|

市場調查報告書

商品編碼

1906002

騎乘裝備:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Riding Gear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

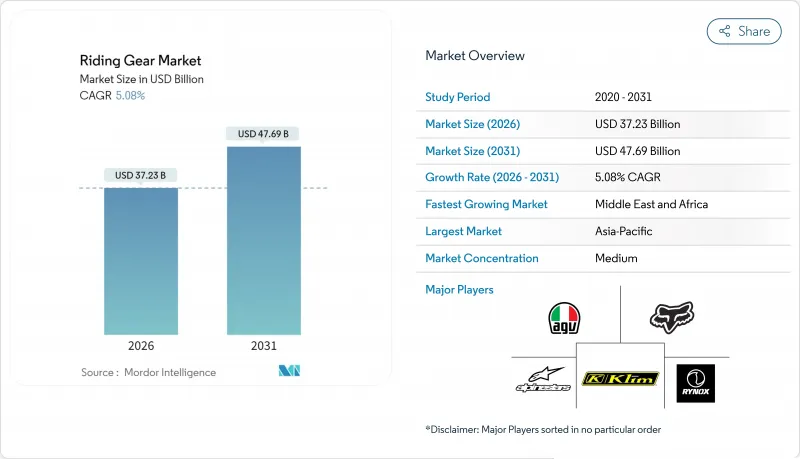

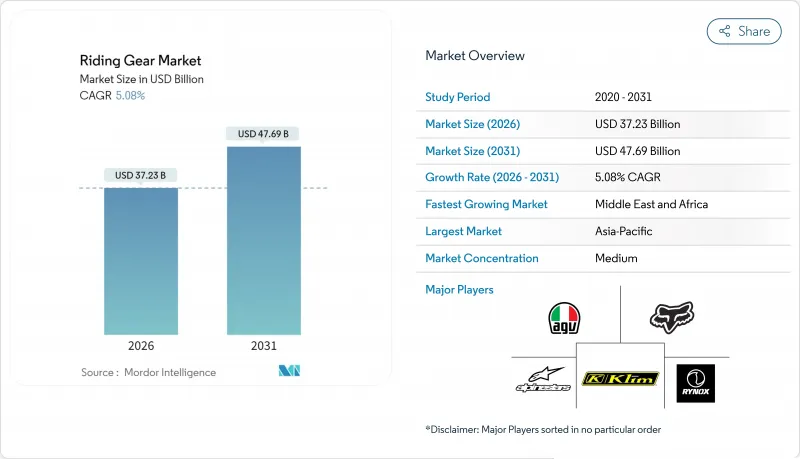

2025年騎行裝備市場價值為354.3億美元,預計到2031年將達到476.9億美元,高於2026年的372.3億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 5.08%。

強制佩戴頭盔、女性騎士的崛起以及氣囊夾克的快速普及正在改變市場需求模式,推動摩托車裝備從基礎防護向創新互聯的安全生態系統轉型。技術主導的差異化正在縮小高階市場和大眾市場之間的差距,碳纖維複合材料和電子感測器等技術正從精英賽車裝備走向主流產品。監管協調,特別是歐盟法規2016/425引入CE標誌,使認證裝備成為法律強制要求而非個人生活方式選擇,從而擴大了目標市場。同時,哈雷戴維森和凱旋等品牌推出的OEM生活風格產品模糊了防護衣和時尚潮流之間的界限,即使在宏觀經濟波動的情況下,也能支撐其高平均售價。儘管分散的競爭格局持續加劇價格戰,但英國駕駛員和車輛標準局(DVSA)等機構對假冒仿冒品的打擊,正促使消費者回歸值得信賴的品牌,並強化質量至上的購買觀念。

全球騎乘裝備市場趨勢與洞察

新興市場摩托車擁有量不斷成長

印度、印尼和越南摩托車的迅速普及催生了對認證頭盔、騎行服和手套的新需求,在短短幾個季度內就實現了已開發國家需要數十年才能達到的市場發展水平。印度電動摩托車市場在過去一年中快速成長,顯示消費者對安全設備的接受度不斷提高,潛在客戶群也日益擴大。預計到2024年,中國將出口大量摩托車,佔全球出貨量的一半以上,將鞏固中國作為騎行裝備市場大規模生產中心的地位。在這些國家,現代安全法規與機動化進程同步推進,迅速加快了安全裝備的普及速度,並使認證裝備以前所未有的速度取代了非品牌替代品。能夠根據熱帶氣候和價格敏感型客戶的需求,量身定做功能豐富的中等價格分佈產品線的製造商,正在贏得客戶的早期忠誠度,這種忠誠度往往會持續到整個使用周期結束。

更嚴格的全球安全法規強制要求穿戴防護裝備

監管趨勢正從建議轉向強制性規定。歐盟委員會的EN 17092標準(2018年生效)引入了檢驗的耐磨性、衝擊強度和縫線強度等級,零售商必須在銷售點展示這些等級。個人防護設備(PPE)法規加強了對不合規產品的處罰力度,並在海關檢查點預先攔截不合格產品。北美機構正在參考類似的ANSI/UL通訊協定,巴西和印尼正在起草類似的法規,預計2026年生效。合規要求提高了技術最低標準,為擁有內部測試實驗室或與認證機構長期夥伴關係的生產商創造了優勢。缺乏認證預算的新參與企業擴大轉向與知名品牌簽訂貼牌生產協議,導致製造技術集中在少數人手中。從中長期來看,統一的全球標準將減少滋生假冒仿冒品貿易的灰色地帶,並使高階品牌能夠在量產產品中應用傳統奢侈品技術,同時降低法律責任風險。

經認證的高級防護裝備高成本

認證費、多層材料成本和品牌使用費共同推高了溢價,使得一些新興市場的買家望而卻步。相容安全氣囊的皮夾克零售價可高達1,100美元(大致相當於印度一輛普通通勤自行車的價格),迫使騎乘者在購買車輛和全面防護之間做出選擇。雖然模組化設計可以降低長期更換零件的成本,但初始成本仍然是一大障礙,尤其是在強制佩戴安全帽的地區。製造商正在嘗試與小額信貸機構合作以及訂閱模式(將付款分攤到多個季度),但這些模式在北美和歐洲以外的地區應用有限。如果沒有大規模的成本創新,一旦早期用戶達到飽和,溢價成長速度可能會放緩。

細分市場分析

到2025年,頭盔仍將是騎乘裝備市場的主導產品,佔總收入的24.46%。監管要求和普遍的風險意識意味著頭盔不再是可有可無的商品,而是在發生事故或五年使用壽命結束後,必須進行更換的固定產品。頭盔技術正在不斷發展,例如多密度內襯、旋轉力緩解系統和整合式抬頭顯示器等,這些技術都在推高平均售價,但並未阻礙銷量成長。同時,氣囊夾克/背心細分市場預計將以5.29%的複合年成長率成長,從而推動對適用於所有摩托車類型的軀幹保護解決方案的高階需求。

隨著通勤人群的成長,他們擴大購買入門級全罩式安全帽,而將購買全套騎乘服的計畫推遲到可支配收入增加時。這改變了他們的購買週期,並提高了客戶的終身價值。賽車和越野賽事持續推動最尖端科技創新,MotoGP 和 WorldSBK 的 FIM 認證標準使得相關技術能夠在兩到三個賽季內轉移到消費級產品。歐洲一些賽道禁止在頭盔上安裝運動攝影機,凸顯了對空氣力學和安全認證的重視,間接推動了對原廠相機介面的需求——這項功能既能支援內容創作者,又能保持安全帽外殼的強度。這些產品類型之間的差異表明,雖然頭盔是騎乘裝備市場的基礎,但電子安全氣囊系統正日益成為高階防護裝備的代名詞。

截至2025年,皮革製品將佔騎行裝備市場53.11%的佔有率,這印證了其基於耐磨性和與摩托車文化緊密聯繫而經久不衰的吸引力。鞣製牛皮和袋鼠皮因其在公路上的耐用性,在賽車領域仍然備受歡迎。然而,環境問題和不斷上漲的皮革成本正促使人造皮革和植物來源合成材料湧現,這些材料在模仿木紋結構的同時,也能減少二氧化碳排放。碳纖維複合材料預計將以5.26%的複合年成長率成長,其重量僅為皮革的幾分之一,卻能有效分散衝擊能量。它們正吸引著那些重視輕量化材料以提升操控性能的高性能騎士的目光。整合到手套和靴子中的碳芳香聚醯胺織物形成超薄保護層,在不犧牲減震性能的前提下,增強了操控靈活性。克維拉、諾梅克斯和考杜拉纖維則佔據了中等價格分佈市場,它們可水洗、耐候,為溫暖氣候下的騎行季提供了更多選擇。

混合製造技術將滑行區的皮革外層與衝擊點的碳纖維或克維拉纖維面板相結合,兼顧了安全性和輕量化,使其在各個價格分佈都廣受歡迎。這種整合方式實現了供應鏈的模組化,使供應商能夠根據監管法規和客戶預算調整材料配比。傳統上被丟棄的複合材料邊角料,如今正透過熱解和化學解聚等方式進行回收利用,將高階創新與永續性理念相結合,從而贏得了年輕騎士的青睞。整體而言,材料技術的進步正推動傳統皮革產品保持其銷售優勢,而利潤率和品牌價值則日益集中在尖端複合材料領域。

區域分析

到2025年,亞太地區將佔全球摩托車收入的38.55%,其銷售密度遠超其他任何地區,主要得益於中國3,676萬輛的摩托車出口量以及印度電動摩托車的快速普及。該地區的騎行裝備市場規模受益於政府強制要求騎士和乘客佩戴認證頭盔,從而迅速提升了安全標準。本土製造商正透過與天貓和Flipkart等正規電商平台合作,快速擴大規模,並將業務拓展至先前依賴非正規管道的郊區和城市地區。從紗線紡織到最終組裝的垂直整合,使亞洲企業能夠在不影響CE認證的前提下,以低於進口價格的價格銷售產品,從而鞏固了該地區的自主性。

中東和非洲地區將迎來最快成長,到2031年複合年成長率將達到5.37%。基礎建設和共享出行平台的普及,使得摩托車通勤在開羅、內羅畢和拉各斯等城市根深蒂固。海灣地區的富裕愛好者偏好歐洲奢侈品牌,而快速成長的非洲送貨車隊則優先考慮能夠抵禦熱帶暴雨的耐用紡織服裝。發展機構正在推廣穿戴式安全裝備的津貼,並輔以捐助者資助的頭盔支持,以加速零工經濟騎士佩戴防護服的普及。同時,拉丁美洲將實現個位數的溫和成長,其中巴西和哥倫比亞將引領這一成長。由於國內服裝產能僅能滿足五分之三的需求,因此需要進口經過認證的歐洲和亞洲產品。

北美和歐洲市場成熟且盈利,平均更換週期為四到六年,但騎乘者願意為更高的安全性支付額外費用。歐元區的通貨膨脹並未抑制對二級防護裝備和內置安全氣囊的需求,這表明高所得群體對價格具有彈性。德國的「EcoBonus」政策(該政策將適用於2025年之前的冬季通勤用電加熱手套)就是一個很好的例子,說明地方法規如何鼓勵人們使用夾克和頭盔以外的其他配件。雖然安全標準在各地區日益全球化,供應鏈也日益同質化,但氣候多樣性仍對區域產品開發產生影響。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 新興市場摩托車擁有量不斷成長

- 更嚴格的全球安全法規強制要求穿戴防護裝備

- 探險旅行和長途騎行文化的蓬勃發展

- 摩托車品牌拓展OEM生活風格產品

- 由於價格下降,氣囊夾克迅速普及。

- 女性騎士人數的成長導致對專業服裝的需求增加。

- 市場限制

- 經認證的高級防護裝備高成本

- 由於假冒CE標誌產品氾濫,導致信任度下降。

- 寒冷地區季節性需求下降

- 永續性議題引發了對動物源皮革材料的強烈反對

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(價值(美元))

- 依產品類型

- 夾克

- 頭盔

- 手套

- 褲子/褲子

- 靴子/鞋子

- 防彈衣

- 安全氣囊外套/背心

- 材料

- 皮革

- 紡織品

- 網

- 碳纖維複合材料

- 克維拉/芳香聚醯胺混合物

- 延伸閱讀

- 透過分銷管道

- 線上

- 離線

- 最終用戶

- 公路駕駛

- 越野/摩托車越野賽

- 探險與旅遊

- 通勤者

- 按價格分佈

- 優質的

- 中檔

- 經濟

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 埃及

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- AGVSport

- Alpinestars SpA

- Dainese SpA

- Fox Racing Inc.

- Klim Technical Riding Gear

- REV'IT!Sport International

- ScorpionEXO

- Icon Motorsports

- Royal Enfield Gear

- HJC Helmets

- Shoei Co., Ltd.

- Arai Helmet Ltd.

- Bell Helmets

- Rynox Gears India Pvt. Ltd.

- Spartan ProGear Co.

- Kushitani Co., Ltd.

- Held GmbH

- Sena Technologies Inc.

- LS2 Helmets

- Studds Accessories Ltd.

- Komine Co., Ltd.

- Oxford Products Ltd.

- Thor MX

第7章 市場機會與未來展望

The Riding Gear Market was valued at USD 35.43 billion in 2025 and estimated to grow from USD 37.23 billion in 2026 to reach USD 47.69 billion by 2031, at a CAGR of 5.08% during the forecast period (2026-2031).

Mandatory helmet laws, widening female rider participation, and rapid adoption of air-bag jackets have reshaped demand patterns, pivoting the category from basic protection toward innovative, connected safety ecosystems. Technology-led differentiation tightens the gap between premium and mass segments as carbon-fiber composites and electronic sensors migrate from elite racing gear to mainstream products. Regulatory harmonization, most notably CE Marking under Regulation (EU) 2016/425, has expanded the addressable base by making certified gear a legal necessity rather than a lifestyle choice. At the same time, OEM lifestyle merchandising by brands such as Harley-Davidson and Triumph is blurring the divide between protective apparel and aspirational fashion, sustaining higher average selling prices despite macro-economic volatility. Fragmented competition continues to spur price rivalry, yet counterfeit crackdowns by agencies like the U.K. Driver and Vehicle Standards Agency are steering consumers back to reputable labels, reinforcing quality-driven purchasing behavior.

Global Riding Gear Market Trends and Insights

Rising Motorcycle Ownership In Emerging Markets

Spiraling two-wheeler uptake in India, Indonesia, and Vietnam translates into first-time purchases of certified helmets, jackets, and gloves, compressing what took decades in developed economies into a few selling seasons. Over the past year, sales in India's electric two-wheeler market have surged, underscoring robust growth and heightened consumer acceptance, instantly widening the safety-gear addressable base. China exported a huge number of motorcycles in 2024, more than half of global unit shipments, strengthening the country's status as the volume engine of the riding gear market. Because these countries implement modern safety rules concurrently with motorization, penetration curves steepen quickly, letting certified gear displace unbranded alternatives in record time. Manufacturers able to calibrate feature-rich mid-range lines for tropical climates and price-sensitive customers are capturing early loyalty that tends to persist through the ownership cycle.

Stricter Global Safety Regulations Mandating Protective Gear

Regulatory momentum continues to move from recommendation toward obligation. The European Commission's EN 17092 classification, effective 2018, introduced verifiable abrasion, impact, and seam-strength gradations that retailers must display at point of sale. The Personal Protective Equipment Regulation amplifies penalties for non-compliance, pre-emptively banning sub-standard imports at customs checkpoints. North American agencies reference similar ANSI/UL protocols, while Brazil and Indonesia are drafting mirror statutes slated for 2026. Compliance requirements raise the minimum technological baseline and create a moat around producers with in-house testing labs or long-standing notified-body partnerships. Market entrants lacking certification budgets now pivot toward private-label contracts for established brands, effectively consolidating manufacturing know-how under fewer roof-tops. Over the medium term, uniform global standards shrink the gray zone that fueled counterfeit trade, allowing premium players to cascade former high-end technologies into volume ranges with reduced liability exposure.

High Cost Of Certified Premium Protective Gear

Certification fees, multi-layer material bills, and brand royalties add sizable premiums that price out a portion of emerging-market buyers. An airbag-ready leather jacket can retail at USD 1,100-nearly the same as a basic commuter motorcycle in India-forcing riders to choose between vehicle acquisition and comprehensive protection. While modular design lowers replacement part costs over time, initial outlay remains a sticking point, particularly where helmet-only laws dominate. Manufacturers experiment with micro-financing partnerships and subscription models that spread payments across riding seasons, but adoption has been limited outside North America and Europe. Absent large-scale cost innovation, premium growth could decelerate once early adopters saturate.

Other drivers and restraints analyzed in the detailed report include:

- Boom In Adventure-Touring And Long-Distance Riding Culture

- OEM Lifestyle Merchandise Expansion By Motorcycle Brands

- Proliferation Of Counterfeit Ce-Marked Products Eroding Trust

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The riding gear market size attributed to helmets remained dominant in 2025 as the category captured 24.46% of revenue. Regulatory mandates and universal risk acknowledgment ensure helmets remain non-discretionary, delivering predictable replacement cycles tied to crash events and five-year age limits. Helmet technology is evolving toward multi-density liners, rotational-force mitigation systems, and integrated heads-up displays, each feature nudging average selling prices upward without deterring unit growth. Simultaneously, the airbag jackets and vests sub-segment, forecast to expand at a 5.29% CAGR, channels premium demand toward torso protection solutions that can pair with any motorcycle style.

A growing segment of commuters now buys entry-level integral helmets first and postpones full riding suits until disposable income improves, creating staggered purchase cycles that enlarge lifetime customer value. Racing and off-road disciplines continue to dictate top-tier innovation, with FIM homologation for MotoGP and WorldSBK feeding trickle-down tech to consumer models within two to three seasons. Helmet-mounted action-camera bans in several European tracks emphasize the premium placed on aerodynamics and safety certification, indirectly lifting demand for factory-integrated camera ports, which maintain shell integrity while serving content creators. Collectively, these product-type nuances affirm that while helmets secure the broad base of the riding gear market, electronic airbag systems increasingly frame the narrative around premium protection.

Leather accounted for 53.11% of the riding gear market share in 2025, underscoring its enduring appeal built on abrasion resistance and cultural association with motorcycling. Tanned cowhide and kangaroo leather remain favored in racing for their slide durability. Still, environmental scrutiny and rising hide costs are opening avenues for lab-grown or plant-based synthetics that mimic grain structure while lowering CO2 footprints. Carbon-fiber composites, projected for a 5.26% CAGR, achieve crash energy dispersion at fractions of leather's weight, capturing the imagination of performance riders who equate reduced mass with handling gains. Integrated carbon-aramid weaves in gloves and boots yield ultra-thin protective layers, supporting dexterity without sacrificing impact mitigation. Kevlar, Nomex, and Cordura textiles fill the mid-market niche, offering washable, weather-proof alternatives that expand riding seasons in temperate climates.

Hybrid manufacturing combines leather exteriors for slide zones with carbon-fiber or Kevlar panels over impact points, achieving a safety-weight equilibrium that appeals across price tiers. Such fusion builds modularity into supply chains, letting vendors dial material splits based on regulatory destination and customer budget. Recycling pathways for composite off-cuts traditionally landfill waste are emerging through pyrolysis and chemical depolymerization, aligning premium innovation with sustainability credentials that resonate with younger riders. Altogether, material advancements ensure that heritage-rich leather continues to dominate unit volumes, yet cutting-edge composites are where margins and branding prestige now concentrate.

The Riding Gear Market Report is Segmented by Product Type (Jackets and More), Material (Leather, Textile, and More), Distribution Channel (Online and Offline), End-User (On-Road Riding, Off-road/Motocross, and More), Price Range (Premium, Mid-Range, and Economy), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 38.55% of global revenue in 2025, rivaled by no other region in sheer unit density due to China's 36.76 million motorcycle exports and India's surging electric two-wheeler adoption. The riding gear market size in the area benefits from governments enforcing the use of certified helmets for riders and pillion riders alike, instantly elevating baseline protection standards. Local manufacturers scale rapidly by partnering with regulated e-commerce platforms, such as T-Mall and Flipkart, thereby amplifying their reach to peri-urban clusters that were previously dependent on informal channels. Vertical integration-from yarn spinning to final assembly enables Asian companies to undercut imported gear without compromising CE compliance, thereby cementing regional self-sufficiency.

The Middle East and Africa region registers the fastest 5.37% CAGR through 2031 as infrastructural upgrades and ride-sharing platforms normalize two-wheel commuting across Cairo, Nairobi, and Lagos. Gulf states' affluent hobbyist riders gravitate toward premium European labels, yet burgeoning African courier fleets prefer rugged textile gear capable of enduring tropical downpours. Development agencies advocate wearable safety grants in conjunction with donor-funded helmets, fostering early adoption of protective jackets among gig-economy riders. Meanwhile, Latin America records mid-single digit growth anchored by Brazil and Colombia, where domestic apparel capacity meets only three-fifth of demand, opening import lanes for certified European and Asian products.

North America and Europe remain mature but lucrative; replacement cycles average 4-6 years, but riders willingly pay premiums for incremental safety gains. Eurozone inflation has not dampened demand for Level-2 armor and integrated airbags, indicating price elasticity in upper-income segments. Policy tools such as Germany's 2025 eco-bonus for electrically heated gloves during winter commuting illustrate how municipal regulations can nudge accessory uptake beyond core jackets and helmets. Across all geographies, convergence toward global safety standards homogenizes supply chains, yet climatic diversity keeps product development regionally nuanced.

- AGVSport

- Alpinestars S.p.A.

- Dainese S.p.A.

- Fox Racing Inc.

- Klim Technical Riding Gear

- REV'IT! Sport International

- ScorpionEXO

- Icon Motorsports

- Royal Enfield Gear

- HJC Helmets

- Shoei Co., Ltd.

- Arai Helmet Ltd.

- Bell Helmets

- Rynox Gears India Pvt. Ltd.

- Spartan ProGear Co.

- Kushitani Co., Ltd.

- Held GmbH

- Sena Technologies Inc.

- LS2 Helmets

- Studds Accessories Ltd.

- Komine Co., Ltd.

- Oxford Products Ltd.

- Thor MX

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Motorcycle Ownership In Emerging Markets

- 4.2.2 Stricter Global Safety Regulations Mandating Protective Gear

- 4.2.3 Boom In Adventure-Touring And Long-Distance Riding Culture

- 4.2.4 OEM Lifestyle Merchandise Expansion By Motorcycle Brands

- 4.2.5 Rapid Adoption Of Airbag-Integrated Jackets After Price Drop

- 4.2.6 Growing Female Rider Segment Demanding Tailored Apparel

- 4.3 Market Restraints

- 4.3.1 High Cost Of Certified Premium Protective Gear

- 4.3.2 Proliferation Of Counterfeit Ce-Marked Products Eroding Trust

- 4.3.3 Seasonality Dampening Demand In Cold Regions

- 4.3.4 Sustainability Backlash Against Animal-Based Leather Materials

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Product Type

- 5.1.1 Jackets

- 5.1.2 Helmets

- 5.1.3 Gloves

- 5.1.4 Pants / Trousers

- 5.1.5 Boots / Shoes

- 5.1.6 Body Armor & Protectors

- 5.1.7 Airbag Jackets & Vests

- 5.2 By Material

- 5.2.1 Leather

- 5.2.2 Textile

- 5.2.3 Mesh

- 5.2.4 Carbon-Fiber Composites

- 5.2.5 Kevlar / Aramid Blends

- 5.2.6 Other Materials

- 5.3 By Distribution Channel

- 5.3.1 Online

- 5.3.2 Offline

- 5.4 By End-user

- 5.4.1 On-road Riding

- 5.4.2 Off-road / Motocross

- 5.4.3 Adventure & Touring

- 5.4.4 Commuter

- 5.5 By Price Range

- 5.5.1 Premium

- 5.5.2 Mid-range

- 5.5.3 Economy

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 Egypt

- 5.6.5.5 South Africa

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 AGVSport

- 6.4.2 Alpinestars S.p.A.

- 6.4.3 Dainese S.p.A.

- 6.4.4 Fox Racing Inc.

- 6.4.5 Klim Technical Riding Gear

- 6.4.6 REV'IT! Sport International

- 6.4.7 ScorpionEXO

- 6.4.8 Icon Motorsports

- 6.4.9 Royal Enfield Gear

- 6.4.10 HJC Helmets

- 6.4.11 Shoei Co., Ltd.

- 6.4.12 Arai Helmet Ltd.

- 6.4.13 Bell Helmets

- 6.4.14 Rynox Gears India Pvt. Ltd.

- 6.4.15 Spartan ProGear Co.

- 6.4.16 Kushitani Co., Ltd.

- 6.4.17 Held GmbH

- 6.4.18 Sena Technologies Inc.

- 6.4.19 LS2 Helmets

- 6.4.20 Studds Accessories Ltd.

- 6.4.21 Komine Co., Ltd.

- 6.4.22 Oxford Products Ltd.

- 6.4.23 Thor MX

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment