|

市場調查報告書

商品編碼

1852040

非洲農業曳引機:市場佔有率分析、行業趨勢與統計、成長預測(2025-2030 年)Africa Agricultural Tractor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

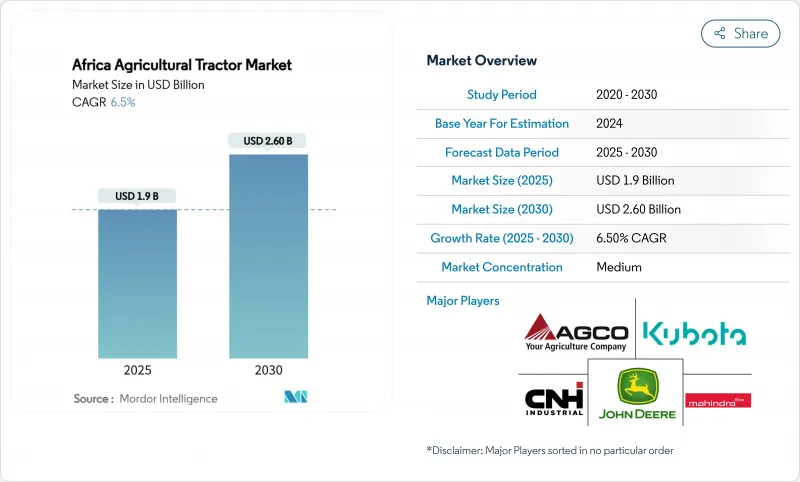

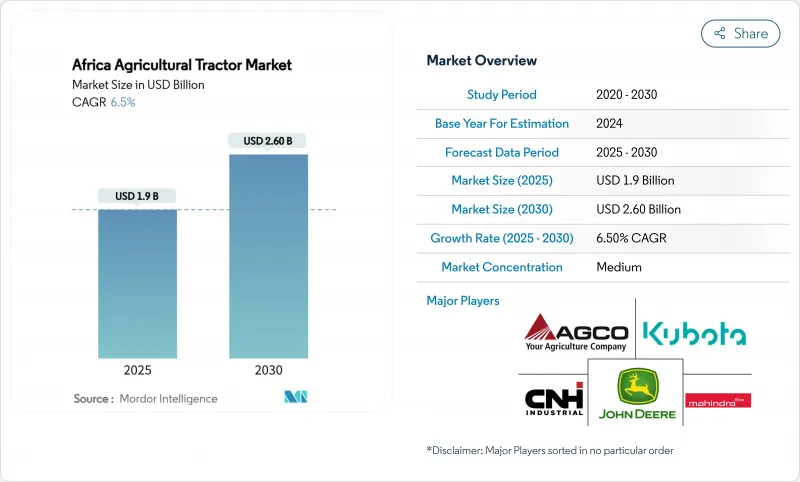

預計到 2025 年,非洲農業曳引機市場規模將達到 19 億美元,到 2030 年將達到 26 億美元,年複合成長率為 6.5%。

市場成長主要受機械化程度提高、商業農地擴張和政府扶持計畫的推動。創新資金籌措方案的引入降低了農機設備購置門檻,而精準導航和互聯技術的進步則鼓勵農民升級到更大馬力的曳引機。數位化農機租賃平台透過提高利用率,改善了小農戶的農機使用條件。外匯波動和所擁有土地分散制約了市場成長,而熟練操作人員和維修人員的短缺問題仍然是一項關鍵挑戰。

非洲農業曳引機市場趨勢與洞察

擴大農業機械化和精密農業的引進

目前,非洲每1000公頃土地上運作的曳引機不足兩台,這意味著設備普及潛力巨大。奈及利亞透過與Hello Tractor公司官民合作關係,計劃在五年內將曳引機推廣到900萬公頃新土地上。南非的商業農民正在應用GPS導航和遠端資訊處理系統,而凱斯紐荷蘭公司(Case IH)則透過免除2024年10月之後購買的設備使用FieldOps應用程式的費用來提高其應用普及率。肯亞的「四大發展議程」(Big 4 Agenda)正在支持將機電一體化和數據驅動型作物管理相結合的自動化試驗。這些技術帶來的產量提升和廢棄物減少將激勵非洲農民在農業曳引機市場投資購買更強大、更先進的機械設備。

政府補貼和機械化計劃

政府補貼正在降低農民的前期成本。肯亞國家化肥補貼計畫於2022年9月撥款35.5億肯亞先令(約2,300萬美元),用於2023年7月前發放350萬袋50公斤的化肥,進而刺激農業機械的需求。奈及利亞正從政府經營的租賃項目轉向混合模式,將私人業者和計量型租賃相結合,以提高設備運轉率。南非的農業總體規劃採用混合融資機制向農民提供信貸,以支持出口收入,預計2024年出口收入將達137億美元。埃及的氣候智慧型策略強調機械化,以因應預計2050產量下降的問題。成功與否取決於能否將財政支持與私人服務提供者和農民培訓計劃結合。

土地所有權分散限制了曳引機的使用。

隨著家庭農場日益分散,耕地面積持續減少,機械效率也隨之降低。肯亞的研究表明,分散地塊之間的運輸增加了運輸成本和設備停機時間。東非和南部非洲的勞動力評估顯示,勞動力需求超過供給,凸顯的是勞動力獲取管道有限,而非缺乏需求。盧安達的土地利用整合計畫前景可期,但主要受益者是擁有鄰近地塊的農民。客製化租賃服務有助於解決土地分散問題,但車隊管理成本仍然很高。土地交換和密集種植有可能提高設備利用率,但要廣泛實施還需要時間。

細分市場分析

到2024年,35-50馬力細分市場將佔據35.2%的市場佔有率,為多元化的小農戶提供最佳的性價比。農民可以透過土地準備、播種和運輸等融資項目獲得這些曳引機。由於農場整合和出口作物的增加,76-100馬力曳引機細分市場將以8.2%的複合年成長率成長。市場轉向高功率機型的轉變將使收入成長超過銷售成長。

製造商正在開發適用於不同功率等級的模組化平台。 2024年,馬恆達在開普敦發布了其OJA系列,該系列包含功率從20馬力到70馬力的四輪車型,並配備了數位智慧系統,強調其適應性。 35馬力以下的曳引機在果園和小塊農田中仍然佔有一席之地,但由於租賃車隊更傾向於中階曳引機,其成長受到限制。 100匹馬力以上的曳引機市場規模雖小,但成長迅速,尤其是在南非的糧食產區,更高的生產力需求推動了相關投資。不同功率範圍的需求差異反映了機械化普及率、農場規模和經濟能力之間的關聯。

到2024年,兩輪驅動(2WD)曳引機將佔非洲農業曳引機市場規模的81.2%。這一主導地位主要歸功於該地區平坦的地形和成本優勢。隨著農民將耕作範圍擴展到坡地和未耕地,並推廣精密農業,預計四輪驅動(4WD)曳引機的年複合成長率將達到10.1%。這一成長趨勢在南非尤為顯著,當地降雨模式的改善為農業擴張提供了支持。

四輪驅動(4WD)曳引機能夠減少土壤壓實,並允許使用保護性犁地所需的重型設備。肯亞政府以糧食安全為重點,支持推廣多功能四輪驅動曳引機,這些曳引機能夠勝任整個生長季的多種田間作業。遠端資訊處理數據顯示,四輪驅動曳引機的作業效率更高,促使農業承包商投資購買四輪驅動曳引機,以提高服務可靠性。這種向高性能設備的持續轉變預計將逐步降低兩輪驅動曳引機的市場佔有率。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 擴大農業機械化和精密農業的引進

- 政府補貼和機械化計劃

- 商業園藝及種植出口經濟作物

- 擴大農業信貸和曳引機融資計劃

- 透過行動平台計量型租賃曳引機

- 在大面積農田推廣低馬力自主電動曳引機

- 市場限制

- 土地所有權分散限制了曳引機的使用。

- 熟練操作人員和維修技術人員短缺

- 外匯波動和進口關稅推高了曳引機的購買價格。

- 灰色市場零件供應鏈中斷

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模和成長預測(價值和數量)

- 按引擎輸出

- 不到35馬力

- 35-50 HP

- 51-75 HP

- 76-100 HP

- 100馬力或以上

- 透過牽引技術

- 兩輪驅動(2WD)

- 四輪驅動(4WD)

- 透過推進力

- 柴油引擎

- 混合動力/電動

- 透過使用

- 大田作物

- 園藝和葡萄栽培

- 人工林和莊園作物

- 透過分銷管道

- 授權經銷商

- 線上和行動應用程式租賃平台

- 按地區

- 南非

- 肯亞

- 埃及

- 其他非洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- AGCO Corporation

- CNH Industrial NV

- Deere & Company

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- Argo Tractors SpA

- Tractors and Farm Equipment Limited

- International Tractors Limited

- CLAAS KGaA mbH

- SDF SpA(Same Deutz-Fahr Tanzania Limited)

- YTO Group Corporation

- Zetor Tractors as

- JC Bamford Excavators Ltd.

- Caterpillar Inc.

- Captain Tractors Pvt. Ltd.

第7章 市場機會與未來展望

The Africa agricultural tractor market size is USD 1.9 billion in 2025 and is projected to reach USD 2.6 billion by 2030, growing at a CAGR of 6.5%.

The market growth is driven by increasing mechanization, expansion of commercial farming estates, and government support programs. The introduction of innovative financing options has reduced barriers to equipment ownership, while advancements in precision guidance and connectivity technologies encourage farmers to upgrade to higher-horsepower tractors. Digital platforms for equipment rental have improved access for smallholder farmers by increasing utilization rates. Currency fluctuations and fragmented landholdings constrain market growth, while addressing the shortage of skilled operators and maintenance personnel remains a key challenge.

Africa Agricultural Tractor Market Trends and Insights

Increasing Adoption of Farm Mechanization and Precision Agriculture

Africa currently operates fewer than two tractors per 1,000 hectares, indicating significant potential for equipment adoption. Nigeria aims to deploy tractors across 9 million hectares of new production through a public-private partnership with Hello Tractor over five years. South African commercial farmers are implementing GPS guidance and telematics systems, while Case IH eliminated subscription fees for its FieldOps application on machines purchased after October 2024 to increase usage. Kenya's Big Four Agenda supports automation trials combining mechatronics with data-driven crop management. The improved yields and reduced waste from these technologies encourage farmers to invest in higher horsepower and advanced machinery in the Africa agricultural tractor market.

Government Subsidies and Mechanization Programs

Government subsidies are reducing initial costs for farmers. Kenya's National Fertilizer Subsidy Program allocated 3.55 billion Kenyan shillings (USD 23 million) in September 2022 and distributed 3.5 million 50 kg bags by July 2023, driving demand for agricultural equipment. Nigeria has shifted from government-operated rental programs to mixed models combining private operators and pay-as-you-go leasing, which has improved equipment utilization. South Africa uses blended financing mechanisms in its agricultural master plan to provide credit to farmers, supporting export earnings that reached USD 13.7 billion in 2024. Egypt's climate-smart strategy emphasizes mechanization to address projected yield reductions by 2050. Success depends on combining financial support with private service providers and farmer training programs.

Fragmented Land Holdings Limiting Tractor Utilization Rates

Farm plot sizes continue to decrease as families subdivide their agricultural holdings, reducing equipment efficiency. Studies in Kenya show increased transportation costs and equipment downtime due to movement between scattered land parcels. Labor assessments in Eastern and Southern Africa indicate that demand surpasses supply, emphasizing access limitations rather than lack of need. While Rwanda's Land Use Consolidation program demonstrates promise, it primarily benefits farmers with adjacent plots. Though custom-hire services help address land fragmentation issues, significant fleet management costs remain. Land parcel exchanges and intensive cropping practices may enhance equipment utilization, but broad implementation requires time.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Commercial Horticulture and Export-Oriented Cash Crops

- Expansion of Agricultural Credit and Tractor Financing Facilities

- Shortage of Skilled Operators and Maintenance Technicians

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 35-50 HP segment holds 35.2% of the Africa agricultural tractor market share in 2024, providing an optimal cost-to-performance ratio for diverse smallholder operations. Farmers access these units through financing programs for land preparation, seeding, and transport activities. The 76-100 HP tractor segment grows at 8.2% CAGR, driven by farm consolidation and expansion of export crops. This market evolution toward higher-powered models increases revenue growth beyond unit sales volumes.

Manufacturers develop modular platforms across power segments. In 2024, Mahindra introduced the OJA series in Cape Town, featuring 20-70 HP four-wheel-drive models with digital intelligence systems, emphasizing adaptability. While below-35 HP tractors remain crucial for orchards and small plots, their growth is limited as rental fleets prefer mid-range machines. Over 100 HP tractors represent a small but growing segment, particularly in South African grain-producing regions where productivity requirements support higher investments. The varying demand across horsepower ranges reflects the correlation between mechanization adoption, farm size, and economic capacity.

Two-wheel drive (2WD) tractors account for 81.2% of the Africa agricultural tractor market size in 2024. The dominance stems from the region's predominantly flat terrain and cost considerations. Four-wheel drive (4WD) tractors are projected to grow at a 10.1% CAGR as farmers expand operations into sloped and uncultivated areas while implementing precision agriculture. This growth trend is particularly evident in South Africa, where improved rainfall patterns support agricultural expansion.

Four-wheel drive (4WD) tractors reduce soil compaction and enable the use of heavier implements required for conservation tillage practices. The Kenyan government's focus on food security supports increased adoption of 4WD tractors, which offer greater versatility for multiple field operations throughout the growing season. Telematics data demonstrating operational efficiency has prompted agricultural contractors to invest in 4WD models to enhance service reliability. This ongoing transition toward performance-focused equipment is anticipated to gradually reduce the two-wheel-drive market share.

The Africa Agricultural Tractor Market Report is Segmented by Engine Power (Less Than 35 HP, and More), by Traction Technology (2-Wheel Drive (2WD), and More), by Propulsion (Diesel, and Hybrid/Electric), by Application (Row-Crop Farming, and More), by Distribution Channel (Authorised Dealerships, and More), and by Geography (South Africa, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- AGCO Corporation

- CNH Industrial N.V.

- Deere & Company

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- Argo Tractors S.p.A.

- Tractors and Farm Equipment Limited

- International Tractors Limited

- CLAAS KGaA mbH

- SDF S.p.A (Same Deutz-Fahr Tanzania Limited)

- YTO Group Corporation

- Zetor Tractors a.s.

- J C Bamford Excavators Ltd.

- Caterpillar Inc.

- Captain Tractors Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption of Farm Mechanization and Precision Agriculture

- 4.2.2 Government Subsidies and Mechanization Programs

- 4.2.3 Growth in Commercial Horticulture and Export-Oriented Cash Crops

- 4.2.4 Expansion of Agricultural Credit and Tractor Financing Facilities

- 4.2.5 Pay-As-You-Go Tractor Leasing via Mobile Platforms

- 4.2.6 Uptake of Low-Horsepower Autonomous Electric Tractors on Large Estates

- 4.3 Market Restraints

- 4.3.1 Fragmented Land Holdings Limiting Tractor Utilization Rates

- 4.3.2 Shortage of Skilled Operators and Maintenance Technicians

- 4.3.3 Volatile Foreign-Exchange Rates and Import Duties Inflating Tractor Purchase Prices

- 4.3.4 Grey-Market Spare-Parts Supply-Chain Disruptions

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Engine Power

- 5.1.1 Less than 35 HP

- 5.1.2 35 - 50 HP

- 5.1.3 51 - 75 HP

- 5.1.4 76 - 100 HP

- 5.1.5 Above 100 HP

- 5.2 By Traction Technology

- 5.2.1 2-Wheel Drive (2WD)

- 5.2.2 4-Wheel Drive (4WD)

- 5.3 By Propulsion

- 5.3.1 Diesel

- 5.3.2 Hybrid/Electric

- 5.4 By Application

- 5.4.1 Row-Crop Farming

- 5.4.2 Horticulture and Viticulture

- 5.4.3 Plantation and Estate Crops

- 5.5 By Distribution Channel

- 5.5.1 Authorized Dealerships

- 5.5.2 Online and Mobile-App-Based Rental Platforms

- 5.6 By Geography

- 5.6.1 South Africa

- 5.6.2 Kenya

- 5.6.3 Egypt

- 5.6.4 Rest of Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AGCO Corporation

- 6.4.2 CNH Industrial N.V.

- 6.4.3 Deere & Company

- 6.4.4 Kubota Corporation

- 6.4.5 Mahindra & Mahindra Ltd.

- 6.4.6 Argo Tractors S.p.A.

- 6.4.7 Tractors and Farm Equipment Limited

- 6.4.8 International Tractors Limited

- 6.4.9 CLAAS KGaA mbH

- 6.4.10 SDF S.p.A (Same Deutz-Fahr Tanzania Limited)

- 6.4.11 YTO Group Corporation

- 6.4.12 Zetor Tractors a.s.

- 6.4.13 J C Bamford Excavators Ltd.

- 6.4.14 Caterpillar Inc.

- 6.4.15 Captain Tractors Pvt. Ltd.