|

市場調查報告書

商品編碼

1851581

電子商務包裝:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)E-commerce Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

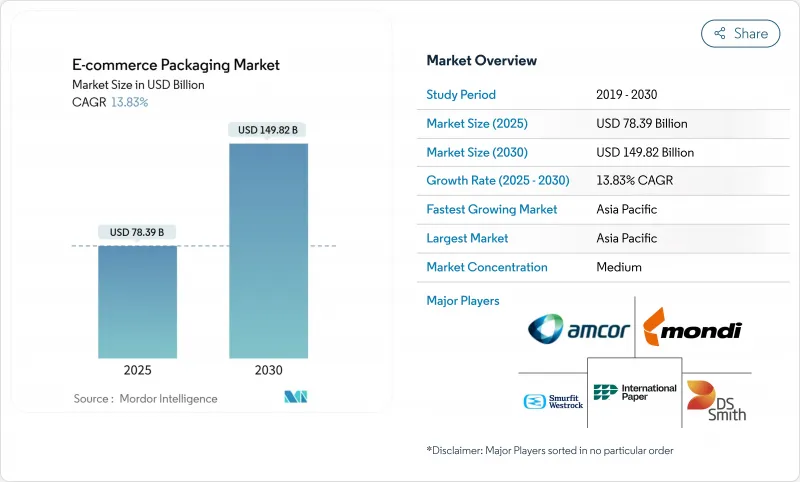

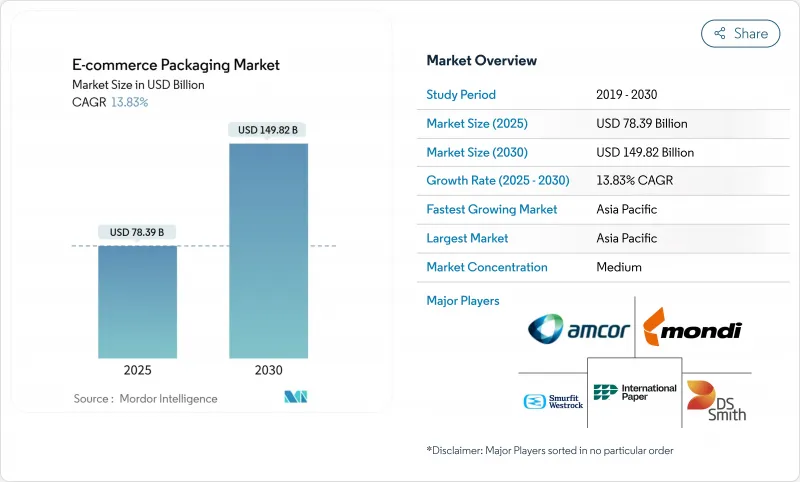

預計到 2025 年,電子商務包裝市場規模將達到 783.9 億美元,到 2030 年將達到 1,498.2 億美元,預測期(2025-2030 年)複合年成長率為 13.83%。

銷售成長主要得益於線上零售交易的爆炸性成長,單件小包裹配送取代了以往的店內批量配送。強制法規對難以回收的材料進行處罰,加上自動化和產品設計軟體的快速發展,持續推動消費者對更聰明、更輕巧、更永續包裝的需求。隨著新的再生材料配額的實施,以紙張、生質塑膠和單一材料軟性薄膜取代傳統包裝材料的趨勢正在加速,品牌也在全通路物流網路中保護其產品。同時,消費者對優質開箱體驗的期望迫使商家在美觀與產品生命週期結束後的循環利用之間尋求平衡,從而將包裝從成本中心提升為能夠創造收益的品牌資產。

全球電子商務包裝市場趨勢與洞察

線上零售商品交易總額 (GMV) 呈現爆炸性成長

全球電子商務商品交易金額持續以兩位數的速度成長。隨著訂單量的成長,包裝和運輸環節也需要使用更多保護性包裝,這使得包裝需求成長超過了零售額的成長。光是中國165個跨境電商試點區預計到2024年每天就將處理近2,000萬個包裹,這表明全國範圍內的商品交易額成長直接推動了紙板和郵寄包裝的消費。印度都市區的快消業者正致力於實現10-15分鐘的生鮮配送,他們透過單獨配送易碎的生鮮食品而非使用大宗木箱來提高包裝比例。訂閱制電商進一步提升了包裝量,其產品以品牌包裝盒定期配送,並按月補貨。跨境電商的運輸路線不斷延長,從深圳履約到西方消費者,這促使人們對更厚的瓦楞紙板和緩衝材料的需求增加,以應對多種運輸方式的搬運。這些需求和性能的變化共同支撐著全球電子商務包裝市場的成長。

朝向輕便、靈活的形式轉變

宅配按體積重量計費,對尺寸過小的紙箱徵收高額費用,促使賣家採用尺寸合適的郵寄袋、折疊式袋和風琴袋,以節省空運空間和運輸成本。亞馬遜的按需包裝舉措,結合機器學習軟體和自動裝袋機,為每個訂單用薄膜密封,已將運輸損壞率降低了24%,出境運費降低了5%。利潤率較低的品類,例如快時尚,正在使用軟性聚乙烯郵寄袋,將包裝成本控制在產品價值的5%以下。雖然早期採用率最高的是美國和歐洲,但這一趨勢正在亞太地區加速發展,因為在亞太地區,最後一公里運輸成本可能超過物流總成本的30%。隨著宅配業者加強計量銷售定價,輕型包裝形式預計將在電商包裝市場佔據越來越大的佔有率。

嚴格的塑膠禁令和生產者責任延伸制度推高了成本。

生產者延伸責任制(EPR)根據每種材料的實際可回收性收取費用,導致部分歐盟市場中難以回收的多層包裝袋成本加倍。加州的《塑膠污染防治法》對每公斤售出的包裝徵收固定費用,迫使品牌商調整產品組合或承擔罰款。缺乏監管人員的小型線上經銷商難以完成繳費申報,這使得能夠將合規固定成本分攤到更大銷售上的綜合性企業在競爭中佔據優勢。這些不利因素降低了未來兩年電子商務包裝市場的潛在複合年成長率。

細分市場分析

由於瓦楞紙板具有成本效益高、堆疊強度高和可普遍回收等優點,預計到2024年,瓦楞紙板將佔據電商包裝市場51%的佔有率。中國國家快遞包裝品質標準規範了國內和出口瓦楞紙板的等級分類,該標準將持續推動瓦楞紙板產業的發展。同時,生質塑膠是成長最快的材料類別,預計到2030年將以14.97%的複合年成長率成長,這反映了監管政策的利多和消費者觀念的轉變。加工商正將聚乳酸(PLA)與消費後回收材料混合,以生產符合歐盟30%回收材料標準的包裝材料,同時又不影響其抗張強度。東南亞地區對可擴展發酵設施的投資將逐步降低生物塑膠的溢價,使其應用範圍從高階化妝品和有機食品經銷商擴展到更廣泛的領域。

品牌所有者正在努力平衡紙板可靠的保護性能與可再生替代品,以減少範圍 3 的排放。 D2C 電子產品經銷商正在大力推廣可堆肥薄膜收縮套標,將其視為一項顯而易見的永續性升級。傳統的 PE 和 PP 生產商則透過設計可機械回收的單一材料產品來應對,力求保住市場佔有率。可再生和化石基聚合物的共存標誌著一個過渡過程,而非一夜之間被完全取代,這確保了兩種材料叢集對電子商務包裝市場仍然至關重要。

電子商務包裝市場報告按材料(塑膠、紙/紙板、瓦楞紙板、軟性薄膜/郵寄袋等)、包裝類型(盒子/紙箱、郵寄袋/信封、保護性包裝等)、最終用戶(時尚/服裝、家用電器、食品和飲料、個人護理/化妝品、雜貨/速賣、其他最終用戶)和地區進行細分。

區域分析

亞太地區將在2024年以52%的市佔率引領電商包裝市場,並在2030年之前維持15.70%的複合年成長率。中國國家標準GB 43352-2023定義了快遞包裝的關鍵性能指標,從而為600萬活躍的線上賣家製定了統一的品質標準。同時,預計2025年至2030年間,印度的電商銷售額將成長兩倍,這將推動對輕便耐用、能夠抵禦季風潮濕氣候的包裝袋的需求。東南亞的電商平台也正在採用類似的規則,利用紙質緩衝材料減少塑膠廢棄物,進一步推動了區域市場的發展。

北美位居第二。加州減少塑膠資源的目標以及加拿大禁止使用難以回收的發泡聚苯乙烯,正在加速基材的轉變。履約中心正在投資人工智慧主導的紙箱選擇工具,這些工具可減少12%的紙板用量,進而兼顧成本控制和永續性目標。隨著預計2025年線上食品雜貨滲透率將達到16%,美國低溫運輸創新也蓬勃發展,這將刺激對食品和藥品耐溫內襯的需求。

歐洲仍然是全球循環經濟的試驗場,PPWR(包裝材料再利用條例)的再生材料含量和再利用要求正在塑造一種最終將在全球推廣的模式。德國零售商正在人口密集的都市區試行使用可回收的電商食品包裝盒,減少了80%的一次性包裝。其他地區,中東和非洲在採用率方面落後於歐洲,但隨著跨境平台擴大其物流規模,這些地區也實現了兩位數的成長。儘管基礎設施不足和海關手續繁瑣限制了銷量,但智慧型手機的普及將釋放長期成長潛力,新興地區也被納入未來電商包裝市場擴張的考量。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 線上零售商品交易總額 (GMV) 呈現爆炸性成長

- DIM-轉向更輕、更靈活的格式以降低重量成本

- 永續性法規加速造紙業和生物基材料的採用

- 將開箱體驗作為品牌互動管道

- 人工智慧驅動的自動化產品適配減少了材料浪費

- 快速商業/訂閱零售的迅速興起導致出貨頻率增加

- 市場限制

- 全球嚴格的塑膠禁令和生產者責任延伸制度費用推高了合規成本。

- 牛皮紙和樹脂價格波動對壓力轉換器利潤的影響

- 跨境履約的破損和退貨率會降低包裝投資報酬率。

- 數據和知識的匱乏迫使人們重新設計碳足跡審核。

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 按材料類型分類

- 塑膠

- 紙和紙板

- 紙板

- 軟性薄膜和郵寄包裝

- 生質塑膠

- 其他

- 包裝類型細分

- 盒子和紙箱

- 郵件和信封

- 保護性包裝(填充物、緩衝材料、襯墊)

- 標籤、膠帶和封口件

- 特殊/可退回系統

- 最終使用者群體

- 時尚與服裝

- 消費性電子產品

- 飲食

- 個人護理和化妝品

- 雜貨和快餐

- 家居生活/家具

- 其他線上零售商

- 區域細分

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略性舉措(授權與授權、能力、技術)

- 市佔率分析

- 公司簡介

- Amcor plc

- Mondi plc

- International Paper

- Smurfit Kappa Group

- DS Smith plc

- WestRock Company

- Georgia-Pacific LLC

- Sealed Air Corporation

- Ranpak Holdings Corp.

- Pregis LLC

- Klabin SA

- Rengo Co. Ltd

- Stora Enso Oyj

- Nippon Paper Industries

- Oji Holdings

- Ranpak Holdings Corp

- Packhelp SA

- Shorr Packaging Corp.

- Packsize Intl.

- Packsize International

第7章 市場機會與未來展望

The E-commerce Packaging Market size is estimated at USD 78.39 billion in 2025, and is expected to reach USD 149.82 billion by 2030, at a CAGR of 13.83% during the forecast period (2025-2030).

Volume growth stems from the surge in online retail transactions, where every single-parcel shipment replaces what was once a consolidated store delivery. Regulatory mandates that penalize difficult-to-recycle materials, coupled with rapid advances in automation and fit-to-product design software, continue to propel demand for smarter, lighter, and more sustainable packs. Material substitution toward paper, bioplastic, and mono-material flexible films is accelerating as brands align with new recycled-content quotas while still protecting goods in omnichannel logistics networks. Meanwhile, consumer expectations for premium unboxing experiences force sellers to balance aesthetics with end-of-life circularity, elevating packaging from a cost center to a revenue-generating brand asset.

Global E-commerce Packaging Market Trends and Insights

Explosive Online Retail GMV Growth

E-commerce gross merchandise value continues to climb in double digits worldwide, and every incremental order ships in its protective pack, multiplying packaging demand faster than headline retail sales. China's 165 cross-border pilot zones alone processed nearly 20 million packages daily in 2024, underscoring how country-level GMV expansion directly fuels corrugated and mailer consumption. Urban India's quick-commerce operators now target 10-to-15-minute grocery delivery windows, raising packaging-to-product ratios because fragile fresh items ship individually rather than in bulk crates. Subscription commerce further amplifies volumes as recurring shipments deliver monthly replenishments in branded cartons. Longer trade lanes in cross-border commerce, from Shenzhen fulfilment hubs to Western consumers, elevate the need for thicker flute grades and engineered cushioning that can withstand multi-modal handling. These volume and performance shifts anchor the growth trajectory of the global e-commerce packaging market.

Shift Toward Lightweight and Flexible Formats

Courier dimensional-weight pricing penalizes half-empty cartons, pushing sellers to adopt right-sized mailers, collapsible pouches, and gusseted bags that shave airspace and freight spend. Amazon's on-demand packaging initiative trimmed shipping damage 24% and cut outbound freight costs 5% by pairing machine-learning software with auto-baggers that seal film around each order. Lower-margin categories such as fast-fashion rely on flexible poly-mailers to keep packaging costs below 5% of product value, while mono-material films answer recyclability rules without sacrificing density gains. Early adoption is strongest in the United States and Europe, but the trend accelerates in Asia Pacific, where last-mile costs can exceed 30% of total logistics spend. As couriers tighten volumetric pricing, lightweight formats are likely to capture an increasing share of the e-commerce packaging market.

Stringent Plastics Bans and EPR Fees Inflate Costs

Extended Producer Responsibility schemes levy fees that vary with each material's real-world recyclability, doubling the cost of difficult-to-recycle multilayer pouches in some EU markets. California's Plastic Pollution Prevention Act tags flat fees on every kilogram of packaging sold, compelling brands to overhaul portfolios or absorb penalties. Smaller online sellers lacking regulatory staff struggle to complete fee filings, tilting competitive advantage toward integrated players that can spread compliance fixed costs across higher volumes. These financial headwinds pare back the potential CAGR of the e-commerce packaging market over the next two years.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability Regulations Accelerating Paper and Bio-Based Adoption

- Unboxing Experience as a Brand Channel

- Kraft Paper and Resin Price Volatility Squeezes Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Corrugated board captured 51% of the e-commerce packaging market in 2024 thanks to cost efficiency, high stacking strength, and near-universal curbside recyclability. The segment continues to benefit from China's national express-packaging quality standard, which formalizes corrugate flute grades for domestic and export shipments. Meanwhile, bioplastics form the fastest-growing material group at a 14.97% CAGR through 2030, reflecting both regulatory tailwinds and shifting consumer sentiment. Converters blend PLA with post-consumer recyclate to create mailers that meet EU 30% recycled-content thresholds without compromising tensile performance. Investments in scalable fermentation facilities across Southeast Asia will gradually lower bio-resin premiums, enabling wider uptake beyond premium cosmetics and organic food sellers.

Brand owners balance corrugated's reliable protection with renewable alternatives to reduce Scope 3 emissions. Although corrugate commands volume, bioplastics bring differentiation; D2C electronics sellers tout compostable film shrink sleeves as a visible sustainability upgrade. Traditional PE and PP operators respond by designing mono-material variants compatible with mechanical recycling, seeking to defend their share. The coexistence of renewable and fossil-based polymers signals a transition, not an overnight swap, ensuring both material clusters remain essential to the e-commerce packaging market.

The E-Commerce Packaging Market Report is Segmented by Material (Plastic, Paper and Paperboard, Corrugated Board, Flexible Films and Mailers, and More), Packaging Format (Boxes and Cartons, Mailers and Envelopes, Protective Packaging, and More), End-User Vertical (Fashion and Apparel, Consumer Electronics, Food and Beverages, Personal Care and Cosmetics, Grocery and Quick-Commerce, and Other End Users), and Geography.

Geography Analysis

Asia Pacific led the e-commerce packaging market with a 52% revenue share in 2024 and is scaling at a 15.70% CAGR through 2030. China's national standard GB 43352-2023 defines mandatory performance metrics for express packs, driving uniform quality expectations across 6 million active online sellers. Concurrently, India's quick-commerce sales triple between 2025 and 2030, elevating demand for lightweight yet durable bags that perform in monsoon humidity. Southeast Asian marketplaces adopt similar rules, leveraging paper cushioning to cut plastic waste, reinforcing regional momentum.

North America ranks second. California's plastic-source-reduction targets and Canada's ban on difficult-to-recycle foam prompt accelerated substrate shifts. Fulfilment centers invest in AI-driven box-selection tools that trim corrugated usage by 12%, supporting both cost and sustainability goals. The United States also incubates cold-chain innovations as online grocery penetration touches 16% in 2025, spurring demand for temperature-stable liners across food and pharma.

Europe remains the global test bed for circularity, with the PPWR's recycled-content and reuse mandates shaping formats that eventually scale worldwide. Retailers in Germany pilot returnable e-grocery crates that cut single-use packs by 80% in dense urban districts. Elsewhere, the Middle East and Africa trail in adoption but record double-digit gains as cross-border platforms extend logistics footprints. Infrastructure gaps and customs complexities temper volume, yet rising smartphone penetration unlocks long-run upside, embedding emerging regions in future expansion of the e-commerce packaging market.

- Amcor plc

- Mondi plc

- International Paper

- Smurfit Kappa Group

- DS Smith plc

- WestRock Company

- Georgia-Pacific LLC

- Sealed Air Corporation

- Ranpak Holdings Corp.

- Pregis LLC

- Klabin SA

- Rengo Co. Ltd

- Stora Enso Oyj

- Nippon Paper Industries

- Oji Holdings

- Ranpak Holdings Corp

- Packhelp SA

- Shorr Packaging Corp.

- Packsize Intl.

- Packsize International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive growth of online retail GMV

- 4.2.2 Shift toward lightweight and flexible formats to lower DIM-weight costs

- 4.2.3 Sustainability regulations accelerating paper and bio-based adoption

- 4.2.4 "Unboxing experience" as a brand-engagement channel

- 4.2.5 AI-enabled fit-to-product automation reducing material waste

- 4.2.6 Rapid rise of quick-commerce/subscription retail raising shipment frequency

- 4.3 Market Restraints

- 4.3.1 Stringent global plastics bans and EPR fees inflate compliance costs

- 4.3.2 Kraft paper and resin price volatility squeezes converter margins

- 4.3.3 Cross-border fulfilment damage/return rates erode ROI on packaging

- 4.3.4 Carbon-footprint audits forcing redesigns amid data-knowledge gaps

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 Segmentation by Material Type

- 5.1.1 Plastic

- 5.1.2 Paper and Paperboard

- 5.1.3 Corrugated Board

- 5.1.4 Flexible Films and Mailers

- 5.1.5 Bioplastics

- 5.1.6 Others

- 5.2 Segmentation by Packaging Format

- 5.2.1 Boxes and Cartons

- 5.2.2 Mailers and Envelopes

- 5.2.3 Protective Packaging (void-fill, cushioning, liners)

- 5.2.4 Labels, Tapes and Closures

- 5.2.5 Specialty/Returnable Systems

- 5.3 Segmentation by End User

- 5.3.1 Fashion and Apparel

- 5.3.2 Consumer Electronics

- 5.3.3 Food and Beverage

- 5.3.4 Personal Care and Cosmetics

- 5.3.5 Grocery and Quick-Commerce

- 5.3.6 Home and Living/Furniture

- 5.3.7 Other Online Retailers

- 5.4 Segmentation by Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (MandA, capacity, tech)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Mondi plc

- 6.4.3 International Paper

- 6.4.4 Smurfit Kappa Group

- 6.4.5 DS Smith plc

- 6.4.6 WestRock Company

- 6.4.7 Georgia-Pacific LLC

- 6.4.8 Sealed Air Corporation

- 6.4.9 Ranpak Holdings Corp.

- 6.4.10 Pregis LLC

- 6.4.11 Klabin SA

- 6.4.12 Rengo Co. Ltd

- 6.4.13 Stora Enso Oyj

- 6.4.14 Nippon Paper Industries

- 6.4.15 Oji Holdings

- 6.4.16 Ranpak Holdings Corp

- 6.4.17 Packhelp SA

- 6.4.18 Shorr Packaging Corp.

- 6.4.19 Packsize Intl.

- 6.4.20 Packsize International

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment