|

市場調查報告書

商品編碼

1851823

整合通訊(UC) 與協作:市場佔有率分析、產業趨勢、統計數據與成長預測 (2025-2030)Unified Communications And Collaboration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

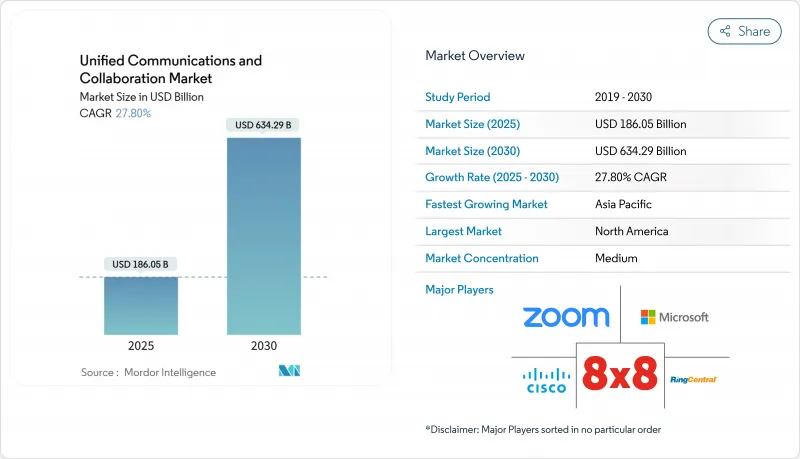

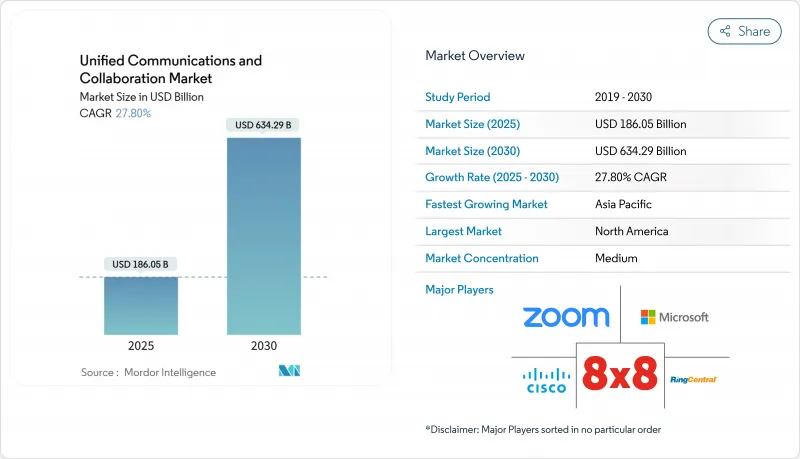

預計到 2025 年,整合通訊(UC) 和協作市場規模將達到 1,860.5 億美元,到 2030 年將達到 6,342.9 億美元,複合年成長率為 27.80%。

這一趨勢的驅動力來自混合辦公室模式的擴展、人工智慧賦能的生產力提升,以及將語音、視訊、通訊和工作流程應用整合到單一雲端環境的需求。企業持續將數位轉型預算分配給能夠提升分散式團隊員工參與度的溝通工具。微軟、思科和RingCentral等現有企業透過橫向平台深度來捍衛其市場佔有率,而人工智慧優先策略則著眼於填補特定工作流程的空白。策略併購——例如RingCentral以6.5億美元收購Mitel以及愛立信以62億美元收購一家供應商——表明,供應商正在將整合通訊與客服中心和API功能捆綁在一起,以擴大其目標市場。

全球整合通訊(UC) 與協作市場趨勢及洞察

混合辦公模式的需求加速了向統一通訊即服務 (UCaaS) 的轉型。

遷移工作負載至 Microsoft Teams Phone 後,許多企業表示,更換傳統 PBX 系統後,維護成本降低,正常運作延長。其中,佛羅裡達水晶公司 (Florida Crystals Corporation) 的通訊成本降低了 78%。加拿大中型企業採用率的不斷上升也印證了類似的趨勢,顯示雲端統一通訊 (UC) 對地理位置分散的員工隊伍具有顯著優勢。將語音、視訊、聊天和工作流程應用程式捆綁到單一許可證中的供應商正在取代傳統的單點解決方案,並提高客戶留存率。這種轉變給缺乏雲端規模的傳統通訊供應商帶來了壓力,同時也增強了能夠快速執行全球部署的 UCaaS 專家的收入來源。北美龐大的裝置量繼續鞏固了該地區在新功能採用方面的領先地位。

人工智慧驅動的會議效率和自動化工具

微軟的人工智慧業務,憑藉其嵌入Teams會議、通話和訊息功能的Copilot服務,在2025年第二季度實現了130億美元的年收入。 RingCentral也以類似的方式實現了其人工智慧接待員功能的商業化,擁有超過1000家客戶,年度經常性收入超過5000萬美元。即時轉錄、多語言翻譯和自動會議摘要,將統一整合通訊從被動連線轉變為主動決策支援。使用人工智慧呼叫分診功能的醫療機構報告稱,爽約率降低,反應時間縮短,展現了切實的臨床成效。如今,競爭的焦點已從單純的功能數量轉向推理品質和無縫的工作流程整合。

嚴格的安全和合規要求減緩了採用速度。

醫療保健領域的 HIPAA、支付領域的 PCI-DSS 以及歐洲用戶資料的 GDPR 都增加了加密、審核和本地化等多重要求,從而延長了實施週期。 Smarsh 於 2025 年 2 月收購了 CallCabinet,將人工智慧驅動的通話錄音和分析功能整合到其歸檔平台中,從而增強了其合規實力。金融公司必須捕捉所有模式(語音、視訊、聊天)才能符合 MiFID II 的要求,這提高了供應商的實質審查調查標準,並增加了對專業合規解決方案的需求。未獲得端到端認證的供應商可能面臨被排除在受監管的競標之外的風險,從而限制其潛在收入。

細分市場分析

2024年,雲端服務將佔總支出的65.7%,維持最高的複合年成長率(CAGR),達到29.20%,使其成為整合通訊(UC)和協作市場的核心。隨著企業淘汰折舊免稅額的PBX硬體,雲端部署的整合通訊(UC)和協作市場規模預計將快速成長。供應商不斷提供高級加密、自主雲端選項和行業標準認證,甚至說服受監管的企業採用純SaaS模式。另一方面,在需要空氣間隙環境的情況下,本地部署和託管架構仍然可行,但其收入貢獻逐年下降。混合架構正在崛起,使風險規避型企業能夠在雲端彈性擴展工作負載,同時在本地端保持關鍵的呼叫控制。未來五年,捆綁式遷移工具、零接觸設備配置和按用戶訂閱選項將進一步降低本地部署的市場佔有率。

到2024年,語音/IP電話將維持35.4%的收入佔有率,反映出銷售、服務和事件回應領域對即時對話的持續依賴。然而,協作/內容共用將以27.90%的複合年成長率成長,成為成長最快的領域,凸顯了向融合聊天、協同編輯、白板和任務追蹤等功能的多工具工作空間的轉變。語音在整合通訊(UC)和協作市場中的佔有率將逐漸萎縮,而與業務應用程式整合的非同步媒體將佔據主導地位。在整合通訊(UC)和協作市場,供應商正透過將文件協同編輯、數位白板和持續聊天功能整合到視訊會議中,模糊各個組件之間的界限。

區域分析

北美地區預計2024年將佔總營收的25.7%,凸顯其作為整合通訊(UC)平台關鍵研發和早期採用地區的地位。美國企業正在加速雲端遷移,微軟的商業雲端收入在2025年第三季將超過424億美元,年增20%。加拿大中型企業的雲端採用率超過四分之三,反映出良好的寬頻普及率和分散辦公室模式。墨西哥的製造業近岸外包業務蓬勃發展,推動了跨國協作的需求。

亞太地區是成長最快的區域,複合年成長率達18.7%。中國的雲端通訊供應商將受益於國家支持的5G部署和企業數位化轉型,而資料主權規則則有利於國內託管合作夥伴。日本的5G投資藍圖目標是在2026會計年度實現4.362兆日圓(約310億美元)的通訊設備銷售額,顯示日本將持續增加對身臨其境型協作基礎設施的投入。印度的「Bharat 6G聯盟」在與美國和其他國家簽署的政府間合作備忘錄的支持下,旨在跨越式提升寬頻應用準備水平,並增強統一通訊供應商的長期市場潛力。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 混合辦公模式的需求加速了向統一通訊即服務 (UCaaS) 的轉型。

- 人工智慧驅動的會議效率和自動化工具

- 透過 UC-CCaaS 整合簡化客戶體驗

- 5G和邊緣運算實現低延遲身臨其境型協作

- 產業工作流程整合(例如,遠端醫療統一通訊套件)

- 永續性要求鼓勵採用節能型雲端統一通訊解決方案。

- 市場限制

- 嚴格的安全和合規要求減緩了採用速度。

- 舊有系統整合的複雜性和高昂的切換成本

- 電信API商品化擠壓業者淨利率

- 區域資料主權分散,推高了營運成本。

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 評估市場的宏觀經濟因素

第5章 市場規模與成長預測

- 按部署模式

- 本機部署/託管

- 雲

- 按組件

- 語音/IP電話

- 視訊會議

- 通訊和線上狀態

- 協作/內容共用

- 其他

- 按組織規模

- 小型企業

- 主要企業

- 按最終用戶行業分類

- BFSI

- 醫療保健和生命科學

- 零售與電子商務

- 公共部門和教育

- 資訊科技和電訊

- 製造與物流

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 歐洲

- 德國

- 英國

- 法國

- 荷蘭

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Microsoft

- Cisco Systems

- Zoom Video Communications

- RingCentral

- 8x8

- Avaya

- Mitel

- Google(Google Workspace and Voice)

- GoTo(GoToConnect)

- Verizon

- ATandT

- T-Mobile US

- Vonage

- Dialpad

- Nextiva

- Alcatel-Lucent Enterprise

- NEC Corporation

- Sangoma Technologies

- Ericsson(Vonage APIs)

- Fuze

- Twilio(Flex and UC APIs)

- Slack(Salesforce)

- Amazon Web Services(Chime, Connect)

- Tencent Cloud

- Orange Business Services

- Comcast Business/Masergy

第7章 市場機會與未來展望

The unified communications and collaboration market stands at USD 186.05 billion in 2025 and is forecast to reach USD 634.29 billion by 2030, translating into a 27.80% CAGR.

Expanding hybrid-work programs, AI-augmented productivity features, and the need to collapse disparate voice, video, messaging, and workflow applications into a single cloud environment drive this momentum. Enterprises continue reallocating digital-transformation budgets toward communication tools that raise employee engagement across distributed teams. Incumbents such as Microsoft, Cisco, and RingCentral defend share through horizontal platform depth, while AI-first challengers target niche workflow gaps. Strategic mergers-RingCentral's USD 650 million purchase of Mitel and Ericsson's USD 6.2 billion acquisition of Vonage-illustrate how vendors bundle unified communications with contact-center and API capabilities to widen addressable markets.

Global Unified Communications And Collaboration Market Trends and Insights

Hybrid-Work Demand Accelerates UCaaS Migration

Enterprises replacing legacy PBX systems report lower maintenance costs and improved uptime after moving workloads into Microsoft Teams Phone, achieving a 78% telecom-expense reduction at Florida Crystals Corporation. Rising adoption rates among Canadian mid-market firms show the same trajectory, validating cloud UC for geographically dispersed staff. Providers that bundle voice, video, chat, and workflow apps on one license displace point solutions and deepen customer stickiness. The shift squeezes traditional telephony vendors that lack cloud scale, bolstering revenue for UCaaS specialists able to execute global roll-outs quickly. Larger install bases in North America mean the region remains the bellwether for new functionality introductions.

AI-Augmented Meeting Productivity and Automation Tools

Microsoft's AI business exited Q2 2025 at a USD 13 billion annual run rate, driven by Copilot services embedded in Teams meetings, calls, and messages. RingCentral likewise monetizes AI Receptionist capabilities, crossing 1,000 customers with over USD 50 million in annual recurring revenue. Real-time transcription, multilingual translation, and automated meeting summaries move unified communications from passive connectivity to active decision support. Healthcare providers using AI call-triage features report lower no-show rates and faster response times, demonstrating tangible clinical outcomes. Competitive focus now centers on inference quality and seamless workflow integration rather than raw feature counts.

Stringent Security and Compliance Requirements Slow Adoption

HIPAA for healthcare, PCI-DSS for payments, and GDPR for European user data add encryption, audit, and localization layers that lengthen deployment timelines. Smarsh reinforced its compliance position by acquiring CallCabinet in February 2025, bundling AI-driven call recording and analytics into its archive platform. Financial firms must capture every modality-voice, video, chat-for MiFID II, prompting rigorous vendor due-diligence and driving demand for specialty compliance stacks. Providers without end-to-end certifications risk exclusion from regulated tenders, limiting addressable revenue.

Other drivers and restraints analyzed in the detailed report include:

- UC-CCaaS Convergence to Streamline Customer Experience

- 5G and Edge Computing Enable Low-Latency Immersive Collaboration

- Legacy System Integration Complexity and High Switching Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud services represented 65.7% of spending in 2024 and maintain the highest trajectory at 29.20% CAGR, making the segment the nucleus of the unified communications and collaboration market. The unified communications and collaboration market size for cloud deployments is forecast to widen sharply as companies phase out depreciated PBX hardware. Vendors continue to certify advanced encryption, sovereign-cloud options, and industry templates, convincing even regulated firms to adopt pure SaaS footprints. Conversely, on-premises and hosted models persist where air-gapped environments are mandatory, though their collective revenue contribution declines each year. Hybrid architectures gain traction by retaining critical call control on-site while bursting elastic workloads into the cloud, giving risk-averse enterprises a transition runway. Over the next five years, bundled migration tooling, zero-touch device provisioning, and per-user subscription options will further compress the on-premises share.

Voice/IP telephony retained 35.4% revenue share in 2024, reflecting continued reliance on live conversations for sales, service, and incident response. Yet collaboration/content sharing climbs fastest at 27.90% CAGR, underscoring moves toward multitool workspaces that combine chat, co-editing, whiteboarding, and task tracking. The unified communications and collaboration market share for voice will gradually compress as organizations favor asynchronous media that integrates with business applications. Inside the unified communications and collaboration market, vendors embed document co-authoring, digital whiteboards, and persistent chat into video meetings, blurring component boundaries.

The Unified Communications and Collaboration Market is Segmented by Deployment Model (On-premises/Hosted, Cloud), Component (Voice/IP Telephony, Video Conferencing, Messaging and Presence and More), Organization Size (SMEs, Large Enterprises), End-User Industry (BFSI, Healthcare and Life Sciences, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

North America contributed 25.7% of 2024 revenue, underscoring its role as the primary R&D and early-adopter region for unified communications platforms. U.S. enterprises accelerated cloud migrations as Microsoft's commercial cloud sales surpassed USD 42.4 billion in Q3 2025, up 20% year over year. Canadian mid-market adoption tops three quarters of medium-sized firms, reflecting favorable broadband penetration and distributed workforce patterns. Mexico's near-shoring manufacturing boom increases cross-border collaboration demand, encouraging Spanish-English language services within UC suites.

Asia-Pacific is the fastest-growing territory at an 18.7% CAGR. China's cloud-communications vendors benefit from state-backed 5G roll-outs and enterprise digitization drives, although data-sovereignty rules favor domestic hosting partners. Japan's 5G investment roadmap, targeting JPY 4.362 trillion (USD 0.031 trillion) in telecom equipment sales by FY 2026, signals sustained spending on immersive collaboration infrastructure. India's Bharat 6G alliance, supported by government memoranda of understanding with the United States and others, aims to leapfrog high-bandwidth application readiness, enhancing long-term TAM for UC vendors.

- Microsoft

- Cisco Systems

- Zoom Video Communications

- RingCentral

- 8x8

- Avaya

- Mitel

- Google (Google Workspace and Voice)

- GoTo (GoToConnect)

- Verizon

- ATandT

- T-Mobile US

- Vonage

- Dialpad

- Nextiva

- Alcatel-Lucent Enterprise

- NEC Corporation

- Sangoma Technologies

- Ericsson (Vonage APIs)

- Fuze

- Twilio (Flex and UC APIs)

- Slack (Salesforce)

- Amazon Web Services (Chime, Connect)

- Tencent Cloud

- Orange Business Services

- Comcast Business / Masergy

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Hybrid?work demand accelerates UCaaS migration

- 4.2.2 AI-augmented meeting productivity and automation tools

- 4.2.3 UC-CCaaS convergence to streamline customer experience

- 4.2.4 5G and edge computing enable low-latency immersive collaboration

- 4.2.5 Vertical-specific workflow integration (e.g., tele-health UC kits)

- 4.2.6 Sustainability mandates favor energy-efficient cloud UC solutions

- 4.3 Market Restraints

- 4.3.1 Stringent security and compliance requirements slow adoption

- 4.3.2 Legacy system integration complexity and high switching costs

- 4.3.3 Telecom-API commoditization squeezing provider margins

- 4.3.4 Regional data-sovereignty fragmentation inflates operating costs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Model

- 5.1.1 On-premises / Hosted

- 5.1.2 Cloud

- 5.2 By Component

- 5.2.1 Voice / IP Telephony

- 5.2.2 Video Conferencing

- 5.2.3 Messaging and Presence

- 5.2.4 Collaboration/Content Sharing

- 5.2.5 Others

- 5.3 By Organization Size

- 5.3.1 SMEs

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Retail and E-commerce

- 5.4.4 Public Sector and Education

- 5.4.5 IT and Telecom

- 5.4.6 Manufacturing and Logistics

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Netherlands

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Microsoft

- 6.4.2 Cisco Systems

- 6.4.3 Zoom Video Communications

- 6.4.4 RingCentral

- 6.4.5 8x8

- 6.4.6 Avaya

- 6.4.7 Mitel

- 6.4.8 Google (Google Workspace and Voice)

- 6.4.9 GoTo (GoToConnect)

- 6.4.10 Verizon

- 6.4.11 ATandT

- 6.4.12 T-Mobile US

- 6.4.13 Vonage

- 6.4.14 Dialpad

- 6.4.15 Nextiva

- 6.4.16 Alcatel-Lucent Enterprise

- 6.4.17 NEC Corporation

- 6.4.18 Sangoma Technologies

- 6.4.19 Ericsson (Vonage APIs)

- 6.4.20 Fuze

- 6.4.21 Twilio (Flex and UC APIs)

- 6.4.22 Slack (Salesforce)

- 6.4.23 Amazon Web Services (Chime, Connect)

- 6.4.24 Tencent Cloud

- 6.4.25 Orange Business Services

- 6.4.26 Comcast Business / Masergy

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment