|

市場調查報告書

商品編碼

1851916

垂直升降模組(VLM):市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030)Vertical Lift Module (VLM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

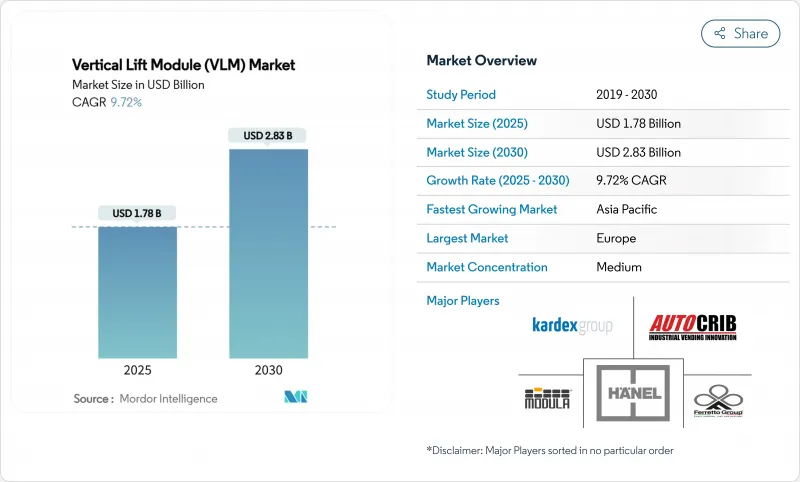

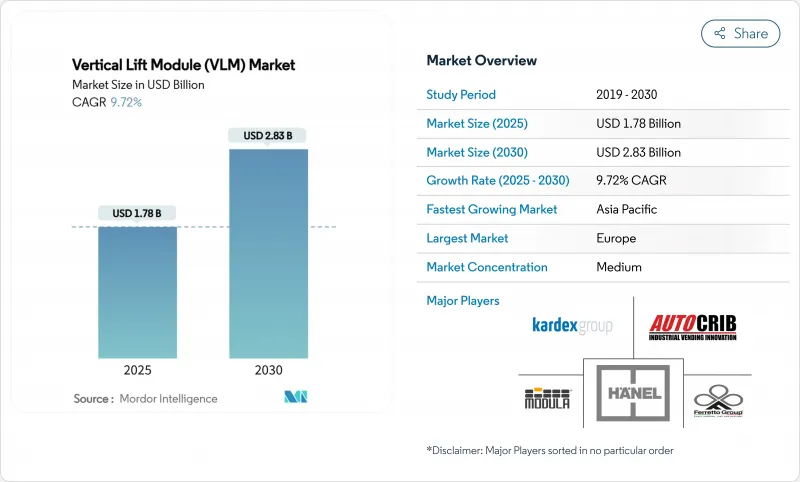

預計到 2025 年,垂直升降模組市場規模將達到 17.8 億美元,到 2030 年將達到 28.3 億美元,年複合成長率為 9.72%。

隨著電商企業用貨到人系統取代履約的托盤貨架,將訂單履行週期從數天縮短至數小時,市場需求加速成長。汽車製造商增設自動化緩衝儲存系統以維持準時制生產節奏,生命科學無塵室採用封閉式模組以滿足可追溯性和污染控制要求。低溫運輸營運商將節能型雙碟馬達視為24個月內實現投資回報的途徑,而預測性維護軟體套件則為設備製造商開闢了售後服務收入來源。

全球垂直升降模組(VLM)市場趨勢與洞察

電子商務主導的微型履約的興起

零售商正從區域配送中心轉向位於現有門市內部或附近的自動化微型履約中心。預計到2030年,全球將有超過7300個自動化微型履約中心運作,其中近一半位於美國,這將持續推動對佔地面積不超過10000平方英尺的緊湊型高密度模組的運作。透過與機器人揀貨機整合,垂直物流模組(VLM)可實現99.99%的訂單準確率,同時減少高達66%的人工需求。儘管供應鏈的限制減緩了部分零售商的採用速度,但早期採用者正透過縮短最後一公里配送前置作業時間而獲得快速的投資回報。

都市區倉庫中垂直整合管理(VLM)的應用加速

亞洲主要城市的工業倉庫租金正高於區域平均水平,迫使營運商尋求垂直空間。垂直物流倉庫(VLM)層高可達98英尺(約30公尺),儲存密度是傳統倉庫的四倍,同時將搬運任務轉移到揀選任務,這在勞動力稀缺且成本高昂的地區至關重要。DAIFUKU CO. LTD.在印度新建的製造工廠正是為了滿足都市區自動化需求的激增。因此,房地產資源緊張和工資上漲共同推動了垂直物流倉庫投資在管理層優先事項清單上的優先順序上升。

歐洲棕地設施的屋頂高度限制

許多建於1990年之前的歐洲工廠缺乏25英尺的淨空高度,無法充分發揮垂直升降機(VLM)的效率。改裝需要加固地板和進行結構檢查,這會增加計劃成本。 AutoStore估計,歐洲65%的VLM裝置都需要進行此類維修,這不僅凸顯了機遇,也暴露了其限制。

細分市場分析

單層系統佔2024年銷售額的57%,這反映了其與現有建築高度的兼容性以及易於操作的特點。典型的吞吐量平均為每小時250件,足以滿足中等速度環境的需求。然而,預計到2030年,雙層系統將以11.9%的複合年成長率成長。透過實現揀選和托盤展示的同步進行,這些系統每小時可處理350件商品,使其成為擁有充足垂直空間的棕地項目的首選。卡迪斯正在升級其控制器韌體,以允許兩種配置在同一倉庫管理系統 (WMS) 中共存,從而使營運商能夠根據訂單模式的變化靈活地混合使用不同類型的系統。隨著倉庫追求更高的單位面積揀選量,垂直升降模組市場將繼續向雙層系統投資傾斜。

模組化設計框架降低了工程成本並加快了安裝速度。如今,原始設備製造商 (OEM) 提供即插即用的輸送機對接平台和機器人介面,使得單級模組可以作為相鄰高吞吐量區域的緩衝,而雙級單元則可以處理高速移動的物體。這種混合策略確保了在季節性高峰期生產的連續性,而無需為滿足平均需求而過度配置設備,從而增強了垂直升降模組市場在平衡資本投資規劃方面的價值提案。

到2024年,額定載重在20至50噸之間的設備將佔據43%的市場佔有率,這反映出它們適用於盒裝汽車零件、手提式電商庫存以及單托盤重量很少超過1000磅的藥品有效載荷。這些系統無需特殊地板材料或起重機輔助,因此成為多行業部署的支柱。 50噸以上的模組將以12.6%的複合年成長率成長,這主要得益於航太和重型設備供應商將超大型零件集中儲存。相反,20噸以下的設備在電子和醫療設備組裝中佔據著獨特的地位,在這些領域,清潔度和精度比重量更重要。

Schaefer 的 LOGIMAT 系統正是這一趨勢的典型代表,其單托盤承重能力高達 1 噸,並配備 ERP 連接器,可將整合時間縮短 30%。隨著工業 4.0 的日益普及,工廠將基於數位雙胞胎模擬而非傳統經驗法則來選擇負載等級。因此,採購週期將因資料建模的加入而延長,但隨著垂直升降模組的市場規模與可量化的生產力提升緊密相關,其應用勢頭將持續強勁。

垂直升降模組(VLM)市場按類型(單層輸送、雙層輸送)、承載能力(20噸以下、20-50噸、50噸以上)、應用(儲存和緩衝等)、終端用戶行業(汽車、電氣電子等)和地區進行細分。市場預測以美元計價。

區域分析

以德國、西班牙和法國等汽車製造中心為首的歐洲,到2024年將佔36%的市場。由於許多工廠的淨空高度已超過現代標準,因此現有棕地的維修十分普遍。儘管新建項目成長放緩,原始計劃製造商(OEM)對可追溯性和降低能耗的強制性要求,以及嚴格的工人安全規範,仍在推動該地區垂直升降模組市場的成長。德國一級供應商正在整合基於人工智慧的馬達診斷系統,以防止生產線意外停機,目前該系統已被納入大多數歐洲採購規範。

到2030年,亞太地區將以12.3%的複合年成長率成為成長最快的地區。中國正在新建智慧工廠中部署待開發區模組(VLM),這些工廠採用單元式製造模式,需要緊湊的銷售點門市。隨著印度新建產業走廊獲得公共資金用於建造綜合供應鏈園區,其在物流自動化方面的支出也在增加,這進一步增強了該地區對高密度垂直儲存的需求。日本和韓國正在應用模組技術來緩解人口老化導致的勞動力短缺問題。該地區的規模和待開發區的性質意味著供應商正在以承包工程的形式銷售完整的生態系統——包括VLM硬體、倉庫管理系統(WMS)和自主移動機器人(AMR)車隊——這將在未來十年內持續推動垂直升降模組市場規模的成長。

北美市場持續穩定擴張。零售商正在對郊區門市維修,增設微型履約中心;美國東北部的生命科學叢集正在採用符合GMP標準的生技藥品模組。美國和加拿大的冷藏倉庫營運商對雙碟起吊裝置的效率讚賞有加,因為它可以降低尖峰時段的電力成本。拉丁美洲和中東及非洲市場正在崛起,但發展並不均衡。巴西的合約物流公司正在探索租賃模式,以避免資本投資障礙;而南非的經銷商則面臨電力品質問題,需要附加元件,這在短期內限制了垂直升降模組的市場滲透率。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電子商務主導的微型倉配的擴張將加速城市倉庫中垂直物流管理(VLM)技術的應用。

- 原始設備製造商推動全面自動化

- 歐洲汽車產業的閉合迴路備件存儲

- 美國生命科學無塵室中以合規為主導的可追溯性需求

- 東南亞人事費用差距擴大推動了自動化立體改裝

- 節能型雙碟馬達可在24個月內為冷凍設施帶來投資回報。

- AI賦能的VLM OEM預測性維護套餐提升售後服務收入

- 市場限制

- 歐洲棕地設施的屋頂高度限制

- 亞太地區兩大城市前期投資高昂,且提供多種接駁路線選擇

- 非洲新興物流中心電力品質不平衡

- 中小企業領域中可進行改裝升級的ERP/WMS介面有限

- 價值/供應鏈分析

- 技術展望

- 監理展望

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 定價分析

- 投資分析

第5章 市場規模與成長預測

- 按類型

- 單層交付

- 雙層交付

- 按載重能力

- 不足20噸

- 20至50噸

- 超過50噸

- 透過使用

- 儲存和緩衝

- 揀貨和組裝

- 備用零件處理

- 按最終用戶行業分類

- 車

- 金屬和機械

- 電氣和電子

- 零售、分銷和電子商務

- 生命科學(製藥和醫療設備)

- 食品和飲料

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 中東和非洲

- 土耳其

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Kardex Group

- Hnel Storage Systems

- Modula Inc.(System Logistics)

- SSI SCHFER Systems International Inc.

- Ferretto Group SpA

- AutoCrib Inc.

- Weland Lagersystem AB

- Automha SpA

- Stanley Black & Decker Storage Solutions

- Green Automated Solutions Inc.

- Intertex Maschinenbau GmbH

- ICAM srl

- Mecalux SA

- Godrej

- Koerber Logistics Solutions

- Dexion(Gonvarri Material Handling)

- Constructor Group(Kasten)

- EffiMat Storage Technology A/S

- Randex Ltd.

- Omnia Technologies

- Sapient Automation

- ICY Lift Systems

第7章 市場機會與未來展望

The vertical lift module market size stands at USD 1.78 billion in 2025 and is forecast to reach USD 2.83 billion by 2030, advancing at a 9.72% CAGR.

Demand accelerates as e-commerce firms replace bulky pallet racking with goods-to-person systems that compress fulfillment cycles from days to hours. Automakers add automated buffer storage to sustain just-in-time production rhythms, while life-sciences cleanrooms adopt enclosed modules that meet traceability and contamination-control mandates. Cold-chain operators view energy-efficient dual-drive motors as a route to ROI in less than 24 months, and predictive-maintenance software packages open an after-sales revenue stream for equipment makers.

Global Vertical Lift Module (VLM) Market Trends and Insights

E-commerce-led micro-fulfillment expansion

Retailers are shifting from regional distribution centers to automated micro-fulfillment nodes located inside or adjacent to existing stores. More than 7,300 automated micro-fulfillment centers are expected to be operational worldwide by 2030, almost half of them in the United States, creating sustained demand for compact, high-density modules that fit within 10,000 square-foot footprints . VLMs integrate with robotic pickers to achieve 99.99% order-accuracy rates while reducing labor needs by up to 66% . Although supply-chain constraints have slowed some retailer roll-outs, early adopters demonstrate rapid payback by compressing last-mile delivery lead times.

Accelerating VLM adoption in urban warehouses

Industrial rents in key Asian capitals outpace regional averages, forcing operators to reclaim vertical space. VLMs that reach ceiling heights of 98 feet quadruple storage density while shifting work from travel to picking, essential where labor is scarce and expensive. Daifuku's new manufacturing plant in India was commissioned to satisfy this surge in urban automation demand. Real-estate constraints and wage inflation thus act in tandem to move VLM investments higher on management priority lists.

Facility roof-height limitations in brownfield European sites

Many European plants built before 1990 lack the 25-foot clear height that unlocks peak VLM efficiency. Retrofitting involves floor reinforcement and structural checks that inflate project costs; in some locations, heritage rules bar vertical alterations. AutoStore estimates that 65% of its European installs occur in such retrofit scenarios, highlighting both opportunity and constraint

Other drivers and restraints analyzed in the detailed report include:

- OEM push for fully automated, closed-loop spare-parts storage in European automotive sector

- Compliance-driven traceability needs in U.S. life-sciences cleanrooms

- High up-front investment vs. multi-shuttle alternatives in APAC tier-2 cities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Single-level systems captured 57% of 2024 revenue, a reflection of their compatibility with existing building heights and straightforward operations. Typical throughput averages 250 items per hour, adequate for medium-velocity environments. Dual-level variants, however, post an 11.9% CAGR through 2030. They hit 350 items per hour by allowing simultaneous extraction and presentation trays, making them a preferred choice when brownfield sites possess sufficient vertical clearance. Kardex has upgraded controller firmware to harmonize either configuration within the same WMS, giving operators flexibility to mix system types as order profiles evolve. The vertical lift module market continues to tilt toward dual-level investments as facilities chase higher picks-per-square-foot.

A modular design framework lowers engineering costs and accelerates installation. OEMs now offer plug-and-play conveyor docks and robotic interfaces, allowing single-level modules to serve as buffers for adjacent high-throughput zones while dual-level units handle fast movers. This hybrid strategy ensures continuity during seasonal spikes without oversizing equipment for average demand, reinforcing the vertical lift module market's value proposition for balanced capex planning.

Units rated for 20-50 tons held 43% market share in 2024, reflecting their suitability for boxed automotive parts, tote-handled e-commerce inventory, and pharmaceutical payloads that rarely exceed 1,000 pounds per tray. These systems form the backbone of multi-industry deployments because they require no special flooring or crane assistance. Above-50-ton modules record a 12.6% CAGR, fueled by aerospace and heavy-machinery suppliers consolidating oversized components into single storage points. Conversely, sub-20-ton machines occupy niche roles in electronics and medical device assembly lines where cleanliness and precision outweigh weight metrics.

Schaefer's LOGIMAT illustrates the trend, offering capacities up to 1 ton per tray with ERP connectors that reduce integration times by 30%. As Industry 4.0 spreads, facilities select load classes based on digital-twin simulations rather than generic rules of thumb. Consequently, procurement cycles extend to include data modeling, yet adoption momentum sustains because the vertical lift module market size aligns closely with quantifiable productivity gains.

Vertical Lift Module (VLM) Market is Segmented by Type (Single-Level Delivery, Dual-Level Delivery), Load Capacity (Up To 20 Tons, 20 - 50 Tons, Above 50 Tons ), Application (Storage and Buffering and More), End-User Industry (Automotive, Electrical and Electronics and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe leads with 36% revenue share in 2024, anchored by automotive manufacturing corridors in Germany, Spain, and France. Brownfield retrofits dominate because many facilities predate modern ceiling-height norms. OEM mandates for traceability and energy-footprint reduction, combined with strict worker-safety codes, keep the regional vertical lift module market growing even when new-build projects slow. Germany's Tier-1 suppliers integrate AI-based motor diagnostics to prevent unscheduled line stops, a feature now embedded in most European purchase specifications.

Asia-Pacific posts the fastest 12.3% CAGR through 2030. China deploys VLMs in greenfield smart factories where cell-based manufacturing needs compact point-of-use stores. India's logistics automation spending is climbing as new industrial corridors receive public funding for integrated supply-chain parks, reinforcing regional appetite for high-density vertical storage. Japan and South Korea apply modules to alleviate labor shortages caused by aging demographics. The region's scale and greenfield nature mean suppliers sell complete ecosystems-VLM hardware, WMS, and AMR fleets-in one turnkey package, bolstering the vertical lift module market size across the decade.

North America maintains a steady expansion track. Retailers retrofit suburban outlets with micro-fulfillment nodes, and life-sciences clusters in the U.S. Northeast adopt GMP-compliant modules for biologics. Cold-storage operators in the U.S. Midwest and Canada appreciate dual-drive hoist efficiencies that curb utility bills during peak tariffs. Latin America and the Middle East & Africa are emerging but uneven. Brazil's contract-logistics firms explore leasing models to bypass capex barriers, while South African distributors face power-quality issues that necessitate voltage-regulation add-ons, a factor that suppresses near-term vertical lift module market penetration.

- Kardex Group

- Hnel Storage Systems

- Modula Inc. (System Logistics)

- SSI SCHFER Systems International Inc.

- Ferretto Group S.p.A.

- AutoCrib Inc.

- Weland Lagersystem AB

- Automha S.p.A.

- Stanley Black & Decker Storage Solutions

- Green Automated Solutions Inc.

- Intertex Maschinenbau GmbH

- ICAM srl

- Mecalux S.A.

- Godrej

- Koerber Logistics Solutions

- Dexion (Gonvarri Material Handling)

- Constructor Group (Kasten)

- EffiMat Storage Technology A/S

- Randex Ltd.

- Omnia Technologies

- Sapient Automation

- ICY Lift Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce-led Micro-fulfilment Expansion Accelerating VLM Adoption in Urban Warehouses

- 4.2.2 OEM Push for Fully Automated

- 4.2.2.1 Closed-Loop Spare-Parts Storage in the European Automotive Sector

- 4.2.3 Compliance-Driven Traceability Needs in U.S. Life-Sciences Cleanrooms

- 4.2.4 Rising Labor-Cost Differentials in South-East Asia Driving AS/RS Retrofits

- 4.2.5 Energy-Efficient Dual-Drive Motors Enabling ROI < 24 Months in Cold-Storage Facilities

- 4.2.6 AI-Enabled Predictive-Maintenance Bundles from VLM OEMs Boosting After-sales Revenues

- 4.3 Market Restraints

- 4.3.1 Facility Roof-Height Limitations in Brownfield European Sites

- 4.3.2 High Up-front Investment vs. Multi-Shuttle Alternatives in APAC Tier-2 Cities

- 4.3.3 Power-Quality Variations in Emerging African Logistics Hubs

- 4.3.4 Limited Retrofit-Ready ERP/WMS Interfaces in SME Segments

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Pricing Analysis

- 4.9 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Single-Level Delivery

- 5.1.2 Dual-Level Delivery

- 5.2 By Load Capacity

- 5.2.1 Up to 20 Tons

- 5.2.2 20 - 50 Tons

- 5.2.3 Above 50 Tons

- 5.3 By Application

- 5.3.1 Storage and Buffering

- 5.3.2 Order-Picking and Kitting

- 5.3.3 Spare-Parts Handling

- 5.4 By End-User Industry

- 5.4.1 Automotive

- 5.4.2 Metal and Machinery

- 5.4.3 Electrical and Electronics

- 5.4.4 Retail / Distribution and E-commerce

- 5.4.5 Life-Sciences (Pharma Medical Devices)

- 5.4.6 Food and Beverage

- 5.4.7 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Turkey

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 United Arab Emirates

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Kardex Group

- 6.4.2 Hnel Storage Systems

- 6.4.3 Modula Inc. (System Logistics)

- 6.4.4 SSI SCHFER Systems International Inc.

- 6.4.5 Ferretto Group S.p.A.

- 6.4.6 AutoCrib Inc.

- 6.4.7 Weland Lagersystem AB

- 6.4.8 Automha S.p.A.

- 6.4.9 Stanley Black & Decker Storage Solutions

- 6.4.10 Green Automated Solutions Inc.

- 6.4.11 Intertex Maschinenbau GmbH

- 6.4.12 ICAM srl

- 6.4.13 Mecalux S.A.

- 6.4.14 Godrej

- 6.4.15 Koerber Logistics Solutions

- 6.4.16 Dexion (Gonvarri Material Handling)

- 6.4.17 Constructor Group (Kasten)

- 6.4.18 EffiMat Storage Technology A/S

- 6.4.19 Randex Ltd.

- 6.4.20 Omnia Technologies

- 6.4.21 Sapient Automation

- 6.4.22 ICY Lift Systems

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet