|

市場調查報告書

商品編碼

1773256

垂直升降模組 (VLM) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Vertical Lift Module (VLM) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

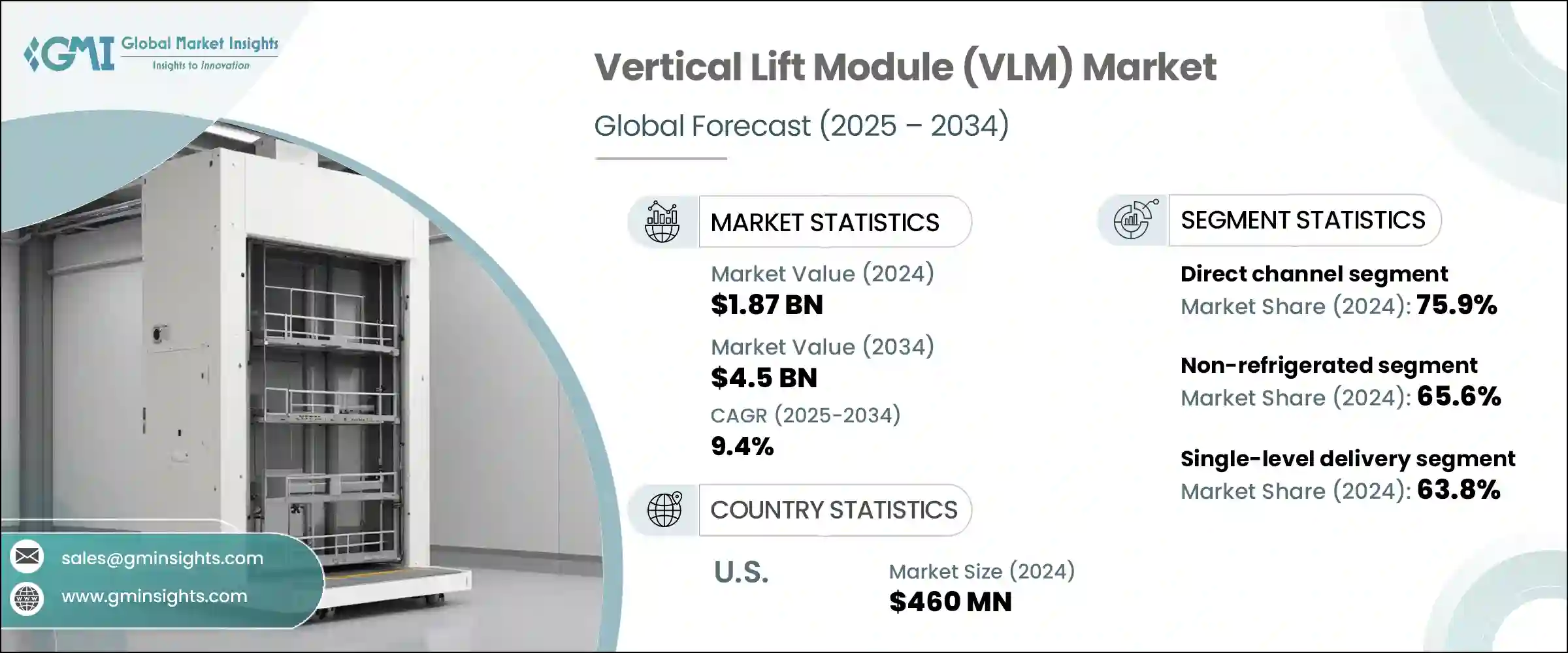

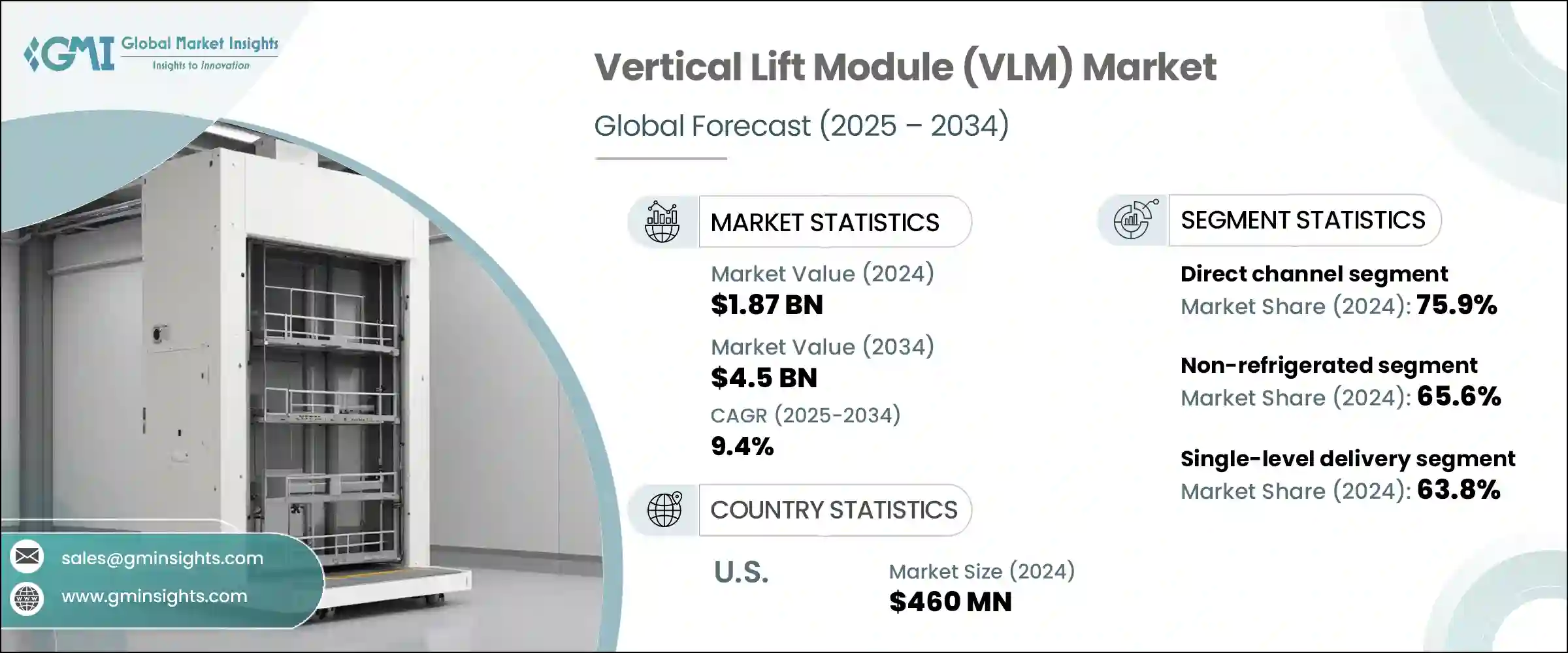

2024年,全球垂直升降模組 (VLM) 市場規模達18.7億美元,預計到2034年將以9.4%的複合年成長率成長,達到45億美元。隨著各行各業日益尋求高效、節省空間的儲存和檢索解決方案,該市場正呈現強勁成長動能。汽車、製藥和電子商務等行業正在迅速採用VLM來增強庫存管理,簡化揀選流程,並提高整體生產力。緊湊型高速儲存的需求正在激增,尤其是在智慧倉儲實踐的興起之下。 VLM有助於提高訂單準確性,減少對人工的依賴,這與全球向自動化和精益製造轉型的趨勢相契合。

企業正致力於建構配備先進軟體、即時追蹤和非接觸式介面的系統,使其適用於工業4.0環境。日益成長的城市化和有限的倉庫空間也推動了對垂直儲存系統的需求。垂直升降模組 (VLM) 技術的最新進展更加重視環境責任。製造商正在引入節能馬達和再生驅動系統,以便在運行過程中回收能量,從而降低整體功耗。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18.7億美元 |

| 預測值 | 45億美元 |

| 複合年成長率 | 9.4% |

採用模組化結構可實現可擴充安裝,最大程度減少浪費,同時使用輕質可回收材料也符合循環經濟原則。許多 VLM 現在整合了智慧電源管理系統,可根據需求自動調整能源使用,進一步提升永續性。這些創新不僅有助於企業實現綠色目標,也符合全球減少工業碳足跡的目標,使 VLM 成為追求營運和生態效率的現代倉庫和智慧製造環境的首選。

2024年,非冷藏型VLM市場佔65.6%的市場佔有率,預計到2034年將以8.7%的複合年成長率成長。這類系統之所以佔據主導地位,是因為其在汽車、電子和工業製造等無需氣候控制環境的產業中得到了廣泛的應用。由於配置更簡單且無需冷卻裝置,這類系統更易於部署和維護。它們也對基礎設施預算有限的公司具有吸引力,同時營運和能源成本也更低。

單層配送式VLM在2024年佔63.8%的市場佔有率,預計2025年至2034年的複合年成長率將達到8.9%。各行各業的企業都青睞這種設計,因為它符合人體工學設計,而且操作簡單。操作員受益於以恆定高度配送物品,從而減輕身體負擔並提高工作流程效率。這些設備幾乎不需要培訓,是員工流動頻繁的設施的理想選擇。中小企業尤其重視其經濟實惠和可擴展性,這使得它們非常適合快節奏、高吞吐量且需要可靠性的環境。

美國垂直升降模組 (VLM) 市場佔 87.3% 的市場佔有率,2024 年市場規模達 4.6 億美元。美國憑藉其先進的工業基礎設施以及在製造和倉儲領域大力推行自動化,在該領域佔據主導地位。空間最佳化和營運效率是該地區企業關注的重點,尤其是在勞動成本不斷上漲的背景下。自動化投資、政府對智慧製造的激勵措施以及成熟的解決方案提供商網路,都有助於該地區在 VLM 應用方面佔據領先地位。

推動全球垂直升降模組 (VLM) 市場發展的公司包括 AutoCrib、卡迪斯 (Kardex)、Vidmar、Modula GROUP、Weland Solutions、Vidir Solutions, Inc.、ICAM SpA、SSI SCHAFER、Rabatex Group、ELF Automation、Hanel Buro、Ferret SplingA、Conveyor Handto Company、LISTA 和 LISTA、LIA、Convey領先的 VLM 製造商正在實施一系列策略性舉措,以擴大其市場影響力。他們透過整合基於人工智慧的庫存最佳化、非接觸式操作和基於雲端的系統診斷,不斷創新產品線。

企業也正在與電商和物流企業合作,開發客製化的倉儲解決方案。研發投資優先用於提升系統模組化、降低能耗和提高吞吐量。許多企業正在透過在關鍵市場建立在地化生產和支援設施來擴大其全球影響力。客製化服務和靈活的租賃模式有助於滿足中小企業的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 倉庫自動化需求不斷成長

- 工業環境中的空間最佳化

- 與工業4.0技術的融合

- 產業陷阱與挑戰

- 初期投資及維護成本高

- 技術複雜性和客製化問題

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依儲存類型

- 監理框架

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計數據

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按儲存類型,2021 - 2034 年(百萬美元)

- 溫控/冷藏

- 非冷藏

第6章:市場估計與預測:按交付類型,2021 - 2034 年(百萬美元)

- 單級交付

- 雙層交付

第7章:市場估計與預測:按裝載量,2021 - 2034 年(百萬美元)

- 每托盤最多 500 公斤

- 每托盤500至700公斤

- 每托盤700公斤以上

第8章:市場估計與預測:按最終用途,2021 - 2034 年(百萬美元)

- 汽車

- 食品和飲料

- 零售、倉儲和物流

- 金屬和機械

- 化學

- 其他(醫療保健、航空等)

第9章:市場估計與預測:按配銷通路,2021 - 2034 年(百萬美元)

- 直銷

- 間接銷售

第 10 章:市場估計與預測:按地區,2021 年至 2034 年(百萬美元)

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- AutoCrib

- Conveyor Handling Company

- ELF Automation

- Ferretto SpA

- Hanel Buro

- ICAM SpA

- Kardex

- LISTA

- Mecalux, SA

- Modula GROUP

- Rabatex Group

- SSI SCHAFER

- Vidir Solutions, Inc.

- Vidmar

- Weland Solutions

The Global Vertical Lift Module (VLM) Market was valued at USD 1.87 billion in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 4.5 billion by 2034. The market is seeing robust growth as industries increasingly seek efficient, space-saving storage and retrieval solutions. Sectors such as automotive, pharmaceuticals, and e-commerce are rapidly embracing VLMs to enhance inventory management, streamline picking operations, and boost overall productivity. The demand for compact and high-speed storage is surging, particularly with the rise of smart warehousing practices. VLMs contribute to improved order accuracy and reduced reliance on manual labor, aligning with global shifts toward automation and lean manufacturing.

Companies are focusing on building systems equipped with advanced software, real-time tracking, and contactless interfaces, making them suitable for Industry 4.0 environments. Growing urbanization and limited warehouse space are also driving demand for vertical storage systems. Recent advancements in vertical lift module (VLM) technology are placing a strong emphasis on environmental responsibility. Manufacturers are introducing energy-efficient motors and regenerative drive systems that recover energy during operation, reducing overall power consumption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.87 Billion |

| Forecast Value | $4.5 Billion |

| CAGR | 9.4% |

The adoption of modular construction allows for scalable installations with minimal waste, while the use of lightweight, recyclable materials supports circular economy principles. Many VLMs now integrate intelligent power management systems that automatically adjust energy usage based on demand, further improving sustainability. These innovations not only help businesses meet their green targets but also align with global goals for reducing industrial carbon footprints, making VLMs a preferred choice in modern warehouses and smart manufacturing environments aiming for operational and ecological efficiency.

In 2024, the non-refrigerated VLMs segment accounted for a 65.6% share and is anticipated to grow at a CAGR of 8.7% through 2034. Their dominance stems from widespread use in sectors like automotive, electronics, and industrial manufacturing, where climate-controlled environments are not required. These systems are easier to deploy and maintain due to their simpler configuration and absence of cooling units. They also appeal to companies with limited infrastructure budgets while offering lower operating and energy costs.

The single-level delivery VLM segment held a 63.8% share in 2024 and is expected to grow at a CAGR of 8.9% from 2025 to 2034. Businesses across industries prefer this design for its ergonomic design and ease of use. Operators benefit from items being delivered at a consistent height, reducing physical strain and improving workflow efficiency. These units require minimal training and are ideal for facilities with frequent staff turnover. Small and mid-size enterprises are especially drawn to their affordability and scalability, making them suitable for fast-paced, high-throughput environments that demand reliability.

United States Vertical Lift Module (VLM) Market held an 87.3% share, generating USD 460 million in 2024. The U.S. dominates the space due to its advanced industrial infrastructure and strong embrace of automation in manufacturing and warehousing. Space optimization and operational efficiency are top priorities for regional players, especially given rising labor costs. Investments in automation, government incentives for smart manufacturing, and a mature network of solution providers all contribute to the region's leadership in VLM adoption.

Companies driving the Global Vertical Lift Module (VLM) Market include AutoCrib, Kardex, Vidmar, Modula GROUP, Weland Solutions, Vidir Solutions, Inc., ICAM S.p.A., SSI SCHAFER, Rabatex Group, ELF Automation, Hanel Buro, Ferretto SpA, Conveyor Handling Company, LISTA, and Mecalux, S.A. Leading VLM manufacturers are implementing a range of strategic actions to expand their market footprint. They are consistently innovating product lines by integrating AI-based inventory optimization, touchless operations, and cloud-based system diagnostics.

Companies are also forming collaborations with e-commerce and logistics players to develop tailored storage solutions. R&D investments are being prioritized to improve system modularity, reduce energy consumption, and boost throughput. Many players are expanding their global footprint by establishing localized production and support facilities in key markets. Customization offerings and flexible leasing models help address the needs of small and medium-sized businesses.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collections methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 By storage type

- 2.2.2 By delivery type

- 2.2.3 By loading capacity

- 2.2.4 By End use

- 2.2.5 By Distribution channel

- 2.2.6 By region

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for warehouse automation

- 3.2.1.2 Space optimization in industrial settings

- 3.2.1.3 Integration with Industry 4.0 technologies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Technical complexity and customization issues

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By storage type

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger & acquisitions

- 4.6.2 Partnership & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Storage Type, 2021 - 2034 ($Mn) (Thousand Units)

- 5.1 Temperature controlled/refrigerated

- 5.2 Non-refrigerated

Chapter 6 Market Estimates & Forecast, By Delivery Type, 2021 - 2034 ($Mn) (Thousand Units)

- 6.1 Single-level delivery

- 6.2 Dual-level delivery

Chapter 7 Market Estimates & Forecast, By Loading Capacity, 2021 - 2034 ($Mn) (Thousand Units)

- 7.1 Up to 500 kg per tray

- 7.2 500 to 700 kg per tray

- 7.3 Above 700 kg per tray

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn) (Thousand Units)

- 8.1 Automotive

- 8.2 Food & beverage

- 8.3 Retail, warehouse & logistics

- 8.4 Metals & machinery

- 8.5 Chemical

- 8.6 Others (healthcare, aviation, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn) (Thousand Units)

- 9.1 Direct sales

- 9.2 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 AutoCrib

- 11.2 Conveyor Handling Company

- 11.3 ELF Automation

- 11.4 Ferretto SpA

- 11.5 Hanel Buro

- 11.6 ICAM S.p.A.

- 11.7 Kardex

- 11.8 LISTA

- 11.9 Mecalux, S.A.

- 11.10 Modula GROUP

- 11.11 Rabatex Group

- 11.12 SSI SCHAFER

- 11.13 Vidir Solutions, Inc.

- 11.14 Vidmar

- 11.15 Weland Solutions