|

市場調查報告書

商品編碼

1851729

Wi-Fi 分析:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Wi-Fi Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

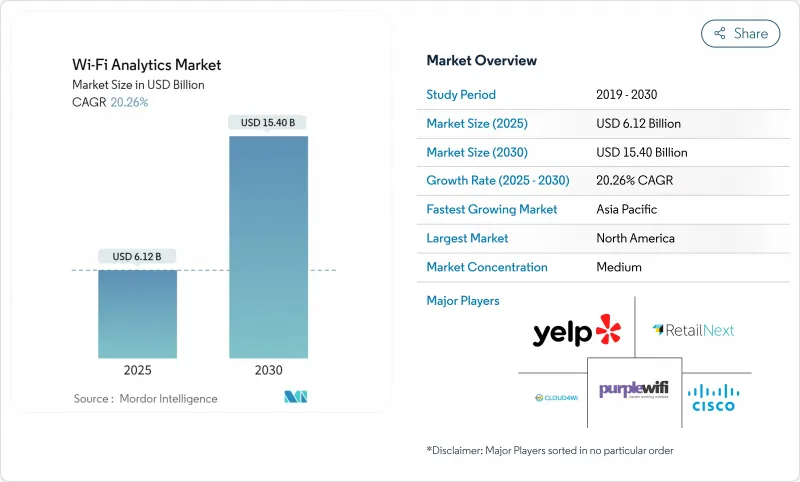

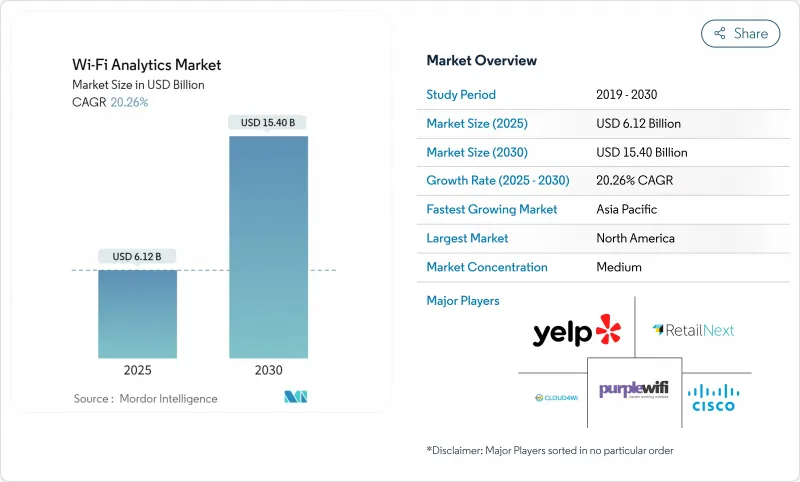

預計到 2025 年,Wi-Fi 分析市場將創造 61.2 億美元的收入,到 2030 年將達到 154 億美元。

如今,企業不再將網路基地台視為基本的連接工具,而是將其視為驅動即時決策的資料擷取資產。 Wi-Fi 7 的商業化推廣、6 GHz 頻段存取的增加以及邊緣人工智慧在網路基地台的廣泛應用,都將推動市場需求。雖然酒店業仍然是最大的用戶群體,但零售業的快速成長表明,實體零售商正在將位置資訊轉化為競爭優勢。雲端部署佔據主導地位,因為企業傾向於採用訂閱模式,這種模式允許他們在無需大量資本支出的情況下實現規模化擴展。

全球Wi-Fi分析市場趨勢與洞察

智慧型手機和智慧型裝置的普及速度正在迅速提升

到2024年,將有超過211億台Wi-Fi設備處於活躍狀態,其中Wi-Fi 6E和Wi-Fi 7設備的出貨量分別為5.762億台和2.314億台。如今,每個連網使用者都攜帶多台設備,從而能夠更豐富地分析跨會話行為。企業可以利用這個高密度的Wi-Fi網路,將匿名的客流量資料轉換為分層的客戶旅程地圖,以提高轉換率並延長顧客停留時間。零售連鎖店透過將店內熱力圖與設備類型關聯起來,可以更精準地分配員工和促銷,增加客單價,並減少缺貨情況。人工智慧也反映了這一趨勢,隨著樣本量的成長,預測模型得到增強,能夠提前幾分鐘預測排隊狀況和顧客對產品的興趣變化。

實體場所中公共 Wi-Fi 的快速普及

體育場館、機場和購物中心已將Wi-Fi從成本中心轉變為收入引擎。 Extreme Networks目前為25個NFL球場提供分析支持,將球迷動向轉化為即時互動隊伍。 TD花園球館的訪客平台展示了無縫登入如何提高使用者選擇加入率和第一方資料收集量。交通運輸機構利用停留時間指標重新定位特許經營攤位,速食店則升級網路基地台,向管理人員推送排隊長度警報。新興趨勢是將首頁同意資訊與會員ID關聯起來,建立持久的使用者畫像,並將這些畫像延伸到場館以外的全通路行銷。

嚴格的隱私權法規(GDPR、CCPA 等)

巨額罰款迫使營運商重新思考其使用者許可流程,增設資料保護負責人,並進行定期審核,這可能會使部署預算增加 15% 至 20%。像 Purple 這樣的公司正在轉向使用明確的使用者帳戶和細粒度的許可日誌,以滿足 GDPR 的要求。一些公司現在正在晶片層級對探測請求資料進行匿名化處理,用聚合密度圖取代單一路徑。隨著企業尋求合規保證,那些將隱私保護放在首位的供應商正在贏得競標。

細分市場分析

解決方案仍將佔據主導地位,預計到 2024 年將佔 Wi-Fi 分析市場佔有率的 56.5%。然而,受市場對即用型洞察而非 DIY 儀錶板的需求驅動,服務將以 21.4% 的複合年成長率 (CAGR) 超越市場整體成長速度。企業正將分析解讀、隱私管治和跨系統整合等工作外包給專家,從而減少內部工作量並加快價值實現速度。

預計2025年至2030年間,Wi-Fi分析服務市場規模將成長一倍以上,因為供應商會將諮詢、託管營運和基於結果的定價模式捆綁在一起。 RetailNext從Battery Ventures資金籌措進一步鞏固了投資者對分析即服務模式將推動未來成長的信心。 Cloud4Wi的Fogsense微型設備展示了服務公司如何縮小硬體佔用空間,並將價值向上游轉移至業務層面。

到2024年,雲端平台將佔據Wi-Fi分析市場62.9%的佔有率,預計該細分市場將以21.8%的複合年成長率成長。訂閱模式無需資本支出,並提供彈性儲存和當日更新的AI功能。過去缺乏內部IT人員的中小型零售商現在可以在數小時內完成部署,從而釋放先前閒置的網路數據。

思科的AI原生Wi-Fi 7網路基地台可在本地處理遙測數據,並將摘要同步到雲端。在國防、醫療保健和金融機構等仍採用自主託管和傳統架構的行業,本地部署仍然至關重要。

區域分析

到2024年,北美將佔全球收入的31.2%,這主要得益於企業早期採用以及隱私和分析之間成熟的監管平衡。 Extreme Networks的高密度Wi-Fi最佳實踐已在25個NFL體育場部署,便是典型例證。智慧型手機的高普及率和強大的雲端基礎設施為平台的持續升級提供了可能。

亞太地區是成長最快的地區,預計到2030年複合年成長率將達到20.5%。中國擁有約4,000家私人無線工廠,為進行細緻分析提供了基礎;而印度計畫分配的6GHz頻譜預計在2034年前釋放4.03兆美元的經濟價值。快速的都市化和政府的公共數位化政策正在推動無線技術在交通樞紐、購物中心和智慧校園等場所的部署。

在歐洲,GDPR將催生以隱私為主導的模式,並指導平台設計。能夠獲得用戶同意並匿名化數據的營運商將享有先發優勢。在德國,一家大型零售連鎖店正嚴格遵守相關規定,將訪客Wi-Fi與其忠誠度計畫關聯起來;英國火車站的公共Wi-Fi舉措則展示了在全國範圍內進行高流量分析的能力。邊緣部署降低了雲端存取成本,並符合當地的永續性目標。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 智慧型手機和智慧型裝置的快速普及

- 實體場所中公共 Wi-Fi 的快速普及

- 零售和餐旅服務業對即時客戶體驗個人化的需求

- AI/ML引擎與Wi-Fi分析平台的整合

- 採用Wi-Fi RTT進行亞米級室內定位

- 基於邊緣運算的存取點分析可降低整體擁有成本

- 市場限制

- 嚴格的隱私權法規(GDPR、CCPA 等)

- 持續存在的網路層級安全漏洞

- MAC位址隨機化會影響資料準確性

- 高密度區域的頻譜壅塞

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 評估市場的宏觀經濟因素

第5章 市場規模與成長預測

- 按組件

- 解決方案

- 服務

- 透過部署

- 本地部署

- 雲

- 透過使用

- 存在分析

- 市場分析

- 按最終用戶行業分類

- 零售

- 飯店業

- 運動與休閒

- 運輸

- 衛生保健

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 荷蘭

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Cisco Systems Inc.

- Cloud4Wi Inc.

- Purple WiFi Ltd

- RetailNext Inc.

- Yelp WiFi Inc.

- CommScope Inc.(Ruckus Wireless)

- Fortinet Inc.

- Blix Inc.

- Skyfii Limited

- Singtel Optus Pty Ltd

- MetTel Inc.

- Hewlett Packard Enterprise(Aruba Networks)

- Extreme Networks Inc.

- Cambium Networks Ltd

- Ubiquiti Inc.

- Aislelabs Inc.

- Plume Design Inc.

- Euclid Analytics

- Near Intelligence Holdings

- Mist Systems(Juniper Networks)

- Cloud5 Communications

- Datavalet Technologies Inc.

- GoZone WiFi LLC

第7章 市場機會與未來展望

The Wi-Fi analytics market generated USD 6.12 billion in 2025 and is on track to reach USD 15.40 billion by 2030, reflecting a 20.26% CAGR.

Enterprises now treat access points as data-collection assets that fuel real-time decision making, rather than as basic connectivity tools. Commercial roll-outs of Wi-Fi 7, wider 6 GHz spectrum access, and the spread of edge AI in access points amplify demand. Hospitality remains the largest user group, while retail's fast climb shows how brick-and-mortar operators are turning location data into a competitive advantage. Cloud deployment rules the landscape as companies favor subscription models that scale without heavy capital expense.

Global Wi-Fi Analytics Market Trends and Insights

Surging Smartphone and Smart-Device Penetration

More than 21.1 billion Wi-Fi devices were active in 2024, with 576.2 million Wi-Fi 6E and 231.4 million Wi-Fi 7 units shipped during the year. Each connected user now carries multiple devices, enabling richer cross-session behavioral profiles. Enterprises that harness this density translate anonymous foot-traffic counts into layered customer-journey maps, improving conversion and dwell time. Retail chains that correlate device classes with in-store heatmaps allocate associates and promotions more precisely, raising basket size and reducing stock-outs. The trend strengthens predictive modeling accuracy as sample sizes grow, feeding AI that anticipates queue build-ups or product interest shifts minutes ahead of time.

Rapid Rollout of Public Wi-Fi in Physical Venues

Stadiums, airports, and malls moved Wi-Fi from cost center to revenue engine. Extreme Networks now supports analytics at 25 NFL stadiums, turning fan movement into real-time engagement cues. TD Garden's guest platform shows how seamless log-in increases opted-in first-party data capture. Transport hubs use dwell metrics to reshape concession placement, while quick-service restaurants upgrade access points to push queue-length alerts to managers. The emerging norm links splash-page consent with loyalty IDs, building persistent profiles that extend beyond venue walls into omnichannel marketing.

Stringent Privacy Regulations (GDPR, CCPA, etc.)

Hefty fines push operators to overhaul consent flows, add data-protection officers, and run routine audits that can add 15-20% to deployment budgets. Firms such as Purple pivoted to explicit user accounts and granular consent logs that meet GDPR demands. Some venues now anonymize probe-request data at the chip level, trading individual paths for aggregated density maps. Vendors that bake privacy first in their design win bids as enterprises seek compliance assurance.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Real-Time Customer Experience Personalisation

- Integration of AI/ML Engines with Wi-Fi Analytics Platforms

- MAC-Address Randomization Impacting Data Accuracy

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions continued to dominate, holding 56.5% of the Wi-Fi analytics market share in 2024. However, services are outpacing at 21.4% CAGR, driven by demand for turnkey insight rather than do-it-yourself dashboards. Enterprises outsource analytics interpretation, privacy governance, and cross-system integration to specialists, lowering internal workloads while compressing time-to-value.

The Wi-Fi analytics market size for services is anticipated to more than double between 2025 and 2030 as vendors bundle consulting, managed operations, and outcome-based pricing. RetailNext's fresh funding from Battery Ventures underscores investor belief that analytics-as-a-service will underpin future growth. Cloud4Wi's Fogsense micro-device shows how service firms shrink hardware footprints and shift value upstream to business context.

Cloud platforms controlled 62.9% of the Wi-Fi analytics market share in 2024, and the segment is forecast to advance at a 21.8% CAGR. Subscription models eliminate capex and provide elastic storage plus AI updates on release day. Small and midsize retailers that once lacked internal IT staff now deploy within hours, unlocking network data that previously sat idle.

Edge compute addresses latency and data-sovereignty concerns; Cisco's AI-native Wi-Fi 7 access points process telemetry locally while syncing summaries to the cloud.On-premise remains relevant in defense, healthcare, and financial institutions where sovereign hosting or legacy architectures persist.

Wi-Fi Analytics Market Report is Segmented by Component (Solutions, Services), Deployment (On-Premise, Cloud), Application (Presence Analytics, Marketing Analytics), End-User Vertical (Retail, Hospitality, Sports and Leisure, Transportation, Healthcare and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

North America accounted for 31.2% of global revenue in 2024, driven by early enterprise adoption and mature regulatory balance between privacy and analytics. Flagship examples include Extreme Networks' deployments across 25 NFL stadiums that demonstrate best practices in high-density Wi-Fi. High smartphone penetration and robust cloud infrastructure sustain continuous platform upgrades.

Asia-Pacific is the fastest expanding region, growing at a 20.5% CAGR through 2030. China hosts about 4,000 private wireless factories that lay groundwork for granular analytics, while India's prospective 6 GHz allocation could unlock USD 4,030 billion in economic value by 2034. Rapid urbanisation and government digital-in-public policies spur deployments across transport hubs, malls, and smart campuses.

Europe presents a privacy-led model where GDPR dictates platform design. Operators that secure user consent and anonymise data gain first-mover advantage. Germany leads with large retail chains linking guest Wi-Fi to loyalty programs under strict compliance, and the United Kingdom's public Wi-Fi initiatives in rail stations illustrate high-traffic analytics at national scale. Edge-enabled deployments lower cloud egress costs and align with the region's sustainability targets.

- Cisco Systems Inc.

- Cloud4Wi Inc.

- Purple WiFi Ltd

- RetailNext Inc.

- Yelp WiFi Inc.

- CommScope Inc. (Ruckus Wireless)

- Fortinet Inc.

- Blix Inc.

- Skyfii Limited

- Singtel Optus Pty Ltd

- MetTel Inc.

- Hewlett Packard Enterprise (Aruba Networks)

- Extreme Networks Inc.

- Cambium Networks Ltd

- Ubiquiti Inc.

- Aislelabs Inc.

- Plume Design Inc.

- Euclid Analytics

- Near Intelligence Holdings

- Mist Systems (Juniper Networks)

- Cloud5 Communications

- Datavalet Technologies Inc.

- GoZone WiFi LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging smartphone and smart-device penetration

- 4.2.2 Rapid rollout of public Wi-Fi in physical venues

- 4.2.3 Demand for real-time CX personalisation in retail and hospitality

- 4.2.4 Integration of AI/ML engines with Wi-Fi analytics platforms

- 4.2.5 Adoption of Wi-Fi RTT for sub-meter indoor positioning

- 4.2.6 Edge-based analytics on access points lowering TCO

- 4.3 Market Restraints

- 4.3.1 Stringent privacy regulations (GDPR, CCPA, etc.)

- 4.3.2 Persistent network-level security vulnerabilities

- 4.3.3 MAC-address randomisation impacting data accuracy

- 4.3.4 Spectrum congestion in high-density locations

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By Application

- 5.3.1 Presence Analytics

- 5.3.2 Marketing Analytics

- 5.4 By End-user Vertical

- 5.4.1 Retail

- 5.4.2 Hospitality

- 5.4.3 Sports and Leisure

- 5.4.4 Transportation

- 5.4.5 Healthcare

- 5.4.6 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Netherlands

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems Inc.

- 6.4.2 Cloud4Wi Inc.

- 6.4.3 Purple WiFi Ltd

- 6.4.4 RetailNext Inc.

- 6.4.5 Yelp WiFi Inc.

- 6.4.6 CommScope Inc. (Ruckus Wireless)

- 6.4.7 Fortinet Inc.

- 6.4.8 Blix Inc.

- 6.4.9 Skyfii Limited

- 6.4.10 Singtel Optus Pty Ltd

- 6.4.11 MetTel Inc.

- 6.4.12 Hewlett Packard Enterprise (Aruba Networks)

- 6.4.13 Extreme Networks Inc.

- 6.4.14 Cambium Networks Ltd

- 6.4.15 Ubiquiti Inc.

- 6.4.16 Aislelabs Inc.

- 6.4.17 Plume Design Inc.

- 6.4.18 Euclid Analytics

- 6.4.19 Near Intelligence Holdings

- 6.4.20 Mist Systems (Juniper Networks)

- 6.4.21 Cloud5 Communications

- 6.4.22 Datavalet Technologies Inc.

- 6.4.23 GoZone WiFi LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment