|

市場調查報告書

商品編碼

1851966

印度農業曳引機:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)India Agricultural Tractor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

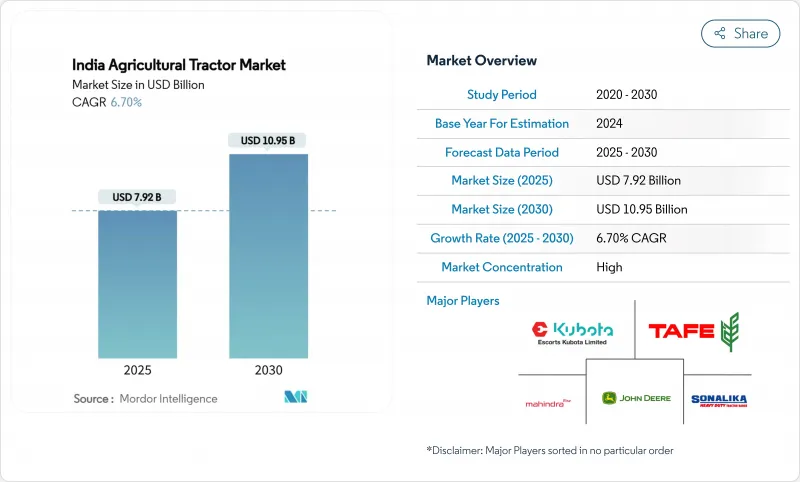

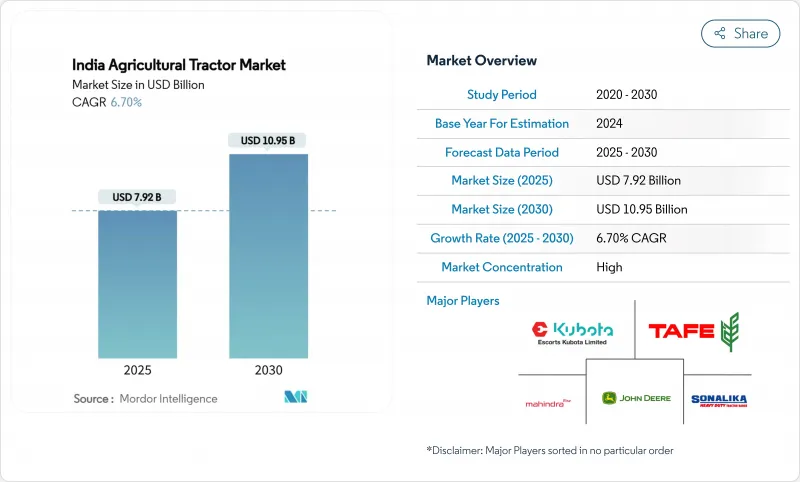

印度農業曳引機市場規模預計在 2025 年達到 79.2 億美元,在 2030 年達到 109.5 億美元,年複合成長率為 6.70%。

成長與直接福利轉移計畫、排放合規期限以及政府支持的機械化基金密切相關,這些因素共同塑造了採購週期。太陽能水泵覆蓋範圍的擴大、二手設備平台的快速數位化以及精密農業的普及正在擴大基本客群,而日益緊縮的信貸環境則抑制了成長勢頭。區域需求高度集中在北部平原地區,而西部各州近期經歷了最快速的成長,因為多元化的作物組合使得高階設備更具吸引力。

印度農業曳引機市場趨勢與洞察

直接髮放「總理農民收入支持計畫」(PM-Kisan)補貼後,與補貼相關的需求激增

2025年8月,PM-Kisan季度補貼2,050億盧比(約25億美元)注入流動性,六週內曳引機融資申請量激增。受益農民近期對31-50馬力曳引機支付了高達20%的首付,進一步強化了生產者與補貼發放週期同步的周期性需求成長。因此,印度曳引機產業正更加密切地關注資金流動以及作物季節性變化。製造商透過將生產分類為中階和高階市場來對沖波動。數位化支付管道減少了資金流失,提高了銷售預測的可靠性。只要每年600億盧比(約7,200萬美元)的補貼維持不變,印度曳引機產業就可能迎來一波可預測的流動性成長。

甘蔗種植區快速曳引機電氣化試點項目

在PM E-DRIVE(PM電動驅動創新車輛升級計畫)計畫的支持下,政府採集費用提供高達40%的補貼,並已啟動試點計畫。在這些試驗計畫中,甘蔗合作社測得每小時燃料節省量達60-70%。在馬哈拉斯特拉邦和北方邦,由於甘蔗種植密度高,電動曳引機的使用率很高,投資回報前景可觀。早期用戶正在維修棚屋,安裝30kW的充電樁,並連接到非尖峰時段電價。零件製造商表示,國內用於牽引電池、溫度控管和小型逆變器的生態系統仍在發展中。印度曳引機產業將電氣化視為規避排放法規並吸引注重環境、社會和治理(ESG)的買家的一種途徑。雖然目前的試點車隊規模較小,僅有幾百台,但預計到2027年電池成本將大幅下降,這將使25-35馬力範圍內的曳引機成為主流,尤其是在太陽能水泵已經改善農村負載率的地區。

更嚴格的非道路排放氣體法規(TREM-V),以及虛高的價格標籤

針對功率超過37千瓦的引擎,第五階段排放法規將增加排放氣體後處理系統,將使工廠成本增加8-12%。主要目標商標產品製造商(OEM)正在本地新建生產線上生產柴油氧化觸媒(DOC)和柴油顆粒過濾器(DPF)模組,例如FPT位於諾伊達的F28工廠。規模較小的品牌則面臨退出市場或尋求契約製造的風險。農民會優先購買早期階段的曳引機,可能導致2024-2025年出現需求激增,隨後出現低谷。信貸機構將錯開貸款期限,並將殘值與法規規定的報廢期限掛鉤。隨著供應商擴大過濾器基板和感測器的生產規模,成本轉嫁最終會趨於正常,但短期內的價格缺口將抑製印度曳引機產業的成長。

細分市場分析

31-50馬力頻寬佔據印度曳引機市場46%的佔有率,主要面向1-3公頃的耕地,在這些耕地上,多功能性比專業動力更為重要。尤其是在柴油價格上漲之後,農民們更青睞那些在購置成本和燃油效率之間取得良好平衡的引擎。隨著多種作物種植和打包機的普及,對更高扭力的需求日益成長,51-80馬力區間的曳引機將以9.3%的複合年成長率成長。 TREM-V技術的推廣將加速優質化,使入門級車型的價格接近配置豐富的車型。 GPS導航、CAN總線控制的農具以及更長的保養週期正逐漸成為50馬力及以上曳引機的標配。馬恆達進軍30馬力以下細分市場表明,微型農地的需求仍然存在,但資金籌措障礙限制了其成長。 80馬力以上的曳引機主要面向承包商和出口作物種植園,但在市場整合加劇之前,仍將保持小眾市場地位。

中階曳引機擴大配備遠端資訊處理系統,用於追蹤工作小時數、負載容量和燃油量,從而幫助貸款機構進行風險評估。隨著二手曳引機交易平台日趨成熟,31-50馬力曳引機的殘值不斷提升,進一步檢驗了其經濟性。田間試驗顯示,在印度恆河平原的稻麥耕耘機可使生產率提高12%。更高馬力的曳引機採用機器人換檔變速箱和電液轉向系統來減輕操作員的疲勞,但其普及程度取決於工資成長和定製作業的密度。因此,印度曳引機產業呈現功率等級分層的趨勢:中型曳引機保值性高,高階曳引機技術創新強勁,而小型曳引機則面臨價格壓力。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 總理農民補貼直接支付後,與補貼相關的需求激增

- 甘蔗種植帶曳引機車隊快速電氣化試點項目

- 規範二手曳引機市場將改善升級週期。

- 最低支援價格(MSP)下滑有利於中型馬力曳引機的銷售

- 無人機輔助掛鉤系統促進交叉銷售

- 農場太陽能水泵計畫旨在提高曳引機動力輸出軸(PTO)的利用率

- 市場限制

- 由於更嚴格的非道路排放法規(TREM-V)導致價格上漲

- 面積小於一公頃的土地持續零散分佈

- 遠端資訊處理技術普及率低限制了資金籌措創新

- 非銀行金融公司流動性危機後,農村信貸成長疲軟。

- 監管環境

- 技術展望

- 波特的五力模型

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按引擎輸出

- 小於30馬力

- 31-50 HP

- 51-80 HP

- 超過 80 匹馬力

- 按驅動類型

- 兩輪驅動

- 四輪驅動

- 透過使用

- 高地農用曳引機

- 果園曳引機

- 其他用途

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Mahindra&Mahindra Ltd.

- Tractors and Farm Equipment Limited

- Escorts Kubota Limited.

- Deere & Company

- CNH Industrial NV

- Sonalika Group(International Tractors Limited(ITL))

- VST Tillers Tractors Limited

- Same Deutz-Fahr India Private Limited(SDF Group SpA)

- Indo Farm Equipment Limited

- Captain Tractors Pvt. Ltd.

- Action Construction Equipment Limited

- Preet Tractors Private Limited

第7章 市場機會與未來展望

The India agricultural tractor market size stands at USD 7.92 billion in 2025 and is forecast to reach USD 10.95 billion by 2030, advancing at a 6.70% CAGR.

Growth is tied to direct-benefit transfer programs, emission compliance deadlines, and state-backed mechanization funds that shape procurement cycles. Expanding solar pump coverage, rapid digitalization of used-equipment platforms, and precision-agriculture adoption are widening the customer base, while a gradually tightening credit environment tempers momentum. Regional demand is highly concentrated in the northern plains, and western states have recently registered the quickest expansion as diversified crop portfolios justify premium equipment.

India Agricultural Tractor Market Trends and Insights

Subsidy-Linked Demand Spikes After PM-Kisan Direct Benefit Transfers

Quarterly PM-Kisan disbursements of INR 20,500 crore (USD 2.5 billion) in August 2025 infused liquidity that lifted tractor finance applications within six weeks Beneficiary farmers recently cover up to 20% of a down payment on 31-50 HP models, reinforcing cyclical surges that producers synchronize with payment calendars. The tractor industry in the Indian market, therefore, tracks fiscal flows more closely than crop-seasonality alone. Manufacturers hedge volatility by splitting production runs between mid-range volumes and premium variants, while dealers preload inventory before each installment release. Digital payment rails shrink leakages and make sales forecasting more reliable. As long as the annual INR 6,000 (USD 72) benefit stays intact, the tractor industry in the Indian market is likely to ride predictable liquidity waves.

Rapid Tractor Fleet Electrification Pilots in Sugar-Cane Belts

Subsidies covering up to 40% of e-tractor acquisition costs under the PM E-DRIVE (PM Electric Drive Revolution in Innovative Vehicle Enhancement) program have triggered pilots where cane cooperatives measure 60-70% fuel-cost savings per hour. Maharashtra and Uttar Pradesh leverage dense cane clusters that assure high utilization, boosting payback prospects. Early adopters retrofit sheds with 30 kW chargers linked to off-peak tariffs. Component makers report a nascent domestic ecosystem for traction batteries, thermal management, and compact inverters. The tractor industry in the Indian market sees electrification as an avenue to sidestep emission penalties and win ESG-minded buyers. While current pilot numbers are in the low hundreds, battery cost declines projected for 2027 could unlock mainstream uptake in the 25-35 HP range, especially where solar pumps already improve rural load factors.

Tightening Non-Road Emission Standards (TREM-V), Inflating Price Tags

Stage V limits for engines above 37 kW add emission after-treatment systems that raise factory costs by 8-12%. Larger OEMs (Original Equipment Manufacturers) localize DOC-DPF modules at new lines such as FPT's F28 plant in Noida. Smaller brands risk market exit or seeking contract manufacturing. Farmers front-load purchases of pre-stage tractors, causing a demand pull-forward in 2024-25 and a potential trough thereafter. Credit financiers split loan tenors so residual values align with regulatory obsolescence. Over time, cost pass-through will normalize as suppliers scale filter substrates and sensors, but an interim affordability gap dampens the tractor industry in the Indian market's growth.

Other drivers and restraints analyzed in the detailed report include:

- Formalization of Used-Tractor Marketplaces Improving Upgrade Cycles

- Minimum Support Price (MSP) indexation favoring mid-HP tractor sales

- Low Telematics Adoption is Limiting Financing Innovation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 31-50 HP band owns 46% of the tractor industry in India market share, anchored in plots of 1-3 hectares where versatility trumps specialized power. Farmers gravitate to engines that balance purchase price with fuel efficiency, especially after diesel price spikes. The 51-80 HP segment expands at a 9.3% CAGR as multi-crop rotations and baler adoption demand higher torque. Premiumization gathers pace because TREM-V compliance pushes base-model prices closer to feature-rich trims. GPS guidance, CAN-enabled implement control, and longer service intervals are becoming standard above 50 HP. Mahindra's thrust into sub-30 HP niches illustrates residual demand for micro-plots, yet financing hurdles temper growth. Above 80 HP units cater to contractors and export-crop estates but remain niche until consolidation advances.

Mid-range tractors increasingly embed telematics that capture hours, load, and fuel, assisting lenders with risk scoring. As used-tractor portals mature, residual values for 31-50 HP units strengthen, further validating ownership economics. Field trials show a 12% productivity lift when mid-HP tractors pair with minimal-tillage implements, especially in rice-wheat systems across the Indo-Gangetic plain. High-HP modules leverage robotic shift transmissions and electro-hydraulic steering to cut operator fatigue, but adoption hinges on wage inflation and custom-hiring density. The tractor industry in the Indian market thus sees power-band stratification: value retention in mid-range, innovation in upper tiers, and affordability pressure in sub-compact classes.

The India Tractor Market Report is Segmented by Engine Power (Less Than 30 HP, 31-50 HP, and More), by Drive Type (Two-Wheel Drive and Four-Wheel Drive), and by Application (Row Crop Tractors, Orchard Tractors, and Other Applications). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Mahindra&Mahindra Ltd.

- Tractors and Farm Equipment Limited

- Escorts Kubota Limited.

- Deere & Company

- CNH Industrial N.V.

- Sonalika Group (International Tractors Limited (ITL)

- VST Tillers Tractors Limited

- Same Deutz-Fahr India Private Limited (SDF Group S.p.A.)

- Indo Farm Equipment Limited

- Captain Tractors Pvt. Ltd.

- Action Construction Equipment Limited

- Preet Tractors Private Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Subsidy-linked demand spikes after PM-Kisan Direct Benefit transfers

- 4.2.2 Rapid tractor fleet electrification pilots in sugar-cane belts

- 4.2.3 Formalization of used-tractor marketplaces improving upgrade cycles

- 4.2.4 Minimum Support Price (MSP) indexation favoring mid-HP tractor sales

- 4.2.5 Drone-ready hitching systems boosting cross-selling

- 4.2.6 On-farm solar-pump schemes raising tractor PTO (Power take-off) utilization

- 4.3 Market Restraints

- 4.3.1 Tightening non-road emission standards (TREM-V) inflating price tags

- 4.3.2 Persistent land-holding fragmentation below 1 hectare

- 4.3.3 Low telematics adoption limiting financing innovation

- 4.3.4 Stagnant rural credit growth post-NBFC (Non-Banking Financial Company) liquidity crunch

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Engine Power

- 5.1.1 Less than 30 HP

- 5.1.2 31-50 HP

- 5.1.3 51-80 HP

- 5.1.4 Above 80 HP

- 5.2 By Drive Type

- 5.2.1 Two-wheel Drive

- 5.2.2 Four-wheel Drive

- 5.3 By Application

- 5.3.1 Row-Crop Tractors

- 5.3.2 Orchard Tractors

- 5.3.3 Other Applications

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Mahindra&Mahindra Ltd.

- 6.4.2 Tractors and Farm Equipment Limited

- 6.4.3 Escorts Kubota Limited.

- 6.4.4 Deere & Company

- 6.4.5 CNH Industrial N.V.

- 6.4.6 Sonalika Group (International Tractors Limited (ITL)

- 6.4.7 VST Tillers Tractors Limited

- 6.4.8 Same Deutz-Fahr India Private Limited (SDF Group S.p.A.)

- 6.4.9 Indo Farm Equipment Limited

- 6.4.10 Captain Tractors Pvt. Ltd.

- 6.4.11 Action Construction Equipment Limited

- 6.4.12 Preet Tractors Private Limited