|

市場調查報告書

商品編碼

1906007

水力壓裂:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Hydraulic Fracturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

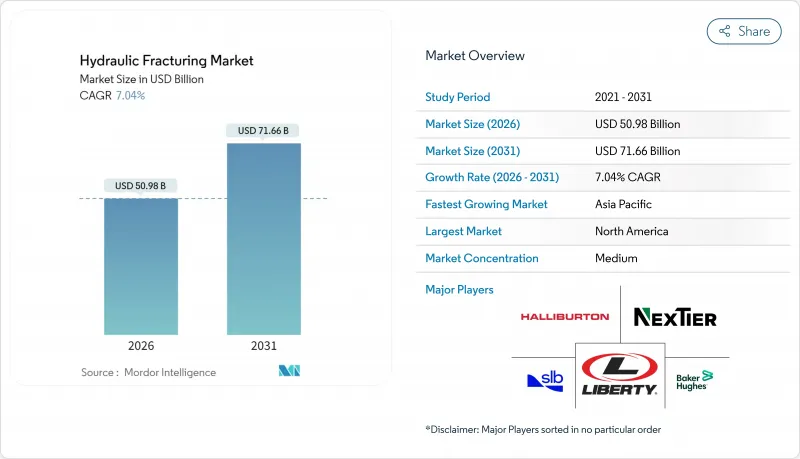

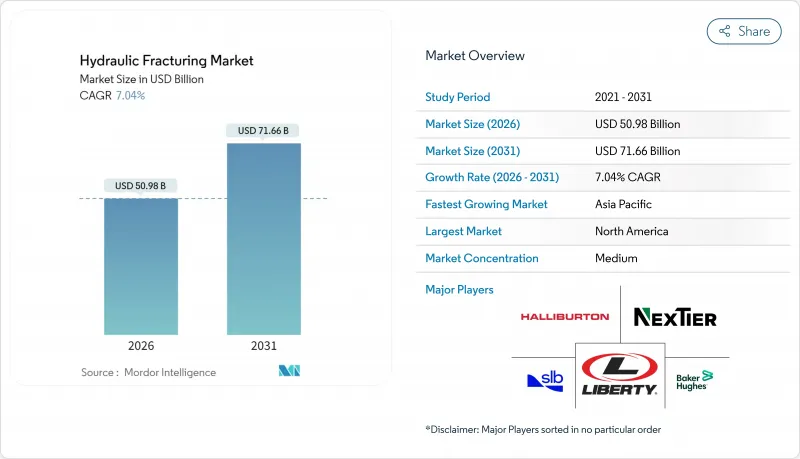

水力壓裂市場預計將從 2025 年的 476.3 億美元成長到 2026 年的 509.8 億美元,預計到 2031 年將達到 716.6 億美元,2026 年至 2031 年的複合年成長率為 7.04%。

持續電氣化、即時監測和自動化使井場燃料成本降低了高達 25%,並將分段供油效率提高了 17%。北美成熟的頁岩層支撐著當前的需求,而中國和阿根廷的政策支持則刺激了新的油氣活動。服務供應商之間的整合正在集中技術所有權,而適度的市場集中度則為擁有利基技術的區域性公司留下了空間。環境法規使水資源管理成本增加了 15% 至 20%,但這些法規也推動了對無水壓裂技術的投資,使滲透率提高了幾個數量級。

全球水力壓裂市場趨勢與洞察

頁岩氣及緻密油開發熱潮

預計到2024年,二疊紀盆地緻密油日產量將達到100萬桶,證實了對水力壓裂服務的長期需求。阿根廷的瓦卡穆埃爾塔組受益於RIGI(投資基礎設施投資計畫)提供的為期30年的稅收穩定方案,該方案降低了超過2億美元投資的財務風險。在中國,儘管成本不斷上升,但直接補貼和基礎建設資金維持了壓裂作業量。持續的技術創新使主要頁岩油產區的營運商能夠實現每桶低於40美元的損益平衡成本。這些因素共同支撐了多個大洲壓裂設備的高運轉率。

全球天然氣需求不斷成長及燃料轉換趨勢

國際能源總署(IEA)預測,受電力和工業原料領域從煤炭轉向天然氣的推動,天然氣使用量將在2030年前穩步成長。亞太地區的公共產業正優先發展燃氣發電廠以實現氣候目標,預計這將促進該地區水力壓裂市場的活躍度。工業對石化產品和化肥的需求將進一步擴大傳統天然氣的產量。近期供應衝擊引發的能源安全疑慮促使各國政府鼓勵國內天然氣生產。持續的需求有助於保障服務公司的合約履行,並抵銷大宗商品價格的周期性波動。

水資源限制與環保運動

科羅拉多強制要求新完工的油井必須循環利用80%的水,這使得油井成本增加了高達20%。德拉瓦河流域仍禁止水力壓裂,一些歐洲國家也暫停水力壓裂作業。法律糾紛延長了核准流程,增加了不確定性。開發商正透過閉合迴路系統和電壓裂技術來應對這些挑戰,這些技術在避免消耗淡水的同時,可以將滲透率提高幾個數量級。雖然資金需求增加,但長期的環境合規性提高了計劃的可接受性。

細分市場分析

預計到2025年,水平井將佔水力壓裂收入的79.85%,其市佔率將以8.16%的複合年成長率成長。多層增產措施可提高水平井的採收率,即使在大宗商品價格走軟的情況下,也能維持水平井工程的經濟吸引力。設計標準化和工廠化作業模式縮短了作業週期,使得水平井完井成為大多數頁岩油氣產區的標準選擇。

雪佛龍的三重壓裂工作流程可同時完成多口井的作業,進而減少30%的墊片運作。對所有水平段進行即時感測,可最佳化丙烷的投放,提高最終採收率並減少丙烷廢棄物。垂直井在煤層氣和現有油田中仍將發揮一定作用,但其佔有率預計將持續下降。水平壓裂技術密集的特性將增強整個水力壓裂產業對整合數位平台的需求。

到2025年,Slickwater將佔水力壓裂市場收入的56.65%,在競爭激烈的市場環境中仍能支撐其發展。其低黏度可降低泵浦功率,進而提高泵速,降低壓裂成本。混合型壓裂液結合了泡沫相和凝膠相,尤其適用於乾燥盆地,因為它無需大量用水即可改善支撐劑輸送,預計其複合年成長率將達到9.02%。

泡沫基壓裂液適用於對水敏感的儲存,並符合更嚴格的環保法規。作業者正在試驗活性油和二氧化碳基系統以減少消費量。添加劑供應商正在開發低劑量高效能減磨劑,從而提高滑溜水壓裂的經濟效益。這些進步在拓展水力壓裂產業壓裂液選擇範圍的同時,也鞏固了滑溜水壓裂的核心地位。

水力壓裂市場報告按井類型(水平井與垂直井)、流體類型(滑溜水、凝膠基、泡沫基、混合/活性)、支撐劑類型(壓裂砂、樹脂塗層砂、陶瓷支撐劑)、應用(頁岩氣、緻密油、煤層氣)和地區(北美、歐洲、亞太、南美、中東和非洲)進行細分。

區域分析

北美擁有豐富的頁岩資源和成熟的物流網路,預計2025年將佔據全球水力壓裂市場67.60%的佔有率。二疊紀盆地以低於每桶40美元的損益平衡成本主導,而加拿大傳統天然氣和油砂開採活動也進一步增加了服務需求。墨西哥的能源改革帶來了新的機遇,但基礎設施的匱乏在短期內限制了相關活動。電動壓裂車隊的普及和墊片場自動化正在鞏固該地區的技術領先地位和成本競爭力。

亞太地區是成長最快的地區,預計到2031年將以9.95%的複合年成長率成長。中國正在簡化頁岩氣開發的補貼和核准程序,即使在大宗商品價格低迷時期,也維持水力壓裂市場的合約。印度正在探索法規結構,以促進大規模盆地開發;澳洲則依靠煤層氣和緻密氣計劃來補充其出口管道。區域成長依賴政府的持續支持和中游投資,以降低市場供應成本。

歐洲受到嚴格的環境法規和多個國家暫停開採的限制。中東和非洲地區,緻密氣和頁岩氣資源與現有生產基地相契合的地區機會有限。南美洲的前景主要集中在阿根廷的瓦卡穆埃爾塔頁岩氣田,在米利總統的改革下,該地區資本流入不斷增加。在全部區域,基礎建設、金融穩定性和當地服務能力將決定水力壓裂技術市場普及的速度。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 頁岩氣及緻密油開發熱潮

- 全球天然氣需求不斷成長及燃料轉換趨勢

- 多層次水平壓裂技術的進步。

- 中國和阿根廷的政府激勵措施

- 即時光纖和人工智慧驅動的壓裂最佳化

- 電動壓裂車(e-Frac)的快速普及

- 市場限制

- 用水限制和環保團體的反對

- 商品價格波動會削弱獲利能力。

- 禁止採砂擾亂支撐劑供應鏈

- 獲得與環境、社會及公司治理(ESG)相關的資金管道有限

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按井類型

- 水平的

- 垂直的

- 按流體類型

- 滑水

- 凝膠基

- 泡沫基

- 混合/能量型

- 按支撐劑類型

- 壓裂砂

- 樹脂塗層砂

- 陶瓷支撐劑

- 透過使用

- 頁岩氣

- 緻密油

- 煤炭層氣

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 俄羅斯

- 挪威

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 韓國

- 東南亞國協

- 澳洲

- 亞太其他地區

- 南美洲

- 阿根廷

- 巴西

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略性舉措(併購、聯盟、購電協議)

- 市場佔有率分析(主要企業的市場排名和佔有率)

- 公司簡介

- Halliburton Company

- Schlumberger Ltd.

- Baker Hughes Co.

- Liberty Energy Inc.

- NexTier Oilfield Solutions Inc.

- Patterson-UTI(Seventy Seven)

- Calfrac Well Services Ltd.

- FTS International Services

- Archer Ltd.

- Basic Energy Services

- RPC Inc.(Cudd Energy)

- ProPetro Holding Corp.

- BJ Energy Solutions

- Trican Well Service Ltd.

- China Oilfield Services Ltd.

- Sinopec Oilfield Service Corp.

- Weatherford International plc

- STEP Energy Services

- Superior Energy Services(Frac Tech)

- SD Energy

第7章 市場機會與未來展望

The Hydraulic Fracturing market is expected to grow from USD 47.63 billion in 2025 to USD 50.98 billion in 2026 and is forecast to reach USD 71.66 billion by 2031 at 7.04% CAGR over 2026-2031.

Continued electrification, real-time monitoring, and automation reduce wellsite fuel costs by up to 25% and improve stage-delivery efficiency by 17%. Mature shale plays in North America underpin current demand, while policy support in China and Argentina accelerates new activity. Consolidation among service providers concentrates technology ownership, yet moderate market concentration leaves space for regional firms with niche capabilities. Environmental regulations raise water-management costs by 15-20%, but the same rules spur investment in waterless fracturing methods that enhance permeability by several orders of magnitude.

Global Hydraulic Fracturing Market Trends and Insights

Shale Gas & Tight-Oil Development Boom

Tight-oil output in the Permian Basin is expected to reach 1 million barrels per day in 2024, underscoring the long-term demand for hydraulic fracturing market services. Argentina's Vaca Muerta formation benefits from 30-year tax stability under the RIGI regime, which lowers fiscal risk for investments above USD 200 million. China maintains direct subsidies and infrastructure funding that sustain fracturing volumes despite higher costs. Operators in premier shale plays achieve breakeven costs below USD 40 per barrel through continuous technology upgrades. These factors collectively support high utilization of fracturing fleets across multiple continents.

Rising Global Gas Demand & Fuel-Switching

The International Energy Agency expects natural-gas use to climb steadily to 2030, bolstered by coal-to-gas switching for power and industrial feedstocks.Asia-Pacific utilities are favoring gas-fired plants to meet their climate goals, which is expected to lift regional hydraulic fracturing market activity. Industrial demand for petrochemicals and fertilizers further expands unconventional gas production. Energy-security concerns following recent supply shocks prompt governments to encourage domestic gas production. Sustained demand underpins contract visibility for service companies, offsetting the periodic fluctuations in commodity prices.

Water-Use Restrictions & Environmental Opposition

Colorado now requires 80% water recycling for new completions, increasing well costs by up to 20%. The Delaware River Basin maintains a ban on fracking, and several European nations have imposed moratoria. Legal challenges prolong permitting and heighten uncertainty. Operators respond with closed-loop systems and electro-fracturing techniques that avoid freshwater consumption while boosting permeability by several magnitudes. Capital needs rise, but long-term environmental compliance improves project acceptability.

Other drivers and restraints analyzed in the detailed report include:

- Advances in Multi-Stage Horizontal Fracturing

- Government Incentives in China & Argentina

- Commodity-Price Volatility Hurting Well Economics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Horizontal wells represented 79.85% of 2025 revenue, and their share of the hydraulic fracturing market size is projected to rise alongside an 8.16% CAGR. Multi-stage stimulation of extended laterals lifts recovery per well, keeping horizontal programs economically attractive even when commodity prices soften. Factory-style operations standardize designs and shorten cycle time, making horizontal completions the default choice in most shale plays.

Chevron's triple-frac workflow enables the completion of several wells in parallel, reducing pad days by 30%. Real-time sensing along the entire lateral tunes proppant placement, increasing ultimate recovery and lowering proppant waste. Vertical wells retain niche roles in coal-bed methane and legacy fields, but will continue losing share. The technology-intensive nature of horizontal fracturing strengthens demand for integrated digital platforms across the hydraulic fracturing industry.

Slick-water held 56.65% revenue in 2025, anchoring the hydraulic fracturing market despite competition. Its low viscosity reduces pumping horsepower and allows higher pump rates, cutting stage costs. Hybrid fluids, which combine foams or gels, are forecast to grow at a 9.02% CAGR by improving proppant transport without requiring large water volumes, a benefit particularly in arid basins.

Foam-based fluids serve water-sensitive reservoirs and comply with stricter environmental regulations. Operators experiment with energized oils and CO2-based systems to limit water consumption. Additive suppliers refine friction reducers that work at lower dosages, enhancing slick-water economics. These developments broaden fluid choices within the hydraulic fracturing industry while preserving the core position of slick-water.

The Hydraulic Fracturing Market Report is Segmented by Well Type (Horizontal and Vertical), Fluid Type (Slick-Water, Gel-Based, Foam-Based, and Hybrid/Energized), Proppant Type (Frac Sand, Resin-Coated Sand, and Ceramic Proppants), Application (Shale Gas, Tight Oil, and Coal-Bed Methane), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

North America commanded 67.60 of % hydraulic fracturing market share in 2025, supported by prolific shale resources and mature logistics. The Permian Basin leads with breakeven costs below USD 40 per barrel, while Canada's unconventional gas and oil-sands activity adds depth to service demand. Mexico's energy reforms open prospects, though near-term activity remains limited by infrastructure gaps. Widespread adoption of electric fleets and pad-level automation reinforces the region's technology leadership and cost competitiveness.

Asia-Pacific region is the fastest-growing region, with a 9.95% CAGR projected through 2031. China directs subsidies and streamlined permits toward shale gas development, sustaining hydraulic fracturing market contracts even during commodity downturns. India evaluates regulatory frameworks that could unlock sizeable basins, while Australia relies on coal-bed methane and tight-gas projects to fill export pipelines. Regional growth hinges on ongoing government support and midstream investment that lowers delivered cost to market.

Europe remains constrained by strict environmental rules, with several nations imposing moratoria. The Middle East and Africa show selective opportunities where tight-gas or shale resources align with existing production hubs. South America's outlook centers on Argentina's Vaca Muerta, now drawing increased capital under President Milei's reforms. Across all emerging regions, infrastructure development, fiscal stability, and local service capabilities will determine the pace of hydraulic fracturing market adoption.

- Halliburton Company

- Schlumberger Ltd.

- Baker Hughes Co.

- Liberty Energy Inc.

- NexTier Oilfield Solutions Inc.

- Patterson-UTI (Seventy Seven)

- Calfrac Well Services Ltd.

- FTS International Services

- Archer Ltd.

- Basic Energy Services

- RPC Inc. (Cudd Energy)

- ProPetro Holding Corp.

- BJ Energy Solutions

- Trican Well Service Ltd.

- China Oilfield Services Ltd.

- Sinopec Oilfield Service Corp.

- Weatherford International plc

- STEP Energy Services

- Superior Energy Services (Frac Tech)

- SD Energy

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shale gas & tight-oil development boom

- 4.2.2 Rising global gas demand & fuel-switching

- 4.2.3 Advances in multi-stage horizontal fracturing

- 4.2.4 Government incentives in China & Argentina

- 4.2.5 Real-time fiber-optic & AI-driven frac optimization

- 4.2.6 Rapid adoption of electric frac fleets (e-Frac)

- 4.3 Market Restraints

- 4.3.1 Water-use restrictions & environmental opposition

- 4.3.2 Commodity-price volatility hurting well economics

- 4.3.3 Sand-mining bans disrupting proppant supply chain

- 4.3.4 ESG-linked capital access constraints

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Well Type

- 5.1.1 Horizontal

- 5.1.2 Vertical

- 5.2 By Fluid Type

- 5.2.1 Slick-water

- 5.2.2 Gel-based

- 5.2.3 Foam-based

- 5.2.4 Hybrid/Energized

- 5.3 By Proppant Type

- 5.3.1 Frac Sand

- 5.3.2 Resin-Coated Sand

- 5.3.3 Ceramic Proppants

- 5.4 By Application

- 5.4.1 Shale Gas

- 5.4.2 Tight Oil

- 5.4.3 Coal-Bed Methane

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 Russia

- 5.5.2.5 Norway

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 South Korea

- 5.5.3.4 ASEAN Countries

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Argentina

- 5.5.4.2 Brazil

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Halliburton Company

- 6.4.2 Schlumberger Ltd.

- 6.4.3 Baker Hughes Co.

- 6.4.4 Liberty Energy Inc.

- 6.4.5 NexTier Oilfield Solutions Inc.

- 6.4.6 Patterson-UTI (Seventy Seven)

- 6.4.7 Calfrac Well Services Ltd.

- 6.4.8 FTS International Services

- 6.4.9 Archer Ltd.

- 6.4.10 Basic Energy Services

- 6.4.11 RPC Inc. (Cudd Energy)

- 6.4.12 ProPetro Holding Corp.

- 6.4.13 BJ Energy Solutions

- 6.4.14 Trican Well Service Ltd.

- 6.4.15 China Oilfield Services Ltd.

- 6.4.16 Sinopec Oilfield Service Corp.

- 6.4.17 Weatherford International plc

- 6.4.18 STEP Energy Services

- 6.4.19 Superior Energy Services (Frac Tech)

- 6.4.20 SD Energy

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment