|

市場調查報告書

商品編碼

1852152

超材料:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Metamaterials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

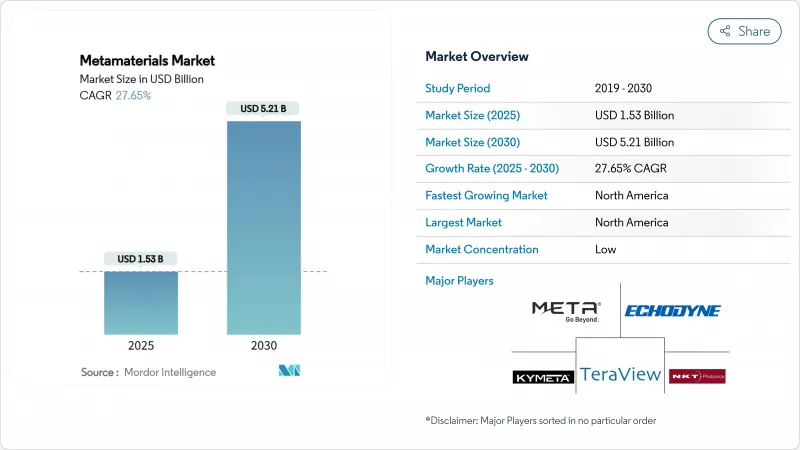

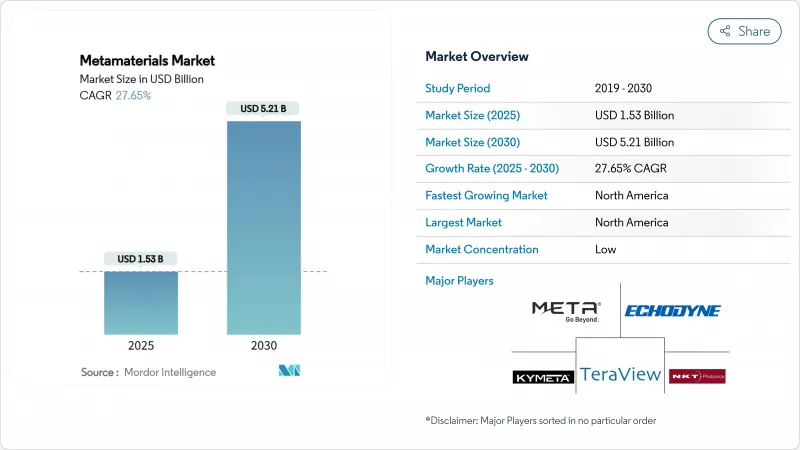

預計到 2025 年,超材料市場規模將達到 15.3 億美元,到 2030 年將達到 52.1 億美元,預測期(2025-2030 年)複合年成長率為 27.65%。

北美地區佔據35.88%的區域市場佔有率,是成長最快的地區,預計到2030年複合年成長率將達到28.92%。 5G/6G部署、國防隱身需求以及節能設備的需求是推動市場成長的主要因素。電磁超材料因其在天線和表面擇頻元件中的多功能應用,將佔總收入的44.19%。天線和雷達系統目前已佔總支出的62.94%,其中航太和國防領域的買家佔終端用戶需求的54.19%。該領域的競爭格局依然分散,許多專業廠商都在將各自的設計商業化。高昂的製造成本和有限的標準化程度阻礙了產品的廣泛應用,但積層製造和奈米製造技術的快速發展正在逐步縮小這些限制。

全球超材料市場趨勢與洞察

擴展 5G 和 6G 網路規劃:超材料輔助下一代連接

基於超材料的天線正在重新定義毫米波傳輸,它們將波束控制硬體壓縮到超薄層中,同時保持Gigabit的吞吐量。已在 60 GHz 頻段演示的數位編碼超表面能夠產生多個同步波束,從而緩解都市區的訊號阻塞並支援 6G 的可靠性。2D超表面可以改善非地面電波5G/6G 覆蓋的鏈路預算。商業供應商正從實驗室原型轉向整合可重構智慧表面的混合衛星終端,以確保行動平台不間斷的連接。這種超薄硬體與軟體定義控制的結合,使超材料市場在通訊業者在全球密集部署高頻段網路的過程中,能夠持續吸引通訊領域的投資。

奈米技術與材料科學進展:原子尺度精密工程

根據國家奈米技術計劃,聯邦政府已申請2025年撥款22億美元,累積支出超過450億美元,用於建造原子級製造的共用基礎設施。逐層積層製造技術如今能夠在整個表面上建立連續變化的梯度折射率分佈,使工程師能夠局部調節相位、振幅和偏振。這種高精度加速了超材料在結構健康監測器、生物醫學植入和汽車雷達外殼中的應用。早期使用3D列印互鎖模組製造頻率選擇性吸收器的生產測試實現了99.5%的吸收率,同時減少了模具工序。此類突破降低了准入門檻,使主流設備製造商在中期內實現大規模生產成為可能。

超材料:對知識差距認知不足阻礙市場滲透

複雜的波動物理概念令那些缺乏專案研發預算的領域的決策者望而卻步。美國國家科學基金會累計3.8667億美元用於其先進製造業人才培養計劃,旨在透過實踐培訓彌補這一缺口。展示天線小型化和噪音衰減優勢的示範計劃正在推動相關技術的應用,但拉丁美洲和東南亞部分地區的中小型企業仍面臨陡峭的學習曲線。

細分市場分析

預計到2024年,電磁感應技術將佔超材料市場收入的44.19%,年複合成長率達29.27%,鞏固其作為超材料市場核心地位的地位。該技術在頻率選擇面板、相位陣列天線和負折射率透鏡等領域的整合應用,正在推動電訊和國防領域的需求成長。以以金額為準,該領域目前佔超材料市場規模的7.2259億美元,預計到2030年將超過30億美元。利用具有增強生物化學靈敏度的石墨烯共振器進行兆赫探測的興起,將為未來帶來更多機會。

聲學、雙曲面和負指數等新興領域拓展了功能範圍。聲學結構透過歐盟資助的METAVISION試驗,用於抑制工業工廠中的機械振動。雙曲面板可引導亞衍射光子,實現超高解析度成像,這在醫學診斷領域具有重要意義。結合多種類型的混合堆疊結構,可在單一層壓板中實現對聲音、熱和光的多模態控制。因此,研究興趣正在多元化發展,同時電磁波在大規模應用的優勢也日益凸顯。

區域分析

北美地區佔35.88%,複合年成長率最高,達28.92%。聯邦政府對先進製造業和勞動力項目的3.8667億美元投資正在加強一個強大的創新生態系統。航太、國防和電訊的集中,確保了早期需求,並使本地供應商能夠改進大規模生產方法。

亞太地區正經歷工業化和電子技術能力融合的浪潮,而大規模的公共資金投入正是推動這項進程的關鍵。中國的戰略技術規劃正將資源集中在6G和衛星網路建設,加速超表面材料在基地台和行動終端天線領域的本地化應用。在印度的生產關聯激勵計劃(PLI)下,其電子產品產量預計將從2020-21會計年度的55.4萬液盎司(約合760億美元)增至2023-24會計年度的95.2萬液盎司(約合1150億美元),這將為半導體級超材料元件的發展創造有利條件。日本和韓國正在改進用於自動駕駛汽車和智慧工廠的高頻雷達吸波材料。

歐洲佔了重要佔有率,這得益於英國創新戰略和德國工業4.0藍圖下針對先進材料的公私合作項目。低場磁振造影和工業噪音控制的現場試驗表明,歐洲已建立起蓬勃發展的合作研究網路。政策框架強調開放測試平台和標準化,引導超材料市場走向跨國規模發展。

南美洲和中東及非洲是利用超材料增強型電訊骨幹網路實現跨越式發展的新興領域,可望超越傳統基礎設施。能源採集為遠端感測器節點供電,符合該地區非電氣化的發展優先事項,一旦成本障礙消除,其潛力將充分發揮。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 擴展 5G 和 6G 網路計劃

- 奈米技術和材料科學的進展

- 量子計算和光電的進展

- 來自航太和國防工業的需求不斷成長

- 日益重視能源效率和永續性

- 市場限制

- 對超材料優勢缺乏認知

- 合成超材料的成本

- 材料耐久性和標準化問題

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 專利分析

第5章 市場規模與成長預測

- 按類型

- 電磁

- 兆赫

- 光子

- 可調

- 表面擇頻元件(FSS)

- 其他類型(聲學、負指數/雙曲、非線性、掌性)

- 透過使用

- 天線和雷達

- 感應器

- 屏蔽裝置

- 超級鏡頭

- 光線和聲音過濾

- 其他用途(太陽能、吸收器等)

- 按最終用戶行業分類

- 航太/國防

- 電訊

- 電子學

- 衛生保健

- 其他終端使用者產業(汽車和交通運輸、能源和電力等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Acoustic Metamaterials Group Limited(AMG)

- Echodyne Corp.

- Evolv Technologies, Inc.

- Fractal Antenna Systems, Inc

- JEM Engineering

- Kymeta Corporation

- Meta Materials Inc.

- Metalenz, Inc.

- Metamagnetics

- Multiwave Technologies

- Nanohmics Inc.

- Nanoscribe GmbH and Co. KG

- NanoSonic, Inc.

- NKT Photonics A/S

- Pivotal Commware

- Teraview Limited

第7章 市場機會與未來展望

The Metamaterials Market size is estimated at USD 1.53 billion in 2025, and is expected to reach USD 5.21 billion by 2030, at a CAGR of 27.65% during the forecast period (2025-2030).

North America holds the leading 35.88% regional slice and is also the fastest-growing territory, propelled by a 28.92% CAGR through 2030. Demand pivots on 5G/6G roll-outs, defense stealth requirements, and energy-efficient devices. Electromagnetic metamaterials account for 44.19% of revenue thanks to their versatile role in antennas and frequency-selective surfaces. Antenna and radar systems already command 62.94% of spending, and aerospace and defense buyers contribute 54.19% of end-user demand. The competitive field remains fragmented as niche specialists commercialize proprietary designs. High fabrication costs and limited standardization still curb wider uptake, but rapid advances in additive manufacturing and nanofabrication are narrowing these constraints.

Global Metamaterials Market Trends and Insights

Expansion of 5G and 6G Network Plan: Metamaterials Enabling Next-Generation Connectivity

Metamaterial-based antennas are redefining millimeter-wave transmission by compressing beam-steering hardware into ultra-thin layers while sustaining multi-gigabit throughput. A digitally coded metasurface demonstrated at 60 GHz produced multiple simultaneous beams, a capability that mitigates urban signal blockage and underpins 6G reliability. Satellite links profit as well; 2D metasurfaces boost link budgets for non-terrestrial 5G/6G coverage. Commercial vendors have moved beyond lab prototypes, with hybrid satellite terminals integrating reconfigurable intelligent surfaces to secure uninterrupted connectivity for mobile platforms. This marriage of low-profile hardware and software-defined control positions the metamaterials market for sustained telecom spending as carriers densify high-band networks worldwide.

Advancements in Nanotechnology and Material Science: Precision Engineering at Atomic Scale

Federal programs request USD 2.2 billion for 2025 under the National Nanotechnology Initiative, lifting cumulative outlays above USD 45 billion and furnishing shared infrastructure for atomic-scale fabrication . Layer-by-layer additive methods now build graded index profiles that vary continuously across a surface, giving engineers a toolbox for tailoring phase, amplitude, and polarization locally. Such precision accelerates the insertion of metamaterials into structural health monitors, biomedical implants, and automotive radar housings. Early production trials using 3D-printed interlocking blocks to create frequency-selective absorbers reached 99.5% absorptivity while reducing tooling steps. These breakthroughs lower entry barriers and make volume output feasible for mainstream device makers over the medium term.

Lack of Awareness of Benefits of Metamaterials: Knowledge Gap Limiting Market Penetration

Complex wave-physics concepts deter decision-makers in sectors without dedicated R&D budgets. The U.S. National Science Foundation earmarked USD 386.67 million for advanced manufacturing workforce programs to bridge this gap with hands-on training . Demonstration projects that visualize gains in antenna miniaturization or noise attenuation are widening adoption, yet smaller firms in Latin America and parts of Southeast Asia still face steep learning curves.

Other drivers and restraints analyzed in the detailed report include:

- Growing Advancements in Quantum Computing and Photonics: Convergence Creating New Possibilities

- Increasing Demand from the Aerospace and Defense Industry: Strategic Applications Driving Adoption

- Cost of Synthesization of Metamaterials: Economic Barriers to Commercialization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electromagnetic variants accounted for 44.19% of 2024 revenue and are forecast to expand at 29.27% CAGR, reinforcing their role as the cornerstone of the metamaterials market. Their integration into frequency-selective panels, phased-array antennas, and negative-index lenses drives pervasive demand across telecom and defense. In value terms, this cohort represented USD 722.59 million of the metamaterials market size and is on track to cross USD 3.0 billion by 2030. The rise of terahertz detection, powered by graphene resonators with heightened biochemical sensitivity, amplifies future opportunities.

Emerging niches such as acoustic, hyperbolic, and negative-index formats broaden the functional palette. Acoustic structures dampen machinery vibration in industrial plants, supported by EU-funded METAVISION trials. Hyperbolic slabs channel sub-diffraction photons for super-resolution imaging, an asset in medical diagnostics. Hybrid stacks that fuse multiple classes unlock multi-modal control over sound, heat, and light within a single laminate. Research interest therefore accelerates diversification while reinforcing electromagnetic dominance at scale.

The Metamaterials Market Report Segments the Industry by Type (Electromagnetic, Terahertz, Tunable, Photonic, and More), Application (Antenna and Radar, Sensors, Cloaking Devices, Superlens, and More), End-User Industry (Healthcare, Telecommunication, and More), and Geography (Asia-Pacific, North America, Europe, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America translated a 35.88% stake and the highest regional CAGR of 28.92%. Federal investments of USD 386.67 million for advanced manufacturing and workforce programs reinforce a robust innovation ecosystem. Concentrated aerospace, defense, and telecom primes guarantee early-stage demand, enabling local suppliers to refine mass-production methods.

Asia-Pacific follows as industrialization and electronics capacity converge with sizable public funding. China's strategic technology plans channel resources into 6G and satellite networks, accelerating local adoption of metasurfaces for base-station and handset antennas. India's electronics output grew from INR 5.54 lakh crore (USD 76 billion) in FY 2020-21 to INR 9.52 lakh crore (USD 115 billion) in FY 2023-24 under the PLI scheme, providing fertile ground for semiconductor-grade metamaterial components. Japan and South Korea refine high-frequency radar absorbers for autonomous vehicles and smart factories.

Europe commands a sizeable share thanks to public-private programs targeting advanced materials under the UK Innovation Strategy and Germany's Industry 4.0 roadmap. Field trials in low-field MRI and industrial noise abatement testify to a thriving collaboration network. Policy frameworks emphasize open test beds and standardization, steering the metamaterials market toward cross-border scalability.

South America and the Middle East & Africa represent emerging frontiers, leveraging metamaterial-enhanced telecom backbones to leapfrog legacy infrastructure. Energy-harvesting metasurfaces that power remote sensor nodes align with regional off-grid electrification priorities, signaling untapped potential once cost barriers abate.

- Acoustic Metamaterials Group Limited (AMG)

- Echodyne Corp.

- Evolv Technologies, Inc.

- Fractal Antenna Systems, Inc

- JEM Engineering

- Kymeta Corporation

- Meta Materials Inc.

- Metalenz, Inc.

- Metamagnetics

- Multiwave Technologies

- Nanohmics Inc.

- Nanoscribe GmbH and Co. KG

- NanoSonic, Inc.

- NKT Photonics A/S

- Pivotal Commware

- Teraview Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of 5G and 6G Network Plan

- 4.2.2 Advancements in Nanotechnology and Material Science

- 4.2.3 Growing Advancements in Quantum Computing and Photonics

- 4.2.4 Increasing Demand from the Aerospace and Defense Industry

- 4.2.5 Growing Emphasis on Energy Efficiency and Sustainability

- 4.3 Market Restraints

- 4.3.1 Lack of Awareness of Benefits of Metamaterials

- 4.3.2 Cost of Synthesization of Metamaterials

- 4.3.3 Concerns of Material Durability and Standardization

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Patent Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Electromagnetic

- 5.1.2 Terahertz

- 5.1.3 Photonic

- 5.1.4 Tunable

- 5.1.5 Frequency Selective Surface (FSS)

- 5.1.6 Other Types(Acoustic, Negative-Index and Hyperbolic, Non-linear and Chiral)

- 5.2 By Application

- 5.2.1 Antenna and Radar

- 5.2.2 Sensors

- 5.2.3 Cloaking Devices

- 5.2.4 Superlens

- 5.2.5 Light and Sound Filtering

- 5.2.6 Other Applications (Solar, Absorbers, etc.)

- 5.3 By End-user Industry

- 5.3.1 Aerospace and Defense

- 5.3.2 Telecommunications

- 5.3.3 Electronics

- 5.3.4 Healthcare

- 5.3.5 Other End user Industries (Automotive and Transportation, Energy and Power, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Acoustic Metamaterials Group Limited (AMG)

- 6.4.2 Echodyne Corp.

- 6.4.3 Evolv Technologies, Inc.

- 6.4.4 Fractal Antenna Systems, Inc

- 6.4.5 JEM Engineering

- 6.4.6 Kymeta Corporation

- 6.4.7 Meta Materials Inc.

- 6.4.8 Metalenz, Inc.

- 6.4.9 Metamagnetics

- 6.4.10 Multiwave Technologies

- 6.4.11 Nanohmics Inc.

- 6.4.12 Nanoscribe GmbH and Co. KG

- 6.4.13 NanoSonic, Inc.

- 6.4.14 NKT Photonics A/S

- 6.4.15 Pivotal Commware

- 6.4.16 Teraview Limited

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Use of Metamaterials in Solar Systems

- 7.3 Metamaterial-based Radars for Drones