|

市場調查報告書

商品編碼

1906251

義大利地理空間分析:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Italy Geospatial Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

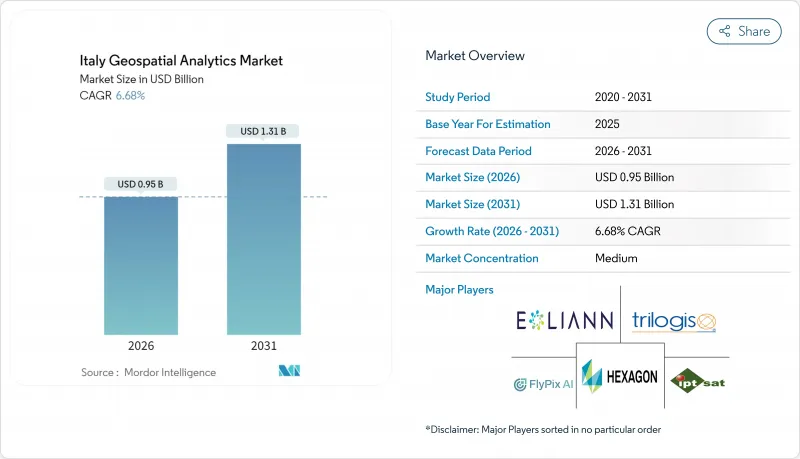

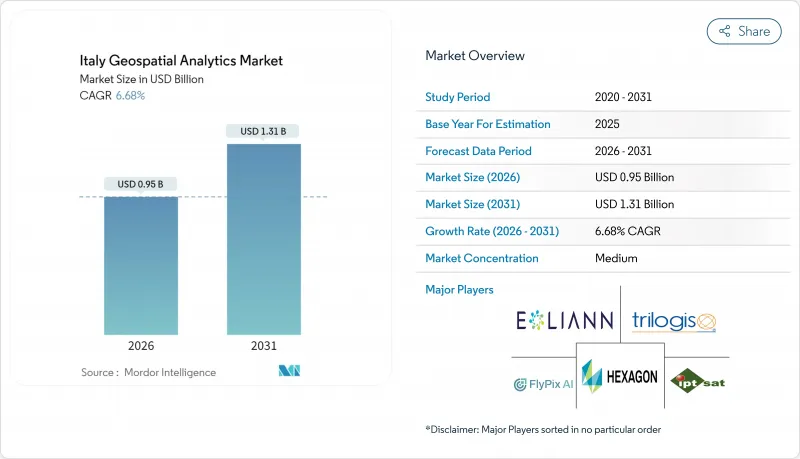

預計義大利地理空間分析市場將從 2025 年的 8.9 億美元成長到 2026 年的 9.5 億美元,到 2031 年將達到 13.1 億美元,2026 年至 2031 年的複合年成長率為 6.68%。

歐盟資助的數位轉型、熱那亞大橋坍塌後強制性的基礎設施安全措施以及2025年《公共工程法》規定的強制性BIM-GIS整合,共同推動了成長。米蘭、都靈和博洛尼亞等城市的市政數位雙胞胎部署正在創造持續的平台需求,而IRIDE地球觀測衛星群則豐富了數據供應。隨著HERE Technologies利用其與AWS價值11億美元的合作關係提供人工智慧驅動的定位服務,雲端採用正在加速。受2025年1月起強制性氣候變遷保險政策的推動,對參數型保險的需求進一步擴大了高解析度風險分析的使用,隨著企業將稀缺的太空資料科學技能外包,供應商也隨之成長。

義大利地理空間分析市場趨勢與洞察

義大利主要城市擴大智慧城市計劃

米蘭市實施了涵蓋全市的數位雙胞胎,整合了181平方公里的城市數據。該專案將物聯網感測器與地理空間分析平台連接起來,以最佳化交通流量和建築能源利用。都靈市將其拉瓦扎園區孿生計畫的洞察擴展到全區資產監控,從而降低了12%的空間利用成本。波隆那的智慧運輸控制中心每天處理487,700公里的道路數據,將尖峰時段的壅塞減少了9%。 5G行動網路支援資料流傳輸,促使各城市採用可擴展的雲端原生地理空間解決方案。這些計劃為可複製的歐盟智慧城市框架提供了藍圖,並增強了對義大利地理空間分析市場的需求。

促進橋樑、水壩和鐵路等基礎設施的健康監測

熱那亞大橋事故後,義大利高速公路公司(Autostrade per Litaria)於2024年進行了1407次無人機飛行,利用合成孔徑雷達(SAR)增強分析,將缺陷檢測精度提高了11%。目前,國家指南要求6萬座橋樑和542座大壩使用衛星干涉測量技術,以毫米級精度追蹤其形變。數位雙胞胎技術將衛星數據與地面感測器數據相結合,為16800公里鐵路資產提供預測性維護平台,重新分配預算,並為分析供應商贏得多年期契約,從而推動了義大利地理空間分析市場的成長。

高級空間資料科學人才短缺

76%的義大利公司表示難以填補空間分析職缺,原因是每年僅有6,200名STEM(科學、技術、工程和數學)專業畢業生。 2024年,人工智慧投資僅佔IT總預算的8.2%,低於歐盟13.5%的平均水平,凸顯了勞動力供應鏈的技能短缺問題。大學難以更新雲端原生地理空間架構的課程,迫使企業將部分功能外包給服務供應商。這導致計劃成本居高不下,地理空間分析在義大利的市場滲透率緩慢。

細分市場分析

到2025年,解決方案將佔據義大利地理空間分析市場56.00%的佔有率,因為買家傾向於選擇端到端的平台來實現合規性和監控。然而,服務預計將縮小這一差距,實現12.55%的複合年成長率,這主要得益於BIM-GIS的強制應用,而BIM-GIS需要專業的配置知識。技能短缺日益嚴重,推動了外包業務的發展,顧問公司代表客戶整合雲端、人工智慧和地理空間功能。

義大利地理空間分析服務市場的擴張反映了託管數位雙胞胎營運、預測性維護建模和自動化特徵提取的需求。北部各市已簽署多年期契約,涵蓋平台建置、工作流程自動化和持續資料管理。中小企業選擇基於訂閱的託管服務以避免資本支出,這將進一步鞏固該市場到2031年的兩位數成長動能。

2025年,地表分析將佔義大利地理空間分析市場規模的45.30%,主要驅動力來自地籍測量和公共產業資產管理。地理視覺化分析將以13.4%的複合年成長率成為成長最快的領域,這主要得益於3D城市孿生模型和身臨其境型儀錶板的普及應用。網路分析將透過最佳化貨運走廊,在物流領域保持穩定的滲透率,這些走廊每年處理1440億噸公里的貨物。

在義大利,地理視覺化領域在地理空間分析市場中所佔佔有率不斷成長,這主要得益於支援 WebGL 的平台,這些平台能夠在普通裝置上流暢播放逼真的模型。包括米蘭斯福爾扎城堡在內的文化遺產管理機構利用這些工具來平衡文物保護義務與城市發展壓力。企業則利用 3D 技術來縮短環境影響評估時間,並加快許可證核准。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 在義大利主要城市推廣智慧城市項目

- 促進橋樑、水壩和鐵路等基礎設施的健康監測

- 擴大來自哥白尼計畫和民用地球觀測衛星星系的數據供應

- 根據新的《公共工程法》,BIM-GIS整合成為強制性要求。

- 利用地理空間風險評分的參數化保險的發展

- 歐盟復甦與韌性基金(RRF)為泛歐交通運輸走廊(TEN-T走廊)提供的數位雙胞胎資金

- 市場限制

- 免費/開放地理空間資料集的可用性

- 高技能空間資料科學家短缺

- 分散的市政採購和較長的銷售週期

- Garante per la Protezione dati 加強隱私監控

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 報價

- 解決方案

- 服務

- 按類型

- 表面分析

- 網路分析

- 地理空間視覺化分析

- 最終用戶

- 運輸/物流

- 政府和國防機構

- 能源、公共產業和採礦

- 銀行、金融服務和保險

- 農業/林業

- 房地產和建築

- 其他最終用戶

- 透過技術

- 地理資訊系統軟體

- 遙感探測與地球觀測

- 全球導航衛星系統和定位

- 空間資料科學與人工智慧平台

- 透過部署

- 雲

- 本地部署

- 按公司規模

- 主要企業

- 小型企業

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Airbus Defence and Space GmbH

- Ariespace Srl

- e-Geos SpA

- ESRI Italia Srl

- Flypix AI GmbH

- Fugro NV

- GECOsistema Srl

- Genius Loci Srl

- HERE Technologies Italia Srl

- Hexagon AB

- IPTSAT Srl

- Latitudo 40 Srl

- Planet Labs Italy Srl

- Rheticus Srl

- Telespazio SpA

- TomTom Italia SpA

- Trilogis Srl

- TeamDev Srl

- Topcon Positioning Italy Srl

- Trimble Italy Srl

第7章 市場機會與未來展望

The Italy geospatial analytics market is expected to grow from USD 0.89 billion in 2025 to USD 0.95 billion in 2026 and is forecast to reach USD 1.31 billion by 2031 at 6.68% CAGR over 2026-2031.

Growth rests on EU-funded digital transformation, infrastructure safety mandates after the Genoa bridge collapse, and mandatory BIM-GIS convergence under the 2025 Public Works Code. Municipal digital-twin rollouts in Milan, Turin, and Bologna generate sustained platform demand, while the IRIDE earth-observation constellation enriches data supply. Cloud deployment accelerates as HERE Technologies leverages a USD 1.1 billion AWS alliance to deliver AI-powered location services. Parametric insurance needs, catalyzed by compulsory climate coverage from January 2025, further expand high-resolution risk analytics consumption, and services vendors grow as firms outsource scarce spatial data science skills.

Italy Geospatial Analytics Market Trends and Insights

Smart-city programme scale-up across major Italian municipalities

Milan deployed a city-scale digital twin that integrates 181 sq km of urban data, combining IoT sensors with geospatial analytics platforms to optimize traffic flow and building energy use. Turin extends lessons from the Lavazza campus twin to district-wide asset monitoring that cuts space-utilization costs by 12%. Bologna's smart-mobility control room processes 487,700 km of road data daily, lowering peak-hour congestion by 9%. Fifth-generation mobile coverage underpins data streaming, pushing cities to procure scalable cloud-native geospatial solutions. These projects serve as blueprints for replicable EU smart-city frameworks that reinforce Italy's geospatial analytics market demand.

Infrastructure health-monitoring push for bridges, dams and rail

After the Genoa disaster, Autostrade per l'Italia ran 1,407 drone sorties in 2024, improving defect detection by 11% through SAR-enhanced analytics. National guidelines now require millimeter-level deformation tracking across 60,000 bridges and 542 dams via satellite interferometry. Digital twins link satellite feeds with ground sensors, supplying predictive maintenance dashboards for rail assets spanning 16,800 km. Resulting budget reallocations secure multiyear contracts for analytics vendors and fuel Italy geospatial analytics market growth.

Shortage of advanced spatial-data-science talent

Seventy-six percent of Italian firms report hiring difficulties for spatial analytics roles as annual STEM graduates tally just 6,200. AI investment sits at 8.2% of overall IT budgets in 2024, lagging the EU average of 13.5%, underscoring under-skilled labor pipelines. Universities struggle to refresh curricula on cloud-native geospatial architectures, prompting enterprises to outsource functions to service providers, which, in turn, inflates project costs and slows Italy's geospatial analytics market penetration.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory BIM-GIS convergence under Public Works Code

- Parametric-insurance growth using geospatial risk scores

- Fragmented municipal procurement and long sales cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions accounted for 56.00% of Italy geospatial analytics market share in 2025 as buyers preferred end-to-end platforms for compliance and monitoring. Services posted a 12.55% CAGR, however, and are projected to narrow the gap, propelled by mandatory BIM-GIS rollouts that require specialized configuration expertise. The escalating skills shortage drives outsourcing, letting consultancies integrate cloud, AI, and geospatial functions on behalf of clients.

Italy geospatial analytics market size gains within services reflect demand for managed digital-twin operations, predictive-maintenance modeling, and automated feature extraction. Northern municipalities award multi-year contracts covering platform setup, workflow automation, and continuous data stewardship. SMEs pick subscription-based managed services to sidestep capital outlays, reinforcing double-digit growth momentum through 2031.

Surface analysis delivered 45.30% of the Italy geospatial analytics market size in 2025, underpinned by cadastral mapping and utility asset management. Geo-visualization analysis grows fastest at 13.4% CAGR as three-dimensional city twins and immersive dashboards hit mainstream adoption. Network analysis retains steady uptake in logistics by optimizing freight corridors that handle 144 billion tonne-kilometers annually.

Italy's geospatial analytics market share gains for geo-visualization stem from WebGL-enabled platforms that stream photorealistic models on commodity devices. Heritage-site custodians, including Milan's Castello Sforzesco, employ these tools to reconcile preservation mandates with urban-development pressures. Enterprises leverage 3D insights to shorten environmental-impact assessments and accelerate permit approvals.

The Italy Geospatial Analytics Market Report is Segmented by Offering (Solution, Service), Type (Surface Analysis, and More), End-User (Transportation and Logistics, Government and Defence, and More), Technology (GIS Software, Remote-Sensing and Earth Observation, and More), Deployment (Cloud, On-Premise), Organisation Size (Large Enterprises, Smes), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Airbus Defence and Space GmbH

- Ariespace S.r.l.

- e-Geos S.p.A.

- ESRI Italia S.r.l.

- Flypix AI GmbH

- Fugro N.V.

- GECOsistema S.r.l.

- Genius Loci S.r.l.

- HERE Technologies Italia S.r.l.

- Hexagon AB

- IPTSAT S.r.l.

- Latitudo 40 S.r.l.

- Planet Labs Italy S.r.l.

- Rheticus S.r.l.

- Telespazio S.p.A.

- TomTom Italia S.p.A.

- Trilogis S.r.l.

- TeamDev S.r.l.

- Topcon Positioning Italy S.r.l.

- Trimble Italy S.r.l.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Smart-city programme scale-up across major Italian municipalities

- 4.2.2 Infrastructure health-monitoring push for bridges, dams and rail

- 4.2.3 Copernicus and private EO constellations expanding data supply

- 4.2.4 Mandatory BIM-GIS convergence under new Public Works Code

- 4.2.5 Parametric-insurance growth using geospatial risk scores

- 4.2.6 EU RRF digital-twin funds for TEN-T corridors

- 4.3 Market Restraints

- 4.3.1 Availability of free/open geospatial data sets

- 4.3.2 Shortage of advanced spatial-data-science talent

- 4.3.3 Fragmented municipal procurement and long sales cycles

- 4.3.4 Heightened privacy scrutiny by Garante per la Protezione dati

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Type

- 5.2.1 Surface Analysis

- 5.2.2 Network Analysis

- 5.2.3 Geo-visualisation Analysis

- 5.3 By End-user

- 5.3.1 Transportation and Logistics

- 5.3.2 Government and Defence

- 5.3.3 Energy, Utilities and Mining

- 5.3.4 Banking, Financial Services and Insurance

- 5.3.5 Agriculture and Forestry

- 5.3.6 Real-Estate and Construction

- 5.3.7 Other End-users

- 5.4 By Technology

- 5.4.1 GIS Software

- 5.4.2 Remote-Sensing and Earth Observation

- 5.4.3 GNSS and Positioning

- 5.4.4 Spatial Data-Science and AI Platforms

- 5.5 By Deployment

- 5.5.1 Cloud

- 5.5.2 On-premise

- 5.6 By Organisation Size

- 5.6.1 Large Enterprises

- 5.6.2 SMEs

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Airbus Defence and Space GmbH

- 6.4.2 Ariespace S.r.l.

- 6.4.3 e-Geos S.p.A.

- 6.4.4 ESRI Italia S.r.l.

- 6.4.5 Flypix AI GmbH

- 6.4.6 Fugro N.V.

- 6.4.7 GECOsistema S.r.l.

- 6.4.8 Genius Loci S.r.l.

- 6.4.9 HERE Technologies Italia S.r.l.

- 6.4.10 Hexagon AB

- 6.4.11 IPTSAT S.r.l.

- 6.4.12 Latitudo 40 S.r.l.

- 6.4.13 Planet Labs Italy S.r.l.

- 6.4.14 Rheticus S.r.l.

- 6.4.15 Telespazio S.p.A.

- 6.4.16 TomTom Italia S.p.A.

- 6.4.17 Trilogis S.r.l.

- 6.4.18 TeamDev S.r.l.

- 6.4.19 Topcon Positioning Italy S.r.l.

- 6.4.20 Trimble Italy S.r.l.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment