|

市場調查報告書

商品編碼

1852153

工業閥門:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Industrial Valves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

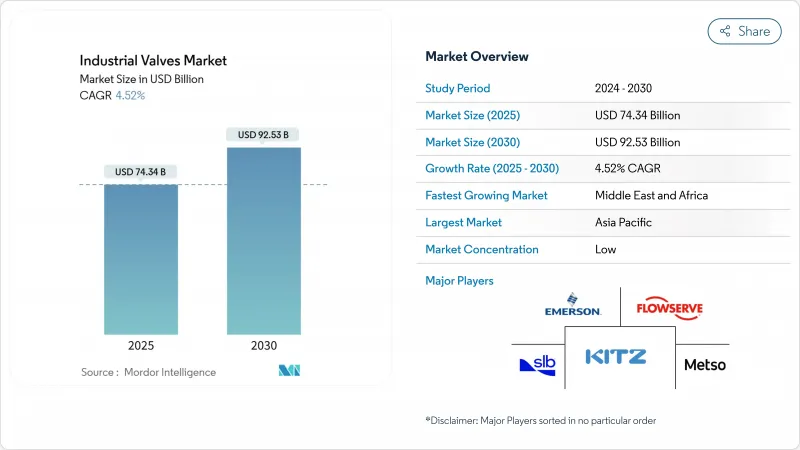

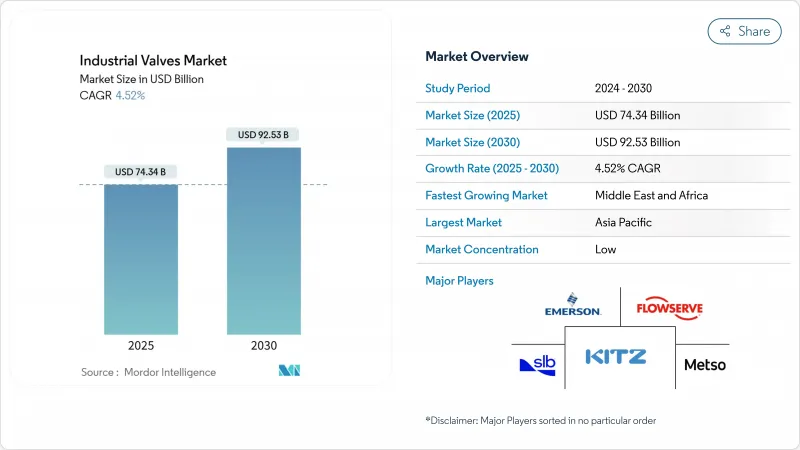

預計到 2025 年,工業閥門市場規模將達到 743.4 億美元,到 2030 年將達到 925.3 億美元,在預測期(2025-2030 年)內,複合年成長率將達到 4.52%。

這項穩定擴張得益於氫氣、液化天然氣和海水淡化基礎設施的同步成長,以及油氣船舶支出的週期性復甦。對預測性維護的投資增加和更嚴格的排放法規正在加速閥門更換週期,而鎳基合金供應鏈的瓶頸則迫使企業進行材料替代。隨著一級供應商競相認證其氫氣閥門並整合數位診斷功能,競爭日益激烈;這些動態共同作用,助力工業閥門市場在能源轉型過程中保持韌性。

全球工業閥門市場趨勢與洞察

氫能和碳捕獲計劃

歐洲和北美氫能谷和碳捕集中心的擴張,使得對能夠承受氫脆和二氧化碳腐蝕的高壓、高純度閥門的需求變得迫切。歐洲大陸目前已有512座氫氣生產設施運作,總產能達1,123萬噸。計劃開發商仍然傾向於選擇經過認證的直角回轉閥門,用於電解槽電解槽系統。閥門供應商也紛紛推出專用產品,例如艾默生的HV-7000系列,該系列閥門可提供兩級減壓,將壓力降至700巴,周邊輔助系統於車輛加氫。推進氫能準備工作推高了認證成本,但也創造了溢價空間,顯著提升了工業閥門市場的銷售量。嚴格的氫氣排放法規將進一步推動對低滲透性閥桿密封的金屬密封球閥的需求。隨著公共政策框架計劃到2030年為氫能投入900億歐元,計劃儲備規模龐大,這將支撐專用閥門組件訂單的持續兩位數成長。

LNG接收站建設

預計到2040年,全球液化天然氣(LNG)消費量將持續成長,主要驅動力來自中國的工業用戶以及南亞和東南亞的新興需求中心。光是中國就將引領全球新增LNG產能,而美國預計在2025年將LNG出口量增加18%,高於2024年的2%成長。每條新的液化裝置和每個LNG再氣化泊位都需要數千個低溫球閥、塞閥和閘閥。儘管美國墨西哥灣沿岸的人事費用上漲高達20%,但供應合約依然強勁,LNG基礎設施將成為近期工業閥門市場的主要推動力。雖然原始設備銷售仍佔據主導地位,但旨在消除現有終端瓶頸的改造計劃將為智慧致動器和定位器帶來豐厚的改裝收入。

鎳基合金短缺

受電池產業的推動,預計2019年至2023年間鎳需求將成長超過200%,導致閥門等級合金供應趨緊。由於93%的銅鎳合金原料由印尼輸往中國的管道控制,高合金鑄件的前置作業時間目前已超過40週,阻礙了低溫和酸性環境閥門的交付。製造商正在轉向低鎳雙相不銹鋼等替代材料,但認證週期的變化進展緩慢。液化天然氣和氫氣計劃需要使用含鎳量為9%的鋼或因科鎳合金閥芯,這限制了工業閥門市場的近期成長。

細分市場分析

由於球閥具有無洩漏關閉、快速四分之一圈旋轉動作以及與可清管管道的兼容性等優點,預計到2024年,球閥將佔據工業閥門市場40%的佔有率。近期,球閥產品創新,特別是針對耐氫滲透聚合物閥座的設計,使其在更廣泛的球閥產品系列中佔據了高階市場。同時,止回閥作為防止回流的關鍵部件,預計將以7.11%的複合年成長率成長,這主要得益於液化天然氣儲罐、農場泵隔離和市政供水管網投資的增加。靜音型雙板止回閥因其能夠減輕水錘效應並保護下游設備,逐漸獲得市場佔有率。

2024年,球閥、蝶閥和旋塞式四分之一轉閥將佔總銷量的54%。其緊湊的尺寸、低扭矩和短動作時間使其在煉油廠歧管和分配迴路中繼續保持良好的採購優勢。多轉閥將迎來加速成長(年複合成長率5.8%),尤其是在需要精確節流的應用領域。然而,由於ISO-5211安裝墊片便於致動器整合,日益成長的自動化需求仍青睞四分之一轉閥設計。例如,艾默生AVENTICS XV系列等新產品可提供比上一代產品高出兩倍的氣流,進而縮短氣動網路的循環時間。

區域分析

亞太地區將引領工業閥門市場,預計到2024年將佔全球支出的40%。該地區的成長動能主要源自於中國石化聯合企業的崛起、印度分散式水處理設施的建設以及液化天然氣接收站的建設。預計到2030年,中國將啟動全球大部分再氣化計劃,這將推動低溫隔離閥和緊急切斷閥的現場需求。

美國計劃在2025年將液化天然氣出口量提高18%,將推動近期壓力釋放、防突波和洩壓裝置的安裝需求激增。墨西哥灣沿岸化工工業的數位化維修正在加速推進,預測分析技術能夠縮短檢修週期。加拿大的碳捕獲激勵政策也刺激了其二氧化碳運輸網路中對耐腐蝕合金閥門的需求。

歐洲市場反映了氫能發展計畫的加速、環保合規要求的提高以及老舊基礎設施的更新換代。中東和非洲是成長最快的地區,複合年成長率達6.51%。沙烏地阿拉伯和阿拉伯聯合大公國佔海灣合作理事會(GCC)海水淡化產能的65%,預計2050年將增加至8,000萬立方公尺/天,這意味著閥門採購需求龐大。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 氫氣和碳捕獲計劃的擴張將推動歐洲和北美對高壓閥門的需求。

- 亞太地區的LNG接收站建設需要閥門。

- 海灣合作理事會加速對海水淡化廠的投資,促進閥門銷售

- 快速採用預測性維護平台可提高北美化工廠的閥門更換週期

- 海上深水能源和電力設備投資的復甦刺激了閥門訂單。

- 市場限制

- 鎳基合金鑄造供應鏈短缺導致前置作業時間超過40週。

- 球墨鑄鐵價格波動增加歐洲公共產業買家的總擁有成本

- 更嚴格的廢氣排放法規將增加中小型製造商獲得認證的成本。

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按類型

- 球閥

- 蝶閥

- 閘閥

- 球閥

- 塞閥

- 其他類型

- 依產品

- 直角回轉閥

- 多圈閥

- 其他產品

- 透過閥門功能

- 隔離閥

- 調節閥

- 止回閥和安全閥

- 按身體材料

- 鋼(碳鋼和不銹鋼)

- 合金基(雙相鋼、因科鎳合金等)

- 鑄鐵/球墨鑄鐵

- 低溫鎳合金

- 其他

- 透過使用

- 石油和天然氣

- 電力

- 用水和污水管理

- 化學

- 新能源

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 印尼

- 越南

- 馬來西亞

- 泰國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 北歐國家

- 土耳其

- 俄羅斯

- 西班牙

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 奈及利亞

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Alfa Laval

- AVK International A/S

- Baker Hughes Company

- Circor International Inc.

- Crane Company

- Curtiss-Wright Corporation

- Danfoss A/S

- Emerson Electric Co.

- Flowserve Corporation

- Georg Fischer Ltd.

- Hitachi Ltd

- Honeywell International Inc.

- IMI Critical Engineering(IMI PLC)

- ITT Inc.

- KITZ Corporation

- KLINGER Holding

- Metso

- Mueller Co. LLC

- Nibco Inc.

- Okano Valve Mfg. Co. Ltd.

- SAMSON AKTIENGESELLSCHAFT

- SLB

- Technipfmc PLC

- The Weir Group PLC

- Valvitalia SpA

- Velan

- Xylem

第7章 市場機會與未來展望

The Industrial Valves Market size is estimated at USD 74.34 billion in 2025, and is expected to reach USD 92.53 billion by 2030, at a CAGR of 4.52% during the forecast period (2025-2030).

This steady expansion is underpinned by simultaneous growth in hydrogen, LNG, and desalination infrastructure, alongside cyclical recovery in offshore oil and gas spending. Rising investments in predictive maintenance and stricter fugitive-emission rules are accelerating replacement cycles, while supply-chain bottlenecks for nickel-based alloys are forcing material substitutions. Competitive intensity is increasing because tier-one suppliers are racing to certify valves for hydrogen service and to integrate digital diagnostics, and these dynamics together keep the industrial valves market resilient during the energy transition.

Global Industrial Valves Market Trends and Insights

Hydrogen and Carbon Capture Projects

Expanding hydrogen valleys and carbon-capture hubs across Europe and North America translate into urgent requirements for high-pressure and high-purity valves that tolerate hydrogen embrittlement and CO2 corrosion. The continent already hosts 512 operational hydrogen facilities with 11.23 Mt of production capacity, and project developers continue to favour certified quarter-turn designs for electrolyser balance-of-plant service. Valve suppliers are responding with purpose-built offerings such as Emerson's HV-7000 series, which delivers two-stage pressure reduction up to 700 bar for vehicle refuelling. The push to lock in hydrogen readiness elevates qualification costs but simultaneously creates premium pricing windows, adding meaningful volume to the industrial valves market. Stringent fugitive-emission limits for hydrogen further reinforce demand for metal-seated ball valves sporting low-permeation stem seals. As public-funded policy frameworks earmark EUR 90 billion for hydrogen through 2030, project pipelines are large enough to support sustained double-digit order growth for specialised valve packages

LNG Terminal Build-outs

Global LNG consumption is expected to increase by 2040, driven by industrial users in China and new demand centres across South and Southeast Asia. China alone leads global regasification capacity additions, while the United States is on track to lift LNG exports 18% in 2025, from a 2% rise in 2024. Each new liquefaction train or regasification berth requires thousands of cryogenic ball, plug, and gate valves. Despite labour-cost inflation of up to 20% on the U.S. Gulf Coast, supply contracts remain robust, making LNG infrastructure a near-term catalyst for the industrial valves market. Original-equipment sales predominate, but turnback projects aimed at debottlenecking existing terminals add lucrative retrofit revenues for smart actuators and positioners.

Nickel-Based Alloy Shortage

Battery-sector uptake drove nickel demand up more than 200% between 2019 and 2023, tightening supply for valve-grade alloys. With 93% of matte feedstock controlled by Indonesia-to-China flows, high-alloy castings now exceed 40-week lead times, hampering delivery of cryogenic and sour-service valves. Manufacturers are pivoting to low-nickel duplex substitutes, yet qualification cycles slow switchover. The drag is acute for LNG and hydrogen projects that demand 9% nickel steel or Inconel trim, trimming near-term growth in the industrial valves market.

Other drivers and restraints analyzed in the detailed report include:

- Desalination Plant Investments

- Predictive Maintenance Adoption

- Ductile-Iron Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ball valves held 40% of the industrial valves market in 2024, due to their zero-leakage shut-off, quick quarter-turn motion, and compatibility with piggable pipelines. Recent product innovations focus on polymer seat designs that endure hydrogen permeation, enabling premium niches inside the broader ball-valve family. At the same time, check valves, critical for backflow prevention, are projected to grow at 7.11% CAGR, underpinned by rising investments in LNG tank-farm pump isolation and municipal water networks. Silent-operating dual-plate styles are gaining share because they mitigate water hammer, protecting downstream assets.

Quarter-turn valves, spanning ball, butterfly, and plug constructions, accounted for 54% of 2024 revenue. Their compact footprints, low torque, and short actuation times continue to underpin procurement choices in refinery manifolds and water distribution loops. Multi-turn valves grow faster (5.8% CAGR) where precise throttling is paramount, yet rising automation mandates still favour quarter-turn designs because ISO-5211 mounting pads ease actuator integration. New offerings such as Emerson's AVENTICS XV series double the airflow of earlier generations, lowering cycle time in pneumatic networks.

The Industrial Valves Market Report Segments the Industry by Type (Ball Valve, Butterfly Valve, Gate Valve, Globe Valve, and More), Product (Quarter-Turn Valve, Multi-Turn Valve, and Others), Valve Function (Isolation Valves, and More), Body Material (Steel, Alloy-Based, and More), Application (Oil and Gas, Power, Water and Wastewater Management, and More), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia-Pacific leads the industrial valves market with 40% of 2024 spending. The region's momentum stems from China's petrochemical complexes, India's distributed water treatment build-outs, and the rise of LNG receiving terminals. China is forecast to commission the bulk of global regasification projects before 2030, increasing on-site requirements for cryogenic isolation and emergency shutdown valves.

Planned U.S. LNG export expansions of 18% in 2025 point to a near-term installation wave for pressure-relief, anti-surge, and blow-down packages. Digital retrofits are gathering pace in Gulf Coast chemical corridors, where predictive analytics shorten turnaround cycles. Canada's carbon-capture incentives also stimulate demand for corrosion-resistant alloy valves in CO2 transport networks.

Europe's market reflects accelerating hydrogen commitments, environmental compliance and aging infrastructure replacement. The Middle-East and Africa are the fastest-growing regions at 6.51% CAGR. Saudi Arabia and the UAE jointly constitute 65% of GCC desalination throughput, and their expansion to 80 million m3/day by 2050 underlines sizable valve procurement pipelines

- Alfa Laval

- AVK International A/S

- Baker Hughes Company

- Circor International Inc.

- Crane Company

- Curtiss-Wright Corporation

- Danfoss A/S

- Emerson Electric Co.

- Flowserve Corporation

- Georg Fischer Ltd.

- Hitachi Ltd

- Honeywell International Inc.

- IMI Critical Engineering (IMI PLC)

- ITT Inc.

- KITZ Corporation

- KLINGER Holding

- Metso

- Mueller Co. LLC

- Nibco Inc.

- Okano Valve Mfg. Co. Ltd.

- SAMSON AKTIENGESELLSCHAFT

- SLB

- Technipfmc PLC

- The Weir Group PLC

- Valvitalia SpA

- Velan

- Xylem

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Hydrogen and Carbon Capture Projects Driving High-Pressure Valve Demand in Europe and North America

- 4.2.2 LNG Terminal Build-outs Across APAC Requiring Valves

- 4.2.3 Accelerating Desalination Plant Investments in GCC Boosting Valve Sales

- 4.2.4 Rapid Adoption of Predictive Maintenance Platforms Elevating Replacement Cycles for Valves in North America Chemical Plants

- 4.2.5 Offshore Deep-water Energy and Power Capex Recovery Stimulating Valve Orders

- 4.3 Market Restraints

- 4.3.1 Supply-Chain Shortage of Nickel-Based Alloy Castings Extending Lead Times Beyond 40 Weeks

- 4.3.2 Price Volatility in Ductile Iron Increasing Total Cost of Ownership for Utility Buyers in Europe

- 4.3.3 Stricter Fugitive-Emission Regulations Elevating Qualification Costs for Small and Mid-Size Manufacturers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Ball Valve

- 5.1.2 Butterfly Valve

- 5.1.3 Gate Valve

- 5.1.4 Globe Valve

- 5.1.5 Plug Valve

- 5.1.6 Other Types

- 5.2 By Product

- 5.2.1 Quarter-Turn Valve

- 5.2.2 Multi-Turn Valve

- 5.2.3 Other Products

- 5.3 By Valve Function

- 5.3.1 Isolation Valves

- 5.3.2 Regulation Valves

- 5.3.3 Check and Safety Valves

- 5.4 By Body Material

- 5.4.1 Steel (Carbon and Stainless Steel)

- 5.4.2 Alloy-Based (Duplex, Inconel, etc.)

- 5.4.3 Cast/Ductile Iron

- 5.4.4 Cryogenic Nickel Alloys

- 5.4.5 Others

- 5.5 By Application

- 5.5.1 Oil and Gas

- 5.5.2 Power

- 5.5.3 Water and Wastewater Management

- 5.5.4 Chemicals

- 5.5.5 New Energy

- 5.5.6 Other Applications (Includes Food Processing, Mining, and Marine)

- 5.6 By Geography

- 5.6.1 Asia-Pacific

- 5.6.1.1 China

- 5.6.1.2 India

- 5.6.1.3 Japan

- 5.6.1.4 South Korea

- 5.6.1.5 Indonesia

- 5.6.1.6 Vietnam

- 5.6.1.7 Malaysia

- 5.6.1.8 Thailand

- 5.6.1.9 Rest of Asia-Pacific

- 5.6.2 North America

- 5.6.2.1 United States

- 5.6.2.2 Canada

- 5.6.2.3 Mexico

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 Italy

- 5.6.3.4 France

- 5.6.3.5 Nordics

- 5.6.3.6 Turkey

- 5.6.3.7 Russia

- 5.6.3.8 Spain

- 5.6.3.9 Rest of Europe

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Rest of South America

- 5.6.5 Middle-East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Qatar

- 5.6.5.4 Egypt

- 5.6.5.5 Nigeria

- 5.6.5.6 South Africa

- 5.6.5.7 Rest of Middle-East and Africa

- 5.6.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Alfa Laval

- 6.4.2 AVK International A/S

- 6.4.3 Baker Hughes Company

- 6.4.4 Circor International Inc.

- 6.4.5 Crane Company

- 6.4.6 Curtiss-Wright Corporation

- 6.4.7 Danfoss A/S

- 6.4.8 Emerson Electric Co.

- 6.4.9 Flowserve Corporation

- 6.4.10 Georg Fischer Ltd.

- 6.4.11 Hitachi Ltd

- 6.4.12 Honeywell International Inc.

- 6.4.13 IMI Critical Engineering (IMI PLC)

- 6.4.14 ITT Inc.

- 6.4.15 KITZ Corporation

- 6.4.16 KLINGER Holding

- 6.4.17 Metso

- 6.4.18 Mueller Co. LLC

- 6.4.19 Nibco Inc.

- 6.4.20 Okano Valve Mfg. Co. Ltd.

- 6.4.21 SAMSON AKTIENGESELLSCHAFT

- 6.4.22 SLB

- 6.4.23 Technipfmc PLC

- 6.4.24 The Weir Group PLC

- 6.4.25 Valvitalia SpA

- 6.4.26 Velan

- 6.4.27 Xylem

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Increase in Demand for Automatic Valves