|

市場調查報告書

商品編碼

1851785

電力電子:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Power Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

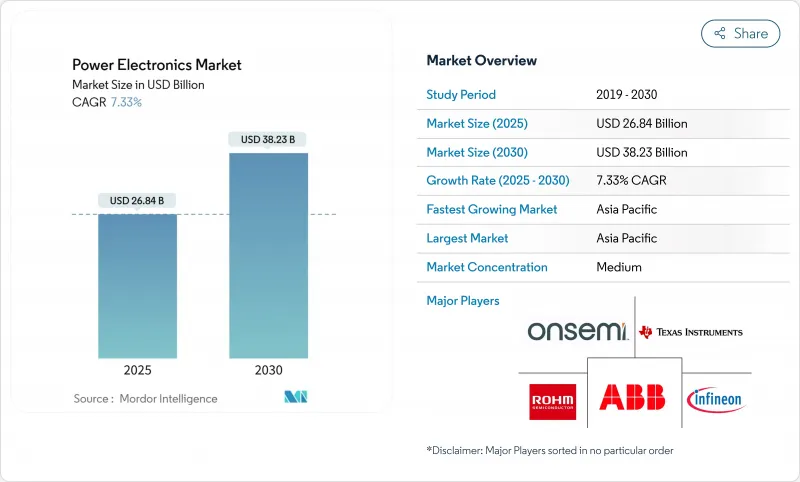

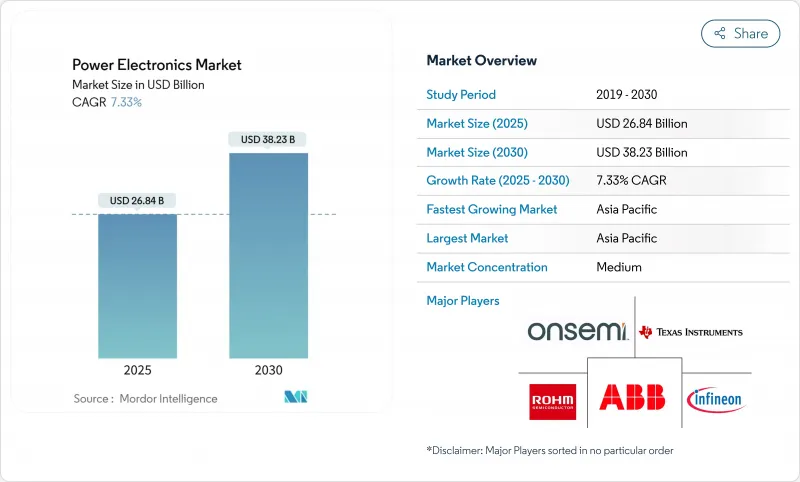

預計到 2025 年,電力電子市場規模將達到 268.4 億美元,到 2030 年將達到 382.3 億美元,在此期間的複合年成長率為 7.33%。

這項進展得益於傳統矽系統向碳化矽和氮化鎵解決方案的持續轉型,從而在關鍵應用中實現了更高的效率、功率密度和更小的尺寸。隨著汽車製造商擴大電動車產量、公用事業公司升級逆變器以支援可再生能源以及資料中心營運商採用高壓直流架構,市場需求加速成長。寬能能隙的普及也得益於區域政策的支持,這些政策鼓勵國內半導體製造和電動車基礎設施建設。同時,供應鏈多元化舉措,尤其是在亞太地區,促進了基板、外延和先進封裝的本地化生產,從而縮短了前置作業時間並降低了運輸風險。

全球電力電子市場趨勢與洞察

加速在電動車快速充電基礎設施中採用碳化矽和氮化鎵裝置

為了達到併並聯型效率目標,歐洲充電網路營運商優先採用800V架構,這需要1200V和1700V的碳化矽(SiC)MOSFET。在獎勵計畫的支持下,計劃普遍採用SiC功率級,從而降低了能量損耗並縮小了冷卻子系統的尺寸。系統整合商和半導體供應商之間的合作縮短了設計週期,而與汽車原始設備製造商(OEM)的聯盟協議則確保了長期的批量供應。互通性法規進一步為基於寬能能隙裝置的模組化、高密度充電器創造了更有利的競爭環境。成功的部署吸引了全球的關注,並將歐洲打造成為下一代快速充電解決方案的標竿市場。

亞洲大型太陽能和風力發電廠逆變器升級

中國、印度和越南的大型太陽能發電廠已用碳化矽(SiC)組件取代了傳統的矽逆變器,這些組件能夠在高溫高濕環境下承受高開關頻率。 Wolfspeed 最新推出的公用事業級組件具備 3MW 至 5MW 集中式逆變器所需的熱循環可靠性。離岸風力發電開發商也採用了類似的功率級,以滿足風機機艙的尺寸和重量限制。區域代工廠商透過本地化組裝來規避進口關稅,並加快了與傳統矽逆變器價格的趨同。這些升級符合各國政府的可再生能源組合標準,並有助於維持新興經濟體能源價格的競爭力。

150毫米以上尺寸碳化矽晶圓供應鏈瓶頸

長期的基板短缺限制了產量成長,導致平均售價居高不下。 Wolfspeed 暫時的流動性問題增加了依賴其 200mm 晶圓藍圖的合作夥伴的風險敞口,並導致瑞薩電子放棄了其原始的 SiC 平台計劃。中國企業加快了產能擴張,但在汽車客戶的認證方面遇到了障礙。晶圓廠的投產與正式投產之間存在數年的時間差,這使得裝置製造商和系統 OEM 廠商的需求預測變得複雜。因此,一些汽車製造商採取了雙供應商策略來對沖晶圓配額風險。

細分市場分析

到2030年,功率模組的複合年成長率將達到8.6%,這主要得益於設計團隊傾向於採用預封裝組件,以簡化散熱佈局和電磁屏蔽。到2024年,分立電晶體和二極體仍將佔總收入的46.3%,從而維持了消費性電子和低功率工廠設備的靈活性。功率超過50kW的牽引逆變器和可再生能源轉換器對模組的需求激增,這些模組整合了閘極驅動器、溫度感測器和隔離功能,從而縮短了開發週期。嵌入式冷卻基板已進入試生產階段,提高了模組的功率密度,並使電動車的逆變器機殼尺寸得以縮小。整合功率IC在100W以下快速充電器適配器中獲得了市場佔有率,它將控制和開關功能整合到單一塑膠封裝中,滿足了嚴格的尺寸限制。智慧型手機品牌採用了這些單晶片GaN解決方案,實現了透過緊湊型牆插進行65W充電。隨著汽車零件製造商轉向800V平台,而消費性電子設計仍保持分立元件的銷量,模組化功率電子市場規模預計將穩定成長。

模塑封裝已成為市場標準,降低了成本,並提高了在惡劣氣候下運行的工業驅動器的防潮性能。製造商利用自動化組裝來滿足不斷成長的生產需求,尤其是在亞太地區。分立元件在照明安定器、家用電器和機器人控制器等應用領域仍然佔據重要地位,在這些應用中,客製化的基板佈局和多樣化的電壓等級比整合裝置的優勢更為顯著。預計在預測期內,碳化矽晶圓供應可得性的增加將進一步推動模組化元件市場佔有率的成長。

到2024年,MOSFET將佔總營收的44.1%,複合年成長率達9.1%,成為規模最大且成長最快的裝置類別。這種架構有利於漸進式研發,Wolfspeed的第四代平台在維持現有閘極驅動要求的同時,降低了導通電阻。充電器適配器和太陽能微型逆變器中的高頻諧振拓撲結構傾向於採用GaN增強型MOSFET,而SiC平面MOSFET在功率超過100kW的車輛牽引級中表現出色。 IGBT仍然是軌道運輸推進和大型工業驅動裝置的關鍵元件,滿足了對功率等級超出MOSFET實際應用範圍的需求。閘流體繼續用於併網緩衝啟動器和高壓直流輸電線路,儘管其總體佔有率有所下降。

裝置製造商已推出與碳化矽 (SiC) MOSFET 封裝的肖特基二極體,以放寬反向恢復限制並簡化基板佈局;同時,氮化鎵 (GaN) 製造商改進了動態導通電阻 (RDS(on)) 特性,以延長元件在硬開關條件下的使用壽命。由於 MOSFET 的外形尺寸與現有驅動器生態系統相容,降低了系統工程師的設計門檻,因此電力電子市場持續青睞 MOSFET 的創新。未來的市場佔有率變化將取決於寬能能隙晶圓的價格以及下一代 MOSFET 閘極實現汽車應用認證的速度。

電力電子市場按組件(分立元件、模組、整合功率 IC)、裝置類型(MOSFET、IGBT、閘流體、二極體)、材料(矽、碳化矽、其他)、終端用戶產業(消費性電器、汽車、ICT 和通訊、工業、非洲與電力、航太和國防、其他)以及產業(消費性電器、汽車、ICT 及通訊、工業、南美、航空航太及

區域分析

亞太地區預計2024年將貢獻全球54.4%的收入,以10.2%的複合年成長率進一步擴大領先優勢。中國、日本和韓國的國家級計畫資助了晶圓廠、模組組裝和電動車供應鏈,確保了基板和先進封裝的在地採購生產。日本政府承諾投入670億美元支持國內半導體產業發展,扶持SONY和三菱電機等公司,並加強與大學的科學研究合作。儘管存在技術領先優勢,中國當地仍利用規模經濟優勢,擴大材料生產和後端組裝,從而快速供應區域客戶並降低土地成本。

北美保持了其第二大市場的地位,這得益於其強大的技術創新能力以及人工智慧伺服器、電動皮卡和可再生微電網等充滿活力的終端市場。各州政府的獎勵措施吸引了新的碳化矽晶圓廠,並有助於確保向200毫米製程轉型所需的資金。國防採購持續資助抗輻射氮化鎵(GaN)的研究,後來被應用於商業通訊系統。隨著資料中心營運商採用400V直流架構以減少銅用量並提高機架密度,北美電力電子市場正在蓬勃發展。

歐洲將資源集中於電動車充電走廊和電網級儲能。政策制定者強制要求充電硬體互通性,間接推動了碳化矽(SiC)的普及,因為其在800V電壓下具有較高的效率。一級汽車供應商與半導體供應商合作,共同開發牽引逆變器,並建立整合參考平台以加速認證。中東和非洲地區起步較小,但投資建造了大型太陽能發電廠和海水淡化設施,這些設施需要性能強大的逆變器。南美洲則從巴西和阿根廷的風能走廊以及鼓勵在該地區組裝功率模組在地採購政策中獲得了商機。總而言之,這些動態表明,電力電子市場在各大洲持續擴張,儘管擴張速度因行業成熟度和政策支持的不同而有所差異。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐洲電動車快速充電基礎設施中SiC/GaN裝置的採用速度加快

- 亞洲大型太陽能和風力發電廠的逆變器升級將推動高壓功率模組的發展

- 北美地區5G基地台部署需要高效率射頻功率放大器

- 東南亞7.5kW以上工業電機驅動電氣化

- 中國的電網級電池計畫促進了雙向功率轉換器的發展

- 美國國防部向全電動平台現代化轉型推動電力電子市場加強。

- 市場限制

- 150毫米及以上尺寸碳化矽晶圓的供應鏈瓶頸阻礙了大規模生產。

- 1.2kV以上模組的封裝溫度控管限制

- 200mm寬能能隙晶圓廠的高昂資本支出阻礙了新進者。

- 供應鏈分析

- 監理與技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資與資金籌措分析

- 評估市場的宏觀經濟因素

第5章 市場規模與成長預測

- 按組件

- 離散的

- 模組

- 整合電源IC

- 依設備類型

- MOSFET

- IGBT

- 閘流體

- 二極體

- 材料

- 矽(Si)

- 碳化矽(SiC)

- 氮化鎵(GaN)

- 按最終用戶行業分類

- 消費性電子產品

- 汽車(電動車、充電)

- 資訊通訊技術與通訊

- 工業(驅動、自動化)

- 能源與電力(可再生能源、高壓直流輸電)

- 航太/國防

- 醫療設備

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 台灣

- 印度

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略性舉措(併購、合資、許可)

- 市佔率分析

- 公司簡介

- Infineon Technologies AG

- Mitsubishi Electric Corporation

- ON Semiconductor Corporation

- STMicroelectronics NV

- Texas Instruments Inc.

- ROHM Co., Ltd.

- ABB Ltd.

- Toshiba Electronic Devices & Storage Corp.

- Vishay Intertechnology Inc.

- Renesas Electronics Corp.

- Wolfspeed Inc.

- Fuji Electric Co., Ltd.

- SEMIKRON Danfoss

- Littelfuse Inc.

- GeneSiC Semiconductor

- Navitas Semiconductor Corp.

- GaN Systems Inc.

- Alpha & Omega Semiconductor

- Microchip Technology Inc.

- Diodes Incorporated

第7章 市場機會與未來展望

The power electronics market size stood at USD 26.84 billion in 2025 and is forecast to reach USD 38.23 billion by 2030, reflecting a 7.33% CAGR during the period.

Continued migration from legacy silicon systems toward silicon-carbide and gallium-nitride solutions underpins this advance, enabling higher efficiency, power density, and smaller form factors in critical applications. Demand accelerated as automakers scaled electric-vehicle production, utilities upgraded renewable-energy inverters, and data-center operators adopted high-voltage direct-current architectures. Wide-bandgap adoption also benefited from regional policy support that encouraged domestic semiconductor manufacturing and electric-mobility infrastructure. Meanwhile, supply-chain diversification initiatives, especially across Asia-Pacific, bolstered localized production of substrates, epitaxy, and advanced packaging, reducing lead times and transportation risk.

Global Power Electronics Market Trends and Insights

Accelerated adoption of SiC and GaN devices in EV fast-charging infrastructure

European charging-network operators prioritized 800 V architectures that require 1,200 V and 1,700 V SiC MOSFETs to meet grid-connection efficiency targets. Projects backed by incentive programs are standardized on SiC power stages that cut energy losses and shrink cooling subsystems. Collaboration between system integrators and semiconductor suppliers shortened design cycles, while alliance agreements with automotive OEMs ensured long-term volume commitments. Interoperability regulations further created a level playing field that favors modular, high-density chargers based on wide-bandgap devices. Successful deployments draw global attention, positioning Europe as the reference market for next-generation fast-charging solutions.

Large-scale solar and wind farm inverter upgrades in Asia

Utility-scale solar farms in China, India, and Vietnam replaced legacy silicon inverters with SiC-based modules that withstand high switching frequencies in hot, humid environments. Wolfspeed's latest utility modules provided the thermal-cycling reliability demanded by centralized 3 MW to 5 MW inverters. Offshore wind developers adopted similar power stages to meet size and weight limits on turbine nacelles. Regional contract manufacturers localized assembly to avoid import duties, accelerating price parity with conventional silicon alternatives. These upgrades align with government renewable portfolio standards, keeping energy tariffs competitive across emerging economies.

Supply-chain bottlenecks for 150 mm and larger SiC wafers

Chronic substrate shortages constrained volume ramps, keeping average selling prices elevated. Wolfspeed's temporary liquidity challenges increased risk exposure for partners that relied on its 200 mm roadmap, leading Renesas to exit its planned SiC platform. Chinese entrants accelerated capacity additions yet faced qualification hurdles with automotive customers. The multiyear lag between announced fabs and production readiness complicated demand-forecast accuracy for both device makers and system OEMs. As a result, several automakers executed dual-sourcing strategies to hedge wafer allocations.

Other drivers and restraints analyzed in the detailed report include:

- 5G base-station roll-outs requiring high-efficiency RF power amplifiers

- Electrification of industrial motor drives above 7.5 kW in Southeast Asia

- Packaging thermal-management constraints above 1.2 kV modules

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Power modules delivered 8.6% CAGR through 2030 as design teams opted for pre-packaged assemblies that simplify thermal layout and electromagnetic shielding. In 2024, discrete transistors and diodes still contributed 46.3% of revenue, preserving flexibility in consumer and low-power factory equipment. Demand for modules surged in traction inverters and renewable-energy converters above 50 kW where integrating gate drivers, temperature sensors, and isolation reduced development cycles. Embedded-cooling substrates entered pilot production, pushing module power density upward and enabling smaller inverter housings in electric vehicles. Integrated power ICs gained share in fast-charger adapters below 100 W, combining control and switching in a single plastic package that meets stringent size constraints. Smartphone brands adopted these monolithic GaN solutions to achieve 65 W charging in compact wall plugs. The power electronics market size for modules is forecast to expand steadily as automotive suppliers transition to 800 V platforms, while consumer design wins sustain volume in discrete devices.

Market-wide standardization on transfer-molded packages offered cost reductions and better moisture resistance for industrial drives operating in harsh climates. Manufacturers leveraged automated assembly lines to meet rising output needs, particularly across Asia-Pacific. Discrete devices nevertheless preserved a sizeable presence in lighting ballasts, home appliances, and robotic controllers, where customized board layouts and diverse voltage classes outweighed the integration advantage. Over the forecast span, increased silicon-carbide wafer availability will further tilt the share toward modules, yet discrete volumes will decline gradually rather than collapse.

MOSFETs captured 44.1% of 2024 revenue and their 9.1% CAGR positions them as both the largest and fastest-growing device category. The architecture lends itself to incremental R&D, evident in Wolfspeed's Gen 4 platform that reduced on-state resistance while maintaining familiar gate-drive requirements. High-frequency resonance topologies in charger adapters and solar micro-inverters gravitated to GaN enhancement-mode MOSFETs, whereas SiC planar MOSFETs excelled in vehicle traction stages above 100 kW. IGBTs remained essential in rail propulsion and large industrial drives, sustaining demand in power classes beyond practical MOSFET limits. Thyristors continued serving grid-tied soft-starters and HVDC links, though their overall contribution shrank.

Device-makers introduced co-packaged Schottky diodes with SiC MOSFETs, easing reverse-recovery constraints and simplifying board layouts. Meanwhile, gallium-nitride suppliers improved dynamic-RDS(on) behavior to extend device life in hard-switching conditions. The power electronics market continues to reward MOSFET innovation because the form factor aligns with existing driver ecosystems, lowering design barriers for system engineers. Future share shifts will hinge on wide-bandgap wafer pricing and the speed of automotive qualification for next-generation MOSFET gates.

Power Electronics Market is Segmented by Component (Discrete, Module, and Integrated Power IC), Device Type (MOSFET, IGBT, Thyristor, and Diode), Material (Silicon, Silicon Carbide, and More), End-User Industry (Consumer Electronics, Automotive, ICT and Telecommunication, Industrial, Energy and Power, Aerospace and Defense, and More), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa).

Geography Analysis

Asia-Pacific generated 54.4% of global revenue in 2024 and is widening its lead with a 10.2% CAGR. National programs in China, Japan, and South Korea funded wafer fabs, module assembly, and electric-vehicle supply chains, ensuring local availability of substrates and advanced packaging. Japanese authorities pledged USD 67 billion to support domestic semiconductor fleets, aiding companies such as Sony and Mitsubishi Electric, and reinforcing university research collaborations. Mainland China leveraged economies of scale in material growth and backend assembly to supply regional customers quickly, lowering landed cost despite technology gaps in the leading edge.

North America remained the second-largest region, pairing innovation strengths with thriving end-markets in AI servers, electric pickup trucks, and renewable microgrids. State-level incentives attracted new SiC wafer plants and helped secure capital for 200 mm transitions. Defense procurement continued to fund radiation-tolerant GaN research, which later filtered into commercial telecom systems. The power electronics market size in North America is on an upward trajectory as data-center operators adopt 400 V DC architectures that reduce copper usage and improve rack density.

Europe focused resources on e-mobility charging corridors and grid-level storage. Policymakers mandated interoperability of charging hardware, indirectly favoring SiC adoption due to its efficiency at 800 V. Automotive Tier 1 suppliers partnered with semiconductor vendors to co-develop traction inverters, creating integrated reference platforms that accelerate homologation. The Middle East and Africa region, while starting from a smaller base, invested in large photovoltaic plants and desalination facilities that require robust inverter stages. South America's opportunities emerged from wind corridors in Brazil and Argentina and from local content rules that encourage assembly of power modules within the region. Collectively, these dynamics keep the power electronics market expanding on every continent, though rates vary with industrial maturity and policy support.

- Infineon Technologies AG

- Mitsubishi Electric Corporation

- ON Semiconductor Corporation

- STMicroelectronics N.V.

- Texas Instruments Inc.

- ROHM Co., Ltd.

- ABB Ltd.

- Toshiba Electronic Devices & Storage Corp.

- Vishay Intertechnology Inc.

- Renesas Electronics Corp.

- Wolfspeed Inc.

- Fuji Electric Co., Ltd.

- SEMIKRON Danfoss

- Littelfuse Inc.

- GeneSiC Semiconductor

- Navitas Semiconductor Corp.

- GaN Systems Inc.

- Alpha & Omega Semiconductor

- Microchip Technology Inc.

- Diodes Incorporated

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Adoption of SiC/GaN Devices in EV Fast-Charging Infrastructure across Europe

- 4.2.2 Large-Scale Solar and Wind Farm Inverter Upgrades in Asia Driving High-Voltage Power Modules

- 4.2.3 5G Base-Station Roll-outs Requiring High-Efficiency RF Power Amplifiers in North America

- 4.2.4 Electrification of Industrial Motor Drives Exceeding 7.5 kW in South-East Asia

- 4.2.5 Grid-Level Battery Storage Programs in China Boosting Bidirectional Power Converters

- 4.2.6 U.S. DoD Modernization Toward All-Electric Platforms Stimulating Rugged Power Electronics

- 4.3 Market Restraints

- 4.3.1 Supply-Chain Bottlenecks for 150 mm+ SiC Wafers Limiting Volume Production

- 4.3.2 Packaging Thermal-Management Constraints Above 1.2 kV Modules

- 4.3.3 High CAPEX for 200 mm Wide-Bandgap Fabs Hindering New Entrants

- 4.4 Supply Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment and Funding Analysis

- 4.8 Assessment of macroeconomic factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Discrete

- 5.1.2 Module

- 5.1.3 Integrated Power IC

- 5.2 By Device Type

- 5.2.1 MOSFET

- 5.2.2 IGBT

- 5.2.3 Thyristor

- 5.2.4 Diode

- 5.3 By Material

- 5.3.1 Silicon (Si)

- 5.3.2 Silicon Carbide (SiC)

- 5.3.3 Gallium Nitride (GaN)

- 5.4 By End-user Industry

- 5.4.1 Consumer Electronics

- 5.4.2 Automotive (xEV, Charging)

- 5.4.3 ICT and Telecommunication

- 5.4.4 Industrial (Drives, Automation)

- 5.4.5 Energy and Power (Renewables, HVDC)

- 5.4.6 Aerospace and Defense

- 5.4.7 Healthcare Equipment

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 Taiwan

- 5.5.3.5 India

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Licensing)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Infineon Technologies AG

- 6.4.2 Mitsubishi Electric Corporation

- 6.4.3 ON Semiconductor Corporation

- 6.4.4 STMicroelectronics N.V.

- 6.4.5 Texas Instruments Inc.

- 6.4.6 ROHM Co., Ltd.

- 6.4.7 ABB Ltd.

- 6.4.8 Toshiba Electronic Devices & Storage Corp.

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Renesas Electronics Corp.

- 6.4.11 Wolfspeed Inc.

- 6.4.12 Fuji Electric Co., Ltd.

- 6.4.13 SEMIKRON Danfoss

- 6.4.14 Littelfuse Inc.

- 6.4.15 GeneSiC Semiconductor

- 6.4.16 Navitas Semiconductor Corp.

- 6.4.17 GaN Systems Inc.

- 6.4.18 Alpha & Omega Semiconductor

- 6.4.19 Microchip Technology Inc.

- 6.4.20 Diodes Incorporated

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment