|

市場調查報告書

商品編碼

1716536

自主移動機器人 (AMR) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Autonomous Mobile Robots (AMR) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

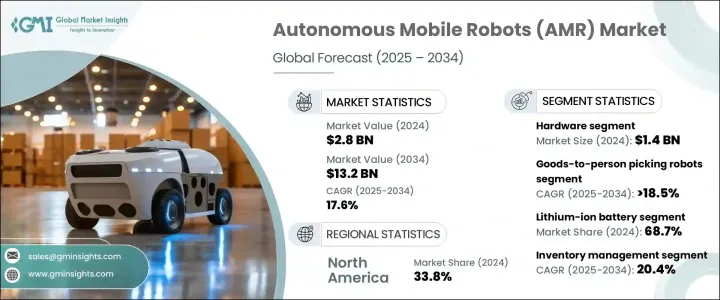

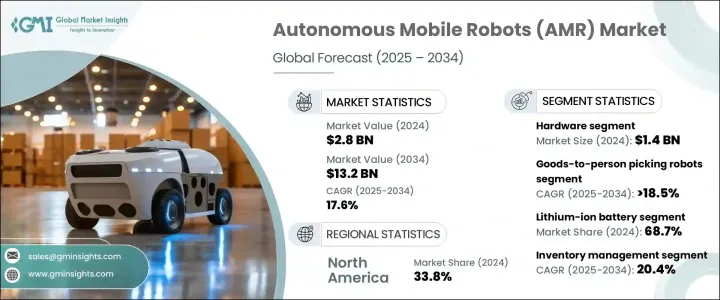

2024 年全球自主移動機器人市場價值為 28 億美元,預計 2025 年至 2034 年的複合年成長率為 17.6%。這一成長受到電子商務的興起、倉庫自動化的普及以及農業和酒店業對 AMR 需求不斷成長的推動。電子商務和全通路零售的激增推動了 AMR 在分類、運輸、組裝和庫存管理方面的廣泛部署。製造商正專注於開發配備人工智慧導航和自動化的高度先進的 AMR,以滿足全球電子商務和物流市場不斷成長的需求。

由於勞動力短缺、精準農業的需求以及提高生產力的目標,農業部門正在經歷向自動化的快速轉變。 AMR 可實現播種、收割、除草和作物監測等基本農業作業的自動化,從而降低營運成本並提高效率。同樣,酒店業正在整合 AMR 以簡化營運、改善客戶體驗並解決勞動力挑戰。這些機器人協助送餐、行李搬運和家事服務,有助於提高效率和服務品質。為了利用這些機會,製造商正在開發行業特定的 AMR,以滿足農業和酒店業的獨特需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 28億美元 |

| 預測值 | 132億美元 |

| 複合年成長率 | 17.6% |

根據組件,AMR 市場分為硬體、軟體和服務。硬體領域價值 14 億美元,由於對先進感測器、LiDAR、攝影機和機械手臂的需求不斷成長,佔據市場主導地位。電池壽命、有效載荷容量和處理能力的提高正在提高 AMR 的效率並推動硬體的採用。對高性能處理器和人工智慧晶片的投資增加進一步推動了硬體需求。

從類型來看,市場包括貨到人揀選機器人、無人機、自動駕駛堆高機和自主庫存機器人。預計到 2034 年,貨到人揀選機器人的複合年成長率將超過 18.5%。由於倉庫自動化趨勢、電子商務訂單的增加以及勞動力短缺,這些機器人越來越受歡迎。它們能夠最大限度地減少人際接觸、最大限度地提高儲存密度並加快訂單履行速度,從而推動其在物流和供應鏈行業的應用。

根據電池類型,市場分為鉛電池、鋰離子電池、鎳基電池和其他電池。鋰離子電池憑藉其高能量密度、長電池壽命、快速充電和便攜性,在 2024 年佔據 68.7% 的市場佔有率。它們的高效性和低維護性使其成為製造、物流和醫療保健領域的理想選擇。

在應用方面,AMR 用於分類、運輸、組裝和庫存管理。預計庫存管理領域從 2025 年到 2034 年的複合年成長率將達到 20.4%,這得益於零售和倉儲領域擴大使用 AMR 來提高訂單準確性、最佳化庫存水準和追蹤即時位置。

根據導航技術,市場分為雷射/LiDAR、視覺引導和其他。雷射/雷射雷達由於其感知周圍環境、檢測障礙物和在動態環境中自主導航的能力,在 2024 年佔據了 44.1% 的市場佔有率,這對於物流、倉儲和工業應用至關重要。

在有效載荷能力方面,有效載荷能力為 100 公斤至 500 公斤的 AMR 憑藉其在倉庫、物流和零售行業物料運輸自動化方面的靈活性和多功能性,在 2024 年佔據了 39% 的市場佔有率,佔據了市場主導地位。

推動市場成長的終端產業包括物流和倉儲、零售、汽車、電子、製藥、食品和飲料、航太、飯店等。受零售、電子商務和第三方物流自動化需求的成長,推動,物流和倉儲領域將在 2024 年佔據 33.6% 的市場佔有率。

從地區來看,由於物流、電子商務和製造業快速採用自動化,北美將在 2024 年以 33.8% 的市佔率領先市場。 AMR 投資的不斷成長、勞動力短缺以及對營運效率的追求正在加速該地區 AMR 市場的成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 電子商務和倉庫自動化的成長

- AMR 在醫療保健和製藥領域的擴展

- AMR 在農業和食品加工的應用

- 提高工業和物流營運的安全性和效率

- 自主移動機器人在旅館業的應用日益廣泛

- 產業陷阱與挑戰

- 自主移動機器人成本高

- AMR 技術整合與部署面臨的挑戰

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 硬體

- 軟體和服務

第6章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 貨到人揀選機器人

- 自動駕駛堆高機

- 自主庫存機器人

- 無人機

第7章:市場估計與預測:按有效載荷容量,2021 - 2034 年

- 主要趨勢

- 100公斤以下

- 100公斤-500公斤

- 超過500公斤

第 8 章:市場估計與預測:按導航技術,2021 年至 2034 年

- 主要趨勢

- 雷射/LiDAR

- 視覺引導

- 其他

第9章:市場估計與預測:按電池類型,2021 - 2034 年

- 主要趨勢

- 鉛蓄電池

- 鋰離子電池

- 鎳基電池

- 其他

第 10 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 排序

- 運輸

- 集會

- 庫存管理

- 其他

第 11 章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 物流與倉儲

- 零售

- 汽車

- 電子和半導體

- 製藥和醫療保健

- 食品和飲料

- 航太與國防

- 飯店業

- 其他

第 12 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第13章:公司簡介

- ABB Ltd.

- Aethon, Inc.

- Balyo

- Boston Dynamics

- Honda Motor Co., Ltd.

- JBT

- KUKA AG

- Locus Robotics

- Mobile Industrial Robots

- Murata Machinery, Ltd.

- Omron Corporation

- Onward Robotics

- Seegrid

- Teradyne Inc.

- Vecna Robotics

- YUJIN ROBOT Co., Ltd.

- Zebra Technologies Corp

The Global Autonomous Mobile Robots Market was valued at USD 2.8 billion in 2024 and is projected to grow at a CAGR of 17.6% from 2025 to 2034. This growth is fueled by the rise of e-commerce, increased adoption of warehouse automation, and growing demand for AMRs across agriculture and hospitality industries. The surge in e-commerce and omnichannel retailing has driven the widespread deployment of AMRs for sorting, transportation, assembly, and inventory management. Manufacturers are focusing on developing highly advanced AMRs equipped with AI-guided navigation and automation to meet the expanding demands of global e-commerce and logistics markets.

The agriculture sector is witnessing a rapid shift towards automation due to labor shortages, the need for precision agriculture, and the goal of boosting productivity. AMRs automate essential farming operations such as sowing, reaping, weeding, and crop monitoring, reducing operational costs and enhancing efficiency. Similarly, the hospitality industry is integrating AMRs to streamline operations, improve customer experiences, and address labor challenges. These robots assist with food delivery, luggage handling, and housekeeping, contributing to enhanced efficiency and service quality. To capitalize on these opportunities, manufacturers are developing industry-specific AMRs that address the unique demands of the agriculture and hospitality sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $13.2 Billion |

| CAGR | 17.6% |

By component, the AMR market is segmented into hardware, software, and services. The hardware segment, valued at USD 1.4 billion in 2024, dominates the market due to rising demand for advanced sensors, LiDAR, cameras, and robotic arms. Improvements in battery life, payload capacity, and processing power are enhancing the efficiency of AMRs and driving hardware adoption. Increased investment in high-performance processors and AI chips is further boosting hardware demand.

In terms of type, the market includes goods-to-person picking robots, unmanned aerial vehicles, self-driving forklifts, and autonomous inventory robots. Goods-to-person picking robots are expected to grow at a CAGR of over 18.5% through 2034. These robots are gaining traction due to warehouse automation trends, increasing e-commerce orders, and labor shortages. Their ability to minimize human contact, maximize storage density, and accelerate order fulfillment is driving their adoption across logistics and supply chain industries.

By battery type, the market is segmented into lead batteries, lithium-ion batteries, nickel-based batteries, and others. Lithium-ion batteries dominated with a market share of 68.7% in 2024 due to their high energy density, long battery life, fast charging, and portability. Their efficiency and low maintenance make them ideal for use in the manufacturing, logistics, and healthcare sectors.

Regarding applications, AMRs are utilized for sorting, transportation, assembly, and inventory management. The inventory management segment is expected to grow at a CAGR of 20.4% from 2025 to 2034, driven by the rising use of AMRs in retail and warehousing to improve order accuracy, optimize stock levels, and track real-time locations.

Based on navigation technology, the market is divided into laser/LiDAR, vision guidance, and others. Laser/LiDAR held a 44.1% market share in 2024 due to its ability to perceive surroundings, detect obstacles, and navigate autonomously in dynamic environments, which is essential for logistics, warehousing, and industrial applications.

In terms of payload capacity, AMRs with a payload capacity of 100 kg to 500 kg dominated the market with a 39% share in 2024 due to their flexibility and versatility in automating material movement across warehouses, logistics, and retail industries.

The end-use industries driving market growth include logistics and warehousing, retail, automotive, electronics, pharmaceuticals, food and beverage, aerospace, hospitality, and others. The logistics and warehousing segment accounted for a 33.6% market share in 2024, driven by the increasing need for retail, e-commerce, and third-party logistics automation.

Regionally, North America led the market with a 33.8% share in 2024, driven by rapid automation adoption across logistics, e-commerce, and manufacturing sectors. Growing investments in AMRs, labor shortages, and the push for operational efficiency are accelerating AMR market growth in the region.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth of e-commerce and warehouse automation

- 3.2.1.2 Expansion of AMRs in healthcare and pharmaceuticals

- 3.2.1.3 Adoption of AMRs in agriculture and food processing

- 3.2.1.4 Enhanced safety and efficiency in industrial and logistics operations

- 3.2.1.5 Increasing application of autonomous mobile robot in hospitality industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with autonomous mobile robot

- 3.2.2.2 Challenges in integration and deployment of AMR technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 (USD Mn & Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software & services

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Mn & Units)

- 6.1 Key trends

- 6.2 Goods-to-person picking robots

- 6.3 Self-driving forklifts

- 6.4 Autonomous inventory robots

- 6.5 Unmanned aerial vehicles

Chapter 7 Market Estimates and Forecast, By Payload Capacity, 2021 - 2034 (USD Mn & Units)

- 7.1 Key trends

- 7.2 Below 100 kg

- 7.3 100 kg - 500 kg

- 7.4 More than 500 kg

Chapter 8 Market Estimates and Forecast, By Navigation Technology, 2021 - 2034 (USD Mn & Units)

- 8.1 Key trends

- 8.2 Laser/LiDAR

- 8.3 Vision guidance

- 8.4 Others

Chapter 9 Market Estimates and Forecast, By Battery Type, 2021 - 2034 (USD Mn & Units)

- 9.1 Key trends

- 9.2 Lead battery

- 9.3 Lithium-ion battery

- 9.4 Nickel-based battery

- 9.5 Others

Chapter 10 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Mn & Units)

- 10.1 Key trends

- 10.2 Sorting

- 10.3 Transportation

- 10.4 Assembly

- 10.5 Inventory management

- 10.6 Others

Chapter 11 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Mn & Units)

- 11.1 Key trends

- 11.2 Logistics & warehousing

- 11.3 Retail

- 11.4 Automotive

- 11.5 Electronics & semiconductor

- 11.6 Pharmaceuticals & healthcare

- 11.7 Food & beverage

- 11.8 Aerospace & defense

- 11.9 Hospitality

- 11.10 Others

Chapter 12 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Mn & Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 Saudi Arabia

- 12.6.2 South Africa

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 ABB Ltd.

- 13.2 Aethon, Inc.

- 13.3 Balyo

- 13.4 Boston Dynamics

- 13.5 Honda Motor Co., Ltd.

- 13.6 JBT

- 13.7 KUKA AG

- 13.8 Locus Robotics

- 13.9 Mobile Industrial Robots

- 13.10 Murata Machinery, Ltd.

- 13.11 Omron Corporation

- 13.12 Onward Robotics

- 13.13 Seegrid

- 13.14 Teradyne Inc.

- 13.15 Vecna Robotics

- 13.16 YUJIN ROBOT Co., Ltd.

- 13.17 Zebra Technologies Corp