|

市場調查報告書

商品編碼

1852038

亞太地區油漆塗料:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Asia-Pacific Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

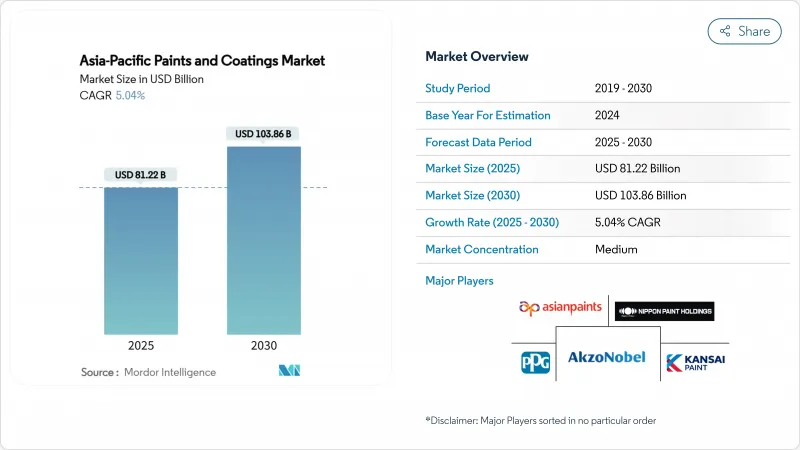

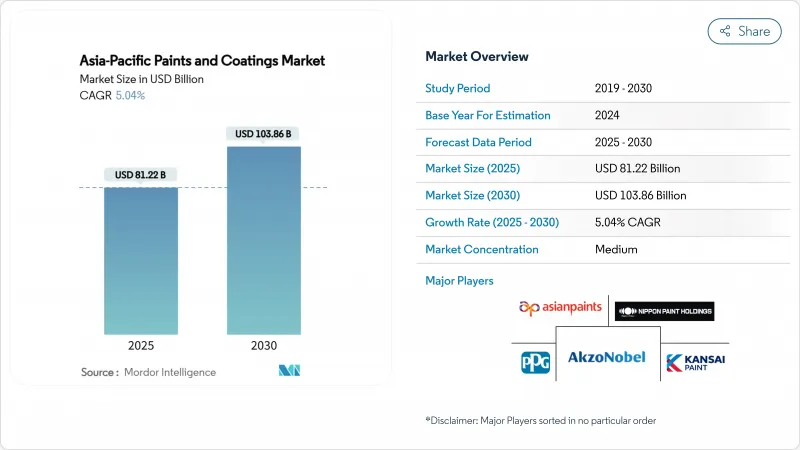

亞太地區油漆和塗料市場規模預計在 2025 年達到 812.2 億美元,預計到 2030 年將達到 1,038.6 億美元,預測期(2025-2030 年)複合年成長率為 5.04%。

日益嚴格的環境法規、加速的都市化以及汽車和工業生產的快速擴張支撐了持續的需求,而向水性平台的轉型則使技術領先企業能夠保持利潤率的韌性。中國在2024年仍將保持其主導地位,市佔率高達56.42%,但隨著基礎建設投資和房屋重建的加速發展,印度將在2030年之前主導成長。BASF和阿克蘇諾貝爾等公司的策略調整表明,規模、產品組合平衡和地理深度將決定競爭優勢。數位化色彩工具、高階都市區住宅更快的翻新週期以及政策支持的「綠色船舶」維修,都為亞太地區的塗料市場增添了新的需求,使其區別於更成熟的化工價值鏈。

亞太地區塗料市場趨勢及洞察

新興東協城市的建設熱潮

印尼、泰國、越南、馬來西亞和菲律賓的建築業蓬勃發展,持續推動建築和防護塗料的銷售量。印尼預計在2025年成為全球第三大建築市場,貢獻9%的GDP,並維持13%的年成長率。大型交通走廊、工業和經濟適用房專案為混凝土、鋼骨和木材基材的塗料應用創造了更多機會。國際承包商通常會根據綠色建築認證的要求指定低VOC塗料,這進一步推動了對水性塗料的需求。汽車和電子產業叢集的外商直接投資也帶動了高性能OEM塗料、地板塗料和機械塗料的訂單。雖然持續的資本流入取決於宏觀經濟穩定和地緣政治平靜,但短期訂單足以滿足亞太地區塗料市場與建築相關的銷售成長需求。

縮短中國一流住宅大樓的重新粉刷週期

在中國成熟的房地產市場,隨著業主優先考慮美觀提升和資產保值,房屋重新粉刷的周期正在縮短。立邦塗料報告稱,一、二線城市的市場成長顯著,房屋重新粉刷的周期已從5-7年縮短至3-5年。能夠確保色彩持久的高階品牌正抓住這一趨勢,引導客戶轉向利潤更高的產品。新屋開工量的結構性放緩,使得可支配收入更多地用於房屋維修,即使竣工量不高,也推高了每套房屋的價值。市場需求主要集中在符合GB/T 33372-2020排放標準的室內整理加工劑、水性底漆和無味面漆。雖然這一成長動能能否持續取決於家庭收入成長和整體房地產市場情緒,但亞太地區塗料市場的短期成長潛力已相當可觀。

對揮發性有機化合物和甲醛的監管更加嚴格

中國GB/T 33372-2020標準將建築塗料中VOC(揮發性有機化合物)的允許基準值降低至120克/公升,各地執法宣傳活動正在加強審核。缺乏研發能力或水性分散基礎設施的小型生產商將面臨配方調整成本,並在合規期限過後面臨供應鏈中斷的風險。越南和馬來西亞也正在推出類似的規定,迫使跨境供應商協調產品線、儲備特定SKU或退出低利潤的溶劑型產品類別。雖然從長遠來看,這將促使市場需求轉向更高價值的水性產品,但短期產能調整和轉型成本將限制整體產量,從而抑制亞太地區塗料市場的成長動能。

細分市場分析

預計到2024年,水性塗料將佔亞太地區塗料市場佔有率的57.05%,並在2030年之前以5.71%的複合年成長率成長。 2018年上海外牆溶劑禁令的實施,引發了廣東、北京以及沿海工業一系列廣泛的政策變革,促使建築商轉向低VOC、低氣味的替代品。因此,亞太地區的塗料市場正從逐步採用轉向系統性替換,這主要得益於新型丙烯酸乳化的出現,這些乳液具有與溶劑型醇酸塗料相媲美的抗粘連性、早期防水性和快速重塗性能。汽車原始設備製造商(OEM)正在檢驗能夠承受東南亞常見濕度波動的水性底塗層和透明塗層組合,消除了以往的品質擔憂。

粉狀、紫外光固化、高固含量塗料系統是亞太地區塗料產業中一個規模雖小但成長迅速的細分市場,尤其適用於金屬家具、家用電器和3C電子產品領域。粉末塗料的零VOC認證和超過95%的可回收性使其符合新加坡和澳洲以ESG主導的採購政策。然而,烘箱和預處理生產線的購買成本限制了資金緊張的中小企業叢集採用此類塗料。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 新興東協城市的建設熱潮

- 縮短中國一流住宅的重新粉刷週期

- 原始設備製造商轉向水性汽車面漆

- 政府「綠色船舶」改造補貼(韓國、日本)

- 印度智慧城市計畫強制要求使用冷屋頂塗料

- 市場限制

- 對揮發性有機化合物和甲醛的監管更加嚴格(例如,中國GB/T 33372-2020)

- 二氧化鈦價格波動

- 印尼和越南缺乏合格的工業油漆工

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 透過技術

- 水系統

- 溶劑型

- 粉末塗裝

- 其他技術(紫外線/電子束、高固含量等)

- 依樹脂類型

- 丙烯酸纖維

- 醇酸

- 聚氨酯

- 環氧樹脂

- 聚酯纖維

- 其他(酚類、酮類等)

- 按最終用戶行業分類

- 建築/裝飾

- 車

- 木頭

- 保護漆

- 一般工業用途

- 運輸

- 包裝

- 按地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 印尼

- 泰國

- 馬來西亞

- 越南

- 菲律賓

- 新加坡

- 亞太其他地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- 3TREESGROUP

- Akzo Nobel NV

- Asian Paints

- Avian Brands

- Axalta Coating Systems, LLC

- BASF

- Berger Paints India

- Boysen Paints

- Chokwang Paint

- Davies Paints Philippines Inc.

- DuluxGroup Ltd

- Hempel A/S

- Jotun

- Kansai Paint Co., Ltd

- Nippon Paint Holdings Co., Ltd

- PPG Industries Inc.

- Propanraya

- The Sherwin-Williams Company

第7章 市場機會與未來展望

The Asia-Pacific Paints and Coatings Market size is estimated at USD 81.22 billion in 2025, and is expected to reach USD 103.86 billion by 2030, at a CAGR of 5.04% during the forecast period (2025-2030).

Tightening environmental regulations, accelerating urbanization, and the rapid scale-up of automotive and industrial production underpin sustained demand, while the shift to water-borne platforms positions technology leaders for margin resilience. China retained dominance with a 56.42% share in 2024, yet India is setting the growth pace through 2030 as infrastructure outlays and housing upgrades gain momentum. Raw-material volatility, especially in titanium-dioxide pricing, keeps margin management in sharp focus, and strategy realignments, such as divestitures by BASF and AkzoNobel, signal that scale, portfolio balance, and regional depth will define competitive advantage. Digitalized color tools, faster repaint cycles in premium urban housing, and policy-backed "green ship" retrofits add incremental layers of demand that distinguish the Asia-Pacific paints and coatings market from more mature chemical value chains.

Asia-Pacific Paints And Coatings Market Trends and Insights

Construction Boom in Emerging ASEAN Cities

Surging construction activity in Indonesia, Thailand, Vietnam, Malaysia, and the Philippines continues to lift architectural and protective coating volumes. Indonesia is on track to become the world's third-largest construction market by 2025, contributing 9% to national GDP while growing 13% year-on-year. Large transport corridors, industrial estates, and affordable-housing programs multiply coating touchpoints across concrete, steel, and wood substrates. International contractors typically specify low-VOC paints that align with green-building certifications, further tilting demand toward water-borne chemistry. Foreign direct investment in automotive and electronics clusters is also pushing orders for high-performance OEM, floor, and machinery coatings. Continued inflows hinge on macroeconomic stability and geopolitical calm, but near-term backlogs keep the Asia-Pacific paints and coatings market well supplied with construction-linked volume upside.

Re-painting Cycle Compression in Tier-1 Chinese Housing

China's mature property markets are experiencing shorter repaint intervals as owners prioritize aesthetic upgrades and asset preservation. Nippon Paint reported growth in Tier-1 and Tier-2 cities where repaint cycles have narrowed from 5-7 years to 3-5 years. Premium brands able to guarantee color retention for extended periods are exploiting the trend to trade customers up to higher-margin SKUs. Structural deceleration in new housing starts has redirected disposable incomes toward renovation outlays, raising value per dwelling even as unit completions soften. Demand is concentrated in interior finishes, water-borne primers and odor-free top-coats that meet GB/T 33372-2020 emission limits. Sustained momentum will depend on household income growth and sentiment in the broader real-estate market, yet the near-term uplift is already material for the Asia-Pacific paints and coatings market.

Tightening VOC and Formaldehyde Caps

China's GB/T 33372-2020 standard lowered permissible VOC thresholds for architectural coatings to 120 g/L, and provincial enforcement campaigns have intensified audit frequency. Smaller manufacturers lacking research and development and water-borne dispersion infrastructure face reformulation expenses and risk supply-chain disruptions if compliance deadlines lapse. Similar directives are taking shape in Vietnam and Malaysia, pushing cross-border suppliers to harmonize product lines, stock separate SKUs or exit low-margin solvent categories. While the long-term net effect channels demand into higher-value water-borne offerings, near-term capacity rationalization and transition costs suppress overall output, trimming Asia-Pacific paints and coatings market momentum.

Other drivers and restraints analyzed in the detailed report include:

- OEM Shift to Water-borne Auto Topcoats

- Mandated Cool-Roof Coatings in India's Smart-City Program

- Skills Deficit of Certified Industrial Coaters in Indonesia and Vietnam

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Water-borne formulations captured 57.05% of the Asia-Pacific paints and coatings market share in 2024 and are projected to record a 5.71% CAGR through 2030. Shanghai's 2018 exterior-wall solvent ban crystallized a wider policy wave across Guangdong, Beijing, and coastal industrial parks, steering builders toward low-VOC and low-odor alternatives. The Asia-Pacific paints and coatings market has therefore shifted from incremental adoption to systemic replacement, helped by new acrylic emulsions that deliver block resistance, early-water resistance, and rapid re-coat times comparable with solvent-borne alkyds. Automotive OEMs have validated water-borne base-coat clear-coat stacks that withstand humidity swings common to Southeast Asia, erasing previous quality concerns.

Powder, UV-curable, and high-solids systems together account for a smaller but fast-growing slice of the Asia-Pacific paints and coatings industry, particularly in metal furniture, appliances, and 3C electronics. Powder's zero-VOC credentials, plus reclamation efficiencies above 95%, appeal to ESG-driven procurement policies in Singapore and Australia. However, capital costs for ovens and pre-treatment lines limit penetration in cash-constrained SME clusters.

The Asia-Pacific Paints and Coatings Market Report is Segmented by Technology (Water-Borne, Solvent-Borne, Powder Coating, and Other Technologies), Resin Type (Acrylic, Alkyd, Polyurethane, and More), End-User Industry (Architectural/Decorative, Automotive, Wood, and More), and Geography (China, India, Japan, South Korea, Australia and New Zealand, Indonesia, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- 3TREESGROUP

- Akzo Nobel N.V.

- Asian Paints

- Avian Brands

- Axalta Coating Systems, LLC

- BASF

- Berger Paints India

- Boysen Paints

- Chokwang Paint

- Davies Paints Philippines Inc.

- DuluxGroup Ltd

- Hempel A/S

- Jotun

- Kansai Paint Co., Ltd

- Nippon Paint Holdings Co., Ltd

- PPG Industries Inc.

- Propanraya

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Construction Boom in Emerging ASEAN Cities

- 4.2.2 Re-Painting Cycle Compression in Tier-1 Chinese Housing

- 4.2.3 OEM Shift to Water-Borne Auto Topcoats

- 4.2.4 Government "Green Ship" Retro-Fit Subsidies (Korea, Japan)

- 4.2.5 Mandated Cool-Roof Coatings in India's Smart-City Program

- 4.3 Market Restraints

- 4.3.1 Tightening VOC and Formaldehyde Caps (China GB/T 33372-2020, Etc.)

- 4.3.2 Titanium-Dioxide Price Volatility

- 4.3.3 Skills Deficit of Certified Industrial Coaters in Indonesia and Vietnam

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Water-Borne

- 5.1.2 Solvent-Borne

- 5.1.3 Powder Coating

- 5.1.4 Other Technologies (UV/ EB, High-Solids, etc.)

- 5.2 By Resin Type

- 5.2.1 Acrylic

- 5.2.2 Alkyd

- 5.2.3 Polyurethane

- 5.2.4 Epoxy

- 5.2.5 Polyester

- 5.2.6 Others (Phenolic, Ketonic, etc.)

- 5.3 By End-user Industry

- 5.3.1 Architectural/ Decorative

- 5.3.2 Automotive

- 5.3.3 Wood

- 5.3.4 Protective Coatings

- 5.3.5 General Industrial

- 5.3.6 Transportation

- 5.3.7 Packaging

- 5.4 By Geography

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Australia and New Zealand

- 5.4.6 Indonesia

- 5.4.7 Thailand

- 5.4.8 Malaysia

- 5.4.9 Vietnam

- 5.4.10 Philippines

- 5.4.11 Singapore

- 5.4.12 Rest of Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3TREESGROUP

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Asian Paints

- 6.4.4 Avian Brands

- 6.4.5 Axalta Coating Systems, LLC

- 6.4.6 BASF

- 6.4.7 Berger Paints India

- 6.4.8 Boysen Paints

- 6.4.9 Chokwang Paint

- 6.4.10 Davies Paints Philippines Inc.

- 6.4.11 DuluxGroup Ltd

- 6.4.12 Hempel A/S

- 6.4.13 Jotun

- 6.4.14 Kansai Paint Co., Ltd

- 6.4.15 Nippon Paint Holdings Co., Ltd

- 6.4.16 PPG Industries Inc.

- 6.4.17 Propanraya

- 6.4.18 The Sherwin-Williams Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment