|

市場調查報告書

商品編碼

1851601

離型紙:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Release Liners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

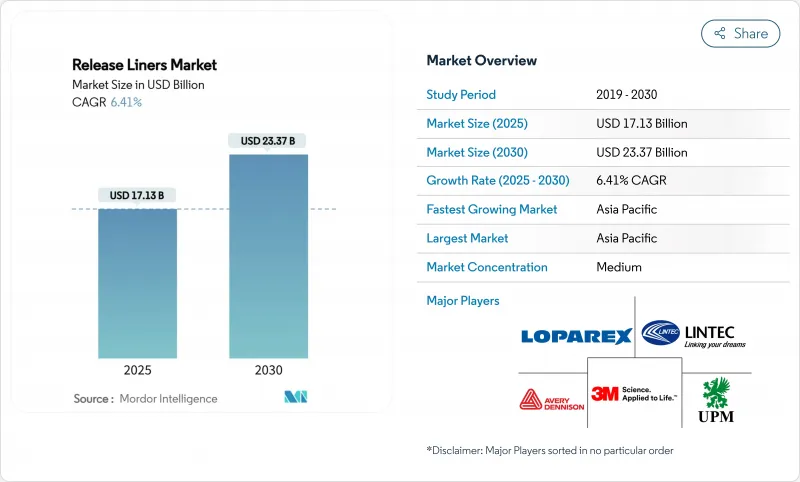

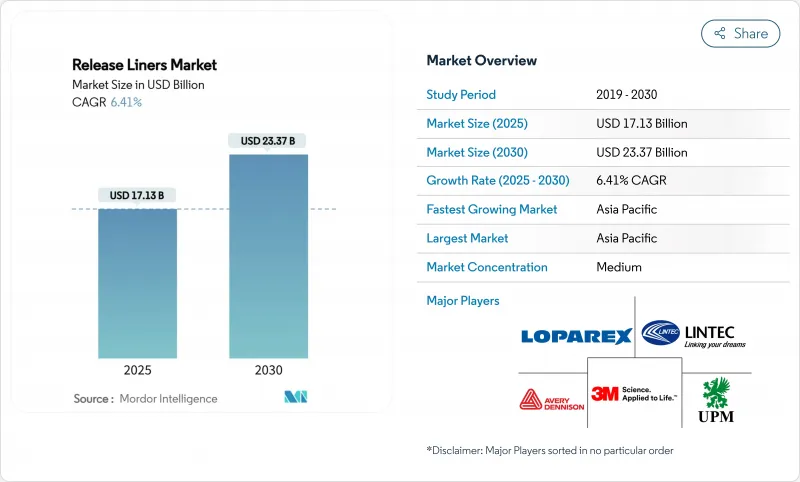

據估計,離型紙市場規模將在 2025 年達到 171.3 億美元,到 2030 年達到 233.7 億美元,在預測期(2025-2030 年)內複合年成長率為 6.41%。

對穩定性能和尺寸精度要求高的應用領域,例如電商物流、高階食品包裝和先進工業膠帶,正推動強勁的需求。標籤仍是核心應用領域,但醫療設備、預浸複合材料和電池膠帶的應用成長更為迅速,產品結構正向利潤率更高、技術密集結構轉變。亞太地區在銷售和成長率方面均領先主導,鞏固了其規模優勢,同時也使西方品牌所有者面臨供應鏈集中帶來的風險。材料創新正在加速。雖然玻璃紙仍佔據主導地位,但薄膜和聚合物塗層替代品正在蓬勃發展,因為加工商正在尋求既能防潮、耐熱、耐化學腐蝕又不犧牲可回收性的產品。

全球離型紙市場趨勢與洞察

食品飲料產業對潔淨標示包裝的需求日益成長

食品飲料品牌商正以未漂白的玻璃紙、水溶性矽酮和符合直接食品接觸法規的可堆肥化學品,取代漂白基材和溶劑型塗料。 Lintec的天然色調玻璃紙標誌著一種趨勢,即轉向加工最少的紙張,這種紙張無需使用螢光增白劑,並能實現凹版印刷的保真度。其功能性能如今也擴展到阻隔油污和水分,從而在不發生黏合劑遷移的情況下保持成分透明。能夠提供可追溯性證明的加工商,隨著零售商加強其永續性評估,正獲得更高的溢價。對不含 PFAS 系統的需求正從歐盟蔓延至北美,迫使供應商開發即使在高速塗覆下也能清潔釋放的無氟替代品。預計到 2024 年,食品飲料市場佔有率將達到 29.26%,材料升級將迅速波及全球市場,並提高供應商的認證門檻。

電子商務的蓬勃發展推動了對標籤的需求。

隨著線上訂購線下取貨、訂閱服務和當日送達模式的興起,小包裹量持續成長。離型紙必須能夠支援超過150公尺/分鐘的自動化列印生產線、可變資料條碼以及-20°C至40°C的低溫運輸。穩定的剝離力和紙幅平整度能夠最大限度地減少停機時間和誤貼,從而直接影響每個包裹的履約成本。高階開箱體驗的趨勢如今已擴展到全通路食品雜貨和個人護理用品的配送領域,這推動了對帶有紋理清漆和金屬裝飾的多層標籤的需求。這些標籤採用精密塗層的離型紙製成,以保護油墨的完整性直至使用。因此,離型紙市場正在經歷銷售成長,價值重心也轉向了針對機器人和影像檢查設備最佳化的高規格紙張和薄膜背襯。

離型紙廢棄物處理難題

由於矽油殘留阻礙了常規回收利用,廢舊襯紙大多被掩埋。 FINAT 的 CELAB-Europe 聯盟的目標是到 2025 年實現 75% 的回收率,但進展取決於回收物流和終端市場對再生纖維的需求。西密西根大學研發的水溶性隔離層能夠在製漿過程中去除矽油,但由於製程維修和打包運輸成本,商業性應用仍然有限。 Sustana 集團位於威斯康辛州的工廠已證明其技術可行性,但其業務範圍有限。隨著生產者延伸責任製漿計畫的日益普及,加工商面臨著不斷上漲的費用,這削弱了無襯紙和可重複使用紙漿的價格競爭力。

細分市場分析

預計到2024年,玻璃紙仍將佔據離型紙市場37.18%的佔有率,憑藉其成本效益、表面光滑度和FDA食品接觸認證,將繼續為大批量標籤和膠帶項目提供支援。然而,由於品牌商為了減少運輸排放而指定使用低克重離型紙,導致儘管平方公尺需求增加,但噸位卻有所下降,因此玻璃紙的成長將較為溫和。聚乙烯塗層牛皮紙因其優於無塗布牛皮紙的防潮性能,在冷藏食品和戶外標籤領域的需求不斷成長。由BO-PET和BOPP製成的薄膜離型紙在電子、航太和汽車層壓材料領域迅速擴張,這些材料的固化溫度高於纖維素紙的玻璃化轉變溫度。

雙向拉伸聚醯胺、聚四氟乙烯塗層玻璃布和微纖化纖維素複合材料具有多種功能特性,包括抗靜電性、260°C以上的熱穩定性以及防水性。儘管處理過程仍處於小眾市場,但隨著加工商採用多道塗層生產線或線上等離子處理來固定脫模劑,平均售價正在上漲。玻璃紙供應商正透過推出阻隔性增強型產品來回應潔淨標示包裝的需求,這些產品包括未漂白、金屬化和碳酸鈣填充型。這些迭代式的改進使玻璃紙保持了其市場地位,即使其成長最快的市場佔有率已被工程薄膜所取代。

到2024年,矽酮體系將佔據離型紙市場81.22%的佔有率,這主要得益於其多樣化的固化化學特性、低表面能以及豐富的矽氧烷原料供應。鉑催化紫外光固化矽酮透過縮短固化視窗並實現1000公尺/分鐘的高速塗覆,從而保持了價格競爭力。含氟聚合物離型紙市場雖然規模較小,但以7.64%的複合年成長率成長。這是因為全氟化鏈賦予了離型紙化學惰性和超低剝離強度,這對於高溫複合材料模具和強力膠帶至關重要。

對 PFAS 化學品的監管壓力正在加劇市場分化:航太領域對傳統氟矽油的需求依然旺盛,而包裝和衛生用品領域則轉向丙烯酸和聚烯脫模清漆。像 Hightower Products 這樣的供應商現在提供不含 PFAS 的配方,這些配方可根據黏度和固色樹脂進行客製化,以平衡清潔脫模和可回收性。矽油製造商正在推出遷移控制等級的產品,以最大限度地減少矽氧烷遷移到光學薄膜和半導體晶圓。競爭優勢取決於能夠檢驗亞 ppm 級遷移並加快客戶認證的分析能力。

區域分析

預計到2024年,亞太地區將佔據全球42.74%的市場佔有率,並在2030年之前以7.56%的複合年成長率成長,這主要得益於該地區垂直整合的從紙漿到塗料的供應鏈以及不斷成長的中階消費。隨著包裝加工商將產能擴展到更靠近電商履約中心的地方,中國將佔據噸位成長的大部分佔有率;而日本和韓國則專注於為半導體工廠和電池組裝提供高精度襯墊。政府對可再生能源的激勵措施也推動了風力渦輪機葉片製造領域對預浸襯墊的需求。

北美在航太、醫療設備和快餐店包裝領域擁有龐大的安裝基礎。美國受惠於以明尼蘇達州、麻薩諸塞州和加州為中心的叢集,是FDA核准的醫用膠帶的研發中心。加拿大利用其豐富的森林資源推廣FSC認證的玻璃紙和黏土塗層牛皮紙,滿足零售商的永續性要求。墨西哥的近岸外包熱潮正促使跨國公司將RFID、標籤和薄膜塗層工廠設在汽車和消費性電子工廠附近。艾利丹尼森公司1億美元的投資正是這發展動能的有力證明。

歐洲在監管方面始終處於領先地位,並積極推動循環經濟目標,獎勵那些能夠證明其消費後襯紙回收率的供應商。德國在與汽車輕量化相關的工業膠帶創新方面處於領先地位,而義大利和法國則在高階包裝領域佔據優勢,小批量生產和高品質標籤對高階襯紙的需求日益成長。北歐國家透過強制逐步淘汰 PFAS 並推廣生物基替代品,正在影響全球材料標準。東歐是為歐盟單一市場供應原料的成本效益型生產走廊,但地緣政治緊張局勢可能會擾亂原物料物流。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 食品飲料產業對潔淨標示包裝的需求日益成長

- 電子商務的蓬勃發展推動了對標籤的需求。

- 推廣優質衛生和醫用膠帶

- 航太和風能預浸料需要特殊襯裡

- 電動車電池電極膠帶的應用現狀

- 市場限制

- 離型紙廢棄物處理難題

- 紙漿和矽膠原料價格波動

- 轉向無底紙標籤系統

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按基礎材料

- 玻璃紙/超壓光紙

- 聚乙烯塗佈紙

- 薄膜襯墊

- 黏土塗層牛皮紙

- 其他(例如,聚塗層雙向拉伸聚對苯二甲酸乙二醇酯(BO-PET)薄膜等)

- 透過釋放劑

- 矽酮

- 氟樹脂

- 非矽酮(丙烯酸等)

- 透過使用

- 標籤

- 形象的

- 磁帶

- 醫療的

- 工業的

- 其他用途(衛生用品等)

- 按最終用途行業分類

- 飲食

- 醫療保健和製藥

- 個人護理和化妝品

- 汽車與運輸

- 電子學

- 建築/施工

- 其他終端用戶產業(例如農業)

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- 3M

- Ahlstrom

- Avery Dennison Corporation

- Dow

- Eastman Chemical Company

- Elkem ASA

- Felix Schoeller

- Gascogne Group

- Laufenberg GmbH

- LINTEC Corporation

- Loparex

- Mativ Holdings, Inc.

- Mitsubishi Chemical Group Corporation.

- Mondi

- Polyplex

- Sappi Ltd

- SJA Film Technologies Ltd.

- Techlan

- The Griff Network

- UPM

第7章 市場機會與未來展望

The Release Liners Market size is estimated at USD 17.13 billion in 2025, and is expected to reach USD 23.37 billion by 2030, at a CAGR of 6.41% during the forecast period (2025-2030).

Steady demand stems from e-commerce logistics, premium food packaging, and advanced industrial tapes, all of which require consistent release performance and tight dimensional tolerances. Labels remain the anchor application, yet medical devices, prepreg composites, and battery cell tapes are expanding faster and reshaping the product mix toward higher-margin, technology-intensive constructions. Asia-Pacific's dual leadership in volume and growth reinforces production scale advantages while exposing Western brand owners to supply-chain concentration risks. Material innovation is accelerating: glassine paper still dominates, but filmic and poly-coated alternatives are growing quickly as converters seek moisture, heat, and chemical resistance without sacrificing recyclability.

Global Release Liners Market Trends and Insights

Growing Demand for Clean-Label Packaging in Food and Beverage

Food and beverage brand owners are replacing bleached substrates and solvent-based coatings with unbleached glassine, water-borne silicones, and compostable chemistries that meet direct-food-contact rules. LINTEC's natural-tone glassine illustrates the pivot toward minimally processed papers that enable gravure print fidelity while eliminating optical brighteners . Functional performance now extends to barrier protection against grease and moisture, permitting clear ingredient transparency without adhesive migration. Converters able to document traceability capture price premiums as retailers tighten sustainability scorecards. Demand for PFAS-free systems is spreading from the EU to North America, pushing suppliers to scale fluorine-free alternatives that still release cleanly at high application speeds. With food and beverage holding 29.26% share in 2024, iterative material upgrades ripple quickly across global volumes and reinforce supplier qualification hurdles.

E-commerce Boom Accelerating Label Demand

Parcel volumes continue rising with click-and-collect, subscription, and same-day delivery models. Release liners must perform across automated print-apply lines that exceed 150 m/min, handle variable-data barcoding, and endure cold-chain swings from -20 °C to 40 °C. Consistent release force and web flatness minimize downtime and misapplies, directly influencing fulfillment cost per package. Premium unboxing trends now extend to omnichannel grocery and personal-care shipments, boosting demand for multi-layer labels with tactile varnishes and metallic accents. These constructions rely on precision-coated liners to protect ink integrity until point-of-use. The release liner market, therefore, sees volume gains plus a value shift toward high-spec paper and film backings optimized for robotics and vision inspection equipment.

Release-Liner Waste Disposal Challenges

Used liner is largely landfilled because silicone residues impede standard recycling. FINAT's CELAB-Europe consortium aims for 75% recycling by 2025, but progress hinges on collection logistics and end-market demand for recovered fibers. Western Michigan University's water-soluble barrier layer enables silicone removal during pulping, yet commercial adoption remains limited by process retrofits and bale transport costs. Sustana Group's Wisconsin plant shows technical feasibility, but its geographic reach is narrow. As Extended Producer Responsibility schemes spread, converters face escalating fees that erode price competitiveness versus linerless or reusable formats.

Other drivers and restraints analyzed in the detailed report include:

- Uptake of Premium Hygiene and Medical Tapes

- Aerospace and Wind Prepregs Needing Specialty Liners

- Volatile Pulp and Silicone Raw-Material Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Glassine retained 37.18% share of release liner market size in 2024 and continues to anchor high-volume label and tape programs thanks to cost efficiency, surface smoothness, and FDA food-contact clearances. Yet growth moderates as brand owners specify lower-grammage liners to cut freight emissions, eroding tonnage even where square-meter demand rises. Polyethylene-coated kraft papers are gaining in chilled-food and outdoor labeling where moisture resistance outperforms uncoated grades. Filmic liners made from BO-PET and BOPP are expanding quickly in electronics, aerospace, and automotive laminates that cure at temperatures beyond the glass-transition point of cellulosic papers.

Alternative substrates inside the "Others" category are setting the pace: bi-axially oriented polyamide, PTFE-coated glass cloth, and micro-fibrillated cellulose composites deliver multi-functional properties such as anti-static release, thermal stability above 260 °C, and repulpability. Adoption remains niche yet lifts average selling price because converters implement multi-pass coating lines and inline plasma treatments to anchor release agents. Glassine suppliers are responding with barrier-enhanced variations-unbleached, metallized, or calcium-carbonate-filled-aimed at clean-label packaging. These iterative shifts ensure glassine stays relevant while ceding the fastest growth slices to engineered films.

Silicone systems controlled 81.22% of the 2024 release liner market, supported by versatile cure chemistries, low surface energy, and abundant supply of base siloxanes. Platinum-catalyzed UV silicones shorten cure windows, enabling high-speed 1,000 m/min coating that sustains price competitiveness. The release liner market size for fluoropolymer-based agents is smaller yet advancing at 7.64% CAGR because perfluorinated chains deliver chemical inertness and ultra-low release force vital in high-temperature composite molds and aggressive adhesive tapes.

Regulatory pressure on PFAS chemicals is fostering a split: legacy fluoro-silicones for aerospace retain demand, while packaging and hygiene sectors shift toward acrylic or polyolefin release varnishes. Suppliers such as Hightower Products now market PFAS-free formulations customized by viscosity and anchorage resins, balancing clean release with recyclability. Silicone producers answer with controlled-migration grades that minimize siloxane transfer onto optical films and semiconductor wafers. Competitive advantage hinges on analytical capability to verify sub-ppm migration and accelerate customer qualification.

The Release Liner Market Report is Segmented by Substrate (Clay-Coated Kraft Paper, Filmic Liners, and, More), Release Agent (Silicone, Fluoropolymer, and More), Application (Labels, Graphics, and More), End-Use Industry (Food and Beverage, Healthcare and Pharmaceuticals, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated with 42.74% market share in 2024 and is projected to grow at a 7.56% CAGR through 2030, underpinned by the region's vertically integrated pulp-to-coating supply chain and expanding middle-class consumption. China accounts for the bulk of incremental tonnage as packaging converters ramp capacity near e-commerce fulfilment hubs, while Japan and South Korea specialize in high-precision liners for semiconductor fabs and battery cell assembly. Government incentives for renewable energy also lift demand for prepreg liners in wind-blade production.

North America preserves a sizeable installed base in aerospace, medical device, and quick-service restaurant packaging. The United States is the hub for FDA-cleared medical tape development, benefiting from clusters around Minnesota, Massachusetts, and California. Canada leverages abundant forest resources to promote FSC-certified glassine and clay-coated kraft, aligning with retailer sustainability mandates. Mexico's near-shoring boom encourages multinationals to co-locate RFID, label, and filmic coating facilities close to automotive and consumer-electronics plants; Avery Dennison's USD 100 million investment testifies to this momentum.

Europe remains the regulatory vanguard, driving circularity targets that reward suppliers able to certify post-consumer liner recycling rates. Germany spearheads industrial tape innovation linked to automotive lightweighting, whereas Italy and France capitalize on luxury packaging where small-batch, high-finish labels command premium liners. Nordic countries influence global material standards by mandating PFAS phase-outs and promoting bio-based alternatives. Eastern Europe serves as a cost-effective production corridor supplying the EU single market, though geopolitical tensions occasionally disrupt feedstock logistics.

- 3M

- Ahlstrom

- Avery Dennison Corporation

- Dow

- Eastman Chemical Company

- Elkem ASA

- Felix Schoeller

- Gascogne Group

- Laufenberg GmbH

- LINTEC Corporation

- Loparex

- Mativ Holdings, Inc.

- Mitsubishi Chemical Group Corporation.

- Mondi

- Polyplex

- Sappi Ltd

- SJA Film Technologies Ltd.

- Techlan

- The Griff Network

- UPM

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Clean-label Packaging in Food and Beverage

- 4.2.2 E-commerce Boom Accelerating Label Demand

- 4.2.3 Uptake of Premium Hygiene and Medical Tapes

- 4.2.4 Aerospace and Wind Prepregs Needing Specialty Liners

- 4.2.5 Electric Vehicles Battery Cell Electrode Tapes Adoption

- 4.3 Market Restraints

- 4.3.1 Release-liner Waste Disposal Challenges

- 4.3.2 Volatile Pulp and Silicone Raw-material Prices

- 4.3.3 Shift Toward Liner-less Labelling Systems

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Substrate

- 5.1.1 Glassine / Super-calendered Paper

- 5.1.2 Polyethylene-coated Paper

- 5.1.3 Filmic Liners

- 5.1.4 Clay-coated Kraft Paper

- 5.1.5 Others (Poly-coated Biaxially Oriented Polyethylene Terephthalate (BO-PET) film, etc.)

- 5.2 By Release Agent

- 5.2.1 Silicone

- 5.2.2 Fluoropolymer

- 5.2.3 Non-silicone (Acrylic, Others)

- 5.3 By Application

- 5.3.1 Labels

- 5.3.2 Graphics

- 5.3.3 Tapes

- 5.3.4 Medical

- 5.3.5 Industrial

- 5.3.6 Other Applications (Hydiene Products, etc.)

- 5.4 By End-use Industry

- 5.4.1 Food and Beverage

- 5.4.2 Healthcare and Pharmaceuticals

- 5.4.3 Personal Care and Cosmetics

- 5.4.4 Automotive and Transportation

- 5.4.5 Electronics

- 5.4.6 Building and Construction

- 5.4.7 Other End-user Industries (Agriculture, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Ahlstrom

- 6.4.3 Avery Dennison Corporation

- 6.4.4 Dow

- 6.4.5 Eastman Chemical Company

- 6.4.6 Elkem ASA

- 6.4.7 Felix Schoeller

- 6.4.8 Gascogne Group

- 6.4.9 Laufenberg GmbH

- 6.4.10 LINTEC Corporation

- 6.4.11 Loparex

- 6.4.12 Mativ Holdings, Inc.

- 6.4.13 Mitsubishi Chemical Group Corporation.

- 6.4.14 Mondi

- 6.4.15 Polyplex

- 6.4.16 Sappi Ltd

- 6.4.17 SJA Film Technologies Ltd.

- 6.4.18 Techlan

- 6.4.19 The Griff Network

- 6.4.20 UPM

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Incorporation of Nano-coatings into Release Liners for Enhanced Release Properties