|

市場調查報告書

商品編碼

1906159

歐洲汽車物流:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Europe Automotive Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

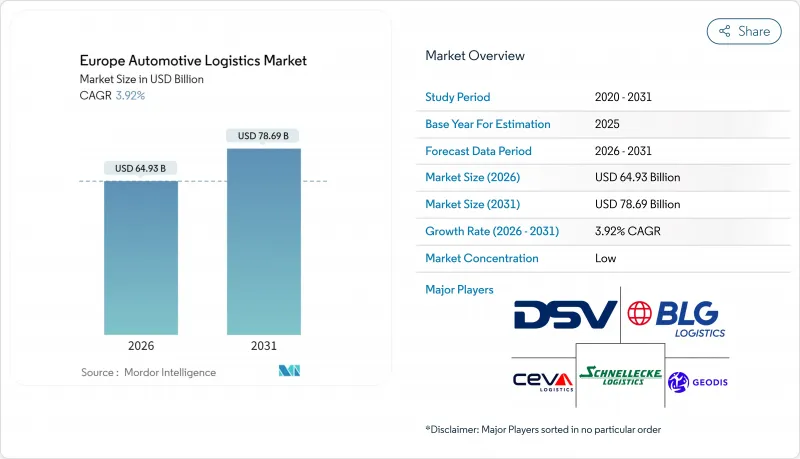

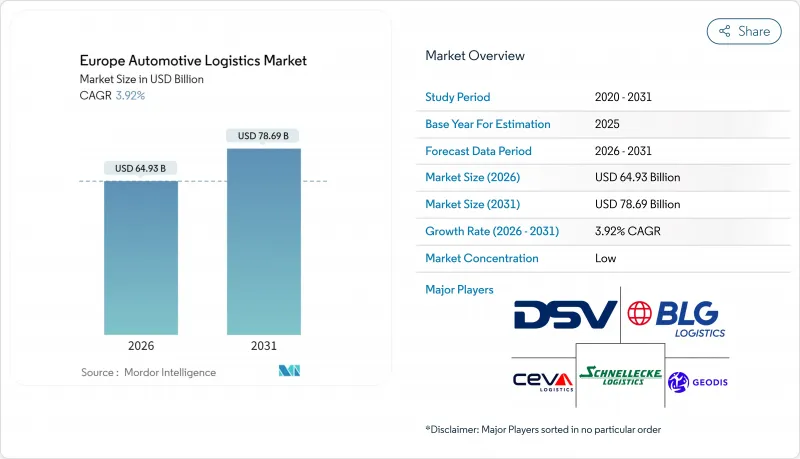

歐洲汽車物流市場預計到 2026 年將達到 649.3 億美元,高於 2025 年的 624.8 億美元。

預計到 2031 年將達到 786.9 億美元,2026 年至 2031 年的複合年成長率為 3.92%。

隨著原始設備製造商 (OEM)、第三方物流 (3PL) 營運商和技術專家圍繞電氣化、數位化協作和嚴格的脫碳要求重組其網路,這一前景逐漸顯現。儘管運輸服務仍然重要,但對溫控電池物流和高頻電商組件供應的快速需求正促使投資轉向增值能力。整合的 3PL/4PL夥伴關係、多模態最佳化和自動化應用正在提高營運韌性,而公路和鐵路運力限制則繼續限制利潤率的提升。德國是區域收入的基礎,而波蘭倉儲業的蓬勃發展凸顯了一種地域格局的重新平衡,這種平衡有利於擁有泛歐業務的靈活供應商。

歐洲汽車物流市場趨勢與洞察

OEM製造商擴大將業務外包給整合的3PL/4PL專業公司

歐洲汽車製造商正擴大將端到端物流外包給兼具實體和數位化能力的策略合作夥伴。大眾汽車和寶馬汽車正在深化與供應商簽訂的多年期契約,這些供應商能夠協調零件入庫管理、工廠準時交付以及整車跨境運輸。德迅集團和DHL供應鏈正在積極回應,擴展其“汽車解決方案中心”,整合運輸規劃、控制塔分析和永續發展報告。 ISO 14001和IATF 16949認證提高了行業標準,促使企業更加關注那些擁有品質和環境資質的供應商。歐洲汽車物流市場正受惠於汽車製造商將資金從資產所有權轉向電氣化研發,從而將物流創新交給專業公司。外包還能透過變動成本合約和靈活調整規模以應對需求高峰和低谷來緩衝生產波動。

由於電動車產量快速成長,對溫控電池物流的需求日益成長。

匈牙利、德國和波蘭的超級工廠集群正在加速對溫度控制在攝氏15至25度之間的溫控供應鏈的需求,以保護鋰離子電池的完整性。 DHL在義大利和英國的電動車專業中心提供配備滅火系統、符合ADR標準的包裝和即時溫度監控系統的專用倉儲設施。物流業者正在投資隔熱交換車廂、電動穿梭車和冗餘電源,以確保跨境運輸過程中的溫度穩定性。這導致歐洲汽車物流市場資本投資激增,包括專用車輛資產和倉庫維修,這些投資價格不菲。寧德時代等電池製造商正在利用區域服務中心擴大對入庫和出庫流程的直接控制,以縮短運輸時間並維持保固標準。

歐洲公路和鐵路貨運面臨司機短缺和運力不足的問題

在德國,超過8萬名專業駕駛員的缺口正對汽車物流的即時交付模式帶來巨大壓力,並推高薪資成本。年輕人對長途駕駛工作的低迷加劇了離職率,而基礎設施建設和以乘客為先的政策也給鐵路貨運能力帶來了壓力。物流公司正透過發放留任獎金、實施彈性工作制和引入自動駕駛場內牽引車來維持服務水準。運力波動導致歐洲汽車物流市場出現溢價和現貨運費波動。汽車製造商正努力透過增加安全庫存緩衝和在工廠附近實施越庫作業轉運來降低交貨風險。

細分市場分析

到2025年,貨運將佔歐洲汽車物流市場61.35%的佔有率,這主要得益於道路運輸的柔軟性,能夠滿足嚴格的準時制生產週期。同時,隨著碳定價推動運輸方式的重新平衡,鐵路和短程海運在長途運輸的重要性日益凸顯。附加價值服務雖然規模較小,但在2026年至2031年間,其複合年成長率將達到3.52%,這主要得益於交貨前檢驗、電動車電池維護和控制塔協調等服務的成長。供應商正透過機器人驅動的越庫作業數位雙胞胎來最佳化服務組合,從而提高車輛停留時間和堆場容量。到2031年,在公路貨運價格持續承壓的情況下,附加價值服務將有助於穩定利潤率,並鞏固供應商作為歐洲汽車物流市場整合合作夥伴的地位。

倉儲業正經歷同步成長,自動化提高了多品種零件庫存的吞吐量。 ISO 9001 和 IATF 16949 認證正成為供應商選擇的標準,確保了收貨、生產線定序和售後補貨的可追溯性。智慧貨架、AGV 車隊和 RFID 掃描等技術的運用縮短了週期時間,進一步推動了歐洲汽車物流市場在核心運輸之外的服務層面的成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- OEM製造商擴大將業務外包給整合的3PL/4PL專業公司

- 隨著電動車產量激增,對溫控電池物流的需求日益成長。

- 售後服務電子商務推動了小批量、高頻率的物流發展。

- 歐盟綠色交易獎勵促進多式聯運和二氧化碳減排

- 半導體和軟體定義汽車組件創造了新的高附加價值流程

- 區域電池回收走廊的出現(從原始設備製造商到超級工廠的反向循環)

- 市場限制

- 歐洲公路和鐵路貨運面臨司機和運力短缺問題

- 燃料和人事費用上漲給利潤率帶來壓力。

- 滾裝船短缺導致成品車港口擁擠

- 互聯物流平台中的網路安全漏洞

- 價值/供應鏈分析

- 監管環境(政府法規和政策)

- 技術展望(自動化、物聯網、人工智慧、區塊鏈)

- 專題報導-電子商務對汽車物流的影響

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 地緣政治事件的影響

第5章 市場規模與成長預測

- 透過服務

- 運輸

- 路

- 鐵路

- 航空

- 海上/滾裝/近岸

- 倉儲、配送和庫存管理

- 附加價值服務

- 運輸

- 按類型

- OEM

- 售後市場

- 按貨物類型

- 已完成的汽車

- 汽車零件

- 電動汽車電池和電力電子

- 其他貨物

- 按國家/地區

- 德國

- 西班牙

- 法國

- 義大利

- 波蘭

- 英國

- 比荷盧經濟聯盟(比利時、荷蘭、盧森堡)

- 北歐國家(丹麥、芬蘭、冰島、挪威、瑞典)

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- BLG Logistics

- CEVA Logistics AG

- DSV

- Schnellecke Logistics

- GEODIS

- Nippon Express Co., Ltd

- XPO Logistics, Inc.

- DHL Supply Chain

- Kuehne+Nagel

- Hellmann Worldwide Logistics

- Wallenius Wilhelmsen Logistics

- Yusen Logistics

- CAT Group

- FIEGE Automotive

- Ryder System, Inc.

- Rohlig Logistics

- Rhenus Logistics

- Scan Global Logistics

- LOGISTEED Europe BV

- TOP AUTO Logistik GmbH

第7章 市場機會與未來展望

Europe Automotive Logistics Market size in 2026 is estimated at USD 64.93 billion, growing from 2025 value of USD 62.48 billion with 2031 projections showing USD 78.69 billion, growing at 3.92% CAGR over 2026-2031.

The outlook emerges as OEMs, 3PLs, and technology specialists reshape networks around electrification, digital orchestration, and rigorous decarbonization mandates. Transportation services remain pivotal, yet rapid demand for temperature-controlled battery flows and high-frequency e-commerce parts fulfillment is refocusing investment toward value-added capabilities. Integrated 3PL/4PL partnerships, multimodal optimization, and automation adoption drive operational resilience while capacity constraints in road and rail continue to temper margin expansion. Germany anchors regional revenue, but Poland's warehouse boom underscores a geographic rebalancing that rewards agile providers with pan-European reach.

Europe Automotive Logistics Market Trends and Insights

OEMs' Rising Outsourcing to Integrated 3PL/4PL Specialists

European manufacturers increasingly channel end-to-end logistics to strategic partners that fuse physical and digital competencies. Volkswagen and BMW deepen multi-year agreements with providers capable of orchestrating inbound parts, just-in-sequence plant deliveries, and outbound finished-vehicle distribution across borders. Kuehne+Nagel and DHL Supply Chain answer by expanding Automotive Solution Centers that unify transport planning, control-tower analytics, and sustainability reporting. Certifications under ISO 14001 and IATF 16949 elevate selection thresholds, directing share toward providers with quality and environmental credentials. The Europe automotive logistics market benefits as OEM capital shifts from asset ownership to electrification R&D, leaving logistics innovation to specialized experts. Outsourcing also buffers production volatility by allowing variable-cost contracts that scale with demand peaks and troughs.

Surge in EV Production Requiring Temperature-Controlled Battery Logistics

Gigafactory clusters in Hungary, Germany, and Poland accelerate demand for 15-25 °C controlled supply chains that safeguard lithium-ion cell integrity. DHL's EV Centers of Excellence in Italy and the UK showcase purpose-built storage with fire-suppression systems, ADR-compliant packaging, and real-time thermal monitoring. Logistics providers invest in insulated swap bodies, electric shuttles, and redundant power backup to guarantee temperature stability during cross-border transits. The Europe automotive logistics market thus funnels capex into specialized fleet assets and warehouse retrofits that command premium pricing. Battery OEMs such as CATL extend direct control over inbound and reverse flows, leveraging in-region service hubs to curtail transit time and uphold warranty standards.

Driver & Capacity Shortages in European Road/Rail Freight

A deficit exceeding 80,000 professional drivers in Germany strains just-in-time automotive flows and inflates wage costs. Low appeal of long-haul careers among younger cohorts compounds attrition, while infrastructure works and passenger priority squeeze rail freight slots. Logistics firms adopt retention bonuses, flexible scheduling, and autonomous yard tractors to sustain service levels. The Europe automotive logistics market experiences spot-rate volatility as capacity swings trigger premium surcharges. OEMs respond by increasing safety-stock buffers and exploring cross-docking near plants to dampen schedule risk.

Other drivers and restraints analyzed in the detailed report include:

- After-Sales E-Commerce Boosting Small-Lot, High-Frequency Flows

- EU Green Deal Incentives for Multimodal Freight & CO2 Cuts

- Rising Fuel and Labor Costs Squeezing Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transportation accounted for a 61.35% share of the Europe automotive logistics market in 2025, anchored by road haulage flexibility that meets stringent just-in-sequence production cadences. Rail and short-sea alternatives gain relevance on longer corridors as carbon pricing steers modal recalibration. Meanwhile, value-added services, though smaller, are expanding at a 3.52% CAGR (2026-2031), driven by pre-delivery inspection, EV battery conditioning, and control-tower orchestration. Providers elevate service mix through robotics-enabled cross-docks and digital twins that optimize dwell time and yard capacity. By 2031, value-added offerings will underpin margin resilience as commoditized line-haul rates remain under pressure, thereby entrenching integrated partners across the Europe automotive logistics market.

A parallel upswing is visible in warehousing, where automation increases throughput for multi-SKU part inventories. ISO 9001 and IATF 16949 certifications govern provider selection, ensuring traceability across inbound, line-side sequencing, and aftermarket replenishment. Smart racking, AGV fleets, and RFID scanning compress cycle times, reinforcing the Europe automotive logistics market size growth trajectory for service layers beyond core transport.

The Europe Automotive Logistics Market Report is Segmented by Service (Transportation, Warehousing, Distribution & Inventory Management, and Value-Added Services), Type (OEM and Aftermarket), Cargo Type (Finished Vehicles, Auto Components, EV Batteries & Power-Electronics, and Other Cargo), Country (Germany, Spain, France, Italy, United Kingdom, Poland, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- BLG Logistics

- CEVA Logistics AG

- DSV

- Schnellecke Logistics

- GEODIS

- Nippon Express Co., Ltd

- XPO Logistics, Inc.

- DHL Supply Chain

- Kuehne + Nagel

- Hellmann Worldwide Logistics

- Wallenius Wilhelmsen Logistics

- Yusen Logistics

- CAT Group

- FIEGE Automotive

- Ryder System, Inc.

- Rohlig Logistics

- Rhenus Logistics

- Scan Global Logistics

- LOGISTEED Europe B.V.

- TOP AUTO Logistik GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 OEMs' rising outsourcing to integrated 3PL/4PL specialists

- 4.2.2 Surge in EV production requiring temperature-controlled battery logistics

- 4.2.3 After-sales e-commerce boosting small-lot, high-frequency flows

- 4.2.4 EU Green Deal incentives for multimodal freight & CO2 cuts

- 4.2.5 Semiconductor & software-defined vehicle parts creating new high-value flows

- 4.2.6 Emergence of regional battery-recycling corridors (OEM-to-gigafactory reverse loops)

- 4.3 Market Restraints

- 4.3.1 Driver & capacity shortages in European road/rail freight

- 4.3.2 Rising fuel and labor costs squeezing margins

- 4.3.3 Ro-Ro vessel scarcity causing port congestion for finished vehicles

- 4.3.4 Cyber-security vulnerabilities in connected logistics platforms

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape (Government Regulations & Initiatives)

- 4.6 Technological Outlook (Automation, IoT, AI, Blockchain)

- 4.7 Spotlight - E-commerce Impact on Automotive Logistics

- 4.8 Porter's Five Forces

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

- 4.9 Impact of Geo-Political Events

5 Market Size & Growth Forecasts

- 5.1 By Service

- 5.1.1 Transportation

- 5.1.1.1 Road

- 5.1.1.2 Rail

- 5.1.1.3 Air

- 5.1.1.4 Sea / Ro-Ro / Short-Sea

- 5.1.2 Warehousing, Distribution & Inventory Management

- 5.1.3 Value-added Services

- 5.1.1 Transportation

- 5.2 By Type

- 5.2.1 OEM

- 5.2.2 Aftermarket

- 5.3 By Cargo Type

- 5.3.1 Finished Vehicles

- 5.3.2 Auto Components

- 5.3.3 EV Batteries and Power-Electronics

- 5.3.4 Other Cargo

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 Spain

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Poland

- 5.4.6 United Kingdom

- 5.4.7 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.8 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.9 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.4.1 BLG Logistics

- 6.4.2 CEVA Logistics AG

- 6.4.3 DSV

- 6.4.4 Schnellecke Logistics

- 6.4.5 GEODIS

- 6.4.6 Nippon Express Co., Ltd

- 6.4.7 XPO Logistics, Inc.

- 6.4.8 DHL Supply Chain

- 6.4.9 Kuehne + Nagel

- 6.4.10 Hellmann Worldwide Logistics

- 6.4.11 Wallenius Wilhelmsen Logistics

- 6.4.12 Yusen Logistics

- 6.4.13 CAT Group

- 6.4.14 FIEGE Automotive

- 6.4.15 Ryder System, Inc.

- 6.4.16 Rohlig Logistics

- 6.4.17 Rhenus Logistics

- 6.4.18 Scan Global Logistics

- 6.4.19 LOGISTEED Europe B.V.

- 6.4.20 TOP AUTO Logistik GmbH

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment