|

市場調查報告書

商品編碼

1851899

柔版印刷機:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Flexographic Printing Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

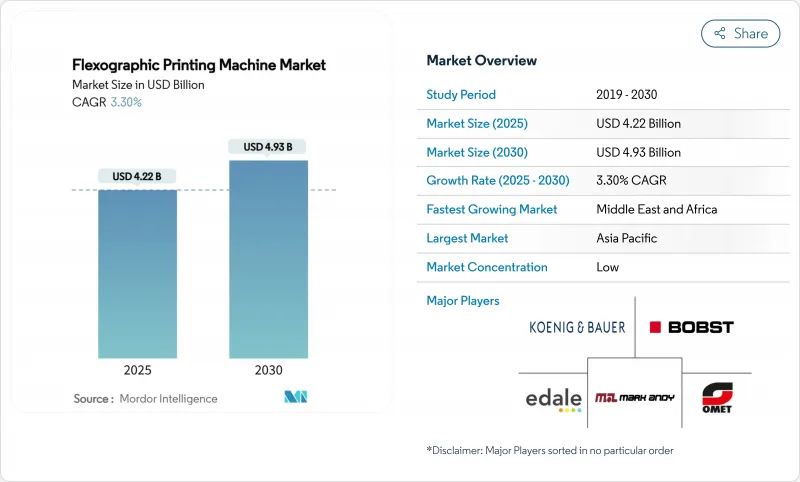

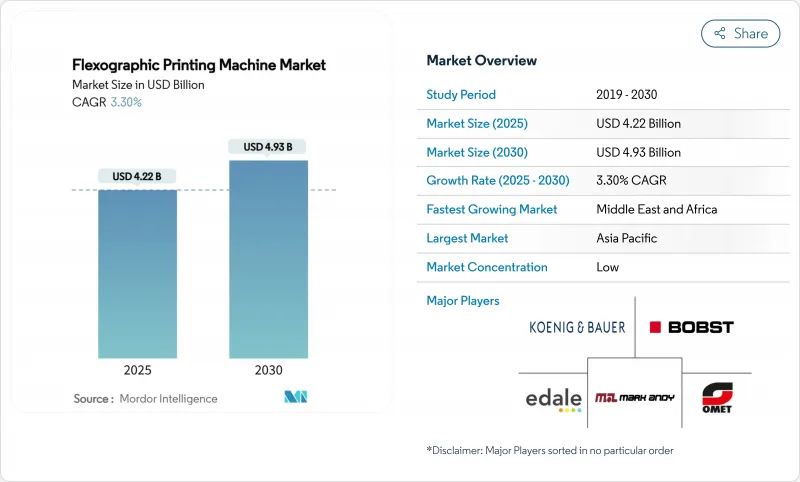

預計柔版印刷機市場規模將在 2025 年達到 42.2 億美元,在 2030 年達到 49.3 億美元,年複合成長率穩定在 3.3%。

如今,投資重點不再是單純的產能擴張,而是更多地轉向自動化、混合印刷能力以及滿足日益嚴格的永續性法規。與電子商務相關的短版印刷、水性油墨的強制使用以及數位雙胞胎維護平台正在重塑加工企業的採購標準。能夠兼顧快速換版和低VOC性能的供應商正在贏得市場佔有率,而區域性補貼計劃,例如中國的「綠色印刷2026」計劃,正在改變競爭格局。同時,XSYS-MacDermid和INX-C&A等併購案例表明,製版和油墨專家正在透過整合來縮短前置作業時間並應對PFAS法規。

全球柔版印刷機市場趨勢及洞察

經濟高效的小批量包裝能力

柔版印刷機製造商已將設定時間和盈利的最低印量從5000公尺縮短至近500公尺。更快的印刷週期使擁有季節性或區域性SKU的品牌能夠以較低的成本推出定製圖案。 MacDermid的LUX ITP印版現在只需8小時即可出版,而此前需要兩天,這消除了加工商在隔天更換設計稿時面臨的關鍵瓶頸。更快的印版速度和更便捷的換版流程使柔版印刷機能夠重新獲得先前轉移到數位印刷的工作。因此,加工商正在投資於兼顧速度和靈活性的中階模組化生產線,以滿足整個柔版印刷機市場的設備需求。

食品級永續軟性包裝的激增

歐洲和北美的法規正在逐步淘汰 PFAS,並強制要求完全可回收。 Cycaflex 計劃在 2030 年實現 100% 可回收產品組合,其中 5% 為消費後回收材料 (PCR),這反映了壓印加工商在循環經濟方面必須達到的標準。 INX 的 GelFlex EB 墨水無需覆膜層,在保持阻隔性的同時,減輕了包裝總重量。 inxinternational.com。與 Solenis Heidelberg 等公司合作的線上阻隔塗層夥伴關係進一步減少了二次加工工序。隨著加工商競相在歐盟 2026 年 8 月 PFAS 排放上限生效前完成新化學品的認證,能夠以具有競爭力的速度運作水性油墨和 EB 固化油墨的印刷機需求激增,這將有利於柔版印刷市場的發展。

多色CI印刷機需要大量資金投入

一條配置齊全的1300毫米連續印刷生產線售價高達400萬美元,遠高於其模組化替代方案。因此,即使是全球性公司也在延後2024年的訂單,博斯特的連續印刷訂單量下降了24%。在平均運作下降的情況下,中型加工商不願投資高階印刷機,減緩了柔版印刷機市場的更新換代週期。

細分市場分析

到2024年,紙張和紙板將以45.56%的市場佔有率主導柔版印刷機市場,其中零售電商紙盒和再生牛皮紙是主要應用領域。加工商依靠紙張易於回收的特性來滿足品牌法規要求,而改進的塗層則延長了常溫食品的保存期限。然而,塑膠薄膜將以6.57%的複合年成長率成為成長最快的市場,因為單一材料複合材料和PCR(再生塑膠)混合物能夠滿足循環利用和阻隔方面的需求。

INX的EB油墨能夠去除薄膜結構中的層壓層,從而在不影響阻隔性的前提下降低薄膜厚度,這加劇了對替代產品的競爭。 UFlex在埃及新建的PET樹脂產能反映了全球樹脂自給自足、縮短供應鏈的趨勢。總體而言,紙張加工商正在擴大其瓦楞紙板生產線,而薄膜製造商則致力於生產高阻隔包裝袋,這支撐了針對特定基材的柔版印刷機市場對設備的需求。

由於購置成本低廉且易於更換作業,深受自有品牌食品和獨立化妝品企業的青睞,線上/模組化系統在2024年佔據了39.34%的收入佔有率。而資本密集的中央壓印機則以5.45%的複合年成長率成為成長最快的設備,這主要得益於品牌對收縮套標和寬幅捲筒零食等產品中精準套準的要求。

混合式設計打破了傳統界限:Uteco 的 OnyxOMNIA 將噴墨列印頭與八色柔印機結合,實現了可變數據列印,速度高達 400 公尺/分鐘。隨著 CI OEM 廠商推出自動化印版滾筒和數位雙胞胎診斷技術,24/6 輪班製版機正向高階市場轉型,推動柔印機市場向更高規格的平台發展。

柔版印刷機市場按承印物(紙/紙板、塑膠薄膜、瓦楞紙板等)、印刷機類型(中央壓印滾筒式、堆疊式、聯線/模組化)、終端用戶行業(食品/飲料、醫藥/醫療保健等)、自動化程度(傳統型、智慧/物聯網型)和地區進行細分。市場規模和預測以美元計價。

區域分析

到2024年,亞太地區將佔全球銷售額的40.56%,其中中國產能擴張和補貼主導的升級改造將有利於符合「綠色、智慧」標準的壓機。日本高昂的人事費用將加速機器人物料輸送的應用,而韓國和東協的加工商將投資建造軟質包裝線,以滿足區域零食和個人護理品牌的需求。

中東和非洲是成長最快的地區,複合年成長率達6.14%。人口成長、低溫運輸改善以及快速消費品滲透率的提高,正推動著新型軟包裝工廠的建設,並吸引了諸如UFlex在埃及的PET晶片工廠等投資,該工廠有助於當地樹脂供應。海灣國家也正在試驗改造現有維修,採用水性油墨,以達成循環經濟目標。

在日益成熟但日益嚴格的 PFAS 和 VOC 法規的背景下,北美和歐洲仍然是技術領導者。歐盟 25 ppb 的 PFAS 限值將於 2026 年 8 月生效,這將迫使加工商對其阻隔塗層進行全面升級。北美印刷商也面臨各州溶劑法規的類似壓力,促使他們升級到封閉式刮刀系統和熱固型空氣管理系統。因此,儘管這些地區的宏觀銷售成長放緩,但更換的需求仍保持著柔版印刷市場的活力。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 經濟高效的小批量包裝能力

- 食品級永續軟性包裝的激增

- 快速擴張瓦楞紙包裝產能以履約

- 北美和歐盟強制要求使用水性低VOC油墨

- 將生產線數位雙胞胎和人工智慧驅動的預測性維護相結合

- 中國2026年綠色印刷補貼政策(適用於CI柔版印刷設備)

- 市場限制

- 多色CI印刷機需要大量資金投入

- 歐洲和日本缺乏熟練的印刷操作員

- 超短期生產中前置作業時間的瓶頸

- 加強對阻隔塗層相容性的 PFAS 法規

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 材料

- 紙和紙板

- 塑膠薄膜

- 金屬薄膜和箔

- 紙板

- 其他材料(生質塑膠、層壓材料)

- 按壓類型

- 中央廣告曝光率(CI)

- 堆疊

- 內嵌/模組化

- 按最終用戶行業分類

- 食品/飲料

- 製藥和醫療保健

- 個人護理和化妝品

- 消費性電子產品

- 物流與電子商務

- 其他終端用戶產業

- 按自動化級別

- 傳統的

- 智慧/物聯網相容

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 義大利

- 英國

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- ASEAN

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 肯亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Bobst Group SA

- Windmoller and Holscher KG

- Koenig and Bauer AG

- Mark Andy Inc.

- Uteco Group

- Heidelberger Druckmaschinen AG

- OMET Srl

- MPS Systems BV

- Nilpeter A/S

- Gallus Ferd. Ruesch AG

- Soma Engineering

- PCMC(Barry-Wehmiller)

- Star Flex International

- Orient Sogyo Co. Ltd.

- Taiyo Kikai Ltd.

- Comexi Group

- Rotatek SA

- Wolverine Flexographic LLC

- Zhejiang Weigang Machinery

- Edale Ltd.

第7章 市場機會與未來展望

The flexographic printing machine market size stands at USD 4.22 billion in 2025 and is on track to reach USD 4.93 billion by 2030, reflecting a steady 3.3% CAGR.

Investment priorities now revolve around automation, hybrid press capabilities, and compliance with tightening sustainability rules rather than simple capacity expansion. E-commerce-related short runs, water-based ink mandates, and digital-twin maintenance platforms are reshaping procurement criteria across converters. Suppliers that marry fast changeovers with low-VOC performance are gaining share, while regional subsidy programs, most notably China's 2026 "Green Press" policy, are altering the competitive map. At the same time, mergers such as XSYS-MacDermid and INX-C&A illustrate how plate-making and ink specialists are consolidating to cut lead times and navigate PFAS restrictions.

Global Flexographic Printing Machine Market Trends and Insights

Cost-effective short-run packaging capability

Flexographic press builders have slashed setup times, taking profitable minimum runs from 5,000 m to close to 500 m. Shorter cycles mean brands with seasonal or regional SKUs can deploy custom graphics without prohibitive costs. MacDermid's LUX ITP plates now leave the plate room in eight hours, down from two days, which removes a key bottleneck for converters targeting next-day art changes. Together, faster plates and rapid changeovers allow flexography to reclaim work that once defaulted to digital presses. Converters are therefore investing in mid-range modular lines that balance speed with flexibility, underpinning equipment demand across the flexographic printing machine market.

Surge in food-grade sustainable flexible packaging

European and North American regulations are eliminating PFAS while demanding full recyclability. Saica Flex plans a 100% recyclable portfolio by 2030 with 5% PCR content, showcasing the pressure on converters to prove circularity. INX's GelFlex EB inks remove lamination layers, cutting total pack weight yet maintaining barrier integrity inxinternational.com. Inline barrier-coating partnerships, such as Solenis-Heidelberg, further reduce secondary processes. As converters race to certify new chemistries before the EU's August 2026 PFAS cap, demand crescendos for presses that can run water-based or EB curing inks at competitive speeds benefiting the flexographic printing machine market.

Cap-ex intensive multi-color CI presses

A fully optioned 1,300 mm CI line can command USD 4 million, well above modular alternatives. As a result, even global accounts deferred orders in 2024, cutting Bobst CI bookings by 24%. Mid-market converters hesitate to finance premium presses when average run lengths are shrinking, slowing replacement cycles in the flexographic printing machine market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid corrugated capacity additions in e-commerce fulfillment

- Mandates on water-based low-VOC inks

- Skilled press-operator shortage in Europe and Japan

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Paper and paperboard led the flexographic printing machine market with 45.56% share in 2024, buoyed by retail e-commerce cartons and recycled kraft liners. Converters rely on paper's easy recyclability to satisfy brand mandates, while improved coatings are extending shelf life for ambient foods. Plastic films, however, chart the fastest 6.57% CAGR as mono-material laminates and PCR blends solve circularity and barrier needs.

The substitution battle intensifies as INX's EB inks allow film structures to drop a lamination layer, cutting gauge without compromising barrier. UFlex's new PET resin capacity in Egypt reflects global resin self-sufficiency moves to shorten supply chains. Overall, paper converters expand corrugator fleets, whereas film suppliers chase high-barrier pouches together sustaining equipment demand across the flexographic printing machine market size for substrate-specific presses.

In-line/modular systems held 39.34% revenue share in 2024 thanks to affordable acquisition costs and nimble job changes traits favored by private-label food and indie cosmetics. Central-impression presses, though capital-heavy, are gaining fastest at 5.45% CAGR, propelled by brand demands for tight color-to-color register on shrink sleeves and wide web snacks.

Hybrid designs blur former lines: Uteco's OnyxOMNIA stitches inkjet heads onto an eight-color flexo deck, delivering 400 m/min while enabling variable data . As CI OEMs roll out automatic plate cylinders and digital-twin diagnostics, converters with 24/6 shifts migrate upscale, driving the flexographic printing machine market toward higher-spec platforms.

Flexographic Printing Machine Market is Segmented by Material (Paper and Paperboard, Plastic Films, Corrugated Board, and More), Press Type (Central-Impression (CI), Stack, and In-Line / Modular), End-User Industry (Food and Beverage, Pharmaceutical and Healthcare, and More), Automation Level (Conventional, and Smart / IoT-Enabled), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 40.56% of global revenues in 2024, aided by China's capacity expansions and subsidy-driven equipment renewals that favor CI presses meeting "green, intelligent" criteria. Japan's high labor costs accelerate adoption of robotic material handling, while South Korean and ASEAN converters invest in flexible packaging lines to serve regional snack and personal-care brands.

Middle East & Africa is the fastest-growing territory at 6.14% CAGR. Population growth, cold-chain improvements, and rising FMCG penetration spur new flexible packaging plants, drawing investments like UFlex's PET chip facility in Egypt which anchors local resin supply. Gulf States are also piloting water-based ink retrofits to meet circular-economy targets.

North America and Europe, though mature, remain technology pacesetters as PFAS and VOC regulations tighten. The EU's 25 ppb PFAS ceiling effective August 2026 forces converters to overhaul barrier coatings. North American printers face similar pressure from state-level solvent rules, driving upgrades to enclosed-chamber doctor-blade systems and heat-set air management. Consequently, replacement demand keeps the flexographic printing machine market dynamic despite slower macro-volume growth in these regions.

- Bobst Group SA

- Windmoller and Holscher KG

- Koenig and Bauer AG

- Mark Andy Inc.

- Uteco Group

- Heidelberger Druckmaschinen AG

- OMET Srl

- MPS Systems BV

- Nilpeter A/S

- Gallus Ferd. Ruesch AG

- Soma Engineering

- PCMC (Barry-Wehmiller)

- Star Flex International

- Orient Sogyo Co. Ltd.

- Taiyo Kikai Ltd.

- Comexi Group

- Rotatek SA

- Wolverine Flexographic LLC

- Zhejiang Weigang Machinery

- Edale Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cost-effective short-run packaging capability

- 4.2.2 Surge in food-grade sustainable flexible packaging

- 4.2.3 Rapid corrugated capacity additions in e-commerce fulfilment

- 4.2.4 Mandates on water-based low-VOC inks in North America and EU

- 4.2.5 Converting-line digital twin and AI predictive-maintenance adoption

- 4.2.6 China 2026 Green Press subsidy for CI-flexo equipment

- 4.3 Market Restraints

- 4.3.1 Cap-ex intensive multi-colour CI presses

- 4.3.2 Skilled press-operator shortage in Europe and Japan

- 4.3.3 Plate-making lead-time bottlenecks for ultra-short runs

- 4.3.4 Tightening PFAS restrictions on barrier coating compatibility

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Paper and Paperboard

- 5.1.2 Plastic Films

- 5.1.3 Metallic Films and Foils

- 5.1.4 Corrugated Board

- 5.1.5 Others Material (Bioplastics, Laminates)

- 5.2 By Press Type

- 5.2.1 Central-Impression (CI)

- 5.2.2 Stack

- 5.2.3 In-Line / Modular

- 5.3 By End-User Industry

- 5.3.1 Food and Beverage

- 5.3.2 Pharmaceutical and Healthcare

- 5.3.3 Personal-Care and Cosmetics

- 5.3.4 Consumer Electronics

- 5.3.5 Logistics and E-commerce

- 5.3.6 Other End-user Industry

- 5.4 By Automation Level

- 5.4.1 Conventional

- 5.4.2 Smart / IoT-Enabled

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 Italy

- 5.5.2.4 United Kingdom

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 ASEAN

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Kenya

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bobst Group SA

- 6.4.2 Windmoller and Holscher KG

- 6.4.3 Koenig and Bauer AG

- 6.4.4 Mark Andy Inc.

- 6.4.5 Uteco Group

- 6.4.6 Heidelberger Druckmaschinen AG

- 6.4.7 OMET Srl

- 6.4.8 MPS Systems BV

- 6.4.9 Nilpeter A/S

- 6.4.10 Gallus Ferd. Ruesch AG

- 6.4.11 Soma Engineering

- 6.4.12 PCMC (Barry-Wehmiller)

- 6.4.13 Star Flex International

- 6.4.14 Orient Sogyo Co. Ltd.

- 6.4.15 Taiyo Kikai Ltd.

- 6.4.16 Comexi Group

- 6.4.17 Rotatek SA

- 6.4.18 Wolverine Flexographic LLC

- 6.4.19 Zhejiang Weigang Machinery

- 6.4.20 Edale Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment