|

市場調查報告書

商品編碼

1852183

物聯網半導體:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)IoT Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

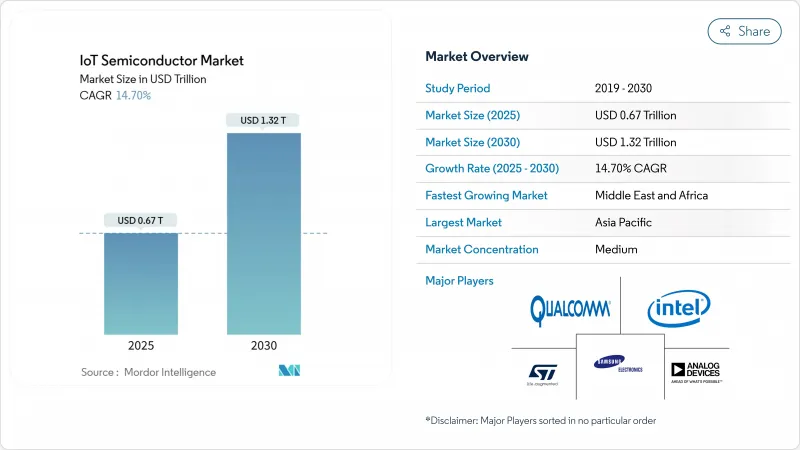

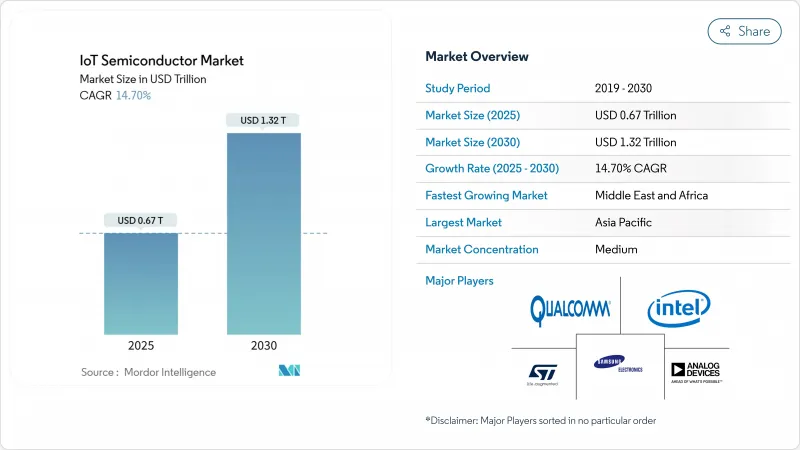

預計到 2025 年,物聯網半導體市場規模將達到 6,700 億美元,到 2030 年將達到 1.32 兆美元,預測期(2025-2030 年)的複合年成長率為 14.70%。

全球物聯網半導體市場的擴張主要得益於分散式邊緣人工智慧處理、工業自動化專案以及互聯消費設備的穩定成長。隨著製造商將工作負載從雲端遷移到邊緣,物聯網晶片面臨著在保持低於個位數毫瓦功耗預算的同時,增加神經網路加速功能的壓力。政府鼓勵半導體製造區域化的獎勵正在推動北美和歐洲新建晶圓廠,而製造業回流政策也正在改變全球物聯網半導體市場的籌資策略。供應鏈多元化與技術節點分化一致:先進節點(<14奈米)支援資源彙整人工智慧推理,而成熟節點(40-28奈米)則維持了面向大眾市場感測器的成本競爭力。

全球物聯網半導體市場趨勢與洞察

互聯消費品和穿戴式裝置的興起

對環境運算體驗的需求推動了對配備持續啟動感測器和無線電模組的超低功耗晶片的需求。注重健康的穿戴式裝置擴大配備醫用級光電體溫計、體溫計和心電圖感測器,這需要安全的資料路徑來符合日益嚴格的隱私法規。高通公司報告稱,2025年第一季物聯網營收將達到15億美元,年增36%,印證了消費者需求的成長動能。隨著5G調變解調器與裝置端人工智慧的融合,設計人員正轉向異構SoC,將應用處理器、NPU和連接功能整合到單一晶粒上,提升了全球物聯網半導體市場的晶片面積效率。

工業4.0主導了對低功耗MCU的需求。

實施數位孿生和預測性維護的工廠需要能夠本地採集振動、溫度和聲學數據並降低網路延遲的微控制器。英特爾的智慧工廠生產線透過即時微影術校準實現了接近理論值的產量比率,證明了邊緣分析在嚴苛環境下的價值。堅固耐用的微控制器將機器學習指令集與安全啟動和空中升級相結合,為全球物聯網半導體市場在未來十年持續獲得工業訂單奠定了基礎。

端對端安全和隱私漏洞

白宮網路信任標誌要求符合 NIST IR 8425 標準,這提高了資源受限設備中安全元件整合的門檻。對成本敏感的原始設備製造商 (OEM) 將面臨額外的晶片面積和韌體檢驗成本。量子運算日益成長的威脅將迫使晶片製造商支援基於格的密碼學,從而延遲產品發布並限制近期全球物聯網半導體市場的成長。

細分市場分析

2024年,處理器將實現25.65%的最大營收成長,主要得益於整合CPU、NPU和多重通訊協定無線電的晶粒晶片組合。更高的整合度可減少印刷電路面積並縮短認證週期,從而鞏固處理器在全球物聯網半導體市場的主導地位。安全IC預計將以17.90%的複合年成長率實現最快成長,因為零信任架構在物聯網半導體市場的每個節點都嵌入了硬體信任根。感測器、連接、記憶體、邏輯和電源管理等細分市場的出貨量將呈現更廣泛的成長曲線,其中專用低功耗DRAM將以價格分佈出售。

封裝內電壓調節升級使AI加速器能夠在低於0.5V的電壓下工作,從而延長穿戴式裝置的電池續航時間。 MEMS製造商將可出貨的壓力感測器高度降低至低於0.8毫米,拓展了戒指和耳塞的設計空間。 SEALSQ贏得一份契約,為英國智慧電錶提供2400萬顆抗量子晶片,這標誌著關鍵基礎設施安全防護的轉變。

數位雙胞胎技術在亞太地區的工廠中應用日益廣泛,預計到2024年,工業和製造業的市場佔有率將保持在22.71%。對狀態監測MCU的需求將維持兩位數成長直至2030年,其中汽車產業將以16.74%的複合年成長率引領成長,這主要得益於軟體定義車輛對計算區域的集中化管理。由於採用區域架構的普及,汽車晶片的物聯網半導體市場規模預計將快速擴張,該架構能夠減輕線束重量,並支援透過OTA進行功能提升銷售。

醫療保健領域將從遠端監控擴展到受監管的設備連接框架,從而增強對認證安全元件的需求。利用人工智慧驅動的庫存機器人進行零售測試,將使視覺最佳化的系統單晶片 (SoC) 能夠即時核對貨架庫存,從而使物聯網半導體市場的收入來源多元化。隨著被動光纖網路透過單一光纖骨幹網路連接暖通空調、照明和安防系統,建築自動化訂單將會增加。

區域分析

到2024年,亞太地區將佔物聯網半導體市場收入的34.92%,這主要得益於台灣地區63.8%的半導體總產量佔有率以及中國不斷成長的產能。從晶圓到封裝的垂直整合縮短了前置作業時間,使原始設備製造商(OEM)能夠快速迭代。然而,出口限制正促使跨國OEM廠商在日本、印度和美國部署產能以對沖風險,再形成物聯網半導體市場的供應格局。

中東和非洲地區以18.71%的複合年成長率呈現最快成長態勢。海灣國家的智慧城市預算正投入數十億美元用於交通分析、能源儀表板和公共感測器網路,這需要堅固耐用、寬溫域的矽晶片。北非的5G網路部署將為從港口延伸至內陸自由貿易區的物流走廊提供低延遲遙測功能,進而擴大物聯網半導體市場的終端用戶群。

北美和歐洲仍然是技術創新中心。美國《晶片法案》將向16個州的晶圓廠注資500億美元,到2027年將國內先進節點晶片產能翻倍至22%。歐洲《晶片法案》的目標是到2030年佔據20%的全球市場佔有率,英特爾和義法半導體正在德國和法國投資建造晶片叢集。這些地區優先發展高價值的汽車和醫療晶片,儘管物聯網半導體市場成長放緩,但這些晶片仍佔據了物聯網半導體市場中利潤豐厚的佔有率。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 聯網消費者與穿戴裝置的興起

- 工業4.0主導了對低功耗MCU的需求。

- 汽車ADAS和V2X晶片要求

- 物聯網SoC內部的邊緣AI推理

- Matter 通訊協定加速智慧家庭更新換代週期

- 透過衛星和Sub-GHz頻段連線進行遠端資產追蹤

- 市場限制

- 端對端安全和隱私漏洞

- 碎片化的通訊標準

- 傳統製程節點(28/40nm)的代工廠產能緊張。

- 先進射頻知識產權的出口管制限制

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟趨勢對市場的影響

第5章 市場規模與成長預測

- 依產品

- 處理器

- 感應器

- 連線IC

- 儲存裝置

- 邏輯裝置

- 電源管理積體電路

- 安全積體電路

- 最終用戶

- 衛生保健

- 消費性電子產品

- 工業和製造業

- 車

- BFSI

- 零售

- 建築自動化

- 其他最終用戶

- 依技術節點

- 90奈米或以上

- 65-45 nm

- 40-28 nm

- 22-16 nm

- 14奈米或更小

- 透過連接技術

- Bluetooth /BLE

- Wi-Fi(802.11x)

- NB-IoT/LTE-M

- 5G RedCap

- 超寬頻(UWB)

- Thread/Zigbee

- 衛星物聯網

- 依處理器架構

- 基於 Arm 的

- RISC-V

- x86

- 其他/混合型

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 新加坡

- 澳洲

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Qualcomm Technologies Inc.

- Intel Corporation

- Texas Instruments Incorporated

- NXP Semiconductors NV

- Cypress Semiconductor Corporation(Infineon)

- MediaTek Inc.

- Microchip Technology Inc.

- Samsung Electronics Co., Ltd.

- Silicon Laboratories Inc.

- TDK InvenSense Inc.

- STMicroelectronics NV

- Nordic Semiconductor ASA

- Analog Devices, Inc.

- Broadcom Inc.

- Infineon Technologies AG

- Renesas Electronics Corporation

- ON Semiconductor Corporation

- Arm Holdings plc

- NVIDIA Corporation

- Marvell Technology Group Ltd.

第7章 市場機會與未來展望

The IoT Semiconductor Market size is estimated at USD 0.67 trillion in 2025, and is expected to reach USD 1.32 trillion by 2030, at a CAGR of 14.70% during the forecast period (2025-2030).

The Global IoT Semiconductor market size expansion is powered by distributed edge-AI processing, industrial automation programs, and a steady rise in connected consumer devices. Manufacturers are moving workloads from cloud to edge, forcing IoT silicon to add neural acceleration while holding power budgets below single-digit milliwatts. Government incentives aimed at regionalizing semiconductor fabrication are encouraging new fabs in North America and Europe, while reshoring policies are altering sourcing strategies across the Global IoT Semiconductor market. Supply-chain diversification aligns with technology-node bifurcation: advanced nodes (<14 nm) enable resource-intensive AI inference, whereas mature nodes (40-28 nm) keep costs competitive for mass-market sensors.

Global IoT Semiconductor Market Trends and Insights

Proliferation of Connected Consumer and Wearable Devices

Demand for ambient computing experiences is lifting volumes for ultra-low-power chips that keep sensors and radios active at all times. Health-focused wearables now integrate medical-grade photoplethysmography, temperature, and ECG sensors that need secure data paths to comply with tightening privacy rules. Qualcomm reported USD 1.5 billion in IoT revenue for Q1 2025, up 36% year over year, underscoring consumer momentum. As 5G modems converge with on-device AI, designers shift to heterogeneous SoCs that fuse application processors, NPUs, and connectivity on one die, driving silicon-area efficiency across the Global IoT Semiconductor market.

Industry 4.0-Led Demand for Low-Power MCUs

Factories deploying digital twins and predictive maintenance lean on microcontrollers that ingest vibration, thermal, and acoustic data locally, cutting network latency. Intel's smart-factory line achieved near-theoretical yield through real-time lithography calibration, proving the value of edge analytics inside harsh environments. Rugged MCUs now combine machine-learning instruction sets with secure boot and OTA updates, positioning the Global IoT Semiconductor market for sustained industrial orders through the decade.

End-to-End Security and Privacy Vulnerabilities

The White House Cyber Trust Mark requires compliance with NIST IR 8425, raising the bar for secure-element integration in resource-limited devices. Cost-sensitive OEMs face additional silicon area and firmware validation expenses. Rising quantum-computing threats press chipmakers to support lattice-based cryptography, delaying product launches and tempering short-term Global IoT Semiconductor market growth.

Other drivers and restraints analyzed in the detailed report include:

- Automotive ADAS and V2X Silicon Requirements

- Edge-AI Inference Inside IoT SoCs

- Legacy-Node (28/40 nm) Foundry Capacity Crunch

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Processors generated the largest revenue slice in 2024 at 25.65%, anchored by single-die combos that merge CPU, NPU, and multi-protocol radios. Enhanced integration trims printed-circuit area and shortens certification cycles, fortifying processor dominance in the Global IoT Semiconductor market. Security ICs are poised for the fastest expansion with a 17.90% CAGR as zero-trust architectures embed hardware roots-of-trust into every node of the IoT Semiconductor market. Sensor, connectivity, memory, logic, and power-management lines track broader unit shipment curves, with specialized low-power DRAM commanding premium price points.

Upgrades in in-package voltage regulation now supply sub-0.5 V rails for AI accelerators, extending battery life in wearables. MEMS makers push shippable pressure sensors below 0.8 mm height, opening design space in rings and earbuds. SEALSQ secured contracts for 24 million quantum-resistant chips that protect UK smart meters, showcasing a security shift across critical infrastructure.

Industrial and manufacturing retained a 22.71% share in 2024 as digital-twin rollouts scaled across APAC plants. Demand for condition-monitoring MCUs sustains double-digit unit growth through 2030. Automotive leads in CAGR at 16.74% as software-defined vehicles centralize compute domains. The IoT Semiconductor market size for automotive silicon is projected to climb sharply on the back of zonal architectures that cut harness weight and enable OTA feature upsells.

Healthcare extends beyond remote monitoring to regulated device connectivity frameworks, strengthening demand for certified secure elements. Retail pilots using AI-powered inventory robots enlist vision-optimized SoCs to reconcile shelf stock in real time, diversifying the IoT Semiconductor market revenue base. Building-automation orders rise as passive optical networks connect HVAC, lighting, and security over a single fibre backbone.

The IoT Semiconductor Market is Segmented by Product (Processor, Sensor, and More), End-User (Healthcare, Consumer Electronics, and More), Technology Node, Connectivity Technology (Bluetooth/BLE, Wi-Fi, and More), Processor Architecture (Arm-Based, RISC-V, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 34.92% of the IoT Semiconductor market revenue in 2024, propelled by Taiwan's 63.8% share of total semiconductor output and China's capacity build-out. Vertical integration from wafer to packaging lowers lead times, letting OEMs iterate faster. Yet export controls nudge multinational OEMs toward capacity hedging in Japan, India, and the United States, reshaping the IoT Semiconductor market supply map.

The Middle East and Africa exhibit the fastest trajectory at 18.71% CAGR. Gulf smart-city budgets allocate billions for traffic analytics, energy dashboards, and public-safety sensor grids, demanding robust, wide-temperature-range silicon. 5G rollouts across North Africa unlock low-latency telemetry for logistics corridors stretching from ports to inland free-trade zones, enlarging the endpoint base for the IoT Semiconductor market.

North America and Europe remain innovation centers. The U.S. CHIPS Act channels USD 50 billion into fabs across 16 states, doubling domestic advanced-node capacity to 22% by 2027. Europe's Chips Act targets a 20% global share by 2030, with Intel and STMicroelectronics investing in Germany and France clusters. These regions prioritize high-value automotive and medical silicon, forming lucrative slices of the IoT Semiconductor market size despite moderate unit growth.

- Qualcomm Technologies Inc.

- Intel Corporation

- Texas Instruments Incorporated

- NXP Semiconductors N.V.

- Cypress Semiconductor Corporation (Infineon)

- MediaTek Inc.

- Microchip Technology Inc.

- Samsung Electronics Co., Ltd.

- Silicon Laboratories Inc.

- TDK InvenSense Inc.

- STMicroelectronics N.V.

- Nordic Semiconductor ASA

- Analog Devices, Inc.

- Broadcom Inc.

- Infineon Technologies AG

- Renesas Electronics Corporation

- ON Semiconductor Corporation

- Arm Holdings plc

- NVIDIA Corporation

- Marvell Technology Group Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of connected consumer and wearable devices

- 4.2.2 Industry 4.0-led demand for low-power MCUs

- 4.2.3 Automotive ADAS and V2X silicon requirements

- 4.2.4 Edge-AI inference inside IoT SoCs

- 4.2.5 Matter protocol accelerating smart-home refresh cycles

- 4.2.6 Satellite and sub-GHz connectivity for remote asset tracking

- 4.3 Market Restraints

- 4.3.1 End-to-end security and privacy vulnerabilities

- 4.3.2 Fragmented communications standards

- 4.3.3 Legacy-node (28/40 nm) foundry capacity crunch

- 4.3.4 Export-control limits on advanced RF IP

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Product

- 5.1.1 Processor

- 5.1.2 Sensor

- 5.1.3 Connectivity IC

- 5.1.4 Memory Device

- 5.1.5 Logic Device

- 5.1.6 Power-Management IC

- 5.1.7 Security IC

- 5.2 By End-user

- 5.2.1 Healthcare

- 5.2.2 Consumer Electronics

- 5.2.3 Industrial and Manufacturing

- 5.2.4 Automotive

- 5.2.5 BFSI

- 5.2.6 Retail

- 5.2.7 Building Automation

- 5.2.8 Other End-users

- 5.3 By Technology Node

- 5.3.1 >=90 nm

- 5.3.2 65-45 nm

- 5.3.3 40-28 nm

- 5.3.4 22-16 nm

- 5.3.5 <=14 nm

- 5.4 By Connectivity Technology

- 5.4.1 Bluetooth / BLE

- 5.4.2 Wi-Fi (802.11x)

- 5.4.3 NB-IoT / LTE-M

- 5.4.4 5G RedCap

- 5.4.5 Ultra-Wideband (UWB)

- 5.4.6 Thread / Zigbee

- 5.4.7 Satellite IoT

- 5.5 By Processor Architecture

- 5.5.1 Arm-based

- 5.5.2 RISC-V

- 5.5.3 x86

- 5.5.4 Other / Hybrid

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Singapore

- 5.6.4.6 Australia

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Qualcomm Technologies Inc.

- 6.4.2 Intel Corporation

- 6.4.3 Texas Instruments Incorporated

- 6.4.4 NXP Semiconductors N.V.

- 6.4.5 Cypress Semiconductor Corporation (Infineon)

- 6.4.6 MediaTek Inc.

- 6.4.7 Microchip Technology Inc.

- 6.4.8 Samsung Electronics Co., Ltd.

- 6.4.9 Silicon Laboratories Inc.

- 6.4.10 TDK InvenSense Inc.

- 6.4.11 STMicroelectronics N.V.

- 6.4.12 Nordic Semiconductor ASA

- 6.4.13 Analog Devices, Inc.

- 6.4.14 Broadcom Inc.

- 6.4.15 Infineon Technologies AG

- 6.4.16 Renesas Electronics Corporation

- 6.4.17 ON Semiconductor Corporation

- 6.4.18 Arm Holdings plc

- 6.4.19 NVIDIA Corporation

- 6.4.20 Marvell Technology Group Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment