|

市場調查報告書

商品編碼

1910484

定向纖維板(OSB):市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Oriented Strand Board (OSB) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

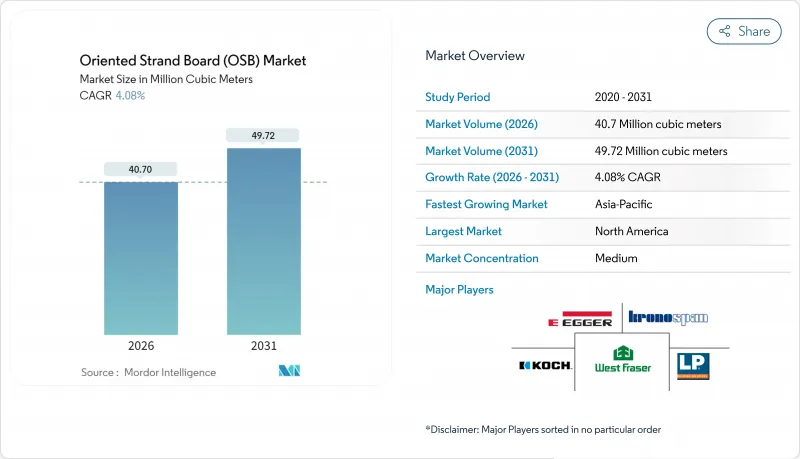

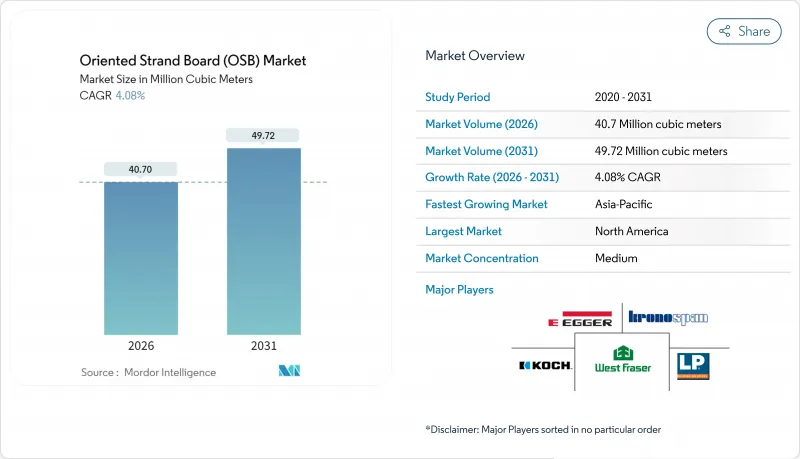

預計到 2026 年,定向纖維板(OSB) 市場規模將達到 4,070 萬立方米,高於 2025 年的 3,910 萬立方米。

預計到 2031 年將達到 4,972 萬立方米,2026 年至 2031 年的複合年成長率為 4.08%。

這種穩定成長的趨勢凸顯了定向塑合板(OSB)相對於膠合板的成本優勢、支援低碳材料的監管政策以及對製程自動化的投資如何共同推動了OSB市場需求的成長。成熟地區的建築商正在追求營運效率的提升,而新興經濟體的政府則將基礎設施建設資金投入工程木材領域,這些因素共同促進了OSB銷售的健康成長。競爭的焦點集中在工廠自動化和等級創新上,威好公司(Weyerhaeuser)的AI賦能乾燥最佳化技術便是數位化工具如何提高產量和下游板材品質的絕佳例證。

全球定向纖維板(OSB)市場趨勢與洞察

比膠合板更經濟實惠的替代品

製造商正透過利用刨花鋪放軟體和精準樹脂計量技術來降低變動成本,從而不斷縮小與軟木膠合板的生產成本差距。路易斯安那太平洋公司2025年第一季定向塑合板(OSB)銷售額達2.67億美元,儘管現貨價格下跌了11%,但出貨量仍維持穩定。這表明,OSB市場正在消化因膠合板產能限制而導致的需求變化。可預測的板材價格有助於住宅確保預算的確定性,尤其是在木材價格每立方公尺波動超過100美元的情況下。因此,定向纖維板市場正在向傳統上由膠合板主導的室內裝飾和家具基材領域擴張。

全球建設活動不斷擴大

亞太地區的基礎建設仍是最大的需求轉折點,該地區預計複合年成長率將達到6.34%。中國穩定的原木價格維持在每立方公尺110美元,支撐了板材買家的利潤前景;而印度和印尼的公共管道建設則支撐了工程木材的長期需求成長。預計到2024年,北美單戶住宅開工量將成長7%,這將推動對室外膠合板的需求,因為建築商看重定向塑合板(OSB)穩定的釘子固定性能。在中東,沙烏地阿拉伯和阿拉伯聯合大公國1,800億美元的脫碳計畫正推動木材進口量成長兩倍,這為出口商開拓新的OSB市場創造了機會。預製構件工廠正在利用OSB的尺寸精度來縮短施工週期,進一步將建築需求的成長動能與板材消費連結起來。

加強甲醛和揮發性有機化合物法規

歐盟將於2026年8月實施甲醛含量低於0.080 mg/m³的限值,這將迫使依賴脲醛樹脂的製造商改變配方,否則將失去市場佔有率。雖然使用MDI黏合劑生產的定向塑合板(OSB)通常可以豁免,但化學成分的改變將使變動成本增加15-20%,從而擠壓普通級OSB的利潤空間。在美國,環保署(EPA)的風險評估草案列出了62種可能導致更嚴格的職場接觸標準的用例,這將導致用於擴建通風和測試設施的資本支出。擁有規模和專業知識的垂直整合型企業在開發黏合劑方面具有優勢,這進一步凸顯了技術靈活性在OSB市場中的戰略重要性。

細分市場分析

預計到2025年,OSB/3將佔據OSB市場46.85%的佔有率,並在2031年之前以4.58%的複合年成長率持續成長,進一步擴大其在OSB市場中的地位。這主要得益於建築規範對潮濕環境板材的推薦。製造商採用酚醛樹脂或MDI樹脂來增強防水性能,同時又不影響螺絲的固定力,因此OSB/3深受設計人員的青睞,尤其是在設計多用戶住宅的牆體和屋頂板時。同時,OSB/4已在重型地板材料領域佔據了一席之地,但其密度的不斷增加限制了價格敏感型需求的成長。 OSB/2作為乾燥室內襯墊材料仍然具有成本效益,但由於設計人員擴大選擇批量採購單一等級的材料以進行高效的庫存管理,OSB/2的市場佔有率正面臨來自性能更優的OSB/3的蠶食。

表面處理技術的創新正在拓展OSB/3的應用範圍,使其進入櫥櫃和裝飾市場。由於OSB/3表面粗糙,這些市場以往難以進入。精細OSB產品線將塑合板面板與OSB芯材結合,可實現高壓層壓黏合,並拓展下游應用。這正在推動定向纖維板在家具行業的市場滲透。在監管方面,由於對更嚴格的甲醛法規的擔憂,對OSB/1的需求有所下降。這促使工廠的資本投資轉向改造傳統生產線,以生產高價值的結構級OSB。

定向塑合板報告按等級(OSB/1、OSB/2、OSB/3、OSB/4)、最終用戶應用(建築、家具、包裝)和地區(亞太、北美、歐洲、南美、中東和非洲)進行細分。市場預測以體積(立方米)為單位。

區域分析

預計到2025年,北美仍將保持60.05%的定向塑合板(OSB)市場佔有率,這得益於其龐大的現有工廠規模、一體化的軟木供應鏈以及建築商對該產品的高度認知。美國是全球最大的OSB進口國,市場規模達19億美元,其OSB主要來自加拿大和巴西的工廠。儘管美國國內的工廠也透過採用人工智慧烘乾機等現代化設備來提高產能運轉率,但其OSB進口量仍居高不下。加拿大仍然是出口導向國家,但不斷上漲的纖維原料成本迫使其選擇性地調整生產,例如West Fraser關閉了位於弗雷澤湖的工廠。這導致區域供應緊張,並支撐了OSB價格。

亞太地區預計將成為成長的主要驅動力,到2031年將以6.23%的複合年成長率成長,這主要得益於中國、印度和東南亞國協加速城市軌道交通、資料中心和中高層住宅計劃的建設。陸裡集團運作中國首條精細定向塑合板(OSB)生產線,標誌著中國正從依賴進口轉向國內一體化生產,從而縮短前置作業時間並可根據當地法規客製化等級。印度的智慧城市計畫正在推動工程板材的應用,工程板材在成本和施工速度方面均優於實木板材。在東南亞,旅遊業主導的住宿設施建設正在推動需求成長,但當地產能已無法滿足需求,這為來自北美和智利的供應商開闢了進口管道。

在歐洲,嚴格的氣候法規鞏固了有利於木材的政策,而成熟的住宅存量限制了需求成長,導致市場成長穩定但緩慢。將於2026年在歐盟範圍內生效的甲醛法規將淘汰不合規的供應商,為已在使用MDI系統的工廠創造機會。由於南歐的維修稅收優惠和北歐的預製產品出口,OSB市場仍能抵禦CLT的衝擊。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 比膠合板更經濟實惠的替代品

- 全球建設活動不斷擴大

- 對永續性工程木材的需求

- 模組化和預製住宅熱潮

- 新型低VOC MDI黏合劑OSB級

- 市場限制

- 加強甲醛和揮發性有機化合物法規

- 木纖維價格波動

- CLT的採用會蠶食結構材料市場的佔有率

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按年級

- OSB/1

- OSB/2

- OSB/3

- OSB/4

- 透過最終用戶使用

- 建造

- 地板和屋頂

- 牆

- 門

- 柱和梁(模板)

- 樓梯

- 其他建築

- 家具

- 住宅

- 商業的

- 包裝

- 食品/飲料

- 產業

- 製藥

- 化妝品

- 其他包裝

- 建造

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Arbec Forest Products Inc.

- Besgrade Plywood Sdn. Bhd.

- Coillte

- EGGER

- JM Huber Corporation

- Koch IP Holdings, LLC

- Koyuncuoglu Group of Companies

- Kronoplus Limited

- Louisiana-Pacific Corporation

- RoyOMartin

- Sonae Arauco

- STRANDPLYOSB

- Swiss Krono Group

- Tolko Industries Ltd.

- West Fraser

- Weyerhaeuser Company

- Yalong Wood

第7章 市場機會與未來展望

Oriented Strand Board (OSB) market size in 2026 is estimated at 40.7 Million cubic meters, growing from 2025 value of 39.10 Million cubic meters with 2031 projections showing 49.72 Million cubic meters, growing at 4.08% CAGR over 2026-2031.

This steady trajectory highlights how cost advantages over plywood, regulatory tailwinds favoring low-embodied-carbon materials, and process-automation investments are reinforcing demand across the oriented strand board market. Builders in mature regions seek operating efficiencies, while governments in emerging economies channel infrastructure funds toward engineered wood, collectively underpinning healthy volume growth. Competitive activity centers on mill automation and grade innovation; Weyerhaeuser's AI-guided dryer optimization exemplifies how digital tools are lifting throughput and down-line panel quality.

Global Oriented Strand Board (OSB) Market Trends and Insights

Cost-effective Substitution for Plywood

Manufacturers continue to narrow production spreads versus softwood plywood, leveraging strand-alignment software and precision resin dosing to cut variable costs. Louisiana-Pacific booked USD 267 million in OSB revenue in Q1-2025 and maintained shipment volumes despite an 11% spot-price slide, underscoring how the oriented strand board market absorbs demand displaced from constrained plywood capacity. Predictable panel pricing supports budget certainty for residential framers, especially when lumber volatility exceeds USD 100 per m3 swings. Consequently, the oriented strand board market now penetrates interior finish and furniture substrates once dominated by plywood.

Expansion of Global Construction Activity

Asia-Pacific's infrastructure drive remains the single largest demand inflection, reflected in the region's 6.34% CAGR outlook. China's stabilized log cost of USD 110 per m3 supports margin visibility for panel buyers, while public-works pipelines in India and Indonesia lift long-term engineered-wood offtake. North American single-family starts rose 7% in 2024, translating into incremental sheathing volume as builders favor OSB's uniform nail-holding capacity. the Middle East, Saudi and UAE decarbonization plans worth USD 180 billion triple timber imports, positioning exporters to tap fresh oriented strand board market pockets. Prefab factories leverage OSB's dimensional tolerance to shorten install cycles, further linking construction momentum with panel consumption.

Formaldehyde and VOC Regulations Tightening

The EU will enforce sub-0.080 mg/m3 formaldehyde ceilings from August 2026, compelling mills still reliant on UF-based resins to re-formulate or cede share. While OSB produced with MDI binders often qualifies for exemption, switching chemistry inflates variable cost 15-20%, squeezing commodity-grade margins. On the U.S. front, EPA's draft risk assessment flags 62 use-cases that might trigger tougher workplace exposure limits, creating capital spend for enhanced ventilation and test labs. Compliance pathways favor vertically integrated operators with adhesive research and development scale, adding strategic weight to technological agility in the oriented strand board market.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability-driven Demand for Engineered Wood

- Modular and Prefab Housing Boom

- Wood-fiber Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

OSB/3 generated 46.85% of oriented strand board market share in 2025 and is slated to widen its role as the oriented strand board market size for this grade grows at 4.58% CAGR through 2031, buoyed by building-code preference for panels rated for humid conditions. Manufacturers rely on phenol-formaldehyde or MDI resins to deliver water resistance without sacrificing screw-holding, attracting specifiers in multifamily walls and roof decks. In parallel, OSB/4 captures niche heavy-load floors, but its higher density caps price-sensitive uptake. OSB/2 remains cost-effective in dry-interior sheathing, yet faces share leakage to enhanced OSB/3 as designers adopt one-grade fits-all procurement to streamline inventories.

Surface innovations are expanding OSB/3 utility into cabinetry and decorative markets previously closed due to rough finish. Fine-OSB lines that overlay particleboard faces onto OSB cores permit high-pressure laminate adhesion, enlarging downstream applications and supporting oriented strand board market penetration in furniture clusters. On the regulatory side, OSB/1 demand wanes amid looming formaldehyde scrutiny, steering mill capital toward converting legacy production to higher-value structural grades.

The Oriented Strand Board Report is Segmented by Grade (OSB/1, OSB/2, OSB/3, and OSB/4), End-User Application (Construction, Furniture, and Packaging), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Cubic Meters).

Geography Analysis

North America retained 60.05% oriented strand board market share in 2025 thanks to a deep installed mill base, integrated softwood supply, and builder familiarity with the product. The United States remains the world's largest importer at USD 1.9 billion, primarily sourcing from Canadian and Brazilian plants even while domestic mills modernize with AI-enabled dryers to lift uptime. Canada's export orientation continues, but high fiber costs have forced selective curtailments as illustrated by West Fraser's Fraser Lake shutdown, tightening regional supply, and underpinning pricing.

Asia-Pacific is the growth engine, expanding at a 6.23% CAGR through 2031 as China, India, and ASEAN economies fast-track urban rail, data-center, and mid-rise residential projects. Luli Group's commissioning of China's first Fine-OSB line marks a pivot from reliance on imports toward domestic integrated production that shortens lead times and customizes grades for local codes. India's Smart City program lifts engineered panel adoption, where cost and speed edge out solid timber. Southeast Asian demand rises on tourism-driven hospitality builds, though local capacity lags, opening import lanes for North American and Chilean suppliers.

Europe shows steady but lower growth as stringent climate regulations lock in wood-favoring policies yet mature housing stock tempers volume upside. The EU-wide 2026 formaldehyde limit will likely displace non-compliant suppliers, increasing opportunities for mills already using MDI systems. Southern Europe's renovation credits and Northern Europe's prefab exports provide incremental tailwinds, keeping the oriented strand board market defensible against CLT incursion.

- Arbec Forest Products Inc.

- Besgrade Plywood Sdn. Bhd.

- Coillte

- EGGER

- J.M. Huber Corporation

- Koch IP Holdings, LLC

- Koyuncuoglu Group of Companies

- Kronoplus Limited

- Louisiana-Pacific Corporation

- RoyOMartin

- Sonae Arauco

- STRANDPLYOSB

- Swiss Krono Group

- Tolko Industries Ltd.

- West Fraser

- Weyerhaeuser Company

- Yalong Wood

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cost-effective substitution for plywood

- 4.2.2 Expansion of global construction activity

- 4.2.3 Sustainability-driven demand for engineered wood

- 4.2.4 Modular and prefab housing boom

- 4.2.5 Emerging low-VOC MDI-bonded OSB grades

- 4.3 Market Restraints

- 4.3.1 Formaldehyde and VOC regulations tightening

- 4.3.2 Wood-fiber price volatility

- 4.3.3 CLT adoption stealing structural share

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Grade

- 5.1.1 OSB/1

- 5.1.2 OSB/2

- 5.1.3 OSB/3

- 5.1.4 OSB/4

- 5.2 By End-user Application

- 5.2.1 Construction

- 5.2.1.1 Floor and Roof

- 5.2.1.2 Wall

- 5.2.1.3 Door

- 5.2.1.4 Column and Beam (Shuttering)

- 5.2.1.5 Staircase

- 5.2.1.6 Other Constructions

- 5.2.2 Furniture

- 5.2.2.1 Residential

- 5.2.2.2 Commercial

- 5.2.3 Packaging

- 5.2.3.1 Food and Beverage

- 5.2.3.2 Industrial

- 5.2.3.3 Pharmaceutical

- 5.2.3.4 Cosmetics

- 5.2.3.5 Other Packaging

- 5.2.1 Construction

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level overview, Market-level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Arbec Forest Products Inc.

- 6.4.2 Besgrade Plywood Sdn. Bhd.

- 6.4.3 Coillte

- 6.4.4 EGGER

- 6.4.5 J.M. Huber Corporation

- 6.4.6 Koch IP Holdings, LLC

- 6.4.7 Koyuncuoglu Group of Companies

- 6.4.8 Kronoplus Limited

- 6.4.9 Louisiana-Pacific Corporation

- 6.4.10 RoyOMartin

- 6.4.11 Sonae Arauco

- 6.4.12 STRANDPLYOSB

- 6.4.13 Swiss Krono Group

- 6.4.14 Tolko Industries Ltd.

- 6.4.15 West Fraser

- 6.4.16 Weyerhaeuser Company

- 6.4.17 Yalong Wood

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment