|

市場調查報告書

商品編碼

1851617

點選流分析:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Clickstream Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

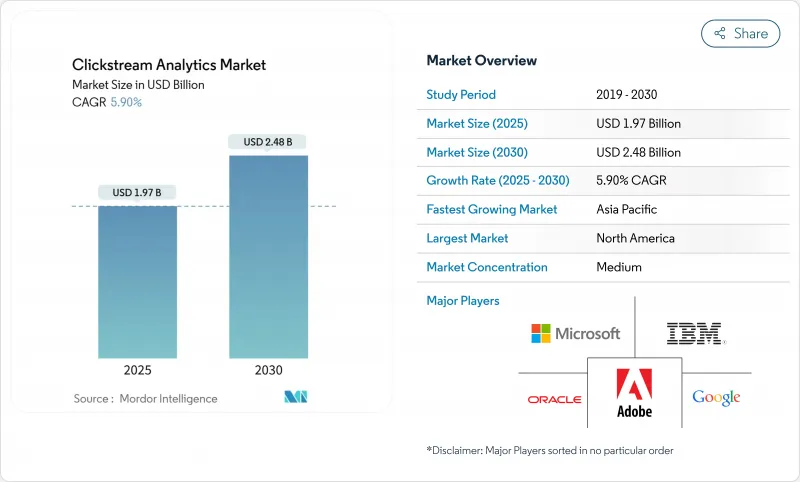

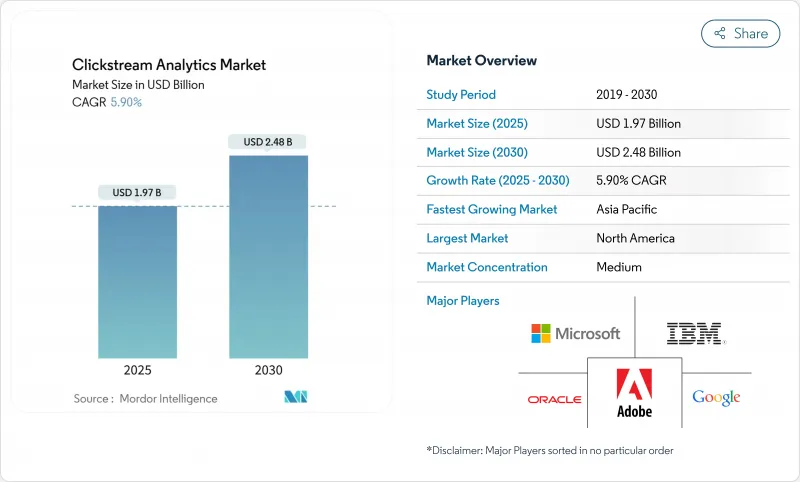

點選流分析市場預計到 2025 年將達到 19.7 億美元,到 2030 年將達到 24.8 億美元,在此期間的複合年成長率為 5.9%。

採用方式正穩步從簡單的頁面瀏覽量計數器轉向能夠即時攝取數十億事件的AI原生客戶智慧平台。雲端原生架構縮短了引進週期,以隱私為先的資料策略確保了測量框架的未來適應性,機器學習模型的快速發展將原始行為資料轉化為預測性洞察,這些都推動了成長。供應商正日益將身分解析、使用者授權編配和邊緣處理整合到單一技術堆疊中,使點選流分析市場成為企業體驗雲端的核心組成部分。策略性買家正透過收購進入該領域,從而創造出一個創新與合規同等重要的平衡競爭環境。

全球點選流分析市場趨勢與洞察

基於人工智慧的即時個人化提升了點選流套件的投資報酬率

人工智慧驅動的引擎如今能在毫秒內將事件流轉化為最佳行動建議,企業透過部署即時模型,客戶滿意度提升了 31.5%,轉換率提高了 28.3%。 Adobe Experience Cloud 近期整合了一個生成式代理,可即時觸發網頁、行動裝置和商店螢幕上的內容變更。奢侈品零售商 Burberry 將點選流處理延遲降低了 99%,使門市員工能夠在與消費者互動之前獲取其數位行為數據。這些近乎零延遲的決策凸顯了點選流分析市場正從描述性儀表板轉向預測性變現工具的轉變。

行動端和網頁端全通路客戶旅程的興起

消費者每天在智慧型手機、桌上型電腦、社群媒體和超級應用程式之間切換,在每個接觸點都留下數位痕跡。亞洲的超級應用生態系統融合了商業、支付和社交功能,產生多維點選流數據,需要將其整合為統一的身份資訊。預計歐洲每月行動數據使用量將從2022年的15GB激增至2030年的75GB,這將增加需要捕獲和分析的事件數量。 Mercado Libre連接了來自市場和金融科技領域的第一方點選流數據,為廣告網路提供支持,使其收入來源多元化,超越核心零售。因此,對於希望在點選流分析市場中獲得永續佔有率的品牌而言,掌握跨裝置用戶旅程至關重要。

嚴格的隱私權法規(GDPR、CCPA、DPDP 法案)

監管機構在2024年加強了打擊力度,迫使企業重新設計像素標籤和重播腳本,並引發了一系列訴訟,導致合規成本上升。由於隱私保護措施導致第三方資料集被壓制, Oracle的廣告科技部門在2022年至2024年間收入下降了17億美元。跨國品牌現在必須協調同意分類、區域資料保存義務、跨境傳輸條款等諸多問題,這推高了點選流部署的總擁有成本,並暫時延緩了計劃核准。

細分市場分析

到2024年,軟體將佔據71%的市場佔有率,鞏固其作為核心產品的地位,為企業提供將資料擷取、串流轉換和視覺化整合到單一介面的解決方案。用於自動化行為叢集的AI模組,結合雲端的計量收費,正持續佔據全球品牌的市場佔有率。然而,到2030年,業務收益將以14.9%的複合年成長率成長,買家將面臨隱私重構、SDK升級和複雜的遺留系統整合等挑戰。我們的諮詢團隊透過提供伺服器端資料收集藍圖、設定授權層以及最佳化事件分類,幫助客戶最大限度地發揮其軟體投資的價值。託管分析服務使中型企業能夠外包低延遲管道的全天候運行,從而消除本地叢集的資本投資負擔,並隨著點選流分析市場規模的成長而增加經常性服務收入,進一步推動市場成長。

轉換率最佳化和用戶體驗調優歷來是點選流支出的核心,這也解釋了該領域到 2024 年收入成長 39% 的原因。零售商不斷迭代結帳流程、A/B訊息和素材加載,以降低跳出率;媒體平台則監控用戶參與度,以調整內容佈局。點擊路徑分析還能辨識瓶頸,供產品團隊在敏捷迭代中解決。同時,隨著銀行、付款閘道和遊戲應用採用行為生物識別技術來標記會話流程和滑鼠軌跡中的異常情況,詐欺檢測和合規領域正以 16.8% 的複合年成長率蓬勃發展。 PSCU 避免詐欺損失的 3,500 萬美元表明了該應用子集的財務風險和成長潛力,鞏固了其在不斷發展的點擊點選流分析市場佔有率中的地位。

點選流分析市場按產品/服務(軟體和服務)、應用程式(點擊路徑最佳化、網站/應用最佳化等)、終端用戶產業(零售和電子商務、媒體和娛樂等)、部署類型和地區進行細分。市場預測以美元計價。

區域分析

北美地區預計到2024年將佔全球收入的42%,這主要得益於高額的數位廣告預算、豐富的AI人才儲備以及嚴格的隱私保護法規。 Adobe的數據顯示,從2024年7月到2025年2月,由生成式聊天機器人支援的零售網站流量激增了1,300%。聯邦隱私提案如今的嚴格程度與《加州消費者隱私法案》(CCPA)不相上下,正促使各大品牌採用高級用戶同意流程,從而推動了點選流分析市場的潛在需求。

亞太地區是重要的成長引擎,預計到2030年將以13.2%的複合年成長率成長。光是印尼一國,其電子商務銷售額就將從2023年的529.3億美元成長到2028年的868.1億美元,每天新增數百萬筆行為記錄。 Viacom18旗下的印度串流平台每天分析700GB至1TB的數據,並提供4.5萬小時的個人化影片內容。雲端供應商正在擴展區域覆蓋範圍以滿足資料本地化法規的要求,從而推動點選流分析市場中SaaS的快速普及。

儘管面臨諸多限制,歐洲仍維持了穩定成長。 GDPR強化了對第一方資料的依賴,推動了差分隱私和設備端處理技術的創新,這些技術既能保護使用者權利,又能保留資料洞察的價值。隨著拉丁美洲跨境電子商務成長34%,預計到2026年非洲數位商務規模將達到720億美元,在地化演算法和輕量級行動SDK為企業在中期內贏得競爭優勢提供了新的閒置頻段。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 行動端和網頁端全通路客戶旅程的興起

- 基於人工智慧的即時個人化提升了點選流套件的投資報酬率

- 無 cookie 的未來推動第一方行為資料投資

- 電子商務在新興亞洲和拉丁美洲的普及速度加快

- 雲端原生分析可降低中型企業的整體擁有成本

- 5G部署擴大了高速資料傳輸量

- 市場限制

- 嚴格的隱私權法規(GDPR、CCPA、DPDP 法案)

- 消除限制資料豐富性的第三方 Cookie

- 與遺留資料棧的整合複雜性高

- 高級分析人才短缺

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 報價

- 軟體

- 服務

- 透過使用

- 點擊路徑最佳化

- 網站/應用程式最佳化

- 客戶分析

- 詐欺偵測與合規

- 按最終用戶行業分類

- 零售與電子商務

- 媒體與娛樂

- 電訊和資訊技術

- BFSI

- 運輸與物流

- 能源與公共產業

- 透過部署模式

- 雲

- 本地部署/混合部署

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 歐洲

- 義大利

- 西班牙

- 法國

- 英國

- 德國

- 亞太地區

- 印度

- 中國

- 日本

- 中東

- 土耳其

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 非洲

- 肯亞

- 南非

- 奈及利亞

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Adobe Inc.

- Google LLC

- Oracle Corp.

- IBM Corp.

- Microsoft Corp.

- SAP SE

- Hewlett Packard Enterprise

- Splunk Inc.

- Talend Inc.

- Verto Analytics Inc.

- Webtrends Corp.

- Mixpanel Inc.

- Amplitude Inc.

- Contentsquare SA

- Heap Inc.

第7章 市場機會與未來展望

The clickstream analytics market is valued at USD 1.97 billion in 2025 and is forecast to reach USD 2.48 billion by 2030, registering a 5.9% CAGR over the period.

Adoption is steadily shifting from simple page-view counters to AI-native customer intelligence platforms that ingest billions of events in real time. Growth is reinforced by cloud-native architectures that compress deployment cycles, privacy-first data strategies that future-proof measurement frameworks and rapid advances in machine-learning models that convert raw behavioural data into predictive insights. Vendors increasingly bundle identity resolution, consent orchestration and edge processing in a single stack, positioning the clickstream analytics market as a core pillar of enterprise experience clouds. Strategic buyers are extending into the space through acquisition, creating a balanced competitive environment where innovation and compliance carry equal weight.

Global Clickstream Analytics Market Trends and Insights

AI-Based Real-Time Personalization Boosting ROI of Clickstream Suites

AI-driven engines now translate event streams into next-best-action recommendations in milliseconds, with enterprises reporting 31.5% gains in customer satisfaction and 28.3% uplifts in conversion when deploying real-time models. Adobe's Experience Cloud recently embedded generative agents that trigger content variants instantaneously across web, mobile and storefront screens. Luxury retailer Burberry cut clickstream processing latency by 99%, allowing in-store associates to access digital behaviour before engaging shoppers. Such near-zero-latency decisioning underpins the clickstream analytics market's transition from descriptive dashboards to predictive monetization levers.

Proliferation of Omni-Channel Customer Journeys Across Mobile and Web

Consumers routinely hop between smartphones, desktops, social feeds and super-apps, leaving fragmented digital breadcrumbs at every touchpoint. Super-app ecosystems in Asia aggregate commerce, payments and social functions, producing multi-dimensional clickstream data that demands unified identity stitching. European monthly mobile data usage is poised to leap from 15 GB in 2022 to 75 GB by 2030, magnifying event volumes to be captured and analysed. Mercado Libre ties first-party clickstream data across its marketplace and fintech arms to fuel an advertising network that diversifies revenue beyond core retail. Mastery of cross-device journeys has therefore become a prerequisite for brands seeking sustained share in the clickstream analytics market.

Stringent Privacy Regulations (GDPR, CCPA, DPDP Act)

Regulators intensified enforcement in 2024, forcing redesigns of pixel tags and replay scripts and triggering litigation that raised compliance costs. Oracle's adtech arm saw USD 1.7 billion in revenue erosion between 2022 and 2024 as privacy crackdowns curtailed third-party datasets. Multinational brands must now juggle consent taxonomies, regional data-retention mandates and cross-border transfer clauses, inflating total cost of ownership for clickstream deployments and temporarily slowing project approvals.

Other drivers and restraints analyzed in the detailed report include:

- Cookieless Future Driving First-Party Behavioural Data Investments

- Third-Party Cookie Deprecation Limiting Data Enrichment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software retains the lion's share at 71% in 2024, cementing its role as the core purchase for enterprises consolidating data capture, streaming transformation and visualization within one interface. AI modules that auto-cluster behaviours, coupled with cloud's pay-as-you-ingest economics, sustain wallet share among global brands. Yet services revenues are compounding at 14.9% annually to 2030 as buyers confront privacy rewiring, SDK upgrades and complex legacy integrations. Advisory teams deliver blueprints for server-side collection, configure consent layers and fine-tune event taxonomies, ensuring clients extract full value from their software spend. Managed analytics further thrive as mid-sized enterprises outsource 24X7 operation of low-latency pipelines, uplifting recurring service income inside the clickstream analytics market size equation without the capex drag of on-premises clusters.

Conversion optimisation and user-experience tuning form the historical nucleus of clickstream spending, explaining the segment's dominant 39% revenue in 2024. Retailers iterate checkout flows, A/B messages and asset loads to shrink bounce rates, while media platforms monitor engagement depth to calibrate content layouts. Alongside, click-path analysis identifies bottlenecks that product squads address in agile sprints. Meanwhile, fraud detection and compliance are sprinting at a 16.8% CAGR as banks, payment gateways and i-gaming apps embrace behavioural biometrics to flag anomalies in session cadence or mouse trajectories. PSCU's USD 35 million fraud-loss avoidance showcases the financial stakes and growth headroom for this application subset, reinforcing its weight inside the evolving clickstream analytics market share narrative.

The Clickstream Analytics Market Segmented by Offering (Software and Services), Application (Click-Path Optimization, Website / App Optimization and More), End-User Industry (Retail and E-Commerce, Media and Entertainment and More), Deployment Mode and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 42% of 2024 revenue, anchored by high digital-ad budgets, deep AI talent pools and proactive privacy statutes. Adobe logged a 1,300% traffic spike in retail sites supported by generative chatbots between July 2024 and February 2025. Federal privacy proposals now mirror CCPA rigor, prompting brands to embed advanced consent workflows, raising baseline demand in the clickstream analytics market.

Asia Pacific is the standout growth engine, forecast at 13.2% CAGR to 2030. Indonesia alone is scaling e-commerce turnover from USD 52.93 billion in 2023 to USD 86.81 billion by 2028, injecting millions of new behavioural records daily. Viacom18's Indian streaming platform parses 700 GB to 1 TB of data each day to personalise 45,000 hours of video. Cloud vendors have expanded regional zones to satisfy data-localisation rules, unlocking rapid SaaS uptake across the clickstream analytics market.

Europe records steady albeit regulated expansion. GDPR entrenches first-party data dependence, spurring innovation in differential-privacy and on-device processing that safeguards user rights while preserving insight value. Latin America's 34% rise in cross-border e-commerce and Africa's projected USD 72 billion digital commerce by 2026 provide fresh white space where localised algorithms and lightweight mobile SDKs will define competitive advantage over the medium term.

- Adobe Inc.

- Google LLC

- Oracle Corp.

- IBM Corp.

- Microsoft Corp.

- SAP SE

- Hewlett Packard Enterprise

- Splunk Inc.

- Talend Inc.

- Verto Analytics Inc.

- Webtrends Corp.

- Mixpanel Inc.

- Amplitude Inc.

- Contentsquare SA

- Heap Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of omni-channel customer journeys across mobile and web

- 4.2.2 AI-based real-time personalization boosting ROI of clickstream suites

- 4.2.3 Cookieless future driving first-party behavioural data investments

- 4.2.4 Accelerating e-commerce penetration in emerging Asia and LatAm

- 4.2.5 Cloud-native analytics lowering TCO for mid-market adopters

- 4.2.6 5G rollout expanding high-velocity data volumes

- 4.3 Market Restraints

- 4.3.1 Stringent privacy regulations (GDPR, CCPA, DPDP Act)

- 4.3.2 Third-party cookie deprecation limiting data enrichment

- 4.3.3 High integration complexity with legacy data stacks

- 4.3.4 Shortage of advanced analytics talent

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Application

- 5.2.1 Click-Path Optimization

- 5.2.2 Website / App Optimization

- 5.2.3 Customer Analysis

- 5.2.4 Fraud Detection and Compliance

- 5.3 By End-user Industry

- 5.3.1 Retail and E-commerce

- 5.3.2 Media and Entertainment

- 5.3.3 Telecom and IT

- 5.3.4 BFSI

- 5.3.5 Transport and Logistics

- 5.3.6 Energy and Utilities

- 5.4 By Deployment Mode

- 5.4.1 Cloud

- 5.4.2 On-premise / Hybrid

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.3 Europe

- 5.5.3.1 Italy

- 5.5.3.2 Spain

- 5.5.3.3 France

- 5.5.3.4 United Kingdom

- 5.5.3.5 Germany

- 5.5.4 Asia-Pacific

- 5.5.4.1 India

- 5.5.4.2 China

- 5.5.4.3 Japan

- 5.5.5 Middle East

- 5.5.5.1 Turkey

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Saudi Arabia

- 5.5.6 Africa

- 5.5.6.1 Kenya

- 5.5.6.2 South Africa

- 5.5.6.3 Nigeria

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Adobe Inc.

- 6.4.2 Google LLC

- 6.4.3 Oracle Corp.

- 6.4.4 IBM Corp.

- 6.4.5 Microsoft Corp.

- 6.4.6 SAP SE

- 6.4.7 Hewlett Packard Enterprise

- 6.4.8 Splunk Inc.

- 6.4.9 Talend Inc.

- 6.4.10 Verto Analytics Inc.

- 6.4.11 Webtrends Corp.

- 6.4.12 Mixpanel Inc.

- 6.4.13 Amplitude Inc.

- 6.4.14 Contentsquare SA

- 6.4.15 Heap Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment