|

市場調查報告書

商品編碼

1851854

肉類包裝:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Meat Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

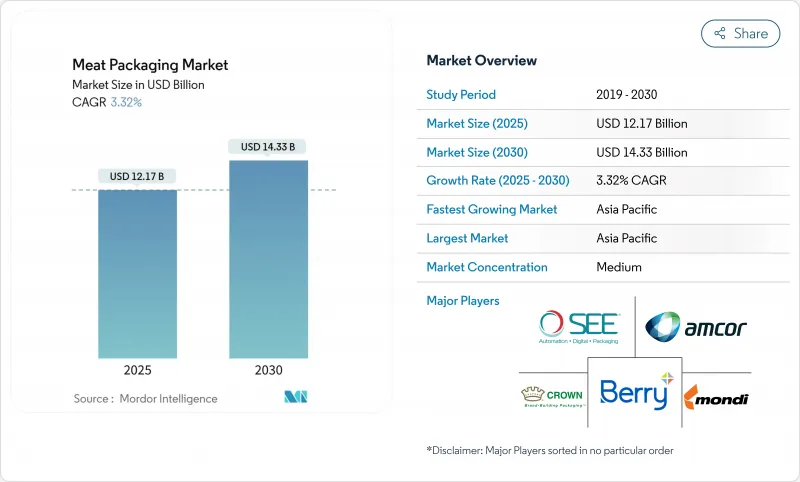

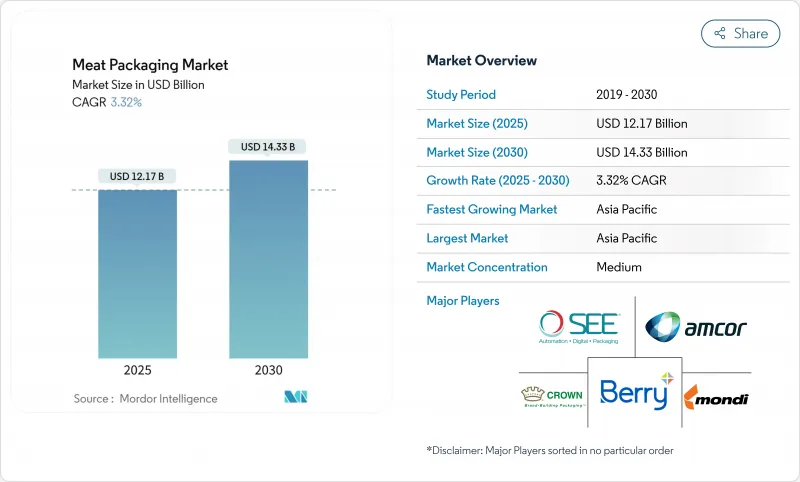

預計到 2025 年,肉類包裝市場規模將達到 121.7 億美元,到 2030 年將成長至 143.3 億美元,複合年成長率為 3.32%。

這一成長反映了市場對方便肉類產品的穩定需求、低溫運輸物流的日益普及以及全球食品安全和永續性法規的不斷加強。由於零售商追求更長的保存期限和更佳的視覺吸引力,軟性塑膠、氣調包裝和高阻隔單一物流成為主要規格。亞太地區銷售量最大,其中線上雜貨和食材自煮包通路的成長速度最快。塑膠廢棄物法規、原料價格波動以及替代蛋白的興起正在削弱淨利率前景,促使生產商尋求可回收薄膜、自動化和智慧包裝方面的創新。

全球肉類包裝市場趨勢與洞察

對方便即食肉類的需求

2016年至2022年間,消費者對增值肉類的接受度將從37%成長至67%,這將推動加工商轉向採用即食包裝,以保持肉的色澤和質地,並最大程度地減少商店處理。泰森鮮肉推出了通用即食包裝項目,旨在利用先進的阻隔薄膜簡化分銷流程並延長保存期限。時間緊迫的都市區消費者願意為方便快速烹飪的包裝支付更高的價格。新鮮已調理食品的成長將推動對高壓加工和氣調包裝系統的需求,以保持肉的風味和營養。這些動態將推動成熟城市和新興城市肉類包裝市場持續成長。

有組織的零售和低溫運輸物流的擴張

預計2023年,中國便利商店銷售額將年增10.8%,達到4,248億元人民幣,其中生鮮食品將引領成長。像悅仕機器人這樣的新興企業正在部署可在-30度C低溫下運作的自主堆高機,從而提升冷藏配送中心的效率。預計到2035年,更廣泛的商用冷藏投資將達到562億美元,這需要能夠承受低溫壓力並最大限度地減少氧氣滲入的包裝。零售商也要求採用標準化包裝形式以加快貨架補貨速度,因此加工商正在轉向與大規模生產線相容的軟包裝袋和熱成型托盤。這些趨勢確保了有組織的零售業將在長期內成為肉類包裝市場發展的催化劑。

抗菌奈米複合膜的應用

抗菌奈米複合材料可直接抑制肉類表面的微生物生長,延長保存期限並減少對防腐劑的依賴。注入天然萃取物的水凝膠載體已證實能夠在降低細菌數量的同時確保食品安全。北美和歐洲的試點生產線正在擴大生產規模,以期實現商業性應用。將這些薄膜與透明的氣調包裝蓋配合使用,可產生協同效應,既能提供有效的保護,又能保證產品的可視性,這兩點對於冷藏櫃而言都至關重要。

細分市場分析

到2024年,軟性塑膠將佔據肉類包裝市場42%的佔有率,這主要得益於其對不規則切割的適應性和優異的印刷性能。可生物分解薄膜雖然目前仍處於小眾市場,但隨著監管機構傾向於可堆肥或可回收的解決方案,其複合年成長率將達到7.2%。金屬罐和金屬箔仍然是高檔膩子和需要滅菌的長保存期限產品的重要包裝材料。抗菌奈米複合材料層正被應用於軟性薄膜中,在提供有效阻隔性能的同時,也能抑制細菌滋生。樹脂和塗層技術的不斷創新使加工商能夠在保持抗穿刺性的同時降低薄膜厚度,從而保持軟性包裝的成本競爭力。

硬質托盤通常由PET或PP製成,用於包裝切片產品,因為這類產品對堆疊性要求較高。但由於其材料重量較大,其永續性備受關注。透明的單層PET托盤正在取代發泡托盤,因為後者更容易回收分揀。金屬托盤因其優異的氣密性而常用於出口的鹹牛肉和午餐肉,但重量和成本問題限制了其市場成長。總體而言,隨著品牌在永續性和商品行銷需求之間尋求平衡,軟性包裝解決方案將繼續引領肉類包裝市場。

到2024年,新鮮和冷凍食品將佔肉類包裝市場規模的54%,這主要得益於超級市場對美觀、防漏且保存期限可達數天的托盤和外包裝的需求。隨著新興經濟體低溫運輸覆蓋範圍的擴大,這個市場將持續維持健康成長。從家常小菜切片到常溫肉乾,已調理食品系列將以5.5%的複合年成長率成長,因為人們的生活方式更注重便利性。這些產品需要高阻氧和防潮性能、微波爐適用密封以及方便消費者使用的開口,從而推動了易撕蓋和份量控制方面的創新。

加工肉品市場佔有率穩定,但健康趨勢正促使消費者轉向瘦肉和植物肉替代品。密著包裝的升級重點在於可重複密封的拉鍊和真空貼體包裝,這些措施既能改善肉質,又能最大限度地減少氣泡。各品類的需求都集中在能夠智慧識別變質風險的指示器上,這有助於在琳瑯滿目的商品中脫穎而出,並提升消費者對肉類包裝市場的信心。

區域分析

到2024年,亞太地區將佔肉類包裝市場規模的34%,這主要得益於中國近1億噸的肉類消費量和積極的零售現代化。到2030年,該地區的複合年成長率將達到4.8%,這反映了從北京到班加羅爾的都市化以及對低溫運輸樞紐的投資。中國線上牛肉購買比例將超過44%,顯示專為小包裹網路設計的電商友善包裝正在迅速普及。印度超級市場正在擴大冷凍庫區,從而擴大氣調包裝(MAP)和真空包裝(VSP)解決方案的應用。東南亞的便利連鎖店也紛紛效仿,採用能適應潮濕氣候的標準化包裝袋。

北美地區人均肉類消費量高,零售基礎建設成熟。區塊鏈溯源、抗菌薄膜和自動化裝袋機等技術的應用推動了該地區的成長。監管改革正在促進單一材料阻隔薄膜的試驗,尤其是在加拿大的大型連鎖超市。歐洲在循環經濟方面處於領先地位,推動加工商採用可回收的PE/PP結構和紙纖維混合材料。能夠同時滿足氧氣阻隔性和可回收性目標的包裝公司正在獲得歐盟食品雜貨商的優先供應商地位。

在南美洲,巴西等出口導向加工商的需求穩定,他們需要堅固耐用的包裝以進行跨洋運輸。高阻隔包裝袋、壓花真空袋和耐用紙板外包裝已成為標準配備。中東和非洲的普及程度不一,海灣地區的零售商指定銷售優質氣調包裝牛排,許多非洲市場仍依賴肉品。儘管低溫運輸差異限制了氣調包裝的普及,但基礎設施投資和快速商業試點計畫正在逐步推動其應用。這些地理動態驅動著全球肉類包裝市場呈現多速成長的態勢。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對肉類即食肉類產品的需求

- 有組織的零售和低溫運輸物流的擴張

- 保存期限延長及食品安全法規

- 永續發展主導的向高阻隔單一材料的轉變

- 抗菌/奈米複合薄膜的應用

- 基於區塊鏈的可追溯性和防篡改格式

- 市場限制

- 塑膠廢棄物法規和可回收性挑戰

- 聚合物和金屬投入價格波動

- 一次性包裝稅和生產者責任延伸費

- 替代蛋白的興起降低了對紅肉的需求。

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 疫情影響與恢復分析

第5章 市場規模與成長預測

- 依材料類型

- 塑膠

- 軟包裝袋

- 包包

- 薄膜和包裝

- 其他靈活

- 硬質托盤和容器

- 其他硬質材料

- 金屬

- 鋁

- 鋼

- 其他金屬

- 塑膠

- 按肉類類型

- 新鮮/冷凍

- 加工

- 已調理食品

- 透過包裝技術

- 調氣包裝(MAP)

- 真空緊縮包裝(VSP)

- 主動式智慧包裝

- 可食用和可生物分解的薄膜

- 透過最終用戶管道

- 零售(超級市場/大賣場)

- 食品服務/飯店餐飲

- 線上雜貨和食材自煮包

- 肉類加工/包裝

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略舉措與發展

- 市佔率分析

- 公司簡介

- Amcor plc

- Sealed Air Corporation

- Berry Global Group Inc.

- Mondi plc

- Crown Holdings Inc.

- Coveris Management GmbH

- Winpak Ltd.

- Smurfit Kappa Group plc

- Viscofan SA

- Sonoco Products Company

- Huhtamaki Oyj

- DS Smith plc

- WestRock Company

- Graphic Packaging Holding Company

- Tetra Pak International SA

- Klockner Pentaplast GmbH

- Constantia Flexibles GmbH

- Cascades Inc.

- Innovia Films Ltd.

- LINPAC Packaging Ltd.

第7章 市場機會與未來展望

The meat packaging market size reached USD 12.17 billion in 2025 and is forecast to grow to USD 14.33 billion by 2030 at a 3.32% CAGR.

Growth reflects steady demand for convenience meat formats, widening adoption of cold-chain logistics, and tightening global food-safety and sustainability rules. Flexible plastics, modified-atmosphere formats, and high-barrier mono-materials dominate specifications as retailers push longer shelf life and stronger visual appeal. Asia-Pacific drives the largest volumes, while online grocery and meal-kit channels record the fastest incremental gains. Plastic-waste regulation, raw-material volatility, and the rise of alternative proteins temper margin outlooks, encouraging producers to pursue recyclable films, automation, and smart-packaging innovations.

Global Meat Packaging Market Trends and Insights

Demand for Convenience and Ready-to-Eat Meat Products

Consumer adoption of value-added meat rose from 37% to 67% between 2016 and 2022, pushing processors toward case-ready formats that minimise in-store handling while preserving colour and texture. Tyson Fresh Meats launched its Universal Case Ready Program to streamline distribution and extend shelf life via advanced barrier films. Urban shoppers, pressed for time, accept premium price points for packs enabling rapid meal preparation. Growth in fresh-prepared foods accelerates demand for high-pressure processing and modified-atmosphere systems that safeguard taste and nutrients. These dynamics reinforce sustained volume gains for the meat packaging market in both mature and emerging cities.

Expansion of Organized Retail and Cold-Chain Logistics

Convenience-store sales in China climbed to CNY 424.8 billion in 2023, up 10.8% year on year, with fresh foods steering the rise. Start-ups such as Yueshi Robot are deploying autonomous forklifts operating at -30 °C, lifting efficiency in frozen distribution nodes. Broader commercial-refrigeration investment, projected to reach USD 56.2 billion by 2035, requires packaging that resists low-temperature stress while keeping oxygen ingress minimal. Retailers also demand standardised shapes to speed shelf replenishment, steering converters toward flexible pouches and thermoformed trays adapted for high-volume lines. These trends cement organised retail as a long-run catalyst for the meat packaging market.

Adoption of Antimicrobial/Nanocomposite Films

Antimicrobial nanocomposites inhibit microbial growth directly on the meat surface, extending shelf life and lowering reliance on preservatives. Hydrogel carriers infused with natural extracts show efficacy in lowering bacterial counts while remaining food-safe. Pilot lines in North America and Europe are scaling production for commercial launch. Synergies arise when such films are paired with transparent MAP lids, offering both active protection and product visibility critical for refrigerated cases.

Other drivers and restraints analyzed in the detailed report include:

- Shelf-Life Extension and Food-Safety Regulations

- Sustainability-Led Shift to High-Barrier Mono-Materials

- Blockchain-Enabled Traceability and Tamper-Evident Formats

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexible plastics held 42% of the meat packaging market in 2024, propelled by conformance to irregular cuts and excellent printability. Biodegradable films, though still niche, record a 7.2% CAGR as regulators favour compostable or recyclable solutions. Metal cans and foil remain vital for premium pate and long-life products requiring sterilisation. Antimicrobial nanocomposite layers are entering flexible webs, offering active bacterial suppression alongside barrier performance. Continuous resin and coating innovation allows converters to downgrade gauge while maintaining puncture resistance, keeping flexible packs cost-competitive.

Rigid trays, often PET or PP, serve sliced products where stackability matters, but face sustainability scrutiny for their higher material mass. Foam trays are losing ground to clear mono-PET variants that ease recyclability sorting. Metal options endure in export-grade corned beef and luncheon meat thanks to superior hermetic integrity, yet their growth is limited by weight and cost. Overall, flexible solutions will keep leading the meat packaging market as brands balance sustainability with merchandising demands.

Fresh and frozen products generated 54% of the meat packaging market size in 2024, backed by supermarket demand for visually appealing, leak-proof trays and overwraps that endure multi-day shelf life. Growth remains healthy as cold-chain coverage widens in emerging economies. Ready-to-eat lines, from deli slices to shelf-stable jerky, grow at 5.5% CAGR as lifestyles favour convenience. These formats need high-oxygen and moisture barriers, microwave-safe seals, and consumer-friendly openings, spurring innovation in peelable lidding and portion control.

Processed meats enjoy steady share, though health trends shift some volume toward leaner cuts and plant alternatives. Packaging upgrades focus on resealable zippers and vacuum skin formats that highlight texture while minimising air pockets. Across categories, demand converges toward smart indicators that display spoilage risk, reinforcing differentiation in crowded cases and boosting shopper confidence in the meat packaging market.

The Meat Packaging Market Report is Segmented by Material Type (Plastic, Metal), Meat Type (Fresh and Frozen, Processed, Ready-To-Eat), Packaging Technology (Modified Atmosphere Packaging (MAP), Vacuum Skin Packaging, and More ), End-User Channel (Retail, Foodservice, Online Grocery, Meat Processors), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 34% of the meat packaging market size in 2024, underpinned by China's near-100 million-ton meat consumption and vigorous retail modernisation. Regional CAGR of 4.8% through 2030 reflects urbanisation and investment in cold-chain nodes from Beijing to Bangalore. China's online beef purchases surpassed 44% share, signalling rapid uptake of e-commerce friendly packs designed for parcel networks. Indian supermarkets multiply freezer aisles, widening the addressable base for MAP and VSP solutions. Southeast Asian convenience chains follow suit, embracing standardised pouch formats that withstand humid climates.

North America combines high per-capita meat intake with mature retail infrastructure. Growth stems from technology adoption: blockchain tracing, antimicrobial films, and automation-ready baggers. Regulatory reviews spur trials of monomaterial barrier films, especially in Canada's major chains. Europe leads in circular-economy compliance, pushing converters toward recyclable PE/PP structures and paper-fibre hybrids. Packaging firms that meet both oxygen-barrier and recyclability targets unlock preferred supplier status with EU grocers.

South America sees steady demand from Brazil's export-oriented processors that need robust packs for transoceanic shipping. High-barrier pouches, embossed vacuum bags, and strong corrugated outers are standard. Middle East & Africa exhibit uneven penetration; Gulf retailers specify premium MAP steaks, while many African markets still rely on butcher paper. Cold-chain gaps limit adoption but infrastructure investments and quick-commerce pilots point to gradual uptake. Together, these geographic dynamics foster multi-speed growth paths that expand the global meat packaging market.

- Amcor plc

- Sealed Air Corporation

- Berry Global Group Inc.

- Mondi plc

- Crown Holdings Inc.

- Coveris Management GmbH

- Winpak Ltd.

- Smurfit Kappa Group plc

- Viscofan S.A.

- Sonoco Products Company

- Huhtamaki Oyj

- DS Smith plc

- WestRock Company

- Graphic Packaging Holding Company

- Tetra Pak International S.A.

- Klockner Pentaplast GmbH

- Constantia Flexibles GmbH

- Cascades Inc.

- Innovia Films Ltd.

- LINPAC Packaging Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for convenience and RTE meat products

- 4.2.2 Expansion of organized retail and cold-chain logistics

- 4.2.3 Shelf-life extension and food?safety regulations

- 4.2.4 Sustainability-led shift to high-barrier mono-materials

- 4.2.5 Adoption of antimicrobial / nanocomposite films (under-radar)

- 4.2.6 Blockchain-enabled traceability and tamper-evident formats (under-radar)

- 4.3 Market Restraints

- 4.3.1 Plastic-waste regulations and recyclability challenges

- 4.3.2 Volatile polymer and metal input prices

- 4.3.3 Single-use-packaging taxes and EPR fees

- 4.3.4 Growth of alternative proteins reducing red-meat demand (under-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pandemic Impact and Recovery Analysis

5 MARKET SIZE and GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.1.1 Flexible Pouches

- 5.1.1.1.1 Bags

- 5.1.1.1.2 Films and Wraps

- 5.1.1.1.3 Other Flexible

- 5.1.1.2 Rigid Trays and Containers

- 5.1.1.2.1 Other Rigid

- 5.1.2 Metal

- 5.1.2.1 Aluminium

- 5.1.2.2 Steel

- 5.1.2.3 Other Metals

- 5.1.1 Plastic

- 5.2 By Meat Type

- 5.2.1 Fresh and Frozen

- 5.2.2 Processed

- 5.2.3 Ready-to-Eat

- 5.3 By Packaging Technology

- 5.3.1 Modified Atmosphere Packaging (MAP)

- 5.3.2 Vacuum Skin Packaging (VSP)

- 5.3.3 Active and Intelligent Packaging

- 5.3.4 Edible and Biodegradable Films

- 5.4 By End-user Channel

- 5.4.1 Retail (Supermarkets / Hypermarkets)

- 5.4.2 Food-service / HORECA

- 5.4.3 Online Grocery and Meal-kit

- 5.4.4 Meat Processors / Packers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Sealed Air Corporation

- 6.4.3 Berry Global Group Inc.

- 6.4.4 Mondi plc

- 6.4.5 Crown Holdings Inc.

- 6.4.6 Coveris Management GmbH

- 6.4.7 Winpak Ltd.

- 6.4.8 Smurfit Kappa Group plc

- 6.4.9 Viscofan S.A.

- 6.4.10 Sonoco Products Company

- 6.4.11 Huhtamaki Oyj

- 6.4.12 DS Smith plc

- 6.4.13 WestRock Company

- 6.4.14 Graphic Packaging Holding Company

- 6.4.15 Tetra Pak International S.A.

- 6.4.16 Klockner Pentaplast GmbH

- 6.4.17 Constantia Flexibles GmbH

- 6.4.18 Cascades Inc.

- 6.4.19 Innovia Films Ltd.

- 6.4.20 LINPAC Packaging Ltd.

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment