market Estimates & Forecast, By Data Center Size, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Small data center

- 7.3 Medium data center

- 7.4 Large data center

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 BFSI

- 8.3 Colocation

- 8.4 Energy

- 8.5 Government

- 8.6 Healthcare

- 8.7 Manufacturing

- 8.8 IT & Telecom

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Data Center, 2021-2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Hyperscale

- 9.3 Colocation

- 9.4 Enterprise

- 9.5 Edge

- 9.6 Cloud

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Poland

- 10.3.9 Benelux

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.4.6.1 Brunei

- 10.4.6.2 Cambodia

- 10.4.6.3 Indonesia

- 10.4.6.4 Laos

- 10.4.6.5 Malaysia

- 10.4.6.6 Myanmar

- 10.4.6.7 Philippines

- 10.4.6.8 Singapore

- 10.4.6.9 Thailand

- 10.4.6.10 Timor-Leste

- 10.4.6.11 Vietnam

- 10.5 South America

- 10.5.1 Brazil

- 10.5.2 Argentina

- 10.5.3 Colombia

- 10.5.4 Chile

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Carrier Global

- 11.1.2 Daikin Industries

- 11.1.3 Emerson Electric

- 11.1.4 Honeywell International

- 11.1.5 Johnson Controls

- 11.1.6 Mitsubishi

- 11.1.7 Schneider Electric

- 11.1.8 Siemens

- 11.1.9 Trane Technologies

- 11.1.10 Vertiv

- 11.2 Regional Players

- 11.2.1 Airedale International

- 11.2.2 Asetek

- 11.2.3 Coolcentric

- 11.2.4 CoolIT Systems

- 11.2.5 Green Revolution Cooling (GRC)

- 11.2.6 LiquidStack

- 11.2.7 Motivair

- 11.2.8 Rittal

- 11.2.9 STULZ

- 11.2.10 Submer Technologies

- 11.3 Emerging Players

- 11.3.1 Boyd

- 11.3.2 Chilldyne

- 11.3.3 ExaScaler

- 11.3.4 Hardcore Computer

- 11.3.5 Iceotope Technologies

- 11.3.6 Kaltra

- 11.3.7 Midas Green Technologies

- 11.3.8 Phononic

- 11.3.9 TMGcore

- 11.3.10 ZutaCore