|

市場調查報告書

商品編碼

1851616

自主移動機器人(AMR):市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Autonomous Mobile Robot (AMR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

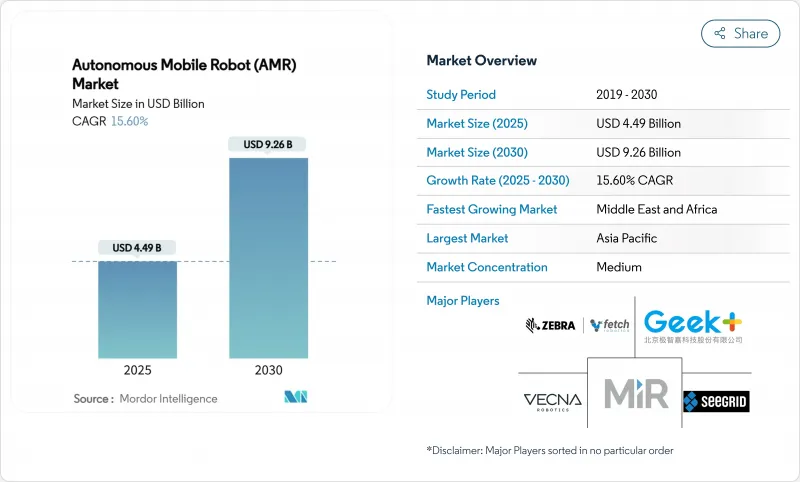

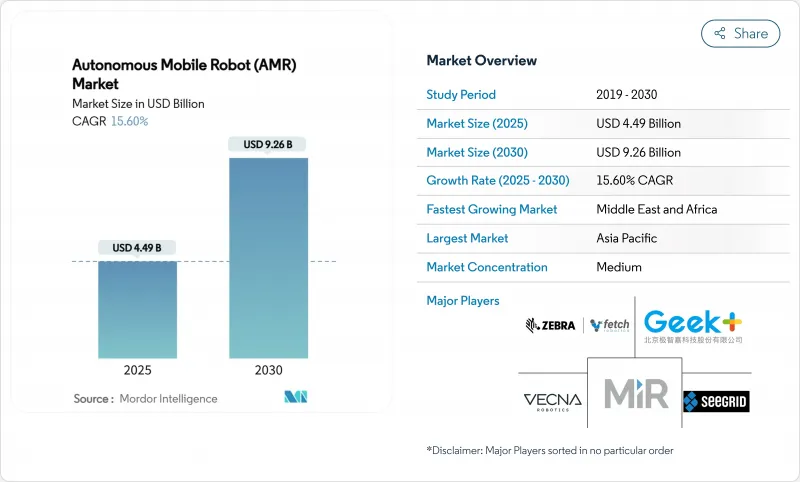

預計自主移動機器人 (AMR) 市場將從 2025 年的 44.9 億美元成長到 2030 年的 92.6 億美元,複合年成長率為 15.6%。

人工智慧、5G-Advanced 連接和低成本鋰離子電池的快速普及將加速履約、製造和醫療保健領域的商業性化進程。營運商將部署機器人來填補勞動力短缺,無需建造固定輸送機即可實現全天候運轉,並提高職場的安全性。在亞太地區,中國供應商憑藉以軟體為中心的設計理念和極具競爭力的價格,引領著機器人技術的應用;同時,中東的大型企劃也催生了對重型系統的新需求。隨著供應商競相整合車隊級編配軟體並建立通路夥伴關係關係以縮短價值實現時間,競爭將愈演愈烈。歐盟的「未來工廠」津貼等監管激勵措施,將透過補貼中小企業的資本支出,進一步推動機器人技術的應用。

全球自主移動機器人(AMR)市場趨勢與洞察

電子商務履約需求快速成長

如今,線上零售的關鍵在於當日送達。亞馬遜計劃在2025年7月前部署100萬台機器人,並利用DeepFleet車隊智慧系統將每次揀貨的行走時間縮短了10%。 Locus Robotics整合了LocusOne軟體,在將生產效率提高兩到三倍的同時,將工傷事故減少了80%,揀貨量也超過了30億次。因此,零售商們正在積極採用市場上的緊湊型自主移動機器人解決方案,這些機器人能夠靈活適應季節性業務量變化,並最大限度地減少設備更換。 Geek+-Intel設計採用的純視覺導航技術無需固定標記,從而降低了安裝成本和時間。

經合組織市場倉庫工人短缺

經合組織國家的雇主反映,夜班和高峰時段的職缺持續存在。歐洲職業安全與健康署強調,自動化對於彌補勞動年齡人口的減少至關重要。斯凱奇公司用機器人取代輸送機後,節能高達80%,證明了在技術純熟勞工短缺的情況下,自動化投資的回報是檢驗的。如今,雇主們正在圍繞機器人監管和維護重新設計崗位,使倉庫工作不再那麼耗費體力,也更具吸引力。

互通性標準碎片化

儘管 ISO 3691-4 和 ANSI/RIA R15.08 詳細規定了安全性,但它們忽略了車隊通訊協定,迫使買家只能使用單一供應商的產品,從而推高了整合成本。中間件供應商正試圖填補這一空白,但專有數據格式會延緩部署速度並降低他們的議價能力。

細分市場分析

到2024年,無人地面車輛將佔銷售額的46.0%。人形機器人雖然相對較新,但由於它們能夠在不改變佈局的情況下在人為設計的空間內導航,預計將以19.22%的複合年成長率成長。亞馬遜正在試用一款人形搬運機器人,該機器人可從Rivian電動貨車上裝載小包裹,這標誌著自主移動機器人市場正在向戶外領域擴展。無人空中和無人水下機器人目前仍處於小眾市場,但對於能源資產的巡檢至關重要。一旦人形自主移動機器人的運作可靠性達到倉庫性能標準,其市場規模可能會迅速成長。

傳統機器人車隊依賴單一任務最佳化的專用外形規格,缺乏多功能性。人形機器人可望簡化車隊,使單一平台即可在不同角色間切換,例如貨架搬運和分類。因此,投資正從純粹的行動硬體轉向人工智慧的視覺和抓取能力,以期達到媲美人類的靈巧程度。這種轉變將降低生命週期成本,並催生新的服務模式,例如機器人即服務訂閱模式。

到2024年,憑藉在擁擠通道中毫米級的重複定位精度,雷射雷達SLAM將佔41.5%的市場佔有率。基於視覺的系統正以21.22%的複合年成長率快速成長,無需昂貴的感測器和反射目標,即可降低中型營運商的資本支出。 Geek+公司展示了其採用英特爾RealSense深度攝影機和板載AI技術,實現了與雷射雷達媲美的精度。隨著邊緣處理器能夠在低功耗預算下處理即時影像分割,視覺導航自主移動機器人的市場規模將進一步擴大。

混合感測器融合技術結合了攝影機、LiDAR和慣性感測器,使機器人車隊能夠在遇到灰塵、眩光或頻寬等情況時自動切換模式。這種自適應方法能夠滿足港口倉庫目前對室內外混合作業的需求。認證各種感測器性能的標準將加速多感測器技術的應用,並確保機器人在公共人行道上安全通行。

自主移動機器人 (AMR) 市場細分:按類型(無人地面車輛、人形機器人、其他)、按導航技術(雷射雷達 SLAM、視覺導航、磁力/引導/2D碼引導、其他)、按終端用戶行業(倉儲物流、製造業、汽車業、其他)以及按地區。市場預測以美元計價。

區域分析

亞太地區預計2024年將貢獻37.8%的收入。像極智多星這樣的中國企業出口超過三分之一的產品,充分利用了成本優勢和政府鼓勵試點計畫的扶持政策。許多日本和韓國工廠為了縮短投資回報期,也向中國品牌購買機器人。北美在自主移動機器人市場保持第二大地位,這得益於亞馬遜遍布全球的業務網路以及豐富的軟體新興企業生態系統,這些企業為第三方物流供應商構建了編配層。

歐洲正受益於結構性補貼。歐盟的「未來工廠」舉措為自動化硬體的資本支出提供高達20%的報銷,從而加速了中型製造商的採用。隨著津貼從2025年起生效,歐洲自主移動機器人的市佔率可望上升。中東和非洲是成長最快的地區,複合年成長率達19.0%,這主要得益於沙烏地阿拉伯的「2030願景」以及NEOM承諾為建築機器人投入7.746億美元。高昂的物流成本和待開發區倉庫使得營運商能夠從一開始就圍繞機器人進行設計。

南美洲仍處於起步階段。在巴西和墨西哥,進口自動化設備的稅收減免政策鼓勵了試點部署,但外匯波動減緩了普及速度。在非洲,部署主要集中在南非和摩洛哥,這兩個國家的汽車組裝廠需要將設備準時交付生產線旁。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 快速的履約需求

- 經合組織市場倉庫工人短缺

- 鋰離子電池價格跌破每千瓦時70美元

- 歐盟「未來工廠」補貼計畫自2025年起

- 5G高階專用網路部署

- 人工智慧賦能的「群體編配」平台

- 市場限制

- 互通性標準碎片化

- 網實整合實體安全漏洞

- 大容量自主移動機器人需要較高的初始投資

- 工會反對機器人密度限制

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 無人地面車輛(UGV)

- 人形

- 無人駕駛飛行器(UAV)

- 無人水面航行器(UMV)

- 透過導航技術

- LiDAR猛擊

- 基於視覺(2D/3D 相機)

- 磁感應/2D碼指南

- 混合式多感測器融合

- 按有效載荷能力

- 體重低於100公斤

- 100-500 kg

- 500-1,000 kg

- 超過1000公斤

- 按最終用戶行業分類

- 倉儲和物流

- 製造業

- 車

- 飲食

- 衛生保健

- 零售與電子商務

- 國防與安全

- 採礦和礦產

- 能源與電力

- 石油和天然氣

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Zebra Technologies Corporation(Fetch Robotics)

- Teradyne Inc.-Mobile Industrial Robots(MiR)

- Geek+Technology Co., Ltd.

- Vecna Robotics, Inc.

- Seegrid Corporation

- Aethon, Inc.(ST Engineering)

- Omron Corporation

- Clearpath Robotics Inc.(OTTO Motors)

- HIK Robot Co., Ltd.

- SoftBank Robotics Group Corp.

- SMP Robotics Systems Corp.

- Locus Robotics Corp.

- Amazon.com, Inc.(Kiva/System Robotics)

- Agilox Services GmbH

- Balyo SA

- Vendor Positioning Analysis

- Investment Analysis

第7章 市場機會與未來展望

The autonomous mobile robot market is valued at USD 4.49 billion in 2025 and is forecast to reach USD 9.26 billion by 2030, expanding at a 15.6% CAGR.

Fast adoption of artificial intelligence, 5G-Advanced connectivity and lower-cost lithium-ion batteries together accelerate commercial feasibility across fulfilment, manufacturing and healthcare environments. Operators deploy robots to offset persistent labour shortages, to gain 24/7 throughput without building fixed conveyor infrastructure and to improve workplace safety. Asia-Pacific leads adoption thanks to Chinese suppliers that blend software-centric design and aggressive pricing, while Middle East mega-projects generate fresh demand for heavy-duty systems. Competitive intensity rises as vendors race to embed fleet-level orchestration software and to secure channel partnerships that shorten time-to-value. Regulatory incentives, such as EU "Factory of the Future" grants, further stimulate uptake by subsidizing capital outlays for small and mid-sized enterprises.

Global Autonomous Mobile Robot (AMR) Market Trends and Insights

Rapid e-commerce fulfilment demand

Online retail now hinges on same-day delivery expectations. Amazon surpassed 1 million deployed robots by July 2025 and cut travel time per pick by 10% through DeepFleet fleet intelligence, proving that mobile automation can quadruple throughput using the same headcount. Locus Robotics crossed 3 billion picks after integrating its LocusOne software, which doubled to tripled productivity while reducing injuries by 80%. Retailers are therefore adopting compact autonomous mobile robot market solutions that flex with seasonal volumes and require minimal facility changes. Vision-only navigation, showcased in the Geek+-Intel design, trims installation cost and time because no fixed markers are needed.

Scarcity of warehouse labour in OECD markets

OECD operators report persistent vacancies for night and peak-season shifts. The European Agency for Safety and Health at Work highlights automation as essential for offsetting shrinking working-age populations. Skechers logged 80% energy savings after replacing conveyors with robots, validating the return on investment where skilled labour is scarce. Employers now redesign rolls around robot supervision and maintenance, making warehouse jobs less physically demanding and more attractive.

Fragmented interoperability standards

ISO 3691-4 and ANSI/RIA R15.08 detail safety, yet they omit fleet communication protocols, forcing buyers into single-vendor ecosystems and inflating integration cost. Middleware suppliers attempt to bridge gaps, but proprietary data formats slow deployment and reduce bargaining power.

Other drivers and restraints analyzed in the detailed report include:

- Falling Li-ion battery cost below USD 70/kWh

- AI-enabled swarm orchestration platforms

- Cyber-physical security vulnerabilities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Unmanned ground vehicles controlled 46.0% revenue in 2024. Humanoids, although young, are forecast to expand at 19.22% CAGR because they navigate human-designed spaces without layout changes. Amazon is piloting humanoid couriers that load parcels from Rivian electric vans, hinting at outdoor extension of the autonomous mobile robot market. Unmanned aerial and marine robots remain niche but critical for inspection in energy assets. The autonomous mobile robot market size for humanoids is likely to rise quickly once manipulation reliability reaches warehouse performance benchmarks.

Traditional fleets rely on specialized form factors that optimize one task but lack versatility. Humanoids promise fleet simplification because one platform can switch roles, from shelving to sorting. Investment has therefore shifted from pure mobility hardware to artificial intelligence vision and grasping capability that matches human dexterity. This transition will lower life-cycle cost and unlock new service models such as robot-as-a-service subscriptions.

LiDAR SLAM held 41.5% share in 2024 because of millimetre-level repeatability in congested aisles. Vision-based systems, expanding at 21.22% CAGR, eliminate expensive sensors and reflective targets, which reduces capital outlay for mid-market operators. Geek+ demonstrated LiDAR-equivalent accuracy through Intel RealSense depth cameras and onboard AI. The autonomous mobile robot market size for vision navigation will further increase as edge processors handle real-time image segmentation at lower power budgets.

Hybrid sensor fusion combines cameras, LiDAR and inertial sensors so fleets can switch modes when dust, glare or bandwidth constraints appear. This adaptive approach supports mixed indoor-outdoor operations that warehouses at ports now demand. Standards that certify performance across modalities will accelerate multi-sensor adoption, ensuring safety as robots cross public walkways.

Autonomous Mobile Robot (AMR) Market Report Segmented by Type (Unmanned Ground Vehicles, Humanoids and More), Navigation Technology (LiDAR SLAM, Vision-Based, Magnetic/Inductive/QR Guided and More), End-User Industry (Warehouse & Logistics, Manufacturing, Automotive and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 37.8% of 2024 revenue. Chinese firms such as Geek+ export over one-third of production, leveraging cost advantages and government support programs that expedite piloting. Many Japanese and Korean factories now source robots from Chinese brands to cut payback periods. North America remains the second-largest autonomous mobile robot market owing to Amazon's multi-site expansion and a deep ecosystem of software startups that tailor orchestration layers for third-party logistics providers.

Europe benefits from structured subsidies. The EU "Factory of the Future" initiative reimburses up to 20% of automation hardware capital expenditure, which accelerates adoption among mid-sized manufacturers. The autonomous mobile robot market share for Europe will rise as grants kick in post-2025. The Middle East and Africa is the fastest-growing region at a 19.0% CAGR, driven by Saudi Arabia's Vision 2030 and NEOM's USD 774.6 million commitment to construction robotics. High logistics spend and greenfield warehouses allow operators to design around robots from day one.

South America remains early stage. Duty exemptions on imported automation in Brazil and Mexico encourage pilots, yet currency volatility slows wide rollout. Africa's uptake concentrates in South Africa and Morocco where automotive assembly plants demand just-in-time delivery to lineside.

- Zebra Technologies Corporation (Fetch Robotics)

- Teradyne Inc. - Mobile Industrial Robots (MiR)

- Geek+ Technology Co., Ltd.

- Vecna Robotics, Inc.

- Seegrid Corporation

- Aethon, Inc. (ST Engineering)

- Omron Corporation

- Clearpath Robotics Inc. (OTTO Motors)

- HIK Robot Co., Ltd.

- SoftBank Robotics Group Corp.

- SMP Robotics Systems Corp.

- Locus Robotics Corp.

- Amazon.com, Inc. (Kiva/System Robotics)

- Agilox Services GmbH

- Balyo SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid e-commerce fulfilment demand

- 4.2.2 Scarcity of warehouse labor in OECD markets

- 4.2.3 Falling Li-ion battery $/kWh below USD 70

- 4.2.4 Post-2025 EU "Factory of the Future" grants

- 4.2.5 5G-Advanced private network roll-outs

- 4.2.6 AI-enabled "swarm orchestration" platforms

- 4.3 Market Restraints

- 4.3.1 Fragmented interoperability standards

- 4.3.2 Cyber-physical security vulnerabilities

- 4.3.3 High up-front capex for heavy-payload AMRs

- 4.3.4 Union push-back on robot density limits

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Unmanned Ground Vehicles (UGV)

- 5.1.2 Humanoids

- 5.1.3 Unmanned Aerial Vehicles (UAV)

- 5.1.4 Unmanned Marine Vehicles (UMV)

- 5.2 By Navigation Technology

- 5.2.1 LiDAR SLAM

- 5.2.2 Vision-based (2D/3D camera)

- 5.2.3 Magnetic / Inductive / QR Guided

- 5.2.4 Hybrid & Multi-Sensor Fusion

- 5.3 By Payload Capacity

- 5.3.1 Up to 100 kg

- 5.3.2 100 - 500 kg

- 5.3.3 500 - 1,000 kg

- 5.3.4 Above 1,000 kg

- 5.4 By End-user Industry

- 5.4.1 Warehouse and Logistics

- 5.4.2 Manufacturing

- 5.4.3 Automotive

- 5.4.4 Food and Beverage

- 5.4.5 Healthcare

- 5.4.6 Retail and E-commerce

- 5.4.7 Defense and Security

- 5.4.8 Mining and Minerals

- 5.4.9 Energy and Power

- 5.4.10 Oil and Gas

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Zebra Technologies Corporation (Fetch Robotics)

- 6.4.2 Teradyne Inc. - Mobile Industrial Robots (MiR)

- 6.4.3 Geek+ Technology Co., Ltd.

- 6.4.4 Vecna Robotics, Inc.

- 6.4.5 Seegrid Corporation

- 6.4.6 Aethon, Inc. (ST Engineering)

- 6.4.7 Omron Corporation

- 6.4.8 Clearpath Robotics Inc. (OTTO Motors)

- 6.4.9 HIK Robot Co., Ltd.

- 6.4.10 SoftBank Robotics Group Corp.

- 6.4.11 SMP Robotics Systems Corp.

- 6.4.12 Locus Robotics Corp.

- 6.4.13 Amazon.com, Inc. (Kiva/System Robotics)

- 6.4.14 Agilox Services GmbH

- 6.4.15 Balyo SA

- 6.5 Vendor Positioning Analysis

- 6.6 Investment Analysis

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment