|

市場調查報告書

商品編碼

1858840

ADAS半導體市場機會、成長促進因素、產業趨勢分析及2025-2034年預測ADAS Semiconductors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

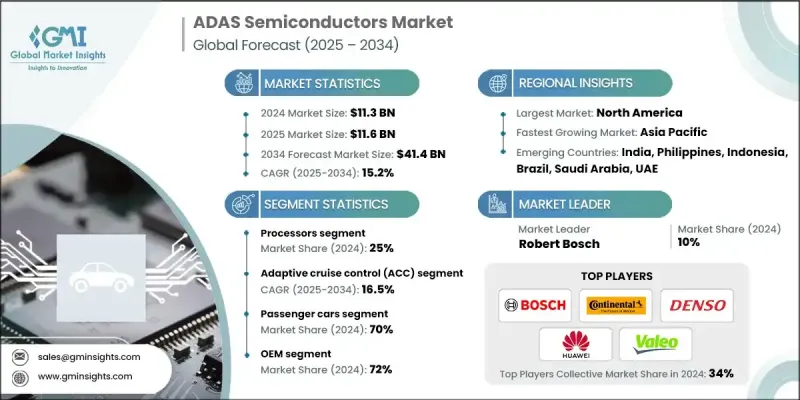

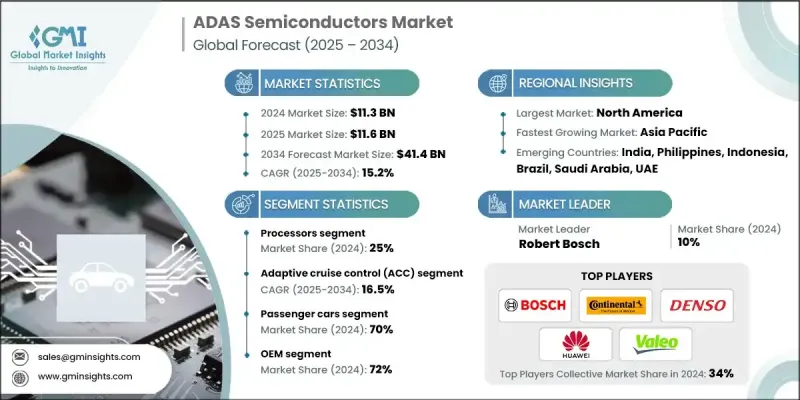

2024 年全球 ADAS 半導體市場價值為 113 億美元,預計到 2034 年將以 15.2% 的複合年成長率成長至 414 億美元。

由於更嚴格的安全標準、對自動駕駛功能日益成長的需求以及ADAS技術在車輛中日益普及,市場正經歷快速成長。汽車製造商正在整合各種半導體組件,包括高性能微控制器、雷達晶片、雷射雷達介面IC、影像訊號處理器和人工智慧加速器,以提升決策能力、即時感知能力、能源效率和可靠性。一級供應商和汽車製造商也在推動感測器融合、預測分析和人工智慧驅動系統等技術,以滿足嚴格的安全法規要求。開發封裝更優、導熱性更高、功耗更低的半導體對於處理大量資料和遵守Euro NCAP、NHTSA和UNECE等法規至關重要。此外,新冠疫情暴露了半導體供應鏈的脆弱性,促使企業進行多角化經營與外包。隨著汽車產業向電氣化和自動駕駛汽車轉型,對汽車晶片的投資不斷增加,訂閱服務和晶片組整合合作等新型商業模式提供了可擴展且靈活的解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 113億美元 |

| 預測值 | 414億美元 |

| 複合年成長率 | 15.2% |

到2024年,處理器細分市場將佔據25%的市場佔有率,並有望以17%的複合年成長率實現最快成長,這主要得益於對高性能計算日益成長的需求,以支持高級駕駛輔助系統(ADAS)功能並提升車輛的自主性。汽車產業正逐步採用配備集中式域控制系統和人工智慧驅動的系統級晶片(SoC)的車輛,這些晶片能夠處理複雜的感測器資料、執行即時決策,並實現深度學習和電腦視覺等複雜演算法。

2024 年,自適應巡航控制 (ACC) 市佔率為 22%。雖然 ACC 不是最廣泛使用的功能,但由於其能夠根據交通狀況自動調整車速,從而提高舒適性和安全性,預計 2025 年至 2034 年間,其需求將以 16.5% 的複合年成長率成長。

美國ADAS半導體市場佔據主導地位,市佔率高達85%,預計到2024年將達到29.1億美元。美國強大的汽車研發實力、對安全技術的早期應用以及政府強制執行的安全標準,鞏固了其在該行業的領先地位。領先的汽車製造商正積極將先進的雷達、攝影機和人工智慧晶片整合到車輛中,以滿足消費者對安全性和駕駛輔助功能日益成長的需求。

ADAS半導體市場的主要參與者包括NVIDIA、Mobileye(英特爾旗下)、大陸集團、電裝、博世、高通、特斯拉、採埃孚、華為和法雷奧。為了鞏固市場地位,ADAS半導體市場的企業正專注於幾個關鍵策略。他們大力投資研發,以開發滿足ADAS日益複雜需求的尖端晶片,例如即時處理和增強型感測器融合。他們也積極尋求與汽車製造商的合作與夥伴關係,將人工智慧和機器學習整合到產品中,從而提供更有效率、可擴展的解決方案。此外,各公司也不斷改進產品,推出能夠處理大量資料集的低功耗、高性能半導體,以滿足先進安全系統和自動駕駛功能的需求。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預測模型

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 對先進安全功能的需求不斷成長以及監管要求的提高。

- 自動駕駛和半自動駕駛汽車普及率激增。

- 人工智慧和機器學習在進階駕駛輔助系統中的應用日益廣泛。

- 電動車的普及需要高性能的ADAS解決方案。

- 感測器融合和多感測器ADAS架構的增加。

- 產業陷阱與挑戰

- ADAS半導體解決方案成本高昂,限制了其大規模應用。

- 跨不同車輛平台整合的複雜性。

- 市場機遇

- 開發低功耗、人工智慧最佳化的汽車半導體。

- 原始設備製造商 (OEM) 與半導體公司之間日益密切的合作關係。

- 對77GHz雷達和LiDAR整合晶片的需求不斷成長。

- ADAS在新興市場的擴展。

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 網路安全與功能安全整合

- 汽車網路安全框架實施

- 硬體安全模組 (HSM) 整合

- 安全啟動和信任鏈

- ISO 21434 網路安全合規性

- 威脅建模與風險評估

- 透過設計實現安全的方法

- 事件回應與復原系統

- 隱私保護計算技術

- 顛覆性技術的整合與應用

- 神經形態計算在ADAS應用的應用

- Chiplet架構和解耦式設計

- 記憶體處理(PIM)技術

- 光子運算整合潛力

- 量子運算的未來應用

- RISC-V 開放式架構的採用

- 邊緣人工智慧加速器整合

- 模擬人工智慧運算解決方案

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 處理器

- 感應器

- 記憶

- 電源管理積體電路

- 連接性和介面

- 其他

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 自適應巡航控制(ACC)

- 盲點偵測系統(BSD)

- 停車協助

- 車道偏離預警系統(LDWS)

- 輪胎壓力監測系統(TPMS)

- 自動緊急煞車(AEB)

- 自適應頭燈(AFL)

- 其他

第7章:市場估價與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 多用途乘用車

- 商用車輛

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車輛(HCV)

- 搭乘用車

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- OEM

- 售後市場

第9章:市場估計與預測:依自主程度分類,2021-2034年

- 主要趨勢

- 一級(駕駛輔助)

- 二級(部分自動化)

- 3級(條件自動化)

- 4級(高度自動化)

- 5級(全自動)

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 菲律賓

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- 全球參與者

- Continental

- Denso

- Huawei

- Mobileye (Intel)

- NVIDIA

- Qualcomm

- Robert Bosch

- Tesla

- VALEO

- ZF Friedrichshafen

- 區域玩家

- Analog Devices

- Apvit

- Baidu Apollo

- Infineon

- Innoviz Technologies

- Luminar Technologies

- Magna International

- Microchip Technology

- NXP semiconductors

- ON Semiconductor

- Rohm Semiconductor

- Toshiba Electronic Devices

- Velodyne Lidar

- 新興參與者

- Ambarella

- Black Sesame

- Hailo Technologies

- Horizon Robotics

- Lattice Semiconductor

- SiTime

- Xilinx

The Global ADAS Semiconductors Market was valued at USD 11.3 billion in 2024 and is estimated to grow at a CAGR of 15.2% to reach USD 41.4 billion by 2034.

The market is experiencing rapid growth due to stricter safety standards, greater demand for automated driving features, and the increasing integration of ADAS technologies in vehicles. Automakers are incorporating a wide range of semiconductor components, including high-performance microcontrollers, radar chips, lidar interface ICs, image signal processors, and AI accelerators, to improve decision-making, real-time perception, energy efficiency, and reliability. Tier-1 suppliers and vehicle manufacturers are also advancing technologies like sensor fusion, predictive analytics, and AI-driven systems to comply with tough safety regulations. The development of semiconductors with better packaging, improved thermal conductivity, and lower power consumption is crucial for handling large data volumes and adhering to regulations such as Euro NCAP, NHTSA, and UNECE. Additionally, the COVID-19 pandemic exposed vulnerabilities in the semiconductor supply chain, prompting companies to diversify and outsource. As the automotive industry moves toward electrification and autonomous vehicles, investments in automotive chips have increased, with new business models such as subscription-based services and chipset integration partnerships offering scalable and flexible solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.3 Billion |

| Forecast Value | $41.4 Billion |

| CAGR | 15.2% |

In 2024, the processors segment held a 25% share and is expected to grow at the highest rate, with a CAGR of 17%, driven by the increasing demand for high-performance computing to support advanced ADAS features and enhance vehicle autonomy. The automotive sector is progressively adopting vehicles with centralized domain controls and AI-powered system-on-chips (SoCs) that can process complex sensor data, perform real-time decision-making, and implement sophisticated algorithms like deep learning and computer vision.

The adaptive cruise control (ACC) segment held a 22% share in 2024. Although ACC is not the most widely used feature, its demand is expected to grow at a CAGR of 16.5% between 2025 and 2034, driven by its ability to automatically adjust vehicle speed based on traffic conditions, improving both comfort and safety.

U.S. ADAS Semiconductors Market held a dominant share of 85% generating USD 2.91 billion in 2024. The strong presence of automotive research and development, along with early adoption of safety technologies and government-imposed safety standards, has solidified the U.S. as a leader in this industry. Leading car manufacturers are actively integrating advanced radar, camera, and AI-powered chips into their vehicles, catering to the growing consumer demand for safety and driver-assistance features.

Key players in the ADAS Semiconductors Market include NVIDIA, Mobileye (Intel), Continental, Denso, Robert Bosch, Qualcomm, Tesla, ZF Friedrichshafen, Huawei, and VALEO. To strengthen their market position, companies in the ADAS Semiconductors Market are focusing on several key strategies. They are heavily investing in research and development (R&D) to develop cutting-edge chips that meet the increasingly sophisticated needs of ADAS, such as real-time processing and enhanced sensor fusion. Collaborations and partnerships with automakers are also being pursued to integrate AI and machine learning into their products, thus offering more efficient and scalable solutions. Furthermore, companies are enhancing their product offerings with low-power, high-performance semiconductors that can handle large data sets, meeting the demands of advanced safety systems and autonomous driving capabilities.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Application

- 2.2.4 Vehicle

- 2.2.5 End Use

- 2.2.6 Level of autonomy

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in demand for advanced safety features and regulatory mandates.

- 3.2.1.2 Surge in autonomous and semi-autonomous vehicle adoption.

- 3.2.1.3 Growing integration of AI and machine learning in ADAS.

- 3.2.1.4 Expansion of EVs requiring high-performance ADAS solutions.

- 3.2.1.5 Increase in sensor fusion and multi-sensor ADAS architectures.

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of ADAS semiconductor solutions limiting mass adoption.

- 3.2.2.2 Complexity in integration across diverse vehicle platforms.

- 3.2.3 Market opportunities

- 3.2.3.1 Development of low-power, AI-optimized automotive semiconductors.

- 3.2.3.2 Growing partnerships between OEMs and semiconductor companies.

- 3.2.3.3 Rising demand for 77GHz radar and lidar integration chips.

- 3.2.3.4 Expansion of ADAS in emerging markets.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Cybersecurity & Functional Safety Integration

- 3.13.1 Automotive cybersecurity framework implementation

- 3.13.2 Hardware security module (HSM) integration

- 3.13.3 Secure boot & chain of trust

- 3.13.4 ISO 21434 cybersecurity compliance

- 3.13.5 Threat modeling & risk assessment

- 3.13.6 Security by design methodologies

- 3.13.7 Incident response & recovery systems

- 3.13.8 Privacy-preserving computing techniques

- 3.14 Disruptive technology integration & adoption

- 3.14.1 Neuromorphic computing for adas applications

- 3.14.2 Chiplet architecture & disaggregated design

- 3.14.3 Processing-in-memory (PIM) technologies

- 3.14.4 Photonic computing integration potential

- 3.14.5 Quantum computing future applications

- 3.14.6 RISC-V open architecture adoption

- 3.14.7 Edge ai accelerator integration

- 3.14.8 Analog AI computing solutions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Processors

- 5.3 Sensors

- 5.4 Memory

- 5.5 Power Management ICs

- 5.6 Connectivity & Interface

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Adaptive Cruise Control (ACC)

- 6.3 Blind Spot Detection System (BSD)

- 6.4 Park Assistance

- 6.5 Lane Departure Warning System (LDWS)

- 6.6 Tire Pressure Monitoring System (TPMS)

- 6.7 Autonomous Emergency Braking (AEB)

- 6.8 Adaptive Front Lights (AFL)

- 6.9 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.1.1 Passenger cars

- 7.1.1.1 Hatchbacks

- 7.1.1.2 Sedans

- 7.1.1.3 SUVs

- 7.1.1.4 MPVs

- 7.1.2 Commercial vehicles

- 7.1.2.1 Light commercial vehicles (LCVs)

- 7.1.2.2 Medium commercial vehicles (MCVs)

- 7.1.2.3 Heavy commercial vehicles (HCVs)

- 7.1.1 Passenger cars

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Level of Autonomy, 2021-2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Level 1 (Driver assistance)

- 9.3 Level 2 (Partial automation)

- 9.4 Level 3 (Conditional automation)

- 9.5 Level 4 (High automation)

- 9.6 Level 5 (Full automation)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Continental

- 11.1.2 Denso

- 11.1.3 Huawei

- 11.1.4 Mobileye (Intel)

- 11.1.5 NVIDIA

- 11.1.6 Qualcomm

- 11.1.7 Robert Bosch

- 11.1.8 Tesla

- 11.1.9 VALEO

- 11.1.10 ZF Friedrichshafen

- 11.2 Regional Players

- 11.2.1 Analog Devices

- 11.2.2 Apvit

- 11.2.3 Baidu Apollo

- 11.2.4 Infineon

- 11.2.5 Innoviz Technologies

- 11.2.6 Luminar Technologies

- 11.2.7 Magna International

- 11.2.8 Microchip Technology

- 11.2.9 NXP semiconductors

- 11.2.10 ON Semiconductor

- 11.2.11 Rohm Semiconductor

- 11.2.12 Toshiba Electronic Devices

- 11.2.13 Velodyne Lidar

- 11.3 Emerging Players

- 11.3.1 Ambarella

- 11.3.2 Black Sesame

- 11.3.3 Hailo Technologies

- 11.3.4 Horizon Robotics

- 11.3.5 Lattice Semiconductor

- 11.3.6 SiTime

- 11.3.7 Xilinx