|

市場調查報告書

商品編碼

1851720

微晶蠟:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)Microcrystalline Wax - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

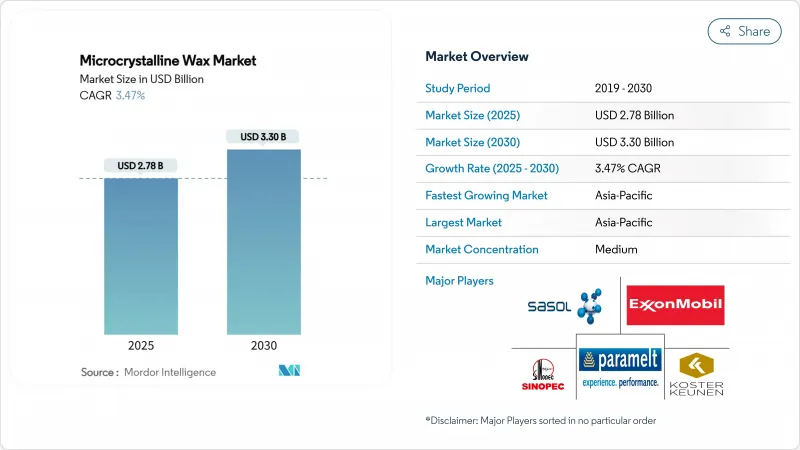

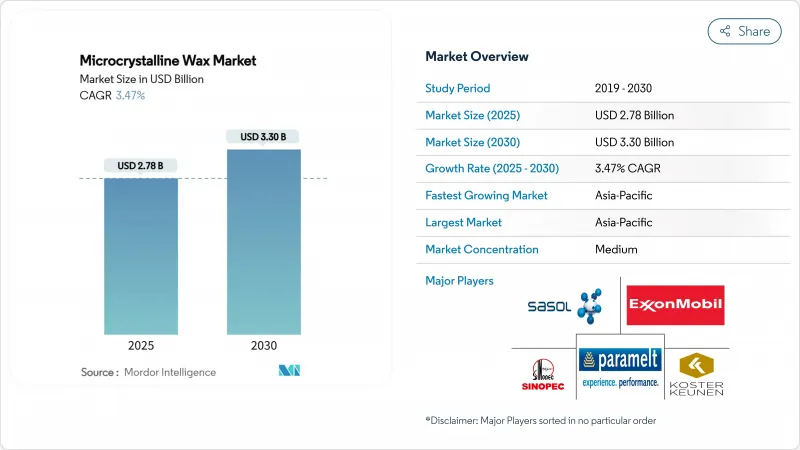

預計到 2025 年,微晶蠟市場規模將達到 27.8 億美元,到 2030 年將達到 33 億美元,預測期(2025-2030 年)的複合年成長率為 3.47%。

化妝品、黏合劑和製藥應用領域的穩步擴張支撐著這一發展趨勢,而向生物基原料的轉型、煉油廠的升級改造以及永續性的主導重塑了競爭格局。 63-91°C 的高熔點、優異的柔韌性和卓越的香氣保持性,使微晶蠟與石蠟區分開來,使配方師能夠滿足熱帶氣候下的性能要求。亞太地區憑藉著成本效益高的生產、不斷成長的國內需求以及在中國和印度的大型煉油計劃,鞏固了其領先地位,這些項目確保了可靠的原料供應。同時,諸如 SASOLWAX LC100排放降低 35% 等永續性指標,如今已成為下游用戶,尤其是高階美妝品牌的重要採購標準。

全球微晶蠟市場趨勢與洞察

擴大我們的化妝品和個人護理用品生產基地

亞太地區的契約製造製造商正在擴大唇膏、潤唇膏和高階護膚的生產,利用微晶蠟來改善質地、防止出汗,並在熱帶高溫下穩定乳液。中國和印度的大型OEM廠商正利用較低的人事費用和強大的供應鏈,增加可與植物油無縫混合的軟性等級產品的消費。美國FDA和歐盟的核准簡化了跨境運輸,使品牌能夠在不影響合規性的前提下,將生產整合到更少、更大的工廠。在印尼、越南和菲律賓,不斷成長的中階消費支出和唇膏新品的推出,使該地區保持了兩位數的成長,進一步支撐了市場需求。追求「清潔美妝」的品牌正在嘗試混合植物蠟,但仍然依賴微晶蠟來保持產品的品質和穩定性。因此,儘管永續性面臨越來越大的壓力,微晶蠟市場仍保持著穩定的銷售量。

對醫藥和醫療應用的需求不斷成長

製藥公司正採用微晶蠟建構緩釋性基質,以確保8至12小時內劑量均勻。微晶蠟的化學惰性使其可直接與活性成分壓片,無需額外的阻隔包衣,從而縮短研發週期。在美國、德國和日本等老化市場,慢性病的高發生率推動了對長效鎮痛和內分泌治療藥物的需求,而這兩種藥物都採用蠟基顆粒技術。 ICH Q12 下的全球監管協調促進了跨區域申報,並降低了含蠟製劑的邊際成本。因此,合約研發受託製造廠商(CDMO) 正在簽訂長期供應協議,以確保產品等級規格的一致性,並確保高純度硬蠟組分的穩定供應。

原油供應波動會影響原料供應

地緣政治緊張局勢和歐佩克減產週期性地導致真空殘渣油供應緊張,迫使煉油商優先生產利潤更高的燃料油而非特種蠟。高企的現貨價格已使微晶蠟原料成本上漲高達22%,擠壓了沒有長期承購協議的獨立混煉廠的利潤空間。西歐和東非等依賴進口的經濟體面臨的衝擊最為迅速,因為運費溢價加劇了市場波動。擁有原油交易部門的大型綜合煉油廠可以透過避險來減輕影響,但規模較小的煉油廠則面臨斷貨風險,從而削弱客戶信心。中期來看,多元化發展合成蠟和生質能衍生蠟可以部分緩解衝擊,但擴大生產規模需要大量資金投入和時間。

細分市場分析

預計硬質蠟將於2025年開始加速成長,到2030年將以4.18%的複合年成長率成長,而軟質蠟在2024年仍將維持62.08%的收入領先優勢。 1型層壓蠟在65°C下用於保護相紙,2型塗佈蠟在81°C下用於增強食品接觸板的強度,3型固化蠟在90°C下用於保護變壓器繞組。它們精細的晶體結構賦予其優異的介電強度,並能抵抗持續高溫造成的塌陷。

基於差示掃描量熱法、穿透試驗和環球軟化點試驗的實驗室通訊協定符合 ISO 22007 的精確度標準,確保批次均勻性。正在進行的研究和開發工作正在探索奈米二氧化矽摻雜,以在不犧牲黏度的前提下將模量提高 18%,從而為電磁干擾屏蔽塗層開闢新的途徑。同時,軟性等級產品在口紅、潤唇膏和紙板層壓板等領域佔據了巨大的銷售量,這些領域對柔韌性和吸油性要求極高。亞太地區代工填充廠的快速擴張支撐了軟性等級產品的穩定產能和基準需求,而硬質等級產品的技術創新則提高了價值獲取。

區域分析

亞太地區預計到2024年將佔全球銷售額的47.22%,並預計在2030年前以3.91%的複合年成長率成長,主要驅動力來自煉油投資和消費品製造業兩大引擎。印度計劃在2030年新增80萬桶/日的煉油產能,從而拓寬當地蠟製品製造商的原料供應管道。中國垂直一體化的石化聯合企業,加上生活方式主導化妝品的流行,將確保其成本領先優勢。日本和韓國將專注於電子產品用高純度硬蠟的生產,並充分利用嚴格的製程控制和先進的品質控制基礎設施。東南亞國協憑藉其關稅優勢和接近性原料供應地的優勢,正在吸引契約製造,從而提高區域自給自足能力。

北美憑藉其專業配製商和研發驅動型精煉商,保持著技術領先地位。 FDA批准其用於食品接觸用途,USP註冊其用於醫藥級產品,這為監管提供了可預測的路徑,從而支持了下游消費的穩定。美國正在其國家實驗室開發下一代生物基蠟混合物,而墨西哥不斷擴張的汽車組裝和包裝產業叢集正在刺激對黏合劑和塗料的需求。加拿大當局已確認,精製結晶質蠟組分對人體健康的風險微乎其微,進一步增強了民眾的接受度。

歐洲正努力在嚴格的永續性法規與專業創新之間尋求平衡。品牌商面臨MOAH和MOSH純度法規的約束,促使供應商實施線上GC-FID監測並採用雙加氫製程。德國正在推動一項循環碳計劃,利用廢棄物生質能氣化生產費托蠟中間體,而荷蘭則在試驗海洋生物來源原料。東歐煉油廠正在維修加氫裂解裝置,以從區域原油流動中獲取價值並提高本地供應量。此外,巴西個人護理用品出口的成長和沙烏地阿拉伯特種化學品投資框架分別預示著南美洲和中東及非洲的成長潛力。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 擴大化妝品和個人護理用品製造地

- 對醫藥和醫療應用的需求不斷成長

- 微晶蠟替代石蠟用於熱熔膠中。

- 煉油廠轉向生物基原料升級

- 用於永續包裝的低溫食品接觸塗料的發展

- 市場限制

- 原油供應波動會影響原料供應能力。

- 監管機構對高階化妝品中礦物成分的抵制

- 對海洋蠟殘留物排放制定嚴格規定

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 定價分析

- 貿易分析

第5章 市場規模與成長預測

- 按類型

- 靈活的

- 難的

- 透過使用

- 化妝品和個人護理

- 蠟燭

- 膠水

- 包裹

- 橡皮

- 其他用途

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Alfa Chemicals

- Alpha Wax

- Blended Waxes Inc.

- The British Wax Refining Company Ltd

- Calumet, Inc.,

- Clarus Specialty Products

- Exxon Mobil Corporation

- Indian Oil Corp. Ltd.

- Industrial Raw Materials LLC.

- Koster Keunen

- Kerax

- NIPPON SEIRO CO., LTD.

- Paramelt BV

- Sasol

- Sonneborn LLC

- The International Group Inc.

第7章 市場機會與未來展望

The Microcrystalline Wax Market size is estimated at USD 2.78 billion in 2025, and is expected to reach USD 3.30 billion by 2030, at a CAGR of 3.47% during the forecast period (2025-2030).

Steady expansion in cosmetics, adhesives and pharmaceutical uses underpins this trajectory, while the shift toward bio-based feedstocks, refinery upgrades and sustainability-driven innovation recalibrate competitive positioning. Higher melting points of 63-91 °C, excellent flexibility and superior fragrance retention continue to differentiate microcrystalline grades from paraffin, enabling formulators to meet performance demands in tropical climates. Asia-Pacific entrenches its leadership through cost-effective production, rising domestic demand and large-scale refinery projects in China and India that ensure reliable feedstock. Meanwhile, sustainability metrics-such as SASOLWAX LC100's 35% lower emissions-now form a critical purchase criterion for downstream users, especially premium beauty brands.

Global Microcrystalline Wax Market Trends and Insights

Expanding Cosmetics and Personal-Care Manufacturing Bases

Asia-Pacific contract manufacturers scale up lipstick, balm and premium skin-care production, and microcrystalline wax enhances texture, prevents sweating and stabilizes emulsions under tropical temperatures. Large OEM hubs in China and India leverage lower labor costs and robust supply chains, raising bulk consumption for flexible grades that blend seamlessly with plant oils. FDA and EU approvals simplify cross-border shipping, allowing brands to consolidate output in a few mega-facilities without compromising compliance. Rising middle-class spending in Indonesia, Vietnam and the Philippines sustains double-digit growth in lip-color launches, further anchoring regional demand. Brands pursuing "clean beauty" narratives trial plant wax blends yet still rely on microcrystalline fractions to maintain payoff quality and product stability. Consequently, the microcrystalline wax market continues to secure volumes even as sustainability pressures intensify.

Growing Demand from Pharmaceutical and Medical Applications

Drug formulators adopt microcrystalline wax to build sustained-release matrices that ensure dose uniformity across 8-12 hour windows. Its chemical inertness allows direct compression with active ingredients, avoiding additional barrier coatings and shortening development timelines. Chronic disease prevalence in aging markets such as the United States, Germany and Japan elevates demand for long-acting pain management and endocrinology therapies, both of which leverage wax-based pellet technology. Global regulatory harmonization under ICH Q12 boosts cross-regional filings, lowering marginal costs for wax-enabled formulations. Contract development manufacturing organizations (CDMOs) therefore lock in long-term supply contracts to secure consistent grade specifications, reinforcing steady offtake for high-purity hard wax fractions.

Crude-Oil Supply Volatility Impacting Feedstock Availability

Geopolitical tensions and OPEC production curbs periodically tighten vacuum-resid availability, leading refiners to prioritize higher-margin fuels rather than specialty wax streams. Spot price spikes raise microcrystalline feed costs by up to 22%, compressing margins for independent compounders lacking long-term offtake contracts. Import-dependent economies in Western Europe and East Africa face the sharpest disruptions, since freight premiums amplify volatility. Integrated majors with captive crude trade desks cushion the impact through hedging, but smaller players risk stock-outs that erode customer trust. Over the medium term, diversification into synthetic and biomass-derived waxes offers partial mitigation, yet scaling remains capital intensive and time consuming.

Other drivers and restraints analyzed in the detailed report include:

- Substitution of Paraffin with Microcrystalline Wax in Hot-Melt Adhesives

- Shift Toward Bio-Based Feedstock Upgrading at Refineries

- Regulatory Pushback on Mineral-Based Ingredients in Premium Cosmetics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hard-type grades opened 2025 with stronger momentum, forecast to climb at a 4.18% CAGR to 2030 while flexible grades maintained 62.08% revenue dominance in 2024. Type 1 laminating wax at 65 °C safeguards photographic paper, Type 2 coating wax at 81 °C fortifies food-contact boards, and Type 3 hardening wax at 90 °C protects transformer windings. These fine-crystal structures impart superior dielectric strength and resist slump under sustained heat, attributes increasingly valued by electric-vehicle capacitor makers.

Laboratory protocols relying on differential scanning calorimetry, needle penetration and ring-and-ball softening point testing ensure batch homogeneity, meeting ISO 22007 precision benchmarks. Ongoing R&D explores nano-silica doping that lifts modulus by 18% without sacrificing viscosity, opening new niches in EMI shielding coatings. Flexible grades, meanwhile, dominate lipstick, balm and board-laminating volumes where pliability and oil-binding are critical. Rapid expansion of APAC contract filling plants underpins consistent throughput for flexible fractions, anchoring baseline demand even as hard-grade innovations lift value capture.

The Microcrystalline Wax Market Report is Segmented by Type (Flexible and Hard), Application (Cosmetics and Personal Care, Candles, Adhesives, Packaging, Rubber, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 47.22% revenue in 2024 and is projected to expand at a 3.91% CAGR through 2030 on the twin engines of refinery investment and consumer-product manufacturing. India plans to add 800,000 barrels per day of refining capacity by 2030, broadening feedstock access for local wax producers. China's vertically integrated petrochemical complexes, coupled with lifestyle-driven cosmetics uptake, secure cost leadership. Japan and South Korea concentrate on high-purity hard grades for electronics, leveraging tight process controls and advanced QC infrastructure. ASEAN nations attract contract manufacturing owing to tariff advantages and proximity to raw-material supply, reinforcing regional self-sufficiency.

North America retains technological leadership via specialty formulators and R&D-oriented refiners. FDA clearances for food-contact use and USP listings for pharmaceutical grades provide predictable regulatory paths, supporting steady downstream consumption. The United States develops next-gen bio-based wax blends within national labs, while Mexico's expanding auto-assembly and packaging clusters stimulate adhesive and coating demand. Canadian authorities confirmed negligible human-health risk from refined microcrystalline fractions, bolstering public acceptance.

Europe balances stringent sustainability rules with specialty innovation. Brands face MOAH and MOSH purity mandates, prompting suppliers to install inline GC-FID monitoring and adopt double-hydrogenation routes. Germany champions circular-carbon projects that gasify waste biomass into Fischer-Tropsch wax intermediates, whereas the Netherlands pilots marine-biogenic feedstock. Eastern European refiners retrofit hydrocrackers to capture value from regional crude flows, raising local availability. Elsewhere, Brazil's booming personal-care exports and Saudi Arabia's specialty-chem investment frameworks hint at incremental pockets of growth in South America and Middle-East and Africa, respectively.

- Alfa Chemicals

- Alpha Wax

- Blended Waxes Inc.

- The British Wax Refining Company Ltd

- Calumet, Inc.,

- Clarus Specialty Products

- Exxon Mobil Corporation

- Indian Oil Corp. Ltd.

- Industrial Raw Materials LLC.

- Koster Keunen

- Kerax

- NIPPON SEIRO CO., LTD.

- Paramelt B.V

- Sasol

- Sonneborn LLC

- The International Group Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding Cosmetics and Personal-Care Manufacturing Bases

- 4.2.2 Growing Demand from Pharmaceutical and Medical Applications

- 4.2.3 Substitution of Paraffin with Microcrystalline Wax in Hot-Melt Adhesives

- 4.2.4 Shift Toward Bio-Based Feedstock Upgrading at Refineries

- 4.2.5 Growth of Low-Temperature Food-Contact Coatings for Sustainable Packaging

- 4.3 Market Restraints

- 4.3.1 Crude-Oil Supply Volatility Impacting Feedstock Availability

- 4.3.2 Regulatory Pushback on Mineral-Based Ingredients in Premium Cosmetics

- 4.3.3 Tight Marine Discharge Regulations on Wax Residues

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

- 4.6 Price Analysis

- 4.7 Trade Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Flexible

- 5.1.2 Hard

- 5.2 By Application

- 5.2.1 Cosmetics and Personal Care

- 5.2.2 Candles

- 5.2.3 Adhesives

- 5.2.4 Packaging

- 5.2.5 Rubber

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Alfa Chemicals

- 6.4.2 Alpha Wax

- 6.4.3 Blended Waxes Inc.

- 6.4.4 The British Wax Refining Company Ltd

- 6.4.5 Calumet, Inc.,

- 6.4.6 Clarus Specialty Products

- 6.4.7 Exxon Mobil Corporation

- 6.4.8 Indian Oil Corp. Ltd.

- 6.4.9 Industrial Raw Materials LLC.

- 6.4.10 Koster Keunen

- 6.4.11 Kerax

- 6.4.12 NIPPON SEIRO CO., LTD.

- 6.4.13 Paramelt B.V

- 6.4.14 Sasol

- 6.4.15 Sonneborn LLC

- 6.4.16 The International Group Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment