|

市場調查報告書

商品編碼

1690833

歐洲收縮和彈力套筒標籤:市場佔有率分析、行業趨勢和成長預測(2025-2030)Europe Shrink and Stretch Sleeve Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

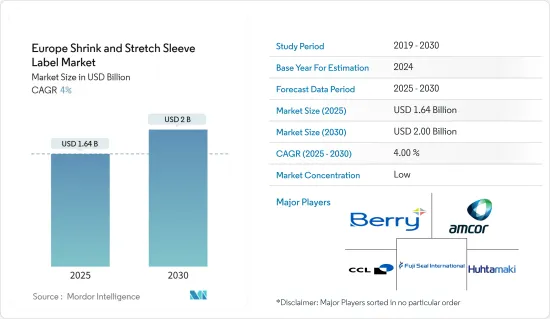

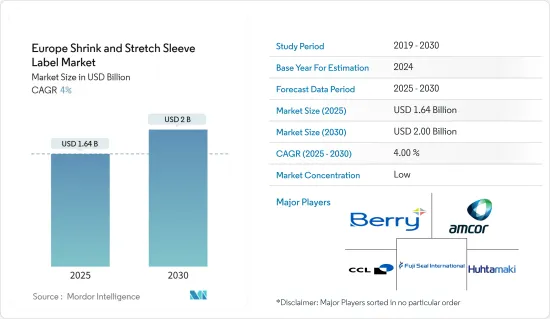

預計 2025 年歐洲收縮和彈力套筒標籤市場規模將達到 16.4 億美元,預計 2030 年將達到 20 億美元,預測期內(2025-2030 年)的複合年成長率為 4%。

COVID-19 疫情爆發及由此導致的停工影響了全部區域的工業活動。然而,2020 年前四個月造成的中斷預計將導致訂單延遲,並且到 2021 年第二季整個套筒標籤供應鏈的前置作業時間增加。

由於原料供應商效率低下,疫情也為套筒標籤製造商帶來了短期供應壓力。由於許多國家停工,許多歐洲包裝公司無法實現全部生產能力。

關鍵亮點

- 貨架上的產品展示對推動銷售起著至關重要的作用,尤其是在零售店和超級市場。此外,包裝 3D 建模技術的出現簡化了印前流程,使轉換器能夠在送去印刷之前為品牌模擬成品包裝的外觀。

- 此外,收縮套筒標籤從上到下覆蓋容器,並透過在同一標籤上加入易開或保證密封來防止內容物被篡改,從而為產品公司提供更高的安全性。

- 例如,Brown-Forman Beverages 使用 Eastman Embrace LV 共聚酯製作收縮膜標籤,該標籤覆蓋了英國推出的限量版包裝 Southern Comfort 的整個 700 毫升瓶子。收縮標籤覆蓋瓶頸和瓶蓋,起到防篡改密封的作用,給人一種包裝好的禮物的感覺。

- PVC 或 PETG 基收縮標籤的密度比水大。這會污染再生 PET 流並劣化再生 PET (rPET) 產品的品質。這導致人們加強開發新的聚烯薄膜結構,這種薄膜在清洗過程中可以漂浮,使標籤和瓶子材料分離。

- 歐盟將於2021年禁止一次性塑膠製品。成員國必須達成2025年寶特瓶回收率達到77%,到2029年達到90%的目標。此外,到2025年寶特瓶必須至少使用25%的再生材料,到2030年必須至少使用30%的再生材料。監管規範的這種動態變化,尤其是塑膠禁令,預計將對該地區的收縮和彈力套筒標籤市場產生負面影響。

歐洲收縮和彈力套筒標籤市場趨勢

PE 領域顯著成長

- 聚乙烯是最受歡迎的收縮和拉伸包裝材料,因為它相對便宜,可以生產出各種密度,並且可以透過添加劑改質以提供多種功能。大部分收縮膜都是LDPE,更複雜的薄膜也會混合LLDPE。也可以添加少量 HDPE。

- 大多數市場相關人員都在推出新標籤,提供多種永續解決方案供選擇。例如,2020 年 5 月,芬歐藍泰標籤推出了 UPM Raflatac Forest Film PE,以補充其永續薄膜標籤解決方案系列。新型 PE 薄膜標籤推動了芬歐藍泰標籤對超越化石能源的智慧未來的探索,減少了居家醫療和個人護理標籤應用中原始化石基原料的使用。

- 此外,聚乙烯薄膜製造商和回收商 Barbier Group 全力致力於向更永續的模式轉型。透過在生產過程中使用再生聚合物,Barbier 集團減少了原生塑膠(石化燃料)的消費量並減少了其碳排放。每噸再生塑膠取代一噸石油基材料就相當於減少三噸碳排放。

- 然而,PE成長放緩也減緩了新產能的推出。 2020 年計畫總合運作710 萬噸 PE,其中 270 萬噸預計將延後至 2021 年(資料來源:歐盟委員會)。

飲料佔很大市場佔有率

- 套式標籤在飲料終端用戶領域的使用持續成長。這主要是由於消費者認可度的競爭日益激烈。

- 使用寶特瓶和鋁罐來包裝飲料產品的趨勢日益明顯。越來越多的人開始在鋁罐上使用收縮套標來代替直接印刷。封套上列出了品牌數量和版本靈活性。永續性、貨架影響力、功能性和數位印刷預計將在未來幾年推動飲料行業標籤使用的創新。

- 為了應對永續性問題,許多公司正在推出採用新材料形式的封套。 Sliver International 最近推出了一款新產品 LDPET,用於更好地回收廢棄寶特瓶。

- 2021 年 2 月,CCL Label 推出了其永續拉伸套標「Eco 拉伸」。使用後, 拉伸會在該公司位於奧地利的工廠進行回收,並在完全封閉式的生產循環中返回製造流程。該回收設施將位於 CCL 位於奧地利的 Voelkermarkt 工廠。該工廠是拉伸和收縮套管的生產中心,主要針對乳製品、飲料和居家醫療產業。

- 此外,根據歐洲飲料協會聯盟(UNESDA)的數據,2019年,歐盟成員國公民平均每年消費約94.7公升軟性飲料。在英國等主要已開發國家,軟性飲料消費量遠高於歐盟平均。 2010年,歐盟人均非酒精飲料消費量為238.2公升,到2019年將上升至243.9公升。這樣的案例可能會帶來顯著的市場成長。

歐洲收縮和彈力套筒標籤行業概況

歐洲收縮和彈力套筒標籤市場適度細分。創新可改善端到端客戶體驗並簡化部署和使用,是市場參與企業產品創新和策略的關鍵驅動力。市場參與企業採取了強力的競爭策略,如產品開發、投資和收購,以維持其在市場中的地位。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業生態系統分析

第5章市場動態

- 市場促進因素

- 提高各類產品貨架吸引力的需求

- 需要防篡改

- 市場限制

- 由於環境問題日益嚴重,監管標準不斷變化

- COVID-19 市場影響

第6章市場區隔

- 按類型

- 熱縮套管

- 拉伸套

- 其他

- 按材質

- PVC

- PET-G

- PE

- PP

- 其他

- 按應用

- 飲料

- 食物

- 個人護理

- 其他

- 按國家

- 德國

- 法國

- 英國

- 義大利

- 俄羅斯

- 波蘭

- 荷蘭

- 西班牙

- 其他歐洲國家

第7章競爭格局

- 公司簡介

- Berry Global Inc.

- CCL Industries Inc.

- Klockner Pentaplast Group

- Fuji Seal International Inc.

- Huhtamaki OYJ

- The Dow Chemical Company

- Amcor PLC

- Clondalkin Group Holdings BV

- Westrock Company

- Decomatic SA

- Oerlemans Plastics

- Maca SRL

第8章 主要機械供應商

第9章投資分析

第10章:投資分析市場的未來

The Europe Shrink and Stretch Sleeve Label Market size is estimated at USD 1.64 billion in 2025, and is expected to reach USD 2.00 billion by 2030, at a CAGR of 4% during the forecast period (2025-2030).

The COVID-19 pandemic and the consequent lockdowns have affected industrial activities across the region. However, the disruptions caused in the first four months of 2020 were expected to result in order delays and increased lead times across the sleeve label supply chain until the second quarter of 2021.

The pandemic has also created a short-term supply pressure on sleeve label players, as raw material suppliers have been functioning at lowered efficiencies. Most packaging companies in Europe were not able to manage full production capacities due to lockdowns in many countries.

Key Highlights

- The shelf appeal of a product plays a crucial role in driving its sales, especially in retail stores, and supermarkets. Moreover, with the advent of the 3D modeling technology for packaging, the streamlining of the pre-press process becomes simpler and allows the converter to simulate the appearance of the finished product packaging to brands before they hit the press.

- Further, shrink sleeve labels offer added security and safety for product companies as they cover the container from top to bottom, and incorporate an easy open or guarantee seal on the same label, thereby protecting the contents from being tampered with.

- For example, Brown-Forman Beverages used the Eastman Embrace LV copolyester for shrink film labels, covering the entire 70 cl bottle of Southern Comfort liquor for a limited edition package, which was launched in the United Kingdom. The shrink label includes the neck and cap, acting as a tamper-evident seal and giving the impression of a wrapped gift.

- Shrink-sleeve labels that are either PVC-based or PETG-based have a density higher than water. Hence, they contaminate the recycled PET stream and deteriorate the quality of recycled PET (rPET) products. This has led to increased efforts for developing new polyolefin film structures that float during washing to enable the separation of the label and bottle materials.

- The European Union banned single-use plastic items in 2021. The member states need to achieve a 77% collection target for plastic bottles by 2025 and 90% by 2029. Also, the law requires plastic bottles to contain at least 25% recycled content by 2025 and 30% recycled content by 2030. Such dynamic changes in regulatory standards, especially the ban on plastic, are expected to have an adverse effect on the shrink and stretch sleeve label market in the region.

Europe Shrink and Stretch Sleeve Label Market Trends

PE Segment to Witness Significant Growth

- Polyethylene is the most commonly used material for shrink and stretch wrapping because it is relatively cheap, and can be produced in a wide range of different densities and modified with additives to perform many functions. The vast majority of shrink film is LDPE, and some of the more sophisticated films have blends of LLDPE as well. Sometimes, a small quantity of HDPE material is also added.

- Most market players are launching new labels that offer a wide variety of sustainable solutions to choose from. For instance, in May 2020, UPM Raflatac launched UPM Raflatac Forest Film PE to complement its range of sustainable film labeling solutions. The new PE film label takes UPM Raflatac forward in its quest for a smarter future beyond fossils, decreasing the use of fossil-based virgin raw materials in home and personal care labeling applications.

- Furthermore, Barbier Group, a producer of polyethylene films and recyclers, is fully committed to transition to a more sustainable model. Using recycled polymers in its production process, Barbier Group reduces its carbon impact by reducing its consumption of virgin plastic (fossil fuels). One ton of recycled plastics, when replacing one ton of material from oil, corresponds to a savings of three tons of carbon.

- However, with the decline in the growth of PE, there is a delay in new capacity start-ups. A total of 7.1 million tons of PE were due on stream in the 2020 year, but 2.7 million tons of this was expected to be shifted to 2021 (source: European Commission).

Beverages to Occupy Significant Market Share

- The use of sleeve-format labels has been growing continuously in the beverage end-user segment. This is primarily driven by the growing competition for consumer acceptance.

- There is a growing trend of use of plastic bottles and aluminum cans for beverage products. Aluminum cans are increasingly using shrink sleeves, replacing direct printing. Sleeves provide the brand volume and versioning flexibility. Sustainability, shelf impact, functionality, and digital printing are expected to drive innovation in the use of labels in the beverage industry in the future.

- In order to address sustainability concerns, many companies are launching sleeves in new material formats. Sleever International recently launched the LDPET, a new product for the better recovery of used PET bottles.

- In February 2021, CCL Label launched EcoStretch, a sustainable stretch sleeve option, which, after use, would be recycled at the company's facility in Austria and returned to the manufacturing process in an entirely closed production loop. The recycling facility would be located at CCL's Voelkermarkt site in Austria, a hub for the production of stretch and shrink sleeves mainly produced for the dairy, beverage, and home care industries.

- Further, according to the Union of European Beverages Associations (UNESDA), in 2019, the average citizen of an EU member state consumed about 94.7 liters of soft drinks annually. Leading industrialized countries, such as the United Kingdom, see a much higher consumption of soft drinks than the EU average. In 2010, 238.2 liters of non-alcoholic drinks were consumed per person in the European Union, which increased to 243.9 liters per person by 2019. Such instances may lead to substantial market growth.

Europe Shrink and Stretch Sleeve Label Industry Overview

The European shrink and stretch sleeve label market is moderately fragmented. Innovation and ease in deployment and usage, which leads to increased end-to-end customer satisfaction, have been the key factors driving the product innovation and strategies among the market players. The market players are are adopting powerful competitive strategies, such as product development, investments, and acquisitions, to remain relevant in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand to Increase On-shelf Appeal of Various Products

- 5.1.2 Need for Tamper-evident Protection

- 5.2 Market Restraints

- 5.2.1 Changes in Regulatory Standards due to Increasing Environmental Concerns

- 5.3 Impact of COVID -19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Heat Shrink Sleeve

- 6.1.2 Stretch Sleeve

- 6.1.3 Other Types

- 6.2 By Material

- 6.2.1 PVC

- 6.2.2 PET-G

- 6.2.3 PE

- 6.2.4 PP

- 6.2.5 Other Materials

- 6.3 By Application

- 6.3.1 Beverage

- 6.3.2 Food

- 6.3.3 Personal Care

- 6.3.4 Other Applications

- 6.4 By Country

- 6.4.1 Germany

- 6.4.2 France

- 6.4.3 United Kingdom

- 6.4.4 Italy

- 6.4.5 Russia

- 6.4.6 Poland

- 6.4.7 Netherlands

- 6.4.8 Spain

- 6.4.9 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Berry Global Inc.

- 7.1.2 CCL Industries Inc.

- 7.1.3 Klockner Pentaplast Group

- 7.1.4 Fuji Seal International Inc.

- 7.1.5 Huhtamaki OYJ

- 7.1.6 The Dow Chemical Company

- 7.1.7 Amcor PLC

- 7.1.8 Clondalkin Group Holdings BV

- 7.1.9 Westrock Company

- 7.1.10 Decomatic SA

- 7.1.11 Oerlemans Plastics

- 7.1.12 Maca SRL