|

市場調查報告書

商品編碼

1906160

中東和非洲風力發電:市場佔有率分析、行業趨勢和統計數據、成長預測(2026-2031 年)Middle-East And Africa Wind Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

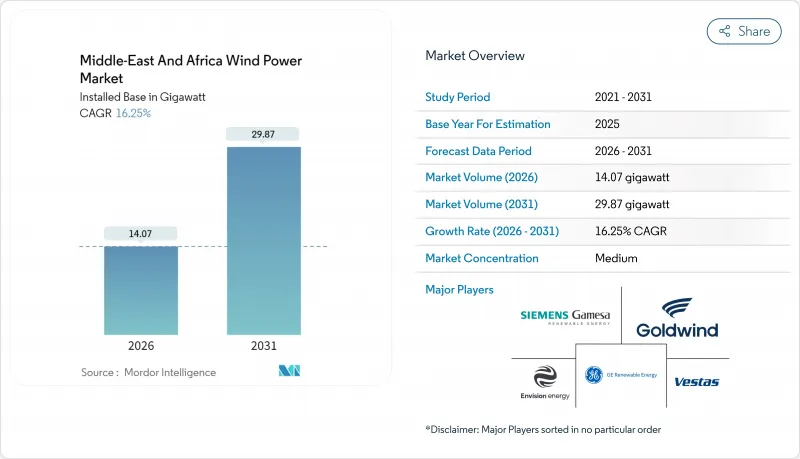

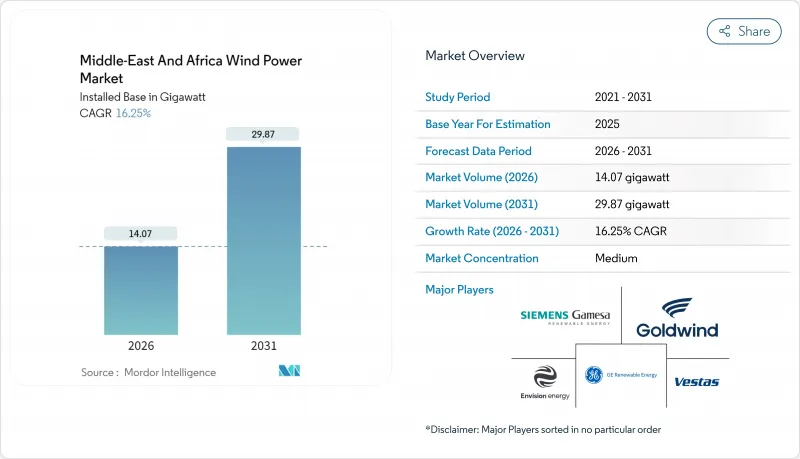

預計中東和非洲風電市場將從 2025 年的 12.10 吉瓦成長到 2026 年的 14.07 吉瓦,到 2031 年將達到 29.87 吉瓦,2026 年至 2031 年的複合年成長率為 16.25%。

強勁的主權財富基金投資,特別是沙烏地公共投資基金500億美元的可再生能源投資,支撐了這一成長。政策目標的強化、陸域風電平準化度電成本(LCOE)的下降以及購電協議(PPA)的擴大是推動成長的關鍵因素。國際風力渦輪機製造商正在加強其在當地的佈局,而中國新參與企業則憑藉成本驅動的競標獲得了優勢。開發商透過試點儲能系統來平滑電力輸出波動,並採用混合設計方案,從而對沖電網風險。區域港口的供應鏈擁塞以及離岸風力發電早期階段的核准流程仍然是營運中的摩擦點,但明確的國家目標確保了計劃多年可預見性。

中東和非洲風力發電廠的發展趨勢與分析

政府可再生能源目標和競標制度

國家競標計劃是計劃儲備的基礎。沙烏地阿拉伯的目標是到2030年達到50%的清潔電力,風電裝置容量達到16吉瓦,並計畫在2024年於杜馬特·賈達爾(Dumaat Al Jandal)風電場創下每千瓦時0.0199美元的歷史最低風價。埃及的目標是到2035年實現7.2吉瓦的風電裝置容量,並獲得32億美元的多邊融資支持。摩洛哥的目標是到2030年實現10吉瓦的風電裝置容量,並充分利用其大西洋沿岸的資源。阿拉伯聯合大公國已將2050年電力結構的12%規劃為風電。這些協調一致的政策降低了需求風險,吸引了一流的金融機構,並促進了在地化供應鏈的建立。

陸域風電平準化能源成本低於區域石化燃料基準水平

在摩洛哥、埃及和沙烏地阿拉伯,風力發電成本已降至每千瓦時0.03美元以下,超過了天然氣價格(每度電0.035-0.045美元)。杜馬特·賈達爾(Doumat Al-Jandal)電廠2024年的電價比石化燃料替代能源低40%。摩洛哥的塔法亞(Tarfaya)風電場售價為每千瓦時0.025美元,使得跨國出口具有商業性可行性。蘇伊士灣風電計劃的運轉運轉率超過40%,進一步增強了風電投資的經濟合理性。

撒哈拉以南地區多個市場的政策不確定性

在奈及利亞,波動不定的上網電價和多層級核准流程導致資金籌措成本上升150-200個基點。肯亞新的電網法規造成了過渡期延誤,加納因貨幣波動面臨容量支付通膨,而衣索比亞的地區衝突則阻礙了風電走廊的開發。這些挑戰導致開發週期延長長達18個月,並限制了缺乏健全競標機制地區近期新增裝置容量。

細分市場分析

受成熟的供應鏈和低資本成本的推動,陸上計劃預計將在 2025 年引領中東和北非地區風電場的整體成長,並在 2031 年前保持 16.25% 的複合年成長率。南非東開普省和沙烏地阿拉伯杜馬特賈達爾的風電場容量係數約為 40%,而摩洛哥大西洋沿岸穩定的信風使容量係數超過 45%。

離岸風力發電也擁有巨大的潛力。紅海沿岸水深20-50米,風速可達9米/秒。 NEOM的4吉瓦計畫旨在2028年前啟動首批計劃的建設。埃及正在籌備10吉瓦的離岸風電開發項目,並正與歐洲方面洽談優惠獲利能力。如果先導計畫證明可行,中東和非洲的風電場預計從2027年起迅速向離岸風電轉型。

這份中東和非洲風電場報告按地點(陸上和海上)、風機容量(3兆瓦以下、3-6兆瓦和6兆瓦以上)、應用領域(大型公用事業、商業和工業以及區域計劃)和地區(沙烏地阿拉伯、阿拉伯聯合大公國、約旦、伊朗、南非、埃及、摩洛哥以及其他中東和非洲國家)進行分析。市場規模和預測以裝置容量(吉瓦)為單位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 政府可再生能源目標和競標

- 陸域風電平準化能源成本低於區域石化燃料基準

- 資料中心和採礦業企業間購電協議 (PPA) 的擴展

- 海灣合作理事會和東非地區的輸電網擴建投資

- 利用紅海沿岸離岸風力發電製氫的試點項目

- 沙烏地阿拉伯渦輪機製造在地化獎勵

- 市場限制

- 撒哈拉以南多個市場的政策不確定性

- 電網穩定性和限電風險

- 海上計劃的初始資本投資成本高

- 中東和非洲港口供應鏈堵塞

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按位置

- 陸上

- 離岸

- 按渦輪機容量

- 3兆瓦或以下

- 3~6MW

- 超過6兆瓦

- 透過使用

- 實用規模

- 商業和工業

- 社區計劃

- 按成分(定性分析)

- 機艙/渦輪機

- 刀刃

- 塔

- 發電機和減速器

- 系統周邊設備

- 按地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 約旦

- 伊朗

- 南非

- 埃及

- 摩洛哥

- 其他中東和非洲地區

第6章 競爭情勢

- 市場集中度

- 策略性舉措(併購、夥伴關係、購電協議)

- 市場佔有率分析(主要企業的市場排名和佔有率)

- 公司簡介

- Siemens Gamesa Renewable Energy

- Vestas Wind Systems A/S

- GE Renewable Energy

- Xinjiang Goldwind Science & Technology

- Envision Energy

- Acciona Energia

- Mainstream Renewable Power

- EDF Renouvelables

- Enel Green Power

- ENGIE

- ACWA Power

- Masdar Clean Energy

- Lekela Power

- Orascom Construction

- Nordex SE

- Enercon GmbH

- Ming Yang Smart Energy

- Siemens Energy

- Doosan Enerbility

- Suzlon Energy Ltd.

第7章 市場機會與未來展望

The Middle-East And Africa Wind Power Market is expected to grow from 12.10 gigawatt in 2025 to 14.07 gigawatt in 2026 and is forecast to reach 29.87 gigawatt by 2031 at 16.25% CAGR over 2026-2031.

Robust sovereign wealth-fund investments, especially the Saudi Public Investment Fund's USD 50 billion renewable allocation, anchor this momentum. Intensifying policy targets, declining onshore levelized costs, and expanding corporate power purchase agreements (PPAs) form the core growth architecture. International turbine makers strengthen local footprints while Chinese entrants win cost-sensitive bids. Developers hedge grid risks through storage pilots and hybrid designs that smooth output variability. Supply-chain congestion at regional ports and early-stage offshore permitting remain operational friction points, yet the depth of national targets secures multi-year project visibility.

Middle-East And Africa Wind Power Market Trends and Insights

Government Renewable-Energy Targets & Auctions

National auction programs underpin project pipelines. Saudi Arabia targets 50% clean electricity by 2030 with 16 GW of wind capacity, achieving a record USD 0.0199 per kWh tariff at Dumat Al Jandal in 2024. Egypt aims to achieve 7.2 GW of wind energy by 2035, backed by USD 3.2 billion in multilateral financing. Morocco's 10 GW target for 2030 exploits Atlantic resources, while the UAE channels 12% of its 2050 generation mix toward wind. These synchronized mandates reduce demand risk, attract tier-one financiers, and encourage supply-chain localization.

Falling On-Shore LCOE Below Regional Fossil Benchmarks

Wind costs have dropped below USD 0.03 per kWh in Morocco, Egypt, and Saudi Arabia, which is lower than natural-gas tariffs of USD 0.035-0.045 per kWh. Dumat Al Jandal's 2024 tariff came in 40% under fossil alternatives. Morocco's Tarfaya complex sells at USD 0.025 per kWh, making cross-border exports commercially viable. Gulf of Suez projects operate at capacity factors above 40%, reinforcing the economic argument for wind investment.

Policy Uncertainty in Several Sub-Saharan Markets

Nigeria's shifting feed-in tariffs and multi-layer permitting elevate financing spreads by 150-200 basis points. Kenya's new grid codes create transition delays, Ghana faces currency fluctuations that inflate capacity payments, and Ethiopia's regional conflicts hinder wind corridor development. These issues stretch development timelines by up to 18 months and temper near-term capacity additions outside stable auction jurisdictions.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Corporate PPAs from Data-Center & Mining Sectors

- Grid-Expansion Investments Across GCC & East Africa

- Grid Stability & Curtailment Risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Onshore projects are expected to control the entire Middle East and Africa wind power market in 2025 and sustain a 16.25% CAGR to 2031, driven by mature supply chains and low capital costs. South Africa's Eastern Cape farms and Saudi Arabia's Dumat Al Jandal demonstrate performance with capacity factors of nearly 40%. Morocco's Atlantic villas exceed 45% factors thanks to consistent trade winds.

Offshore potential is substantial. The Red Sea coasts offer water depths of 20-50 m with wind speeds of 9 m/s. NEOM's 4 GW plan aims to anchor the first projects by 2028. Egypt is lining up 10 GW of offshore prospects and is negotiating concessional European financing. As pilot arrays prove bankable, the Middle East and Africa wind power market may diversify rapidly toward offshore capacity after 2027.

The Middle East and Africa Wind Power Market Report is Segmented by Location (Onshore and Offshore), Turbine Capacity (Up To 3 MW, 3 To 6 MW, and Above 6 MW), Application (Utility-Scale, Commercial and Industrial, and Community Projects), and Geography (Saudi Arabia, UAE, Jordan, Iran, South Africa, Egypt, Morocco, and Rest of Middle East and Africa). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Siemens Gamesa Renewable Energy

- Vestas Wind Systems A/S

- GE Renewable Energy

- Xinjiang Goldwind Science & Technology

- Envision Energy

- Acciona Energia

- Mainstream Renewable Power

- EDF Renouvelables

- Enel Green Power

- ENGIE

- ACWA Power

- Masdar Clean Energy

- Lekela Power

- Orascom Construction

- Nordex SE

- Enercon GmbH

- Ming Yang Smart Energy

- Siemens Energy

- Doosan Enerbility

- Suzlon Energy Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government renewable-energy targets & auctions

- 4.2.2 Falling on-shore LCOE below regional fossil benchmarks

- 4.2.3 Expansion of corporate PPAs from data-centre & mining sectors

- 4.2.4 Grid-expansion investments across GCC & East Africa

- 4.2.5 Offshore wind-to-hydrogen pilots along the Red Sea

- 4.2.6 Saudi localisation incentives for turbine manufacturing

- 4.3 Market Restraints

- 4.3.1 Policy uncertainty in several Sub-Saharan markets

- 4.3.2 Grid stability & curtailment risk

- 4.3.3 High upfront CAPEX for offshore projects

- 4.3.4 Supply-chain congestion at MEA ports

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Location

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 By Turbine Capacity

- 5.2.1 Up to 3 MW

- 5.2.2 3 to 6 MW

- 5.2.3 Above 6 MW

- 5.3 By Application

- 5.3.1 Utility-scale

- 5.3.2 Commercial and Industrial

- 5.3.3 Community Projects

- 5.4 By Component (Qualitative Analysis)

- 5.4.1 Nacelle/Turbine

- 5.4.2 Blade

- 5.4.3 Tower

- 5.4.4 Generator and Gearbox

- 5.4.5 Balance-of-System

- 5.5 By Geography

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Jordan

- 5.5.4 Iran

- 5.5.5 South Africa

- 5.5.6 Egypt

- 5.5.7 Morocco

- 5.5.8 Rest of Middle East & Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Siemens Gamesa Renewable Energy

- 6.4.2 Vestas Wind Systems A/S

- 6.4.3 GE Renewable Energy

- 6.4.4 Xinjiang Goldwind Science & Technology

- 6.4.5 Envision Energy

- 6.4.6 Acciona Energia

- 6.4.7 Mainstream Renewable Power

- 6.4.8 EDF Renouvelables

- 6.4.9 Enel Green Power

- 6.4.10 ENGIE

- 6.4.11 ACWA Power

- 6.4.12 Masdar Clean Energy

- 6.4.13 Lekela Power

- 6.4.14 Orascom Construction

- 6.4.15 Nordex SE

- 6.4.16 Enercon GmbH

- 6.4.17 Ming Yang Smart Energy

- 6.4.18 Siemens Energy

- 6.4.19 Doosan Enerbility

- 6.4.20 Suzlon Energy Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment