|

市場調查報告書

商品編碼

1846271

家禽包裝:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Poultry Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

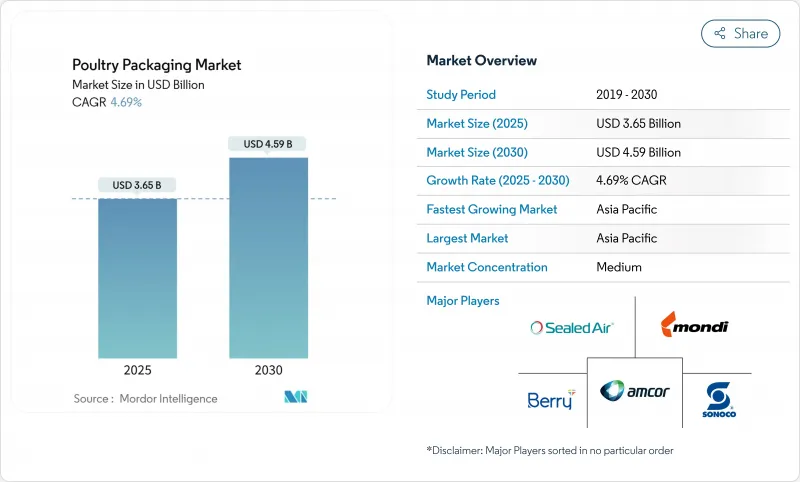

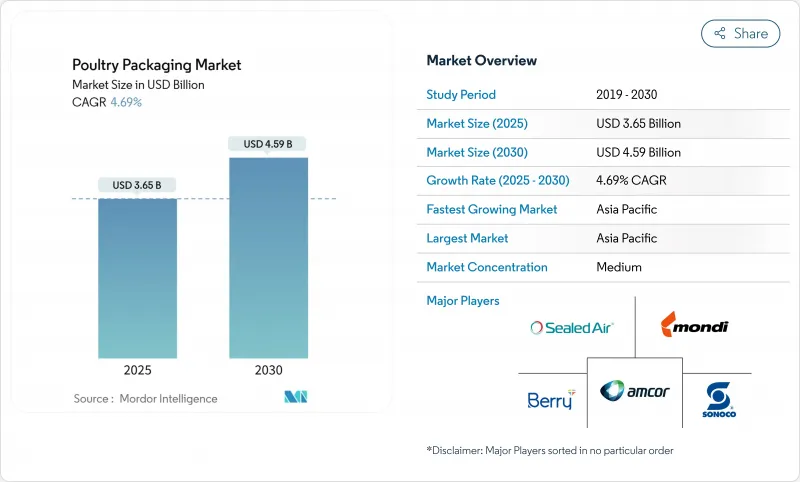

預計到 2025 年,家禽包裝市場規模將達到 36.5 億美元,到 2030 年將達到 45.9 億美元,年複合成長率為 4.69%。

對即食雞肉需求的成長、新型改良氣調包裝解決方案的出現以及永續性法規的推動,共同支撐著這個產業的穩定成長。零售商青睞可減少損耗和人工成本的即食雞肉托盤。電商則需要能夠承受多日運輸的保溫托盤。紙基複合材料的興起迫使生產商在不降低產量的前提下,不斷創新隔離層材料。同時,產業整合正在改變加工商和生產商之間的議價能力,而科技公司則在產業鏈的每個環節植入感測器,以預警溫度超標的情況。

全球家禽包裝市場趨勢與洞察

消費者對方便快速的即食雞肉的需求不斷成長

千禧世代和Z世代消費者偏好便捷易取的雞肉餐,尤其是採用易撕托盤或烤箱適用包裝袋的雞肉餐。因此,大型零售商紛紛採用集中式預包裝方案,以減少店內人工成本並提高產品品質的一致性。托盤製造商現在會在包裝內加入吸水墊片和氣體沖洗閥,從而延長保存期限數天。像G. Mondini這樣的設備供應商提供模組化生產線,將精確分裝與薄膜厚度結合,在不影響美觀的前提下減少材料用量。連鎖餐廳也順應這一趨勢,訂購預先醃製真空密著包裝,可直接從冷藏室取出放入烤架。高階食材自煮包平台也採用相同的包裝來延長運輸過程中的保存期限,從而獲得更高的利潤,抵消了先進薄膜的成本。

MAP和真空皮膚技術的普及

雖然調氣包裝透過減緩微生物生長來延長保存期限,但早期的高氧配方會促進脂質氧化和顏色變化。加工商目前正在試驗一氧化碳助劑,這種助劑可以在不引起安全隱患的情況下穩定肉的色澤。像Duropac這樣的公司生產的真空貼體膜因其能防止滲漏和抗穿刺,而備受帶骨肉塊的青睞。等離子處理的托盤可在包裝內產生臭氧,無需使用化學物質即可減少90%的曲狀桿菌和60%的沙門氏菌。像MULTIVAC這樣的設備製造商將MAP閥與微孔蓋結合,使加工商能夠針對每個SKU客製化氣體比例。

禽流感導致的供應中斷

2024-2025 年的高致病性禽流感疫情導致數百萬隻禽鳥從供應鏈中消失,生產計畫被打亂,托盤需求也因重量等級而異。美國為此支付了 18 億美元的賠償金,但禽舍需要 24 週才能恢復飼養,延長了生產的不穩定性。華盛頓大學研發的一種快速生物感測器可在五分鐘內檢測出 H5N1 病毒,從而實現早期控制和有針對性的撲殺。更短的禽群週期迫使加工商訂購更靈活規格的禽鳥並調整品牌組合。

細分市場分析

由於消費者廣泛接受以及去骨生產線的精簡高效,雞肉類別佔據了家禽包裝市場65.89%的佔有率。高產量使加工商能夠與供應商協商薄膜成本,促使他們嘗試使用易撕封口蓋來減少食物廢棄物。儘管鴨肉市場基數較小,但隨著高階零售商在真空包裝托盤中採用先進的雞胸肉分割控制技術,鴨肉市場預計將以5.61%的複合年成長率成長。隨著特色肉品逐漸進入主流冷凍庫,鴨肉包裝市場規模預計將穩定成長。安姆科的強化阻隔袋可防止油脂遷移,保持肉色鮮豔,並符合高階產品展示標準。

鴨肉消費量的上升要求加工商採用防油塗層,並保持透明度以吸引零售商。鴨肉加工如今已自動化,符合重量規格,並能像雞肉一樣直接包裝販售。雖然季節性的整禽包裝形式仍能維持火雞的市場佔有率,但增值烤肉和切片熟食包裝則支撐了全年需求。這就要求針對每種蛋白質客製化阻隔性、抗穿刺性和外形,迫使薄膜製造商在不增加SKU數量的前提下拓展產品組合。

到2024年,軟性包裝結構將佔據家禽包裝市場62.93%的佔有率,這主要得益於其較低的材料強度和透過醒目的圖形設計提升的貨架展示效果。隨著單層PET和PE複合材料實現可回收利用,這種包裝形式仍將保持成長勢頭,年成長率達5.39%。在家禽包裝市場中,硬質托盤仍將適用於高階烤箱適用產品和整禽包裝,因為這些產品需要良好的堆疊穩定性。

GEA 的 PowerPak 1000 等設備使中型工廠能夠在單一機架上切換真空包裝、氣調包裝和剝離包裝,從而減少換型停機時間。如今,軟包裝袋內建了新鮮度感測器,會隨著 pH 值升高而改變顏色,使包裝機成為品質監測器。這些升級既能保護對成本敏感的蛋白質產品的價格分佈,又能滿足零售商延長包裝繩使用壽命以減少損耗的需求。

區域分析

預計到2024年,亞太地區將佔全球禽肉包裝市場38.71%的佔有率,並在2030年之前以5.24%的複合年成長率持續成長。中國和印度快速的城市化進程以及可支配收入的成長正在推動冷藏雞肉的需求,而泰國也不斷鞏固其出口地位。各國循環經濟法規正在促進可回收複合材料的應用,當地加工商正與全球機械製造商合作,以滿足出口衛生標準。進軍印尼和越南市場的跨國零售商正在推行即用型包裝方案,這為區域加工商帶來了新的商機。

以以金額為準計算,北美位居第二。儘管聯邦法規保持穩定,但加州和奧勒岡州等州正在增加生產者責任費,並鼓勵使用單一材料包裝。消費者表現出強烈的意願為不含抗生素和獲得永續性認證的包裝買單,這促使品牌試用可堆肥托盤。加拿大更新後的「零塑膠廢棄物」議程與歐盟的目標相呼應,並進一步加速了向紙-聚合物混合材料的過渡。智慧標籤正在被早期採用,大型零售商正在測試包裝上的QR碼以實現可追溯性。

歐洲整體經濟成長緩慢,但創新密度很高。 2025/40號法規要求在2030年實現100%可回收利用,並禁止使用PFAS,這將迫使加工商迅速尋找替代材料。零售商正與供應商合作,檢驗,該托盤可使雞肉保鮮21天。在德國,智慧感測器試點計畫追蹤時間和溫度濫用情況,提供數據以幫助動態折扣,從而減少浪費。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 市場定義與研究假設

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 方便快速且對即食雞肉的需求不斷成長

- MAP和真空皮膚技術的普及

- 轉向使用生物基和可回收材料

- 電子商務與低溫運輸的擴張

- 智慧保鮮感光元件

- 主要市場強制要求使用再生材料

- 市場限制

- 禽流感導致的供應中斷

- 高昂的食品接觸合規成本

- 聚烯原料價格波動

- 高氧平均動脈壓

- 價值/供應鏈分析

- 關鍵法規結構評估

- 關鍵相關人員影響評估

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 宏觀經濟因素的影響

第5章 市場規模與成長預測

- 按肉類類型

- 雞

- 火雞

- 鴨子

- 按包裝類型

- 固定/剛性

- 柔軟的

- 透過包裝材料

- 塑膠

- 紙和紙板

- 金屬

- 透過包裝技術

- 調氣包裝(MAP)

- 真空緊縮包裝(VSP)

- 主動式智慧包裝

- 高壓和其他

- 按分銷管道

- 零售

- 食品服務/飯店餐飲

- 工業和設施

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲國家

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Amcor plc

- Berry Global Group Inc.

- Mondi plc

- Sealed Air Corporation

- Sonoco Products Company

- ProAmpac Holdings LLC

- UFlex Limited

- Huhtamaki Oyj

- Winpak Ltd.

- Glenroy Inc.

- LINPAC SEALPAC International BV

- Coveris Holding SA

- Smurfit Kappa Group plc

- Klockner Pentaplast GmbH

- Cascades Inc.

- DS Smith plc

- Printpack Inc.

- Graphic Packaging Holding Company

- Innovia Films Ltd.

- Flexopack SA

第7章 市場機會與未來趨勢

- 閒置頻段與未滿足需求評估

The poultry packaging market reached USD 3.65 billion in 2025 and is expected to achieve USD 4.59 billion by 2030, advancing at a 4.69% CAGR.

Rising demand for case-ready poultry, new modified-atmosphere solutions, and sustainability regulations underpin this steady growth. Retailers prefer shelf-stable chicken trays that reduce shrink and labor. E-commerce adds volume for insulated formats that survive multi-day transit. Material shifts toward paper-based laminates press producers to innovate barrier layers without losing throughput. Meanwhile, merger activity is altering bargaining power between converters and processors, and technology firms are embedding sensors that warn of temperature abuse at every link in the chain.

Global Poultry Packaging Market Trends and Insights

Rising Demand for Convenience and Case-Ready Poultry

Millennial and Generation Z shoppers favor quick, no-mess poultry meals that arrive in easy-peel trays or ovenable pouches. Large retailers therefore specify centralized case-ready programs that cut in-store labor and improve product consistency. Tray producers now integrate absorbent pads and gas-flush valves that extend freshness by several days. Equipment vendors such as G.Mondini supply modular lines that blend precise portioning with lower film gauge, trimming material use without sacrificing visual appeal. Foodservice chains mirror this shift by ordering pre-marinated, vacuum-skin packs that move from cooler to grill in one step. Premium meal-kit platforms exploit the same packaging to boost shelf life during shipping, capturing higher margins that offset advanced film costs.

Surge in MAP and Vacuum-Skin Technologies

Modified-atmosphere packaging improves shelf life by slowing microbial growth, yet early high-oxygen blends accelerated lipid oxidation and color shifts. Converters now trial carbon-monoxide adjuncts that stabilize bloom without raising safety concerns. Vacuum-skin films from firms like Duropac prevent purge and withstand puncture, making them attractive for bone-in cuts. Plasma-treated trays that create in-pack ozone cut Campylobacter by 90% and Salmonella by 60% without chemicals. Equipment makers such as MULTIVAC pair MAP valves with micro-perforated lids so processors can tune gas ratios to each SKU.

Avian-Influenza Supply Disruptions

The 2024-2025 HPAI wave removed millions of birds from supply chains, unsettling production schedules and altering tray demand by weight class. USDA spent USD 1.8 billion on indemnities, but barns need up to 24 weeks to repopulate, prolonging volume instability. Rapid biosensors from Washington University now detect H5N1 in five minutes, enabling earlier lockdowns and targeted culls. Shorter flock cycles force processors to order more flexible sizes and adjust brand mix, which in turn influences run-length planning for converters.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Bio-Based and Recyclable Materials

- E-Commerce Cold-Chain Expansion

- Stringent Food-Contact Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The chicken category owns 65.89% of the poultry packaging market, thanks to broad consumer acceptance and streamlined deboning lines. High throughput lets processors negotiate film cost and spur experimentation with peel-reseal lids that cut food waste. Duck, despite its modest base, grows at a 5.61% CAGR as upscale retailers introduce portion-controlled breasts in sleek vacuum-skin trays. Here, the poultry packaging market size for duck is forecast to climb steadily as exotic proteins move into mainstream freezers. Enhanced barrier bags from Amcor prevent grease migration and preserve dark-meat color, meeting premium presentation standards.

Duck's rise compels converters to integrate oil-resistant coatings while keeping clarity for retail appeal. Automation now portions duck to weight specs, enabling case-ready rollouts similar to chicken. Turkey holds share through seasonal whole-bird formats, yet value-added roasts and sliced deli packs sustain year-round demand. Each protein therefore demands tailored barrier, puncture strength, and silhouette, nudging film suppliers to broaden portfolios without inflating SKU count.

Flexible structures delivered 62.93% of the poultry packaging market in 2024, supported by lower material intensity and high graphics that elevate shelf presence. The format will remain the growth leader, advancing 5.39% each year as mono-PET and PE laminates become store-drop recyclable. Within the poultry packaging market size, rigid trays retain roles in premium oven-ready SKUs and whole-bird presentations that benefit from stacking stability.

Equipment such as GEA's PowerPak 1000 lets mid-scale plants swing between vacuum, MAP, and skin variants on a single frame, cutting change-over downtime . Flexible pouches now embed freshness sensors that change color when pH rises, turning the wrapper into a quality monitor. These upgrades defend price points in a cost-sensitive protein category and satisfy retailers that push for longer coded life to lower shrink.

The Poultry Packaging Market Report is Segmented by Meat Type (Chicken, Turkey, Duck), Packaging Format (Fixed/Rigid, Flexible), Packaging Material (Plastics, Paper and Paperboard, Metals), Packaging Technology (Modified Atmosphere Packaging, Vacuum Skin Packaging, and More), Distribution Channel (Retail, Foodservice/HORECA, Industrial and Institutional), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 38.71% of the poultry packaging market in 2024 and is projected to expand at a 5.24% CAGR to 2030. Rapid urban migration and rising disposable income in China and India lift chilled-poultry demand, while Thailand strengthens its export position. National circular-economy rules spur adoption of recyclable laminates, and local processors engage global machinery firms to meet export hygiene codes. Multinational retailers entering Indonesia and Vietnam specify case-ready programs, unlocking new business for regional converters.

North America ranks second in value. Federal regulation remains stable, but states such as California and Oregon add producer-responsibility fees that reward mono-material formats . Consumers display strong willingness to pay for antibiotic-free and sustainability-certified packs, encouraging brands to pilot compostable trays. Canada's updated Zero Plastic Waste agenda echoes EU targets, further accelerating the shift to paper-polymer hybrids. Intelligent labels see early uptake as big-box stores test on-pack QR codes for traceability.

Europe shows low headline growth yet high innovation density. Regulation 2025/40 enforces 100% recyclability by 2030 and bans PFAS, forcing converters into rapid material substitution. Retailers collaborate with suppliers to validate fully fiber trays that keep poultry fresh for 21 days, exemplified by Coveris' new BarrierFresh line. Smart-sensor pilots in Germany track time-temperature abuse, delivering data that informs dynamic discounting to curb waste.

- Amcor plc

- Berry Global Group Inc.

- Mondi plc

- Sealed Air Corporation

- Sonoco Products Company

- ProAmpac Holdings LLC

- UFlex Limited

- Huhtamaki Oyj

- Winpak Ltd.

- Glenroy Inc.

- LINPAC SEALPAC International BV

- Coveris Holding SA

- Smurfit Kappa Group plc

- Klockner Pentaplast GmbH

- Cascades Inc.

- DS Smith plc

- Printpack Inc.

- Graphic Packaging Holding Company

- Innovia Films Ltd.

- Flexopack SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for convenience and case-ready poultry

- 4.2.2 Surge in MAP and vacuum-skin technologies

- 4.2.3 Shift toward bio-based and recyclable materials

- 4.2.4 E-commerce cold-chain expansion

- 4.2.5 Adoption of intelligent freshness sensors

- 4.2.6 Recycled-content mandates in key markets

- 4.3 Market Restraints

- 4.3.1 Avian-influenza supply disruptions

- 4.3.2 Stringent food-contact compliance costs

- 4.3.3 Feedstock-price volatility for polyolefins

- 4.3.4 Consumer skepticism of high-O? MAP

- 4.4 Value / Supply-Chain Analysis

- 4.5 Evaluation of Critical Regulatory Framework

- 4.6 Impact Assessment of Key Stakeholders

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of Macro-economic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Meat Type

- 5.1.1 Chicken

- 5.1.2 Turkey

- 5.1.3 Duck

- 5.2 By Packaging Format

- 5.2.1 Fixed / Rigid

- 5.2.2 Flexible

- 5.3 By Packaging Material

- 5.3.1 Plastics

- 5.3.2 Paper and Paperboard

- 5.3.3 Metals

- 5.4 By Packaging Technology

- 5.4.1 Modified Atmosphere Packaging (MAP)

- 5.4.2 Vacuum Skin Packaging (VSP)

- 5.4.3 Active and Intelligent Packaging

- 5.4.4 High-Pressure and Others

- 5.5 By Distribution Channel

- 5.5.1 Retail

- 5.5.2 Foodservice / HORECA

- 5.5.3 Industrial and Institutional

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia and New Zealand

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Berry Global Group Inc.

- 6.4.3 Mondi plc

- 6.4.4 Sealed Air Corporation

- 6.4.5 Sonoco Products Company

- 6.4.6 ProAmpac Holdings LLC

- 6.4.7 UFlex Limited

- 6.4.8 Huhtamaki Oyj

- 6.4.9 Winpak Ltd.

- 6.4.10 Glenroy Inc.

- 6.4.11 LINPAC SEALPAC International BV

- 6.4.12 Coveris Holding SA

- 6.4.13 Smurfit Kappa Group plc

- 6.4.14 Klockner Pentaplast GmbH

- 6.4.15 Cascades Inc.

- 6.4.16 DS Smith plc

- 6.4.17 Printpack Inc.

- 6.4.18 Graphic Packaging Holding Company

- 6.4.19 Innovia Films Ltd.

- 6.4.20 Flexopack SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-need Assessment