|

市場調查報告書

商品編碼

1852148

甲酸:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030)Formic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

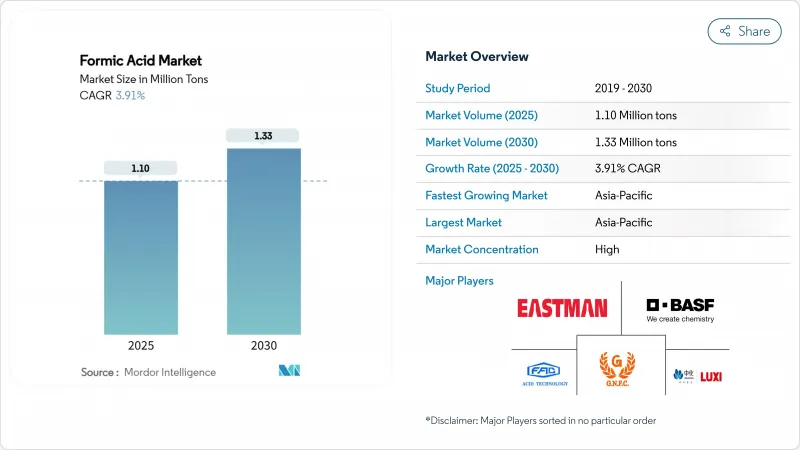

預計到 2025 年,甲酸市場規模將達到 110 萬噸,到 2030 年將達到 133 萬噸,預測期(2025-2030 年)複合年成長率為 3.91%。

對無抗生素動物飼料的需求不斷成長,生物基生產投資加速增加,以及皮革、橡膠和製藥等行業的應用穩步推進,共同支撐著這一成長趨勢。牲畜飼料保鮮已佔全球消費量的37.04%,隨著生產商尋求降低碳足跡,生物基路線正以4.72%的複合年成長率快速擴張。亞太地區引領著區域成長勢頭,該地區豐富的生產能力和扶持政策預計將推動其到2030年實現4.61%的區域複合年成長率。製程創新,特別是電化學二氧化碳-甲酸轉化技術,隨著先導計畫走向商業化規模,可望進一步重塑供應經濟格局。

全球甲酸市場趨勢與洞察

對牲畜飼料和青貯添加劑的需求不斷成長

對無抗生素畜牧生產的需求使得甲酸成為理想的防腐劑和抗菌劑。在雞飼料中添加4公斤/噸的甲酸,可以將沙門氏菌的數量降低到無法檢測的水平,從而保障食品安全並加強監管合規性。歐洲食品安全局允許在豬飼料中添加高達12,000毫克/公斤的甲酸,在雞飼料中添加高達10,000毫克/公斤的甲酸,這提供了法律確定性並加速了甲酸的應用。這些因素共同推動了飼料產業甲酸消費量的成長,使其成長速度超過了整體市場成長率。

皮革和製革行業的高需求

在高檔皮革生產中,甲酸用於將鍍液pH值調節至3.8-4.2,與礦物酸相比,甲酸能促進鉻的固定並降低鹽負荷。中國和印度的製革廠供應著全球大部分皮革,它們擴大要求甲酸的純度達到85%或更高,這為能夠保證產品品質穩定的供應商創造了溢價機會。

甲醇原料價格波動

在甲酸甲酯水解生產中,甲醇佔生產成本的60-70%,因此與天然氣價格相關的波動正在擠壓淨利率,並使長期供應協議的簽訂變得複雜。生產商正在透過試驗二氧化碳電解還原路線來規避風險,如果可再生能源價格持續下跌,這些路線有望消除對原料的依賴。

細分市場分析

飼料和青貯添加劑將佔甲酸市場最大佔有率,到2024年將佔全球銷售量的37.04%。預計這一佔有率將以4.21%的複合年成長率成長,這主要得益於對抗菌生長促進劑的監管限制。在禽類飼料中,添加量為4公斤/噸時檢測到了沙門氏菌,增強了養殖戶的信心,也提高了零售商的接受度。皮革鞣製仍然是第二大應用領域,利用了甲酸的pH值控制和鉻浸漬性能;而紡織廠則看重其在染浴中的緩衝能力。對甲酸純度要求較高的醫藥和特種化學品應用領域也正在興起,並佔了較高的價格。

成長前景也延伸至天然橡膠加工領域,甲酸因其更快的凝固動力學和更高的內聚拉伸強度而被廣泛應用。清洗和除垢領域也佔據穩定的市場佔有率,但規模較小,這得益於甲酸溶解礦物垢的能力,以及其比無機酸更低的環境影響。諸如SoftAcids之類的安全配方正在擴大小型營運商的使用範圍,預示著在預測期內市場需求將持續成長。

全球甲酸市場按應用領域(飼料和青貯添加劑、皮革鞣製及其他)、生產方法(甲酸甲酯水解法、羰基化法及其他)、終端用戶行業(農業、皮革和鞋類及其他)以及地區(亞太地區、北美地區及其他)進行細分。市場預測以噸為單位。

區域分析

亞太地區將佔據甲酸市場最大佔有率,到2024年將佔全球消費量的53.21%。中國主導該地區的甲酸供應,透過整合甲醇和下游化工產業,確保了成本競爭力。在出口獎勵政策和國內皮革產量成長的推動下,印度生產商正在建造新工廠,以提高該地區的甲酸自給率。日本和韓國為電子產品和醫藥合成提供高純度原料,而印尼則透過開拓橡膠產業,進一步推動了甲酸市場的成長。

北美是第二大市場,這主要得益於其龐大的動物性蛋白質產業以及政府對二氧化碳利用研發的大力投入。美國在電化學生產設備的試點部署方面處於領先地位,目標是在未來十年內實現商業化規模生產。加拿大的需求主要與糧食和畜牧業生產有關,而墨西哥的皮革和紡織品產業對二氧化碳的需求也不斷成長。

歐洲嚴格的飼料和化學品法規,加上雄心勃勃的脫碳目標,正在刺激對生物基製程的投資。歐盟對進口化學品的反傾銷措施將加劇競爭,並鼓勵本地產能擴張。南美洲將圍繞巴西不斷擴張的畜牧業發展,而中東將受益於鼓勵投資特種化學品的多元化政策。隨著亞洲出口成長和西方向低碳供應鏈轉型,跨區域貿易流動可能會更加順暢。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對牲畜飼料和青貯添加劑的需求不斷成長

- 皮革和製革行業的高需求

- 橡膠製品需求不斷成長

- 其抗菌特性使其在製藥業越來越受歡迎。

- 生物基生產技術的進步

- 市場限制

- 甲醇原料價格波動

- 腐蝕和處理風險

- 擴大生物丙酸作為替代品的應用

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 定價分析

第5章 市場規模與成長預測

- 透過使用

- 飼料和青貯添加劑

- 皮革鞣製

- 紡織品染色和整理

- 醫藥和化學中間體

- 其他用途(橡膠/乳膠凝固劑、清潔/除垢劑等)

- 透過生產方法

- 甲酸甲酯水解

- 羰基化技術

- 其他生產方法(草酸法、發酵/生物法)

- 按最終用途行業分類

- 農業

- 皮革和鞋類

- 纖維

- 化學品和溶劑

- 製藥

- 橡皮

- 其他終端用戶產業(石油天然氣、食品飲料等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

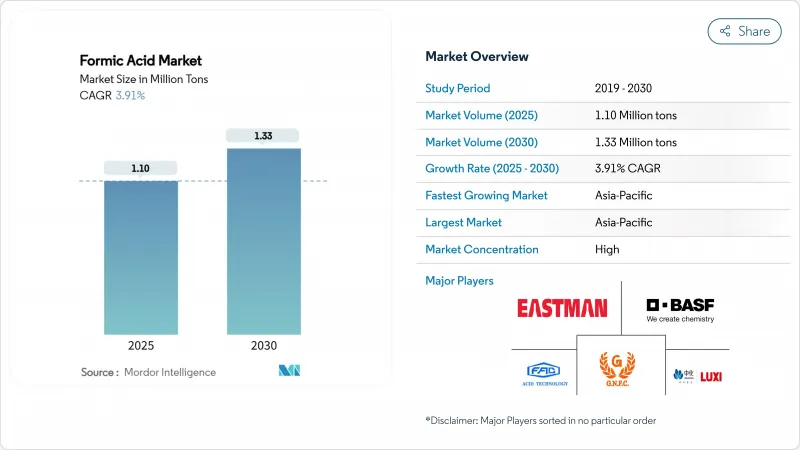

- BASF

- Eastman Chemical Company

- Gujarat Narmada Valley Fertilizers and Chemicals Ltd

- Luxi Chemical Group Co.,Ltd.

- Perstorp

- POLIOLI SpA

- Sintas Kurama Perdana

- Rashtriya Chemicals and Fertilizers Ltd

- Shandong Acid Technology Co., Ltd.

- Shandong Rongyue Chemical Co. Ltd

- Wuhan Ruisunny Chemical Co. Ltd

第7章 市場機會與未來展望

The Formic Acid Market size is estimated at 1.10 Million tons in 2025, and is expected to reach 1.33 Million tons by 2030, at a CAGR of 3.91% during the forecast period (2025-2030).

Rising demand for antibiotic-free animal feed, accelerating investment in bio-based production, and steady uptake across leather, rubber, and pharmaceutical applications underpin this growth path. Animal feed preservation already captures 37.04% of global consumption, and bio-based routes are expanding at 4.72% CAGR as producers seek lower-carbon footprints. Regional momentum is led by Asia-Pacific, where abundant manufacturing capacity and supportive policies are expected to secure a 4.61% regional CAGR through 2030. Process innovation-most notably electrochemical CO2-to-formic acid conversion-could further reshape supply economics as pilot projects move toward commercial scale

Global Formic Acid Market Trends and Insights

Growing Demand for Animal Feed and Silage Additives

Demand for antibiotic-free livestock production has positioned formic acid as a preferred preservative and antimicrobial. At 4 kg/ton in poultry diets, the acid can drive Salmonella counts to undetectable levels, safeguarding food safety and reinforcing regulatory compliance. The European Food Safety Authority allows inclusion rates up to 12,000 mg/kg for pigs and 10,000 mg/kg for poultry, providing legal certainty that accelerates adoption. These factors collectively lift feed-segment consumption above overall formic acid market growth.

Substantial Demand from Leather and Tanning Industry

Premium leather production relies on formic acid to adjust bath pH to 3.8-4.2, accelerating chrome fixation while lowering salt loads compared with mineral acids. Chinese and Indian tanneries, which supply a sizable portion of global hides, increasingly specify >= 85% purity, opening price-premium opportunities for suppliers able to guarantee consistency.

Methanol Feedstock Price Volatility

Because methanol represents 60-70% of production costs in methyl formate hydrolysis, natural-gas-linked price swings compress margins and complicate long-term supply contracts. Producers are hedging by piloting CO2 electro-reduction routes that could break feedstock dependence if renewable power prices keep falling.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand for Rubber Products

- Growing Adoption in Pharmaceutical Industry for Antibacterial Properties

- Risks Related to Corrosion and Handling

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Animal feed & silage additives controlled 37.04% of global volume in 2024, giving the segment the largest slice of formic acid market size. Supported by regulatory curbs on antibiotic growth promoters, this share is projected to widen at a 4.21% CAGR. In poultry rations, inclusion rates of 4 kg/ton eliminate detectable Salmonella, boosting farmer confidence and retailer acceptance. Leather tanning remains the second-largest application, capitalizing on the acid's pH control and chrome-penetration benefits, while textile mills value its dye-bath buffering capability. Pharmaceutical and specialty chemical uses are emerging, where high-purity requirements yield premium prices.

Growth prospects extend to natural rubber processing, which adopts formic acid for faster coagulation kinetics and higher aggregate tensile strength. Cleaning and descaling occupy a steady but smaller niche, leveraging the acid's mineral-scale dissolving power at lower environmental impact than stronger inorganic acids. Safety-engineered formulations such as SoftAcid broaden access among smaller operations, suggesting incremental demand upside over the forecast period.

The Global Formic Acid Market is Segmented by Application (Animal Feed and Silage Additives, Leather Tanning, and More), Production Method (Methyl Formate Hydrolysis, Carbonylation Technology, and Other Production Methods), End-Use Industry (Agriculture, Leather and Footwear, and More) and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia-Pacific held 53.21% of global consumption in 2024, giving the region the largest slice of formic acid market share. China dominates regional supply, leveraging integrated methanol and downstream chemical complexes to ensure cost competitiveness. India's producers, supported by export incentives and growing domestic leather output, are building new plants that lift regional self-sufficiency. Japan and South Korea source high-purity material for electronics and pharmaceutical synthesis, while Indonesia drives incremental growth through rubber-sector uptake.

North America is the second-largest region, propelled by a vast animal-protein sector and government funding for CO2-utilization R&D. The United States leads pilot deployment of electrochemical production units, eyeing commercial scale by decade-end. Canada's demand is tied mainly to grain and livestock production, whereas Mexico sees rising leather and textile usage.

Europe combines strict feed and chemical regulations with aggressive decarbonization targets, spurring investment in bio-based processes. EU anti-dumping measures on imported chemicals intensify competition and encourage local capacity expansion. South America's growth centers on Brazil's expanding livestock sector, while the Middle East benefits from diversification agendas that encourage specialty-chemical investments. Cross-regional trade flows will likely stay fluid as Asia grows exports and western regions pivot to low-carbon supply chains.

- BASF

- Eastman Chemical Company

- Gujarat Narmada Valley Fertilizers and Chemicals Ltd

- Luxi Chemical Group Co.,Ltd.

- Perstorp

- POLIOLI SpA

- Sintas Kurama Perdana

- Rashtriya Chemicals and Fertilizers Ltd

- Shandong Acid Technology Co., Ltd.

- Shandong Rongyue Chemical Co. Ltd

- Wuhan Ruisunny Chemical Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Animal Feed and Silage Additives

- 4.2.2 Substantial Demand from Leather and Tanning Industry

- 4.2.3 Increasing Demand for Rubber Products

- 4.2.4 Growing Adoption in Pharmaceutical Industry for Antibacterial Properties

- 4.2.5 Growing Advancements in its Bio-based Production Technologies

- 4.3 Market Restraints

- 4.3.1 Methanol feedstock price volatility

- 4.3.2 Risks Related to Corrosion and Handling

- 4.3.3 Rising Usage of bio-propionic acid as alternative

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Price Analysis

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Animal Feed and Silage Additives

- 5.1.2 Leather Tanning

- 5.1.3 Textile Dyeing and Finishing

- 5.1.4 Intermediary in Pharmaceuticals and Chemicals

- 5.1.5 Other Applications (Rubber and Latex Coagulation, Cleaning and Descaling Agents, etc.)

- 5.2 By Production Method

- 5.2.1 Methyl Formate Hydrolysis

- 5.2.2 Carbonylation Technology

- 5.2.3 Other Production Methods (Oxalic-acid Route, Fermentation/Bio-based Route)

- 5.3 By End-use Industry

- 5.3.1 Agriculture

- 5.3.2 Leather and Footwear

- 5.3.3 Textile

- 5.3.4 Chemicals and Solvents

- 5.3.5 Pharmaceuticals

- 5.3.6 Rubber

- 5.3.7 Others End User Industries (Oil and Gas, Food and Beverage, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Eastman Chemical Company

- 6.4.3 Gujarat Narmada Valley Fertilizers and Chemicals Ltd

- 6.4.4 Luxi Chemical Group Co.,Ltd.

- 6.4.5 Perstorp

- 6.4.6 POLIOLI SpA

- 6.4.7 Sintas Kurama Perdana

- 6.4.8 Rashtriya Chemicals and Fertilizers Ltd

- 6.4.9 Shandong Acid Technology Co., Ltd.

- 6.4.10 Shandong Rongyue Chemical Co. Ltd

- 6.4.11 Wuhan Ruisunny Chemical Co. Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Sustainable Use of Formic Acid in Fuel Cell