|

市場調查報告書

商品編碼

1851705

地板塗料:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Floor Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

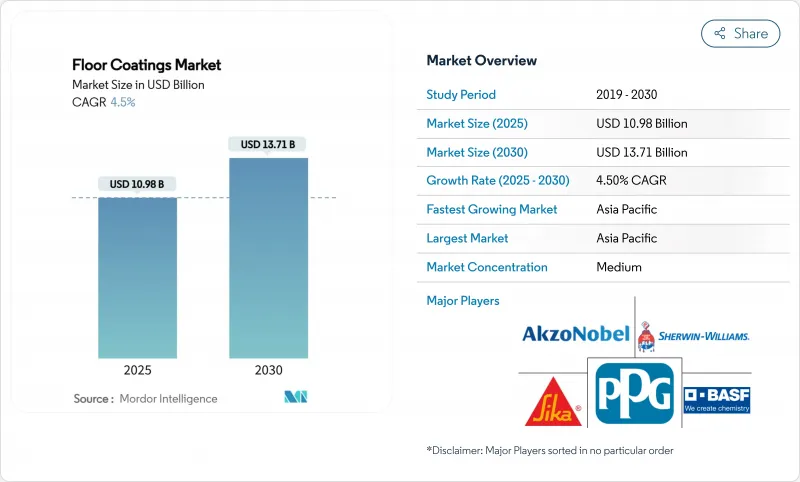

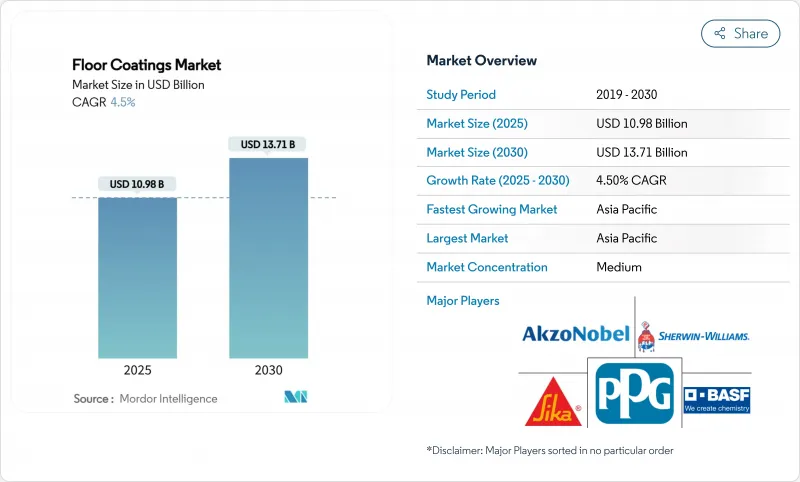

預計到 2025 年,地板塗料市場規模將達到 109.8 億美元,到 2030 年將達到 137.1 億美元,在預測期(2025-2030 年)內複合年成長率為 4.5%。

冷庫、電履約中心、電動車電池工廠和多用戶住宅重建領域對高性能地板材料的持續需求,凸顯了塗料作為基礎設施而非裝飾性飾面的戰略價值。亞太地區預計2024年將佔據38%的市場佔有率,主要得益於中國和印度的工業擴張。同時,樹脂化學正朝著特種環氧樹脂、抗菌劑和導電體系的方向發展,這些產品具有安全、衛生和靜電控制等優勢。環氧樹脂仍然是行業標竿技術,佔據50%的市場佔有率,但聚天冬氨酸酯和紫外光固化產品因其施工快速、VOC含量低而日益受到青睞。原料成本波動和施工人員短缺構成了一定的挑戰,但靈活的供應鏈和簡化的應用化學技術正在緩解這些影響。隨著監管機構收緊VOC基準值,擁有成熟的水性或粉末塗料技術的製造商正在獲得優勢,從而提升該地區的競爭力。

全球地板塗料市場趨勢與洞察

需要抗菌地面塗層的冷藏倉庫

全球冷藏倉庫建設的激增推動了對兼具耐熱衝擊性和可靠殺菌性能的被覆劑的需求。新型化學配方中添加了銀離子或季銨鹽添加劑,這些添加劑在系統的整個使用壽命期間都能保持活性,從而減少病原體數量,並幫助營運商保持符合危害分析和關鍵控制點 (HAZC) 標準。承包商重視快速運作方案,而資產所有者則優先考慮像 Deflecta 水性配方提供的五年細菌控制保證。因此,人們對塗料性能的期望不斷提高,而日益嚴格的食品安全標準正將塗料從可選升級轉變為建築的必備組件。同時,冷塗胺甲酸乙酯水泥產品能夠實現現有冷藏庫的夜間維修,防止庫存變質,保障收入來源。

履約中心推動環氧樹脂需求

線上零售的蓬勃發展不斷增加物流空間的需求,這些空間必須承受堆高機磨損、電池酸液滴漏和機器人通行等考驗。高抗壓強度、快速固化(一夜即可完成)的耐磨環氧樹脂,使得計劃能夠分階段推進,而無需中斷揀貨作業,從而最大限度地減少收入損失。反光面漆進一步降低了照明成本,防滑添加劑保障了工人的安全。設計師們越來越需要以數據為依據的生命週期評估來檢驗耐久性聲明,這促使配方師採用透明的性能文件。隨著全通路物流佈局的擴展,採用「週末快速交付」系統的環氧樹脂供應商獲得了優先競標地位,並面臨持續穩定的市場需求。

原物料價格波動

鋼鐵、銅和天然氣關稅的上漲推高了關鍵樹脂和添加劑的成本,擠壓了混煉商和安裝商的利潤空間。動態額外費用條款已成為計劃競標中的標準條款,將部分風險轉移給了資產所有者。儘管各方也在努力實現原料來源多元化和垂直整合,但完全不受大宗商品價格波動的影響仍然十分困難。利用生物基稀釋劑降低石化產品含量的改質劑也越來越受歡迎,但它們仍需經過嚴格的耐久性測試才能被廣泛接受。

細分市場分析

到2024年,環氧樹脂將佔據地板塗料市場50%的佔有率,並在2030年之前以4.68%的複合年成長率成長,這主要得益於工業領域對耐化學性和高抗壓強度的需求。雖然聚氨酯在柔韌性方面仍然佔據主導地位,但24小時固化的聚天冬胺酸酯技術正在零售整修而言是一筆巨大的損失。裝飾性金屬環氧樹脂繼續為展示室地板增添特色,而自流平耐化學腐蝕等級等功能性創新則表明性能閾值正在不斷提高。結合環氧樹脂的黏合性能和聚天冬胺酸酯樹脂的快速固化性能的混合塗料正在湧現,在不犧牲耐久性的前提下,拓展了應用範圍。承包商非常欣賞這些系統提供的寬廣工作溫度範圍,尤其是在沒有空調的施工現場。經銷商提供預先調色套件,以滿足即時交付的需求,這增強了環氧樹脂對管理分散施工現場的承包商的物流吸引力。具有環保意識的規範制定者越來越傾向於選擇不含紅色清單中有害物質的配方,這迫使配方師在保持固化特性的同時重新評估固化劑。隨著每項技術創新,地板塗料市場都在證明,環氧樹脂的基本性能仍能滿足不斷變化的性能指標,確保該樹脂系列繼續成為重型地板材料規範的基石。

同時,聚天門冬胺酸酯在2024年的維修週期中已不再侷限於小眾市場,其價格高達每平方英尺5至12美元。其快速的隔夜固化特性有助於減少空置率,保障租金收入。其優異的紫外線穩定性和高光澤度使其在豪華公寓和零售商店中更具吸引力。配方生產商也使用低氣味催化劑來解決以往的氣味問題,從而促進其在生活空間中的應用。諸如此類的創新推動了地板塗料市場朝著更快、更環保的施工方法發展,同時又不影響其長期性能。

到2024年,紫外線固化系統將佔據35%的市場佔有率,其快速的生產線速度和節能的固化方式,正是精實建造專案所需要的。紫外線燈照射可實現即時交聯,使設施能夠在數小時內而非數天內恢復全面運作。該工藝透過減少每班工人數量,覆蓋更大面積,從而降低人事費用。隨著VOC(揮發性有機化合物)排放的減少與日益嚴格的環境法規一致,紫外線固化供應商正在醫療保健和食品加工維修中優先考慮採用該技術。新型光引發劑配方擴大了基材相容性,使其能夠在混合用途設施中,在混凝土、鋼材和硬木等多種基材上實現一致的應用。雖然初始投資成本有所上升,但對於大批量生產商而言,這些成本可以迅速攤銷,從而支持在那些追求快速施工進度的地區持續推廣應用。

受北歐激勵政策的影響,水性塗料正在縮小以往在耐磨性和光澤保持性方面的性能差距。採用先進聚氨酯分散體的配方如今已具備與溶劑型塗料相媲美的耐磨性,進一步拓展了建築師可選擇的永續方案。諸如PPG PRIMERON Optimal之類的粉末底漆已證明,靜電噴塗技術可減少高達20%的過噴和廢棄物,從而強化了地板塗料市場對循環經濟原則的承諾。這些技術選擇體現了對固化速度和環境友善性的堅定關注。

區域分析

預計到2024年,亞太地區將佔全球地板塗料市場收入的38%,該地區的需求預計將在2030年之前以4.71%的複合年成長率成長。政府主導的工業、電動車電池大型工廠和物流中心正在推動大規模混凝土塗料應用,而國內消費者的升級改造則刺激了都市區公寓大樓的裝飾需求。中國的排放目標正在促進水性塗料和粉末塗料的普及,從而提升了專注於低VOC系統的本土配方商的競爭力。在印度,與電子產品組裝生產連結獎勵正在加速導電地板材料的普及,使印度成為重要的成長節點。受製造業回流趨勢的推動,東南亞市場正在擴大倉儲規模,刺激區域消費。綜上所述,這些因素共同作用,使亞太地區成為2030年地板塗料市場的主要成長引擎。

北美仍然是關鍵區域,其特點是嚴格的安全法規和高昂的維修成本。資料中心投資要求防靜電地板的電阻低於25,000歐姆,而醫療保健維修指定使用抗菌胺甲酸乙酯水泥以滿足感染控制通訊協定。 2025年商業建築展望預測,先進製造業和冷庫計劃,這些項目大量使用環氧樹脂和胺甲酸乙酯混合物。同時,LEED v5等永續性項目鼓勵採用水性材料和生物基材料,市政競標中也強制要求提供明確的VOC值。然而,安裝人員短缺正在延緩工期,這推動了對能夠減少工時的單日固化技術的需求。

歐洲是一個成熟且創新主導的市場,北歐國家利用公共採購標準加速推廣無揮發性有機化合物(VOC)產品。歐盟指令2024/825將於2024年3月生效,禁止使用模糊的生態標籤,並要求供應商提供生命週期資料來檢驗其永續性聲明。這種監管壓力有利於能夠進行第三方產品聲明的製造商,同時也提高了後入者的進入門檻。隨著工廠管理者將節能和工人安全放在首位,粉末底漆和UV-LED生產線正在蓬勃發展。此外,循環經濟獎勵鼓勵回收計畫和可再生包裝,將永續性深度融入採購標準。因此,歐洲既是高階市場,也是影響全球地板塗料市場配方趨勢的法規標竿。

其他好處

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 冷庫快速擴張,需要抗菌地面塗層

- 履約中心的激增推動了對耐磨環氧樹脂的需求。

- 多用戶住宅翻新熱潮推動了美容水療中心地板的建設

- 電動車電池工廠的防靜電要求促使導電地板的應用。

- 北歐政府鼓勵使用不含揮發性有機化合物(VOC)的水處理系統

- 市場限制

- 原物料價格波動

- 新興國家建築工程師短缺

- 混凝土拋光優於地板塗層

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 環氧樹脂

- 聚氨酯

- 聚天門冬胺酸

- 丙烯酸纖維

- 其他

- 透過技術

- 溶劑型

- 水系統

- 粉末

- 紫外線固化

- 按地板材料

- 具體的

- 木頭

- 其他

- 按最終用途行業分類

- 業/設施

- 商業的

- 住宅

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Akzo Nobel NV

- Ardex Group

- Arkema(Bostik)

- Asian Paints

- Axalta Coating Systems

- BASF SE(Master Builders Solutions)

- Hempel A/S

- Henkel AG & Co. KGaA

- Jotun

- Kansai Nerolac Paints Limited

- LATICRETE International Inc.

- MAPEI SpA

- Nippon Paint Holdings Co., Ltd.

- PPG Industries Inc.

- RPM International Inc.

- Sika AG

- Sto SE & Co. KGaA

- Teknos Group

- Tennant Company

- The Sherwin-Williams Company

- Tikkurila

第7章 市場機會與未來展望

The Floor Coatings Market size is estimated at USD 10.98 billion in 2025, and is expected to reach USD 13.71 billion by 2030, at a CAGR of 4.5% during the forecast period (2025-2030).

Continued demand for high-performance flooring in cold-storage warehouses, e-commerce fulfillment centers, EV battery plants, and multifamily housing renovations is reinforcing the strategic value of coatings as infrastructure assets rather than cosmetic finishes. Asia Pacific leads with 38% revenue share in 2024, propelled by industrial expansion in China and India, while resin chemistries are shifting toward specialty epoxy, antimicrobial, and conductive systems that deliver safety, hygiene, and static control benefits. At 50% share, epoxy remains the benchmark technology, but polyaspartic and UV-cured products are capturing attention for rapid installation and low VOC output. Raw-material cost swings and installer shortages create headwinds, yet agile supply chains and simplified application chemistries are cushioning the impact. As regulatory agencies tighten VOC thresholds, manufacturers with mature water-borne or powder technologies gain an edge, reshaping competitive positioning across regions.

Global Floor Coatings Market Trends and Insights

Cold-storage warehousing requiring antimicrobial floor coatings

Surging global construction of refrigerated warehouses is multiplying demand for coatings that combine thermal-shock tolerance with proven biocidal performance. Newer chemistries embed silver-ion or quaternary additives that remain active for the full service life of the system, reducing pathogen counts and helping operators maintain Hazard Analysis Critical Control Point compliance. Installers value fast return-to-service options, while asset owners prioritize five-year bacterial control warranties such as those offered by Deflecta's waterborne formulations. The resulting performance expectations elevate coatings from optional upgrades to mandated building components under tightened food-safety codes. In parallel, low-temperature application urethane-cement products enable overnight refurbishments of existing coolers, preventing inventory spoilage and protecting revenue streams.

E-commerce fulfillment centers boosting epoxy demand

Online retail growth is driving continuous additions of logistics square footage that must resist forklift abrasion, battery acid drips, and robotic traffic. Abrasion-resistant epoxy with high compressive strength and rapid overnight cure allows operators to phase projects without halting picking operations, minimizing revenue loss. Reflective topcoats further cut lighting costs, while anti-slip additives protect worker safety. Specifiers increasingly insist on data-backed life-cycle assessments to validate durability claims, pushing formulators toward transparent performance documentation. Epoxy suppliers responding with "one-weekend" systems gain preferential bidding status and steady recurring demand fuelled by growing omnichannel logistics footprints.

Raw-material price volatility

Escalating tariffs on steel, copper and natural gas have lifted key resin and additive costs, squeezing margins for formulators and installers alike. Dynamic surcharge clauses have become standard in project bids, transferring a portion of risk to asset owners. Parallel efforts to diversify raw-material sourcing and integrate vertically are underway, though complete insulation from commodity swings remains elusive. Reformulations that lower petrochemical content through bio-based diluents are gaining traction but must still satisfy rigorous durability tests before widespread acceptance.

Other drivers and restraints analyzed in the detailed report include:

- EV battery plants stimulating conductive flooring

- Government incentives for VOC-free water-borne systems

- Skilled-installer shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Epoxy commanded 50% of the floor coatings market in 2024, and the segment is forecast to advance at a 4.68% CAGR through 2030, driven by demand for chemical resistance and high compressive strength in industrial zones. Polyurethane trails as the flexibility champion, while polyaspartic technology, prized for 24-hour return-to-service, is carving share in retail refurbishments where downtime penalties are steep. Decorative metallic epoxies continue to differentiate showroom floors, yet functional innovations such as self-leveling chemical-resistant grades illustrate how performance thresholds keep rising. Hybrid blends that marry epoxy adhesion with polyaspartic speed are emerging, expanding addressable applications without sacrificing durability. Installers appreciate the broader working temperature window these systems provide, especially in sites lacking HVAC during construction. Distributors stocking pre-tinted kits meet just-in-time delivery preferences, reinforcing epoxy's logistical appeal to contractors managing scattered job sites. Environment-focused specifiers increasingly request Red List-free formulations, pushing formulators to re-evaluate curing agents while maintaining cure profiles. With every incremental innovation, the floor coatings market demonstrates that epoxy's fundamentals still align with evolving performance metrics, ensuring the resin family remains the backbone of heavy-duty flooring specifications.

Polyaspartic adoption, meanwhile, outsized its niche reputation in 2024 renovation cycles, commanding premium pricing between USD 5 and 12 per square foot. Rapid overnight curing protects rental revenue by limiting unit vacancy, helping property managers justify higher upfront costs. UV stability and high-gloss clarity strengthen its appeal for high-end condominiums and retail storefronts. Formulators are also solving historic odor concerns with low-odor catalysts, smoothing acceptance in occupied spaces. These innovations underpin the floor coatings market trajectory toward faster and greener application methods without compromising long-term performance expectations.

UV-cured systems captured 35% share in 2024, delivering on rapid line speeds and energy-efficient curing demanded by lean construction schedules. Exposure to ultraviolet lamps triggers instant crosslinking, enabling facilities to resume full operation within hours rather than days. The process slashes labor costs because fewer workers can cover larger square footage per shift, a benefit that resonates in tight labor markets. As reduced VOC output aligns with stricter environmental codes, UV-cured suppliers gain specification priority in health-care and food-processing refurbishments. New photoinitiator packages broaden substrate compatibility, allowing coherent application across concrete, steel and hardwood in mixed-use facilities. Despite higher equipment costs, amortization is swift for high-volume contractors, ensuring sustained uptake in regions chasing aggressive construction timetables.

Water-borne chemistries, influenced by Nordic incentives, are narrowing historical performance gaps in abrasion resistance and gloss retention. Formulators leveraging advanced polyurethane dispersions now promise wear-layers that rival solvent-borne counterparts, further expanding the sustainable options available to architects. Powder primers such as PPG PRIMERON Optimal demonstrate how electrostatic spray technology reduces overspray and cuts waste by up to 20%, reinforcing the floor coatings market commitment to circular economy principles. Collectively, technology choices show a decisive pivot toward curing speed and environmental compatibility, traits increasingly written into procurement scorecards across institutional portfolios.

The Floor Coatings Market Report Segments the Industry by Product Type (Epoxy, Polyurethane, and More), Technology (Solvent-Borne, Water-Borne, and More), Floor Material (Concrete, Wood, and Others), End-Use Industry (Industrial/Institutional, Commercial, and Residential), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific dominated the floor coatings market with 38% revenue share in 2024, and regional demand is projected to rise at a 4.71% CAGR to 2030. Government-sponsored industrial parks, EV battery megafactories and logistics hubs drive large-volume concrete coating installations, while domestic consumer upgrades fuel decorative demand in urban condominiums. China's emissions targets spur adoption of water-borne and powder chemistries, giving local formulators specializing in low-VOC systems a competitive edge. India's Production-Linked Incentive schemes for electronics assembly accelerate conductive flooring uptake, positioning the country as a significant growth node. Southeast Asian markets, buoyed by reshoring trends, expand warehousing footprints, compounding regional consumption. Collectively, these factors reinforce Asia Pacific's role as the principal growth engine of the floor coatings market through 2030.

North America remains significant region, characterized by stringent safety regulations and high renovation expenditure. Data-center investments require antistatic floors rated below 25,000 ohms, while healthcare refurbishments specify antimicrobial urethane cement to meet infection-control protocols. The commercial construction outlook for 2025 flags steady spending on advanced manufacturing and cold-storage projects, both heavy users of epoxy and urethane blends. Meanwhile, sustainability programs such as LEED v5 incentivize water-borne and biobased adoption, with municipal bids mandating explicit VOC values. Installer shortages, however, slow completion schedules, prompting greater demand for single-day cure technologies that compress labor hours.

Europe commands a mature yet innovation-driven share, with Nordic nations leveraging public procurement standards to accelerate VOC-free product uptake. The EU Directive 2024/825, effective March 2024, bans vague eco-labels, compelling suppliers to validate sustainability statements with lifecycle data. This regulatory pressure advantages manufacturers capable of third-party product declarations, raising entry barriers for late adopters. Powder primer and UV-LED lines gain momentum as plant managers prioritize energy savings and worker safety. Additionally, circular-economy incentives encourage take-back schemes and reclaimable packaging, embedding sustainability deeply in purchasing criteria. As a result, Europe functions as both a premium market and a regulatory bellwether influencing global formulation trends within the floor coatings market.

- Akzo Nobel N.V.

- Ardex Group

- Arkema (Bostik)

- Asian Paints

- Axalta Coating Systems

- BASF SE (Master Builders Solutions)

- Hempel A/S

- Henkel AG & Co. KGaA

- Jotun

- Kansai Nerolac Paints Limited

- LATICRETE International Inc.

- MAPEI S.p.A

- Nippon Paint Holdings Co., Ltd.

- PPG Industries Inc.

- RPM International Inc.

- Sika AG

- Sto SE & Co. KGaA

- Teknos Group

- Tennant Company

- The Sherwin-Williams Company

- Tikkurila

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Expansion of Cold-Storage Warehousing Requiring Antimicrobial Floor Coatings

- 4.2.2 Surge in E-commerce Fulfilment Centers Boosting Abrasion-Resistant Epoxy Demand

- 4.2.3 Renovation Boom in Multifamily Housing Driving Decorative Polyaspartic Floors

- 4.2.4 Antistatic Requirements in EV Battery Plants Stimulating Conductive Flooring

- 4.2.5 Government Incentives for VOC-Free Water-borne Systems in Nordics

- 4.3 Market Restraints

- 4.3.1 Raw-Material Price Volatility

- 4.3.2 Skilled-Installer Shortage in Emerging Economies

- 4.3.3 Benefits of Concrete Polishing over Floor Coatings

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Epoxy

- 5.1.2 Polyurethane

- 5.1.3 Polyaspartic

- 5.1.4 Acrylic

- 5.1.5 Others

- 5.2 By Technology

- 5.2.1 Solvent-borne

- 5.2.2 Water-borne

- 5.2.3 Powder

- 5.2.4 UV cured

- 5.3 By Floor Material

- 5.3.1 Concrete

- 5.3.2 Wood

- 5.3.3 Others

- 5.4 By End-use Industry

- 5.4.1 Industrial/Institutional

- 5.4.2 Commercial

- 5.4.3 Residential

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Malaysia

- 5.5.1.6 Thailand

- 5.5.1.7 Indonesia

- 5.5.1.8 Vietnam

- 5.5.1.9 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordic Countries

- 5.5.3.7 Turkey

- 5.5.3.8 Russia

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Nigeria

- 5.5.5.4 Egypt

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Ardex Group

- 6.4.3 Arkema (Bostik)

- 6.4.4 Asian Paints

- 6.4.5 Axalta Coating Systems

- 6.4.6 BASF SE (Master Builders Solutions)

- 6.4.7 Hempel A/S

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 Jotun

- 6.4.10 Kansai Nerolac Paints Limited

- 6.4.11 LATICRETE International Inc.

- 6.4.12 MAPEI S.p.A

- 6.4.13 Nippon Paint Holdings Co., Ltd.

- 6.4.14 PPG Industries Inc.

- 6.4.15 RPM International Inc.

- 6.4.16 Sika AG

- 6.4.17 Sto SE & Co. KGaA

- 6.4.18 Teknos Group

- 6.4.19 Tennant Company

- 6.4.20 The Sherwin-Williams Company

- 6.4.21 Tikkurila

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Increasing Popularity of Eco-friendly Bio-based Floor Coatings