|

市場調查報告書

商品編碼

1690933

亞太工業閥門:市場佔有率分析、產業趨勢與成長預測(2025-2030)Asia-Pacific Industrial Valves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

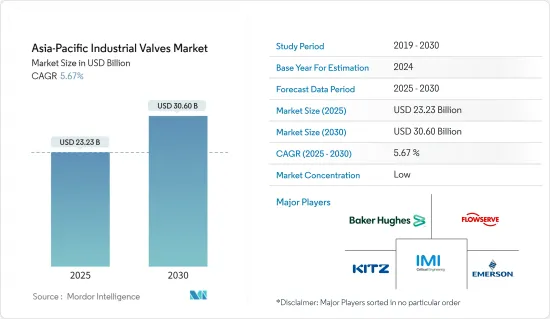

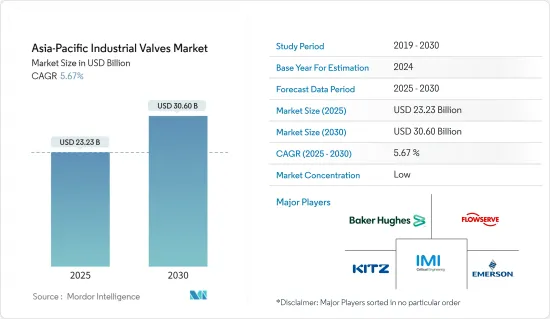

預計 2025 年亞太工業閥門市場規模為 232.3 億美元,到 2030 年將達到 306 億美元,預測期內(2025-2030 年)的複合年成長率為 5.67%。

關鍵亮點

- COVID-19疫情對工業閥門市場構成了重大挑戰。這直接影響了世界各地製造商的供應鏈,他們關閉了生產設施,以最大限度地降低病毒傳播的風險。

- 市場受到水處理廠和石油天然氣行業對閥門日益成長的需求的推動。

- 此外,下游市場對閥門更廣泛的應用的需求也促進了亞太閥門市場的成長。

- 中國佔亞太工業閥門市場的最大佔有率。

亞太工業閥門市場趨勢

石油和天然氣產業的需求不斷成長

- 上游石油和天然氣行業是閥門的最大用戶,安裝了數百萬個井口“聖誕樹”,每個“聖誕樹”通常包含 3-5 個閥門(尺寸為 2'-8')。

- 隨著跨國管道的增加,對儲存碳氫化合物的儲存終端的需求也增加。因此,亞太國家正在計劃投資儲存終端以滿足需求。

- 亞太地區主導下游石油和天然氣市場,大部分需求來自中國、東南亞國家和印度。預計未來20年能源需求將成長50-60%。

- 到2030年,中國計劃興建23座儲氣倉儲設施,耗資約85億美元。預計倉儲設施的竣工和即將鋪設的天然氣管道將推動中游產業的發展。因此,預計到本世紀中葉,石油產品需求將超過 6.5 億噸,其中運輸業的需求量最高,將達到近 3.7 億噸。

- 該地區計劃興建多個石化計劃。例如,預計2021年至2025年間,中國將有512個石化計劃投入使用。根據國際能源總署(IEA)發布的石化報告,到2050年,除歐洲外,幾乎所有地區的主要化學品產量都可能增加。然而,最大的產能成長將發生在亞太地區。

- 中國還計劃透過推動頁岩油田等國內計劃來減少對天然氣進口日益成長的依賴,以確保能源供應。預計政府將出資進行新的努力來提高國內天然氣產量,特別是頁岩氣等傳統天然氣產量。據估計,到2035年,中國的頁岩氣產量將達到約2,800億立方公尺。因此,中國政府推動頁岩氣生產的努力和計劃預計將在未來幾年為工業閥門創造機會。

- 預計這些因素將增加對工業閥門的需求。

印度可望創下最快成長

- 印度是製造業和機械領域發展最快的國家之一,對工業閥門的需求很大。印度政府為設立製造單位的公司提供便利。政府也推出各種措施來促進製造業的發展。例如,根據印度品牌資產基金會(IBEF)的數據,印度製造業出口預計將在2023年創下歷史新高,達到4,474.6億美元,較上年的4,220億美元成長6.03%。

- 印度是世界第三大電力生產國和消費國,截至2024年1月31日,裝置容量為429.96吉瓦。

- 印度採礦業蓬勃發展。 22 會計年度總合通報礦場 1,319 處,其中 545 處為金屬礦產,775 處為非金屬礦產。此外,根據印度品牌資產基金會(IBEF)發布的資料,印度2022-2023年鐵礦石出口將達17.5億美元,而2021-2022年為31.8億美元。

- 印度製藥業在全球佔有重要地位,產量排名第三,價值排名第十四。根據印度品牌資產基金會(IBEF)的預測,該產業規模預計在 2024 年達到 650 億美元,到 2030 年將加倍,達到 1,300 億美元,到 2047 年則將飆升至驚人的 4,500 億美元。

- 石油和天然氣產業是印度八大重點產業之一,在影響印度所有其他重要經濟部門的決策方面發揮著重要作用。印度的石油需求在全球迅速成長,預計到2030年將達到每天1000萬桶。

- 根據國際能源總署(IEA)的數據,到2024年,印度的天然氣消費量預計將增加250億立方公尺(bcm),年均成長率為9%。

- 這些因素可能會在預測期內增加印度對工業閥門的需求。

亞太工業閥門產業概況

亞太工業閥門市場呈現細分化,沒有一家公司能夠佔據較大的市場佔有率。該市場的主要參與企業包括(不分先後順序)艾默生電氣公司、KITZ 公司、福斯公司、貝克休斯和 IMI 關鍵工程公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 水處理廠對閥門的需求不斷增加

- 石油和天然氣產業對閥門的需求不斷增加

- 其他促進因素

- 限制因素

- 高資本投入阻礙市場成長

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按類型

- 蝶閥

- 球閥

- 截止閥

- 閘閥

- 塞閥

- 其他

- 按產品

- 1/4 轉閥

- 多迴轉閥

- 其他產品(控制閥)

- 按應用

- 力量

- 供水和用水和污水管理(包括海水淡化)

- 金屬、礦物和採礦

- 其他

- 按化學產品

- 石油和天然氣

- 上游

- 中游

- 下游

- 食品加工

- 紙漿和造紙

- 其他

- 按地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

第6章競爭格局

- 市場排名分析

- 主要企業策略

- 公司簡介

- Alfa Laval

- AVK Holding AS

- Baker Hughes

- CIRCOR International Inc.

- Crane Co.

- Curtiss-Wright Corporation

- Danfoss AS

- EBRO ARMATUREN Gebr. Brer GmbH

- Emerson Electric Co.

- Flowserve Corporation

- Georg Fischer Ltd

- Hitachi Metals Ltd

- Honeywell International Inc.

- IMI Critical Engineering

- ITT Inc.

- KITZ Corporation

- NIBCO

- Okano Valve Mfg. Co. Ltd

- PARKER HANNIFIN CORP.

- SAMSON AKTIENGESELLSCHAFT

- Schlumberger Limited

- The Weir Group PLC

- Valvitalia SpA

- Velan Inc.

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 72535

The Asia-Pacific Industrial Valves Market size is estimated at USD 23.23 billion in 2025, and is expected to reach USD 30.60 billion by 2030, at a CAGR of 5.67% during the forecast period (2025-2030).

Key Highlights

- The COVID-19 pandemic was a major challenge for the industrial valves market. It directly affected the manufacturer's supply chain across the globe and shut down the production facilities to minimize the risk of spreading the virus.

- The factors driving the market are increasing demand for valves from water treatment plants and the oil and gas industry.

- Further, the need to enable valves for a wider range of applications in the downstream market is contributing to the growth of the Asia-Pacific valves market.

- China accounts for the largest share of the Asia-Pacific industrial valves market.

Asia-Pacific Industrial Valves Market Trends

Growing Demand in the Oil and Gas Industry

- The upstream oil and gas industry is the largest user of valves to outfit millions of wellhead 'Christmas trees' that usually include 3 to 5 valves per tree in sizes of 2' to 8', as well as to segment and control flow through millions of miles of gathering pipelines (2' to 20' valves) and cross-country trunk pipelines (up to 60' or larger) required to bring the crude oil and gas to refineries, and the refined product (gasoline, diesel, natural gas) to end-user markets.

- With the increase in pipelines across the countries, the need for storage terminals to store hydrocarbons also increases. Therefore, Asia-Pacific countries plan to invest in storage terminals to meet the demand.

- Asia-Pacific has dominated the oil and gas downstream market, with most of the demand coming from China, Southeast Asian countries, and India. The energy demand is anticipated to grow by 50-60% in two decades.

- China is expected to build 23 gas storage facilities by 2030, with an investment of around USD 8.5 billion. Completing the storage facilities and the upcoming gas pipelines in the country are expected to boost the midstream sector. As a result, the demand for petroleum products is expected to cross 650 MT by the mid-decade, with the transportation segment having the highest demand of nearly 370 MT.

- Several petrochemical projects are planned to be constructed in the region. For instance, China is expected to have 512 petrochemical projects commence operations in 2021-2025. According to a petrochemicals report published by the International Energy Agency (IEA), nearly all regions except Europe may increase the production of primary chemicals by 2050. However, the most significant capacity growth is seen in Asia-Pacific.

- Also, China targets to slash its growing dependence on gas imports by boosting domestic projects like shale fields to secure its energy supply. The government is expected to fund new efforts to boost domestic production, particularly from unconventional sources like shale gas. It is also estimated that China's shale gas production will reach around 280 billion cubic meters by 2035. Thus, the Chinese government's effort and plan to boost its shale gas production are expected to create an opportunity for industrial valves in the coming years

- Such factors are expected to augment the demand for industrial valves.

India is Expected to Register the Fastest Growth

- India is one of the fastest-growing countries in terms of manufacturing sectors and machinery, giving rise to the need for industrial valves. The government provides benefits to companies setting up manufacturing units. It also outlines various policies to boost the manufacturing sector. For instance, as per the India Brand Equity Foundation (IBEF), in 2023, India's manufacturing exports hit a record high, reaching USD 447.46 billion, marking a 6.03% growth from the previous year, when exports stood at USD 422 billion.

- India is the third-largest producer and consumer of electricity worldwide, with an installed power capacity of 429.96 GW as of January 31, 2024.

- India boasts a thriving mining industry. In FY22, the country had a total of 1,319 reporting mines, with 545 dedicated to metallic minerals and 775 to non-metallic minerals. Moreover, according to the data published by the Indian Brand Equity Foundation (IBEF), during 2022-2023, India's iron ore exports amounted to USD 1.75 billion compared to USD 3.18 billion during 2021-2022.

- India's pharmaceutical industry holds a significant position on the global stage, ranking third in production volume and 14th in production value. Projections from the India Brand Equity Foundation (IBEF) suggest that the industry's market size is set to hit USD 65 billion in 2024, double to USD 130 billion by 2030, and soar to a staggering USD 450 billion by 2047.

- The oil and gas industry is among the eight core industries in India, playing a major role in influencing decision-making for all the other important sections of the economy. India's oil demand is projected to rise rapidly in the world, reaching 10 million barrels per day by 2030.

- According to the International Energy Agency (IEA), natural gas consumption in India is expected to grow by 25 billion cubic meters (bcm), registering an average annual growth of 9% until 2024.

- These factors will likely increase the demand for industrial valves in India during the forecast period.

Asia-Pacific Industrial Valves Industry Overview

The Asia-Pacific industrial valves market is fragmented, with no player capturing a significant share of the market. Some of the major players in the market include (not in any particular order) Emerson Electric Co., KITZ Corporation, Flowserve Corporation, Baker Hughes, and IMI Critical Engineering.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Valves from Water Treatment Plants

- 4.1.2 Increasing Demand for Valves in the Oil and Gas Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Capital Investment to Hamper the Market Growth

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Revenue)

- 5.1 By Type

- 5.1.1 Butterfly Valve

- 5.1.2 Ball Valve

- 5.1.3 Globe Valve

- 5.1.4 Gate Valve

- 5.1.5 Plug Valve

- 5.1.6 Other Types

- 5.2 By Product

- 5.2.1 Quarter-turn Valve

- 5.2.2 Multi-turn Valve

- 5.2.3 Other Products (Control Valves)

- 5.3 By Application

- 5.3.1 Power

- 5.3.2 Water and Wastewater Management (Including Desalination)

- 5.3.2.1 Metal, Mineral, and Mining

- 5.3.2.2 Other Applications

- 5.3.3 By Chemicals

- 5.3.4 Oil and Gas

- 5.3.4.1 Upstream

- 5.3.4.2 Mid-stream

- 5.3.4.3 Downstream

- 5.3.5 Food Processing

- 5.3.6 Pulp and Paper

- 5.3.7 Other Applications

- 5.4 By Geography

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Malaysia

- 5.4.6 Thailand

- 5.4.7 Indonesia

- 5.4.8 Vietnam

- 5.4.9 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Ranking Analysis

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Alfa Laval

- 6.3.2 AVK Holding AS

- 6.3.3 Baker Hughes

- 6.3.4 CIRCOR International Inc.

- 6.3.5 Crane Co.

- 6.3.6 Curtiss-Wright Corporation

- 6.3.7 Danfoss AS

- 6.3.8 EBRO ARMATUREN Gebr. Brer GmbH

- 6.3.9 Emerson Electric Co.

- 6.3.10 Flowserve Corporation

- 6.3.11 Georg Fischer Ltd

- 6.3.12 Hitachi Metals Ltd

- 6.3.13 Honeywell International Inc.

- 6.3.14 IMI Critical Engineering

- 6.3.15 ITT Inc.

- 6.3.16 KITZ Corporation

- 6.3.17 NIBCO

- 6.3.18 Okano Valve Mfg. Co. Ltd

- 6.3.19 PARKER HANNIFIN CORP.

- 6.3.20 SAMSON AKTIENGESELLSCHAFT

- 6.3.21 Schlumberger Limited

- 6.3.22 The Weir Group PLC

- 6.3.23 Valvitalia SpA

- 6.3.24 Velan Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219