|

市場調查報告書

商品編碼

1906225

歐洲定向纖維板(OSB):市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Europe Oriented Strand Board - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

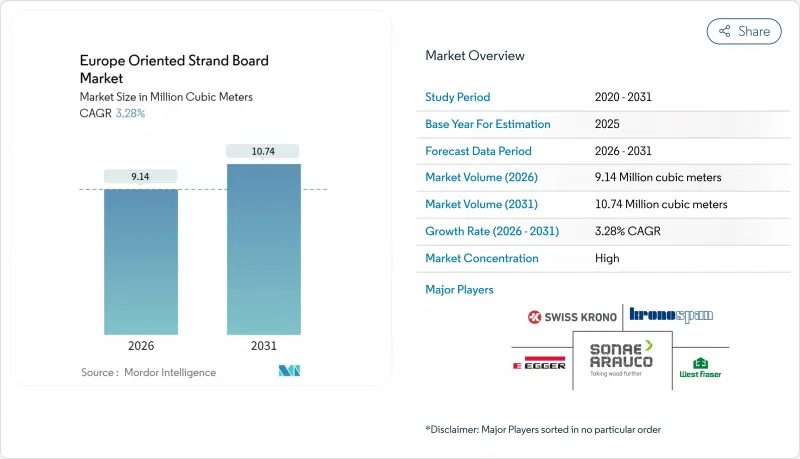

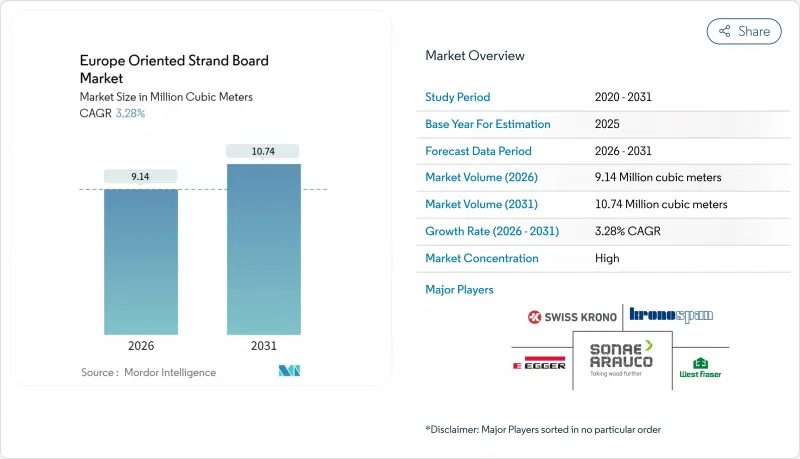

歐洲定向纖維板(OSB) 市場預計將從 2025 年的 885 萬立方米成長到 2026 年的 914 萬立方米,預計到 2031 年將達到 1074 萬立方米,2026 年至 2031 年的複合年成長率為 3.28%。

與膠合板相比,定向塑合板(OSB)具有成本優勢,加上其優異的設計強度和不斷提升的永續性標準,使得歐洲OSB市場保持強勁勢頭,即便傳統木材供應面臨氣候變遷帶來的波動。 OSB/3在結構應用領域的領先地位,源自於建築商對其承載能力和防潮性能平衡的認可,這也與歐盟節能維修和模組化建築的發展趨勢相契合。

歐洲定向纖維板(OSB)市場趨勢與洞察

疫情後多層木造建築的復甦

歐洲各大城市正在核准高層木造建築的建設方案,全球已建成約300座六層樓以上的此類建築,其中巴黎和倫敦尤為集中。這一趨勢正推動歐洲定向塑合板(OSB)市場朝向大型連續板材方向發展,這些板材可輕鬆與交錯層壓木材(CLT)和複合板框架結構相結合。布拉格新建的62套獲得BREEAM高級認證的公寓幾乎全部採用大型木模組建造,充分展現了OSB在提升結構抗剪強度和實現碳減排目標方面的卓越性能。隨著越來越多的城市採用碳蘊藏量建築標準,開發商擴大指定使用OSB/3板材作為牆體和樓板的隔板,因為這種板材不僅具有可預測的抗剪強度,還能實現快速的現場組裝。

REPowerEU隔熱維修提升了OSB的需求

歐盟四分之三的建築需要進行大規模節能維修才能達到2050年的碳排放目標。 REPowerEU計劃將向建築圍護結構維修注入公共資金。定向塑合板(OSB)基材可作為外牆外隔熱系統(ETICS)的堅固背襯,能夠抵抗濕度波動引起的尺寸變化,並保持隔熱材料與外牆之間的黏合力。實驗室測試證實,聚氨酯黏合的OSB板在ETICS組裝中的黏合強度超過80 kPa,超過了歐洲最低標準。在德國,2024年發放的維修許可證數量增加了12%,用於牆體襯墊的OSB採購量超過了建築總產量。這證實了維修需求對歐洲OSB市場的驅動作用。 OSB板材與生物定向纖維板保溫墊結合使用,既能降低運作能耗,也能儲存碳。隨著成員國對維修建築實施生命週期排放上限,這項價值變得日益重要。

更嚴格的甲醛和揮發性有機化合物排放限制

歐盟法規2023/1464規定,自2026年8月起,定向塑合板(OSB)的排放上限為0.062毫克/立方米,迫使OSB生產商用MDI基樹脂取代酚醛樹脂。這將使生產成本增加15%至20%。瑞典實施了更嚴格的臨時限值0.124毫克/立方米,而丹麥則要求每次出貨都必須提供文件,這增加了合規性方面的文書工作。儘管歐洲OSB市場在低排放化學技術方面取得了進展,但維修老舊的壓機生產線仍需要大量資金,尤其是對於中小型生產商而言。然而,研究表明,當排放低於基準值時,高品質OSB的暴露風險極低,知名品牌也以此為由提高價格。同時,經銷商開始銷售雙重認證的「添加甲醛」產品,這不僅分散了市場需求,也創造了一個增值層,可以部分抵消不斷上漲的黏合劑成本。

細分市場分析

預計到2025年,OSB/3將佔總產量的83.10%,並繼續成為歐洲定向纖維板(OSB)市場的支柱,到2031年將以3.47%的複合年成長率成長。此等級產品符合EN 300承重和防潮標準,是新建和維修工程中屋頂、牆體底層和地板材料的理想選擇。建設公司青睞OSB/3,因為它與膠合板相比可節省20-30%的材料,同時保持相當的釘子固定強度。對於利潤空間有限的模組化計劃承包商而言,這無疑是一項顯著的成本節約措施。製造商也圍繞OSB/3最佳化生產計劃,從而實現規模經濟,降低單位能耗。這項優勢目前已在公共採購機構要求的環境產品聲明(EPD)中得到強調。

OSB/4 在重工業地板材料和夾層結構領域保持著一定的市場佔有率,隨著倉庫跨度的增加,其市場佔有率雖小但穩步成長。由於德國和法國建築規範的變更,要求室內隔間牆使用防潮墊層,OSB/2 的市場佔有率持續下降。這實際上將低等級板材限制在了家具和包裝市場。 OSB/1 處於 OSB 等級的最低階,主要用於非結構性裝飾應用和 DIY 應用,在這些應用中,薄板即可滿足需求。因此,歐洲 OSB 市場正日益圍繞 OSB/3 展開,製造商們正在最佳化樹脂體系和板材幾何形狀,以最大限度地提高生產線效率。

歐洲定向纖維板(OSB)市場報告按等級(OSB/1、OSB/2、OSB/3、OSB/4)、終端用戶產業(家具、建築、包裝)和地區(德國、英國、法國、義大利、西班牙、瑞士、奧地利、歐洲其他地區)進行細分。市場預測以銷售量(百萬立方米)為單位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 疫情後多層木造建築的復甦

- REPowerEU隔熱維修提升了OSB的需求

- 模組化異地建造工廠的激增

- 建設產業成長

- 與膠合板相比,定向塑合板具有價格優勢

- 市場限制

- 更嚴格的甲醛和揮發性有機化合物排放法規

- 中歐軟木纖維供應的波動性。

- 室內空氣品質引發的健康問題

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按年級

- OSB/1

- OSB/2

- OSB/3

- OSB/4

- 按最終用戶行業分類

- 家具

- 住宅

- 商業

- 建造

- 地板和屋頂

- 牆

- 門

- 柱和樑

- 樓梯

- 其他建築用途

- 包裝

- 食品/飲料

- 產業

- 製藥

- 化妝品

- 其他包裝

- 家具

- 按地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 瑞士

- 奧地利

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Coillte

- Egger

- HEM DENMARK A/S

- Kronoplus Limited

- Sonae Arauco

- Steico SE

- SWISS KRONO Group

- West Fraser

第7章 市場機會與未來展望

The Europe Oriented Strand Board market is expected to grow from 8.85 million cubic meters in 2025 to 9.14 million cubic meters in 2026 and is forecast to reach 10.74 million cubic meters by 2031 at 3.28% CAGR over 2026-2031.

OSB's cost advantage versus plywood, its engineered strength profile, and tightening sustainability standards together keep the Europe Oriented Strand Board market resilient even as traditional lumber supply faces climate-related volatility. Structural applications dominate because builders value OSB/3's balance of load-bearing capacity and moisture resistance, a pairing that aligns with EU energy-efficiency retrofits and modular construction trends.

Europe Oriented Strand Board Market Trends and Insights

Post-pandemic Rebound in Multi-storey Timber Buildings

European cities are approving an expanding pipeline of tall timber structures, with roughly 300 buildings of six stories or more completed globally and concentrations emerging in Paris and London. This shift pushes the Europe-oriented strand Board market toward larger, continuous-panel formats that integrate easily with CLT and glulam frames. Prague's new 62-unit BREEAM-Excellent apartment block, built almost entirely from mass-timber modules, demonstrates how OSB contributes both to structural shear resistance and to embodied-carbon reduction goals. As more municipalities adopt carbon-based building codes, developers increasingly specify OSB/3 panels for wall and floor diaphragms because they deliver predictable racking resistance while enabling rapid on-site assembly.

REPowerEU Insulation Retrofits Boosting OSB Demand

Three-quarters of EU buildings need deep energy renovation to meet 2050 carbon targets, and the REPowerEU plan channels state aid into envelope upgrades. OSB substrates serve as robust backers for external insulation systems because they resist dimensional change when moisture levels fluctuate, preserving the bond between insulation and facade. Laboratory work shows polyurethane-bonded OSB boards achieving bond strengths above 80 kPa in ETICS assemblies, exceeding European code minima. In Germany, renovation permits issued in 2024 rose 12%, with wall-sheathing OSB purchases outpacing overall construction output, confirming the retrofit pull-through for the Europe Oriented Strand Board market. When paired with bio-based insulation mats, panels store carbon while lowering operational energy, an increasingly valuable proposition as member states introduce lifecycle-emissions caps for renovated stock.

Stricter Formaldehyde and VOC Emission Caps

EU Regulation 2023/1464 fixes a 0.062 mg/m3 emission ceiling from August 2026, compelling OSB mills to replace phenol-formaldehyde resins with MDI-based systems that raise manufacturing cost by 15-20%. Sweden applies an even tighter 0.124 mg/m3 interim limit, and Denmark enforces documentation for every shipment, elevating compliance paperwork. While the Europe Oriented Strand Board market has advanced in low-emission chemistry, retrofitting older press lines remains capital-intensive, especially for small producers. Research nonetheless indicates that high-grade OSB poses minimal exposure risk when emissions stay below code, a narrative larger brands use to justify price premiums. In parallel, merchants are starting to stock dual-certified "Zero-added-formaldehyde" lines, splitting demand but also creating a value-added tier that partially offsets higher binder costs.

Other drivers and restraints analyzed in the detailed report include:

- Construction Industry Growth

- Surge in Modular Off-site Construction Factories

- Volatile Soft-wood Fibre Supply in Central Europe

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

OSB/3 generated 83.10% of 2025 volume and will remain the backbone of the Europe-oriented strand Board market through 2031 with a 3.47% CAGR. The grade satisfies EN 300 load-bearing and humidity standards, making it the default for roof decks, wall sheathing, and flooring under both new-build and retrofit programs. Construction firms prefer OSB/3 because it offers 20-30% material savings versus plywood while delivering comparable nail-holding strength, a key cost lever as contractors navigate tight margins on modular projects. Manufacturers also optimize production scheduling around OSB/3, creating economies of scale that suppress per-unit energy use-an advantage now highlighted in Environmental Product Declarations requested by public-tender authorities.

OSB/4 retains niche demand in heavy-duty industrial flooring and mezzanine applications, capturing a modest but stable share as larger spans become common in logistics warehouses. OSB/2 continues to recede as building codes across Germany and France now require moisture-resistant sheathing even for interior partitions, effectively pushing lower-grade boards toward furniture and packaging outlets. OSB/1 occupies the bottom of the hierarchy, used mainly in non-structural decor or DIY markets where thin panels suffice. As a result, the Europe Oriented Strand Board market increasingly revolves around OSB/3, allowing producers to streamline resin systems and strand geometry for peak line efficiency.

The Europe Oriented Strand Board Market Report is Segmented by Grade (OSB/1, OSB/2, OSB/3, and OSB/4), End-User Industry (Furniture, Construction, and Packaging), and Geography (Germany, United Kingdom, France, Italy, Spain, Switzerland, Austria, and Rest of Europe). The Market Forecasts are Provided in Terms of Volume (Million Cubic Meters).

List of Companies Covered in this Report:

- Coillte

- Egger

- HEM DENMARK A/S

- Kronoplus Limited

- Sonae Arauco

- Steico SE

- SWISS KRONO Group

- West Fraser

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-Pandemic Rebound in Multi-Storey Timber Buildings

- 4.2.2 REPowerEU Insulation Retrofits Boosting OSB Demand

- 4.2.3 Surge in Modular Off-Site Construction Factories

- 4.2.4 Construction Industry Growth

- 4.2.5 OSB Price Advantage Vs Plywood

- 4.3 Market Restraints

- 4.3.1 Stricter Formaldehyde and VOC Emission Caps

- 4.3.2 Volatile Soft-Wood Fibre Supply in Central Europe

- 4.3.3 Health Concerns over Indoor Air Quality

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Grade

- 5.1.1 OSB/1

- 5.1.2 OSB/2

- 5.1.3 OSB/3

- 5.1.4 OSB/4

- 5.2 By End-user Industry

- 5.2.1 Furniture

- 5.2.1.1 Residential

- 5.2.1.2 Commercial

- 5.2.2 Construction

- 5.2.2.1 Floor and Roof

- 5.2.2.2 Wall

- 5.2.2.3 Door

- 5.2.2.4 Column and Beam

- 5.2.2.5 Staircase

- 5.2.2.6 Other Constructions

- 5.2.3 Packaging

- 5.2.3.1 Food and Beverage

- 5.2.3.2 Industrial

- 5.2.3.3 Pharmaceutical

- 5.2.3.4 Cosmetics

- 5.2.3.5 Other Packaging

- 5.2.1 Furniture

- 5.3 By Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Switzerland

- 5.3.7 Austria

- 5.3.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Coillte

- 6.4.2 Egger

- 6.4.3 HEM DENMARK A/S

- 6.4.4 Kronoplus Limited

- 6.4.5 Sonae Arauco

- 6.4.6 Steico SE

- 6.4.7 SWISS KRONO Group

- 6.4.8 West Fraser

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment