|

市場調查報告書

商品編碼

1906084

低密度聚乙烯:市佔率分析、產業趨勢與統計、成長預測(2026-2031)Low Density Polyethylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

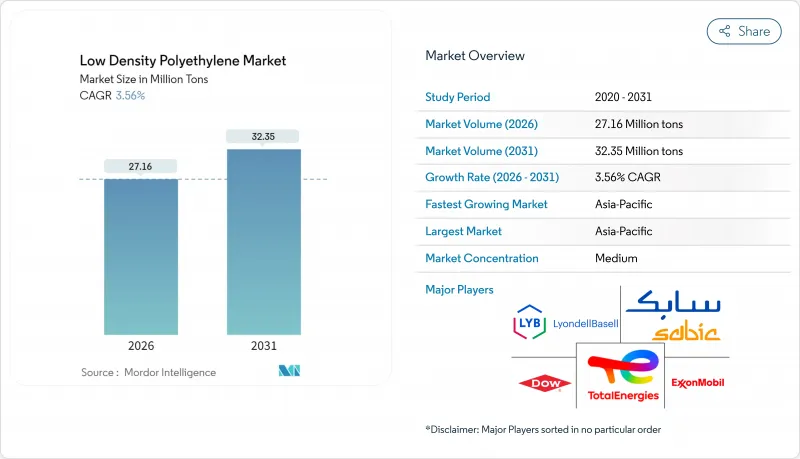

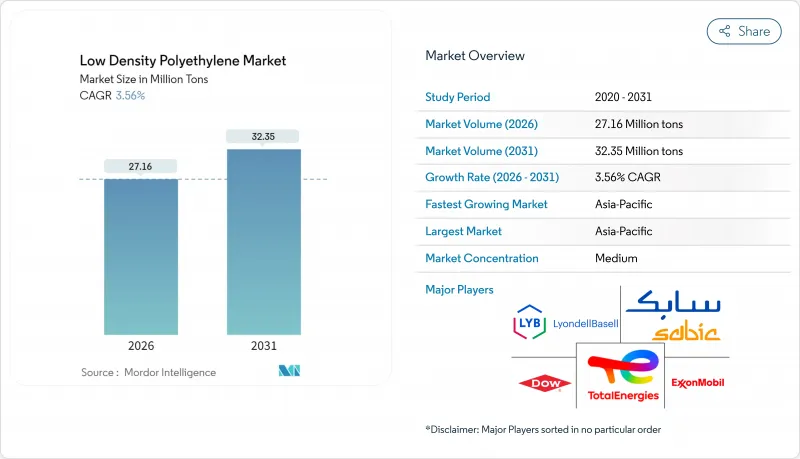

預計低密度聚乙烯市場將從 2025 年的 2,623 萬噸成長到 2026 年的 2,716 萬噸,到 2031 年將達到 3,235 萬噸,2026 年至 2031 年的複合年成長率為 3.56%。

這一成長軌跡反映了軟性薄膜、隔熱材料、塗料和農產品領域的強勁消費,即便監管壓力加速了向循環包裝解決方案的轉型。薄膜仍然是關鍵應用領域,因為加工商優先考慮低密度聚乙烯(LDPE)的密封強度和光學透明度。同時,亞太地區產能的持續擴張正在加強對可再生能源基礎設施、精密農業和電子商務物流的供應基礎。技術許可,尤其是在中國,正在擴大先進管狀和高壓釜製程的應用範圍,以生產高價值等級的產品。同時,歐盟的循環經濟指令正在透過評估消費後回收塑膠的含量和限制複雜的多層結構來重塑籌資策略。受與原油價格掛鉤的乙烯價格的影響,原料成本波動促使利潤管理成為一項策略重點,並促使生產商最佳化其在具有定價權的特殊應用領域產品組合。

全球低密度聚乙烯市場趨勢及洞察

電子商務軟包裝的成長推動了薄膜創新

為了應對快速成長的小包裹量,加工商正致力於開發輕質、抗穿刺的單組分薄膜,以減輕運輸重量並簡化回收流程。埃克森美孚以Exceed和Enable聚合物為基礎的全聚乙烯複合材料平台,可生產97%聚乙烯含量的包裝袋,同時具備優異的氧氣阻隔性。物流業者受益於較薄的壁厚結構,在不犧牲密封強度的前提下減少了材料用量,而這種規格也符合歐洲針對難以回收的多層薄膜所實施的關稅協調制度。零售商正在指定使用分子量分佈窄的低密度聚乙烯(LDPE)等級產品,以兼顧耐衝擊和透明度,從而推動了低密度聚乙烯市場的需求成長。

農業薄膜受益於對永續性和提高生產力的需求。

精密農業、溫室栽培和青貯飼料保藏技術的進步推動了低密度聚乙烯(LDPE)在覆蓋物、燻蒸和溫室薄膜等領域的消費成長。BASF估計,農業薄膜的年需求量為700萬噸,年成長7%,凸顯了該材料在減少水分流失和雜草壓力、提高作物產量方面的重要性。然而,監管機構正在收緊廢棄物處理限制,推動生物基材料和光分解混合物的試驗。為了應對替代風險,製造商正在將Oxo生物分解母粒商業化,這些母料在使用過程中保持薄膜強度,同時在回收後促進鏈斷裂,從而確保LDPE在高性能應用領域的競爭力。

在通用應用領域,與線性低密度聚乙烯(LLDPE)和高密度聚乙烯(HDPE)的競爭日益加劇

茂金屬催化劑的進步正在縮小低密度聚乙烯(LDPE)和鎖狀高密度聚苯乙烯( HDPE)之間的性能差距。現代線性低密度聚乙烯(LLDPE)具有高抗穿刺性和薄壁特性,適用於重型運輸袋,從而蠶食了傳統LDPE的訂單量。同時,HDPE在T卹袋和薄壁容器等應用中持續獲得認可,這些應用對剛性和環境應力開裂性能要求較高。 LDPE生產商正透過將產能轉移到重型收縮罩和黏合劑襯裡等細分應用領域來捍衛市場佔有率,在這些領域,支鏈結構能夠提供線性LDPE無法實現的熱封和光學性能。

細分市場分析

到2025年,薄膜將佔低密度聚乙烯市場佔有率的56.60%,這反映了其在食品柔軟性袋、工業內襯和農業覆蓋物等領域的成熟應用。加工者對薄壁單層結構越來越感興趣,這種結構可實現15微米的拉伸膜厚度,從而在不犧牲撕裂強度的前提下減少樹脂用量。儘管電線電纜絕緣材料的銷量目前小規模,但預計到2031年,其複合年成長率將達到4.07%,這主要得益於可再生能源網路和電動汽車線束的廣泛應用。吹塑成型容器由於兼具透明度和抗衝擊性,有望保持穩定的低密度聚乙烯市場佔有率。同時,射出成型零件正在滿足市場對耐化學腐蝕瓶蓋和封口的需求。

隨著線性聚乙烯替代需求的持續成長,低密度聚乙烯(LDPE)供應商正在開發用於發泡體和片材應用的高熔體強度樹脂,以滿足其能量吸收和柔軟性需求。發泡床墊和運動地板製造商重視LDPE的泡孔結構穩定性,而建築包覆材料製造商則利用其防潮性能。採用無過氧化物高壓高壓釜技術的特種反應器生產線進一步拓展了產品範圍,提供專為醫療設備包覆成型設計的超潔淨等級產品,凸顯了低密度聚乙烯市場產品組合的不斷演變。

低密度聚乙烯市場報告按產品類型(吹塑成型、薄膜、射出成型、片材、發泡體等)、終端用戶行業(農業、電氣電子、包裝、建築、汽車、消費品、醫療保健和製藥)以及地區(亞太、北美、歐洲、南美、中東和非洲)進行細分。市場預測以噸為單位。

區域分析

預計到2025年,亞太地區將佔據低密度聚乙烯市場47.30%的佔有率,這主要得益於中國產能的大規模擴張以及東南亞製造業的成長。中國的樹脂產量激增,寧夏和山東的新管材和旋轉式聚乙烯生產裝置計劃運作,其中許多計劃都採用了利安德巴塞爾的技術許可。

北美擁有極具競爭力的原料成本優勢,這得益於其豐富的乙烷頁岩資源。一體化生產商將剩餘的低密度聚乙烯(LDPE)策略性地出口到拉丁美洲和亞洲,而國內加工商則利用其原料採購能力來支援永續薄膜專案。在歐洲,諸如《包裝廢棄物法規》等嚴格的強制規定正在推動對先進回收基礎設施和再生低密度聚乙烯產品的投資。儘管原生樹脂的成長緩慢,但高價值的循環產品正在為歐洲供應商開闢高階市場。

中東和非洲地區受益於具有競爭力的原料價格和快速成長的人口。阿拉伯灣地區的乙烷裂解裝置和一體化低密度聚乙烯(LDPE)工廠正向東部輸送大量產品,而快速成長的國內建築業和農業部門則推動了當地的消費。南美洲,特別是巴西和阿根廷,對作物保護膜和消費品包裝的需求保持穩定且適度。然而,貨幣波動和經濟不穩定限制了投資決策。印度加強原生聚乙烯品質標準可望提高供應鏈透明度,同時支持農業和消費品產業的基建擴張。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電子商務軟包裝的成長

- 對農業薄膜的需求不斷成長

- 適用於擠壓塗布應用

- 先進的回收技術可生產優質LDPE等級產品

- 太陽能板封裝膜的需求趨勢

- 市場限制

- 來自線性低密度聚乙烯(LLDPE)和高密度聚乙烯(HDPE)的競爭

- 乙烯原料價格波動

- 歐盟禁止使用單層聚烯薄膜

- 資本轉向生物基聚烯

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 吹塑成型

- 電影

- 射出成型

- 床單

- 形式

- 電線電纜絕緣

- 按最終用戶行業分類

- 農業

- 電氣和電子設備

- 包裝

- 建造

- 車

- 消費品

- 醫療/製藥

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Borealis AG

- Braskem SA

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation.

- Dow

- ExxonMobil Corporation

- Formosa Plastics Corporation

- Hanwha Solutions Chemical Division Corporation

- INEOS Group

- LG Chem

- LyondellBasell Industries Holdings BV

- Mitsui Chemicals, Inc.

- NOVA Chemicals Corporation

- PetroChina

- PTT Global Chemical PLC

- Qatar Chemical Company Ltd

- Reliance Industries Limited

- Repsol SA

- SABIC

- Sumitomo Chemical Co., Ltd.

- TotalEnergies SE

- Versalis SpA(Eni)

- Westlake Corporation

第7章 市場機會與未來展望

The Low Density Polyethylene market is expected to grow from 26.23 million tons in 2025 to 27.16 million tons in 2026 and is forecast to reach 32.35 million tons by 2031 at 3.56% CAGR over 2026-2031.

This trajectory reflects entrenched consumption in flexible films, insulation, coatings, and agricultural products, even as regulatory pressures accelerate the shift toward circular packaging solutions. Films retain primacy because converters value LDPE's seal integrity and optical clarity, while sustained capacity additions in Asia-Pacific underpin a supply landscape that feeds renewable-energy infrastructure, precision farming, and e-commerce fulfillment. Technology licensing, particularly in China, is widening access to advanced tubular and autoclave processes that yield higher-value grades. Meanwhile, circular-economy mandates in the European Union are reshaping procurement strategies by rewarding post-consumer-recycled content and penalizing complex multilayer structures. Input-cost volatility tied to crude-driven ethylene prices keeps margin management at the forefront of corporate strategy, encouraging producers to optimize product slates toward specialty applications that command pricing power.

Global Low Density Polyethylene Market Trends and Insights

Growth in E-commerce Flexible Packaging Drives Film Innovation

Surging parcel volumes push converters to engineer lightweight, puncture-resistant mono-material films that slash shipping mass and simplify recycling streams. ExxonMobil's full-polyethylene laminated platforms, built on Exceed and Enable polymers, deliver pouches composed of 97% PE while achieving high oxygen barriers. Logistics operators benefit from down-gauged structures that cut material intensity without sacrificing seal integrity, and the format aligns with European fee modulation schemes that penalize difficult-to-recycle multilayers. Retailers are specifying LDPE grades with narrow molecular-weight distributions that balance dart-impact resistance and clarity, driving incremental demand within the low density polyethylene market.

Agricultural Films Benefit from Sustainability and Productivity Imperatives

Precision farming, greenhouse cultivation, and silage preservation are accelerating LDPE consumption in mulch, fumigation, and greenhouse covers. BASF estimates annual agricultural-film demand at 7 million tons and a 7% growth rate, underscoring the material's role in boosting crop yields by limiting moisture loss and weed pressure. Yet regulators are tightening end-of-life controls, prompting trials of bio-based and photodegradable blends. Producers are countering substitution risk by commercializing oxo-biodegradable masterbatches that retain film strength during field use but accelerate chain scission once recovered, ensuring LDPE remains competitive in high-performance installations.

Competition from LLDPE and HDPE Intensifies in Commodity Applications

Metallocene catalyst advances have narrowed the performance gap between LDPE and its linear and high-density counterparts. Modern LLDPE delivers higher puncture resistance and downgauging potential in heavy-duty shipping sacks, eroding traditional LDPE contract volumes. HDPE, meanwhile, continues to gain traction in t-shirt bags and thin-wall containers, where stiffness and environmental stress crack resistance are prized. LDPE producers are defending share by steering capacity toward niche areas, such as heavy-duty shrink hoods and hot-melt-adhesive backings, where branching architecture delivers heat-seal and optical benefits unattainable with linear grades.

Other drivers and restraints analyzed in the detailed report include:

- Extrusion-Coated Applications Expand Through Technical Innovation

- Advanced Recycling Technologies Enable Premium Grade Recovery

- Ethylene Feedstock Price Volatility Constrains Margin Predictability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Films accounted for 56.60% of low density polyethylene market size in 2025, reflecting entrenched usage in flexible food pouches, industrial liners, and agricultural covers. Converter interest in downgauged mono-material structures has intensified, enabling 15-micron oriented webs that cut resin input without compromising tear strength. Wire and cable insulation, although representing a smaller volume base, is set to post a 4.07% CAGR through 2031 as renewable-energy grids and electric-vehicle harnesses proliferate. The low density polyethylene market share commanded by blow-molded containers remains steady due to their balance of clarity and impact resistance, whereas injection-molded components satisfy chemical-resistant caps and closures.

Continuing substitution pressure from linear grades forces LDPE suppliers to cultivate high-melt-strength resins for foams and sheet applications that demand energy absorption and softness. Foam bedding and sports-flooring producers value LDPE's cell-structure stability, while construction wrap manufacturers leverage its moisture-barrier attributes. Specialty reactor lines equipped with peroxide-free autoclave technology further broaden the offering by delivering ultra-clean grades tailored to medical device over-molding, underscoring the evolving product mix inside the low density polyethylene market.

The Low Density Polyethylene Market Report is Segmented by Product Type (Blow Molded, Films, Injection Molded, Sheets, Foams, and More), End-User Industry (Agriculture, Electrical and Electronics, Packaging, Construction, Automotive, Consumer Goods, Healthcare and Pharma), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific held 47.30% of low density polyethylene market share in 2025, buoyed by China's large-scale capacity additions and Southeast Asia's manufacturing growth. Chinese resin output surged as new tubular and swing-plant projects came online in Ningxia and Shandong provinces, many underpinned by technology licenses from LyondellBasell.

North America enjoys feedstock cost leadership owing to an ethane-rich shale inventory. Integrated producers strategically export surplus LDPE to Latin America and Asia, while domestic converters leverage material availability to support sustainable film programs. Europe confronts stringent directives such as the Packaging and Packaging Waste Regulation, steering investment into advanced recycling infrastructure and post-consumer-recycled LDPE grades. Although virgin-resin growth is modest, value-added circular offerings open premium niches for European suppliers.

The Middle East and Africa capitalize on competitively priced feedstocks and rapid demographic growth. LDPE plants integrated with ethane crackers in the Arabian Gulf ship substantial volumes eastward, but burgeoning domestic construction and agriculture are lifting local off-take. South America, especially Brazil and Argentina, sustains moderate demand tied to crop-protection films and consumer packaging, though currency fluctuation and economic volatility temper investment decisions. India's tightening quality-standard framework for virgin polyethylene is expected to enhance supply-chain transparency while supporting infrastructure expansion in agriculture and fast-moving consumer goods.

- Borealis AG

- Braskem S.A.

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation.

- Dow

- ExxonMobil Corporation

- Formosa Plastics Corporation

- Hanwha Solutions Chemical Division Corporation

- INEOS Group

- LG Chem

- LyondellBasell Industries Holdings BV

- Mitsui Chemicals, Inc.

- NOVA Chemicals Corporation

- PetroChina

- PTT Global Chemical PLC

- Qatar Chemical Company Ltd

- Reliance Industries Limited

- Repsol S.A.

- SABIC

- Sumitomo Chemical Co., Ltd.

- TotalEnergies SE

- Versalis S.p.A. (Eni)

- Westlake Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in e-commerce flexible packaging

- 4.2.2 Rising demand for agricultural films

- 4.2.3 Preference for extrusion-coated applications

- 4.2.4 Advanced recycling enabling premium LDPE grades

- 4.2.5 Solar-panel encapsulant film uptake

- 4.3 Market Restraints

- 4.3.1 Competition from LLDPE and HDPE

- 4.3.2 Ethylene feedstock price volatility

- 4.3.3 EU bans on mono-layer polyolefin films

- 4.3.4 Capital shift to bio-based polyolefins

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Blow Molded

- 5.1.2 Films

- 5.1.3 Injection Molded

- 5.1.4 Sheets

- 5.1.5 Foams

- 5.1.6 Wire and Cable Insulation

- 5.2 By End-user Industry

- 5.2.1 Agriculture

- 5.2.2 Electrical and Electronics

- 5.2.3 Packaging

- 5.2.4 Construction

- 5.2.5 Automotive

- 5.2.6 Consumer Goods

- 5.2.7 Healthcare and Pharma

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Borealis AG

- 6.4.2 Braskem S.A.

- 6.4.3 Chevron Phillips Chemical Company LLC

- 6.4.4 China Petrochemical Corporation.

- 6.4.5 Dow

- 6.4.6 ExxonMobil Corporation

- 6.4.7 Formosa Plastics Corporation

- 6.4.8 Hanwha Solutions Chemical Division Corporation

- 6.4.9 INEOS Group

- 6.4.10 LG Chem

- 6.4.11 LyondellBasell Industries Holdings BV

- 6.4.12 Mitsui Chemicals, Inc.

- 6.4.13 NOVA Chemicals Corporation

- 6.4.14 PetroChina

- 6.4.15 PTT Global Chemical PLC

- 6.4.16 Qatar Chemical Company Ltd

- 6.4.17 Reliance Industries Limited

- 6.4.18 Repsol S.A.

- 6.4.19 SABIC

- 6.4.20 Sumitomo Chemical Co., Ltd.

- 6.4.21 TotalEnergies SE

- 6.4.22 Versalis S.p.A. (Eni)

- 6.4.23 Westlake Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment