|

市場調查報告書

商品編碼

1851654

代幣化解決方案:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Tokenization Solution - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

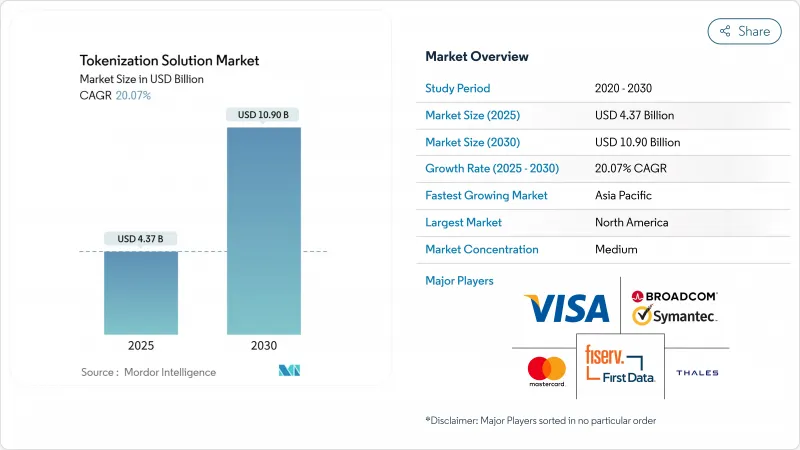

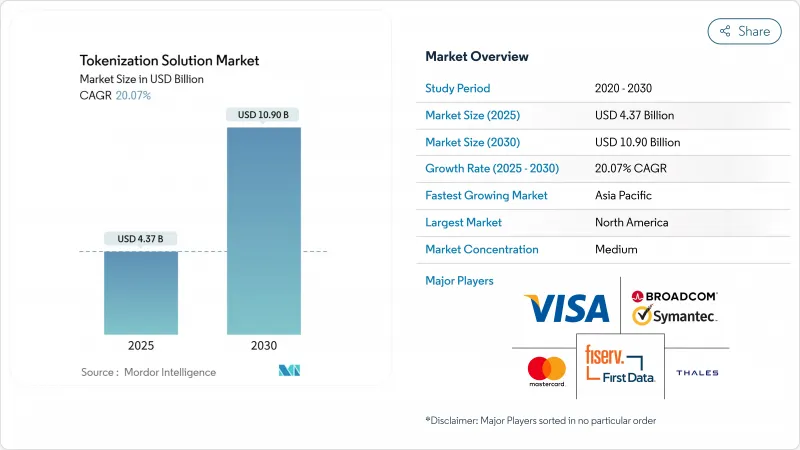

預計到 2025 年,代幣化解決方案市場規模將達到 43.7 億美元,到 2030 年將達到 109 億美元,在此期間的複合年成長率為 20.07%。

投資動能主要受數位優先商務的興起、支付安全法規的強制要求以及向雲端原生基礎設施的快速轉型所驅動。 PCI DSS 4.0 的最後期限,尤其是在美國和加拿大,正迫使企業優先考慮代幣庫現代化或無代幣庫遷移,從而縮短決策週期並加速採用。監管的緊迫性和營運的靈活性相結合,使代幣化解決方案市場成為下一代支付架構的關鍵組成部分。按地區分類,北美將在 2024 年佔據 39% 的收入佔有率,而亞太地區將經歷最快成長,這主要得益於行動錢包的普及和政府支持的即時支付管道的建設。隨著金融科技公司率先推出無代幣庫設計,以及主要支付處理商將網路代幣化直接整合到發卡機構服務中,市場競爭日益激烈。

全球代幣化解決方案市場趨勢與洞察

亞洲非接觸式和行動電子錢包支付中代幣化技術的應用程式激增

亞太地區的行動支付交易量預計將在2024年初年增超過一倍,並將代幣化技術融入該地區的核心支付體系。日本計畫在2025會計年度之前建立一個涵蓋200萬家國內商戶的東協2D碼網路,顯示目前跨錢包互通性對網路代幣的依賴程度之高。預計到2029年,中國的行動支付處理能力將超過1,100兆元人民幣,而其超級應用生態系統的安全保障也仰賴代幣化憑證。日本的無現金支付率將在2024年達到39.3%,區域政策目標將促使商戶進行代幣化,以此作為獲得補貼的先決條件。這種網路效應正迫使全球支付處理商深化與亞洲的夥伴關係,並維持可擴展的交易量。

PCI DSS 4.0 合規期限要求活性化北美代幣化投資

PCI DSS 4.0 提高了持卡人資料的要求,使得令牌化成為快速降低審核範圍和成本的有效途徑。對敏感欄位進行令牌化的公司可以減少年度評估期間隔離的系統數量,從而釋放安全預算,用於主動威脅搜尋和零信任計畫。新標準的持續監控條款支援現代令牌平台內建的即時分析功能,使董事會能夠隨時證明合規性。基於雲端的代幣化服務進一步縮短了實施週期,並加快了全通路零售商和金融科技發卡機構實現價值的速度。

專有令牌服務提供者之間的互通性差距

不同的代幣格式和專有API阻礙了多通路支付的普及,增加了整合成本和供應商鎖定風險。政府機構被要求實現供應商多元化,但往往需要維護並行的代幣基礎設施,這增加了資本支出並使管治更加複雜。缺乏通用的代幣交換通訊協定也阻礙了跨境貿易。

細分市場分析

平台軟體將在代幣化解決方案市場中扮演關鍵角色,預計到2024年,解決方案將佔總收入的72%。專業服務服務和託管服務預計將以20.90%的複合年成長率成長。企業將利用諮詢服務來梳理資料流並降低PCI合規風險,然後轉向持續的服務合約以進行代幣維護。代幣化即服務框架模糊了產品和服務之間的界限,降低了中型企業的進入門檻。諸如Marqeta Docs AI之類的AI賦能的文件工具,透過自動產生程式碼片段,進一步加快了使用者上線速度。

對於尋求擴充性以實現客製化支付流程和混合式本地部署的企業而言,解決方案領域仍然至關重要。功能藍圖透過整合人工智慧分析來發現令牌流中的詐欺模式,從而加速從被動管理到主動決策引擎的轉變。能夠將擴充性API 與合規認證相結合的供應商最有希望贏得長期企業客戶。

到 2024 年,雲端運算將佔總收入的 64%,保持其領先地位,複合年成長率 (CAGR) 為 21.50%。與現有身分和存取管理堆疊的整合使安全團隊能夠集中執行策略,並加快審核和漏洞應對準備。邊緣運算擴展減少了網路躍點,消除了以往有利於本地部署的延遲差距。超大規模資料中心託管的後量子密碼技術藍圖透過降低未來演算法轉換的風險,進一步鞏固了雲端運算的優勢。

在對本地部署有嚴格居住或依賴大型主機的行業中,本地部署仍然佔據主導地位。混合架構提供了一種折衷方案,既能保持本地金鑰管理,又能將令牌化工作負載在季節性高峰期遷移到雲端。隨著零信任框架的日趨成熟,即使是較保守的產業也可能開始考慮卸載非核心工作負載,從而減少本地部署的資源佔用。

區域分析

2024年,北美將佔據代幣化解決方案市場39%的收入佔有率,這主要得益於早期雲端技術的普及和嚴格的支付安全合規體系。 PCI DSS 4.0的實施期限縮短了升級週期,許多後進企業紛紛轉向託管代標記化服務。隨著核心支付卡產業市場接近飽和,服務提供者正將業務重點轉向醫療保健支付和政府支出等相關領域。

亞太地區在行動電子錢包普及和公共部門數位化資金投入的推動下,以20.40%的複合年成長率領先全球,預計到2030年將實現這一目標。日本的東協2D碼計劃和支付寶+商家拓展計劃,充分展現了跨境錢包如何利用網路代幣實現貨幣無關支付。中國的超級應用生態系統持續擴張,需要超高吞吐量的代幣引擎來滿足高峰期的購物需求。印度的統一支付基礎設施為能夠支援本地Aadhaar ID標準的代幣化服務提供者提供了廣闊的發展空間。

在歐洲,數位身分識別技術的普及正穩步推進,既要應對GDPR的限制,又要兼顧強而有力的反詐欺獎勵。各國數位身分識別項目也為公民服務中的標記化創造了新的機會。儘管規則的碎片化仍使得全歐洲範圍內的推廣較為複雜,但方案層面的協調統一正在逐步降低技術門檻。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞洲非接觸式和行動錢包支付的代幣化應用程式激增

- PCI DSS 4.0 合規期限要求活性化北美代幣化投資

- 歐洲非面對面交易中不斷上升的詐欺損失推動了標記化技術的普及。

- 「先買後付」平台的擴充需要整合令牌化憑證

- 卡組織推出的網路標記化程式加速了商家註冊。

- 市場限制

- 專有令牌服務提供者之間的互通性差距

- 高頻交易公司代幣庫架構中的高延遲問題

- 中型醫療服務提供者對非支付代幣化應用案例的了解有限。

- 供應商鎖定風險限制了政府的採用

- 價值/供應鏈分析

- 監管或技術環境

- 監管環境

- 技術創新(標記化即服務、雲端硬體安全模組)

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按組件

- 解決方案

- 服務

- 透過部署模式

- 本地部署

- 雲

- 透過分詞方法

- Vaulted Tokenization

- 無保險庫代幣化

- 按應用程式字段

- 支付安全

- 客戶身份驗證

- 詐欺防制和風險管理

- 合規與審核管理

- 其他

- 按最終用戶行業分類

- BFSI

- 零售與電子商務

- 資訊科技/通訊

- 醫療保健和生命科學

- 運輸與物流

- 政府/公共部門

- 能源與公共產業

- 媒體與娛樂

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 北歐國家

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- ASEAN

- 澳洲

- 紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略性措施與資金籌措

- 市佔率分析

- 公司簡介

- Thales Group

- Broadcom Inc.(Symantec Enterprise)

- Visa Inc.

- Mastercard Inc.

- Fiserv Inc.(First Data)

- Worldpay LLC(FIS)

- PayPal Holdings Inc.(Braintree)

- American Express Company

- Protegrity USA Inc.

- TokenEx LLC

- Entrust Corporation

- Rambus Inc.(Bell ID)

- Sequent Software Inc.

- CardConnect Corporation

- Bluefin Payment Systems

- Marqeta Inc.

- Adyen NV

第7章 市場機會與未來展望

The tokenization solution market size stands at USD 4.37 billion in 2025 and is forecast to reach USD 10.90 billion by 2030, reflecting a 20.07% CAGR across the period.

Investment momentum stems from widespread digital-first commerce, stricter payment security mandates, and rapid shifts toward cloud-native infrastructure. Mandatory PCI DSS 4.0 timelines, especially in the United States and Canada, have compelled enterprises to prioritise token vault modernisation or vaultless migration, compressing decision cycles and accelerating deployments. Converging regulatory urgency with the promise of operational agility positions the tokenization solution market as a cornerstone of next-generation payment architecture. At a geographic level, North America accounts for 39% of 2024 revenue, yet Asia Pacific is compounding fastest on the back of mobile wallet ubiquity and government-backed real-time payment rails. Competitive intensity is rising as fintechs pioneer vaultless designs and large processors embed network tokenisation directly into issuer services.

Global Tokenization Solution Market Trends and Insights

Surge in Tokenisation Adoption for Contactless & Mobile Wallet Payments in Asia

Mobile payment transactions in Asia Pacific more than doubled year-on-year in early 2024, drawing tokenisation into the region's core payments stack. Japan's plan for a joint ASEAN QR network by fiscal 2025, covering 2 million domestic merchants, showcases the scale at which cross-wallet interoperability now depends on network tokens. China's mobile payment throughput, projected above CNY 1,100 trillion by 2029, relies on tokenised credentials to secure super-app ecosystems. With Japan's cashless ratio topping 39.3% in 2024, regional policy targets drive merchants toward tokenisation as a precondition for subsidy eligibility. This network effect compels global processors to deepen Asian partnerships to retain addressable volume.

Mandatory PCI DSS 4.0 Compliance Deadlines Boosting Tokenisation Investments in North America

PCI DSS 4.0 elevates cardholder-data obligations, making tokenisation the quickest path to scope reduction and audit-cost containment. Enterprises that tokenise sensitive fields can quarantine fewer systems under annual assessment, freeing security budgets for proactive threat-hunting and zero-trust initiatives. Continuous-monitoring clauses in the new standard align with real-time analytics embedded in modern token platforms, allowing boards to evidence compliance on demand. Cloud-delivered tokenisation services further compress deployment timelines, accelerating time-to-value for omnichannel retailers and fintech issuers.

Interoperability Gaps Among Proprietary Token Service Providers

Disparate token formats and proprietary APIs hinder multi-rail payment acceptance, elevating integration cost and vendor-lock-in risk. Government agencies mandated to diversify suppliers must often maintain parallel token infrastructures, draining CapEx and complicating governance. Absence of a universal token exchange protocol also impedes cross-border commerce, where mismatched schemes require complex translation gateways that inflate processing fees.

Other drivers and restraints analyzed in the detailed report include:

- Rising Fraud Losses in Card-Not-Present Transactions Driving Vaultless Tokenisation Uptake in Europe

- Expansion of BNPL Platforms Demanding Tokenised Credentials Integration

- High Latency Concerns in Token Vault Architectures for High-Frequency Trading Firms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions accounted for 72% of 2024 revenue, testifying to the foundational role of platform software in the tokenization solution market. Professional and managed services are forecast to grow at a 20.90% CAGR, aided by scarce in-house expertise and continuous compliance obligations that favour outsourcing. Enterprises leverage advisory engagements to map data flows and reduce PCI exposure, then transition to ongoing service contracts for token maintenance. Tokenization-as-a-Service frameworks blur the boundary between product and service, lowering entry barriers for mid-market adopters. AI-enabled documentation tools, such as Marqeta Docs AI, further accelerate onboarding by automating code-snippet generation.

The solutions segment remains critical for enterprises demanding extensibility into proprietary payment flows or hybrid on-premise deployments. Feature roadmaps increasingly embed artificial-intelligence analytics that surface fraud patterns within the token stream, turning passive controls into active decision engines. Vendors that pair extensible APIs with compliance attestation are best placed to lock in long-cycle enterprise accounts.

Cloud held 64% of 2024 revenue and will sustain leadership with a 21.50% CAGR, reflecting the structural advantage of global point-of-presence coverage and elastic scaling. Integrations with existing identity-and-access-management stacks allow security teams to unify policy enforcement, speeding audits and breach preparation. Edge compute extensions reduce network hops, closing the latency gap that once favoured on-premise deployments. Post-quantum cryptography roadmaps hosted by hyperscalers further tip the balance by de-risking future algorithmic transitions.

On-premise installations persist in industries with strict residency mandates or mainframe dependencies. Hybrid architectures offer a middle path, retaining local key custody while bursting tokenisation workloads to the cloud during seasonal spikes. As zero-trust frameworks mature, even conservative sectors may offload non-core workloads, shrinking the on-premise footprint over the forecast horizon.

The Tokenization Solution Market Report is Segmented by Component (Solutions, Services), Deployment Mode (On-Premise, Cloud), Tokenization Technique (Vaulted Tokenization, and More), Application Area (Payment Security, Customer Authentication, and More), End-User Industry (BFSI, Retail and E-Commerce, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 39% of 2024 revenue for the tokenization solution market, anchored by early cloud adoption and a strict payment-security compliance regime. PCI DSS 4.0 deadlines have compressed upgrade cycles, tipping many late adopters toward managed tokenisation services. Market saturation is approaching in core credit-card verticals, so providers are pivoting to adjacent use cases such as healthcare payments and government disbursements.

Asia Pacific is pacing the field with a 20.40% CAGR through 2030, catalysed by mobile-wallet penetration and public-sector digitalisation funds. Japan's ASEAN QR project and Alipay+ merchant expansion exemplify how cross-border wallets leverage network tokens for currency-agnostic settlement. China's super-app ecosystems continue to scale, demanding ultra-high-throughput token engines capable of handling peak shopping festivals. India's unified payments infrastructure offers fertile ground for tokenisation providers that can tailor to local Aadhaar identity norms.

Europe remains a steady adopter, balancing GDPR constraints with strong fraud-prevention incentives. Vaultless implementations resonate with regulators wary of centralised data stores, while national digital-ID programmes open fresh opportunities for citizen-service tokenisation.Fragmented rule sets still complicate pan-European roll-outs, but scheme-level harmonisation is gradually lowering technical barriers.

- Thales Group

- Broadcom Inc. (Symantec Enterprise)

- Visa Inc.

- Mastercard Inc.

- Fiserv Inc. (First Data)

- Worldpay LLC (FIS)

- PayPal Holdings Inc. (Braintree)

- American Express Company

- Protegrity USA Inc.

- TokenEx LLC

- Entrust Corporation

- Rambus Inc. (Bell ID)

- Sequent Software Inc.

- CardConnect Corporation

- Bluefin Payment Systems

- Marqeta Inc.

- Adyen N.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Tokenization Adoption for Contactless and Mobile Wallet Payments in Asia

- 4.2.2 Mandatory PCI DSS 4.0 Compliance Deadlines Boosting Tokenization Investments in North America

- 4.2.3 Rising Fraud Losses in Card-Not-Present Transactions Driving Vaultless Tokenization Uptake in Europe

- 4.2.4 Expansion of "Buy Now Pay Later" Platforms Demanding Tokenized Credentials Integration

- 4.2.5 Emergence of Network Tokenization Programs by Card Schemes Accelerating Merchant Enrolment

- 4.3 Market Restraints

- 4.3.1 Interoperability Gaps among Proprietary Token Service Providers

- 4.3.2 High Latency Concerns in Token Vault Architectures for High-Frequency Trading Firms

- 4.3.3 Limited Awareness of Non-Payment Tokenization Use-Cases in Mid-Tier Healthcare Providers

- 4.3.4 Vendor Lock-in Risk Restricting Adoption by Government Agencies

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.5.1 Regulatory Landscape

- 4.5.2 Technological Innovations (Tokenization-as-a-Service, Cloud HSM)

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By Tokenization Technique

- 5.3.1 Vaulted Tokenization

- 5.3.2 Vaultless Tokenization

- 5.4 By Application Area

- 5.4.1 Payment Security

- 5.4.2 Customer Authentication

- 5.4.3 Fraud Prevention and Risk Management

- 5.4.4 Compliance and Audit Management

- 5.4.5 Others

- 5.5 By End-User Industry

- 5.5.1 BFSI

- 5.5.2 Retail and E-commerce

- 5.5.3 IT and Telecommunications

- 5.5.4 Healthcare and Life Sciences

- 5.5.5 Transportation and Logistics

- 5.5.6 Government and Public Sector

- 5.5.7 Energy and Utilities

- 5.5.8 Media and Entertainment

- 5.5.9 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Nordics

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN

- 5.6.4.6 Australia

- 5.6.4.7 New Zealand

- 5.6.4.8 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Funding

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Thales Group

- 6.4.2 Broadcom Inc. (Symantec Enterprise)

- 6.4.3 Visa Inc.

- 6.4.4 Mastercard Inc.

- 6.4.5 Fiserv Inc. (First Data)

- 6.4.6 Worldpay LLC (FIS)

- 6.4.7 PayPal Holdings Inc. (Braintree)

- 6.4.8 American Express Company

- 6.4.9 Protegrity USA Inc.

- 6.4.10 TokenEx LLC

- 6.4.11 Entrust Corporation

- 6.4.12 Rambus Inc. (Bell ID)

- 6.4.13 Sequent Software Inc.

- 6.4.14 CardConnect Corporation

- 6.4.15 Bluefin Payment Systems

- 6.4.16 Marqeta Inc.

- 6.4.17 Adyen N.V.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Emerging Use-Cases Beyond Payments (Healthcare Records, Digital Twins)

- 7.3 Tokenization in IoT Edge Devices