|

市場調查報告書

商品編碼

1834222

水力壓裂用中水的美國市場:市場趨勢,機會,預測(2025年~2030年)U.S. Midstream Water for Hydraulic Fracturing: Market Trends, Opportunities, and Forecasts, 2025-2030 |

||||||

過去十年,水力壓裂技術徹底改變了美國的能源格局,使美國成為全球最大的油氣生產國。從賓州到德州,水力壓裂技術開採頁岩油氣資源,已成為全球能源安全的基石。目前,美國石油產量佔全球近40%,天然氣產量佔全球37%。

灰水管理,包括供水、處理、回收、再利用和處置,對於這項轉型至關重要。水平井的長度可達五英里,用水量超過1200萬加侖,產生前所未有的大量採出水。預計到 2030 年,油井採出水日產量將達到 5000 萬桶,這將給處理設施帶來更大壓力,並加劇監管審查,尤其是在像橫跨德克薩斯州和新墨西哥州的二疊紀盆地這樣的高產量地區。

隨著這一格局的演變,勘探和生產公司以及中水管理公司正在尋求更全面的水資源解決方案。供水和採出水管正成為卡車運輸的可行替代方案,而採出水回收則預計在 2030 年前滿足超過 77% 的壓裂用水需求。這種轉變,以及水資源價值鏈上的併購和合作等整合活動,正在重塑競爭格局。

本報告研究了美國水力壓裂中水市場,全面分析了主要參與者的策略、市場驅動因素和預測,以及影響油田水資源管理未來的盆地層面動態。

報告+資料選擇

範例資料儀表板

拿起的企業

|

|

目錄

章節1 - 石油、天然氣形勢定義

- 研究方法與資料來源

- 影響中游管理的主要因素

- 耗水量龐大的水力壓裂使美國成為世界最大的石油生產國

- 美國鞏固其作為全球天然氣供應國的地位天然氣

- 自願性油氣價格影響策略

- 水平鑽井和水力壓裂

- 水平鑽機能力:深度與長度

- 水平井長度增加導致含水量增加

- 鑽機數量下降,產量持續成長

- 美國主要頁岩盆地與地層分佈圖

- 二疊紀盆地支撐鑽機數量及鑽井活動

- 二疊紀盆地非常規天然氣產量激增

- 隨著鑽井效率下降,新井完井數量略有下降

- 美國液化天然氣出口增加推動用水需求

章節2 - 中水市場的促進因素,趨勢,課題

- 灰水驅動因素與影響

- 單井水力壓裂用水量

- 完井總用水量持續成長

- 主要盆地井水供應總量持續成長

- 美國西部和南部水資源壓力成長最為嚴重

- 廢棄物處理地震促進了水資源再利用政策的擴展

- 聯邦政策基本上不變

- 州和地方政策概述

章節3 - 中水的市場規模與預測

- 市場預測方法概述

- 中水價值鏈

- 中水價值鏈趨勢

- 預測細分市場

- 各盆地油氣水管理服務支出

- 單井用水量持續成長至2030年

- 再生水供應日益滿足用水需求採出水

- 預計美國各盆地採出水量將增加

- 預計盆地循環利用率將溫和成長,抵銷部分處置量

- 資本支出增加表示基礎設施正在擴張

- 灰水資本支出細分

- 按類型和規模劃分的循環利用設施資本支出

- 未來水解決方案與服務創新與投資的驅動因素

- 各盆地和州的主要機會(2025-2030 年)

章節4 - 流域和頁岩層的簡介

- Anadarko

- Appalachia

- Bakken

- Eagle Ford

- Haynesville

- Niobrara-DJ (Denver-Julesburg)

- Permian

章節5 - 競爭情形

- 中水的競爭套組

- 中水的競爭定位

- M&A趨勢:競爭各市場區隔(2020年~2025年)

- 水專門業者的M&A活動:各擁有類型

- 市場佔有率:開發平台(管線)基礎設施的擴大繼續

- 水相關的收購(2020年~2025年)

- Antero Midstream Corporation

- Aqua Terra Water Management

- Bison Water Midstream

- Blackbuck Resources

- Bosque Systems

- CNX Water

- Dalbo Holdings Inc

- Deep Blue Midland Basin

- Delek Logistics Partners, LP

- Dresser Utility Solutions

- EQT Corporation

- Freestone Midstream

- Goodnight Midstream

- Hess Midstream

- NGL Water Solutions

- Layne Water Midstream

- Martin Water Midstream

- Pilot Water Solutions

- RRIG Water Solutions

- Select Water Solutions

- Stonehill Environmental Partners

- Tallgrass Water

- Texas Pacific Land Corporation

- WaterBridge

- Western Midstream

- XRI Water

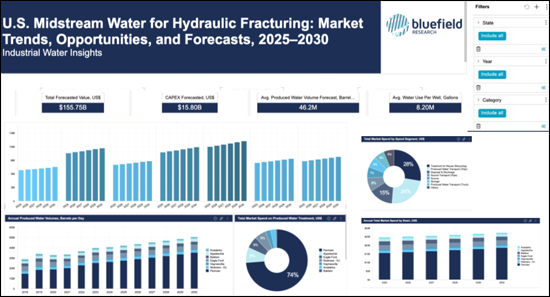

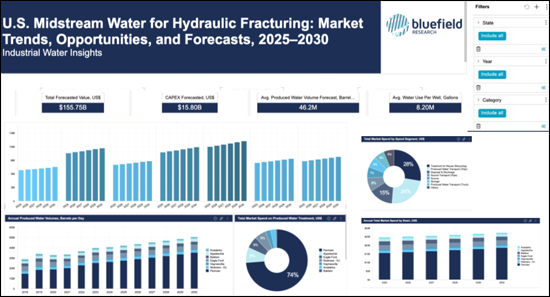

Over the last decade, hydraulic fracturing has transformed the U.S. energy landscape, establishing the country as the world's largest producer of oil and gas. By tapping into shale reserves across regions from Pennsylvania to Texas, fracking has become a cornerstone of global energy security. The U.S. now contributes nearly 40% of global oil production and 37% of natural gas production.

Midstream water management, which involves the supply, treatment, recycling, reuse, and disposal of water, is critical to this transformation. Horizontal well completions can extend up to five miles and require over 12 million gallons of water, resulting in unprecedented volumes of produced water. By 2030, the volume of produced water at wellheads is projected to reach 50 million barrels per day, placing additional stress on disposal facilities and fueling regulatory scrutiny, particularly in high-activity regions like the Permian Basin, which spans Texas and New Mexico.

In this evolving context, exploration and production companies and midstream water management players are pursuing more integrated water solutions. Water supply and produced water pipelines are becoming viable alternatives to trucking and produced water recycling is on track to meet over 77% of fracking water demand by 2030. These shifts, accompanied by consolidation efforts such as mergers and acquisitions and partnerships across the water value chain, are reshaping the competitive landscape.

This Insight Report provides a comprehensive analysis of U.S. midstream water management, encompassing market drivers and forecasts, basin-level dynamics, and the strategies of leading players that are influencing the future of oilfield water management.

Report+Data Option

SAMPLE DATA DASHBOARD

Data is a key component to this analysis. Our team has compiled relevant data dashboards.

Industrial Water Market Corporate Subscription seat holders can access related dashboards.

Companies Mentioned:

|

|

Table of Contents

Section 1 - Defining the Oil & Gas Landscape

- Research Methodology and Data Sources

- Key Factors Influencing Midstream Water Management

- Water-Intensive Fracking Makes U.S. the Leading Global Oil Producer

- U.S. Secures Role as Global Supplier of Natural Gas

- Swings in Oil & Gas Prices Shape Strategies

- Horizontal Drilling and Hydraulic Fracturing

- Horizontal Rig Capabilities: Depths and Lengths

- Horizontal Wellbore Lengths Increase Water Intensity

- Rig Counts Decline, Production Continues to Climb

- Mapping the Key U.S. Shale Basins and Plays

- Permian Basin Underpins Drill Rig Counts and Activity

- Permian Basin Surges in Unconventional Gas Production

- New Well Completions Decline Slightly With Drilling Efficiencies

- Increase in U.S. LNG Exports Drives Water Demand

Section 2 - Midstream Water Market Drivers, Trends, and Challenges

- Midstream Water Drivers and Impacts

- Hydraulic Fracturing Water Use per Well

- Total Water Use for Well Completions Grew Steadily

- Total Well Water Supply Volumes Continue to Grow Across Top Basins

- Water Stress to Increase Most Acutely in Western and Southern U.S.

- Seismic Events from Disposal Push Policy for Expanded Water Reuse

- Federal Policy Remains Largely Unchanged

- State & Local Policy Overview

Section 3 - Midstream Water Market Size and Forecasts

- Market Forecast Methodology Overview

- The Midstream Water Value Chain

- Midstream Water Trends Across the Value Chain

- Forecasted Segments

- Oil & Gas Sector Spend on Water Management Services by Basin

- Increasing Water Usage per Well Continues Through 2030

- Water Demand Increasingly Supplied by Recycled Produced Water

- Produced Water Volumes Set to Increase Across U.S. Basins

- Basin Recycling Rates Projected to Grow Modestly, Offset Disposal

- CAPEX Growth Signals Infrastructure Expansion

- Segmenting Capital Expenditures for Midstream Water

- CAPEX Recycling Facility Growth by Type and Size

- Drivers of Innovation and Investment for Future Water Solutions & Services

- Top Opportunities by Basin and State (2025-2030)

Section 4 - Basin & Shale Play Profiles

- Anadarko

- Appalachia

- Bakken

- Eagle Ford

- Haynesville

- Niobrara-DJ (Denver-Julesburg)

- Permian

Section 5 - Competitive Landscape

- Midstream Water Competitive Set

- Midstream Water Competitive Positioning

- M&A Trends by Competitive Segment (2020-2025)

- Water Pure-Play M&A Activity by Ownership Type

- Market Share: Pipeline Infrastructure Expansion to Continue

- Water-Related Acquisitions (2020-2025)

- Antero Midstream Corporation

- Aqua Terra Water Management

- Bison Water Midstream

- Blackbuck Resources

- Bosque Systems

- CNX Water

- Dalbo Holdings Inc

- Deep Blue Midland Basin

- Delek Logistics Partners, LP

- Dresser Utility Solutions

- EQT Corporation

- Freestone Midstream

- Goodnight Midstream

- Hess Midstream

- NGL Water Solutions

- Layne Water Midstream

- Martin Water Midstream

- Pilot Water Solutions

- RRIG Water Solutions

- Select Water Solutions

- Stonehill Environmental Partners

- Tallgrass Water

- Texas Pacific Land Corporation

- WaterBridge

- Western Midstream

- XRI Water